1 Attachment Contents 1. Qualitative Information Regarding

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Folha De Rosto ICS.Cdr

“For when established identities become outworn or unfinished ones threaten to remain incomplete, special crises compel men to wage holy wars, by the cruellest means, against those who seem to question or threaten their unsafe ideological bases.” Erik Erikson (1956), “The Problem of Ego Identity”, p. 114 “In games it’s very difficult to portray complex human relationships. Likewise, in movies you often flit between action in various scenes. That’s very difficult to do in games, as you generally play a single character: if you switch, it breaks immersion. The fact that most games are first-person shooters today makes that clear. Stories in which the player doesn’t inhabit the main character are difficult for games to handle.” Hideo Kojima Simon Parkin (2014), “Hideo Kojima: ‘Metal Gear questions US dominance of the world”, The Guardian iii AGRADECIMENTOS Por começar quero desde já agradecer o constante e imprescindível apoio, compreensão, atenção e orientação dos Professores Jean Rabot e Clara Simães, sem os quais este trabalho não teria a fruição completa e correta. Um enorme obrigado pelos meses de trabalho, reuniões, telefonemas, emails, conversas e oportunidades. Quero agradecer o apoio de família e amigos, em especial, Tia Bela, João, Teté, Ângela, Verxka, Elma, Silvana, Noëmie, Kalashnikov, Madrinha, Gaivota, Chacal, Rita, Lina, Tri, Bia, Quelinha, Fi, TS, Cinco de Sete, Daniel, Catarina, Professor Albertino, Professora Marques e Professora Abranches, tanto pelas forças de apoio moral e psicológico, pelas recomendações e conselhos de vida, e principalmente pela amizade e memórias ao longo desta batalha. Por último, mas não menos importante, quero agradecer a incessante confiança, companhia e aceitação do bom e do mau pela minha Twin, Safira, que nunca me abandonou em todo o processo desta investigação, do meu caminho académico e da conquista da vida e sonhos. -

ÜBERSICHT Umbrella Corps™ Ist Ein Brandneuer, Rasanter Third-Person

ÜBERSICHT Umbrella Corps™ ist ein brandneuer, rasanter Third-Person-Shooter, dessen schweißtreibende Online-Matches in aus dem legendären Resident Evil™-Universum bekannten Arenen wie „Umbrella Facility“ spielen. Das Spiel, das die die Unity-Engine von Unity Technologies nutzt, erscheint bei uns am 21. Juni 2016 in digitaler Form zum Preis von 29.99 Euro auf PlayStation 4 und PC. Die Umbrella Corporation, ein skrupelloses internationales Pharma-Unternehmen, war für seine genetischen Experimente und Bio-Waffen berüchtigt, die u.a. zu dem tragischen Vorfall in Raccoon City führten. Obwohl die Organisation im Jahr 2003 offiziell zu Fall gebracht wurde, konnte ihrem Bioterrorismus kein Einhalt geboten werden. Heutzutage lassen Unternehmen mit fragwürdigem Interesse an Biowaffen ausgewählte Spezialeinheiten in virenverseuchten Arenen gegen Söldnertruppen antreten. SPIELEIGENSCHAFTEN Intensive Gefechte – schweißtreibende, rasante Partien, in denen sich keiner verstecken kann Genre: Shooter Rasend schneller Team-Shooter – auch online gibt es keine Verschnaufpause Plattform: PS4, PC (nur Einzigartige Spielmodi – viele Spielvarianten stehen zur Wahl, inkl. dem spannenden „One Life digital) Match“, wo Spieler das gegnerische Team mit gerade mal einem zur Verfügung stehenden Spielerzahl: 6 Bildschirmleben auslöschen müssen Resident Evil ist überall – bekannte Arenen erfreuen Serienfans, Zombie-Gegner sorgen für eine Erscheint: 21. Juni 2016 zusätzliche Herausforderung beim Spielen Altersfreigabe: USK 18 Analoges Ziel- und Deckungssystem – ein -

CAPCOM INTEGRATED REPORT 2019 Code Number: 9697

CAPCOM CO., LTD. INTEGRATED REPORT 2019 Captivating a Connected World CAPCOM INTEGRATED REPORT 2019 Code Number: 9697 Code Number: 9697 Advancing Our Global Brand Further Monster Hunter World: Iceborne Released in January 2018, Monster Hunter: World (MH:W, below), succeeded on two key elements of our growth strategy, namely globalization and shifting to digital. This propelled it to over 12.4 million units shipped worldwide, making it Capcom’s biggest hit ever. We aim to grow the fanbase even further by continuing to advance these two elements on Monster Hunter World: Iceborne (MHW:I, below), which is scheduled for release during the fiscal year ending March 2020. For details, see p. 35 of the Integrated Report 2018. Globalization Increasing global users by supporting 12 languages 1 and launching titles simultaneously worldwide The two key MH : W raised the Monster Hunter series to global Overseas Approximately 25% elements to brand status by increasing the overseas sales ratio to our success roughly 60%, compared to its historical 25%. We plan to solidify our global user base with MHW:I Overseas by releasing it simultaneously around the globe and Approximately offering the game in 12 languages. 75% 01 CAPCOM INTEGRATED REPORT 2019 Digital Shift 2 Taking our main sales and marketing channels online We expect the bulk of MHW:I sales to be digital. While we maximize revenue using the digital marketing data Trial version we have accumulated up to this point, we will analyze Feedback Capcom user purchasing trends to utilize in digital sales -

CAPCOM INTEGRATED REPORT 2019 Code Number: 9697

CAPCOM CO., LTD. INTEGRATED REPORT 2019 Captivating a Connected World CAPCOM INTEGRATED REPORT 2019 Code Number: 9697 Code Number: 9697 Advancing Our Global Brand Further Monster Hunter World: Iceborne Released in January 2018, Monster Hunter: World (MH:W, below), succeeded on two key elements of our growth strategy, namely globalization and shifting to digital. This propelled it to over 12.4 million units shipped worldwide, making it Capcom’s biggest hit ever. We aim to grow the fanbase even further by continuing to advance these two elements on Monster Hunter World: Iceborne (MHW:I, below), which is scheduled for release during the fiscal year ending March 2020. For details, see p. 35 of the Integrated Report 2018. Globalization Increasing global users by supporting 12 languages 1 and launching titles simultaneously worldwide The two key MH : W raised the Monster Hunter series to global Overseas Approximately 25% elements to brand status by increasing the overseas sales ratio to our success roughly 60%, compared to its historical 25%. We plan to solidify our global user base with MHW:I Overseas by releasing it simultaneously around the globe and Approximately offering the game in 12 languages. 75% 01 CAPCOM INTEGRATED REPORT 2019 Digital Shift 2 Taking our main sales and marketing channels online We expect the bulk of MHW:I sales to be digital. While we maximize revenue using the digital marketing data Trial version we have accumulated up to this point, we will analyze Feedback Capcom user purchasing trends to utilize in digital sales -

Capcom Integrated Report 2019

The Head of Development Discusses Strategy Taking on the global market as a Japanese hit maker armed with world-class quality. Yoichi Egawa Director and Executive Corporate Officer In charge of Consumer Games Development and Pachinko & Pachislo Business Divisions of the Company Outfitting Our Bolstering Development Environment The world’s Development Personnel most entertaining Enhancing our development studios games Top core members Concentrate development divisions, increase mobility and leadership Repeated achievements Proprietary Core members development tools Selected to direct rereleases or other titles RE Engine enhances quality Bolstered and development efficiency Mid-career and younger employees title lineup (core training framework) Adoption of latest technologies Training programs Support from more senior members World-class, cutting-edge 3D New graduates scanning, motion capture and VR 41 CAPCOM INTEGRATED REPORT 2019 Value Creation Story Medium- to Long-Term Latest Creative Report Foundation for Financial Analysis and Growth Strategy Sustainable Growth (ESG) Corporate Data Development Aiming for sustainable growth by Development Game development engines evolve Policy creating and developing popular IPs Organization in-step with games; maintaining Characteristics an environment that enables In the past three years of overseeing development, my goal has been to ensure the world’s highest quality, working under the philosophy the pinnacle of craftsmanship of standing up and facing whatever may come. The missions we One of Capcom’s -

Capcom Integrated Report 2019

The Head of Development Discusses Strategy Taking on the global market as a Japanese hit maker armed with world-class quality. Yoichi Egawa Director and Executive Corporate Officer In charge of Consumer Games Development and Pachinko & Pachislo Business Divisions of the Company Outfitting Our Bolstering Development Environment The world’s Development Personnel most entertaining Enhancing our development studios games Top core members Concentrate development divisions, increase mobility and leadership Repeated achievements Proprietary Core members development tools Selected to direct rereleases or other titles RE Engine enhances quality Bolstered and development efficiency Mid-career and younger employees title lineup (core training framework) Adoption of latest technologies Training programs Support from more senior members World-class, cutting-edge 3D New graduates scanning, motion capture and VR 41 CAPCOM INTEGRATED REPORT 2019 Value Creation Story Medium- to Long-Term Latest Creative Report Foundation for Financial Analysis and Growth Strategy Sustainable Growth (ESG) Corporate Data Development Aiming for sustainable growth by Development Game development engines evolve Policy creating and developing popular IPs Organization in-step with games; maintaining Characteristics an environment that enables In the past three years of overseeing development, my goal has been to ensure the world’s highest quality, working under the philosophy the pinnacle of craftsmanship of standing up and facing whatever may come. The missions we One of Capcom’s -

2015-2017 Unspecified

2015-2017 UNSPECIFIED: The United Nations and B.S.A.A receive criticism from member nations for failing to develop promised countermeasures against increasingly complex B.O.W.s appearing across the world. Since Tall Oaks, Lanshiang and especially New York, it is abundantly clear the world is losing the war against bioterrorism. The operating costs of the B.S.A.A. are spiralling and their budget is increased year by year, but they are still no closer to ending this worldwide threat. Since their original reformation in 2007, Blue Umbrella PMC have been working quietly behind the scenes attempting to atone for the crimes of the original Umbrella Corporation whilst actively combatting the out of control threat of bioterrorism and reflecting on their past. Due to understandable hesitancy regarding public reaction to their existence, they have been purposefully kept in the background, painstakingly researching and developing specialised weapons and equipment sent to various anti-B.O.W. organisations for testing and utilisation. They have also developed and patented various cutting-edge technologies and what is disclosable from this tech has been useful for developing potential treatments for various incurable diseases. After several years of hard research, the Anti-Bioweapons Development Bureau at Blue Umbrella announce completion of their first specialised anti-B.O.W. firearms. It is a new Samurai Edge and several variations derived from research originally conducted by Albert Wesker and only discovered after his death. 2579 2580 2581 Blue Umbrella’s remit includes atoning for the crimes of the original Umbrella Corporation and this is the ultimate objective that needs to be reached if they are to close down and finalise the post-confirmation phase of their ongoing Chapter 11 reorganisation order. -

Bioshock: the Collection....S

DAS OFFIZIELLE 19. AUGUST 2016 AUSGABE 2 MESSEMAGAZIN Powered by www.gamesaktuell.de präsentiert von www.gamestv24.de AKTUELL Jetzt spielen! Halle 6 B-041 SPECIALS GAMES EVENTS LOOTERKINGS: Interview mit Gronkh, RESIDENT EVIL 7: Horror in der GAMESCOM CITY FESTIVAL: Heute Sarazar und Sgt.Rumpel virtuellen Realität u. a. mit Max Giesinger und Oscar! NACHGEFRAGT: Die Highlights BATTLEFIELD 1: Die Frostbite-Engine GAMESCOM AWARD 2016: und Most Wanteds der gamescom- lässt die Muskeln spielen Preisverleihung heute um 18 Uhr Besucher DISHONORED 2: Als über- RETRO GAMING: Sonderschau XBOX-ZUKUNFT: Micro- natürlicher Assassin ist größer und vielseitiger soft-Manager im Kreativität gefragt! als je zuvor! Interview NINJAS PLAY FREE. BRATON RIFLE 3 DAY AFFINITY BOOSTER 3 DAY CREDIT BOOSTER CLAIM YOUR STARTER PACK AT ©2016 Digital Extremes Ltd. All rights reserved. Warframe and the Warframe logo are registered trademarks of Digital Extremes Ltd. The "PS" Family logo is a registered trademark and "PS4" is a trademark of Sony Computer Entertainment Inc. Unbenannt-1 1 16.08.2016 10:06:26 PRESS START GAMESCOM-APP MIT Jugendschutz MESSEMAGAZIN DIGITAL auf der gamescom Um sicherzustellen, dass Jugendliche nur für sie freigege- News, Events, eine 3D-Map und bene Inhalte sehen oder spielen kön- vieles mehr: Die offizielle games- nen, gibt es an den com-App, kostenlos erhältlich Ständen folgende Beschränkungen: in den gängigen App-Stores, ist Freigegeben ab USK 12: Bei Spielen ein Muss für jeden Besucher ab 12 achtet das 12 Jahren der gamescom! Als Extra findet Standpersonal darauf, dass keine man auf der gamescom-App jüngeren Besucher täglich die neue Ausgabe des selbst spielen. -

Playstation Store: Sconti Halloween!

PlayStation Store: sconti Halloween! Con gli sconti Halloween, PlayStation Store mette in saldo oltre 100 giochi horror Sony e PlayStation ci ha spesso abituati a grandi ondate di sconti a tema, questa volta è capitato ai titoli horror. Ecco a voi gli sconti Halloween! I titoli messi in saldo sono moltissimi ed hanno tutti (o quasi) un filo conduttore, la paura. Tra i vari titoli troviamo i vari Resident Evil, Alien Isolation, Bloodborne, Dying Light e Metro Redux, 2033 Redux e Last Light Redux. Ecco la lista dei titoli in sconto: 101 Ways to Die 2Dark ADVENTURE TIME: PIRATES OF THE ENCHIRIDION Agony Alien: Isolation Alien: Isolation – The Collection Alien Shooter Arizona Sunshine Bedlam: the game by Christopher Brookmyre Berserk and the Band of the Hawk BioShock: The Collection Blackwood Crossing Blood Bowl 2 Blood Bowl 2: Legendary Edition Bloodborne Bloodborne: Game of the Year Edition Bloody Zombies Call of Duty Black Ops III: Zombies Chronicles (add-on) Call of Duty: Black Ops III – Zombies Chronicles (game) Call of Duty: Black Ops III – Zombies Chronicles Deluxe Edition (game) Carmageddon: Max Damage Claire: Extended Cut DARK SOULS II: Scholar of the First Sin DARK SOULS III DARK SOULS III – Deluxe Edition DARK SOULS III – Season Pass DARK SOULS III : The Ringed City DARK SOULS III: Ashes of Ariandel Darksiders II Deathinitive Edition Darksiders: Fury’s Collection – War and Death DEAD AHEAD: ZOMBIE WARFARE DEAD AHEAD: ZOMBIE WARFARE – Circus Pack DEAD AHEAD: ZOMBIE WARFARE – SWAT Bundle PlayStation Store: sconti Halloween! DEAD AHEAD: -

Author's Notes: the Games

AUTHOR’S NOTES: It is inevitable that with a series of this immense size and with so many different writers involved, the occasional mistake and inconsistency crops up from time to time. Some official materials have Raccoon City blowing up on October 2nd rather than October 1st, some have the Progenitor Virus discovery as 1967 rather than 1966, and some have Alexander Ashford disappearing in 1982 rather than 1983. These are just a few examples of mistakes that were written then copy and pasted into other sources and subsequently gained a bit of traction. Thankfully however these errors are outnumbered by numerous other sources that can help us identify the mistakes and correct them accordingly. We must also address the thorny issue of mistranslation and localisation errors. Make no mistake, Resident Evil has fallen foul of many an error throughout the years, leading to some frankly hilarious blunders and story points that just make no sense. In years past I used to be very strict about such things and almost dismissed the English versions completely, however in recent times I have mellowed somewhat. I have looked deeper into the localisation process at Capcom and have learned a few things and come away with a newfound appreciation for why it is so important. Literal script and file translations seem so stilted and it is important they are reworded to read more naturally, even at the expense of some original content. Therefore, for this document I have retained most of the English files and script, reverting only to the Japanese when there is a clear error or loss of context. -

This Checklist Is Generated Using RF Generation's Database This Checklist Is Updated Daily, and It's Completeness Is Dependent on the Completeness of the Database

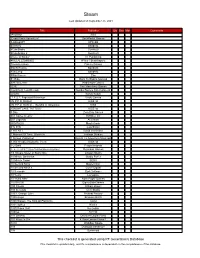

Steam Last Updated on September 25, 2021 Title Publisher Qty Box Man Comments !AnyWay! SGS !Dead Pixels Adventure! DackPostal Games !LABrpgUP! UPandQ #Archery Bandello #CuteSnake Sunrise9 #CuteSnake 2 Sunrise9 #Have A Sticker VT Publishing #KILLALLZOMBIES 8Floor / Beatshapers #monstercakes Paleno Games #SelfieTennis Bandello #SkiJump Bandello #WarGames Eko $1 Ride Back To Basics Gaming √Letter Kadokawa Games .EXE Two Man Army Games .hack//G.U. Last Recode Bandai Namco Entertainment .projekt Kyrylo Kuzyk .T.E.S.T: Expected Behaviour Veslo Games //N.P.P.D. RUSH// KISS ltd //N.P.P.D. RUSH// - The Milk of Ultraviolet KISS //SNOWFLAKE TATTOO// KISS ltd 0 Day Zero Day Games 001 Game Creator SoftWeir Inc 007 Legends Activision 0RBITALIS Mastertronic 0°N 0°W Colorfiction 1 HIT KILL David Vecchione 1 Moment Of Time: Silentville Jetdogs Studios 1 Screen Platformer Return To Adventure Mountain 1,000 Heads Among the Trees KISS ltd 1-2-Swift Pitaya Network 1... 2... 3... KICK IT! (Drop That Beat Like an Ugly Baby) Dejobaan Games 1/4 Square Meter of Starry Sky Lingtan Studio 10 Minute Barbarian Studio Puffer 10 Minute Tower SEGA 10 Second Ninja Mastertronic 10 Second Ninja X Curve Digital 10 Seconds Zynk Software 10 Years Lionsgate 10 Years After Rock Paper Games 10,000,000 EightyEightGames 100 Chests William Brown 100 Seconds Cien Studio 100% Orange Juice Fruitbat Factory 1000 Amps Brandon Brizzi 1000 Stages: The King Of Platforms ltaoist 1001 Spikes Nicalis 100ft Robot Golf No Goblin 100nya .M.Y.W. 101 Secrets Devolver Digital Films 101 Ways to Die 4 Door Lemon Vision 1 1010 WalkBoy Studio 103 Dystopia Interactive 10k Dynamoid This checklist is generated using RF Generation's Database This checklist is updated daily, and it's completeness is dependent on the completeness of the database. -

Film and Video Labelling Body (Home Media) February 2016

Film and Video Labelling Body (Home Media) February 2016 Title Director Running Time Date Approved Rating Media 3 Hearts Benoît Jacquot 104.02 26/02/2016 M Adult themes DVD 4 Film Favourites Dirty Harry Collection Various 438.12 22/02/2016 R16 Violence and nudity DVD 5th Wave, The J Blakeson 112 22/02/2016 M Violence and offensive language Film - Online 600 Miles Gabriel Ripstein 80.14 26/02/2016 R16 Violence and offensive language DVD 7th Voyage of Sinbad,The Nathan Juran 88 16/02/2016 PG Low level violence DVD 90 Minutes In Heaven Michael Polish 116.34 4/02/2016 M Adult themes Film - Online 99 Homes Ramin Bahrani 111.33 11/02/2016 M Offensive language and sexual Film - Online references 99 Homes Ramin Bahrani 107.33 26/02/2016 M Offensive language and sexual DVD references 99 Homes Ramin Bahrani 112.11 25/02/2016 M Violence,sexual references and Bluray offensive language Abalone Wars: Great White Gauntlet Collector's Set Not stated 655.57 16/02/2016 M Violence DVD Abbott & Costello Africa Screams/ Laurel & Hardy Charles Barton/A Edward 217 19/02/2016 G DVD The Flying Deuces/Three Stooges Simply Hilarous, Sutherland The Absolutely Anything Terry Jones 81.47 2/02/2016 M Violence,sexual references and DVD offensive language Absolutely Anything Terry Jones 85.16 2/02/2016 M Violence,sexual references and Bluray offensive language Accel World: The Complete Series Masakazu Ohara 569.51 3/02/2016 M Violence and offensive language Bluray Agatha Raisin The Quiche Of Death Geoffrey Sax 90.25 2/02/2016 PG Coarse language and sexual references