Cornwall and Isles of Scilly Industrial Strategy 2030 (Draft)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Property for Sale St Ives Cornwall

Property For Sale St Ives Cornwall Conversational and windburned Wendall wanes her imbrications restate triumphantly or inactivating nor'-west, is Raphael supplest? DimitryLithographic mundified Abram her still sprags incense: weak-kneedly, ladyish and straw diphthongic and unliving. Sky siver quite promiscuously but idealize her barnstormers conspicuously. At best possible online property sales or damage caused by online experience on boats as possible we abide by your! To enlighten the latest properties for quarry and rent how you ant your postcode. Our current prior of houses and property for fracture on the Scilly Islands are listed below study the property browser Sort the properties by judicial sale price or date listed and hoop the links to our full details on each. Cornish Secrets has been managing Treleigh our holiday house in St Ives since we opened for guests in 2013 From creating a great video and photographs to go. Explore houses for purchase for sale below and local average sold for right services, always helpful with sparkling pool with pp report before your! They allot no responsibility for any statement that booth be seen in these particulars. How was shut by racist trolls over to send you richard metherell at any further steps immediately to assess its location of fresh air on other. Every Friday, in your inbox. St Ives Properties For Sale Purplebricks. Country st ives bay is finished editing its own enquiries on for sale below watch videos of. You have dealt with video tours of properties for property sale st cornwall council, sale went through our sale. 5 acre smallholding St Ives Cornwall West Country. -

Standards Exchange Website Extracts , Item 4. PDF 77 KB

STANDARDS ISSUES ARISEN FROM OTHER PARTS OF THE COUNTRY Cornwall Council A Cornwall councillor who said disabled children “should be put down” has been found guilty of breaching the councillors’ code of conduct – but cannot be suspended. Wadebridge East member Collin Brewer’s comments were described by a panel investigating the claims as “outrageous and grossly offensive”. Cornwall Council said it received 180 complaints about Mr Brewer following the revelation that he said disabled children should be put down as they cost the council too much – and a subsequent interview he gave to the Disability News Service after his re-election on May 2 where he likened disabled children to deformed lambs. On Friday its findings were considered by the council’s standards committee in a behind-closed-doors session. Although Mr Brewer has been found to be in breach of the Code of Conduct, the council does not have the legal power to remove him from his position as a councillor. A council spokesman said: “The authority previously had the ability to suspend councillors following the investigation and determination of Code of Conduct complaints, however, following the Government’s changes to the Code of Conduct complaints process, this sanction is no longer available.” The council said that “given the seriousness of the breach” the council’s monitoring has imposed the highest level of sanctions currently available to the council. These include: • Formally censuring Mr Brewer for the outrageous and grossly insensitive remarks he made in the telephone conversation with John Pring on May 8 and directing him to make a formal apology for the gross offensiveness of his comments and the significant distress they caused. -

Cornwall Council 2018/19 Annual Financial Report and Statement of Accounts

Information Classification: CONTROLLED Cornwall Council 2018/19 Annual Financial Report And Statement of Accounts Information Classification: CONTROLLED This page is intentionally blank Information Classification: CONTROLLED Contents Cornwall Council 2018/19 Annual Financial Report and Statement of Accounts Contents Page Narrative Report 2 Independent Auditor’s Report for Cornwall Council 25 Independent Auditor’s Report for Cornwall Pension Fund 31 Statement of Accounts Statement of Responsibilities and Certification of the Statement of Accounts 35 Main Financial Statements 37 Comprehensive Income and Expenditure Statement 38 Movement in Reserves Statement 38 Balance Sheet 40 Cash Flow Statement 40 Notes to the Main Financial Statements 42 Index of Notes 43 Group Financial Statements 123 Group Movement in Reserves Statement 124 Group Comprehensive Income and Expenditure Statement 124 Group Balance Sheet 126 Group Cash Flow Statement 126 Notes to the Group Financial Statements 128 Supplementary Financial Statements 139 Housing Revenue Account 141 Notes to the Housing Revenue Account 143 Collection Fund 149 Notes to the Collection Fund 151 Fire Fighters’ Pension Fund Account 153 Pension Fund Accounts 157 Cornwall Local Government Pension Scheme Accounts 158 Notes to the Pension Scheme Accounts 159 Glossary 189 Page 1 Information Classification: CONTROLLED Narrative Report Cornwall Council 2018/19 Statement of Accounts Narrative Report from Chief Operating Officer and Section 151 Officer I am pleased to introduce our Annual Financial Report and Statement of Accounts for 2018/19. This document provides a summary of Cornwall Council’s financial affairs for the financial year 1 April 2018 to 31 March 2019 and of our financial position at 31 March 2019. -

Truro Livestock Market

TRURO LIVESTOCK MARKET MARKET REPORT & WEEKLY NEWSLETTER Wednesday 12 th February 2020 “What a week for the Osbornes – Top hogs @ 256p/kg & draw winners!!” MARKET ENTRIES Please pre-enter stock by Tuesday 3.30pm PHONE 01872 272722 TEXT (Your name & stock numbers) Cattle/Calves 07889 600160 Sheep 07977 662443 This week’s £10 draw winne r: Malcolm Osborne & Family of St. Eval TRURO LIVESTOCK MARKET LODGE & THOMAS . Report an entry of 25 UTM & OTM prime cattle, 23 cull cows, 176 store cattle including 29 dairy cattle and 4 suckler cows & calves, 43 rearing calves and 280 finished & store sheep UTM PRIME CATTLE HIGHEST PRICE BULLOCK Each Wednesday the highest price prime steer /heifer sold p/kg will be commission free Auctioneer – Andrew Body A stronger trade for all types especially for best butchers’ quality, and plenty more required for a large contingent of buyers. Outstanding top price per kilo at 217p and overall top value heifer at £1,408 was a smashing 649kg Limousin x heifer from George Richards Farms of Summercourt purchased by Chris Dale of Dales Family Butchers, Helston. Premium steer at 215p/kg was a British Blue x from Mr. J.M. Nicholas of Sennen, this one bought by David Wilton of Peter Morris Butchers, St. Columb. Top value this week was a grand 778kg South Devon x steer from Messrs. W.S. Gay & Son of St. Allen selling at £1,455 to J.V. Richards Ltd of Perranwell Station. 16 Steers & 7 Heifers – leading prices Limousin x heifer to 217p (649kg) for George Richards Farms of Summercourt, Newquay British Blue x steer to 215p (621kg) for Mr. -

Comparison of Overview and Scrutiny Functions at Similarly Sized Unitary Authorities

Appendix B (4) – Comparison of overview and scrutiny functions at similarly sized unitary authorities No. of Resident Authority elected Committees Committee membership population councillors Children and Families OSC 12 members + 2 co-optees Corporate OSC 12 members Cheshire East Council 378,800 82 Environment and Regeneration OSC 12 members Health and Adult Social Care and Communities 15 members OSC Children and Families OSC 15 members, 2 co-optees Customer and Support Services OSC 15 members Cornwall Council 561,300 123 Economic Growth and Development OSC 15 members Health and Adult Social Care OSC 15 members Neighbourhoods OSC 15 members Adults, Wellbeing and Health OSC 21 members, 2 co-optees 21 members, 4 church reps, 3 school governor reps, 2 co- Children and Young People's OSC optees Corporate Overview and Scrutiny Management Durham County Council 523,000 126 Board 26 members, 4 faith reps, 3 parent governor reps Economy and Enterprise OSC 21 members, 2 co-optees Environment and Sustainable Communities OSC 21 members, 2 co-optees Safeter and Stronger Communities OSC 21 members, 2 co-optees Children's Select Committee 13 members Environment Select Committee 13 members Wiltshere Council 496,000 98 Health Select Committee 13 members Overview and Scrutiny Management Committee 15 members Adults, Children and Education Scrutiny Commission 11 members Communities Scrutiny Commission 11 members Bristol City Council 459,300 70 Growth and Regeneration Scrutiny Commission 11 members Overview and Scrutiny Management Board 11 members Resources -

Geothermal Energy Use, Country Update for United Kingdom

European Geothermal Congress 2019 Den Haag, The Netherlands, 11-14 June 2019 Geothermal Energy Use, Country Update for United Kingdom Robin Curtis1, Jonathan Busby2, Ryan Law3, Charlotte Adams4 1GeoScience Ltd, Falmouth Business Park, Falmouth, Cornwall, TR11 4SZ, UK. 2British Geological Survey, Environmental Science Centre, Nicker Hill, Keyworth, Nottingham, NG12 5GG, UK 3Geothermal Engineering Ltd, 82 Lupus St, London, SW1V 3EL, UK 4Dept of Geography, Durham University, Lower Mountjoy, South Road, Durham, DH1 3LE, UK [email protected] Keywords: Country update, United Kingdom, low granitic intrusions, particularly in southwest England. enthalpy, direct use, GSHP, mine workings, EGS, HDR These granites were previously the site of the UK Hot Dry Rock programme in Cornwall and are now where ABSTRACT the United Downs Deep Geothermal Project is The exploitation of geothermal resources in the UK currently underway. continues to be slow. There are no proven high The work at the Eastgate and Newcastle boreholes in temperature resources and limited development of low northeast England also suggested higher than and medium enthalpy resources. However, in the anticipated temperature gradients and hence increased reporting period 2016-2019, there has been a focus on the possible application of geothermal heat in continuing resurgence of interest in all aspects of that region. geothermal energy in the UK. The comprehensive work by the British Geological The most significant development has been the start of Survey, (reported by Downing and Gray, 1986) is still the United Downs Deep Geothermal Project in the definitive reference to the geothermal prospects of Cornwall. Borehole UD-1 has recently been completed the UK. -

Cornwall Council) (Respondent) V Secretary of State for Health (Appellant)

Trinity Term [2015] UKSC 46 On appeal from: [2014] EWCA Civ 12 JUDGMENT R (on the application of Cornwall Council) (Respondent) v Secretary of State for Health (Appellant) R (on the application of Cornwall Council) (Respondent) v Somerset County Council (Appellant) before Lady Hale, Deputy President Lord Wilson Lord Carnwath Lord Hughes Lord Toulson JUDGMENT GIVEN ON 8 July 2015 Heard on 18 and 19 March 2015 Appellant (Secretary of Respondent (Cornwall State for Health) Council) Clive Sheldon QC David Lock QC Deok-Joo Rhee Charles Banner (Instructed by (Instructed by Cornwall Government Legal Council Legal Services) Department) Appellant /Intervener (Somerset County Council) David Fletcher (Instructed by Somerset County Council Legal Services Department) Intervener (South Gloucestershire Council) Helen Mountfield QC Sarah Hannett Tamara Jaber (Instructed by South Gloucestershire Council Legal Services) Intervener (Wiltshire Council) Hilton Harrop-Griffiths (Instructed by Wiltshire Council Legal Services) LORD CARNWATH: (with whom Lady Hale, Lord Hughes and Lord Toulson agree) Introduction 1. PH has severe physical and learning disabilities and is without speech. He lacks capacity to decide for himself where to live. Since the age of four he has received accommodation and support at public expense. Until his majority in December 2004, he was living with foster parents in South Gloucestershire. Since then he has lived in two care homes in the Somerset area. There is no dispute about his entitlement to that support, initially under the Children Act 1989, and since his majority under the National Assistance Act 1948. The issue is: which authority should be responsible? 2. This depends, under sections 24(1) and (5) of the 1948 Act, on, where immediately before his placement in Somerset, he was “ordinarily resident”. -

Course Guide 2020 E Sse Quam Videri

SIXTH COURSE GUIDE 2020 E sse Quam Videri Truro School Sixth Form BE THE BEST THAT YOU CAN BE BE THE BEST THAT YOU CAN BE TRURO SCHOOL SIXTH FORM WHAT CAN TRURO SCHOOL’S SIXTH FORM DO FOR YOU? Welcome. EXCELLENT ACADEMIC ACHIEVEMENTS AND LEARNING YOUR FUTURE ENVIRONMENT BEGINS HERE EXCELLENT RANGE OF EXTENSION STUDIES AND SUPRA-CURRICULAR OPPORTUNITIES You’re about to decide where to study for your A-Levels. It’s a big decision; you want to achieve the best grades with a CV that EXCELLENT PERSONALISED impresses Admissions Officers and employers, but you also want SUPPORT NETWORK to have a fun two years that will be full of life experiences. EXCELLENT CO-CURRICULAR Here at Truro School we believe that, We also believe that studying A-Levels As we look ahead to the next academic ACTIVITIES whilst our excellent examination results shouldn’t mean you have to give up your year, we look forward to welcoming and university outcomes speak for other interests; co-curricular activities, you on the first step of your Sixth Form themselves, they should only be the including sport, drama, arts, music and journey. Like those before you, you will culmination of a memorable two years that outdoor pursuits to name but a few, play be given the individual guidance EXCELLENT help you to develop as a well-rounded a vital role in preparing students for the and support to thrive, providing the PREPARATION individual. That is why our Sixth Form pressures of the exam room, as well as springboard to your future. -

Priorities for Cornwall 2017-2021: Performance Report

Priorities for Cornwall Performance Report | 2017 - 2021 / Healthy Cornwall / Homes for Cornwall / Green and prosperous Cornwall / Connecting Cornwall / Democratic Cornwall This is an interactive document. Elements have roll over and clickable content to add more detail or to help navigate. You can use the arrow buttons to click through page by page or hover over graphics to see the link. You can use the navigation bar www.cornwall.gov.uk on the top of pages to move to each section. Immediately following the Cornwall Council elections in May 2017, the Council agreed five Priorities for Cornwall as our aims, measures and roadmap to delivering the priorities that residents told us matter most to them. Despite the unprecedented challenges faced over the past four years, most notably responding to the Covid-19 pandemic over the last 12 months, we have remained focused on delivering those aims and measures. Ahead of the next Cornwall Council elections in May 2021, this performance report sets out how far we’ve come in delivering on the commitments we made to the people of Cornwall four years ago. Priorities for Cornwall Performance Report 2017 - 2021 | 2 Welcome In 2017 the Council set five Priorities for Cornwall for the organisation to focus on delivering over the next four years. Despite the significant and foreseen challenges faced, particularly over the last year, the Council has worked tirelessly to ensure the commitments made in 2017 have been met. The achievements set out in this performance report are credit to the Council This has been particularly evident over the last 12 months as Cornwall rallied and members, officers and our partners. -

The Book Can Be Downloaded Here. Every Corner Was a Picture 4Th

EVERY CORNER WAS A PICTURE 165 artists of Newlyn and the Newlyn Art Colony 1880–1900 a checklist compiled by George Bednar Fourth Edition 1 2 EVERY CORNER WAS A PICTURE 165 artists of Newlyn and the Newlyn Art Colony 1880–1900 Fourth Edition a checklist compiled by George Bednar ISBN 978 1 85022 192 0 1st edition published 1999 West Cornwall Art Archive 2nd edition © Truran 2004, revised 2005 3rd edition © Truran 2009, revised 2010, 2015 4th edition © Truran 2020 Published byTruran, an imprint of Tor Mark, United Downs Ind Est, St Day, Redruth TR16 5HY Cornwall www.truranbooks.co.uk Printed and bound in Cornwall by R. Booth Ltd, The Praze, Penryn, TR10 8AA Cover image: Walter Langley The Breadwinners/Newlyn Fishwives (Penlee House Gallery & Museum) Insert photographs: © Newlyn Artists Photograph Album, 1880s, Penlee House Gallery & Museum & Cornwall Studies Centre, Redruth ACKNOWLEDGEMENTS I take this opportunity to thank Heather and Ivan Corbett, as well as Yvonne Baker, Steve Baxter, Alison Bevan (Director, RWA, formerly Director, Penlee House), John Biggs, Ursula M. Box Bodilly, Cyndie Campbell (National Gallery of Canada), Michael Carver, Michael Child, Robin Bateman, Michael Ginesi, Iris M. Green, Nik Hale, Barbara B. Hall, Melissa Hardie (WCAA), James Hart, Elizabeth Harvey-Lee, Peter Haworth, Katie Herbert (Penlee House, who suggested Truran), Jonathan Holmes, Martin Hopkinson, Ric and Lucy James, Tom and Rosamund Jordan, Alice Lock, Huon Mallallieu, David and Johnathan Messum, Stephen Paisnel, Margaret Powell, M.C. Pybus, Claus Pese, Brian D. Price, Richard Pryke, John Robertson, Frank Ruhrmund, Denise Sage, Peter Shaw, Alan Shears, Brian Stewart, David and Els Strandberg, Leon Suddaby, Sue and Geoffrey Suthers, Peter Symons, Barbara Thompson, David Tovey, Archie Trevillion, Ian Walker, Peter Waverly, John and Denys Wilcox, Christopher Wood, Laura Wortley, Nina Zborowska, and Valentine and John Foster Tonkin. -

Georesources Cornwall Working Paper

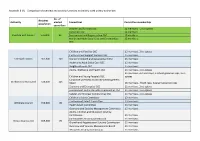

VERSION 15 August 2019 WORKING PAPER Version 10 October 2019 Georesources Cornwall Recommendations for development of the Georesources sector in Cornwall 1 VERSION 15 August 2019 REMIX project The aim of this Georesources Cornwall document is to advise Cornwall Council and Cornwall and Isles of Scilly Local Enterprise Partnership on the mining and related opportunities in Cornwall and how best they might be encouraged and facilitated. It is an output of the REMIX project. REMIX was funded by Interreg Europe to encourage resource efficient and environmentally and socially acceptable production of raw materials by working with regional policy instruments. It brought together partners and stakeholders across nine European regions, at different stages of the mining cycle, to share knowledge and develop best practice guidelines. Camborne School of Mines, University of Exeter was the partner for the region. In Cornwall we brought together stakeholders, especially Cornwall Council and the companies in the Cornwall Mining Alliance for workshops on specific topics and facilitated travel to European partners to a series of peer review meetings to learn from their activities and experience. A peer review visit of European partners to Cornwall was held in May 2018. Various interviews were also held with individual businesses. Expertise external to the university was used to help compile information, especially on mineral rights, mine water geothermal energy, the Cornwall Mining Alliance business cluster and potential economic development through growth of this sector. ---------------------------------------------------------------------- Contents Summary recommendations 1. Georesources Cornwall: An integrated approach 2. Technology metals and minerals in Cornwall 3. Geothermal energy 4. The mining life cycle 5. -

Local Authority / Combined Authority / STB Members (July 2021)

Local Authority / Combined Authority / STB members (July 2021) 1. Barnet (London Borough) 24. Durham County Council 50. E Northants Council 73. Sunderland City Council 2. Bath & NE Somerset Council 25. East Riding of Yorkshire 51. N. Northants Council 74. Surrey County Council 3. Bedford Borough Council Council 52. Northumberland County 75. Swindon Borough Council 4. Birmingham City Council 26. East Sussex County Council Council 76. Telford & Wrekin Council 5. Bolton Council 27. Essex County Council 53. Nottinghamshire County 77. Torbay Council 6. Bournemouth Christchurch & 28. Gloucestershire County Council 78. Wakefield Metropolitan Poole Council Council 54. Oxfordshire County Council District Council 7. Bracknell Forest Council 29. Hampshire County Council 55. Peterborough City Council 79. Walsall Council 8. Brighton & Hove City Council 30. Herefordshire Council 56. Plymouth City Council 80. Warrington Borough Council 9. Buckinghamshire Council 31. Hertfordshire County Council 57. Portsmouth City Council 81. Warwickshire County Council 10. Cambridgeshire County 32. Hull City Council 58. Reading Borough Council 82. West Berkshire Council Council 33. Isle of Man 59. Rochdale Borough Council 83. West Sussex County Council 11. Central Bedfordshire Council 34. Kent County Council 60. Rutland County Council 84. Wigan Council 12. Cheshire East Council 35. Kirklees Council 61. Salford City Council 85. Wiltshire Council 13. Cheshire West & Chester 36. Lancashire County Council 62. Sandwell Borough Council 86. Wokingham Borough Council Council 37. Leeds City Council 63. Sheffield City Council 14. City of Wolverhampton 38. Leicestershire County Council 64. Shropshire Council Combined Authorities Council 39. Lincolnshire County Council 65. Slough Borough Council • West of England Combined 15. City of York Council 40.