Form 10-K Hp Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27

Case 4:13-md-02420-YGR Document 2321 Filed 05/16/18 Page 1 of 74 1 2 3 4 5 6 7 8 UNITED STATES DISTRICT COURT 9 NORTHERN DISTRICT OF CALIFORNIA 10 OAKLAND DIVISION 11 IN RE: LITHIUM ION BATTERIES Case No. 13-md-02420-YGR ANTITRUST LITIGATION 12 MDL No. 2420 13 FINAL JUDGMENT OF DISMISSAL This Document Relates To: WITH PREJUDICE AS TO LG CHEM 14 DEFENDANTS ALL DIRECT PURCHASER ACTIONS 15 AS MODIFIED BY THE COURT 16 17 18 19 20 21 22 23 24 25 26 27 28 FINAL JUDGMENT OF DISMISSAL WITH PREJUDICE AS TO LG CHEM DEFENDANTS— Case No. 13-md-02420-YGR Case 4:13-md-02420-YGR Document 2321 Filed 05/16/18 Page 2 of 74 1 This matter has come before the Court to determine whether there is any cause why this 2 Court should not approve the settlement between Direct Purchaser Plaintiffs (“Plaintiffs”) and 3 Defendants LG Chem, Ltd. and LG Chem America, Inc. (together “LG Chem”), set forth in the 4 parties’ settlement agreement dated October 2, 2017, in the above-captioned litigation. The Court, 5 after carefully considering all papers filed and proceedings held herein and otherwise being fully 6 informed, has determined (1) that the settlement agreement should be approved, and (2) that there 7 is no just reason for delay of the entry of this Judgment approving the settlement agreement. 8 Accordingly, the Court directs entry of Judgment which shall constitute a final adjudication of this 9 case on the merits as to the parties to the settlement agreement. -

Zerohack Zer0pwn Youranonnews Yevgeniy Anikin Yes Men

Zerohack Zer0Pwn YourAnonNews Yevgeniy Anikin Yes Men YamaTough Xtreme x-Leader xenu xen0nymous www.oem.com.mx www.nytimes.com/pages/world/asia/index.html www.informador.com.mx www.futuregov.asia www.cronica.com.mx www.asiapacificsecuritymagazine.com Worm Wolfy Withdrawal* WillyFoReal Wikileaks IRC 88.80.16.13/9999 IRC Channel WikiLeaks WiiSpellWhy whitekidney Wells Fargo weed WallRoad w0rmware Vulnerability Vladislav Khorokhorin Visa Inc. Virus Virgin Islands "Viewpointe Archive Services, LLC" Versability Verizon Venezuela Vegas Vatican City USB US Trust US Bankcorp Uruguay Uran0n unusedcrayon United Kingdom UnicormCr3w unfittoprint unelected.org UndisclosedAnon Ukraine UGNazi ua_musti_1905 U.S. Bankcorp TYLER Turkey trosec113 Trojan Horse Trojan Trivette TriCk Tribalzer0 Transnistria transaction Traitor traffic court Tradecraft Trade Secrets "Total System Services, Inc." Topiary Top Secret Tom Stracener TibitXimer Thumb Drive Thomson Reuters TheWikiBoat thepeoplescause the_infecti0n The Unknowns The UnderTaker The Syrian electronic army The Jokerhack Thailand ThaCosmo th3j35t3r testeux1 TEST Telecomix TehWongZ Teddy Bigglesworth TeaMp0isoN TeamHav0k Team Ghost Shell Team Digi7al tdl4 taxes TARP tango down Tampa Tammy Shapiro Taiwan Tabu T0x1c t0wN T.A.R.P. Syrian Electronic Army syndiv Symantec Corporation Switzerland Swingers Club SWIFT Sweden Swan SwaggSec Swagg Security "SunGard Data Systems, Inc." Stuxnet Stringer Streamroller Stole* Sterlok SteelAnne st0rm SQLi Spyware Spying Spydevilz Spy Camera Sposed Spook Spoofing Splendide -

3M Company (MMM)

COMPANY PROFILES 2008 The Research Group of Godsey & Gibb Associates compiled the following information in Godsey & Gibb Associates’ 2008 Company Profiles from Reuters’ Company Profiles. These reports are intended solely for the clients of Godsey & Gibb Associates and its affiliates. This material is for informational purposes only and is not intended to be a recommendation for the purchase or sale of any individual security. GODSEY & GIBB COMPANY PROFILES 2008 TABLE OF CONTENTS AFLAC Inc. (AFL)………………………………………………………………………………………. 1 AGL Resources Inc. (ATG)…………………………………………………………………………… 3 American Electric Power Co. Inc. (AEP)….………………………………………………………… 5 AT&T, Inc (T)…………………………………………………………………………………………… 7 Barrick Gold Corp. (ABX)……………………….……………………………………………………. 9 BB&T Corp. (BBT)………………………………………………………………..…………………… 10 BP, plc (BP)…………………………………………………………………………………….………. 12 Cisco Systems, Inc. (CSCO)……………………………………………………………….………… 13 Cognizant Technology Solutions (CTSH)……………………………………………………….….. 15 CVS Caremark Corp. (CVS)………………………………………………………………………….. 16 Dominion Resources, Inc. (D)………………………………………………….…………………….. 17 Emerson Electric Co. (EMR)………………………………………………………………………….. 19 Express Scripts, Inc. (ESRX)…………………………………………………………………..……… 23 ExxonMobil Corp. (XOM)………………………………………………………………….…………… 24 General Electric Company (GE)………………………………………………………………..……. 26 Gilead Sciences, Inc. (GILD)…………………………………………………………………………. 27 W.W. Grainger, Inc. (GWW)………………………………………………………………………….. 30 Hewlett-Packard Co. (HPQ)………………………………………………………………………….. 32 Integrys Energy Group, -

ANNUAL REPORT PURSUANT to SECTION 13 OR 15 (D) of THE

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ፤ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended: October 31, 2008 Or អ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-4423 HEWLETT-PACKARD COMPANY (Exact name of registrant as specified in its charter) Delaware 94-1081436 (State or other jurisdiction of (I.R.S. employer incorporation or organization) identification no.) 3000 Hanover Street, Palo Alto, California 94304 (Address of principal executive offices) (Zip code) Registrant’s telephone number, including area code: (650) 857-1501 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common stock, par value $0.01 per share New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes No អ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No ፤ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 (the ‘‘Exchange Act’’) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

The Eyes Have It on the Iris in Terms of Being Used for Identi- Tation in Another New Jersey District in 2003, Continued from Page 1 with a Single Pulse of Light

P.O. Box 85518 Lincoln, NE 68501-5518 CHANGE SERVICE REQUESTED July 28, 2006 Volume 28 Number 30 www.processor.com Products, News & Information Data Centers Can Trust. Since 1979 fully in compliance, so they just want to In This ISSUE be more compliant than the other guys so that whoever the regulatory body is will go COVER FOCUS after the other guy,” Bloomberg says. “Of Regulatory Compliance Compliance course, that’s really dangerous—more dan- Compliance is a fairly ho-hum topic, but it’s gener- gerous than speeding, in a way.” ating a lot of industry activity, including a new set Involve IT of manufacturers and related products. Handling compliance-related issues often Compliance Control ..........................................................1 requires complicated processes and proce- Compliance: Do I Need To Worry?....................................9 dures, though an increasing horde of solu- Coping With Compliance ................................................11 Control tions from software and service vendors gives companies a helping hand. Still, it’s a TECH & TRENDS How Regulations Are Changing difficult process integrating compliance Iris vs. Retina Biometrics | 1 into enterprise strategy, particularly when As implementations yield better results and costs The Enterprise IT Landscape employees struggle to understand that com- drop, iris recognition could be the biometric of pliance should be a regular choice for schools, data centers, and companies. by Christian Perry part of business operations • • • and not a separate proce- Create A Disaster Recovery Plan | 28 ALTHOUGH ROLLING EYES tend to greet dure. Many enterprises either fail to create plans for disas- any standard mention of compliance, In a survey sponsored ter recovery and business continuity or create plans there’s no denying the topic is a massive last year by the Security that are inadequate or quickly become outdated. -

Software Use Analyses Software Catalog 22

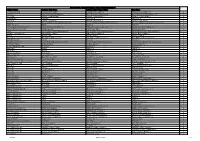

IBM TEM SUA Software Catalog - Newly Added Applications Catalog Publisher Name Software Title Name Software Title Version Name App Name Version ACD Systems Ltd. ACDSee Photo Editor ACDSee Photo Editor 4 ACDSee Photo Editor 4.0 2 Acer Inc. Acer eRecovery Management Acer eRecovery Management 2 Acer eRecovery Management 2.0 2 acs39 Ltd. Science Toolbox Demo Science Toolbox Demo 1 Science Toolbox Demo 1 2 activePDF Inc. PrimoPDF PrimoPDF 4 PrimoPDF 4 2 Activision Ultimate Spiderman Ultimate Spiderman 1 Ultimate Spiderman 1 2 Actuate Actuate e.Report Designer Professional Actuate e.Report Designer Professional 7 Actuate e.Report Designer Professional 7 2 ADINA R & D Inc. ADINA ADINA 8 ADINA 8 2 Adobe Systems Incorporated Adobe Photoshop Lightroom Adobe Photoshop Lightroom 1 Adobe Photoshop Lightroom 1 2 Advanced Geosciences Inc. EarthImager 2D EarthImager 2D 2 EarthImager 2D 2 2 Ageia AGEIA PhysX Boxes Demonstration AGEIA PhysX Boxes Demonstration 2 AGEIA PhysX Boxes Demonstration 2 2 Agilent Technologies Inc. Agilent Data Capture Agilent Data Capture 2 Agilent Data Capture 2 2 AICPCU AICPCU Exam AICPCU Exam 4 AICPCU Exam 4 2 Aide CAD Systems Incorporated Aide PDF to DXF Converter Aide PDF to DXF Converter 6 Aide PDF to DXF Converter 6 2 Alden Group Ltd. Xassist Xassist 1 Xassist 1 2 ALeadSoft.com Inc. Search Engine Builder Professional Search Engine Builder Professional 2 Search Engine Builder Professional 2.0 2 Alentum Software WebLog Expert WebLog Expert 3 WebLog Expert 3 2 AlfaSoft Research Labs AlfaClock AlfaClock 1 AlfaClock 1 2 ALGOR Inc. ALGOR ALGOR 14 ALGOR 14 2 ALGOR Inc. -

Form 10-K Hp Inc

Table of contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended October 31, 2016 Or o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-4423 HP INC. (Exact name of registrant as specified in its charter) Delaware 94-1081436 (State or other jurisdiction of (I.R.S. employer incorporation or organization) identification no.) 1501 Page Mill Road, Palo Alto, California 94304 (Address of principal executive offices) (Zip code) Registrant’s telephone number, including area code: (650) 857-1501 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common stock, par value $0.01 per share New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes x No o Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Form 10-K Hp Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended October 31, 2018 Or o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-4423 HP INC. (Exact name of registrant as specified in its charter) Delaware 94-1081436 (State or other jurisdiction of (I.R.S. employer incorporation or organization) identification no.) 1501 Page Mill Road, Palo Alto, California 94304 (Address of principal executive offices) (Zip code) Registrant’s telephone number, including area code: (650) 857-1501 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common stock, par value $0.01 per share New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes x No o Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Final Judgment of Dismissal with Prejudice Re TOKIN Settlement

Case 4:13-md-02420-YGR Document 2319 Filed 05/16/18 Page 1 of 70 1 2 3 4 5 6 7 8 UNITED STATES DISTRICT COURT 9 NORTHERN DISTRICT OF CALIFORNIA 10 OAKLAND DIVISION 11 IN RE: LITHIUM ION BATTERIES Case No. 13-md-02420-YGR ANTITRUST LITIGATION 12 MDL No. 2420 13 This Document Relates To: FINAL JUDGMENT OF DISMISSAL 14 WITH PREJUDICE AS TO DEFENDANT ALL DIRECT PURCHASER ACTIONS TOKIN CORPORATION 15 AS MODIFIED BY THE COURT 16 17 18 19 20 21 22 23 24 25 26 27 28 FINAL JUDGMENT OF DISMISSAL WITH PREJUDICE AS TO DEFENDANT TOKIN CORPORATION— Case No. 13-md-02420-YGR Case 4:13-md-02420-YGR Document 2319 Filed 05/16/18 Page 2 of 70 1 This matter has come before the Court to determine whether there is any cause why this 2 Court should not approve the settlement between Direct Purchaser Plaintiffs (“Plaintiffs”) and 3 Defendant TOKIN Corporation (“TOKIN”), formerly known as NEC TOKIN Corporation, set 4 forth in the parties’ settlement agreement dated August 30, 2017, in the above-captioned litigation. 5 The Court, after carefully considering all papers filed and proceedings held herein and otherwise 6 being fully informed, has determined (1) that the settlement agreement should be approved, and (2) 7 that there is no just reason for delay of the entry of this Judgment approving the settlement 8 agreement. Accordingly, the Court directs entry of Final Judgment which shall constitute a final 9 adjudication of this case on the merits as to the parties to the settlement agreement. -

View Annual Report

2009 ANNUAL REPORT CEO letter Dear Fellow Stockholders, In 2009, the global economy experienced the Perhaps nowhere has this agility been more evident worst recession in a generation. At HP, all of our than in our Personal Systems Group (PSG). In the work to reduce our cost base and to make it more first quarter, PSG revenue declined 19 percent from variable proved immensely valuable. Beginning the prior year, but the business was able to adjust in our first fiscal quarter, we had to address a quickly to the new environment, rationalizing an rapidly deteriorating demand environment across operating model that encompasses the industry’s our product portfolio. We set a goal of controlling largest PC supply chain and tens of thousands discretionary spending, while keeping the muscle of resellers and retailers around the world. of the organization intact and maintaining forward PSG delivered solid margins and continued to progress on our core strategy. At the same time, we drive innovation into the market with a steady focused on executing the integration of the services rollout of high-performing, well-designed, and businesses acquired from Electronic Data Systems well-received products. Over the course of the Corporation (EDS) in August 2008, ultimately year, PSG not only reaffirmed its position as the rebranding the business HP Enterprise Services worldwide leader in PC market share, but also within the HP Enterprise Business. Although there captured the #1 position in the U.S. enterprise is still much work to do, we enter fiscal 2010 in a market with double-digit share gains. stronger competitive position. -

Technology Tutorials Provides Intelligence About Emerging and Mature Technologies

Technology Tutorials Provides intelligence about emerging and mature technologies. .NET Security (FIPS) Network Documentation and Design Tools 311 Telecom Services Federal Information Security Management Act Network Management Outsourcing Alternatives 3G Wireless Networks Femtocell Technology Network Management Tools AJAX Web Development Techniques Fibre Channel Storage Network Security Best Practices APCO Project 25 Digital Land Mobile Radio First Responder Communications Issues & OMB-A11 Part 7 Rules for Acquisition of IT ASP.NET Architecture Solutions in the US Assets Airport Security Programs in The US Flash Design Techniques OMB-A76 Outsourcing Rules Alternatives for Secure Online Transactions Global Positioning Systems Overview Online Training and e-Learning for Government Application Server Overview Government IT Infrastructure Regulations and Agencies Architecture Maturity Models Standards Open Source Development Platforms Automated Patch Management Grid Computing Applications Open Source Healthcare Software Balanced Scorecard Management HIPAA Alternatives Open Source Network Management Software Best Practices for IT Asset Management HIPAA Compliance Software Optical Disc Storage Technology Best Practices for Preparing a Request for HIPAA Records Management Outsourcing Best Practices Proposal Hardening Network Servers Outsourcing the Enterprise Development Best Practices in Change Management Hardware Lifecycle Management Project Best Practices in Project Management Healthcare Information Management Pandemic Planning Biometric -

Confidential

CONFIDENTIAL records management software that we acquired through our acquisition of Tower Software in fiscal 2008. OpenCall Solutions. OpenCall solutions is a suite of comprehensive, carrier-grade software platforms for service providers that enable them to develop and deploy next-generation voice, data and converged network services. Personal Systems Group PSG is the leading provider of personal computers (‘‘PCs’’) in the world based on unit volume shipped and annual revenue. PSG provides commercial PCs, consumer PCs, workstations, handheld computing devices, calculators and other related accessories, software and services for the commercial and consumer markets. We group commercial desktops, commercial notebooks and workstations into commercial clients and consumer desktop and consumer notebooks into consumer clients when describing our performance in these markets. Like the broader PC market, PSG continues to experience a shift toward mobile products such as notebooks. Both commercial and consumer PCs are based predominately on the Windows operating system and use Intel and AMD processors. Commercial PCs. PSG offers a variety of personal computers optimized for commercial uses, including enterprise and SMB customers, and for connectivity and manageability in networked environments. These commercial PCs include primarily the HP Compaq business desktops, notebooks, and Tablet PCs, the HP EliteBook line of Mobile Workstations and professional notebooks, as well as the HP Mini-Note PC, HP Blade PCs, Retail POS systems, and the HP Compaq and Neoware Thin Clients. Consumer PCs. Consumer PCs include the HP Pavilion and Compaq Presario series of multi- media consumer desktops and notebooks, as well as the HP Pavilion Elite desktops, HP HPDX Premium notebooks and Touchsmart PCs, as well as Voodoo Gaming PCs, which are targeted at the home user.