Multi Commodity Exchange CMP `1,239

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

N-203-19-BSE Pitch Book May 2019

UPDATE MAY 2019 INDEX Section Contents Page No. 1 About BSE 2 2 Listing Business 14 3 Market Business 17 4 Data Business 27 5 Technology Initiatives 29 1 About BSE Evolution of the Exchange Key Milestones Date Milestones 1st Oct, 2018 BSE launches its commodity derivatives segment making it India's 1st Universal Exchange 1st Aug, 2018 BSE launches ‘chatbot’, “Ask Motabhai”, for faster, more convenient access to stock market information 17th July, 2018 BSE building received trademark 15th Nov, 2017 BSE’s 100% subsidiary, Marketplace Tech Infra Services, goes live with hosted trading platform BEST(BSE Electronic Smart Trader) 26th Oct, 2017 India’s Premier Stock Exchange BSE and World’s largest Insurance Exchange Ebix, Inc. Sign MOU to Launch Joint Venture Company, for Setting up Pioneering Insurance Distribution Network in India 3rd Feb, 2017 BSE becomes India's 1st listed Stock Exchange 16th Jan, 2017 Commencement of Trading at India INX 9th Jan, 2017 Hon’ble Prime Minister of India, Shri Narendra Modi inaugurated India International Exchange (IFSC) Ltd, India’s 1st International Exchange 9th July, 2016 Shri Arun Jaitley, Hon'ble Minister of Finance Unveiled the Commemorative Postage Stamp Celebrating 140 glorious years of BSE 2nd Jan, 1986 S&P BSE SENSEX, country's first equity Index launched (Base Year: 1978-79 =100) 31st Aug, 1957 BSE granted permanent recognition under Securities Contracts (Regulation) Act (SCRA) 9th July, 1875 The Native Share & Stock Broker's Association formed 3 BSE Group BSE* Domestic IFSC-GIFT CITY Exchange Central Counter Party (CCP) Central Securities Depository (CSD) Exchange Central Counter Party (CCP ) 100% 100% 24% 100% 100% BSE Investments Ltd. -

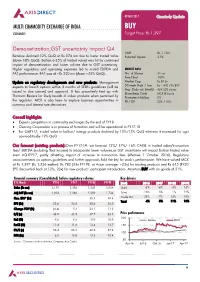

MULTI COMMODITY EXCHANGE of INDIA BUY EXCHANGES Target Price: Rs 1,397

09 MAY 2017 Quarterly Update MULTI COMMODITY EXCHANGE OF INDIA BUY EXCHANGES Target Price: Rs 1,397 Demonetization,GST uncertainty impact Q4 CMP : Rs 1,153 Revenue declined 12% QoQ at Rs 874 mn due to lower traded value Potential Upside : 21% (down 10% QoQ). Bullion (~35% of traded value) was hit by continued impact of demonetization and lower volume due to GST uncertainty. Higher regulatory and operating expenses led to muted EBITDA and MARKET DATA PAT performance. PAT was at ~Rs 220 mn (down ~35% QoQ). No. of Shares : 51 mn Free Float : 100% Update on regulatory developments and new products: Management Market Cap : Rs 59 bn expects to launch options within 3 months of SEBI’s guidelines (will be 52-week High / Low : Rs 1,420 / Rs 852 Avg. Daily vol. (6mth) : 429,628 shares issued in due course) and approval. It has proactively tied up with Bloomberg Code : MCX IB Equity Thomson Reuters for likely launch of index products when permitted by Promoters Holding : 0% the regulator. MCX is also keen to explore business opportunities in FII / DII : 23% / 36% currency and interest rate derivatives. Concall highlights ♦ Expects competition in commodity exchanges by the end of FY18 ♦ Clearing Corporation is in process of formation and will be operational in FY17-18 ♦ For Q4FY17, traded value in bullion/ energy products declined by 18%/13% QoQ whereas it increased for agri commoditiesby 19% QoQ Our forecast (existing products):Over FY17-19, we forecast 12%/ 17%/ 16% CAGR in traded value/transaction fees/ EBITDA (including float income) to incorporate lower volumes,as GST uncertainty will impact bullion traded value even inQ1FY17, partly offsetting impact of increase in transaction fees (effective 1 October 2016). -

TSR DARASHAW LIMITED 6-10, Haji Moosa Patrawala Ind

07-12-2018 National Stock Exchange of India Ltd. Exchange Plaza Plot No.c-1, G-Block IFB Centre Bandra-Kurla Complex Bandra (East), Mumbai 400051 Maharashtra India Attn : The Secretary of Stock Exchange Dear Sir[s]/Madam, RE : LOSS OF SHARE CERTIFICATES. ----------------------------------------------------- We have to advise you to put the appended Notice regarding loss of Certificate[s] for attention of the Members of the Exchange, with instructions that they communicate to us immediately if they are in a position to give us information relating to any transaction or whereabouts of the original certificate[s]. Yours faithfully, for TSR DARASHAW LIMITED. This is computer generated letter and does not require signature. TSR DARASHAW LIMITED 6-10, Haji Moosa Patrawala Ind. Estate, 20 Dr. E Moses Road, Near Famous Studio, Mahalaxmi (W), Mumbai – 400 011. CIN : U67120MH1985PLC037369 Tel.: +91 22 6656 8484 Fax : +91 22 66568494 E-mail : [email protected] Website : www.tsrdarashaw.com --------------------------------------------------------------------------------------------------------------------------------------------------------------- Business hours Monday to Friday 10.00 a.m. to 3.30 p.m. NOTICE VINYL CHEMICALS(INDIA) LIMITED Regd. Off : REGENT CHAMBERS 7TH FLOOR JAMANALAL BAJAJ MARG NARIMAN POINT MUMBAI MAHARASHTRA INDIA 400021 NOTICE is hereby given that the certificate[s] for the under mentioned securities of the Company has / have been lost / mislaid and holder[s] of the said securities has / have applied to the Company to issue duplicate certificate[s]. Any person who has a claim in respect of the said securities should lodge such claim with the Company at the Registered Office, within 15 days from this date, else the Company will proceed to issue duplicate certificate[s] without further intimation. -

Elixir Journal

50958 Garima saxena and Rajeshwari kakkar / Elixir Inter. Law 119 (2018) 50958-50966 Available online at www.elixirpublishers.com (Elixir International Journal) International Law Elixir Inter. Law 119 (2018) 50958-50966 Performance of Stock Markets in the Last Three Decades and its Analysis Garima saxena and Rajeshwari kakkar Amity University, Noida. ARTICLE INFO ABSTRACT Article history: Stock market refers to the market where companies stocks are traded with both listed Received: 6 April 2018; and unlisted securities. Indian stock market is also called Indian equity market. Indian Received in revised form: equity market was not organized before independence due to the agricultural conditions, 25 May 2018; undeveloped industries and hampering by foreign business enterprises. It is one of the Accepted: 5 June 2018; oldest markets in India and started in 18th century when east India Company started trading in loan securities. During post-independence the capital market became more Keywords organized and RBI was nationalized. As we analyze the performance of stock markets Regulatory framework, in the last three decades, it comes near enough to a perfectly aggressive marketplace Reforms undertaken, permitting the forces of demand and delivers an inexpensive degree of freedom to Commodity, perform in comparison to other markets in particular the commodity markets. list of Deposit structure, reforms undertaken seeing the early nineteen nineties include control over problem of Net worth, investors. capital, status quo of regulator, screen primarily based buying and selling and threat management. Latest projects include the t+2 rolling settlement and the NSDL was given the obligation to assemble and preserve an important registry of securities marketplace participants and experts. -

An Observational Study on Financial Jungle with Sharekhan As Your Guide

SUMMER TRAINING PROJECT REPORT SHAREKHAN LTD. Submitted in partial fulfillment of the requirement of Bachelor of Business Administration (BBA) Guru Jambeshwar University, Hissar AN OBSERVATIONAL STUDY ON FINANCIAL JUNGLE WITH SHAREKHAN AS YOUR GUIDE Training Supervisor Submitted By: MR. RAVI VERMA ANUJ DIWAKAR (AREA ASSISTANT MANAGER) (2007-2010) ROLL NO: 07511242131 Session (2007-2010) GURU JAMBESHWAR UNIVERSITY HISSAR-125001 PREFACE No professional curriculum is considered complete without work experience. It is well evident that work experience is an indispensable part of every professional course. In the same manner practical work in any organization is must for each an every individual, who is undergoing management course. Without the practical exposure one cannot consider himself as a qualified capable manager. Entering in the organization is like stepping into altogether a new world. At first, everything seems strange and unheard but as the time passes one can understand the concept and working of the organization thereby develop professional relationship. Initially I felt that as if classroom study was irrelevant and it is useless in any working concern. But gradually I realized that all fundamental basic concepts studied are linked in one or in another way to the organization. But how and what can be done with fundamentals, depend upon the intellectual and applicability skills of an individual. During my summer training, a specific customer survey was assigned to me which helped me to have a full market exposure. This project helped me to understand and cope up with different types of people and there diversified opinions or needs. ACKNOWLEDGEMENT The completion of my summer training and project would not have been possible without the constant and timely encouragement of MR. -

Today's Top Research Idea Market Snapshot Research Covered

12 May 2021 ASIAMONEY Brokers Poll 2020 (India) Today’s top research idea Godrej Consumer : New leadership offers scope for transformative change Upgrade to Buy We view Mr. Sudhir Sitapati’s appointment as MD and CEO of GCPL as a potentially transformative event in the fortunes of the company. Mr. Sitapati comes with impressive experience in heading HUVR’s F&R business and as part of the senior management team in the Detergents business, which Market snapshot have done very well under his tenure and where marketing campaigns in both segments have a high value impact. His appointment as MD and CEO for five Equities - India Close Chg .% CYTD.% years, as well has his relative young age (mid-40s), gives him adequate time to Sensex 49,162 -0.7 3.0 Nifty-50 14,851 -0.6 6.2 formulate and implement strategic changes. Nifty-M 100 24,972 0.8 19.8 The underpenetrated Household Insecticides (HI, ~70%/50% penetration in Equities-Global Close Chg .% CYTD.% urban/rural) and Hair Color (~30% penetration) categories could greatly S&P 500 4,152 -0.9 10.5 benefit from Mr. Sitapati’s past experience, where GCPL has struggled to Nasdaq 13,389 -0.1 3.9 boost penetration. FTSE 100 6,948 -2.5 7.5 DAX 15,120 -1.8 10.2 After more than a decade of being Neutral on the company (downgraded to Hang Seng 10,432 -2.1 -2.9 Neutral in Aug’10), a stand that has been vindicated particularly in the past Nikkei 225 28,609 -3.1 4.2 five years, we are upgrading the stock to Buy. -

Lfs Broking Private Limited

LFS BROKING PRIVATE LIMITED (Member BSE, NSE, MCX & CDSL) A P P L IC A T IO N F O R A D D IT IO N A L S EG M E N T / EX C H A N G E F O R T R A D IN G A C C O U N T Client Code Client Name Branch/ AP Code Branch/ AP Name LFS BROKING PVT. LTD. CIN NO.: U67190PN2011PTC140719 Registered Office Address: Office No. 311/75, 3rd Floor, Shrinath Plaza, ‘B’ Wing, F.C. Road, Shivaji Nagar, Bhamburda, Pune - 411005. Correspondence Office Address: Unit No. 08, 2nd Floor, Prabhadevi Industrial Estate, 408 Veer Savarkar Marg, Prabhadevi, Mumbai - 400025. Tel: (91) 22-49228222 Fax: (91) 22-49228221 Website: www.lfsbroking.in Exchange Segment SEBI Registration No. Member Code Date of Registration BSE CASH/FO INZ 000101238 6628 February 20, 2017 NSE CASH/FO/CD INZ 000101238 90022 February 20, 2017 MCX COMMODITY INZ 000101238 56350 February 20, 2017 CDSL Depository Participant IN-DP-CDSL-363-2018 85400 April 05, 2018 IL & FS Securities Services Ltd. IL&FS House, Plot No.14, Raheja Vihar, Chandivali, Clearing Member for NSE (FO & CD) Segments: Andheri (E), Mumbai - 400072. Tel.: 022-42493000 www.ilfsdp.com SMC Comtrade Ltd. Clearing Member for MCX Commodity 11/6B, Shanti Chamber, Pusa Road, New Delhi ‐ 110005. Derivatives Segment: Tel.: 011-30111000 www.smcindiaonline.com Mr. Anand Tamhane Compliance Officer Details: Ph : 022-49228222 Ext: 225 Email id : [email protected] Mr. Saiyad Jiyajur Rahaman Director/CEO Details: Ph : 022-49228222 Ext. 220 Email id : [email protected] For any grievance / dispute please contact LFS BROKING PVT. -

Smes and Public Equity Financing: a New Dataset of SME Boards in Emerging-Market and Developing Economies

SMEs and Public Equity Financing: A New Dataset of SME Boards in Emerging-Market and Developing Economies John Schellhase and Jim Woodsome August 2017 Introduction In recent years, a number of stock exchanges in emerging-market and developing economies have established dedicated market segments for small and medium-sized enterprises (SMEs). The main purpose of these SME boards, as they are often called, is to expand access to equity finance for relatively small but growing firms with the potential, as a group, to significantly contribute to economic growth and employment. In some cases, SME boards also serve as feeder exchanges, incubating firms for later graduation to a stock exchange’s main board. Today, there around 30 dedicated SME boards in emerging-market and developing economies, the majority of which have been established in the last decade or so. Due to the role these firms can play in creating jobs and diversifying economies, improving access to finance for SMEs is a long-standing policy goal in developed and developing countries alike. As banks have curbed their lending to SMEs in the wake of the global financial crisis, policymakers and industry bodies are now increasingly emphasizing non-bank financing alternatives for SMEs. Public equity financing is one option that may be suitable for fast-growing SMEs with the capacity to meet the listing requirements. SME boards may contribute to expanding financial access for SMEs both directly, by facilitating access to public equity financing, and indirectly, by incentivizing listing firms to improve their financial reporting and corporate governance practices, which may, in turn, make them more appealing to credit-based lenders. -

SME Listing Understanding the Business As a Part of Due Diligence Model of the Issuer Site Visit Is Conducted

Glossary: S.No. Particulars 1 Applicable ICDR Regulations 2 SEBI Chapter XB regulations 3 Eligibility Norms (BSE & NSE) 4 Key features of Listing 5 Flow Chart 6 Roadmap at Macro Level 7 Practical difficulties 8 Key Strategic Points Definitions: Act: Companies Act, 1956/2013. SME: Small and Medium Enterprises SEBI: Securities and Exchange Board of India BSE: Bombay Stock Exchange NSE: National Stock Exchange ICDR: SEBI (Issue of Capital and Disclosure Requirements {ICDR}) Regulations, 2009 About SME Platform: The market regulator SEBI vide its circular dated May 18, 2010 have provided for setting up of a stock exchange/ trading platform by a recognized Stock Exchange having a nationwide trading terminal for SME’s. In this context Chapter XB has been inserted in the SEBI (Issue of Capital and Disclosure Requirements {ICDR}) Regulations, 2009 for the SME platform. CHAPTER XB ISSUE OF SPECIFIED SECURITIES BY SMALL AND MEDIUM ENTERPRISES 1 Applicabili A company can issue specified securities if:- ty . The post-issue face value capital does not exceed Rs.10 Crore. The post-issue face value capital is more than Rs.10 crore and up to Rs.25 Crore. 2 Filing of 1. No draft offer document need to be submitted to SEBI. But it offer has to file offer document with SEBI through MB, document simultaneously with the filing of the prospectus with the SME exchange and the Registrar of Companies or letter of offer with the SME exchange 2. SEBI should not issue any observations on the offer document 3. The offer document shall be displayed from the date of filing on the websites of SEBI, the issuer, MB and SME exchange 3 Min. -

November 5, 2020 To, the Listing Department National Stock

BSE - PUBLIC Date: November 5, 2020 To, The Listing Department National Stock Exchange of India Limited, Exchange Plaza, 5th Floor, Plot No. C-1, Block G, Bandra-Kurla Complex, Bandra (E) Mumbai – 400 051 Symbol: BSE ISIN: INE118H01025 Subject: Submission of Media Release Dear Sir/ Madam, We are enclosing herewith the Media Release dated November 4, 2020, titled: “BSE gets exemptive relief under CFTC Regulation 30.10; enables members to accept futures and options orders from customers located in the US”. This is for your information and record. Thanking you, Yours faithfully, For BSE Limited Sd/- Prajakta Powle Company Secretary and Compliance Officer Encl.: a/a Media Release BSE gets exemptive relief under CFTC Regulation 30.10; enables members to accept futures and options orders from customers located in the US Mumbai, November 04 2020: BSE, Asia’s oldest exchange and the world’s fastest exchange with the speed of 6 microseconds, has received an order from CFTC granting an exemptive relief under CFTC Regulation 30.10 to designated members of BSE from the Commodity Futures Trading Commission (“CFTC”). This exemption will benefit designated members of BSE from the application of some CFTC’s foreign futures and option rules. Under CFTC Regulation 30.10, persons located outside the US, who are subject to comparable regulatory framework in the country in which they are located, should seek an exemption from application of certain CFTC regulations, including the requirement of registration. The members of BSE will now be permitted to solicit and accept futures and options orders and related funds from customers located in the US for futures and options transactions on BSE without registering as a futures commission merchant. -

Overview of Commodity Trading and Market in India

Volume 3 – Issue 6 Online ISSN: 2582-368X OVERVIEW OF COMMODITY TRADING AND MARKET IN INDIA Article Id: AL2021167 Seedari Ujwala Rani Assistant Professor, Department of Agricultural Economics, S.V. Agricultural College, Tirupati, ANGRAU, India Email: [email protected] he commodity markets began with the trading of agricultural products such as corn, cattle, wheat, and pigs in the 19th century. Chicago was the main hub for trading T due to its geographical location near the farm belt with railroad access. In India, commodity trading began with the set up of the Bombay Cotton Trade Association in 1875, which laid the foundation of futures trading in India. The nature of commodities exchanges is changing rapidly. Currently, the trend is in the direction of electronic trading, which is away from traditional trading, where traders meet face-to-face. A commodity market is a physical or virtual marketplace for buying, selling, and trading commodities. It is also called a futures market, futures exchange, organized market for the purchase and sale of enforceable contracts such as derivative products, agricultural products, and other raw materials. A farmer raising corn can sell a futures contract on his corn, which will not be harvested for several months, and gets a guarantee of the price he will be paid when he delivers. This protects the farmer from price drops and the buyer from price rises. Commodity exchange is a legal entity that determines and enforces rules produces for the trading standardized commodity contracts. From 2015, SEBI became a regulatory body for any updates and developments relating to the commodity derivatives market in India The Commodities Traded are Usually Classified Into Four Segments i. -

Multi Commodity Exchange (MCX)

Multi Commodity Exchange (MCX) CMP: | 1587 Target: | 2000 (26%) Target Period: 12 months BUY May 25, 2021 Market leadership, new products to drive earnings MCX reported a moderation in average daily turnover (ADTO) attributable to upfront margin requirement impacting volume. Operational performance remained healthy led by steady revenue and controlled opex. Volatility in other income and tax advantage in base year led to decline in earnings. Particulars ADTO in commodity futures on the exchange declined 13% to | 31823 crore Particulars Amount Update in Q4FY21, due to increase in regulatory requirement of upfront margin Market Capitalisation | 8091 crore partially offset by higher gold priced compared to last year. Markets share Equity Capital | 51 crore in commodity futures space has remained strong at 96.04% in FY21. Networth | 1418 crore Result Number of unique customers increased from 51.5 lakh in Q3FY21 to 60.2 lakh in Q4FY21 while authorised person count was at 52777. Face Value | 10 52 week high/low 1875/1112 Decline in ADTO (13% YoY) was partially offset by healthy realisation FII 36.2% keeping moderation in operational revenue at ~8% YoY to | 97 crore. Tight DII 41.2% control on cost led EBIDTA at | 44.2 crore, up 8.7% YoY, though sequentially declined 9.1%. Subsequently, EBITDA margin increased ~700 bps YoY to 445.6%. However, lower other income at | 11.5 crore in Q4FY21 (led by G- Key Highlights sec yield in narrow range) vs. | 29.7 crore in Q4FY20 and utilisation of MAT Growth in ADTO moderated 13% credit in last year led earnings decline to | 38.5 crore; down ~41% YoY.