Package 'Quanttools'

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NYSE National, Inc. Schedule of Fees and Rebates As of July 1, 2021

NYSE National, Inc. Schedule of Fees and Rebates As Of July 1, 2021 Fees and Credits Applicable to Market Participants • All fee disputes concerning fees billed by the Exchange must be submitted to the Exchange in writing and must be accompanied by supporting documentation. All fee disputes must be submitted no later than sixty (60) days after receipt of a billing invoice. I. Transaction Fees A. Definitions 1. “ADV” means average daily volume. 2. “Adding ADV” means an ETP Holder’s average daily volume of shares executed on the Exchange that provided liquidity. 3. “Adding Liquidity” means the execution of an ETP Holder’s order on the Exchange that provided liquidity. 4. “CADV” means consolidated average daily volume. 5. “Removing Liquidity” means the execution of an ETP Holder’s Aggressing Order, as defined under Rule 7.36(a)(5), or other orders that removed liquidity. 6. “Removing ADV” means an ETP Holder’s average daily volume of shares executed on the Exchange that removed liquidity. 7. “US CADV” means the United States consolidated average daily volume of transactions reported to a securities information processor (“SIP”). Transactions that are not reported to a SIP are not included in the US CADV. B. General • Rebates indicated by parentheses ( ). • For purposes of determining transaction fees and credits based on quoting levels, average daily volume (“ADV”), and consolidated ADV (“CADV”), the Exchange may exclude shares traded any day that (1) the Exchange is not open for the entire trading day, (2) is the date of the annual reconstitution of the Russell Investments Indexes, and/or (3) a disruption affects an Exchange system that lasts for more than 60 minutes during regular trading hours. -

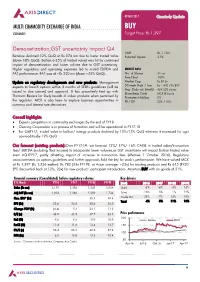

MULTI COMMODITY EXCHANGE of INDIA BUY EXCHANGES Target Price: Rs 1,397

09 MAY 2017 Quarterly Update MULTI COMMODITY EXCHANGE OF INDIA BUY EXCHANGES Target Price: Rs 1,397 Demonetization,GST uncertainty impact Q4 CMP : Rs 1,153 Revenue declined 12% QoQ at Rs 874 mn due to lower traded value Potential Upside : 21% (down 10% QoQ). Bullion (~35% of traded value) was hit by continued impact of demonetization and lower volume due to GST uncertainty. Higher regulatory and operating expenses led to muted EBITDA and MARKET DATA PAT performance. PAT was at ~Rs 220 mn (down ~35% QoQ). No. of Shares : 51 mn Free Float : 100% Update on regulatory developments and new products: Management Market Cap : Rs 59 bn expects to launch options within 3 months of SEBI’s guidelines (will be 52-week High / Low : Rs 1,420 / Rs 852 Avg. Daily vol. (6mth) : 429,628 shares issued in due course) and approval. It has proactively tied up with Bloomberg Code : MCX IB Equity Thomson Reuters for likely launch of index products when permitted by Promoters Holding : 0% the regulator. MCX is also keen to explore business opportunities in FII / DII : 23% / 36% currency and interest rate derivatives. Concall highlights ♦ Expects competition in commodity exchanges by the end of FY18 ♦ Clearing Corporation is in process of formation and will be operational in FY17-18 ♦ For Q4FY17, traded value in bullion/ energy products declined by 18%/13% QoQ whereas it increased for agri commoditiesby 19% QoQ Our forecast (existing products):Over FY17-19, we forecast 12%/ 17%/ 16% CAGR in traded value/transaction fees/ EBITDA (including float income) to incorporate lower volumes,as GST uncertainty will impact bullion traded value even inQ1FY17, partly offsetting impact of increase in transaction fees (effective 1 October 2016). -

Two Market Models Powered by One Cutting Edge Technology

Two Market Models Powered by One Cutting Edge Technology NYSE Amex Options NYSE Arca Options CONTENTS 3 US Options Market 3 US Options Market Structure 4 Traded Volume and Open Interest 4 Most Actively Traded Issues 4 Market Participation 5 Attractive US Options Dual Market Structure 5 NYSE Arca & NYSE Amex Options Private Routing 6-7 NYSE Arca Options - Market Structure - Trading - Market Making - Risk Mitigation - Trading Permits (OTPs) - Fee Schedule 8-10 NYSE Amex Options - Market Structure - Trading - Market Making - Risk Mitigation - Trading Permits (ATPs) - Fee Schedule - Marketing Charge 10 Membership Forms US Options Market The twelve options exchanges: NYSE Arca Options offers a price-time priority trading model and The US Options market is one of the largest, most liquid and operates a hybrid trading platform that combines a state-of-the- fastest growing derivatives markets in the world. It includes art electronic trading system, together with a highly effective options on individual stocks, indices and structured products open-outcry trading floor in San Francisco, CA such as Exchange Traded Funds (ETFs). The US Options market therefore presents a tremendous opportunity for derivatives NYSE Amex Options offers a customer priority trading model traders. and operates a hybrid trading platform that combines an Key features include : electronic trading system, supported by NYSE Universal Trading Twelve US Options exchanges Platform technology, along with a robust open-outcry trading floor at 11 Wall Street in New York, NY Over 4.0 billion contracts traded on the exchanges in 2012 BATS Options offers a price-time priority trading model and Over 15 million contracts traded on average operates a fully electronic trading platform per day (ADV) in 2012 The Boston Options Exchange (BOX) operates a fully electronic Over 3,900 listed equity and index based options market The Penny Pilot Program was approved by the SEC in January The Chicago Board of Options Exchange (CBOE), launched in 2007. -

Elixir Journal

50958 Garima saxena and Rajeshwari kakkar / Elixir Inter. Law 119 (2018) 50958-50966 Available online at www.elixirpublishers.com (Elixir International Journal) International Law Elixir Inter. Law 119 (2018) 50958-50966 Performance of Stock Markets in the Last Three Decades and its Analysis Garima saxena and Rajeshwari kakkar Amity University, Noida. ARTICLE INFO ABSTRACT Article history: Stock market refers to the market where companies stocks are traded with both listed Received: 6 April 2018; and unlisted securities. Indian stock market is also called Indian equity market. Indian Received in revised form: equity market was not organized before independence due to the agricultural conditions, 25 May 2018; undeveloped industries and hampering by foreign business enterprises. It is one of the Accepted: 5 June 2018; oldest markets in India and started in 18th century when east India Company started trading in loan securities. During post-independence the capital market became more Keywords organized and RBI was nationalized. As we analyze the performance of stock markets Regulatory framework, in the last three decades, it comes near enough to a perfectly aggressive marketplace Reforms undertaken, permitting the forces of demand and delivers an inexpensive degree of freedom to Commodity, perform in comparison to other markets in particular the commodity markets. list of Deposit structure, reforms undertaken seeing the early nineteen nineties include control over problem of Net worth, investors. capital, status quo of regulator, screen primarily based buying and selling and threat management. Latest projects include the t+2 rolling settlement and the NSDL was given the obligation to assemble and preserve an important registry of securities marketplace participants and experts. -

Today's Top Research Idea Market Snapshot Research Covered

12 May 2021 ASIAMONEY Brokers Poll 2020 (India) Today’s top research idea Godrej Consumer : New leadership offers scope for transformative change Upgrade to Buy We view Mr. Sudhir Sitapati’s appointment as MD and CEO of GCPL as a potentially transformative event in the fortunes of the company. Mr. Sitapati comes with impressive experience in heading HUVR’s F&R business and as part of the senior management team in the Detergents business, which Market snapshot have done very well under his tenure and where marketing campaigns in both segments have a high value impact. His appointment as MD and CEO for five Equities - India Close Chg .% CYTD.% years, as well has his relative young age (mid-40s), gives him adequate time to Sensex 49,162 -0.7 3.0 Nifty-50 14,851 -0.6 6.2 formulate and implement strategic changes. Nifty-M 100 24,972 0.8 19.8 The underpenetrated Household Insecticides (HI, ~70%/50% penetration in Equities-Global Close Chg .% CYTD.% urban/rural) and Hair Color (~30% penetration) categories could greatly S&P 500 4,152 -0.9 10.5 benefit from Mr. Sitapati’s past experience, where GCPL has struggled to Nasdaq 13,389 -0.1 3.9 boost penetration. FTSE 100 6,948 -2.5 7.5 DAX 15,120 -1.8 10.2 After more than a decade of being Neutral on the company (downgraded to Hang Seng 10,432 -2.1 -2.9 Neutral in Aug’10), a stand that has been vindicated particularly in the past Nikkei 225 28,609 -3.1 4.2 five years, we are upgrading the stock to Buy. -

Lfs Broking Private Limited

LFS BROKING PRIVATE LIMITED (Member BSE, NSE, MCX & CDSL) A P P L IC A T IO N F O R A D D IT IO N A L S EG M E N T / EX C H A N G E F O R T R A D IN G A C C O U N T Client Code Client Name Branch/ AP Code Branch/ AP Name LFS BROKING PVT. LTD. CIN NO.: U67190PN2011PTC140719 Registered Office Address: Office No. 311/75, 3rd Floor, Shrinath Plaza, ‘B’ Wing, F.C. Road, Shivaji Nagar, Bhamburda, Pune - 411005. Correspondence Office Address: Unit No. 08, 2nd Floor, Prabhadevi Industrial Estate, 408 Veer Savarkar Marg, Prabhadevi, Mumbai - 400025. Tel: (91) 22-49228222 Fax: (91) 22-49228221 Website: www.lfsbroking.in Exchange Segment SEBI Registration No. Member Code Date of Registration BSE CASH/FO INZ 000101238 6628 February 20, 2017 NSE CASH/FO/CD INZ 000101238 90022 February 20, 2017 MCX COMMODITY INZ 000101238 56350 February 20, 2017 CDSL Depository Participant IN-DP-CDSL-363-2018 85400 April 05, 2018 IL & FS Securities Services Ltd. IL&FS House, Plot No.14, Raheja Vihar, Chandivali, Clearing Member for NSE (FO & CD) Segments: Andheri (E), Mumbai - 400072. Tel.: 022-42493000 www.ilfsdp.com SMC Comtrade Ltd. Clearing Member for MCX Commodity 11/6B, Shanti Chamber, Pusa Road, New Delhi ‐ 110005. Derivatives Segment: Tel.: 011-30111000 www.smcindiaonline.com Mr. Anand Tamhane Compliance Officer Details: Ph : 022-49228222 Ext: 225 Email id : [email protected] Mr. Saiyad Jiyajur Rahaman Director/CEO Details: Ph : 022-49228222 Ext. 220 Email id : [email protected] For any grievance / dispute please contact LFS BROKING PVT. -

Price Discovery in the U.S. Stock Options Market

Price Discovery in the U.S. Stock Options Market YUSIF E. SIMAAN AND LIUREN WU YUSIF E. SIMAAN In the U.S., several exchanges with different market the Securities and Exchange Commission is an associate professor of microstructure designs compete to provide quotes and (SEC) approved a plan to electronically link finance in the Graduate attract order flow on a common set of stock options. the various market centers (the “Linkage School of Business at Fordham University in In this article, we analyze how the different Plan”). The SEC has also adopted more strin- New York, NY. microstructure designs affect the price discovery of gent quoting and disclosure rules on the options [email protected] options quotes and how they alter the flow of options market. The “firm quote” rule was applied to trading activities over time. We find that the fully the options markets on April 1, 2001. LIUREN WU electronic exchange system at the International Secu- At the time of our study, five options is an associate professor of rities Exchange (ISE), where several market makers exchanges compete to provide quotes and economics and finance in the Zicklin School of provide quotes independently and anonymously to attract order flows on a common set of stock Business, Baruch College at compete for order flow within the exchange, generates options: the American Stock Exchange the City University of New options quotes that are the most informative and the (AMEX), the Chicago Board of Options York in New York, NY. most executable, with the narrowest bid–ask spreads. Exchange (CBOE), the International Securi- [email protected] Over time, the ISE’s leading quote quality has ties Exchange (ISE), the Pacific Stock attracted order flow to the exchange, and has com- Exchange (PCX), and the Philadelphia Stock pelled other exchanges to pursue technology Exchange (PHLX). -

Overview of Commodity Trading and Market in India

Volume 3 – Issue 6 Online ISSN: 2582-368X OVERVIEW OF COMMODITY TRADING AND MARKET IN INDIA Article Id: AL2021167 Seedari Ujwala Rani Assistant Professor, Department of Agricultural Economics, S.V. Agricultural College, Tirupati, ANGRAU, India Email: [email protected] he commodity markets began with the trading of agricultural products such as corn, cattle, wheat, and pigs in the 19th century. Chicago was the main hub for trading T due to its geographical location near the farm belt with railroad access. In India, commodity trading began with the set up of the Bombay Cotton Trade Association in 1875, which laid the foundation of futures trading in India. The nature of commodities exchanges is changing rapidly. Currently, the trend is in the direction of electronic trading, which is away from traditional trading, where traders meet face-to-face. A commodity market is a physical or virtual marketplace for buying, selling, and trading commodities. It is also called a futures market, futures exchange, organized market for the purchase and sale of enforceable contracts such as derivative products, agricultural products, and other raw materials. A farmer raising corn can sell a futures contract on his corn, which will not be harvested for several months, and gets a guarantee of the price he will be paid when he delivers. This protects the farmer from price drops and the buyer from price rises. Commodity exchange is a legal entity that determines and enforces rules produces for the trading standardized commodity contracts. From 2015, SEBI became a regulatory body for any updates and developments relating to the commodity derivatives market in India The Commodities Traded are Usually Classified Into Four Segments i. -

Multi Commodity Exchange (MCX)

Multi Commodity Exchange (MCX) CMP: | 1587 Target: | 2000 (26%) Target Period: 12 months BUY May 25, 2021 Market leadership, new products to drive earnings MCX reported a moderation in average daily turnover (ADTO) attributable to upfront margin requirement impacting volume. Operational performance remained healthy led by steady revenue and controlled opex. Volatility in other income and tax advantage in base year led to decline in earnings. Particulars ADTO in commodity futures on the exchange declined 13% to | 31823 crore Particulars Amount Update in Q4FY21, due to increase in regulatory requirement of upfront margin Market Capitalisation | 8091 crore partially offset by higher gold priced compared to last year. Markets share Equity Capital | 51 crore in commodity futures space has remained strong at 96.04% in FY21. Networth | 1418 crore Result Number of unique customers increased from 51.5 lakh in Q3FY21 to 60.2 lakh in Q4FY21 while authorised person count was at 52777. Face Value | 10 52 week high/low 1875/1112 Decline in ADTO (13% YoY) was partially offset by healthy realisation FII 36.2% keeping moderation in operational revenue at ~8% YoY to | 97 crore. Tight DII 41.2% control on cost led EBIDTA at | 44.2 crore, up 8.7% YoY, though sequentially declined 9.1%. Subsequently, EBITDA margin increased ~700 bps YoY to 445.6%. However, lower other income at | 11.5 crore in Q4FY21 (led by G- Key Highlights sec yield in narrow range) vs. | 29.7 crore in Q4FY20 and utilisation of MAT Growth in ADTO moderated 13% credit in last year led earnings decline to | 38.5 crore; down ~41% YoY. -

Notice Notice Is Hereby Given That the 108Th Annual General “RESOLVED THAT Mr

Notice Notice is hereby given that the 108th Annual General “RESOLVED THAT Mr. Andrew Robb (DIN: 01911023), who was Meeting of the members of Tata Steel Limited will be held appointed by the Board of Directors as an Additional Director on Wednesday, 12 August, 2015, at 3.00 p.m. IST at the Birla of the Company with effect from 12 November, 2014 and who Matushri Sabhagar, 19, Sir Vithaldas Thackersey Marg, Mumbai holds office up to the date of this Annual General Meeting 400 020, to transact the following business: of the Company in terms of Section 161 of the Companies Act, 2013 (“Act”) but who is eligible for appointment and ORDINARY BUSINESS: has consented to act as a Director of the Company and in Item No. 1 – Adoption of Financial Statements respect of whom the Company has received a notice in writing from a Member under Section 160 of the Act proposing his To receive, consider and adopt: candidature for the office of Director of the Company, be and a) the Audited Standalone Financial Statements of the is hereby appointed a Director of the Company. Company for the Financial Year ended 31 March, 2015 and the Reports of the Board of Directors and the RESOLVED FURTHER THAT pursuant to the provisions of Auditors thereon; and Sections 149, 152 and other applicable provisions, if any, of b) the Audited Consolidated Financial Statements of the the Act, and the Rules framed thereunder read with Schedule Company for the Financial Year ended 31 March, 2015 IV to the Act, as amended from time to time, appointment of and the Report of the Auditors thereon. -

ADITYA BIRLA SUN LIFE NIFTY SMALLCAP 50 INDEX FUND (An Open Ended Scheme Tracking Nifty Smallcap 50 TR Index)

ADITYA BIRLA SUN LIFE NIFTY SMALLCAP 50 INDEX FUND (An open ended scheme tracking Nifty Smallcap 50 TR Index) This product is suitable for investors who are seeking*: Long Term Capital Appreciation Investments in Equity and Equity related securities and replicates the composition of the Nifty Smallcap 50 Index *Investors should consult their financial advisers if in doubt whether the product is suitable for them. The product labeling assigned during the NFO is based on internal assessment of the Scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made. Offer of units of Rs. 10/- each during the New Fund Offer and Continuous Offer for Units at NAV based prices. NEW FUND OFFER OPENS ON MONDAY, MARCH 15, 2021 NEW FUND OFFER CLOSES ON FRIDAY, MARCH 26, 2021 SCHEME RE-OPENS ON Within 5 business days from date of allotment The subscription list may be closed earlier by giving at least one day’s notice in one daily newspaper. The Trustee reserves the right to extend the closing date of the New Fund Offer Period, subject to the condition that the subscription list of the New Fund Offer Period shall not be kept open for more than 15 days. NAME OF MUTUAL FUND NAME OF THE ASSET NAME OF THE TRUSTEE MANAGEMENT COMPANY COMPANY ADITYA BIRLA SUN LIFE MUTUAL ADITYA BIRLA SUN LIFE AMC ADITYA BIRLA SUN LIFE TRUSTEE FUND LIMITED PRIVATE LIMITED One World Center, Tower 1, 17th One World Center, Tower 1, 17th One World Center, Tower 1, 17th Floor, Jupiter Mill Compound, 841, Floor, Jupiter Mill Compound, -

Wolverine Trading, LLC on S7-12-06

175 W. Jackson Blvd. Suite 200 Chicago, IL 60604 312.884.4000 312.884.3050 fax September 25, 2006 Ms. Nancy Morris Secretary United States Securities and Exchange Commission 100 F Street, NE Washington, DC 20549- 1090 Re: Release No. 34-541 54; File No. S7-12-06 Amendments to Regulation SWO Dear Ms. Morris: Wolverine Trading, LLC ("Wolverine") welcomes this opportunity to comment on the Securities and Exchange Commission's (the "Commission") release proposing certain amendments (the "Proposed Amendments") to Rules 200 and 203 of Regulation SHO (Release No. 34-54 154; File No. S7- 12-06, referred to herein as the "Release"). Wolverine is a proprietary trading firm that is registered with the Securities and Exchange Commission as a broker-dealer. Wolverine is one of the largest market making firms and it makes markets in the majority of listed index and equity options in the U.S. Wolverine is a member of, and registered as an options market maker on, the American Stock Exchange, the Boston Options Exchange, the Chicago Board Options Exchange, the International Securities Exchange, NYSE Arca, Inc. and the Philadelphia Stock ~xchan~e.'As part of its options market making responsibilities, Wolverine acts as a designated primary market maker, lead market maker, specialist and market maker with a physical presence on the trading floors of the various options exchanges. Wolverine also makes markets remotely from off the trading floor as an electronic designated primary market maker, a competitive market maker and a remote market rnaker on the various options exchanges. As the Comn~issionno doubt is aware, Wolverine has many obligations as a market maker.