An Alabama Lottery: Theft by Consent

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Color Line in Ohio Public Schools, 1829-1890

THE COLOR LINE IN OHIO PUBLIC SCHOOLS, 1829-1890 DISSERTATION Presented In Partial Fulfillment of the Requirements for the Degree Doctor of Philosophy in the Graduate School of The Ohio State University By LEONARD ERNEST ERICKSON, B. A., M. A, ****** The Ohio State University I359 Approved Adviser College of Education ACKNOWLEDGMENTS This dissertation is not the work of the author alone, of course, but represents the contributions of many persons. While it is impossible perhaps to mention every one who has helped, certain officials and other persons are especially prominent in my memory for their encouragement and assistance during the course of my research. I would like to express my appreciation for the aid I have received from the clerks of the school boards at Columbus, Dayton, Toledo, and Warren, and from the Superintendent of Schools at Athens. In a similar manner I am indebted for the courtesies extended to me by the librarians at the Western Reserve Historical Society, the Ohio State Library, the Ohio Supreme Court Library, Wilberforce University, and Drake University. I am especially grateful to certain librarians for the patience and literally hours of service, even beyond the high level customary in that profession. They are Mr. Russell Dozer of the Ohio State University; Mrs. Alice P. Hook of the Historical and Philosophical Society; and Mrs. Elizabeth R. Martin, Miss Prances Goudy, Mrs, Marion Bates, and Mr. George Kirk of the Ohio Historical Society. ii Ill Much of the time for the research Involved In this study was made possible by a very generous fellowship granted for the year 1956 -1 9 5 7, for which I am Indebted to the Graduate School of the Ohio State University. -

Disparate Treatment Analysis

The Diocese of Southern Ohio in Partnership with the Kirwan Institute for the Study of Race and Ethnicity – The Ohio State University The Bishop’s Task Force on Racial Profiling Volume 2 – Disparate Treatment Analysis Citizenship and Racial Profiling Merelyn Bates-Mims, PhD – Principal Investigator Sharon Davies, JD – Principal Investigator Campuses Eric Abercrumbie, PhD; Prince Brown, PhD; Gary Boyle, PPC; Charles O. Dillard, MD; William B. Lawson, MD, PhD; Brandon Abdullah Powell, BFA; Thomas Rudd, MS; Melvin C. Washington, PhD; Tyrone Williams, PhD Unjust law is no law at all. Where there is no law, neither is there violation. A Research Project – March 2014 PRELUDE Black English: A fair shake in judicial systems? By Merelyn B. Bates-Mims. PUBLISHED 2013-02-09 The Cincinnati Herald Because I had long ‘been away’ to big Washington DC, on my return I obligatorily followed Louisiana custom for courteous visitation to all the homes making up Back o’ the Field, the Bates-Johnson ‘extended family’ neighborhood. As we entered his home, I said to Mr. Amos, my mother’s neighbor and old family friend, “Hi, I haven’t seen you for a long while.” His response:“Sho have! Sho have!” nodding his head in “yes” agreement. Though I have recounted this incident a number of times, its impact on me has never faded. Why? Because I had unknowingly and inadvertently discovered in his response a ‘fossil’, which linguists call a “residual vestige” of a proto form of ancient language. In this case, African language. At the time of his “agreement,” however, I dismissed his reply thinking that he, Mr. -

The Truth Clinic

^«i. W W I *<^i The County Line - Collin County to pave all county roads by 2014 - Page 3 The Olympic Drug Jazz Musician "STEP Testing—Is Continues To FORWARD Justice Being Groove PLEASE" Truth Served? Clinic Page 3 Page? Page 9 Visit Our Website At www.MONTheGazette.com 1MPNA Division of ^^^^^^^ppKutumty News, Inc. Volume XII!, Number XXVII " :\' o r t fi *£) a I' f a >• ' '/I' c c f^ I // '7' a p c r of r // o i r c " July 22-July 28,2004 SERVING PLANO, DALLAS, RICHARDSON, GARLAND, ALLEN, MCKINNEY AND MESOUITE Pastor is in 'The Right Season' Fundraising Art Auction pastoring the church that he By Stephanie Ward Gallery grew up in, Saint Mark Baptist A benefit art auction is a fun, that exceeds expectation. Using a Church. sophisticated, annual social event soft-sell approach, he keeps the In 1983, there were 20 - 30 that resiUts in mutually rewarding audience entertained, iriformed, On the Homefront: members who were mostly endeavors for all involved. The and at ease at all times. CCHCC monthly program McKinney residents. Stephanie Ward Galler>' is a people The success of your art auction lunch "Gelling out the Hispanic "We have more families oriented company, striving to put largely depends on the preparation Vote" our sponsoring organizations and and plarming leading up to the Presented on Thursday July 22, now," Wattley said. Ham -1 pm by Good Politics, Saint Mark has members customers first. From booking the event. Strong audience date to post-auction follow-up, we participation approach and Inc. -

H. Doc. 108-222

1482 Biographical Directory 25, 1800; attended the common schools; moved to St. Ste- LYON, Matthew (father of Chittenden Lyon and great- phens (an Indian agency), Ala., in 1817; employed in the grandfather of William Peters Hepburn), a Representative bank at St. Stephens and in the office of the clerk of the from Vermont and from Kentucky; born near Dublin, County county court; studied law; was admitted to the bar in 1821 Wicklow, Ireland, July 14, 1749; attended school in Dublin; and commenced practice in Demopolis; secretary of the State began to learn the trade of printer in 1763; immigrated senate 1822-1830; member of the State senate in 1833; re- to the United States in 1765; was landed as a redemptioner elected to the State senate in 1834 and served as president and worked on a farm in Woodbury, Conn., where he contin- of that body; elected as an Anti-Jacksonian to the Twenty- ued his education; moved to Wallingford, Vt. (then known fourth Congress and reelected as a Whig to the Twenty- as the New Hampshire Grants), in 1774 and organized a fifth Congress (March 4, 1835-March 3, 1839); was not a company of militia; served as adjutant in Colonel Warner’s candidate for renomination; resumed the practice of law and regiment in Canada in 1775; commissioned second lieuten- also engaged in agriculture; in 1845, when the State banks ant in the regiment known as the Green Mountain Boys were placed in liquidation, he was selected as one of three in July 1776; moved to Arlington, Vt., in 1777; resigned commissioners to adjust all claims and -

It Art (Erusade an ANALYSIS of AMERICAN DRAWING MANUALS, 1820-1860

%\it art (Erusade AN ANALYSIS OF AMERICAN DRAWING MANUALS, 1820-1860 For sale by the Superintendent of Documents, U.S. Government Printing OfRce Washington, D.C. 20402 - Price $2.05 Stock No. 047-001-00132-0 Seated woman with pencil and drawing pad by John Gadsby Chapman, The American Drawing Book (SMITHSONIAN INSTITUTION) SMITHSONIAN STUDIES IN HISTORY AND TECHNOLOGY ^ NUMBER 34 WM art Crusade AN ANALYSIS OF AMERICAN DRAWING MANUALS, 1820-1860 by Peter C. MarT^o SMITHSONIAN INSTITUTION PRESS City of Washington 1976 Abstract Marzio, Peter C. The Art Crusade: An Analysis of American Drawing Manuals, 1820-1860. Smithsonian Studies in History and Technology, number 34, 94 pages, 47 figures, 1976.—Between 1820 and 1860 approximately 145 popular drawing manuals were published in the United States. Authored by painters, printers, and educators the drawing books were aimed at the general public. Based on the democratic ideal that "anyone who can learn to write can learn to draw," the manuals followed a highly structured system of drawing based on the theory that lines were the essence of form. The aesthetic system of Sir Joshua Reynolds often served as the principal artistic guideline, while the pedagogy of Johann Heinrich Pestalozzi was used as a tool for making "drawing" part of a general approach to education. Although the American drawing books are often seen as part of the general social effort to democratize art, their appeal went beyond art students to engineers, scientists, and illustrators. Drawing was considered a general skill, such as writing, which could be applied to numerous aspects of life. -

Submitted in Partial Fulfillment of the Requirements for The

PRAIRIE FIRES: URBAN REBELLIONS AS BLACK WORKING CLASS POLITICS IN THREE MIDWESTERN CITIES BY ASHLEY M. HOWARD DISSERTATION Submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy in History in the Graduate College of the University of Illinois at Urbana-Champaign, 2012 Urbana, Illinois Doctoral Committee: Associate Professor Sundiata K. Cha-Jua, Chair Professor James R. Barrett Professor Cheryl Greenberg, Trinity College Associate Professor Clarence Lang, University of Kansas ii ABSTRACT This study investigates the social, economic and political upheavals caused by the urban rebellions of the 1960s. Using Milwaukee, Wisconsin; Cincinnati, Ohio; and Omaha, Nebraska as case studies, this dissertation argues that the uprisings were historically informed acts of resistance, which demonstrated a Midwestern, gendered, and working-class character. Prairie Fires registers the significant impact the rebellions had not only in transforming the consciousness of African Americans but also in altering the relationship between Blacks, urban communities, and the State as well as highlighting class fractures within Black politics. This interpretative lens validates the black urban rebellions not only as legitimate responses to oppression, but part of an American tradition of working class insurrection. iii ACKNOWLEDGEMENTS First and foremost I would like to thank my parents, Hilary and Jeanne Howard. They have always encouraged me to seek knowledge and change the world, for that I am forever indebted. I also thank my sister Gianna, whose frequent phone calls about pop culture, social issues, and what she had for lunch, jolted me from the tedium I often became mired in. My partner Christopher, has contributed incredible insight and supported me in every possible way through this process. -

Religion and Race in Cincinnati in the Era of Vatican Ii

REFORM IN THE QUEEN CITY: RELIGION AND RACE IN CINCINNATI IN THE ERA OF VATICAN II A Dissertation Submitted to the Graduate School of the University of Notre Dame in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy by Michael A. Skaggs _________________________________ Kathleen Sprows Cummings, Director Graduate Program in History Notre Dame, Indiana February 2017 © Copyright by MICHAEL A. SKAGGS 2017 All rights reserved REFORM IN THE QUEEN CITY: RELIGION AND RACE IN CINCINNATI, 1954-1971 Abstract by Michael A. Skaggs This dissertation examines how the Roman Catholic community of Cincinnati, Ohio, experienced the reform movement initiated by the Catholic Church’s Second Vatican Council, at which the world’s bishops met in Rome in four sessions between 1962 and 1965. The study focuses on two aspects of conciliar reform as it shaped life in Cincinnati: Jewish-Catholic relations and the Catholic response to racism in church and society. As such it makes two major interventions into the historiography. First, while the Second Vatican Council (“Vatican II”) is often touted as a revolutionary moment given its repudiation of centuries of Catholic anti-Semitism, in Cincinnati such a pronouncement barely rippled among local Catholics and Jews, who had long cooperated, especially on civic projects, with little thought for the theological obstacles that ostensibly divided them. Thus what was revolutionary at the level of the global Church was met with little attention at the local level. Second, Vatican II’s neglect of race as a discrete social concern fueled intra-Catholic conflict over the Church’s Michael A. -

Charter Schools, Voting, on Candidates' Minds

Volume 96 Number 47 | JULY 10-16, 2019 | MiamiTimesOnline.com | Ninety-Three Cents Travis McNeil Tarnorris Gaye DeCarlos Moore Lynn Weatherspoon Brandon Foster Killed Feb. 11, 2011 Killed Aug. 20, 2010 Killed July 5, 2010 Killed Jan. 1, 2011 Killed Dec. 17, 2010 Federal oversight after multiple shooting of Black men to end as racial incidents persist FELIPE RIVAS [email protected] t has been eight years since Travis McNeil was killed at the hands of a Miami Police officer. His mother, Sheila McNeil, misses him every day. Her son died in February 2011 when Reynaldo Goyos shot him as he reached for something in his car during a traffic stop. No weapon was found on Travis IMcNeil. That day, Feb. 11, 2011, Travis ment admitted no wrongdoing and as evidence as well as a weak McNeil became the seventh Black the justice department withheld performance by the independent person shot and killed by Miami "any claim of use of deadly force." reviewer. Police officers in the span seven Part of the agreement resulted in But less than 10 months before months – from July 2010 to Febru- monitoring and oversight of the the deadline, the independent re- ary 2011. The shootings created force. The feds appointed local viewer in charge of overseeing the tensions and policing concerns in overseers to improve the depart- agreement cannot continue her Overtown, Little Haiti and Liberty ment's culture and practices. It job. What's more, she has recom- Joel Johnson Gibson Junion Belzaire City neighborhoods and caused was to continue until March 2020. -

The Road Half Traveled: University Engagement at a Crossroads

The Road Half Traveled University Engagement at a Crossroads Rita Axelroth and Steve Dubb The Democracy Collaborative at the University of Maryland December 2010 About the Authors Rita Axelroth is a consultant in the fields of education policy, university engagement, and com- munity development. She formerly served as the Research Coordinator for the Netter Center for Community Partnerships at the University of Pennsylvania. Axelroth is the lead writer of the Netter Center’s Annual Reports (2007–08 and 2008–09) and author ofThe Community Schools Approach: Raising Graduation and College Going Rates — Community High School Case Studies, a publication of the Coalition for Community Schools (2009). Steve Dubb is the Research Director of The Democracy Collaborative. Dubb is the principal author of Linking Colleges to Communities: Engaging the University for Community Development (2007) and Building Wealth: The New Asset-Based Approach to Solving Social and Economic Prob- lems (2005). Dubb is also a co-author (with Deborah B. Warren) of Growing a Green Economy for All: From Green Jobs to Green Ownership (2010). The Road Half Traveled University Engagement at a Crossroads Rita Axelroth and Steve Dubb The Democracy Collaborative at the University of Maryland December 2010 The Democracy Collaborative 1140-F Tydings Hall University of Maryland College Park, MD 20742 Copyright © 2010 by The Democracy Collaborative This work is licensed under the Creative Commons Attribution License: http://creativecommons.org/licenses/by-nc/3.0/deed.en_US Contents -

9781643361857.Pdf

In the Service of God and Humanity Conscience, Reason, and the Mind of Martin R. Delany • Tunde Adeleke © 2021 University of South Carolina Published by the University of South Carolina Press Columbia, South Carolina, 29208 www.uscpress.com 30 29 28 27 26 25 24 23 22 21 10 9 8 7 6 5 4 3 2 1 Library of Congress Cataloging-in-Publication Data can be found at http://catalog.loc.gov/. ISBN: 978-1-64336-184-0 (hardcover) ISBN: 978-1-64336-185-7 (ebook) is book is published as part of the Sustainable History Monograph Pilot. With the generous support of the Andrew W. Mellon Foundation, the Pilot uses cutting-edge publishing technology to produce open access digital editions of high-quality, peer-reviewed monographs from leading university presses. Free digital editions can be downloaded from: Books at JSTOR, EBSCO, Hathi Trust, Internet Archive, OAPEN, Project MUSE, and many other open repositories. While the digital edition is free to download, read, and share, the book is under copyright and covered by the following Creative Commons License: BY-NC-ND. Please consult www.creativecommons.org if you have questions about your rights to reuse the material in this book. When you cite the book, please include the following URL for its Digital Object Identier (DOI): https://doi.org/ . / We are eager to learn more about how you discovered this title and how you are using it. We hope you will spend a few minutes answering a couple of questions at this url: https://www.longleafservices.org/shmp-survey/ More information about the Sustainable History Monograph Pilot can be found at https://www.longleafservices.org. -

Kamala Harris Rises in the Polls After Stellar Debate Sen

L.A. City Council Confirms Denise M. Verret as Zoo Direc- NBC4 Names Renee Washington tor of the Los Angeles Zoo & Bo- Vice President of News tanical Gardens (See page A-4) (See page A-4) VOL. LXXVV, NO. 49 • $1.00 + CA. Sales Tax THURSDAY, DECEMBER 12 - 18, 2013 VOL. LXXXV NO. 28, $1.00 +CA. Sales Tax“For Over “For Eighty Over Eighty Years Years, The Voice The Voiceof Our of CommunityOur Community Speaking Speaking for forItself Itself.” THURSDAY, JULY 4, 2019 Kamala Harris Rises in the Polls After Stellar Debate Sen. Bernie Sanders. Her performance at the The debate showcased debate gave her an oppor- Harris’ leadership skills as tunity to express her sen- she called command on all timents when she stated, her opponents when she “There is not a Black man stated to the candidates, I know, be he a relative, a “Guys, you know what? friend, or a coworker, who America does not want to has not been the subject “The biggest thing we can collectively do to support her campaign is to support her financially. At this point in the elec- tion it is through financial support that we can give strength and clarity to her voice throughout the country. Her voice is the voice we need to get this country back on track and provide justice for us all”. - Danny J. Bakewell, Sr. – Chairman & Ex- ecutive Publisher of Bakewell Media and Chairman Emeritus of NNPA – The Black Press of America. witness a food fight; they of profiling or discrimina- want to know how we’re tion,” Harris said during going to put food on their her pointed exchange with table.” Biden. -

Document Title

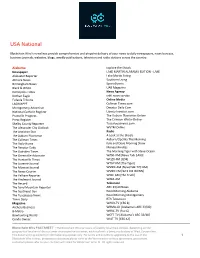

USA National Blockchain Wire’s newslines provide comprehensive and pinpoint delivery of your news to daily newspapers, news bureaus, business journals, websites, blogs, weekly publications, television and radio stations across the country. Alabama Explore the Shoals Newspaper LAKE MARTIN ALABAMA EDITION - LAKE Alabaster Reporter Lake Martin Living Atmore News Southern Living Birmingham News SportsEvents Black & White UAB Magazine Demopolis Times News Agency Dothan Eagle cnhi news service Eufaula Tribune Online Media LAGNIAPPE Cullman Times.com Montgomery Advertiser Decatur Daily.Com National Catholic Register Liberty Investor.com Prattville Progress The Auburn Plainsman Online Press-Register The Crimson White-Online Shelby County Reporter Tuscaloosanews.com The Alexander City Outlook WVTM Online The Anniston Star Radio The Auburn Plainsman A Look at the Shoals The Cullman Times Auburn/Opelika This Morning The Daily Home Kyle and Dave Morning Show The Decatur Daily Money Minutes The Gadsden Times The Morning Tiger with Steve Ocean The Greenville Advocate WANI-AM [News Talk 1400] The Huntsville Times WQZX-FM [Q94] The Luverne Journal WTGZ-FM [The Tiger] The Monroe Journal WVNN-AM [NewsTalk 770 AM] The News-Courier WVNN-FM [92.5 FM WVNN] The Pelham Reporter WXJC-AM [The Truth] The Piedmont Journal WZZA-AM The Record Television The Sand Mountain Reporter ABC 33/40 News The Southeast Sun Good Morning Alabama The Tuscaloosa News Good Morning Montgomery Times Daily RTA Television Magazine WAKA-TV [CBS 8] Archery Business WBMA-LD [Alabama's ABC 33/40] B-Metro WBRC-TV [Fox 6] Bowhunting World WCFT-TV [Alabama's ABC 33/40] Condo Owner WIAT-TV [CBS 42] Blockchain Wire FACTSHEET | The Blockchain Wire service is offered by local West entities, depending on the geographical location of the customer or prospective customer, each such entity being a subsidiary of West Corporation.