2008 Tax Returns

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CHLA 2017 Annual Report

Children’s Hospital Los Angeles Annual Report 2017 About Us The mission of Children’s Hospital Los Angeles is to create hope and build healthier futures. Founded in 1901, CHLA is the top-ranked children’s hospital in California and among the top 10 in the nation, according to the prestigious U.S. News & World Report Honor Roll of children’s hospitals for 2017-18. The hospital is home to The Saban Research Institute and is one of the few freestanding pediatric hospitals where scientific inquiry is combined with clinical care devoted exclusively to children. Children’s Hospital Los Angeles is a premier teaching hospital and has been affiliated with the Keck School of Medicine of the University of Southern California since 1932. Table of Contents 2 4 6 8 A Message From the Year in Review Patient Care: Education: President and CEO ‘Unprecedented’ The Next Generation 10 12 14 16 Research: Legislative Action: Innovation: The Jimmy Figures of Speech Protecting the The CHLA Kimmel Effect Vulnerable Health Network 18 20 21 81 Donors Transforming Children’s Miracle CHLA Honor Roll Financial Summary Care: The Steven & Network Hospitals of Donors Alexandra Cohen Honor Roll of Friends Foundation 82 83 84 85 Statistical Report Community Board of Trustees Hospital Leadership Benefit Impact Annual Report 2017 | 1 This year, we continued to shine. 2 | A Message From the President and CEO A Message From the President and CEO Every year at Children’s Hospital Los Angeles is by turning attention to the hospital’s patients, and characterized by extraordinary enthusiasm directed leveraging our skills in the arena of national advocacy. -

!["/Title/Tt3702160/": {"Director": [["Kimberly Jessy"]], "Plot": ["\Nbeautiful D Anger Is an Animated 3D Made for TV/Short Film](https://docslib.b-cdn.net/cover/9886/title-tt3702160-director-kimberly-jessy-plot-nbeautiful-d-anger-is-an-animated-3d-made-for-tv-short-film-1179886.webp)

"/Title/Tt3702160/": {"Director": [["Kimberly Jessy"]], "Plot": ["\Nbeautiful D Anger Is an Animated 3D Made for TV/Short Film

{"/title/tt3702160/": {"director": [["Kimberly Jessy"]], "plot": ["\nBeautiful D anger is an Animated 3D Made for TV/Short Film. It's a Thriller that combines, M TV's Teen Wolf, Pretty Little Liars, Gossip Girl, Sorcery, Twilight, in one film , Epic fight scenes, No-one is who you think they are, Alternate Universes, Teen Young Adult Action Good Verses Evil, flick with tons of Cliff Hangers! It takes place In Dark Oak, CA were the typical mean girl with magical powers tries to t ake over the school with her mean girl clique. Brooke Charles Takes on Kimberly Jesika and her good girl team. Death Becomes Brook cause she keeps coming back, Think Katherine Vampire Diaries. Kimberly has magical powers and so does her cla n. It's a match to the death. No one is who they seem or who they appear to be! Excitement and sitting on the edge of your seat. Written by\nKimb erly Jessy "], "imdb_rating": [], "mpaa_rating": [], "poster_link": [], "stars": [["Kimberly Jessy"], ["Helena Evans"], ["Chloe Benoit"]], "title": "Beautiful D anger 3D Animated Teen Thriller", "genre": [[" Animation"]], "release_date": [], "writer": [["Kimberly Jesika"], ["Doll Face Animated Films"]]}, "/title/tt25692 02/": {"director": [["Emily Gossett"]], "plot": ["\nThe last year of high school has been barely tolerable for Maggie Masters. After being dumped by her three y ear relationship with Chad, to be traded in for a football dream at UF, she has to succumb to her mother leaving for a better life. Maggie is left to pick up th e remains of her fragmented life. When fate intervenes by the touch from the mys terious and handsome Caleb Jacobson, whom she saves, leaves Maggie breathless, s tartled and captivated. -

Press Kit (PDF)

Synopsis 1 The ocean is a wilderness reaching 'round the globe, wilder than a Bengal jungle, and fuller of monsters, washing the very wharves of our cities and the gardens of our sea-side residences. - Henry David Thoreau, 1864 For the nineteenth century, the world beneath the sea played much the same role that "outer space" played for the twentieth. The ocean depths were at once the ultimate scientific frontier and what Coleridge called "the reservoir of the soul": the place of the unconscious, of imagination and the fantastic. Proteus uses the undersea world as the locus for a meditation on the troubled intersection of scientific and artistic vision. The one-hour film is based almost entirely on the images of nineteenth century painters, graphic artists, photographers and scientific illustrators, photographed from rare materials in European and American collections and brought to life through innovative animation. The central figure of the film is biologist and artist Ernst Haeckel (1834-1919). As a young man, Haeckel found himself torn between seeming irreconcilables: science and art, materialism and religion, rationality and passion, outer and inner worlds. Through his discoveries beneath the sea, Haeckel would eventually reconcile these dualities, bringing science and art together in a unitary, almost mystical vision. His work would profoundly influence not only biology but also movements, thinkers and authors as disparate as Art Nouveau and Surrealism, Sigmund Freud and D.H. Lawrence, Vladimir Lenin and Thomas Edison. The key to Haeckel's vision was a tiny undersea organism called the radiolarian. Haeckel discovered, described, classified and painted four thousand species of these one-celled creatures. -

Gifts Ryan Cyr, Age 10

Ryan Cyr, age 10 giftsin gratitude and recognition Childrens hospiTal los angeles honor roll of donors for the time period of January 1, 2008 through December 31, 2008 The patients, families, staff and Board of Trustees of Childrens Hospital Los Angeles are grateful to the many people who help us build for the future and provide clinical care, research and medical education through their financial support. We recognize esteemed individuals, organizations, corporations and foundations for their generosity during the 2008 calendar year. This Honor Roll lists donors who contributed at least $1,000 in cash gifts, pledges or pledge payments. To view the Red Wagon Society Honor Roll of Donors, which lists gifts of $150 to $999, please visit the electronic version of the Honor Roll at www.ChildrensHospitalLA.org/HonorRoll. Foregoing individual recognition, we also extend thanks to those who made generous contributions directly to one of our Associate and Affiliate, or allied groups. Children’s Miracle Network (CMN) gifts to CMN National will be recognized in a future issue of Imagine. In spite of our best efforts, errors and omissions may occur. Please inform us of any inaccuracies by contacting Marie Logan, director of Donor Relations, at 323-361-1733 or [email protected]. • imagine spring 09 | 1 $4,000,000 and above $100,000 to $499,999 Mrs. Clotil F. Greene Tally and Bill Mingst i Anonymous Friends (2) The Ahmanson Foundation Mr. Douglas W. Grey 104.3 MYfm The Associates Alex’s Lemonade Stand Mrs. Naomi G. Hale Norris Cancer Center The John W. Carson Foundation Foundation Ms. -

Proteus a Nineteenth Century Vision

NIGHT FIRE FILMS www.nightfirefilms.org PROTEUS A NINETEENTH CENTURY VISION CONTACT INFORMATION Production Company: Night Fire Films 3711 Ocean View Ave. Los Angeles, CA 90066 David Lebrun Director, Producer Phone: (310) 821-9133 Fax: (310) 821-0224 [email protected] Rosey Guthrie Partner, Associate Producer Phone: (310) 737-1007 Fax: (310) 737-1120 [email protected] For addt’l information, prints or digital stills, please contact either of the above or go to: www.nightfirefilms.org For U.S. & Int’l Television Rights: Charles Scheurhoff CS Associates 200 Dexter Ave. Watertown, MA 02472 Phone: (617) 923-0077 [email protected] Proteus: On Line Press Kit Page 1 NIGHT FIRE FILMS www.nightfirefilms.org PROTEUS A NINETEENTH CENTURY VISION SYNOPSIS The ocean is a wilderness reaching round the globe, wilder than a Bengal jungle, and fuller of monsters, washing the very wharves of our cities and the gardens of our sea-side residences. – Henry David Thoreau, 1864 For the nineteenth century, the world beneath the sea played much the same role that "outer space" has played for the twentieth. The ocean depths were at once the ultimate scientific frontier and what Coleridge called “the reservoir of the soul”: the place of the unconscious, of imagination and the fantastic. Proteus uses the undersea world as the locus for a meditation on the troubled intersection of scientific and artistic vision. The one-hour film is based almost entirely on the images of nineteenth century painters, graphic artists, photographers and scientific illustrators, photographed from rare materials in European and American collections and brought to life through innovative animation. -

RELATIVITY MEDIA E VOLTAGE PICTURES Presentano Un

RELATIVITY MEDIA e VOLTAGE PICTURES Presentano Un produzione hiRECord FILM e RAM BERGMAN Un film di Joseph Gordon-Levitt Distribuzione Durata: 90 min Uscita 28 Novembre 2013 CAST ARTISTICO Jon “Don Jon” Martello Jr. JOSEPH GORDON-LEVITT Barbara Sugarman SCARLETT JOHANSSON Esther JULIANNE MOORE Jon Martello, Sr. TONY DANZA Bobby ROB BROWN Angela Martello GLENNE HEADLY Monica Martello BRIE LARSON Danny JEREMY LUKE CAST TECNICO Regia di JOSEPH GORDON-LEVITT Prodotto da RAN BERGMAN Scritto da JOSEPH GORDON-LEVITT Produttore esecutivo NICOLAS CHARTIER RYAN KAVANAUGH TUCKER TOOLEY Co-prodotto da JEFF FRANKS Produttore di linea BRUCE WAYNE GILLIES Produttore associato NIKOS KARAMAGIOS Direttore della Fotografia THOMAS KLOSS Montaggio di LAUREN ZUCKERMAN Musiche di NATHAN JOHNSON Scenografia di MEGHAN C. ROGERS Costumi di LEAH KATZNELSON Casting VENUS KANANI CSA, MARY VERNIEU CSA Ufficio Stampa * Via Pierluigi Giovanni Da Palestrina, 47 * 00193 Roma ☎ +39 06916507804 @ www.alerusso.it Alessandro +39 3493127219 [email protected] Valerio +39 3357081956 [email protected] 2 DON JON Jon Martello (Joseph Gordon-Levitt) è un ragazzo bello e aitante, un tipo vecchio stampo. I suoi amici lo chiamano Don Jon per la sua particolare abilità nel “rimorchiare” ogni fine settimana una donna diversa. Eppure, anche la più sublime scappatella non può competere con l’infinito piacere che Jon prova in solitaria, davanti al computer, quando consuma materiale pornografico. La bella Barbara Sugarman (Scarlett Johansson) è una brillante ragazza anche lei vecchio stampo. Cresciuta sognando le storie d’amore hollywoodiane, è risoluta nel trovare un giorno il suo Principe Azzurro per fuggire insieme a lui nel tramonto. Protagonisti di questa inconsueta commedia scritta e diretta da Joseph Gordon-Levitt, Jon e Barbara devono misurarsi con le ancestrali aspettative che si hanno sull’altro sesso e, al contempo, con una società mediatica piena di falsi miti per raggiungere, infine, un’intimità autentica. -

RYAN MURPHY and DAVID MILLER the Couple Has Made an Extraordinary $10 Million Donation in Honor of Their Son, Who Was Treated for Cancer at CHLA

imagineFALL 2018 RYAN MURPHY AND DAVID MILLER The couple has made an extraordinary $10 million donation in honor of their son, who was treated for cancer at CHLA. ABOUT US The mission of Children’s Hospital Los Angeles is to create hope and build healthier futures. Founded in 1901, CHLA is the top-ranked pediatric hospital in California and among the top 10 in the nation, according to the prestigious U.S. News & World Report Honor Roll of children’s hospitals for 2018-19. The hospital is home to The Saban Research Institute and is one of the few freestanding pediatric hospitals where scientific inquiry is combined with clinical care devoted exclusively to children. Children’s Hospital Los Angeles is a premier teaching hospital and has been affiliated with the Keck School of Medicine of USC since 1932. Ford Miller Murphy TABLE OF CONTENTS 2 A Letter From the President and Chief Executive Officer 3 A Message From the Chief Development Officer 4 Grateful Parents Ryan Murphy and David Miller Give $10 Million to CHLA 8 The Armenian Ambassadors Working Together to Support Children’s Health Care 10 Shaving the Way to a Cure St. Baldrick’s Foundation 12 A Miracle in May Costco Wholesale 14 Sophia Scano Fitzmaurice Changing the Future for Children and Adults With a Rare Blood Disease 15 Good News! Charitable Gift Annuity Rates Have Increased 16 Anonymous Donation Funds Emergency Department Expansion 16 Upcoming Events 17 In Memoriam 18 CHLA Happenings Ford Miller Murphy 21 The Children’s Hospital Los Angeles Gala: From Paris With Love 25 Walk and Play L.A. -

University of Southampton Research Repository Eprints Soton

University of Southampton Research Repository ePrints Soton Copyright © and Moral Rights for this thesis are retained by the author and/or other copyright owners. A copy can be downloaded for personal non-commercial research or study, without prior permission or charge. This thesis cannot be reproduced or quoted extensively from without first obtaining permission in writing from the copyright holder/s. The content must not be changed in any way or sold commercially in any format or medium without the formal permission of the copyright holders. When referring to this work, full bibliographic details including the author, title, awarding institution and date of the thesis must be given e.g. AUTHOR (year of submission) "Full thesis title", University of Southampton, name of the University School or Department, PhD Thesis, pagination http://eprints.soton.ac.uk UNIVERSITY OF SOUTHAMPTON FACULTY OF HUMANITIES INTERACTIONS BETWEEN CONTEMPORARY AMERICAN INDEPENDENT CINEMA AND POPULAR MUSIC CULTURE By Matthew William Nicholls For the degree of Doctor of Philosophy July 2011 UNIVERSITY OF SOUTHAMPTON ABSTRACT FACULTY OF HUMANITIES Doctor of Philosophy INTERACTIONS BETWEEN CONTEMPORARY AMERICAN INDEPEND- ENT CINEMA AND POPULAR MUSIC CULTURE By Matthew Nicholls In recent years, many American independent films have become increasingly en- gaged with popular music culture and have used various forms of pop music in their soundtracks to various effects. Disparate films from a variety of genres use different forms of popular music in different ways, however these negotiations with pop music and its cultural surroundings have one true implication: that the 'inde- pendentness' (or 'indieness') of these movies is informed, anchored and embellished by their relationships with their soundtracks and/or the representations of or posi- tioning within wider popular music subcultures. -

Proteus a Nineteenth Century Vision

NIGHT FIRE FILMS www.nightfirefilms.org PROTEUS A NINETEENTH CENTURY VISION ARTIST BIOGRAPHIES MARIAN SELDES (the Narrator) is a major figure in American theatre. Her Broadway roles have included Medea, Crime and Punishment, Ondine, The Chalk Garden, The Milk Train Doesn’t Stop Here Anymore, Tiny Alice, A Delicate Balance, Father’s Day, Equus, Deathrap, Ivanov and Ring Round the Moon. Off-Broadway roles have included The Ginger Man, Isadora Duncan, Painting Churches, Richard II, Richard III, Three Tall Women, The Boys From Syracuse, Dear Liar and The Play About the Baby. Ms. Seldes most recently starred in Becket/Albee at the Century Theater. She has received a Tony Award and 5 Tony nominations, a Drama Desk Award and 5 Drama Desk Nominations, a Helen Hayes Nomination, 3 Obie Awards, including an Obie for Sustained Achievement in 2001, and other awards too numerous to mention. She was inducted into the Theatre Hall of Fame in 1996, and received an Honorary Doctor of Fine Arts from Julliard in 2003. Ms. Seldes also appears frequently on television and in films, most recently in Mona Lisa Smile. COREY BURTON (the voice of Ernst Haeckel) studied radio drama with the legendary Daws Butler, and has worked with nearly all of the original Hollywood Radio Theatre veterans in classic-style broadcasts. The San Fernando Valley native has voiced sound- alikes and original characters for hundreds of commercials and other projects. Theatrical film work includes E.T., Total Recall, Poltergeist and most of Disney Feature Animation's releases over the past two decades, including the roles of Moliere in Atlantis and Captain Hook in Return to Neverland. -

Newsletter 18/08 DIGITAL EDITION Nr

ISSN 1610-2606 ISSN 1610-2606 newsletter 18/08 DIGITAL EDITION Nr. 238 - Oktober 2008 Michael J. Fox Christopher Lloyd LASER HOTLINE - Inh. Dipl.-Ing. (FH) Wolfram Hannemann, MBKS - Talstr. 3 - 70825 K o r n t a l Fon: 0711-832188 - Fax: 0711-8380518 - E-Mail: [email protected] - Web: www.laserhotline.de Newsletter 18/08 (Nr. 238) Oktober 2008 editorial Hallo Laserdisc- und DVD- Rückschau auf das Fantasy Film- Fans, fest nochmals zu verschieben. liebe Filmfreunde! Aber wie sagt ein altes Sprichwort Der Eintrag ins Guinness Buch der so schön: aufgeschoben ist nicht Rekorde ist nicht mehr weit ent- aufgehoben. Den Rückblick auf fernt. Oder wann haben Sie zuletzt das 70mm-Filmfestival in Karlsru- einen Newsletter gesehen, der he indes haben wir dieses Mal un- mehr als 80 Seiten aufweist? Da- serer Kolumnistin überlassen. mit ganz herzlich willkommen zu Wenn Sie also wie wir Fan des einer unserer umfangreichsten Aus- breiten Filmformates sind, dann gaben des Newsletters. Um das sind Sie bei ab Seite 3 bei Anna Ganze dann noch einigermaßen gut aufgehoben. Die Einführungs- handhabbar zu halten, haben wir texte (Neudeutsch: Intros) zu den auf Coverabbildungen komplett Todd-AO-Filmen gibt’s dann noch verzichtet und auch sonst auf bunte als Zugabe in einer der kommen- Bilder weitestgehend verzichtet. den Newsletter-Ausgaben. Auch in Entstanden ist dadurch ein sehr diesem Jahr sind sie wieder der SKULL enthält einen der neuen nüchtern wirkender Newsletter, Feder unseres fleißigen Film- THX-Trailer (“Amazing Life”). Da der dennoch Ihre Aufmerksamkeit Bloggers entsprungen. Seinen heisst es dann: alles festschrauben, verdient. Denn in allen Bereichen Kurzreport über die Presse- damit Ihnen nicht Ihr Heimkino um (BRD, USA und Japan) warten Screenings der vergangenen drei die Ohren fliegt! Sehr empfehlens- Neuerscheinungen geradezu dar- Wochen finden Sie ab Seite 5. -

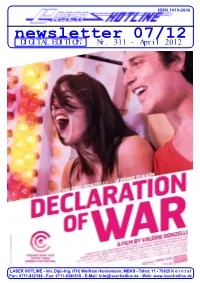

Newsletter 07/12 DIGITAL EDITION Nr

ISSN 1610-2606 ISSN 1610-2606 newsletter 07/12 DIGITAL EDITION Nr. 311 - April 2012 Michael J. Fox Christopher Lloyd LASER HOTLINE - Inh. Dipl.-Ing. (FH) Wolfram Hannemann, MBKS - Talstr. 11 - 70825 K o r n t a l Fon: 0711-832188 - Fax: 0711-8380518 - E-Mail: [email protected] - Web: www.laserhotline.de Newsletter 07/12 (Nr. 311) April 2012 editorial Hallo Laserdisc- und DVD-Fans, liebe Filmfreunde! Herzlich willkommen zur neuen Ausgabe unseres Newsletters, Bericht darüber möchten wir Ihnen natürlich nicht vorenthalten dessen Editorial wir dieses Mal ganz knapp halten. Unser (siehe unten). Das exklusive Video zur Premiere finden Sie wie Filmblogger Wolfram Hannemann hatte nämlich wieder einmal immer auf unserem YouTube-Kanal. Viel Spaß damit! die Gelegenheit, einer Filmpremiere beizuwohnen. Und seinen Ihr Laser Hotline Team Radost will nicht mehr erwachsen sein Von links nach rechts: Anja Jacobs (Regie), Lola Dockhorn (Darstellerin „Radost“), Alexander Funk (Produzent) Bild (c) 2012 Wolfram Hannemann Am 10. April 2012 feierte Anja Jacobs’ Film „Einer wie Bruno“ seine Weltpremiere in Stuttgart Sektempfang, schicke Abendgarderobe, Ka- vorwurfsvoller Frage “Warum kannst Du len die Wahrheit ins Gesicht sagt, spendier- merateams, Blitzlichtgewitter - es ist schon nicht ein ganz normaler Vater sein?” - Anja ten die Gäste spontan Szenenapplaus. Für etwas Besonderes, wenn ein Spielfilm ausge- Jacobs‘ Film versteht sich als ein Plädoyer eine Veranstaltung im Schwabenland gilt so rechnet in der Schwabenmetropole Stuttgart für den richtigen Umgang mit geistig behin- etwas fast schon als eine kleine Sensation. seine Weltpremiere feiert. Im Fall von “Ei- derten Menschen, insbesondere wenn es sich Kräftigen Applaus gab es im Anschluss an die ner wie Bruno” war diese Entscheidung aller- dabei um einen Elternteil handelt. -

Renowned Breast Oncologist Heads To

JUNE 5 • 2009 TheWeekly PUBLISHED FOR THE USC HEALTH SCIENCES CAMPUS COMMUNITY VOLUME 15 • NUMBER 19 Renowned breast oncologist heads to USC By Cheryl Bruyninckx patient-focused programs.” having the two work side by A national figure in breast Tripathy comes to USC side,” said Tripathy. “I believe ‘Dr. Tripathy is a cancer research is headed to from the University of Texas that clinical care, clinical re- national authority USC to serve as co-leader of Southwestern Medical Center search and laboratory research the Women’s Cancer Program at Dallas, where he served as all go hand in hand.” in breast cancer. at the USC Norris Compre- Professor of Internal Medicine, A nationally recognized fig- We are delighted hensive Cancer Center. Director of the Komen/UT ure in clinical research, Tripa- Debasish (Debu) Tripathy Southwestern Breast Cancer thy’s primary area of interest is that he is com- has been appointed professor Research Program and holder breast cancer therapy. For the of medicine by Keck School of the Annette Simmons past 20 years, he has studied ing to USC as we of Medicine Dean Carmen Distinguished Chair in Breast growth factor receptors, impor- strengthen our A. Puliafito, effective Aug. 1, Cancer Research. He was also tant targets in breast and other 2009. Tripathy will hold the President and Chief Executive cancers. Tripathy was part of clinical research Art and Priscilla Ulene Chair Officer of Physicians’ Educa- Debasish (Debu) Tripathy the original team that brought activities and our in Women’s Cancer, and will tion Resource in Dallas, a the now commonly used drug be head of the Section of continuing medical educa- matches the needs of patients Herceptin into clinical care.