ANNUAL REPORT PURSUANT to SECTION 13 OR 15 (D) of THE

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27

Case 4:13-md-02420-YGR Document 2321 Filed 05/16/18 Page 1 of 74 1 2 3 4 5 6 7 8 UNITED STATES DISTRICT COURT 9 NORTHERN DISTRICT OF CALIFORNIA 10 OAKLAND DIVISION 11 IN RE: LITHIUM ION BATTERIES Case No. 13-md-02420-YGR ANTITRUST LITIGATION 12 MDL No. 2420 13 FINAL JUDGMENT OF DISMISSAL This Document Relates To: WITH PREJUDICE AS TO LG CHEM 14 DEFENDANTS ALL DIRECT PURCHASER ACTIONS 15 AS MODIFIED BY THE COURT 16 17 18 19 20 21 22 23 24 25 26 27 28 FINAL JUDGMENT OF DISMISSAL WITH PREJUDICE AS TO LG CHEM DEFENDANTS— Case No. 13-md-02420-YGR Case 4:13-md-02420-YGR Document 2321 Filed 05/16/18 Page 2 of 74 1 This matter has come before the Court to determine whether there is any cause why this 2 Court should not approve the settlement between Direct Purchaser Plaintiffs (“Plaintiffs”) and 3 Defendants LG Chem, Ltd. and LG Chem America, Inc. (together “LG Chem”), set forth in the 4 parties’ settlement agreement dated October 2, 2017, in the above-captioned litigation. The Court, 5 after carefully considering all papers filed and proceedings held herein and otherwise being fully 6 informed, has determined (1) that the settlement agreement should be approved, and (2) that there 7 is no just reason for delay of the entry of this Judgment approving the settlement agreement. 8 Accordingly, the Court directs entry of Judgment which shall constitute a final adjudication of this 9 case on the merits as to the parties to the settlement agreement. -

Zerohack Zer0pwn Youranonnews Yevgeniy Anikin Yes Men

Zerohack Zer0Pwn YourAnonNews Yevgeniy Anikin Yes Men YamaTough Xtreme x-Leader xenu xen0nymous www.oem.com.mx www.nytimes.com/pages/world/asia/index.html www.informador.com.mx www.futuregov.asia www.cronica.com.mx www.asiapacificsecuritymagazine.com Worm Wolfy Withdrawal* WillyFoReal Wikileaks IRC 88.80.16.13/9999 IRC Channel WikiLeaks WiiSpellWhy whitekidney Wells Fargo weed WallRoad w0rmware Vulnerability Vladislav Khorokhorin Visa Inc. Virus Virgin Islands "Viewpointe Archive Services, LLC" Versability Verizon Venezuela Vegas Vatican City USB US Trust US Bankcorp Uruguay Uran0n unusedcrayon United Kingdom UnicormCr3w unfittoprint unelected.org UndisclosedAnon Ukraine UGNazi ua_musti_1905 U.S. Bankcorp TYLER Turkey trosec113 Trojan Horse Trojan Trivette TriCk Tribalzer0 Transnistria transaction Traitor traffic court Tradecraft Trade Secrets "Total System Services, Inc." Topiary Top Secret Tom Stracener TibitXimer Thumb Drive Thomson Reuters TheWikiBoat thepeoplescause the_infecti0n The Unknowns The UnderTaker The Syrian electronic army The Jokerhack Thailand ThaCosmo th3j35t3r testeux1 TEST Telecomix TehWongZ Teddy Bigglesworth TeaMp0isoN TeamHav0k Team Ghost Shell Team Digi7al tdl4 taxes TARP tango down Tampa Tammy Shapiro Taiwan Tabu T0x1c t0wN T.A.R.P. Syrian Electronic Army syndiv Symantec Corporation Switzerland Swingers Club SWIFT Sweden Swan SwaggSec Swagg Security "SunGard Data Systems, Inc." Stuxnet Stringer Streamroller Stole* Sterlok SteelAnne st0rm SQLi Spyware Spying Spydevilz Spy Camera Sposed Spook Spoofing Splendide -

3M Company (MMM)

COMPANY PROFILES 2008 The Research Group of Godsey & Gibb Associates compiled the following information in Godsey & Gibb Associates’ 2008 Company Profiles from Reuters’ Company Profiles. These reports are intended solely for the clients of Godsey & Gibb Associates and its affiliates. This material is for informational purposes only and is not intended to be a recommendation for the purchase or sale of any individual security. GODSEY & GIBB COMPANY PROFILES 2008 TABLE OF CONTENTS AFLAC Inc. (AFL)………………………………………………………………………………………. 1 AGL Resources Inc. (ATG)…………………………………………………………………………… 3 American Electric Power Co. Inc. (AEP)….………………………………………………………… 5 AT&T, Inc (T)…………………………………………………………………………………………… 7 Barrick Gold Corp. (ABX)……………………….……………………………………………………. 9 BB&T Corp. (BBT)………………………………………………………………..…………………… 10 BP, plc (BP)…………………………………………………………………………………….………. 12 Cisco Systems, Inc. (CSCO)……………………………………………………………….………… 13 Cognizant Technology Solutions (CTSH)……………………………………………………….….. 15 CVS Caremark Corp. (CVS)………………………………………………………………………….. 16 Dominion Resources, Inc. (D)………………………………………………….…………………….. 17 Emerson Electric Co. (EMR)………………………………………………………………………….. 19 Express Scripts, Inc. (ESRX)…………………………………………………………………..……… 23 ExxonMobil Corp. (XOM)………………………………………………………………….…………… 24 General Electric Company (GE)………………………………………………………………..……. 26 Gilead Sciences, Inc. (GILD)…………………………………………………………………………. 27 W.W. Grainger, Inc. (GWW)………………………………………………………………………….. 30 Hewlett-Packard Co. (HPQ)………………………………………………………………………….. 32 Integrys Energy Group, -

United States Securities and Exchange Commission Form

Use these links to rapidly review the document Table of Contents ITEM 8. Financial Statements and Supplementary Data. ITEM 15. Exhibits and Financial Statement Schedules. Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended October 31, 2012 Or o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-4423 HEWLETT-PACKARD COMPANY (Exact name of registrant as specified in its charter) Delaware 94-1081436 (State or other jurisdiction of (I.R.S. employer incorporation or organization) identification no.) 3000 Hanover Street, Palo Alto, California 94304 (Address of principal executive offices) (Zip code) Registrant's telephone number, including area code: (650) 857-1501 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common stock, par value $0.01 per share New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes No o Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Hewlett-Packard: the Apotheker Vision Contents New CEO Leo Apotheker Has Laid out His Vision for HP— One That Emphasizes Cloud, Mobility and Software

March 23, 2011 $99 Analytics.InformationWeek.com Analytics Alert Hewlett-Packard: The Apotheker Vision Contents New CEO Leo Apotheker has laid out his vision for HP— one that emphasizes cloud, mobility and software. It’s a 2 Is There Enough Software to Knit HP’s Strategy Together? grand ambition, and the company needs to bulk up in 6 HP’s Leo Apotheker Talks some areas to make it happen. Turkey (and Some Trash) 8 Apotheker Focuses on Cloud, Not Consumers 10 HP Goes All In on the Cloud 13 HP Poised to Capitalize on Apple, Amazon Lessons 16 Related Reports Apotheker Vision Analytics.InformationWeek.com Analytics Alert March 15, 2011 Is There Enough Software to Knit HP’s Strategy Together? By Doug Henschen Throughout the recent hours-long HP Summit, in which CEO Leo Apotheker and his top lieu - tenants laid out the company’s grand strategy, executives repeatedly challenged, “Who is better positioned than HP to execute on this strategy?” When it comes to software, several other com - panies come to mind. IBM and Oracle, for instance, will counter the broad - est ambitions of Hewlett-Packard’s enterprise strategy, and plenty of segment players, such as Apple, EMC and Teradata, will blunt narrower ones. And even HP’s partners might not be supportive of, say, the cloud and WebOS ecosystems it’s now building. Microsoft, for example, has its own hybrid cloud strategy, and how could it view WebOS as anything other than a threat to Windows? If HP is to be greater than the sum of its parts, as CEO Leo Apotheker vowed it would become, software will HP CEO Leo Apotheker have to knit together the pieces, which he acknowl - edged to be more like silos within the company today. -

The Eyes Have It on the Iris in Terms of Being Used for Identi- Tation in Another New Jersey District in 2003, Continued from Page 1 with a Single Pulse of Light

P.O. Box 85518 Lincoln, NE 68501-5518 CHANGE SERVICE REQUESTED July 28, 2006 Volume 28 Number 30 www.processor.com Products, News & Information Data Centers Can Trust. Since 1979 fully in compliance, so they just want to In This ISSUE be more compliant than the other guys so that whoever the regulatory body is will go COVER FOCUS after the other guy,” Bloomberg says. “Of Regulatory Compliance Compliance course, that’s really dangerous—more dan- Compliance is a fairly ho-hum topic, but it’s gener- gerous than speeding, in a way.” ating a lot of industry activity, including a new set Involve IT of manufacturers and related products. Handling compliance-related issues often Compliance Control ..........................................................1 requires complicated processes and proce- Compliance: Do I Need To Worry?....................................9 dures, though an increasing horde of solu- Coping With Compliance ................................................11 Control tions from software and service vendors gives companies a helping hand. Still, it’s a TECH & TRENDS How Regulations Are Changing difficult process integrating compliance Iris vs. Retina Biometrics | 1 into enterprise strategy, particularly when As implementations yield better results and costs The Enterprise IT Landscape employees struggle to understand that com- drop, iris recognition could be the biometric of pliance should be a regular choice for schools, data centers, and companies. by Christian Perry part of business operations • • • and not a separate proce- Create A Disaster Recovery Plan | 28 ALTHOUGH ROLLING EYES tend to greet dure. Many enterprises either fail to create plans for disas- any standard mention of compliance, In a survey sponsored ter recovery and business continuity or create plans there’s no denying the topic is a massive last year by the Security that are inadequate or quickly become outdated. -

HP Annual Report 2007

Annual Report 2007 Forward-looking Statements This document contains forward-looking statements that involve risks, uncertainties and assumptions. If such risks or uncertainties materialize or such assumptions prove incorrect, the results of HP and its consolidated subsidiaries could differ materially from those expressed or implied by such forward-looking statements and assumptions. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including but not limited to any statements of the plans, strategies and objectives of management for future operations; any statements concerning expected development, performance, market share or demand relating to HP’s products and services; any statements regarding anticipated operational and financial results, including the execution of cost reduction programs; any statements including estimates regarding market size or growth; any statements regarding future economic conditions or performance; any statements of expectation or belief; and any statements of assumptions underlying any of the foregoing. Risks, uncertainties and assumptions include the execution and performance of contracts by HP and its customers, suppliers and partners; the achievement of expected results; expectations and assumptions relating to the execution and timing of cost reduction programs; and other risks that are described in HP’s filings with the Securities and Exchange Commission, including but not limited to HP’s Annual Report on Form 10 K for the fiscal year ended October 31, 2007, which is included as part of this document. HP assumes no obligation and does not intend to update these forward-looking statements. CEO Letter Dear Fellow Stockholders: If one word can best describe HP’s performance in fiscal 2007, it is growth. -

2006 HP Annual Report Dear Fellow Stockholders

2006 HP Annual Report [Cover depicts a solid green background with a thin white horizontal stretch bar wrapping around the cover. The HP logo sits in the lower right-hand corner. 2006 HP Annual Report sits within the white bar.] Dear Fellow Stockholders, HP made solid progress this past year toward our goal of becoming the world’s leading IT company. We want to create the best technology on the planet — and be the best at selling, servicing and supporting that technology. To get there, we are focusing our portfolio of products and services on simplifying our customers’ experiences with technology and helping them do what they want to do, wherever they are. For example, in our enterprise business, we are working on helping our customers run their businesses with automated, super-efficient data centers. In our imaging and printing business, we are helping customers more rapidly achieve the benefits of printing from a digital source in areas such as commercial printing and retail photo printing. And in our personal systems business, we are working to empower customers with simple, always-connected, mobile computing experiences at work, at home or on the go. While we worked toward these strategic goals, we also improved the health of our financials. Our revenue increased 6 percent in fiscal year 2006 to $91.7 billion. Non-GAAP EPS increased 47 percent to $2.38¹, and GAAP diluted EPS increased 166 percent to $2.18. And we generated record cash flow from operations of $11.4 billion. We also achieved the most balanced profit mix by business group that HP has seen in years. -

Mercury Interactive Corporation Securities Litigation 05-CV-03395

Adam Sand D3claration Exhibit 23 Press Release Mercury Interactive Corporation Reports Preliminary Fourth Quarter Result s Increasing Revenue and Earnings Estimate s MOUNTAIN VIEW, CALIF. - January 24, 2005 - Mercury Interactive Corporation (NASDAQ : MERQ), the global leader in business technology optimization (BTO), today announced preliminary financial results for the fourth quarter ended December 31, 2004 . Mercury expects total revenue for the fourth quarter of 2004 to be in the range of $203 million to $205 million, which exceeds previously provided guidance of $185 million to $195 million . The increase in deferred revenue for the fourth quarter of 2004 is expected to be in the range of $63 million to $66 million, which exceeds previously provided guidance of $40 million to $50 million . GAAP diluted earnings per share for the fourth quarter of 2004 is expected to be in the range of $0 .34 to $0 .36. Non-GAAP diluted earnings per share for the fourth quarter of 2004 is expected to be in the range of $0 .40 to $0 .42 . In both GAAP and Non-GAAP diluted earnings per share estimations, fully diluted shares were approximated in the range of 97 .7 million to 98 .7 million, which takes into consideration the recent issuance of EITF 04-08, "Effect of Contingently Convertible Debt on Diluted Earnings per Share" . Mercury's previously provided guidance of GAAP diluted earnings per share of $0 .28 to $0 .34 and Non-GAAP diluted earnings per share of $0.32 to $0 .38 were both expected to be reduced by $0 .03 to $0.04, due to the inclusion of the EITF . -

Phân Tích Tài Chính Công Ty Hewlett Packard (Hp)

ĐẠI HỌC ĐÀ NẴNG TRƯỜNG ĐẠI HỌC KINH TẾ KHOA QUẢN TRỊ KINH DOANH PHÂN TÍCH TÀI CHÍNH CÔNG TY HEWLETT PACKARD (HP) GVHD: TS. NGUYỄN THANH LIÊM SVTH: NHÓM JOHNSON & JOHNSON Huỳnh Công Danh – 35K16.1 Nguyễn Thanh Vũ – 35K16.1 Đoàn Thị Minh Nguyệt – 35K16.2 Ngô Bá Lân – 35K16.2 [2012] J O H N S O N & JOHNSON Quản trị tài chính nâng cao GVHD: TS. Nguyễn Thanh Liêm MỤC LỤC DANH MỤC BẢNG BIỂU ............................................................................................ 3 DANH MỤC BIỂU ĐỒ .................................................................................................. 3 DANH MỤC TỪ VIẾT TẮT ......................................................................................... 4 LỜI NÓI ĐẦU ................................................................................................................ 6 1. GIỚI THIỆU CÔNG TY HEWLETT PACKARD ............................................... 7 1.1.Khái quát về HP ................................................................................................................ 7 1.2. Lĩnh vực và phạm vi hoạt động ................................................................................... 7 1.2.1. Nhóm hệ thống cá nhân(PSG) ................................................................................ 7 1.2.2. Dịch vụ HP ............................................................................................................ 7 1.2.3. Nhóm hình ảnh và in ấn (IPG) ............................................................................... 8 1.2.4. Các -

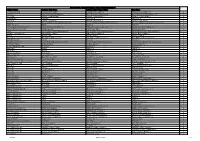

Software Use Analyses Software Catalog 22

IBM TEM SUA Software Catalog - Newly Added Applications Catalog Publisher Name Software Title Name Software Title Version Name App Name Version ACD Systems Ltd. ACDSee Photo Editor ACDSee Photo Editor 4 ACDSee Photo Editor 4.0 2 Acer Inc. Acer eRecovery Management Acer eRecovery Management 2 Acer eRecovery Management 2.0 2 acs39 Ltd. Science Toolbox Demo Science Toolbox Demo 1 Science Toolbox Demo 1 2 activePDF Inc. PrimoPDF PrimoPDF 4 PrimoPDF 4 2 Activision Ultimate Spiderman Ultimate Spiderman 1 Ultimate Spiderman 1 2 Actuate Actuate e.Report Designer Professional Actuate e.Report Designer Professional 7 Actuate e.Report Designer Professional 7 2 ADINA R & D Inc. ADINA ADINA 8 ADINA 8 2 Adobe Systems Incorporated Adobe Photoshop Lightroom Adobe Photoshop Lightroom 1 Adobe Photoshop Lightroom 1 2 Advanced Geosciences Inc. EarthImager 2D EarthImager 2D 2 EarthImager 2D 2 2 Ageia AGEIA PhysX Boxes Demonstration AGEIA PhysX Boxes Demonstration 2 AGEIA PhysX Boxes Demonstration 2 2 Agilent Technologies Inc. Agilent Data Capture Agilent Data Capture 2 Agilent Data Capture 2 2 AICPCU AICPCU Exam AICPCU Exam 4 AICPCU Exam 4 2 Aide CAD Systems Incorporated Aide PDF to DXF Converter Aide PDF to DXF Converter 6 Aide PDF to DXF Converter 6 2 Alden Group Ltd. Xassist Xassist 1 Xassist 1 2 ALeadSoft.com Inc. Search Engine Builder Professional Search Engine Builder Professional 2 Search Engine Builder Professional 2.0 2 Alentum Software WebLog Expert WebLog Expert 3 WebLog Expert 3 2 AlfaSoft Research Labs AlfaClock AlfaClock 1 AlfaClock 1 2 ALGOR Inc. ALGOR ALGOR 14 ALGOR 14 2 ALGOR Inc. -

Oracle's Peoplesoft Enterprise Campus

O RACLE REVISION 2.0 ORACLE’S PEOPLESOFT ENTERPRISE CAMPUS SOLUTIONS 9 USING MICROSOFT SQL SERVER 2005 ON HEWLETT-PACKARD BLADE SERVERS As a global leader in e-business applications, Oracle is committed to delivering high performance solutions that meet our customers’ expectations. Business software must deliver rich functionality with robust performance. This performance must be maintained at volumes that are representative of customer environments. Oracle benchmarks demonstrate our software’s performance characteristics for a range of processing volumes in a specific configuration. Customers and prospects can use this information to determine the software, hardware, and network configurations necessary to support their processing volumes. The primary objective of our benchmarking effort is to provide as many data points as possible to support this important decision. SUMMARY OF RESULTS This benchmark measured the online performance for a large PeopleSoft QuickTest Client Timers database model. Enterprise Campus Solutions 9 Single 5,000 6,000 Testing was conducted in a controlled environment with no Benchmark User Users Users other applications running. The tuning changes, if any, were approved by Oracle Enterprise Development and will be Average Logon 0.58 sec 0.64 sec 0.72 sec generally available in a future update. The goal of this Avg. Load Student 0.64 sec 1.00 sec 1.17 sec Benchmark was to obtain reference response times for Center Campus Solutions Release 9 using SQL Server on HP Blade servers. Avg. Page Load 0.69 sec 0.86 sec