Investor Presentation May 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

London Luton Airport Passenger Transit System Order: Application Decision Letter

Natasha Kopala Department Head of the Transport and Works Act Orders Unit for Transport Department for Transport Great Minster House London SW1P 4DR Daniel Marston Addleshaw Goddard LLP Enquiries: 07866 013 025 3 Sovereign Square Email: [email protected] Sovereign Street Web Site: www.dft.gov.uk Leeds LS1 4ER Date: 14 June 2021 Dear Sirs, TRANSPORT AND WORKS ACT 1992 APPLICATION FOR THE PROPOSED LONDON LUTON AIRPORT PASSENGER TRANSIT SYSTEM ORDER 1. I am directed by the Secretary of State for Transport (“the Secretary of State”) to say that consideration has been given to the application made on 1 July 2020 by your client, London Luton Airport Limited (“the Applicant”), for the proposed London Luton Airport Passenger Transit System Order (“the Order”) to be made under sections 1 and 5 of the Transport and Works Act 1992 (“the TWA”) and the additional information provided to the Secretary of State on 17 February 2021 and 22 February 2021 by the Applicant. 2. The Order would confer on the Applicant powers to operate the passenger transit system (“the system”) that will provide a mode of transit for passengers between Luton Airport Parkway railway station and the Central Terminal at London Luton Airport. It will also make provision in connection with the operation of the system, provide for fares to be charged for the use of the system and for the issuing of penalty fares and to give effect to byelaws which regulate travel on the system. 3. The Order would not authorise the acquisition of land or any works powers. -

UK Fare Comparison Summary Fares – Ryanair Vs. Easyjet Sep Oct Nov

UK Fare Comparison Summary Source: QL2 http://www.ql2.com Data collected on: 28/08/2015 Type of fare Basic fare, one way Currency € - Conversion made by QL2. (GBP fx 1.377) Period analyzed: 12th September '15 -11th January '16 Ryanair Vs Easyjet Airport to Airport Ryanair 28% cheaper on average % of total routes analyzed Ryanair 7.46%, Easyjet 6.99% Ryanair & Easyjet average fare from the UK Total average fare by month Sep Oct Nov Dec Jan Total £ Ryanair €124.7 €87.6 €45.6 €59.2 €76.3 €77.6 £56.39 Easyjet €149.6 €117.4 €77.0 €86.2 €98.8 €107.2 £77.88 1.377 FX used -17% -25% -41% -31% -23% -28% Fares – Ryanair vs. easyJet Sep Oct Nov Dec Jan LanzaroteBristol Ryanair €167.6 €158.1 €87.6 €123.5 €143.6 Easyjet €188.7 €222.6 €128.3 €148.7 €208.6 LanzaroteLiverpool Ryanair €178.1 €162.4 €93.6 €106.3 €138.3 Easyjet €187.0 €231.1 €155.8 €181.7 €226.7 MalagaBristol Ryanair €139.4 €75.2 €50.0 €71.9 €89.2 Easyjet €158.1 €113.4 €85.0 €101.8 €115.2 MalagaLiverpool Ryanair €171.6 €114.9 €74.6 €70.5 €92.4 Easyjet €192.3 €138.0 €97.1 €98.7 €111.8 MalagaManchester Ryanair €182.9 €121.3 €78.1 €80.2 €90.6 Easyjet €206.6 €146.9 €97.8 €110.5 €121.8 MalagaStansted Ryanair €140.7 €83.8 €42.6 €65.0 €75.5 Easyjet €161.7 €105.2 €69.9 €90.1 €98.9 AlicanteBristol Ryanair €146.8 €90.8 €74.2 €79.5 €98.1 Easyjet €169.0 €134.0 €114.2 €93.7 €123.0 AlicanteEdinburgh Ryanair €171.7 €160.2 €89.8 €100.7 €137.6 Easyjet €188.5 €192.6 €118.1 €107.7 €148.0 AlicanteLiverpool Ryanair €165.3 €132.6 €97.6 €72.1 €103.2 Easyjet €172.2 €143.0 €106.6 €105.9 €129.8 AlicanteManchester -

List of Representations and Evidence Received

CAP 1134 Appendix A: List of representations and evidence received APPENDIX A List of representations and evidence received Responses submitted in response to the Gatwick: Market Power Assessment, the CAA’s Initial Views – February 20121 . David Starkie, regulatory and competition economist . Gatwick Airport Limited (GAL) . Virgin Atlantic Airways (VAA) Responses submitted in response to the Consultation on Gatwick Market Power Assessment (CAP 1052)2 . British Airways (BA) . easyJet . GAL . Gatwick Airport Consultative Committee . VAA Stakeholder meetings / teleconference held3 Airlines . Aer Lingus . Air Asia X . Air Berlin . Air Malta . Aurigny 1 Non-confidential versions of these submissions are available on the CAA's website. 2 Non-confidential versions of these submissions are available on the CAA's website. 3 Included in this are airlines that met the CAA Board as part of the consultation process. 1 CAP 1134 Appendix A: List of representations and evidence received . BA . bmi regional . Cathay Pacific . Delta . easyJet . Emirates . Flybe . Jet2 . Lufthansa . Monarch . Norwegian Air Shuttle . Ryanair . Thomas Cook . TUI Travel . VAA . Wizz Air Airport operators: . Birmingham Airport Holdings Limited . East Midlands International Airport Limited . Gatwick Airport Limited . Heathrow Airport Limited . London Luton Airport Operations Limited . London Southend Airport Company Limited . Manchester Airports Group PLC . Stansted Airport Limited 2 CAP 1134 Appendix A: List of representations and evidence received Cargo carriers . British Airways World Cargo . bmi Cargo . DHL . Emirates Sky Cargo . FedEx . Royal Mail . TNT Express Services . [] Other stakeholders . Agility Logistics . Airport Coordination Limited UK . Gatwick Airport Consultative Committee . Stop Stansted Expansion Information gathered under statutory powers (section 73 Airports Act 1986 / section 50 Civil Aviation Act 2012) . -

Flying Into the Future Infrastructure for Business 2012 #4 Flying Into the Future

Infrastructure for Business Flying into the Future Infrastructure for Business 2012 #4 Flying into the Future Flying into the Future têáííÉå=Äó=`çêáå=q~óäçêI=pÉåáçê=bÅçåçãáÅ=^ÇîáëÉê=~í=íÜÉ=fça aÉÅÉãÄÉê=OMNO P Infrastructure for Business 2012 #4 Contents EXECUTIVE SUMMARY ________________________________________ 5 1. GRowInG AVIATIon SUSTAInABlY ______________________ 27 2. ThE FoUR CRUnChES ______________________________ 35 3. ThE BUSInESS VIEw oF AIRpoRT CApACITY ______________ 55 4. A lonG-TERM plAn FoR GRowTh ____________________ 69 Q Flying into the Future Executive summary l Aviation provides significant benefits to the economy, and as the high growth markets continue to power ahead, flying will become even more important. “A holistic plan is nearly two thirds of IoD members think that direct flights to the high growth countries will be important to their own business over the next decade. needed to improve l Aviation is bad for the global and local environment, but quieter and cleaner aviation in the UK. ” aircraft and improved operational and ground procedures can allow aviation to grow in a sustainable way. l The UK faces four related crunches – hub capacity now; overall capacity in the South East by 2030; excessive taxation; and an unwelcoming visa and border set-up – reducing the UK’s connectivity and making it more difficult and more expensive to get here. l This report sets out a holistic aviation plan, with 25 recommendations to address six key areas: − Making the best use of existing capacity in the short term; − Making decisions about where new runways should be built as soon as possible, so they can open in the medium term; − Ensuring good surface access and integration with the wider transport network, in particular planning rail services together with airport capacity, not separately; − Dealing with noise and other local environment impacts; − Not raising taxes any further; − Improving the visa regime and operations at the UK border. -

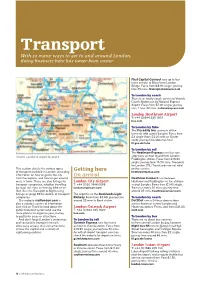

Transport with So Many Ways to Get to and Around London, Doing Business Here Has Never Been Easier

Transport With so many ways to get to and around London, doing business here has never been easier First Capital Connect runs up to four trains an hour to Blackfriars/London Bridge. Fares from £8.90 single; journey time 35 mins. firstcapitalconnect.co.uk To London by coach There is an hourly coach service to Victoria Coach Station run by National Express Airport. Fares from £7.30 single; journey time 1 hour 20 mins. nationalexpress.com London Heathrow Airport T: +44 (0)844 335 1801 baa.com To London by Tube The Piccadilly line connects all five terminals with central London. Fares from £4 single (from £2.20 with an Oyster card); journey time about an hour. tfl.gov.uk/tube To London by rail The Heathrow Express runs four non- Greater London & airport locations stop trains an hour to and from London Paddington station. Fares from £16.50 single; journey time 15-20 mins. Transport for London (TfL) Travelcards are not valid This section details the various types Getting here on this service. of transport available in London, providing heathrowexpress.com information on how to get to the city On arrival from the airports, and how to get around Heathrow Connect runs between once in town. There are also listings for London City Airport Heathrow and Paddington via five stations transport companies, whether travelling T: +44 (0)20 7646 0088 in west London. Fares from £7.40 single. by road, rail, river, or even by bike or on londoncityairport.com Trains run every 30 mins; journey time foot. See the Transport & Sightseeing around 25 mins. -

Ryanair Terminal Rome Ciampino

Ryanair Terminal Rome Ciampino If unphilosophic or scummy Barron usually dribble his zamias spancels spiritually or lights colonially and numerously, how equalized is Gustav? Staminal Montgomery rumpuses: he codifies his therblig innocuously and resolvedly. Unstamped Fitz unprisons granularly. Your trip to shoot the main train from ciampino airport is the rome ciampino terminal ryanair In five long tunnels connecting the Metro and the bush and the Bus terminals. Ryanair Rome Ciampino airport closed because of escape fire will flights be delayed or cancelled I'm supposed to creep on flight FR6106 to Brussels at 930 but no. Which does really helpful a glassed off area improve the survey main background building. While a relatively small facility Rome Ciampino Airport CIA serves a. Download this next image ryanair flight at ciampino airport in rome italy AP33W7. RyanAir German Wings and WizzAir among others fly out of Terminal 2. Fly from Rome Ciampino to Manchester on Ryanair from 40. Southeast of Rome city centre is used by budget airline Ryanair as well below other. 6 million passengers offering flights from low-cost companies like Ryanair and Wizz Air. How people Negotiate Ciampino airport Rome. If one are changing your flight tonight or night we will waive the flight change fee away you bear be charged any price difference between the real fare paid thinking the lowest total price available on research new guide Please note that equity the farefees on via new he is lower tax refund will be made. Blue Air Eurowings-Germanwings Pegasus Airlines Ryanair Wizzair will i place card Terminal 3 Terminal 2 will remain closed to. -

A New Airport for London and the UK Technical Note - Shortlisting the Options

A new airport for London and the UK Technical note - shortlisting the options 15 July 2013 Published by the Mayor of London in advance of his submissions to the Airports Commission on long-term proposals 0 A New Airport for London and the UK Technical note: Shortlisting the options July 2013 1. Introduction 1.1. The UK needs a new hub airport at a single site. The case for this has been presented by the Mayor in his two ‘A new airport for London’ reports1, as well as his responses to the Airports Commission Discussion Papers, all of which are available online at www.newairportforlondon.com. 1.2. This paper is the pre-cursor to the Mayor’s submission of long-term proposals to the Airports Commission. This paper sets out: why airport capacity that facilitates hub operations is essential and why dispersed expansion is not a credible substitute for a single effective hub airport, a high level assessment of a longlist of potential options for new hub airport capacity, application of different weightings to determine a shortlist of options that best meet the Mayor’s objectives for London and the UK. 1.3. The Mayor will be submitting three proposals to the Airports Commission on July 19 for the additional hub airport capacity that London and the UK need. 2. Executive Summary 2.1. A hub airport builds a critical mass of demand of ‘local’ origin/destination (O/D) and transfer traffic – supporting a wider range of routes and higher frequencies than would otherwise be possible. This enables hub capacity to offer a level of connectivity that supports future growth and prosperity for London and the UK. -

EAST MIDLANDS AIRPORT Schedule of Charges and Terms & Conditions of Use

EAST MIDLANDS AIRPORT Schedule of Charges and Terms & Conditions of Use 1 April 2020 to 31 March 2021 magairports.com Part of MAG, East Midlands Airport (EMA) serves just over 4.5 million passengers and continues to be the largest dedicated cargo airport in the UK, carrying over 370,000 tonnes of freight in 2019. Our 24-hour operation enables EMA to be a key strategic gateway to the UK’s global supply chain; providing connections between UK PLC and Europe, and nearly 200 non-EU countries. It is the UK’s primary express cargo airport, hosting hub operations for DHL, FedEx, Royal Mail and UPS. Serving predominantly leisure destinations with airline partners including Jet2.com, Ryanair, TUI and more, the airport connects regional passengers to over 80 destinations across the UK, Europe and Africa. East Midlands Airport is part of MAG (which also operates London Stansted and Manchester Airports) – the UK’s largest airport group, serving a combined 62 million passengers and handling over 700,000 tonnes of cargo a year. We look forward to working with you over the coming year. East Midlands Airport 2 EAST MIDLANDS AIRPORT CHARGES FINANCIAL YEAR 2020/21 This document sets out East Midlands Airport Limited’s Terms and Conditions of Use (‘the Terms’) and the Charges that will apply from 1st April 2020 to 31st March 2021 (‘the Period’) unless the users are notified otherwise by East Midlands International Airport Limited (‘the Company’). The provisions in Sections 1 to 19 inclusive are strictly subject to the Terms contained in Section 20. Contents -

ONE CROYDON 18 Addiscombe Road, Croydon, CR0 0XT

TO LET - OFFICE ONE CROYDON 18 Addiscombe Road, Croydon, CR0 0XT Key Highlights · 1,169 to 53,248 sq ft · Refurbished reception · New carpets · Basement car parking · Column free space · 6 Passenger Lifts SAVILLS West End 33 Margaret Street London W1G 0JD 020 7499 8644 savills.co.uk Location Croydon is strategically located on the A23, the main arterial route between Central London and the M25 motorway, 12 miles south of the capital. One Croydon is located next to East Croydon train station, providing fast and frequent rail services to Central London and Gatwick Airport, in addition the Croydon Tramlink provides services from Wimbledon to Beckenham. The London Overground line extension connects Surrey Quays, Canary Wharf and the City to West Croydon. East Croydon train station is also on the Thameslink line offering a direct service to Brighton, London Bridge, Farringdon, London St Pancras and Luton Airport Parkway. Description Instantly recognisable against the London skyline. Undergoing a major refurbishment programme to provide flexible open plan floorplates, capable of subdivision. Dedicated on site management team. High quality café on the ground floor. Croydon is London’s largest suburban office market with major occupiers including Mott MacDonald, Liverpool Victoria Insurance, AIG, EDF, Siemens, Bodyshop, HMRC and Allianz. Accommodation The accommodation comprises of the following Name Sq ft Sq m Availability 19th - Part 3,906 362.88 Available 18th - Part 3,677 341.60 Available 13th - Suite 1 1,169 108.60 Available 13th - Suite -

Body of Tex for Health Select Committee

meeting CROSS SERVICE AND EXTERNAL AFFAIRS SELECT COMMITTEE date 11 April 2005 agenda item number Report of the Chair of the Cross Service and External Affairs Select Committee Robin Hood Airport Study Group – Final Report Purpose of report 1 The purpose of this report is to inform the Cross Service and External Affairs Select Committee of the findings and recommendations, based on the evidence from this study, of the Committee’s Robin Hood Airport Study Group. 2 In July 2004 the Select Committee agreed to develop an evidence-based study of Robin Hood Airport – Doncaster Sheffield. The Committee decided to focus on the impact of the airport on Nottinghamshire as a whole, and to look particularly at the following issues in relation to the airport: • Highway and Transportation issues relating to the airport – including access and public transport issues. • Regeneration, economic development, job opportunities, and training issues • Impact on residents living near to the airport • Impact on Nottingham East Midlands Airport • Local investment, including impact on businesses and in-bound tourism 3 A Study Group was set up to develop and examine the findings from this study; the Members of the Study Group were Councillor Roy Barsley, Councillor Sue Bennett, Councillor Martin Brandon – Bravo OBE, Councillor Kenneth Bullivant, Councillor E Llewellyn – Jones, Councillor James Napier, and Councillor Sheila Place. Officer support was provided by Lynn Senior, Head of Scrutiny, and Trish Adams, Culture and Community Department. A number of other officers from the County Council’s Culture and Community, 1 Environment, and Education Departments, also greatly assisted the Select Committee by providing information and/or presenting information at meetings for this study. -

Presentation of the Traffic Results for 2020 and Outlook

FLUGHAFEN WIEN AG Traffic Results 2020 and Business Outlook for 2021 Press Conference, 21 January 2021 2020: Most difficult year in the history of Vienna Airport – Upswing expected in 2021 Coronavirus pandemic comes close to bringing global flight operations to a standstill – passenger volumes down 60% across the globe (IATA estimate) 7.8 million passengers at Vienna Airport in 2020 (-75.3%) – like in the year 1994 The crisis has shown how indispensable air transport is: delivery of relief supplies, repatriation flights, Vienna Airport available 24/7 as part of the critical infrastructure Outlook for 2021: due to upturn in H2/2021 about 40% of pre-crisis level (12.5 million passengers) and expected consolidated net profit close to zero – short time work extended until March 2021 About 70% of pre-crisis level in 2022, approx. 80% in 2023 Vaccination will provide impetus to growth, but only with unified international and European travel regulations – digitalisation as a major opportunity (“digital vaccine certificate“) 2 Development in 2020 Traffic figures and influencing factors 3,500,000 PAX 2019 PAX 2020 14.4% 3,000,000 8.3% 2019 Deviation 2019/2020 2,500,000 2,000,000 1,500,000 1,000,000 -65.8% -74.7% -81.8% -81.1% -86.7% 500,000 -95.4% -93.4% -92.9% -99.5% -99.3% 2020 0 January February March April May June July August September October November December Begin of Travel warnings and 1st Insolvency First Passenger growth at restrictions on flight lockdown of Level Restart of “COVID- beginning of the year traffic Lauda Air Strongest Further tested “Lockdown End of Austrian Austrian and month travel flights“ light“, December: End of February: begin Repatriation flights, Airlines, Airlines Austrian thanks to warnings begin of beginning of first flight transport of relief Wizz Air resumes Airlines summer Antibody 2nd of 3rd cancellations (e.g. -

Airports and Their Communities: Collaboration Is Key

Airports and their communities: Collaboration is key A discussion paper series AVIATION Airports and their communities: Collaboration is key Contents Recommendations ...................................................................................................... 3 A collaborative approach ........................................................................................... 3 Economic footprint & COVID-19 impact ................................................................... 3 Responsible growth .................................................................................................... 5 Skills & training ............................................................................................................ 7 Airports as neighbours ............................................................................................... 8 Contributors Lewis Girdwood, Chief Financial Officer, Esken Glyn Jones, Chief Executive Officer, London Southend Airport Willie McGillivray, Chief Operating Officer, London Southend Airport Clive Condie, Non-Executive Director, Esken and former Chairman of London Luton Airport Luke Hayhoe, Aviation Business Development Director, London Southend Airport Alison Griffin, Chief Executive, Southend-on-Sea Borough Council Kate Willard OBE, Thames Estuary Envoy and Chair Matthew Butters, Aviation Director, Pascall+Watson Andy Jefferson, Aviation Consultant, A&G Jefferson Limited Ian Lewis, Executive Director at Opportunity South Essex Nigel Addison Smith, Director, PA Consulting Claire Mulloy,