Overview of Commodity Trading and Market in India

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

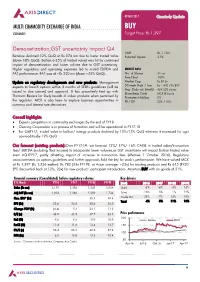

MULTI COMMODITY EXCHANGE of INDIA BUY EXCHANGES Target Price: Rs 1,397

09 MAY 2017 Quarterly Update MULTI COMMODITY EXCHANGE OF INDIA BUY EXCHANGES Target Price: Rs 1,397 Demonetization,GST uncertainty impact Q4 CMP : Rs 1,153 Revenue declined 12% QoQ at Rs 874 mn due to lower traded value Potential Upside : 21% (down 10% QoQ). Bullion (~35% of traded value) was hit by continued impact of demonetization and lower volume due to GST uncertainty. Higher regulatory and operating expenses led to muted EBITDA and MARKET DATA PAT performance. PAT was at ~Rs 220 mn (down ~35% QoQ). No. of Shares : 51 mn Free Float : 100% Update on regulatory developments and new products: Management Market Cap : Rs 59 bn expects to launch options within 3 months of SEBI’s guidelines (will be 52-week High / Low : Rs 1,420 / Rs 852 Avg. Daily vol. (6mth) : 429,628 shares issued in due course) and approval. It has proactively tied up with Bloomberg Code : MCX IB Equity Thomson Reuters for likely launch of index products when permitted by Promoters Holding : 0% the regulator. MCX is also keen to explore business opportunities in FII / DII : 23% / 36% currency and interest rate derivatives. Concall highlights ♦ Expects competition in commodity exchanges by the end of FY18 ♦ Clearing Corporation is in process of formation and will be operational in FY17-18 ♦ For Q4FY17, traded value in bullion/ energy products declined by 18%/13% QoQ whereas it increased for agri commoditiesby 19% QoQ Our forecast (existing products):Over FY17-19, we forecast 12%/ 17%/ 16% CAGR in traded value/transaction fees/ EBITDA (including float income) to incorporate lower volumes,as GST uncertainty will impact bullion traded value even inQ1FY17, partly offsetting impact of increase in transaction fees (effective 1 October 2016). -

Elixir Journal

50958 Garima saxena and Rajeshwari kakkar / Elixir Inter. Law 119 (2018) 50958-50966 Available online at www.elixirpublishers.com (Elixir International Journal) International Law Elixir Inter. Law 119 (2018) 50958-50966 Performance of Stock Markets in the Last Three Decades and its Analysis Garima saxena and Rajeshwari kakkar Amity University, Noida. ARTICLE INFO ABSTRACT Article history: Stock market refers to the market where companies stocks are traded with both listed Received: 6 April 2018; and unlisted securities. Indian stock market is also called Indian equity market. Indian Received in revised form: equity market was not organized before independence due to the agricultural conditions, 25 May 2018; undeveloped industries and hampering by foreign business enterprises. It is one of the Accepted: 5 June 2018; oldest markets in India and started in 18th century when east India Company started trading in loan securities. During post-independence the capital market became more Keywords organized and RBI was nationalized. As we analyze the performance of stock markets Regulatory framework, in the last three decades, it comes near enough to a perfectly aggressive marketplace Reforms undertaken, permitting the forces of demand and delivers an inexpensive degree of freedom to Commodity, perform in comparison to other markets in particular the commodity markets. list of Deposit structure, reforms undertaken seeing the early nineteen nineties include control over problem of Net worth, investors. capital, status quo of regulator, screen primarily based buying and selling and threat management. Latest projects include the t+2 rolling settlement and the NSDL was given the obligation to assemble and preserve an important registry of securities marketplace participants and experts. -

Today's Top Research Idea Market Snapshot Research Covered

12 May 2021 ASIAMONEY Brokers Poll 2020 (India) Today’s top research idea Godrej Consumer : New leadership offers scope for transformative change Upgrade to Buy We view Mr. Sudhir Sitapati’s appointment as MD and CEO of GCPL as a potentially transformative event in the fortunes of the company. Mr. Sitapati comes with impressive experience in heading HUVR’s F&R business and as part of the senior management team in the Detergents business, which Market snapshot have done very well under his tenure and where marketing campaigns in both segments have a high value impact. His appointment as MD and CEO for five Equities - India Close Chg .% CYTD.% years, as well has his relative young age (mid-40s), gives him adequate time to Sensex 49,162 -0.7 3.0 Nifty-50 14,851 -0.6 6.2 formulate and implement strategic changes. Nifty-M 100 24,972 0.8 19.8 The underpenetrated Household Insecticides (HI, ~70%/50% penetration in Equities-Global Close Chg .% CYTD.% urban/rural) and Hair Color (~30% penetration) categories could greatly S&P 500 4,152 -0.9 10.5 benefit from Mr. Sitapati’s past experience, where GCPL has struggled to Nasdaq 13,389 -0.1 3.9 boost penetration. FTSE 100 6,948 -2.5 7.5 DAX 15,120 -1.8 10.2 After more than a decade of being Neutral on the company (downgraded to Hang Seng 10,432 -2.1 -2.9 Neutral in Aug’10), a stand that has been vindicated particularly in the past Nikkei 225 28,609 -3.1 4.2 five years, we are upgrading the stock to Buy. -

Lfs Broking Private Limited

LFS BROKING PRIVATE LIMITED (Member BSE, NSE, MCX & CDSL) A P P L IC A T IO N F O R A D D IT IO N A L S EG M E N T / EX C H A N G E F O R T R A D IN G A C C O U N T Client Code Client Name Branch/ AP Code Branch/ AP Name LFS BROKING PVT. LTD. CIN NO.: U67190PN2011PTC140719 Registered Office Address: Office No. 311/75, 3rd Floor, Shrinath Plaza, ‘B’ Wing, F.C. Road, Shivaji Nagar, Bhamburda, Pune - 411005. Correspondence Office Address: Unit No. 08, 2nd Floor, Prabhadevi Industrial Estate, 408 Veer Savarkar Marg, Prabhadevi, Mumbai - 400025. Tel: (91) 22-49228222 Fax: (91) 22-49228221 Website: www.lfsbroking.in Exchange Segment SEBI Registration No. Member Code Date of Registration BSE CASH/FO INZ 000101238 6628 February 20, 2017 NSE CASH/FO/CD INZ 000101238 90022 February 20, 2017 MCX COMMODITY INZ 000101238 56350 February 20, 2017 CDSL Depository Participant IN-DP-CDSL-363-2018 85400 April 05, 2018 IL & FS Securities Services Ltd. IL&FS House, Plot No.14, Raheja Vihar, Chandivali, Clearing Member for NSE (FO & CD) Segments: Andheri (E), Mumbai - 400072. Tel.: 022-42493000 www.ilfsdp.com SMC Comtrade Ltd. Clearing Member for MCX Commodity 11/6B, Shanti Chamber, Pusa Road, New Delhi ‐ 110005. Derivatives Segment: Tel.: 011-30111000 www.smcindiaonline.com Mr. Anand Tamhane Compliance Officer Details: Ph : 022-49228222 Ext: 225 Email id : [email protected] Mr. Saiyad Jiyajur Rahaman Director/CEO Details: Ph : 022-49228222 Ext. 220 Email id : [email protected] For any grievance / dispute please contact LFS BROKING PVT. -

Multi Commodity Exchange (MCX)

Multi Commodity Exchange (MCX) CMP: | 1587 Target: | 2000 (26%) Target Period: 12 months BUY May 25, 2021 Market leadership, new products to drive earnings MCX reported a moderation in average daily turnover (ADTO) attributable to upfront margin requirement impacting volume. Operational performance remained healthy led by steady revenue and controlled opex. Volatility in other income and tax advantage in base year led to decline in earnings. Particulars ADTO in commodity futures on the exchange declined 13% to | 31823 crore Particulars Amount Update in Q4FY21, due to increase in regulatory requirement of upfront margin Market Capitalisation | 8091 crore partially offset by higher gold priced compared to last year. Markets share Equity Capital | 51 crore in commodity futures space has remained strong at 96.04% in FY21. Networth | 1418 crore Result Number of unique customers increased from 51.5 lakh in Q3FY21 to 60.2 lakh in Q4FY21 while authorised person count was at 52777. Face Value | 10 52 week high/low 1875/1112 Decline in ADTO (13% YoY) was partially offset by healthy realisation FII 36.2% keeping moderation in operational revenue at ~8% YoY to | 97 crore. Tight DII 41.2% control on cost led EBIDTA at | 44.2 crore, up 8.7% YoY, though sequentially declined 9.1%. Subsequently, EBITDA margin increased ~700 bps YoY to 445.6%. However, lower other income at | 11.5 crore in Q4FY21 (led by G- Key Highlights sec yield in narrow range) vs. | 29.7 crore in Q4FY20 and utilisation of MAT Growth in ADTO moderated 13% credit in last year led earnings decline to | 38.5 crore; down ~41% YoY. -

Notice Notice Is Hereby Given That the 108Th Annual General “RESOLVED THAT Mr

Notice Notice is hereby given that the 108th Annual General “RESOLVED THAT Mr. Andrew Robb (DIN: 01911023), who was Meeting of the members of Tata Steel Limited will be held appointed by the Board of Directors as an Additional Director on Wednesday, 12 August, 2015, at 3.00 p.m. IST at the Birla of the Company with effect from 12 November, 2014 and who Matushri Sabhagar, 19, Sir Vithaldas Thackersey Marg, Mumbai holds office up to the date of this Annual General Meeting 400 020, to transact the following business: of the Company in terms of Section 161 of the Companies Act, 2013 (“Act”) but who is eligible for appointment and ORDINARY BUSINESS: has consented to act as a Director of the Company and in Item No. 1 – Adoption of Financial Statements respect of whom the Company has received a notice in writing from a Member under Section 160 of the Act proposing his To receive, consider and adopt: candidature for the office of Director of the Company, be and a) the Audited Standalone Financial Statements of the is hereby appointed a Director of the Company. Company for the Financial Year ended 31 March, 2015 and the Reports of the Board of Directors and the RESOLVED FURTHER THAT pursuant to the provisions of Auditors thereon; and Sections 149, 152 and other applicable provisions, if any, of b) the Audited Consolidated Financial Statements of the the Act, and the Rules framed thereunder read with Schedule Company for the Financial Year ended 31 March, 2015 IV to the Act, as amended from time to time, appointment of and the Report of the Auditors thereon. -

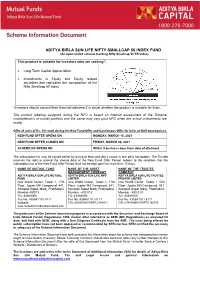

ADITYA BIRLA SUN LIFE NIFTY SMALLCAP 50 INDEX FUND (An Open Ended Scheme Tracking Nifty Smallcap 50 TR Index)

ADITYA BIRLA SUN LIFE NIFTY SMALLCAP 50 INDEX FUND (An open ended scheme tracking Nifty Smallcap 50 TR Index) This product is suitable for investors who are seeking*: Long Term Capital Appreciation Investments in Equity and Equity related securities and replicates the composition of the Nifty Smallcap 50 Index *Investors should consult their financial advisers if in doubt whether the product is suitable for them. The product labeling assigned during the NFO is based on internal assessment of the Scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made. Offer of units of Rs. 10/- each during the New Fund Offer and Continuous Offer for Units at NAV based prices. NEW FUND OFFER OPENS ON MONDAY, MARCH 15, 2021 NEW FUND OFFER CLOSES ON FRIDAY, MARCH 26, 2021 SCHEME RE-OPENS ON Within 5 business days from date of allotment The subscription list may be closed earlier by giving at least one day’s notice in one daily newspaper. The Trustee reserves the right to extend the closing date of the New Fund Offer Period, subject to the condition that the subscription list of the New Fund Offer Period shall not be kept open for more than 15 days. NAME OF MUTUAL FUND NAME OF THE ASSET NAME OF THE TRUSTEE MANAGEMENT COMPANY COMPANY ADITYA BIRLA SUN LIFE MUTUAL ADITYA BIRLA SUN LIFE AMC ADITYA BIRLA SUN LIFE TRUSTEE FUND LIMITED PRIVATE LIMITED One World Center, Tower 1, 17th One World Center, Tower 1, 17th One World Center, Tower 1, 17th Floor, Jupiter Mill Compound, 841, Floor, Jupiter Mill Compound, -

Today's Top Research Idea Market Snapshot Research Covered

12 May 2021 ASIAMONEY Brokers Poll 2020 (India) Today’s top research idea Godrej Consumer : New leadership offers scope for transformative change Upgrade to Buy We view Mr. Sudhir Sitapati’s appointment as MD and CEO of GCPL as a potentially transformative event in the fortunes of the company. Mr. Sitapati comes with impressive experience in heading HUVR’s F&R business and as part of the senior management team in the Detergents business, which Market snapshot have done very well under his tenure and where marketing campaigns in both segments have a high value impact. His appointment as MD and CEO for five Equities - India Close Chg .% CYTD.% years, as well has his relative young age (mid-40s), gives him adequate time to Sensex 49,162 -0.7 3.0 Nifty-50 14,851 -0.6 6.2 formulate and implement strategic changes. Nifty-M 100 24,972 0.8 19.8 The underpenetrated Household Insecticides (HI, ~70%/50% penetration in Equities-Global Close Chg .% CYTD.% urban/rural) and Hair Color (~30% penetration) categories could greatly S&P 500 4,152 -0.9 10.5 benefit from Mr. Sitapati’s past experience, where GCPL has struggled to Nasdaq 13,389 -0.1 3.9 boost penetration. FTSE 100 6,948 -2.5 7.5 DAX 15,120 -1.8 10.2 After more than a decade of being Neutral on the company (downgraded to Hang Seng 10,432 -2.1 -2.9 Neutral in Aug’10), a stand that has been vindicated particularly in the past Nikkei 225 28,609 -3.1 4.2 five years, we are upgrading the stock to Buy. -

Finvasia Securities Private Limited

SET OF ACCOUNT OPENING DOCUMENT FINVASIA SECURITIES PRIVATE LIMITED SEBI REGN NO.: INZ000176037 MCX Member Code : 55135 NCDEX Member Code : 01259 Clearing Member : Globe Commodities Ltd. (MCX & NCDEX 8550) Regd. Address : 802, Ansal Bhawan, 16 K.G. Marg, C.P., New Delhi-1 Corporate Office : FINVASIA CENTRE, D 179, Phase 8 B (Sector 74) Mohali, Punjab 160055 (India) Phone : +91-172-6670000, Fax : +91-172-6670070, E-mail : [email protected] Registered Office : #1108, Sector 21-B, Chandigarh - 160022 Trading Member with MCX & NCDEX Compliance Officer's Details : Ramanjeet Kaur, E-mail : [email protected], Ph.: +91-172-6670000, Fax : +91-172-6670070 INDEX OF DOCUMENTS MANDATORY DOCUMENTS AS PRESCRIBED BY SEBI & EXCHANGES S.No. Name of the Document Brief Significance of the Document Page No. 1. KYC (Account Opening) KYC form - Document captures the basic information about the constitute and an 1-3 Application Form instruction / check list. 2. Uniform Risk Disclosure Documents detailing Risk associated with dealing in the Commodities Market. By Email Document (RDD) 3. Rights and Obligations of Document stating the Rights & Obligation of Member, Authorized Person and client for Trading on exchanges Members, AP and Clients (including additional Rights and Obligations in case of Internet/Wireless Technology based Trading) By Email 4. Do's and Don'ts for the Document detailing Do's & Don'ts for Trading on exchange, for the education for the investors. By Email Investors 5. Policies & Procedures Policies and procedures as per Exchange. By Email 6. Other Details Past Action, Dealing Through Other Member, Introducer Details etc. 4-6 7. Tariff Sheet Document detailing the rate/amount of brokerage and other charges levied on the client for 7-7 trading on the Commodity Exchange & Intimation for Proprietary Trading. -

Security Market Indices and Multi Commodity Exchange

Delhi College Of Arts and Commerce University of Delhi Subject- INVESTING IN STOCK MARKET ( E- Resources) Course- BCom (Prog) Sem IV-C DATE – 22nd April 2020 Unit 1- Investing fundamentals Topic done already- Meaning of investing Nature of investing Difference between Investment and Speculation Process of investment Risk and return in context of financial investment Concept of risk return trade off in investment Concepts of IPO and FPO and difference between them Equity and bonds Types of debentures (Part A and B) Meaning, functions and Categories of financial market Segments of capital market- Primary Market and Secondary Market Market participants in Primary Market Market participants in Secondary Market BSE and NSE Sources of financial information Stock exchange- Meaning and Functions Topic for today- Security market indices and Multi Commodity Exchange Multi Commodity Exchange Type Public Traded as BSE: 534091 Industry Commodity Exchange Founded 10 Nov. 2003 Headquarters Mumbai, India Key people Saurabh Chandra (Chairman) Products Commodity Derivatives Website www.mcxindia.com Multi Commodity Exchange of India Ltd (MCX) (BSE: 534091) is an independent commodity exchange based in India. It was established in 2003 and is based in Mumbai. It is India's largest commodity derivatives exchange where the clearance and settlements of the exchange happen and the turnover of the exchange for the quarter ended September 2018 was 1.78 billion rupees. MCX offers options trading in gold and futures trading in non-ferrous metals, bullion, energy, and a number of agricultural commodities (mentha oil, cardamom, crude palm oil, cotton, and others). In 2016, MCX was seventh among the global commodity exchanges in terms of the number of futures contracts trade, the latest yearly data from Futures Industry Association (FIA) showed. -

Commodity Form

INSTRUCTIONS/CHECK LIST FOR FILLING KYC FORM A. IMPORTANT POINTS: 1. Self-attested copy of PAN card is mandatory for all clients, including Promoters/Partners/Karta/Trustees and whole time directors and persons authorized to deal in commodity derivatives on behalf of company/firm/others. 2. Copies of all the documents submitted by the applicant should be self-attested and accompanied by originals for verification. In case the original of any document is not produced for verification, then the copies should be properly attested by entities authorized for attesting the documents, as per the below-mentioned list. 3. If any proof of identity or address is in a regional language, then an English translation would be required. 4. Name & address of the applicant mentioned on the KYC form should match with the documentary proof submitted. 5. If correspondence & permanent address are different, then proofs for both have to be submitted. 6. Sole proprietor must make the application in his individual name & capacity. 7. For non-residents and foreign nationals, (allowed to trade subject to RBI and FIPB/FEMA guidelines and other applicable statutory approvals), copy of passport/PIO Card/OCI Card and overseas address proof is mandatory. 8. For foreign entities, CIN is optional; and in the absence of DIN number for the directors, their passport copy should be given. 9. In case of Merchant Navy NRI's, Mariner's declaration or certified copy of CDC (Continuous Discharge Certificate) is to be submitted along with other statutory approvals required for investment in commodities. 10. Politically Exposed Persons (PEP) are defined as individuals who are or have been entrusted with prominent public functions in a foreign country, e.g., Heads of States or of Governments, senior politicians, senior Government/judicial/ military officers, senior executives of state owned corporations, important political party officials, etc. -

International Journal of Research in Management ISSN 2249-5908 Available Online on Issue 7, Vol

International Journal of Research in Management ISSN 2249-5908 Available online on http://www.rspublication.com/ijrm/ijrm_index.htm Issue 7, Vol. 3 (May 2017) Understanding the Relationship between Equity Market and Commodity Market: A Theoretical Study Dr. Upendra Singh Assistant Professor Department of Commerce SRM University, Delhi –NCR, Sonepat Mr. Harshul Garg Research Scholar SRM University, Delhi –NCR, Sonepat Abstract This article cover the significant linkage between equity market and commodity market, both are the important component of capital market. Generally, both market target different class of investor who has different view regarding this market. Risk and Return rate are also different in both market, at a same time equity market behave due to performance of company and commodity market behave supply of the commodity. There are also some other causes which affected the market. This paper aims to evaluate portfolio return and portfolio risk of stock market and commodity market for the period of 2011 to 2016. This article also elaborates the coefficient of degree and direction of the relationship between stock market and commodity market. There is various research tools which can be used for finding the relationship involved in these two markets. These tools are Regression, Correlation, Mean, and Moving Average method, Relative Strength Index (RSI), Standard Deviation and Risk-Return Analysis. To finding the relationship it is necessary to evaluate the performance of exchange of these two markets, so this paper also focus on performance of Multi commodity Exchange (MCX), NSE and BSE. It is an effort to analyze the overall relationship between Indian Commodity market and Equity market.