Network Operations Support Systems As a Competitive Advantage

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BMO SHORT-TERM INCOME CLASS Summary of Investment Portfolio • As at June 30, 2015 Q3 Holdings * Portfolio Allocation % of Net Asset Value Issuer % of Net Asset Value

Quarterly Portfolio Disclosure BMO SHORT-TERM INCOME CLASS Summary of Investment Portfolio • As at June 30, 2015 Q3 Holdings * Portfolio Allocation % of Net Asset Value Issuer % of Net Asset Value Corporate Bonds 64.7 Cash/Receivables/Payables 3.6 Government Bonds 26.9 Government of Canada, Treasury Bills, 0.616% Sep 10, 2015 2.7 Money Market Investments 4.8 407 International Inc., Series 10-D1, Medium Term Notes, Cash/Receivables/Payables 3.6 Secured, Subordinated, 3.870% Nov 24, 2017 2.3 Sun Life Financial Inc., Series A, Medium Term Notes, Total portfolio allocation 100.0 Fixed to Floating, Senior, Unsecured, Callable, 4.800% Nov 23, 2035 1.7 Government of Canada, Treasury Bills, 0.617% Jul 16, 2015 1.1 Holdings * Province of British Columbia, Promissory Notes, Issuer % of Net Asset Value 0.759% Sep 9, 2015 1.1 Government of Canada, 1.250% Feb 1, 2016 1.1 Government of Canada, 1.250% Mar 1, 2018 15.0 Canada Housing Trust, Mortgage Bonds, Total holdings as a percentage of net asset value 100.0 Series 41, Secured, 2.750% Jun 15, 2016 10.8 John Deere Canada Funding Inc., Series 13-03, Total net asset value $9.4 million Senior, Unsecured, 2.650% Jul 16, 2018 7.7 Toyota Credit Canada Inc., Medium Term Notes, * Represents the entire portfolio. Senior, Unsecured, 2.200% Oct 19, 2017 7.6 Daimler Canada Finance Inc., Senior, Unsecured, Notes, 2.280% Feb 17, 2017 7.0 GE Capital Canada Funding Company, Senior, Unsecured, Notes, 2.420% May 31, 2018 5.5 Royal Bank of Canada, Senior, Unsecured, Notes, 2.680% Dec 8, 2016 5.4 Wells Fargo Canada Corporation, -

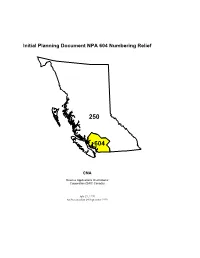

Initial Planning Document NPA 604 Numbering Relief

Initial Planning Document NPA 604 Numbering Relief 250 604 CNA Science Applications International Corporation (SAIC Canada) July 27, 1999 As Presented on 24 September 1999 INITIAL PLANNING DOCUMENT NPA 604 NUMBERING RELIEF JULY 27, 1999 TABLE OF CONTENTS 1. EXECUTIVE SUMMARY ......................................................................................................................... 1 2. INTRODUCTION ..................................................................................................................................... 1 3. CENTRAL OFFICE CODE EXHAUST .................................................................................................... 2 4. CODE RELIEF METHODS...................................................................................................................... 3 4.1. Geographic Split.............................................................................................................................. 3 4.1.1. Definition ...................................................................................................................................... 3 4.1.2. General Attributes ........................................................................................................................ 4 4.2. Distributed Overlay .......................................................................................................................... 4 4.2.1. Definition ..................................................................................................................................... -

Horizon Book of Authorities

PATENTED MEDICINE PRICES REVIEW BOARD IN THE MATTER OF THE PATENT ACT R.S.C. 1985, C. P-4, AS AMENDED AND IN THE MATTER OF HORIZON PHARMA PLC (THE “RESPONDENT”) AND THE MEDICINE CYSTEAMINE BITARTRATE SOLD BY THE RESPONDENT UNDER THE TRADE NAME PROCYSBI® BOOK OF AUTHORITIES OF THE RESPONDENT (MOTION TO BIFURCATE, STRIKE EVIDENCE AND FOR THE INSPECTION AND PRODUCTION OF DOCUMENTS) Torys LLP 79 Wellington St. W., Suite 3000 Toronto ON M5K 1N2 Fax: 416.865.7380 Sheila R. Block Tel: 416.865.7319 [email protected] Andrew M. Shaughnessy Tel: 416.865.8171 [email protected] Rachael Saab Tel: 416.865.7676 [email protected] Stacey Reisman Tel: 416.865.7537 [email protected] Counsel to Respondent, Horizon Pharma PLC INDEX 1. Board Decision – Alexion Pharmaceuticals Inc. and the Medicine “Soliris” (September 20, 2017) 2. Alexion Pharmaceuticals Inc. v. Canada (Attorney General), 2019 FC 734 3. Celgene Corp. v. Canada (Attorney General), 2011 SCC 1 4. Board Decision – Alexion Pharmaceuticals Inc. and the Medicine “Soliris” (March 29, 2016) 5. Mayne Pharma (Canada) Inc. v. Aventis Pharma Inc., 2005 FCA 50 6. P.S. Partsource Inc. v. Canadian Tire Corp., 2001 FCA 8 7. Harrop (Litigation Guardian of) v. Harrop, 2010 ONCA 390 8. Merck & Co v. Canada (Minister of Health), 2003 FC 1511 9. Vancouver Airport Authority v. Commissioner of Competition, 2018 FCA 24 10. Merck & Co, Inc. v. Canada (Minister of Health), 2003 FC 1242 11. H-D Michigan Inc. v. Berrada, 2007 FC 995 12. Roger T. Hughes, Arthur Renaud & Trent Horne, Canadian Federal Courts Practice 2019 (Toronto: LexisNexis Canada Inc., 2019) 13. -

Market Index Uniflex 10%

Investment and retirement 5% 10% Market Index Uniflex 10% 25% Main Product Features 25% 6-year term (not redeemable before maturity) Guarantee of principal on maturity of 100% Low management fees of 1% per year 10% 15% $500 minimum deposit An easy way to diversify Cut-off age: 64 y/o (registered) and 70 y/o (non-registered) Even under a scenario where the return of each share is negative, this product may produce a global positive return Sector diversification of the Market Index Uniflex How it works On the settlement date, a starting level will be determined for each Canadian share included in the portfolio. On the maturity date, a ratio of the closing level over the starting level for each share will be computed. The 8 best performing shares during the 6-year term will be automatically assigned a fixed return of 60%, regardless of whether the actual return was positive or negative. The remaining 12 shares will be assigned their actual return. The global return (maximum 60%) will be calculated by averaging these 20 returns. The value at maturity will be the highest value between: the initial deposit; or the initial deposit PLUS global return (maximum 60%) Exposure to 20 Canadian companies included in the S&P/TSX 60 Index Company Sector Company Sector Metro Inc. Scotiabank Consumer staples Loblaw Companies Limited The Toronto-Dominion Bank Royal Bank of Canada Financial services Bank of Montreal Enbridge Inc. Sun Life Financial Inc. TransCanada Corporation Cenovus Energy Inc. Energy Canadian Natural Resources Limited Canadian National Railway Industrials Suncor Energy Inc. -

Global Telecommunications Primer

MORGAN STANLEY DEAN WITTER Equity Research June 1999 Global Telecommunications Global Telecommunications Primer A Guide to the Information Superhighway The Global Telecommunications Team MORGAN STANLEY DEAN WITTER Global Telecommunications Team North America Wireline U.K/Europe Cellular Simon Flannery [email protected] (212) 761-6432 Fanos Hira [email protected] (44171) 425-6675 Margaret Berghausen [email protected] (212) 761-6392 Jerry Dellis [email protected] (44171) 425-5371 April Henry [email protected] (212) 761-4669 U.K./Europe Alternative Carriers Peter Kennedy [email protected] (212) 761-8033 Edings Thibault [email protected] (212) 761-8553 Saeed Baradar [email protected] (44171) 425-6594 Myles Davis [email protected] (212) 761-6916 Vathana Ly Vath [email protected] (44171) 425-6014 Richard Lee [email protected] (212) 761-3685 Europe Emerging Markets North America Data & Internet Services Damon Guirdham [email protected] (44171) 425-6665 Jeffrey Camp [email protected] (212) 761-3112 Anton Inshutin [email protected] (7 503) 785-2232 Stephen Flynn [email protected] (212) 761-8294 Latin America North America Wireless Luiz Carvalho [email protected] (212) 761-4876 Colette Fleming [email protected] (212) 761-8223 Vera R. Rossi [email protected] (212) 761-4484 Mark Kinarney [email protected] (212) 761-6342 Steve Amaro [email protected] (212) 761-3403 North America Independents and Rural Telephony Asia/Pacific Steven Franck [email protected] (212) 761-7124 Mark Shuper [email protected] (65) 439-8954 Bhaskar Dole [email protected] (9122) 209-6600 Canada David Langford [email protected] (612) 9770-1583 Greg MacDonald -

IDST134 Holdings Description Flyer (PDF)

Invesco Unit Trusts Portfolio Holdings International Dividend Sustainability Portfolio Series 134 Below is the list of companies included in the IDST134 Portfolio. The trust portfolio is provided for informational purposes only and should not be deemed as a recommendation to buy or sell the individual securities shown below. There can be no guarantee or assurance that companies will declare dividends in the future or that if declared, they will remain at current levels or increase over time. Past performance does not guarantee future results. Trust Objective The IDST portfolio seeks to provide above-average capital appreciation by investing in a portfolio of international stocks and American Depositary Receipts (“ADRs”) of companies with a history of increasing dividend distributions. Ticker Company Description ACN Accenture PLC-CL A Accenture PLC provides management and technology consulting services and solutions. The company delivers a range of specialized capabilities and solutions to clients across all industries on a worldwide basis. Accenture's network of businesses provides consulting, technology, outsourcing, and alliances. BAESY BAE Systems PLC- ADR BAE Systems plc develops, delivers, and supports advanced defense and aerospace systems. The Group manufactures military aircraft, surface ships, submarines, radar, avionics, communications, electronics, and guided weapon systems. BAE Systems services clients located throughout the world. BBL BHP Billiton PLC-ADR BHP Billiton plc is an international resources company. The company's principal business lines are mineral exploration and production, including coal, iron ore, gold, titanium, ferroalloys, nickel and copper concentrate, as well as petroleum exploration and production. Dually-listed company with BHP AU. BTI British American Tobacco PLC-ADR British American Tobacco PLC is the holding company for a group of companies that manufacture, market and sell cigarettes and other tobacco products, including cigars and roll-your-own tobacco. -

Case of Financial Ratio Analysis: Communications Industry in Canada (2012-2016) (Bce Bell - Cogeco – Rogers – Shaw – Telus)

CASE FINANCIAL RATIO ANALYSIS – COMMUNICATIONS INDUSTRY (2012-2016) July 21, 2017 CASE OF FINANCIAL RATIO ANALYSIS: COMMUNICATIONS INDUSTRY IN CANADA (2012-2016) (BCE BELL - COGECO – ROGERS – SHAW – TELUS) Alberto Calva // Acus Consulting Ltd [email protected] // Twitter: @acalva July 21, 2017 CONCLUSIONS a) It is important for every manager or business owner to periodically do financial analysis of its business. One of these analysis can be a financial ratio analysis, to review both the performance of the company as well as its profitability. b) Financial ratio, as seen in this analysis, have certain advantages (and some disadvantages, too). It is possible to compare companies with different size. It is possible to compare companies from different countries. Changes in time because of size of the company or inflation can be minimized with a financial ratio analysis. c) All five companies analyzed in this report have in general a good performance and therefore a good profitability. Nevertheless, not all have the same profitability. The areas to improve are very likely not the same for all of them. Also, in general they present better ratios than those available for the Canadian market. WHAT WE DO FOR THIS ANALYSIS a) This is a more or less common analysis that we do at Acus Consulting Ltd. b) Specifically for this analysis we selected five of the largest public companies in the communications industry in Canada. All of them are listed in the Toronto Stock Exchange (TSX). c) The five companies analyzed are BCE (Bell Canada Enterprises) (BCE), Cogeco Communications (CCA), Rogers Communications (RCI), Shaw Communications (SJR) and Telus Corporation (T). -

Rogers and Shaw to Come Together in $26 Billion Transaction, Creating

Rogers and Shaw to come together in $26 billion transaction, creating new jobs and investment in Western Canada and accelerating Canada’s 5G rollout Rogers to purchase all outstanding Class A Shares and Class B Shares of Shaw for $40.50 per share in cash, reflecting a ~70% premium to Shaw’s Class B Share price Shaw Family Trust irrevocably agrees to vote in favour of transaction Rogers will invest $6.5 billion in Western Canada to build critically needed 5G networks, connect underserved rural and Indigenous communities, and bring added choice to customers and businesses New technology and network investments will create up to 3,000 net new jobs across Alberta, British Columbia, Manitoba and Saskatchewan Highlights of the Transaction Rogers to acquire all issued and outstanding Class A Shares and Class B Shares of Shaw for a price of $40.50 per share in cash, amounting to approximately $20 billion, which reflects a premium of approximately 70% to Shaw’s recent Class B Share price Transaction valued at approximately $26 billion inclusive of approximately $6 billion of Shaw debt, equivalent to 10.7x 2021 Calendar Year EBITDA based on latest consensus estimates, or 7.6x post synergies Transaction to be funded by cash consideration of $40.50 to all shareholders, with the exception of approximately 60% of the Shaw family shares which will be exchanged for 23.6 million Class B Shares of Rogers at an exchange ratio of 0.70 reflecting the volume weighted average trading price of Rogers shares over the last 10 days The transaction is not conditional -

Global Pay TV Operator Forecasts

Global Pay TV Operator Forecasts Table of Contents Published in October 2016, this 190-page electronically-delivered report comes in two parts: A 190-page PDF giving a global executive summary and forecasts. An excel workbook giving comparison tables and country-by-country forecasts in detail for 400 operators with 585 platforms [125 digital cable, 112 analog cable, 208 satellite, 109 IPTV and 31 DTT] across 100 territories for every year from 2010 to 2021. Forecasts (2010-2021) contain the following detail for each country: By country: TV households Digital cable subs Analog cable subs Pay IPTV subscribers Pay digital satellite TV subs Pay DTT homes Total pay TV subscribers Pay TV revenues By operator (and by platform by operator): Pay TV subscribers Share of pay TV subscribers by operator Subscription & VOD revenues Share of pay TV revenues by operator ARPU Countries and operators covered: Country No of ops Operators Algeria 4 beIN, OSN, ART, Algerie Telecom Angola 5 ZAP TV, DStv, Canal Plus, Angola Telecom, TV Cabo Argentina 3 Cablevision; Supercanal; DirecTV Australia 1 Foxtel Austria 3 Telekom Austria; UPC; Sky Bahrain 4 beIN, OSN, ART, Batelco Belarus 2 MTIS, Zala Belgium 5 Belgacom; Numericable; Telenet; VOO; Telesat/TV Vlaanderen Bolivia 3 DirecTV, Tigo, Entel Bosnia 3 Telemach, M:Tel; Total TV Brazil 5 Claro; GVT; Vivo; Sky; Oi Bulgaria 5 Blizoo, Bulsatcom, Vivacom, M:Tel, Mobitel Canada 9 Rogers Cable; Videotron; Cogeco; Shaw Communications; Shaw Direct; Bell TV; Telus TV; MTS; Max TV Chile 6 VTR; Telefonica; Claro; DirecTV; -

City of Toronto Customized Global Template

STAFF REPORT June 18, 2001 To: Economic Development Committee From: Joe Halstead, Commissioner Economic Development, Culture and Tourism Subject: South Etobicoke Employer Cluster Capacity Study Etobicoke-Lakeshore - Ward 6 Purpose: The purpose of this report is to provide an overview on the findings and recommendations contained in the South Etobicoke Employer Cluster Capacity Study. Financial Implications and Impact Statement: There are no financial implications resulting from the adoption of this report. Recommendations: It is recommended that: (1) the findings and recommendations of the South Etobicoke Employer Cluster Capacity Study be endorsed by the Economic Development and Parks Committee and Council; (2) this report be forwarded to the Planning and Transportation Committee and Etobicoke Community Council for their information and consideration when reviewing land use options for the New Toronto Secondary Plan; (3) the Commissioner of Economic Development, Culture and Tourism be requested to monitor and report on implementation of the South Etobicoke Employer Cluster Capacity Action Plan; and (4) the appropriate City officials be authorized and directed to take necessary action to give effect thereto. - 2 - Background: South Etobicoke is located in the southwest quadrant of the City and includes the area south of the Queen Elizabeth Highway to Lake Ontario and west of the Humber River to the Etobicoke Creek, as shown on Attachment No. 1. In 1999, South Etobicoke was identified as an “Employment Revitalization Program Area” and private and public resources (including funds from Human Resources Development Canada) were successfully leveraged to revitalize the area. This initiative has facilitated a collaborative community based process designed to encourage reinvestment in the community. -

Communications Network Builders Corporate Profile

Communications Network Builders Corporate Profile Corporate Profile OUR HISTORY Founded in 1967, TELECON quickly established itself with itsits expertise in burying communication cablecabless and a technical service provider to industry leaders such as BBellellellell Canada. FFFromFrom the startstart,,,, TELECON stood out for ititss commitment to quality workmanshipworkmanship and on time deldeliveries.iveries. In the early 1970’s, TELECON widened its array of servicesservices by adding underground infrastructure construction and utility pole installation servicesservices.. Consequently it obtainobtainedededed thethethe contract to renew the entire aerial network of the Abitibi region installtallinginginging over 600 km of specialized cable. This later led to itsitsits diversification into television cacableble distribution and mandates to deploy communicationcommunication networks across the Province of Quebec. The 90’s wewerere markmarkeded by major technological and core business changeschanges in the teletelecommunicationcommunication industries. ThTheseese opportunities led us into specialized sectors suchsuch as wireless technology, optical networknetworkssss deployment, and switched networks supporting voice data and vivivideovi deo servicesservices.. TELECON is a unique partner, one that mastersmasters alalll the necessary elements for the construction of leading edge telecommunication and electrical netwonetworkrkrkssss.... TELECON services are available from coast to coast, using only qualified and certicertifiedfied personnel -

The Best Broadcast Briefing in Canada

The Best Broadcast Briefing in Canada THIS PUBLICATION MAY ONLY BE DISTRIBUTED WITHIN THE SUBSCRIBER'S LOCATION. PLEASE DO NOT FORWARD IT BEYOND YOUR STREET ADDRESS. Christensen Communications Ltd. * 18 Turtle Path * Lagoon City ON * L0K 1B0 www.broadcastdialogue.com * [email protected] Thursday, June 3, 2010 Volume 18, Number 4 Page One of Four ENERAL: Industry Minister Tony Clement and Heritage Minister James Moore introduced Bill C- G32, new copyright legislation, that would allow consumers to copy content from one device to another and to record a television program for later viewing, however not for the purpose of establishing a library. One key element concerns digital locks placed on devices by manufacturers: C-32 will make it illegal for a user to break it... Astral Media Inc. launched its new brand identity, which will be rolled out across all properties, 2010 CONFERENCE including specialty and pay television, radio, out-of-home advertising and digital. The company now operates publicly WAB's 76th Annual Conference under the Astral name while the legal corporate name remains Astral Media Inc. Astral’s new brand image June 4-6, 2010 represents the company’s diverse assets, decentralized yet disciplined business model and the knowledge, passion and Kananaskis, Alberta imagination its employees bring to the marketplace. The vibrant colour palette and creative shape of the new logo are designed to convey human warmth and emotion, within a www.wab.ca defined and responsive structure that is grounded and resilient. As a member of the Astral family, Astral Media or call Radio Sales and Astral Media Broadcast Sales in Vancouver have evolved into what is now Astral (877) 814-2719 RadioPlus.