A Review of the ARJ21 Programme June 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

RASMAG/21 IP/WP Template

RASMAG/21−WP26 14-17/06/2016 International Civil Aviation Organization The Twenty-First Meeting of the Regional Airspace Safety Monitoring Advisory Group (RASMAG/21) Bangkok, Thailand, 14-17 June 2016 Agenda Item 5: Airspace Safety Monitoring Activities/Requirements in the Asia/Pacific Region CHINA RMA LTHM BURDEN ESTIMATE UPDATE (Presented by China RMA) SUMMARY This paper presents the current expected monitoring burden for the aircraft registered and operated by China and DPR Korea to meet the long term height monitoring requirement. The data were based on the RVSM approval database by the end of March, 2016. 1. INTRODUCTION 1.1 The Long Term Height Monitoring Impact Statement developed by RASMAG was endorsed by APANPIRG/20 in September 2009. In RASMAG/11 meeting China RMA provided the burden list to the meeting, and this paper is the update for the data. 2. DISCUSSION 2.1 In the last version for the monitoring burden list of China RMA, there were 61 operators with 2608 aircrafts and the biennial monitoring number is about 329. Because of the rapid development for the Chinese Civil Aviation, by the end of March, 2016, there were 77 operators with 2860 aircrafts. 2.2 Every year the monitoring plan of China RMA will be published and sent to the operators every month. The first time of publishing the plan is confirmed at the beginning of each year and it is adjusted in the middle of the year based on the progress. 2.3 Since 2008 China RMA has been using two sets of EGMU to conduct on-board monitoring for Chinese Airlines. -

Vea Un Ejemplo

3 To search aircraft in the registration index, go to page 178 Operator Page Operator Page Operator Page Operator Page 10 Tanker Air Carrier 8 Air Georgian 20 Amapola Flyg 32 Belavia 45 21 Air 8 Air Ghana 20 Amaszonas 32 Bering Air 45 2Excel Aviation 8 Air Greenland 20 Amaszonas Uruguay 32 Berjaya Air 45 748 Air Services 8 Air Guilin 20 AMC 32 Berkut Air 45 9 Air 8 Air Hamburg 21 Amelia 33 Berry Aviation 45 Abu Dhabi Aviation 8 Air Hong Kong 21 American Airlines 33 Bestfly 45 ABX Air 8 Air Horizont 21 American Jet 35 BH Air - Balkan Holidays 46 ACE Belgium Freighters 8 Air Iceland Connect 21 Ameriflight 35 Bhutan Airlines 46 Acropolis Aviation 8 Air India 21 Amerijet International 35 Bid Air Cargo 46 ACT Airlines 8 Air India Express 21 AMS Airlines 35 Biman Bangladesh 46 ADI Aerodynamics 9 Air India Regional 22 ANA Wings 35 Binter Canarias 46 Aegean Airlines 9 Air Inuit 22 AnadoluJet 36 Blue Air 46 Aer Lingus 9 Air KBZ 22 Anda Air 36 Blue Bird Airways 46 AerCaribe 9 Air Kenya 22 Andes Lineas Aereas 36 Blue Bird Aviation 46 Aereo Calafia 9 Air Kiribati 22 Angkasa Pura Logistics 36 Blue Dart Aviation 46 Aero Caribbean 9 Air Leap 22 Animawings 36 Blue Islands 47 Aero Flite 9 Air Libya 22 Apex Air 36 Blue Panorama Airlines 47 Aero K 9 Air Macau 22 Arab Wings 36 Blue Ridge Aero Services 47 Aero Mongolia 10 Air Madagascar 22 ARAMCO 36 Bluebird Nordic 47 Aero Transporte 10 Air Malta 23 Ariana Afghan Airlines 36 Boliviana de Aviacion 47 AeroContractors 10 Air Mandalay 23 Arik Air 36 BRA Braathens Regional 47 Aeroflot 10 Air Marshall Islands 23 -

July 2020 Edition

WASHINGTON AVIATION SUMMARY JULY 2020 EDITION CONTENTS I. REGULATORY NEWS .............................................................................................. 1 II. AIRPORTS ................................................................................................................3 III. SECURITY AND DATA PRIVACY ............................................................................6 IV. TECHNOLOGY AND EQUIPMENT...........................................................................7 V. ENERGY AND ENVIRONMENT ................................................................................ 8 VI. U.S. CONGRESS.................................................................................................... ...9 VII. BILATERAL AND STATE DEPARTMENT NEWS ................................................... 14 VIII. EUROPE/AFRICA ................................................................................................... 15 IX. ASIA/PACIFIC/MIDDLE EAST ................................................................................ 17 X. AMERICAS .............................................................................................................1 9 For further information, including documents referenced, contact: Joanne W. Young Kirstein & Young PLLC 1750 K Street NW Suite 700 Washington, D.C. 20006 Telephone: (202) 331-3348 Fax: (202) 331-3933 Email: [email protected] http://www.yklaw.com The Kirstein & Young law firm specializes in representing U.S. and foreign airlines, airports, leasing companies, -

Star Rating Airline Country

STAR RATING AIRLINE COUNTRY *** Adria Airways Slovenia *** Aegean Airlines Greece **** Aer Lingus Ireland **** Aeroflot Russian Airlines Russia *** Aerolineas Argentinas Argentina *** Aeromexico Mexico NR Afriqiyah Airways Libya *** Air Algerie Algeria *** Air Arabia UAE *** AirAsia Malaysia *** AirAsiaX Malaysia **** Air Astana Kazakhstan *** Air Austral Réunion *** Air Bagan Myanmar *** Air Baltic Latvia *** Air Berlin Germany *** Aircalin New Caledonia **** Air Canada Canada *** Air Caraibes French Caribbean *** Air China China **** Air Dolomiti Italy *** Air Europa Spain **** Air France France *** Air India India ** Air Italy Italy * Air Koryo North Korea *** Air Macau Macau *** Air Malta Malta **** Air Mauritius Mauritius *** Air Namibia Namibia **** Air New Zealand New Zealand *** Air Niugini Papua New Guinea *** Air Nostrum Spain *** Air Serbia Serbia **** Air Seychelles Seychelles *** Air Tahiti Nui Tahiti *** Air Transat Canada *** Alaska Airlines USA *** Alitalia Italy ***** ANA All Nippon Airways Japan *** Allegiant Air USA *** American Airlines USA *** Arik Air Nigeria *** Arkefly Netherlands ***** Asiana Airlines South Korea **** Austrian Airlines Austria *** Avianca Colombia **** Azerbaijan Airlines Azerbaijan NR Azul Brazilian Airlines Brazil ** Bahamasair Bahamas **** Bangkok Airways Thailand ** Biman Bangladesh Bangladesh **** British Airways UK *** Brussels Airlines Belgium ** Bulgaria Air Bulgaria ***** Cathay Pacific Airways Hong Kong *** Caribbean Airlines Trinidad & Tobago *** Cebu Pacific Philippines NR Chengdu Airlines -

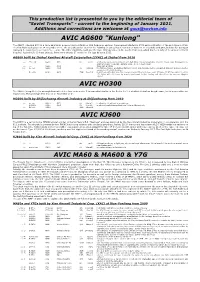

AVIC AG600 "Kunlong"

This production list is presented to you by the editorial team of "Soviet Transports" - current to the beginning of January 2021. Additions and corrections are welcome at [email protected] AVIC AG600 "Kunlong" The AG600 (Jiaolong 600) is a large amphibian powered by four Zhuzhou WJ6 turboprop engines. Development started in 2009 and construction of the prototype in 2014. The first flight took place on 24 December 2017. The aircraft can be used for fire-fighting (it can collect 12 tonnes of water in 20 seconds) and SAR, but also for transport (carrying 50 passengers over up to 5,000 km). The latter capability could give the type strategic value in the South China Sea, which has been subject to various territorial disputes. According to Chinese sources, there were already 17 orders for the type by early 2015. AG600 built by Zhuhai Yanzhou Aircraft Corporation (ZYAC) at Zhuhai from 2016 --- 'B-002A' AG600 AVIC ph. nov20 a full-scale mock-up; in white c/s with dark blue trim and grey belly, titles in Chinese only; displayed in the Jingmen Aviator Town (N30.984289 E112.087750), seen nov20 --- --- AG600 AVIC static test airframe 001 no reg AG600 AVIC r/o 23jul16 the first prototype; production started in 2014, mid-fuselage section completed 29dec14 and nose section completed 17mar15; in primer B-002A AG600 AVIC ZUH 30oct16 in white c/s with dark blue trim and grey belly, titles in Chinese only; f/f 24dec17; f/f from water 20oct18; 172 flights with 308 hours by may20; performed its first landing and take-off on the sea near Qingdao 26jul20 AVIC HO300 The HO300 (Seagull 300) is an amphibian with either four or six seats. -

Global Volatility Steadies the Climb

WORLD AIRLINER CENSUS Global volatility steadies the climb Cirium Fleet Forecast’s latest outlook sees heady growth settling down to trend levels, with economic slowdown, rising oil prices and production rate challenges as factors Narrowbodies including A321neo will dominate deliveries over 2019-2038 Airbus DAN THISDELL & CHRIS SEYMOUR LONDON commercial jets and turboprops across most spiking above $100/barrel in mid-2014, the sectors has come down from a run of heady Brent Crude benchmark declined rapidly to a nybody who has been watching growth years, slowdown in this context should January 2016 low in the mid-$30s; the subse- the news for the past year cannot be read as a return to longer-term averages. In quent upturn peaked in the $80s a year ago. have missed some recurring head- other words, in commercial aviation, slow- Following a long dip during the second half Alines. In no particular order: US- down is still a long way from downturn. of 2018, oil has this year recovered to the China trade war, potential US-Iran hot war, And, Cirium observes, “a slowdown in high-$60s prevailing in July. US-Mexico trade tension, US-Europe trade growth rates should not be a surprise”. Eco- tension, interest rates rising, Chinese growth nomic indicators are showing “consistent de- RECESSION WORRIES stumbling, Europe facing populist backlash, cline” in all major regions, and the World What comes next is anybody’s guess, but it is longest economic recovery in history, US- Trade Organization’s global trade outlook is at worth noting that the sharp drop in prices that Canada commerce friction, bond and equity its weakest since 2010. -

Chengdu Airlines A320 Captains Avionco Is Delighted to Be Recruiting A320 Captains for Chengdu Airlines

Chengdu Airlines A320 Captains Avionco is delighted to be recruiting A320 Captains for Chengdu Airlines. This airline Headquartered in Chengdu, Sichuan, Chengdu's main operating base is located at Chengdu Shuangliu International Airport. Its business scope includes domestic air passenger and cargo transportation business and aviation equipment import and export business. Chengdu Airlines currently has 32 Airbus A320 series aircraft and 6 ARJ21-700 aircraft. It has opened more than 60 domestic routes and has maintained a good safety record since its opening. At present, Chengdu Airlines has established a development strategy of “building one of China's mainstream low-cost carriers and China's composite low-cost market leader”. They are committed to becoming a well-known comprehensive aviation brand in China; a successful commercial for domestic civil aircraft operation, contributing to the construction of a large international aviation hub in Chengdu. Job: A320 Captain Term: 3 years renewable Base: Chengdu Minimum Requirements: • ICAO ATPL • A320 Captains. • Current in type within 12 months. • Total Flying Hours >5000 • Pic on type>1000 • Valid Class I Medical. • ICAO level 4 or above • No flight accident record; No criminal record. • Max. 53 years old Salaries 45 days of paid 45 days of paid 92 days of paid 120 days of paid 6 weeks on, 4 4 weeks leave leave leave leave weeks on, 4 off weeks off Basic Salary $22,500 $19,600 $17,500 $15,500 $13,000 Overtime 200 / h 190 / h 180 / h 170 / h 160 / h fee Housing $1,000/month $1,000/month $1,000/ $1,000/ $1,000/ Allowance month month month Transport $1,000/month $1,000/month $1,000/ $1,000 $1,000/ Allowance month /month month Safety Flight safety bonus is set up for foreign pilots who have completed the first contract period and Bonus renew their contract. -

Airline On-Time Arrival Performance (Aug. 2017)

Airline On-time Arrival Performance (Aug. 2017) Powered by VariFlight incomparable aviation database, the monthly report of Airline On-time Arrival Performance provides an overview of how global airlines are performing every month in 2017. Global Big Airlines Azul Brazilian Airlines tops the big airlines chart in August with an on-time arrival rate of 96.13 percent and an average delay of 4.34 minutes. Ranking IATA Airlines Country Flight On-time Average Code Arrivals Arrival Arrival Delay Performance (minutes) 1 AD Azul Brazilian BR 20968 96.13% 4.34 Airlines 2 QR Qatar Airways QA 13517 95.92% 6.23 3 JL Japan Airlines JP 25048 95.30% 6.87 4 6E IndiGo Airlines IN 27269 94.82% 5.74 5 NH All Nippon Airways JP 38957 94.67% 6.86 6 NZ Air New Zealand NZ 15441 94.60% 6.39 7 IB Iberia Airlines SP 17635 94.56% 5.52 8 EK Emirates Airlines UA 16627 94.19% 6.94 9 KL KLM Royal Dutch NL 23470 93.95% 6.57 Airlines 10 SU Aeroflot – Russian RU 29273 93.80% 8.02 Airlines Source: VariFlight Figure 1: World’s TOP10 best airlines for on-time arrivals (Big airlines, August, 2017) Note: Reporting airlines are those whose actual daily arrival flights are over 400. Global Medium-sized Airlines Hawaiian Airlines delivers the best on time performance among all medium-sized airlines worldwide with 97.36 percent punctuality and an average delay of 3.85 minutes. Ranking IATA Airlines Country Flight On-time Average Code Arrivals Arrival Arrival Delay Performance (minutes) 1 HA Hawaiian Airlines US 8669 97.36% 3.85 2 EY Etihad Airways UA 9013 95.99% 5.93 3 AY Finnair FI 9851 95.56% 5.80 4 WA KLM NL 7076 94.99% 5.30 Cityhopper 5 SQ Singapore Airlines SG 7531 94.94% 5.93 6 UT UTair Aviation RU 7642 94.40% 7.09 7 LS Jet2.com UK 8098 93.91% 6.45 8 O6 Avianca Brazil BR 7646 93.42% 6.35 9 CM Copa Airlines PA 10558 92.92% 9.13 10 Y4 Volaris MX 9045 92.72% 7.95 Source: VariFlight Figure 2: World’s TOP10 best airlines for on-time arrivals (Medium-sized airlines, August, 2017) Note: Reporting airlines are those whose actual daily arrival flights are between 200 to 400. -

ADIT Focusing on International Aerospace and Defense Markets

“The Bulletin ” is a newsletter published by ADIT focusing on international aerospace and defense markets. You will find here a digest and some short analysis of a 480 selection of news picked around the world over the last 7 days. Friday, February 28, 2020 POINTS OF VIEW UE: Boeing Embraer and “the Brussels effect”” ITALY: “Counting ships from the stars” the power [engine] of love PUBLICATION The Power of Love was a song released by the Californian rock band Huey Lewis and the News Modern Russian and Chinese Integrated Air Defence in 1985 as part of Robert Zemeckis’ blockbuster Back to the Future motion soundtrack. And it was Systems: (RUSI - 2020/01/15) starting like this: VALUATION ♫ The power of love is a curious thing Make a one man weep, make another man sing Meggitt Plc.: Examining the moving parts on cash (Morgan Change a hawk to a little white dove More than a feeling, that's the power of love? ♫ Stanley - 2020/02/26) Speaking of power and feelings, last weekend, the Chinese C919 airliner program – currently in a UNLIKELY LINK busy flight testing program was just about to lose its own powerplant, which must cause some SPAIN / UAE: One, two, princes kneel before you strange feelings! No there was not the slightest technical problem with the LEAP -1C engine, the variant specially designed for the airplane, and supplied to COMAC since 2014 by CFM International, the hugely successful JV created in the mid-70’s between US GE Aviation and French SNAPSHOTS Safran . Don’t worry: the flight test campaign of the C919 continues unabated. -

Neo Prospects

FlightGlobal.com November 2020 INSIDE Dassault Falcon 6X cutaway Supersonic charger Boom Neo unveils demonstrator p18 Let our training guide set prospects your career path p50 Why Airbus expects A320 to soar after pandemic p39 9 770015 371327 £4.99 Survival mode On the up £4.99 Can Predator How Boeing will builder adapt manage 737 Max for new fi ght? delivery backlog 35 p22 p36 A different animal for a different world • Rightsize your fl eet • Match capacity with demand • Rebuild business profi tability • Achieve true sustainability ##E22PPrroofi tHHuunntteer EE22PPrrofifitHHuunntteerr..ccoomm Comment No silver bullet There are reasons to think that next year may offer more cheer than 2020, but optimism should still be tempered Patrick J Nelson/Shutterstock Patrick The distance between us ost airlines are resigned to ly changing travel restrictions and the northern hemisphere spring. the next few months be- quarantine requirements. But there are also plenty of de- Ming flat at best in terms of That point stands despite com- velopments that could further de- international air travel de- mercial air travel being relatively lay the significant opening up of mand amid widespread restrictions, safe. But within that context, there is international markets well into next quarantine requirements and rising still a reasonable chance that better year, and perhaps beyond. coronavirus cases in many regions. news for airlines will be forthcoming The benefits of any vaccines will Impatient carriers will continue in the next few months – particularly not be seen overnight; coronavi- to burn through cash and resize in terms of medical developments. rus reinfections could prove more operations, in the hope that next Important data on the final-stage widespread than first thought and year will bring some better news. -

September, 2009 Volumec 12, Numbero 8 Ntents

INTERNATIONAL EDITION SEPTEMBER 2009 Outsize Cargo IATA Cargo Top 50 India Efficiency Proven Daily At Global Aviation, and its subsidiary World Airways, fulfilling your cargo transportation needs presents us with the opportunity to exceed the standards for customized air transport—an attribute our customers have come to expect from us. Our first-class customer service, expertise, and operational know-how ensure that you will receive the most flexible and efficient service in the industry. Contact us today to learn more about our customized cargo solutions. GLAH.COM CARGO SALES [email protected] USA: +1 (800) 967.5310 Int’l: +1 (770) 632.8003 PASSENGER SALES [email protected] USA: +1 (800) 227.4620 Int’l: +1 (770) 632.8382 editorial ith the U.S. unemployment rate near ten percent, treating people as commodi- ties is obviously bad for business. That few companies actually live up to the HR cliché, “our greatest asset is Wour people” is testament to the destructive obsession of performance reporting to Wall Street. UPS Founder Jim Casey believed that people who owned a stake in his company would have a greater incentive to make it successful. Not an original concept, but certainly by the time the company went public in November 1999, the management and supervisor-owned business was extremely successful. So it was no surprise that its initial public offering was oversubscribed. For the fi rst time any- body could benefi t from a business culture that hade survived and prospered despite two World Wars and the Great Depression. UPS says its move from employee to public ownership was the need for additional capital to fuel growth. -

Annual Report 2018

JIANGXI BANK CO., LTD. (A Joint stock company incorporated in the People's Republic of China with limited liability) Stock Code: 1916 Annual Report 2018 Contents Chapter I Chairman’s Statement 2 Chapter II Company Profile 4 Chapter III Summary of Accounting Data and Financial Indicators 9 Chapter IV Management Discussion and Analysis 12 Chapter V Changes in Share Capital and Information on Shareholders 82 Chapter VI Directors, Supervisors, Senior Management Members, Employees and Institutions 98 Chapter VII Corporate Governance Report 121 Chapter VIII Report of the Board of Directors 157 Chapter IX Report of the Board of Supervisors 166 Chapter X Important Matters 170 Chapter XI Internal Control and Internal Audit 173 Chapter XII Independent Auditor’s Report 174 Chapter XIII Financial Statements 186 Chapter XIV Notes to the Financial Statements 195 Unaudited Supplementary Financial Information 359 Definitions 363 * This annual report is prepared in both Chinese and English. In the event of inconsistency, the Chinese version shall prevail. ^ For identification purpose only. CHAPTER I CHAIRMAN’S STATEMENT Endeavor is the most exciting thing. 2018 was the 40th anniversary of China’s reform and opening up, and the third anniversary of the establishment of Jiangxi Bank. More importantly, it was the first year that Jiangxi Bank successfully landed in the international capital market and embarked on a new journey of “going overseas”. At this moment, I pay tribute to the government departments, regulatory agencies, shareholder units, all walks of life, and all the cadres and employees of Jiangxi Bank that care about and support the reform and development of Jiangxi Bank.