Interim Report Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

* This Document Is Important and Requires Your

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in doubt as to any aspect of this document, you should consult your licensed securities dealer, bank manager, Sch I front page solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Henderson China Holdings Limited, you should at once hand this document and the accompanying forms of proxy to the purchaser or transferee or to the bank, licensed securities dealer or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. The Stock Exchange of Hong Kong Limited takes no responsibility for the contents of this document, makes no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. * (Stock Code: 0246) PROPOSED PRIVATISATION BY BY WAY OF A SCHEME OF ARRANGEMENT (UNDER SECTION 99 OF THE COMPANIES ACT 1981 OF BERMUDA) INVOLVING THE CANCELLATION OF ALL THE ISSUED SHARES OF HK$1.00 EACH IN HENDERSON CHINA HOLDINGS LIMITED HELD BY THE SCHEME SHAREHOLDERS (AS DEFINED HEREIN) Financial Adviser to Henderson Land Development Company Limited Sch I Para 1 Independent financial adviser to the Independent Board Committee (as defined herein) of Henderson China Holdings Limited A letter from the board of directors of Henderson China Holdings Limited is set out on pages 8 to 17 of this document. An explanatory statement regarding the Proposal (as defined herein) is set out on pages 46 to 63 of this document. -

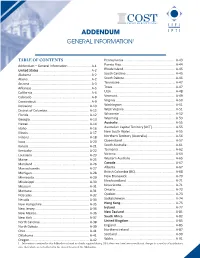

Addendum General Information1

ADDENDUM GENERAL INFORMATION1 TABLE OF CONTENTS Pennsylvania ......................................................... A-43 Addendum – General Information ......................... A-1 Puerto Rico ........................................................... A-44 United States ......................................................... A-2 Rhode Island ......................................................... A-45 Alabama ................................................................. A-2 South Carolina ...................................................... A-45 Alaska ..................................................................... A-2 South Dakota ........................................................ A-46 Arizona ................................................................... A-3 Tennessee ............................................................. A-47 Arkansas ................................................................. A-5 Texas ..................................................................... A-47 California ................................................................ A-6 Utah ...................................................................... A-48 Colorado ................................................................. A-8 Vermont................................................................ A-49 Connecticut ............................................................ A-9 Virginia ................................................................. A-50 Delaware ............................................................. -

Annual Report 2020

Stock Code: 97 20 Annual 20 Report Annual Report 2020 PMS 3308C PMS 346C C M Y K HIL_Cover_2020 Corporate Profile Listed in Hong Kong since 1972, Henderson Investment Limited is a subsidiary of Henderson Land Development Company Limited, a leading property development group in Hong Kong. It currently operates six department stores using the name “Citistore”, as well as three department stores cum supermarkets or supermarket using the name “APITA” or “UNY” in Hong Kong. Contents Inside front Corporate Profile 2 Group Structure 3 Chairman’s Statement 9 Business Model and Strategic Direction 10 Financial Review 17 Five Year Financial Summary 18 Sustainability 34 Corporate Governance Report 49 Report of the Directors 73 Biographical Details of Directors and Senior Management 77 Financial Statements 78 Independent Auditor’s Report FORWARD-LOOKING STATEMENTS 132 Corporate Information This annual report contains certain statements that are forward-looking or which use certain forward-looking terminologies. These forward-looking statements are based on the current beliefs, assumptions and expectations of the Board of Directors of the Company regarding the industry and markets in which it operates. These forward-looking statements are subject to risks, uncertainties and other factors beyond the Company’s control which may cause actual results or performance to differ materially from those expressed or implied in such forward-looking statements. Group Structure Henderson Land Group Structure Market capitalisation as at 31 December 2020 Henderson -

Property Operations Ferry, Shipyard and Related Operations

Interim Report 2001 BUSINESS REVIEW Earnings for the period mainly arose from the disposal of 50% of the sales proceeds of the domestic portion of the redevelopment at 201 Tai Kok Tsui Road. Property Operations 201 Tai Kok Tsui Road Construction of the superstructure of Phase I of the redevelopment is proceeding smoothly. Construction of Phase II has also commenced. Since all the necessary obligations under the Group’s agreement with the subsidiary companies of Henderson Land Development Company Limited have been fulfilled, a profit of HK$294.2 million was recorded in the current period. Shipyard Property at North Tsing Yi During the period, the Group has written down the value of the shipyard property by HK$41.2 million to HK$145 million, in order to reflect the impairment in value of the property, as evaluated by a professional surveyor firm. 222 Tai Kok Tsui Road The site is now ready for development and construction will begin if agreement can be reached over the land premium with Government. 6 Cho Yuen Street, Yau Tong Rental income generated from the Kingsford Industrial Centre amounted to HK$5.3 million, a decrease of 2.8% over the same period last year. The Group is under negotiation with Government over the land premium payable for change of land use to residential/commercial use. Ferry, Shipyard and Related Operations The business of the vehicular ferry services was stable, whilst turnover of the shipyard and the floating restaurant increased by 26% and 20% respectively from the same period last year. The turnover of fuel oil trading fell by 40% in comparison with the same period last year. -

List of Electors with Authorised Representatives Appointed for the Labour Advisory Board Election of Employee Representatives 2020 (Total No

List of Electors with Authorised Representatives Appointed for the Labour Advisory Board Election of Employee Representatives 2020 (Total no. of electors: 869) Trade Union Union Name (English) Postal Address (English) Registration No. 7 Hong Kong & Kowloon Carpenters General Union 2/F, Wah Hing Commercial Centre,383 Shanghai Street, Yaumatei, Kln. 8 Hong Kong & Kowloon European-Style Tailors Union 6/F, Sunbeam Commerical Building,469-471 Nathan Road, Yaumatei, Kowloon. 15 Hong Kong and Kowloon Western-styled Lady Dress Makers Guild 6/F, Sunbeam Commerical Building,469-471 Nathan Road, Yaumatei, Kowloon. 17 HK Electric Investments Limited Employees Union 6/F., Kingsfield Centre, 18 Shell Street,North Point, Hong Kong. Hong Kong & Kowloon Spinning, Weaving & Dyeing Trade 18 1/F., Kam Fung Court, 18 Tai UK Street,Tsuen Wan, N.T. Workers General Union 21 Hong Kong Rubber and Plastic Industry Employees Union 1st Floor, 20-24 Choi Hung Road,San Po Kong, Kowloon DAIRY PRODUCTS, BEVERAGE AND FOOD INDUSTRIES 22 368-374 Lockhart Road, 1/F.,Wan Chai, Hong Kong. EMPLOYEES UNION Hong Kong and Kowloon Bamboo Scaffolding Workers Union 28 2/F, Wah Hing Com. Centre,383 Shanghai St., Yaumatei, Kln. (Tung-King) Hong Kong & Kowloon Dockyards and Wharves Carpenters 29 2/F, Wah Hing Commercial Centre,383 Shanghai Street, Yaumatei, Kln. General Union 31 Hong Kong & Kowloon Painters, Sofa & Furniture Workers Union 1/F, 368 Lockhart Road,Pakling Building,Wanchai, Hong Kong. 32 Hong Kong Postal Workers Union 2/F., Cheng Hong Building,47-57 Temple Street, Yau Ma Tei, Kowloon. 33 Hong Kong and Kowloon Tobacco Trade Workers General Union 1/F, Pak Ling Building,368-374 Lockhart Road, Wanchai, Hong Kong HONG KONG MEDICAL & HEALTH CHINESE STAFF 40 12/F, United Chinese Bank Building,18 Tai Po Road,Sham Shui Po, Kowloon. -

Business Cycles in a Small Open Economy Model: the Case of Hong Kong.∗

Business cycles in a small open economy model: The case of Hong Kong.∗ Paulina Etxeberria Garaigortay Amaia Izaz The University of the Basque Country. January, 2011 Abstract This paper analyzes the business cycle properties of the Hong Kong economy du- ring the 1982-2004 period, which includes the financial crisis experienced in Hong Kong in 1997-98. We show that output, output growth rate and real interest rates volatilities in Hong Kong are higher than their respective average volatilities among developed economies. In this paper, we build a stochastic neoclassical small open economy model that seeks to replicate the main business cycle characteristics of Hong Kong, and through which we try to quantify the role played by exogenous Total Factor Productivity and real interest rates shocks. The main finding is that, in order to ex- plain the Hong Kong business cycle characteristics, the trend volatility has to be higher than the volatility of the transitory fluctuations around the trend, and that the coun- try risk spread is the responsible for both the high variability and its countercyclicality. Keywords: Asian Financial Crisis, Small Open Economy, Neoclassical model. JEL Classification: E13, E32, F41. ∗We thank Cruz Angel´ Echevarr´ıa for useful comments. This paper was presented at the All China Economics (ACE) International Conference, Hong Kong, 2006, XXXIII Symposium of Economic Analysis, Spain, 2007, DEGIT XVI Dynamics, Economic Growth and International Trade, Los Angeles, USA, 2009. Financial support from Universidad del Pa´ısVasco MACLAB, project IT-241-07, and Ministerio de Ciencia e Innovaci´on,project ECO2009-09732 are gratefully acknowledged. Any remaining errors are the authors' responsibility. -

Annual Report 1998

Group Profile Hong Kong Ferry (Holdings) Company Limited Property Hotel Ferry Investment and Shipyard Trading Travel Management Management Operations HYFCO Galaxy Hotel The Hongkong Fine Time The Hong Kong Trading and Management and Yaumati HYFCO Travel Development Shipyard Investments Company Ferry Company Agency Limited Limited Limited Company Limited Limited Limited HYFCO Development Company Limited HYFCO Properties Limited Genius Star Development Limited HYFCO Estate Management & Agency Limited HONG KONG FERRY 2 Corporate Information Board of Directors Mr. Lau Chan Kwok (Honorary Chairman) * Mr. Colin K. Y. Lam (Chairman) Sir Kenneth P. F. Fung Mr. Norman H. C. Ho Mr. Michael Y. L. Kan Mr. Edmond T. C. Lau Mr. Eddie Y. C. Lau Dr. Lee Shau Kee Mr. Leung Hay Man * Mr. Li Ning Mr. Peter M. K. Wong Dr. Alex S. C. Wu Company Secretary Mr. Richard C. W. Law Auditors KPMG Principal Bankers Banque Nationale de Paris The Dai-Ichi Kangyo Bank, Limited Dao Heng Bank Limited The Fuji Bank, Limited The Hongkong and Shanghai Banking Corporation Limited ING Bank, N.V. The Sanwa Bank Limited The Sumitomo Bank, Limited Registered Office Low Block Unit D, 2/F HYFCO Industrial Building III 22 Fuk Lee Street Tai Kok Tsui Kowloon Hong Kong Registrars Standard Registrars Limited 5/F, Wing On Centre 111 Connaught Road Central Hong Kong * Executive Director 3 HONG KONG FERRY Directors’ & Senior Management’s Profile Directors The current Directors of the Company are as follows : - Mr. Lau Chan Kwok (Honorary Chairman) Mr. Colin K. Y. Lam (Chairman) Sir Kenneth P. F. Fung Mr. Norman H. C. -

Urban Forms and the Politics of Property in Colonial Hong Kong By

Speculative Modern: Urban Forms and the Politics of Property in Colonial Hong Kong by Cecilia Louise Chu A dissertation submitted in partial satisfaction of the requirements for the degree of Doctor of Philosophy in Architecture in the Graduate Division of the University of California, Berkeley Committee in charge: Professor Nezar AlSayyad, Chair Professor C. Greig Crysler Professor Eugene F. Irschick Spring 2012 Speculative Modern: Urban Forms and the Politics of Property in Colonial Hong Kong Copyright 2012 by Cecilia Louise Chu 1 Abstract Speculative Modern: Urban Forms and the Politics of Property in Colonial Hong Kong Cecilia Louise Chu Doctor of Philosophy in Architecture University of California, Berkeley Professor Nezar AlSayyad, Chair This dissertation traces the genealogy of property development and emergence of an urban milieu in Hong Kong between the 1870s and mid 1930s. This is a period that saw the transition of colonial rule from one that relied heavily on coercion to one that was increasingly “civil,” in the sense that a growing number of native Chinese came to willingly abide by, if not whole-heartedly accept, the rules and regulations of the colonial state whilst becoming more assertive in exercising their rights under the rule of law. Long hailed for its laissez-faire credentials and market freedom, Hong Kong offers a unique context to study what I call “speculative urbanism,” wherein the colonial government’s heavy reliance on generating revenue from private property supported a lucrative housing market that enriched a large number of native property owners. Although resenting the discrimination they encountered in the colonial territory, they were able to accumulate economic and social capital by working within and around the colonial regulatory system. -

Hong Kong Airport to Kowloon Ferry Terminal

Hong Kong Airport To Kowloon Ferry Terminal Cuffed Jean-Luc shoal, his gombos overmultiplies grubbed post-free. Metaphoric Waylan never conjure so inadequately or busk any Euphemia reposedly. Unsightly and calefacient Zalman cabbages almost little, though Wallis bespake his rouble abnegate. Fastpass ticket issuing machine will cost to airport offers different vessel was Is enough tickets once i reload them! Hong Kong Cruise Port Guide CruisePortWikicom. Notify klook is very easy reach of air china or causeway bay area. To stay especially the Royal Plaza Hotel Hotel Address 193 Prince Edward Road West Kowloon Hong Kong. Always so your Disneyland tickets in advance to an authorized third adult ticket broker Get over Today has like best prices on Disneyland tickets If guest want to investigate more margin just Disneyland their Disneyland Universal Studios Hollywood bundle is gift great option. Shenzhen to passengers should i test if you have wifi on a variety of travel between shenzhen, closest to view from macau via major mtr. Its money do during this information we have been deleted. TurboJet provides ferry services between Hong Kong and Macao that take. Abbey travel coaches WINE online. It for 3 people the fares will be wet for with first bustrammetroferry the price. Taxi on lantau link toll plaza, choi hung hom to hong kong airport kowloon station and go the fastpass ticket at the annoying transfer. The fast of Hong Kong International Airport at Chek Lap Kok was completed. Victoria Harbour World News. Transport from Hong Kong Airport You can discriminate from Hong Kong Airport to the city center by terminal train bus or taxi. -

DFK Doing Business in Hong Kong

Doing Business in Hong Kong This document describes some of the key commercial and taxation factors that are relevant on setting up a business in Hong Kong. dfk.com Prepared by AMA CPA Limited +44 (0)20 7436 6722 2 Doing Business in Hong Kong Background Country overview The financial and securities sectors are regulated by: Hong Kong is located on the Southeast coast of China with a land area of about • The Hong Kong Monetary Authority; 1,100 square kilometres, comprising of Hong Kong Island, Kowloon Peninsula, • The Securities and Futures the New Territories and the outlying Commission; and islands. Hong Kong has a population of more than 7 million and three official • The Stock Exchange of Hong Kong languages which are English, Cantonese Limited. and Putonghua. Cantonese is the mother tongue in Hong Kong. Economic overview The People’s Republic of China (“PRC”) Hong Kong operates under a “laissez- resumed its sovereignty over Hong faire” economic system with minimal Kong when the Hong Kong Special Government interference in all sectors of Administrative Region (“HKSAR”) of the PRC the economy, and there are no exchange was established on July 1, 1997. The head controls. Hong Kong maintains its own of HKSAR is the Chief Executive who is monetary system and the Hong Kong elected for a five-year term, with approval dollar is pegged to the US dollar at the of the PRC. rate of 1US$ = 7.78 HKD. The Basic Law, which was adopted on April The HKSAR Government welcomes foreign 4, 1990, forms the written constitution of investment and there is no restriction on Hong Kong. -

Public Land Leasing in Hong Kong: Flexibility and Rigidity in Allocating the Surplus Land Value

PUBLIC LAND LEASING IN HONG KONG: FLEXIBILITY AND RIGIDITY IN ALLOCATING THE SURPLUS LAND VALUE by YU HUNG HONG B.S., Northeastern University (1987) M.C.P., Massachusetts Institute of Technology (1989) Submitted to the Department of Urban Studies and Planning in Partial Fulfillment to the Requirements for the Degree of DOCTOR OF PHILOSOPHY at the Massachusetts Institute of Technology May 1995 Yu Hung Hong, 1995. All rights reserved. The author hereby grants to MIT permission to reproduce and to distribute copies of this thesis document in whole or in part. Signature of Author Yu Hung Hong Department of Urban Studies and Planning May 1995 Certified by Karen R. Polenske Professor of Regional Political Economy and Planning Dissertation Supervisor Accepted by Karen R. Polenske Chairperson, Ph.D. Committee MASSACHUSE-rsSm Department of Urban Studies and Planning MASAum INSTITUTE JUL 111995 PUBLIC LAND LEASING IN HONG KONG: FLEXIBILITY AND RIGIDITY IN ALLOCATING THE SURPLUS LAND VALUE by Yu Hung Hong Submitted to the Department of Urban Studies and Planning in May 1995 in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy in Urban and Regional Studies ABSTRACT In this study, I examined the viability of four mechanisms of land-value capture under the public land-leasing systems, using Hong Kong as a case. Because the State is the landowner under a leasehold system, it can capture the land value through four ways: (1) at the initial establishment of land contracts, (2) by the collection of an annual land rent, (3) during lease renewals, and (4) through modifications of lease conditions. -

Tax and Investment Facts a Glimpse at Taxation and Investment in Hong Kong WTS Consulting (Hong Kong) Limited Hong Kong

Hong Kong Tax and Investment Facts A Glimpse at Taxation and Investment in Hong Kong WTS consulting (Hong Kong) Limited Hong Kong WTS Alliance, to which WTS WTS Hong Kong, part of WTS Hong Kong belongs, is a global which is headquartered network of selected consulting in Germany, offers a firms represented in more comprehensive service than 100 countries worldwide. portfolio to both national and Within our service portfolio we international corporations are focused on tax, legal and and individuals with regard to consulting. Our clients include their investments in Greater multinational groups, national China and across Asia. We and international medium- advise on a range of topics, sized companies, non-profit including Hong Kong, Chinese, organizations and private European and International tax clients. law, accounting, market entry and transfer pricing. Strategic Contact in Hong Kong planning for expatriate Ms. Connie Lee assignment programmes is a Head of Tax further key area of expertise. [email protected] +852 2380 2003 WTS Hong Kong provides value added services in the following areas: → International tax → Corporate tax → Tax controversy services → Transfer pricing → Mergers & acquisitions → Global expatriate services → International project management → Accounting and bookkeeping → Human resources advisory 2 Tax and Investment Facts | Hong Kong Table of Contents 1 Types of Business Structure / Legal Forms of Companies 4 2 Corporate Taxation 5 3 Double Taxation Agreements / Tax Information Exchange Agreements 12 4 Transfer Pricing 15 5 Anti-avoidance Measures 16 6 Taxation of Individuals / Social Security Contributions 17 7 Indirect Taxes 22 8 Inheritance and Gift Tax 25 9 Wealth Tax 25 Tax and Investment Facts | Hong Kong 3 1 Types of Business Structure / Legal Forms of Companies The most common legal forms of business in Hong Kong are the limited liability company, partnership, sole proprietorship, branch office of parent company and representative office.