Increasing Foreign Control of Canada's Telecommunications: No Evidence

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2017-18 Annual Report

Helping Canadians for 10+ YEARS 2017-18 ANNUAL REPORT “I was very impressed with your services” – L.T., wireless customer in BC “I was very satisfied with the process.” – H.R., internet customer in ON “Awesome service. We are very content with the service and resolution.” – G.C., phone customer in NS “My agent was nice and super understanding” – D.W., TV customer in NB “I was very impressed with your services” – L.T., wireless customer in BC “I was very satisfied with the process.”– H.R., internet customer in ON “Awesome service. We are very content with the service and resolution.” – G.C., phone customer in NS “My agent was nice and super understanding” – D.W., TV customer in NB “I was very impressed with your services” – L.T., wireless customer in BC “I was very satisfied with the process.”– H.R., internet customer in ON “Awesome service. We are very content with the service and resolution.” – G.C., phone customer in NS “My agent was nice and super understanding” – D.W., TV customer in NB “I was very impressed with your services” –L.T., wireless customer in BC “I was very satisfied with the process.” – H.R., internet customer in ON “Awesome service. We are very content with the service and resolution.” – G.C., phone customer in NS “My agent was nice and super understanding” – D.W., TV customer in NB “I was very impressed with your services” – L.T., wireless customer in BC P.O. Box 56067 – Minto Place RO, Ottawa, ON K1R 7Z1 www.ccts-cprst.ca [email protected] 1-888-221-1687 TTY: 1-877-782-2384 Fax: 1-877-782-2924 CONTENTS 2017-18 -

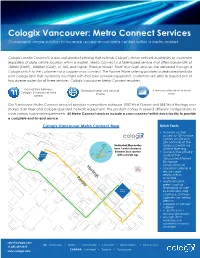

Cologix Vancouver: Metro Connect Services Convenient, Simple Solution to Increase Access Across Data Centres Within a Metro Market

Cologix Vancouver: Metro Connect Services Convenient, simple solution to increase access across data centres within a metro market Cologix’s Metro Connect is a low-cost product offering that extends Cologix’s dense network availability to customers regardless of data centre location within a market. Metro Connect is a fibre-based service that offers bandwidth of 100Mb (FastE), 1000Mb (GigE), or 10G and higher (Passive Wave). FastE and GigE services are delivered through a Cologix switch to the customer via a copper cross-connect. The Passive Wave offering provides a dedicated lambda over Cologix fibre that customers must light with their own network equipment. Customers are able to request one of two diverse routes for all three services. Cologix Vancouver Metro Connect enables: Connections between Extended carrier and network A low-cost alternative to local Cologix’s 2 Vancouver data choice loops centres Our Vancouver Metro Connect product provides connections between 1050 West Pender and 555 West Hastings over shared dark fiber and Cologix-operated network equipment. The product comes in several different confgurations to solve various customer requirements. All Metro Connect services include a cross-connect within each facility to provide a complete end-to-end service. Cologix Vancouver Metro Connect Map Quick Facts: • Network neutral access to 10+ unique carriers on-site plus 20+ networks at the Redundant bre routes ymor St. Harbour Centre via Se have 1 meter clearance diverse fibre ring 1 Meter between duct systems • Home to the primary -

Claimant's Memorial on Merits and Damages

Public Version INTERNATIONAL CENTRE FOR ICSID Case No. ARB/16/16 SETTLEMENT OF INVESTMENT DISPUTES BETWEEN GLOBAL TELECOM HOLDING S.A.E. Claimant and GOVERNMENT OF CANADA Respondent CLAIMANT’S MEMORIAL ON THE MERITS AND DAMAGES 29 September 2017 GIBSON, DUNN & CRUTCHER LLP Telephone House 2-4 Temple Avenue London EC4Y 0HB United Kingdom GIBSON, DUNN & CRUTCHER LLP 200 Park Avenue New York, NY 10166 United States of America Public Version TABLE OF CONTENTS I. Introduction ............................................................................................................................ 1 II. Executive Summary ............................................................................................................... 3 III. Canada’s Wireless Telecommunications Market And Framework For The 2008 AWS Auction................................................................................................................................. 17 A. Overview Of Canada’s Wireless Telecommunications Market Leading Up To The 2008 AWS Auction.............................................................................................. 17 1. Introduction to Wireless Telecommunications .................................................. 17 2. Canada’s Wireless Telecommunications Market At The Time Of The 2008 AWS Auction ............................................................................................ 20 B. The 2008 AWS Auction Framework And Its Key Conditions ................................... 23 1. The Terms Of The AWS Auction Consultation -

Spring/Summer Newsletter 2019

FREE Take One NEWS Spring/Summer 2019 Our Vision “Self reliant Indigenous people thriving in diverse economies” Exchanging Ideas and Growing Together: 2019 Annual Stakeholders Gathering April 24 marked the occasion of Pathways to Technology’s 2019 members talked about opportunities and challenges inherent annual gathering of stakeholders. Representatives from All in the ambitious Connected Coast project. The benefits are Nations Trust Company and the Pathways team spent the day innumerable, but the challenges are significant and include collaborating and exchanging ideas with representatives from issues like affordability, establishing connections to homes and First Nations Emergency Services Society, Write to Read, First buildings once the fibre backbone is in place, and the time- Nations Technology Council, First Nations Health Authority, consuming process of establishing the “passive infrastructure,” Network BC, the Ministry of Indigenous Relations and (such as land and access agreements and other administrative Reconciliation, Indigenous Services Canada, Nuu-Chah-Nulth matters), required to enable the project. Economic Development Corporation, Conuma Cable, TELUS, CityWest, and Strathcona Regional District. TELUS’ Aurora Sekela and PTT’s Thant Nyo presented next and provided a brief case study on the challenges of connecting Musqueam Elder Shane Pointe opened the session with a Penelakut Island. Lessons learned include the importance of welcome and a prayer. During this, attendees held hands with engaging communities early on to identify and solve logistical one-another and reflected on Pointe’s observation that, in the issues that can otherwise cause delays, and of streamlining past, “pathways” were the means by which people would get internal processes to maximize efficiency. -

SCHEDULE H – SERVICE DESCRIPTIONS 1. in Accordance with the Agreement, TELUS Will As of the Effective Date Make Available to T

SCHEDULE H – SERVICE DESCRIPTIONS 1. In accordance with the Agreement, TELUS will as of the Effective Date make available to the GPS Entities the Available Services described in the following Attachments to this Schedule H: a) Attachment H1 - Long Distance Services; i) Attachment H1-A – Outbound Long Distance Services; ii) Attachment H1-B – Calling Card Services; and iii) Attachment H1-C – Toll-Free Services; b) Attachment H2 – Conferencing Services; i) Attachment H2-A - Reservation-less Conferencing Services; ii) Attachment H2-B - Operator Assisted Conferencing Services; iii) Attachment H2-C - Event Conferencing Services; iv) Attachment H2-D - Web Conferencing Services; and v) Attachment H2-E – Crisis Management Conferencing Services; c) Attachment H3 – Voice Services; i) Attachment H3-A – Hosted Telephony Services; ii) Attachment H3-B – Exchange Services; and iii) Attachment H3-C - Hosted IVR Services; d) Attachment H5 – Data Services; i) Attachment H5-A – Initial Data Services ii) Attachment H5-B – Internet and Security Services; iii) Attachment H5-C – Optical Ethernet Service; and iv) Attachment H5-E – STS WAN L3 VPN Services; and e) Attachment H9 – Cellular Services; i) Attachment H9-A – Standard Cellular Services; and ii) Attachment H9-B – iDEN Network (Mike) Services; and f) Attachment H10 – Hardware and Software Procurement Services. 1 Telecommunications Services Master Agreement 2. TELUS will provide the Available Services described in the Attachments to this Schedule if and when requested by a GPS Entity pursuant to a Service Order or Service Change Order, subject to section 7.4.3 of the main body of this Agreement, in each case entered into in accordance with the terms of this Agreement, for the applicable Fees as set out in the Price Book and/or, subject to section 1.3.3 of the main body of this Agreement, the applicable Service Order or Service Change Order and as such Available Services are delivered in accordance with the terms of the Agreement including, without limitation, the Service Levels for such Services. -

Matters Related to the Reliability and Resiliency of the 9-1-1 Networks

Telecom Regulatory Policy CRTC 2016-165 PDF version Reference: Telecom Notice of Consultation 2015-305 Ottawa, 2 May 2016 File number: 8665-C12-201507008 Matters related to the reliability and resiliency of the 9-1-1 networks Canadians rely on the continuous operation of 9-1-1 services to seek help during an emergency. Given the importance of 9-1-1 services to the health and safety of Canadians, the Commission conducted a public proceeding to examine a number of relevant issues. Overall, the 9-1-1 networks in Canada are reliable and resilient. As a result, very few 9-1-1 service outages that impact the delivery of 9-1-1 voice calls have occurred over the last five years. Therefore, the Commission will not establish prescriptive regulatory measures but, instead, directs 9-1-1 network providers to take all reasonable measures to ensure that their 9-1-1 networks are reliable and resilient to the maximum extent feasible, and establishes certain notification and reporting requirements. Regarding concerns raised about MTS Inc.’s (MTS) 9-1-1 service backup solution, the Commission directs MTS and interconnecting telephone service providers in Manitoba to work together to establish interconnection arrangements with MTS’s backup solution. Background 1. Effective access to emergency services is critical to the health and safety of citizens, and is an important part of the Commission’s role in ensuring that Canadians have access to a world-class communication system.1 Canadians have come to rely on the continuous operation of 9-1-1 services to seek help during an emergency. -

Case 20-32299-KLP Doc 208 Filed 06/01/20 Entered 06/01/20 16

Case 20-32299-KLP Doc 208 Filed 06/01/20 Entered 06/01/20 16:57:32 Desc Main Document Page 1 of 137 Case 20-32299-KLP Doc 208 Filed 06/01/20 Entered 06/01/20 16:57:32 Desc Main Document Page 2 of 137 Exhibit A Case 20-32299-KLP Doc 208 Filed 06/01/20 Entered 06/01/20 16:57:32 Desc Main Document Page 3 of 137 Exhibit A1 Served via Overnight Mail Name Attention Address 1 Address 2 City State Zip Country Aastha Broadcasting Network Limited Attn: Legal Unit213 MezzanineFl Morya LandMark1 Off Link Road, Andheri (West) Mumbai 400053 IN Abs Global LTD Attn: Legal O'Hara House 3 Bermudiana Road Hamilton HM08 BM Abs-Cbn Global Limited Attn: Legal Mother Ignacia Quezon City Manila PH Aditya Jain S/O Sudhir Kumar Jain Attn: Legal 12, Printing Press Area behind Punjab Kesari Wazirpur Delhi 110035 IN AdminNacinl TelecomunicacionUruguay Complejo Torre De Telecomuniciones Guatemala 1075. Nivel 22 HojaDeEntrada 1000007292 5000009660 Montevideo CP 11800 UY Advert Bereau Company Limited Attn: Legal East Legon Ars Obojo Road Asafoatse Accra GH Africa Digital Network Limited c/o Nation Media Group Nation Centre 7th Floor Kimathi St PO Box 28753-00100 Nairobi KE Africa Media Group Limited Attn: Legal Jamhuri/Zaramo Streets Dar Es Salaam TZ Africa Mobile Network Communication Attn: Legal 2 Jide Close, Idimu Council Alimosho Lagos NG Africa Mobile Networks Cameroon Attn: Legal 131Rue1221 Entree Des Hydrocarbures Derriere Star Land Hotel Bonapriso-Douala Douala CM Africa Mobile Networks Cameroon Attn: Legal BP12153 Bonapriso Douala CM Africa Mobile Networks Gb, -

2013 BCE Q4 Safe Harbour Notice

BCE INC. Safe Harbour Notice Concerning Forward-Looking Statements February 6, 2014 Safe Harbour Notice Concerning Forward-Looking Statements In this document, we, us, our and BCE mean either BCE Inc. or, collectively, BCE Inc., its subsidiaries, joint arrangements and associates. Bell means our Bell Wireline, Bell Wireless and Bell Media segments on an aggregate basis. Bell Aliant means either Bell Aliant Inc. or, collectively, Bell Aliant Inc., its subsidiaries and associates. Certain statements made in the presentations entitled “Q4 2013 Results and 2014 Analyst Guidance Call”, dated February 6, 2014, and certain oral statements made by our senior management during Bell’s 2014 analyst guidance call held on February 6, 2014 (Bell’s 2014 Analyst Guidance Call), including, but not limited to, statements relating to BCE’s financial guidance (including revenues, EBITDA, capital intensity (Capital Intensity), Adjusted EPS and free cash flow (Free Cash Flow))1, BCE’s business outlook, objectives, plans and strategic priorities, BCE’s 2014 annualized common share dividend, common share dividend policy and targeted dividend payout ratio, Bell Canada’s financial policy targets, our expected 2014 pension cash funding, revenues and EBITDA expected to be generated from growth services, our broadband fibre, Internet protocol television (IPTV) and wireless networks deployment plans, and other statements that are not historical facts, are forward-looking statements. In addition, we or others on our behalf may make other written or oral statements that are forward-looking from time to time. A statement we make is forward-looking when it uses what we know and expect today to make a statement about the future. -

Cover Letter to CRTC

PUBLIC INTEREST ADVOCACY CENTRE LE CENTRE POUR LA DÉFENSE DE L’INTÉRÊT PUBLIC ONE Nicholas Street, Suite 1204, Ottawa, Ontario, Canada K1N 7B7 Tel: (613) 562-4002. Fax: (613) 562-0007. e-mail: [email protected] http://www.piac.ca October 22, 2013 Canadian Radio-Television and Telecommunications Commission Ottawa, ON K1A 0N2 BY ACCESS KEY Attention: Mr. John Traversy, Secretary General Dear Mr. Traversy: Re: Part 1 Application by the Public Interest Advocacy Centre and Consumers' Association of Canada Regarding Certain Telecommunications Service Provider Billing Practices (Pay for Paper Bills) The Public Interest Advocacy Centre (“PIAC”) and the Consumers’ Association of Canada (“CAC”) hereby make an application to the Commission under Part 1 of the CRTC Rules of Practice and Procedure to issue certain directives to the Respondent Telecommunications Service Providers (collectively, “TSPs”) regarding fees these providers have been charging for providing billing in a paper format. Electronic service of this application has been made to the respondents by e-mail, with the associated attachments. This application has also been posted to PIAC’s website at http://www.piac.ca. Yours truly, Original signed John Lawford Counsel for PIAC and CAC Cc: Bell Aliant Regional Communications, Limited Partnership, Bell Canada, MTS Inc., Saskatchewan Telecommunications, TELUS Communications Company, Data & Audio Visual Enterprises Wireless Inc. (Mobilicity), Globalive Wireless Management Corp., Yak Communications (Canada) Corp., Public Mobile Inc., Novus Entertainment -

News Release

News Release November 5, 2010 TELUS Reports Third Quarter 2010 Results Positive trends continue with strong wireless results, record TV additions and cash flow growth Five per cent quarterly dividend increase to 52.5 cents per share Vancouver, B.C. – TELUS Corporation reported third quarter 2010 revenue of $2.46 billion, an increase of two per cent, as continued growth in wireless revenues and wireline data revenues more than offset declines in traditional voice services. Consolidated earnings before interest, taxes, depreciation and amortization (EBITDA) increased by 1.5 per cent due to revenue growth, lower restructuring costs and ongoing benefits from efficiency initiatives. Over the last 12 months, total customer connections increased by 347,000 generated by a 6.8 per cent increase in wireless subscribers and 94 per cent growth in TELUS TV customers, partially offset by continued declines in landline connections. Reported net income and earnings per share (EPS) for the second quarter were $247 million and 77 cents, representing year-over-year decreases of 12 and 13 per cent, respectively. The declines were due to an after-tax impact of approximately $37 million or 12 cents per share from the costs of the early partial redemption of 2011 Notes financed with the proceeds of the successful $1 billion Note issue in July 2010. This redemption will result in future interest cost savings. Third quarter net income and EPS also included an after tax regulatory financing charge of approximately $11 million or three cents per share and favourable income tax-related adjustments of approximately $9 million or three cents per share (compared to $14 million or four cents in the same period a year ago). -

Estate File No.: 31-2531575 in the MATTER of the BANKRUPTCY

ksv advisory inc. 150 King Street West, Suite 2308 Toronto, Ontario, M5H 1J9 T +1 416 932 6262 F +1 416 932 6266 ksvadvisory.com Estate File No.: 31-2531575 IN THE MATTER OF THE BANKRUPTCY OF GREAT SLAVE HELICOPTERS LTD., OF THE CITY OF TORONTO, IN THE PROVINCE OF ONTARIO NOTICE OF BANKRUPTCY AND FIRST MEETING OF CREDITORS (Subsection 102(1)) Take notice that: 1. Great Slave Helicopters Ltd. filed an assignment in bankruptcy on the 8th day of July, 2019 and KSV Kofman Inc. was appointed trustee of the estate of the bankrupt by the Office of the Superintendent of Bankruptcy, subject to affirmation by the creditors of the trustee's appointment or the substitution of another trustee by the creditors. 2. The first meeting of creditors of the bankrupt will be held on the 24th day of July, 2019, at 2:00 p.m., at the offices of Goodmans LLP, 333 Bay Street, Suite 3400, Bay Adelaide Centre, West Tower, Toronto, Ontario. 3. To be entitled to vote at the meeting, creditors must lodge with the trustee, prior to the meeting, proofs of claim and, where necessary, proxies. 4. Enclosed with this notice is a form of proof of claim, a form of general proxy, and a list of creditors with claims amounting to twenty-five dollars or more, showing the amounts of their claims. 5. Creditors must prove their claims against the estate of the bankrupt in order to share in any distribution of the proceeds realized from the estate. DATED at Toronto, Ontario, this 15th day of July, 2019. -

Court File No. CV-16-11257-00CL ONTARIO SUPERIOR COURT of JUSTICE COMMERCIAL LIST

Court File No. CV-16-11257-00CL ONTARIO SUPERIOR COURT OF JUSTICE COMMERCIAL LIST IN THE MATTER OF THE COMPANIES’ CREDITORS ARRANGEMENT ACT, R.S.C. 1985, c. C-36, AS AMENDED AND IN THE MATTER OF A PLAN OF COMPROMISE OR ARRANGEMENT OF PT HOLDCO, INC., PRIMUS TELECOMMUNICATIONS CANADA, INC., PTUS, INC., PRIMUS TELECOMMUNICATIONS, INC., AND LINGO, INC. (Applicants) APPROVAL AND VESTING ORDER SERVICE LIST GENERAL STIKEMAN ELLIOTT LLP Samantha Horn 5300 Commerce Court West Tel: (416) 869- 5636 199 Bay Street Email: [email protected] Toronto, ON M5L 1B9 Maria Konyukhova Tel: (416) 869-5230 Email: [email protected] Kathryn Esaw Tel: (416) 869-6820 Email: [email protected] Vlad Calina Tel: (416) 869-5202 Lawyers for the Applicants Email: [email protected] FTI CONSULTING CANADA INC. Nigel D. Meakin TD Waterhouse Tower Tel: (416) 649-8100 79 Wellington Street, Suite 2010 Fax: (416) 649-8101 Toronto, ON M5K 1G8 Email: [email protected] Steven Bissell Tel: (416) 649-8100 Fax: (416) 649-8101 Email: [email protected] Kamran Hamidi Tel: (416) 649-8100 Fax: (416) 649-8101 Monitor Email: [email protected] 2 BLAKE, CASSELS & GRAYDON LLP Linc Rogers 199 Bay Street Tel: (416) 863-4168 Suite 4000, Commerce Court West Fax: (416) 863-2653 Toronto, ON M5L 1A9 Email: [email protected] Aryo Shalviri Tel: (416) 863- 2962 Fax: (416) 863-2653 Lawyers for the Monitor Email: [email protected] DAVIES WARD PHILLIPS VINEBERG LLP Natasha MacParland 155 Wellington Street West Tel: (416) 863 5567 Toronto, ON M5V 3J7 Fax: (416) 863 0871 Email: [email protected] Lawyers for the Bank of Montreal, as Administrative Agent for the Syndicate FOGLER, RUBINOFF LLP Gregg Azeff 77 King Street West Tel: (416) 365-3716 Suite 3000, P.O.