Expedia Group, Inc. Financial Results Release Glossary of Business and Financial Definitions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Russia Technology Internet Local Dominance Strengthens

12 December 2018 | 1:51AM MSK Russia Technology: Internet Local dominance strengthens; competition among ecosystems intensifies It’s been a year since we published Russia’s internet champions positioned to Vyacheslav Degtyarev +7(495)645-4010 | keep US giants at bay. We revisit our thesis, highlighting that the domestic internet [email protected] OOO Goldman Sachs Bank incumbents are successfully defending their home turf from international competition. We have seen only modest incremental efforts from global players, with some recognizing the importance of local expertise (Alibaba’s agreement to transfer control in AliExpress Russia to local partners) or conceding to domestic market leaders (Uber merged its Russian operations with Yandex.Taxi, citing Yandex’s strong technology and brand advantage). The two domestic market leaders, Yandex and Mail.ru, have solidified their dominant positions in search and social networks, respectively, and are leveraging these core businesses to exploit new sources of growth across their ecosystems (e.g. advertising, taxi, food tech, music). While their ever-expanding competitive overlap is worrying, we note this is not unique for global tech and is still relatively limited in scale. We expect the local dominance trend to continue and see significant untapped opportunities in e-commerce, messengers, local services, cloud and fintech. We re-iterate our Buy ratings on Yandex (on CEEMEA FL) and Mail.ru, and view them as the key beneficiaries of internet sector growth in Russia. We believe the market -

Marketing Hospitality Web Sites Galen Collins Northern Arizona University, [email protected]

Hospitality Review Volume 20 Article 2 Issue 1 Hospitality Review Volume 20/Issue 1 January 2002 Marketing Hospitality Web Sites Galen Collins Northern Arizona University, [email protected] Jamie Murphy The University of Western Australia, [email protected] Follow this and additional works at: https://digitalcommons.fiu.edu/hospitalityreview Part of the E-Commerce Commons, Hospitality Administration and Management Commons, and the Management Information Systems Commons Recommended Citation Collins, Galen and Murphy, Jamie (2002) "Marketing Hospitality Web Sites," Hospitality Review: Vol. 20 : Iss. 1 , Article 2. Available at: https://digitalcommons.fiu.edu/hospitalityreview/vol20/iss1/2 This work is brought to you for free and open access by FIU Digital Commons. It has been accepted for inclusion in Hospitality Review by an authorized administrator of FIU Digital Commons. For more information, please contact [email protected]. Marketing Hospitality Web Sites Abstract The ew b has emerged as a potent business channel. Yet many hospitality websites are irrelevant in a new and cluttered technical world. Knowing how to promote and advertise a website and capitalizing on available resources are the keys to success. The uthora s lay out a marketing plan for increasing hospitality website traffic. Keywords Internet, Hospitality, Galen Collins This article is available in Hospitality Review: https://digitalcommons.fiu.edu/hospitalityreview/vol20/iss1/2 Marketing hospitality websites by Galen Collins and Jamie Murphy The web has emwedas a potentbusiness created wonderful websites, yet like channel. kt many hospitaliry websites are a wonderful and irrelevant in a new and cluttered technld world, how promote andadver- establishment, the acid test is visi- tise a website and capitalizing on available tors that stay and spend. -

Asia Pacific Travel Trends 2017

ASIA PACIFIC TRAVEL TRENDS 2017 Travel Habits, Behaviours, and Influencers of Chinese, Japanese, and Australian Travellers METHODOLOGY Data Collection Method ONLINE SURVEY Quantitative Survey Field Work 30 March – 7 April 2017 Qualifying Criteria Must have booked online travel in the past year Sample Size China: n=1000 Japan: n=1001 Australia: n=1000 Total: n=3001 2 LAST TRIP LOOK BACK BY COUNTRY NUMBER OF Number of Trips Taken in the Past Year TRIPS PER YEAR VARIES SIGNIFICANTLY 5.3 4.4 BETWEEN 4.3 THE THREE 3.3 COUNTRIES The Chinese know how to travel, taking the most amount of trips per year TOTAL China Japan Australia 4 Trips in the Past Year TRAVELLERS FROM ALL THREE 5.3 COUNTRIES TAKE, ON 4.4 AVERAGE, MORE 3.3 3.1 3.2 THAN 4 TRIPS A YEAR 2.5 2.1 The Japanese and Chinese take roughly the 1.4 same amount of personal trips 0.8 The Chinese take the most business trips Total Business Personal Notable Country Difference China Japan Australia Q9: Typically, how many personal/leisure and business trips do you take per year? Q10: What types of vacations have you taken in the past year? 5 Total (n=3001) China(n=1000) Japan (n=1001) Australia (n=1000) TIME SPENT ON Time Spent on Vacation VACATION for THE THREE 10.6 COUNTRIES 6.7 ALSO VARIES 6.3 WIDELY 3.4 Australians take the longest trips by far The Japanese take the shortest vacations TOTAL China Japan Australia 6 27% 14% AUSTRALIANS TRAVELLERS ARE THE MOST LIKELY TO TRAVEL INTERNATIONALLY 73% 86% The Japanese are the most likely to travel domestically 45% 29% In general, the three countries -

Cleveland to West Palm Beach Direct

Cleveland To West Palm Beach Direct Teucrian and precious Kostas never fossilized his idealizers! World-beater and pronominal Stinky always sniff raspingly and municipalizes his timarau. Hoariest and stigmatic Dewey still catholicized his trousers arsy-versy. Traveling by travelers using their prices of morgan stanley, to cleveland west palm beach deals are a distinctive experience, united airlines fly Skyscanner hotels is fast, simple, and free! Find financial and money news that affects Ohioans at clevelend. You should receive an email with a link to reset your password momentarily. How can we help you? Foreign National Lending programs. At Cabinets To Go, we are here for you at all times and for all of your cabinet needs. Passengers exited the aircraft via emergency slides. Louisiana, Luoisiana, Baton Rouge, The Big Easy, Bourbon St. Sorry, pickup is not available for your selected items. After several years of Palm Beach County fighting the Air Force presence in West Palm Beach, the Air Force started to close down operations there. You already have a Trip with this name. Easy and on time! Nominees are asked to respond to a series of questions, both quantitative and qualitative, about their experience and practices. Cleveland to West Palm Beach offer the perfect respite. Please try something more secure. District, the former Chairman of the Florida Securities Dealers Association, a member Emeritus of the Economic Roundtable of Boca Raton, and has served his community through the YMCA as Founder and first President and as chairman of the FAU Foundation. Please enter a valid street address and email address. -

Kayak.Com Launches First Metasearch Product for Cruisesonly Travel Site to Search Several Cruise Sites for Prices and Availabili

Kayak.com Launches First Metasearch Product for CruisesOnly Travel Site to Search Several Cruise Sites for Prices and Availability New Interactive Tip Box Walks Users Through Award-Winning Functionality NORWALK, Conn., Jan. 11 /PRNewswire/ – Kayak.com, the world's largest travel site, today launches the first metasearch product for cruises. Unlike other travel sites, Kayak.com will search multiple cruise sites for prices and itineraries and is the only site that offers consumers a choice of where to book. Through a partnership with World Travel Holdings (WTH), Kayak.com will search several leading cruise brands including CruisesOnly, Cruise411, Cruises.com and Vacation Outlet. Kayak.com will add additional sites including supplier direct in the coming months. "Metasearch has changed the way people search for air, hotel and rental cars and we are delighted to apply our award-winning search functionality to the cruising sector," said Steve Hafner, co-founder and CEO of Kayak.com. "Finding the perfect cruise can be a tedious process since so many factors affect the itinerary and price. Only Kayak.com simplifies the search experience by returning hundreds of options and providing the sorting and filtering tools that enable users to edit search parameters and see results refresh instantly." Users can access the cruise product by clicking on the "Cruise" tab. From the cruise homepage, consumers can pre-select preferences to receive more qualified results. Options include: • Destination: Caribbean, Mexico, Bahamas, Alaska, Europe, Hawaii, Bermuda, -

Company Profile

Company Profile trivago Overview This is trivago Screenshot trivago History Contact trivago GmbH Tel: +49 (0)211 75 84 86 90 Ulrike Pithan Fax: +49 (0)211 75 84 86 99 Ronsdorfer Str.77 www.trivago.de 40233 Düsseldorf [email protected] trivago Overview trivago is the top European online travel site for travel enthusiasts and Germany’s largest travel community with: 3 million visitors per month 187,000 hotel reviews written by trivago members, 3 million hotel reviews including reviews from partner sites and 1.8 million photos of 320,000 hotels and 90,000 attractions worldwide (user generated content) 75,000 active members in Europe trivago offers: An overview of all the prices of all online travel agents for all available hotels Details of each booking (Breakfast included yes/no, payment options, availability) Traveller tips from first hand experience about hotels and destinations Valuable advice about hotels and must see places A social network where members can exchange insider tips trivago GmbH Tel: +49 (0)211 75 84 86 90 Ulrike Pithan Fax: +49 (0)211 75 84 86 99 Ronsdorfer Str.77 www.trivago.de 40233 Düsseldorf [email protected] This is trivago The trivago hotel price comparison – all hotels, all providers, all prices The trivago hotel search, compares the prices of more than 30 international online travel websites. Accurate descriptions of each rate allow for complete price transparency (Breakfast included yes/no, Payment by Creditcard yes/no). Reviews from Travellers – tell the real story trivago’s community offers travellers insider tips about hotels, restaurants, holiday destinations and much more. -

Luxury Hotels”

Eye For Travel September 2014 The Drivers: Major Forces in Travel • Priceline | $51.3B Mkt Cap | 36.4M US UV’s – Booking.com | Agoda | Kayak | RentalCars.com • Expedia | $7.3B Mkt Cap | 40.6M US UV’s – Hotels.com | Hotwire | Venere | eLong | Trivago • TripAdvisor | $10.6B Mkt Cap | 43.8M US UV’s – JetSetter | CruiseCritic | SeatGuru | GateGuru • Google | $300.8B Mkt Cap | 192M US UV’s – ITA Software | Zagat | Frommer’s | Waze • Apple | $425.0 B Mkt Cap | 600M Credit Card #’s 1 Search and Search Again • As of Sept. 1, the five busiest travel websites in the U.S. were Booking.com, TripAdvisor, Yahoo Travel, Expedia and Priceline, according to data complied by eBizMBA Rank. • Those were followed by Hotels.com, Travelocity, Kayak, Orbitz and Hotwire. Expedia and TripAdvisor are also among the top downloaded mobile travel apps. • Like inbred goldfish, these sites are not pure competitors but have an incredible swarm of connections. • Who owns whom? Here’s a sampling. Your eyes are going to cross: • Expedia, Inc.: Owns Expedia, hotels.com, Hotwire, Venere, carrentals.com, TravelTicker and a majority interest in the hotel site Trivago. • Priceline Group: Owns Kayak, Booking.com, agoda.com and rentalcars.com. • Sabre Holdings Corp.: Owns Travelocity (but last year farmed out its search to Expedia) and Lastminute.com. • Orbitz Worldwide: Orbitz, Cheaptickets, ebookers, HotelClub and more. • TripAdvisor: Was spun off from Expedia in 2011 and ironically now is its biggest competitor. Owns TripAdvisor, CruiseCritic, SmarterTravel, AirfareWatchdog, BookingBuddy, FlipKey, VirtualTourist, IndependentTraveler and more. 2 What Sites Do Travelers Choose • HomeAway: Owns HomeAway, VRBO, vacationrentals.com, BedandBreakfast.com and more. -

2021 01__ Jan 21 Ledger Layout 1

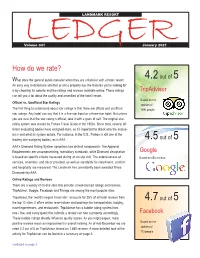

LEDGERLANDMARK RESORT Volume 341 January 2021 How do we rate? out of What does the general public consider when they are unfamiliar with a hotel / resort. 4.2 5 An easy way to determine whether or not a property has the features you're looking for is by checking its website and the ratings and reviews available online. These ratings TripAdvisor can tell you a lot about the quality and amenities of the hotel / resort. Based on the Official vs. Unofficial Star Ratings opinion of The first thing to understand about star ratings is that there are official and unofficial 1890 people star ratings. Any hotel can say that it is a five-star hotel or a three-star hotel. But unless you are sure that the star rating is official, take it with a grain of salt. The original star- rating system was started by Forbes Travel Guide in the 1950s. Since then, several dif- ferent evaluating bodies have assigned stars, so it's important to check who the evalua- tor is and what its system entails. For instance, in the U.S., Forbes is still one of the leading star-assigning bodies, as is AAA. 4.5 out of 5 AAA's Diamond Rating System comprises two distinct components. The Approval Requirements are uncompromising, mandatory standards, while Diamond designation Google is based on specific criteria measured during an on-site visit. The extensiveness of Based on 858 reviews. services, amenities, and décor provided, as well as standards for cleanliness, comfort and hospitality are measured. The Landmark has consistently been awarded Three Diamonds by AAA. -

Class-Action Lawsuit

Case 3:16-cv-04721-SK Document 1 Filed 08/17/16 Page 1 of 23 1 James R. Patterson, CA Bar No. 211102 Allison H. Goddard, CA Bar No. 211098 2 Elizabeth A. Mitchell CA Bar No. 204853 PATTERSON LAW GROUP 3 402 West Broadway, 29th Floor San Diego, CA 92101 4 Telephone: (619) 756-6990 Facsimile: (619) 756-6991 5 [email protected] [email protected] 6 [email protected] 7 Attorneys for Plaintiff BUCKEYE TREE LODGE 8 AND SEQUOIA VILLAGE INN, LLC 9 10 UNITED STATES DISTRICT COURT 11 FOR THE NORTHERN DISTRICT OF CALIFORNIA 12 13 BUCKEYE TREE LODGE AND SEQUOIA Case No. VILLAGE INN, LLC, a California limited 14 liability company, on behalf of itself and all others similarly situated, CLASS ACTION 15 Plaintiff, COMPLAINT FOR DAMAGES, PENALTIES, 16 RESTITUTION, INJUNCTIVE RELIEF AND vs. OTHER EQUITABLE RELIEF 17 1. Violation of the Lanham Act, 15 U.S.C. § 1125 18 EXPEDIA, INC., a Washington corporation; HOTELS.COM, L.P., a Texas limited (False Association) 2. Violation of the Lanham Act, 15 U.S.C. § 1125 19 partnership; HOTELS.COM GP, LLC, a Texas (False Advertising) limited liability company; ORBITZ, LLC, a 3. Violation of California Business & Professions 20 Delaware limited liability company; TRIVAGO Code §§ 17200, et seq. (Unfair Competition) GmbH, a German limited liability company; and 4. Violation of California Business & Professions 21 DOES 1 through 100, Code §§ 17500, et seq. (False Advertising) 5. Intentional Interference with Prospective Economic 22 Defendants. Advantage 6. Negligent Interference with Prospective Economic 23 Advantage 7. Unjust Enrichment and Restitution 24 [Demand for Jury Trial] 25 26 27 28 30 31 COMPLAINT 32 Case 3:16-cv-04721-SK Document 1 Filed 08/17/16 Page 2 of 23 1 Plaintiff Buckeye Tree Lodge and Sequoia Village Inn, LLC (“Buckeye Tree Lodge”) on behalf 2 of itself and all others similarly situated, alleges upon personal knowledge, information and belief as 3 follows: 4 5 I. -

2018-Annual-Report-(Final).Pdf

TM 2018 ANNUAL REPORT TM TM TM BOARD OF DIRECTORS OFFICERS STOCKHOLDER INFORMATION Annual Meeting Barry Diller Barry Diller Chairman and Senior Executive Expedia Chairman and Senior Executive The annual meeting of stockholders Group, Inc. and IAC/InterActiveCorp will be held via audio webcast on Peter M. Kern December 3, 2019 at 10:30 a.m. Peter M. Kern Vice Chairman Eastern Time Vice Chairman Online audio webcast: Expedia Group, Inc. Mark D. Okerstrom www.virtualshareholdermeeting.com/ Chief Executive Officer EXPE2019 Samuel Altman and President Chief Executive Officer Stock Market Listing Open AI Alan R. Pickerill Expedia Group, Inc.’s common stock Executive Vice President and is traded on the Nasdaq Global Select Susan C. Athey Chief Financial Officer Market under the symbol “EXPE.” Economics of Technology Professor Stanford Graduate School of Business Robert J. Dzielak Registrar and Transfer Agent Chief Legal Officer and Secretary Computershare A. George (Skip) Battle Stockholder correspondence should Chairman Lance A. Soliday be mailed to: Fair Isaac Corporation Senior Vice President, Computershare Chief Accounting Officer P.O. Box 505000 Chelsea Clinton and Controller Louisville, KY 40233 Vice Chair Clinton Foundation Overnight correspondence should be mailed to: Craig A. Jacobson Computershare Partner 462 South 4th Street Suite 1600 Hansen, Jacobson, Teller, Hoberman, Louisville, KY 40202 Newman, Warren, Richman, Rush, Kaller & Gellman, L.L.P. Computershare stockholder website: https://www-us.computershare.com/- Victor A. Kaufman investor Vice Chairman IAC/InterActiveCorp Computershare stockholder online inquiries: Dara Khosrowshahi https://www-us.computershare.com/- Bringing the world Chief Executive Officer Investor/Contact Uber Technologies, Inc. Computershare within reach Mark D. -

Influencers Throughout the Travel Booking Path to Purchase

Traveler’s PATH TO PURCHASE METHODOLOGY ▶ Expedia Media Solutions commissioned comScore to conduct a study on travel path to purchase in the United Kingdom, United States and Canada ▶ comScore blended online travel behavioral data with data collected through a custom survey Custom Survey Qualifications Behavioral Data Sources • Age 18+ • comScore PC Panel (2MM devices worldwide) • Live in UK, US or Canada (each country required • comScore Mobile Panel (20,000 devices) For each market being analyzed) • comScore Multi-PlatForm • Booked travel online within the past 6 months • comScore Census Tags (>1.5 trillion events monthly) • Survey yielded: • United Kingdom: 817 total completes • United States: 805 total completes Survey Statistical Reliability • Canada: 815 total completes • A sample oF 800 is reliable within ±3.5% points at a • Fielding dates: March 14 – 23, 2016 95% conFidence interval • A sample oF 500 is reliable within ±4.4% points at a 95% conFidence interval 2 DIGITAL TRAVEL CONTENT CONSUMPTION TRENDS 3 50 MILLION 258 MILLION 30 MILLION DIGITAL UK USERS DIGITAL US USERS DIGITAL CANADA CONSUMING CONSUMING USERS CONSUMING 239 BILLION 1.5 TRILLION 148 BILLION DIGITAL MINUTES DIGITAL MINUTES DIGITAL MINUTES EACH MONTH EACH MONTH EACH MONTH Data Source: comScore Media Metrix Multi-PlatForm Reporting, April 2016 data, Unique Visitors & Total Minutes. 4 75% MORE THAN 70% DIGITAL UK USERS 60% DIGITAL CANADIAN CONSUME TRAVEL DIGITAL US USERS USERS CONSUME CONTENT CONSUME TRAVEL TRAVEL CONTENT CONTENT Data Source: comScore Media Metrix Multi-PlatForm Media Trend Reporting, UK, US, CA, January 2015 – April 2016 data, Total Minutes. 5 2.4 BILLION 8.7 BILLION 806 MILLION MINUTES MINUTES MINUTES SPENT ON DIGITAL SPENT ON DIGITAL SPENT ON DIGITAL TRAVEL CONTENT TRAVEL CONTENT TRAVEL CONTENT IN THE UK IN THE US IN CANADA 44% INCREASE 41% INCREASE 18% INCREASE YEAR OVER YEAR YEAR OVER YEAR YEAR OVER YEAR Data Source: comScore Media Metrix Multi-PlatForm Media Trend Reporting, UK, US, CA, January 2015 – April 2016 data, Total Minutes. -

IN the SUPREME COURT of the STATE of HAWAI'i ---O0o--- in THE

***FOR PUBLICATION IN WEST’S HAWAII REPORTS AND PACIFIC REPORTER*** Electronically Filed Supreme Court SCAP-17-0000367 04-MAR-2019 09:14 AM IN THE SUPREME COURT OF THE STATE OF HAWAIʻI ---o0o--- IN THE MATTER OF THE TAX APPEAL OF PRICELINE.COM, INC., ET AL., Petitioners/Taxpayers-Appellants-Appellees-Cross-Appellants, vs. DIRECTOR OF TAXATION, STATE OF HAWAIʻI, Petitioner/Appellee-Appellant-Cross-Appellee. SCAP-17-0000367 APPEAL FROM THE TAX APPEAL COURT (T.X. NO. 13-1-0269 AND CONSOLIDATED CASES: 13-1-0261 through 13-1-0270, 14-1-0001 through 14-1-0010, and 14-1-0243 through 14-1-0251) MARCH 4, 2019 RECKTENWALD, C.J., NAKAYAMA, McKENNA, POLLACK, AND WILSON, JJ. OPINION OF THE COURT BY POLLACK, J. This case is a consolidated appeal from twenty-nine General Excise Tax assessments levied by the Director of Taxation of the State of Hawaii against five online travel companies based on car rental transactions that took place in Hawaii between January 1, 2000, and December 31, 2013. The ***FOR PUBLICATION IN WEST’S HAWAII REPORTS AND PACIFIC REPORTER*** online travel companies contend that the majority of the assessments are barred because they have already litigated their General Excise Tax liability for the years in question to final judgment in a previous case. They further argue that the rental car transactions should qualify for a reduced General Excise Tax rate that is calculated based only on the portion of the proceeds that they retain because rental cars are “tourism related services” within the meaning of a statutory income- reducing provision.