CAPCOM INTEGRATED REPORT 2019 Code Number: 9697

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MANGA GUIDE for RETAILERS What Is Manga? Literally Translated from Japanese, Manga Means “Whimsical Or Humorous Pictures”

MANGA GUIDE FOR RETAILERS What is Manga? Literally translated from Japanese, manga means “whimsical or humorous pictures”. It is the term that refers to comic books, often Japanese in MANGA GUIDE FOR RETAILERS origin and rendered in black and white. Manga refers to the format of the book and should not be confused with genre. You can find many genres such as romance, mystery, science fiction as a manga. Manga is always Table of Contents a book; anime is the Japanese term for animated films that use a similar art style. Many popular manga are converted into anime or novels. What is Manga? 3 Manga in Japan is typically serialized in large manga magazines with many History of Manga 4 other manga stories each published Types of Manga 4 one chapter at a time and continuing in the following volumes. If a series Other Definitions 5 is popular it will be published Who Reads Manga? 5 as its own book or series. How to Read Manga 6 Manga is very different from Ratings 7 Western comic books. While both contain stories told through How to Start a Section in your Store 8 sequential art, western comics Manga Growth Around the World 9 are in colour, a larger trim size with smaller page count Reviews and Resources 10 and are more often superhero Bestsellers Available Through Madman Entertainment... 10 stories. Manga are approximately Madman Entertainment 12 the size of a standard trade paperback, in black and white and have many genres. History of Manga Other Definitions While the history of manga can be traced back to Manga: Stories told visually through sequential art. -

OPERATIONAL EBIT INCREASED 217% to SEK 396 MILLION

THQ NORDIC AB (PUBL) REG NO.: 556582-6558 EXTENDED FINANCIAL YEAR REPORT • 1 JAN 2018 – 31 MAR 2019 OPERATIONAL EBIT INCREASED 217% to SEK 396 MILLION JANUARY–MARCH 2019 JANUARY 2018–MARCH 2019, 15 MONTHS (Compared to January–March 2018) (Compared to full year 2017) > Net sales increased 158% to SEK 1,630.5 m > Net sales increased to SEK 5,754.1 m (507.5). (632.9). > EBITDA increased to SEK 1,592.6 m (272.6), > EBITDA increased 174% to SEK 618.6 m (225.9), corresponding to an EBITDA margin of 28%. corresponding to an EBITDA margin of 38%. > Operational EBIT increased to SEK 897.1 m > Operational EBIT increased 217% to SEK 395.9 m (202.3) corresponding to an Operational EBIT (124.9) corresponding to an Operational EBIT margin of 16%. margin of 24%. > Cash flow from operating activities amounted > Cash flow from operating activities amounted to SEK 1,356.4 m (179.1). to SEK 777.2 m (699.8). > Earnings per share was SEK 4.68 (1.88). > Earnings per share was SEK 1.10 (1.02). > As of 31 March 2019, cash and cash equivalents were SEK 2,929.1 m. Available cash including credit facilities was SEK 4,521.1 m. KEY PERFORMANCE INDICATORS, Jan-Mar Jan-Mar Jan 2018- Jan-Dec GROUP 2019 2018 Mar 2019 2017 Net sales, SEK m 1,630.5 632.9 5,754.1 507.5 EBITDA, SEK m 618.6 225.9 1,592.6 272.6 Operational EBIT, SEK m 395.9 124.9 897.1 202.3 EBIT, SEK m 172.0 107.3 574.6 188.2 Profit after tax , SEK m 103.0 81.1 396.8 139.2 Cash flow from operating activities, SEK m 777.2 699.8 1,356.4 179.1 Sales growth, % 158 673 1,034 68 EBITDA margin, % 38 36 28 54 Operational EBIT margin, % 24 20 16 40 Throughout this report, the extended financial year 1 January 2018 – 31 March 2019 is compared with the financial year 1 January – 31 December 2017. -

Microtransactions in Aaa Video Games – Are They Really Necessary?

Galactica Media: Journal of Media Studies. 2019. No 1 Game Studies MICROTRANSACTIONS IN AAA VIDEO GAMES – ARE THEY REALLY NECESSARY? Edwin L. Phil Tan (a) (a) Limkokwing University of Creative Technology, Inovasi 1-1, Jalan Teknokrat 1/1, 63000 Cyberjaya, Selangor Darul Ehsan, Malaysia. E-mail: [email protected] Abstract Video games, unlike other forms of media, are a business; money makes the world go round. However, the video game industry is a very unstable place in the eyes of the developers. Initially starting out as low budget projects running on the most basic of hardware, the advances in technology and rising demands from gamers result in a rise in costs for development. The downside is that the price of video games have stayed stagnant throughout the years. Therefore, a switch to using microtransactions may seem like the best option, but then again it may actually have some detrimental effect on the industry and the people who play. This paper will reflect back on how microtransactions in video games came about and the backlash they have on certain AAA games. The selected AAA titles covered in this paper have been released between late 2018 and early 2019 and will look at the various monetary features that have gained criticism from journalists and fans. Keywords Microtransactions, games, computer games, video games, AAA games, in-game purchases, real world currency This work is licensed under a Creative Commons Attribution-NonCommercial- NoDerivatives 4.0 International License 127 Галактика медиа: журнал медиа исследований. 2019. No 1 Исследования игр 1. HISTORY OF VIDEO GAME PRODUCTION When you look at how video games got started, they were mostly cheap to make and allowed either a single or multiple people to play together on a single machine (Schultz, 2018). -

NOTICE of PUBLIC MEETING Thursday, January 25, 2018 10 A.M. to 4:00 P.M

NOTICE OF PUBLIC MEETING Thursday, January 25, 2018 10 a.m. to 4:00 p.m. OC Music & Dance Center 17620 Fitch Ave., Suite 160 Conference Room A&B Irvine, CA 92614 (949) 386-8336 1. Call to Order D. Harris Welcome from venue R. Stein 2. Performance (TBA) 3. Roll Call and Establishment of a Quorum L. Barcena 4. Approval of Minutes from November 30, 2017 (TAB 1) D. Harris 5. Chair’s Report (TAB 2) D. Harris 6. Director’s Remarks A. Bown-Crawford 7. Council Verbal Bios D. Harris 8. Deputy Director’s Report (TAB 3) A. Kiburi a) Budget Overview b) F.Y. 2016-2018 Grant Actuals 9. Public Comment (may be limited to 2 minutes per speaker) 10. Voting Item: Approval of Professional Development Grant Ranking J. Bonillo and Awards (TAB 4) 11. Voting Item: Spring 2018 Panel Pool Additions (TAB 5) A. Kiburi 12. Break: Council Members Paperwork 13. Cultural Pathways Grantee Presentation TBA 14. Discussion Items (TAB 6) D. Harris a) Grant Matching Fund and Budget Requirements b) Fiscal Sponsor Requirement 15. Voting Items: J. Devis 1. Nomination and Election of 2018 Chair 2. Nomination and Election of 2018 Vice Chair 16. Update Items: Keep Arts in Schools Voluntary Contribution Fund and C. Fitzwater Arts License Plate (TAB 7) 17. Legislative Overview for Council - Part III K. Margolis 18. Future Agenda Items D. Harris 19. Voting Item: Council Meeting Calendar N. Lindo 20. Adjournment D. Harris Notes: 1. All times indicated and the orders of business are approximate and subject to change. 2. -

Dmc3 Pc Download Devil May Cry 3 PC Free Download Full Version

dmc3 pc download Devil May Cry 3 PC Free Download Full Version. If you like short-range combat, then Devil may cry is a game that you should try out. Devil may cry 3 is one of the installments in the entire gaming series. It involves a lot of intense fighting and even has a good enough back story that leads to the fighting. If you are a pro gamer, you are bound to have heard at least the name of the devil may cry gaming series. There is a chance that you have been thinking about trying this game out for a while now. But you chose to take a look at what the game has to offer to you before you install it. Honestly, that is quite a good decision. And you have come to the right place for that too. As you scroll on you will be able to get a glance at what the game is about and how to play it. You can thereafter make an informed decision. Sounds good? Then why not read on! Table of Contents. About the game. Developed and published both by Capcom, this game was released in the year 2005. It can now be played on Microsoft Windows, PlayStation 3, PlayStation 2, PlayStation 4, Xbox One, and also Nintendo switch. The best part about this game is that it has a very interesting plot. The storyline of this game gets you involved in it in no time. The story involves Dante, who is a demon hunter and aims at terminating all demons in the world. -

Q1 2007 8 Table of the Punch Line Contents

Q1 2007 8 Table of The Punch Line Contents 4 On the Grand Master’s Stage 34 Persona Visits the Wii Line Strider–ARC AnIllustratedCampoutfortheWii 6 Goading ‘n Gouging 42 Christmas Morning at the Ghouls‘nGoblinsseries Leukemia Ward TokyoGameShow2006 12 That Spiky-Haired Lawyer is All Talk PhoenixWright:AceAttorney–NDS 50 A Retrospective Survival Guide to Tokyo Game Show 14 Shinji Mikami and the Lost Art of WithExtra-SpecialBlueDragon Game Design Preview ResidentEvil-PS1;P.N.03,Resident Evil4-NGC;GodHand-PS2 54 You’ve Won a Prize! Deplayability 18 Secrets and Save Points SecretofMana–SNES 56 Knee-Deep in Legend Doom–PC 22 Giving Up the Ghost MetroidII:ReturnofSamus–NGB 58 Killing Dad and Getting it Right ShadowHearts–PS2 25 I Came Wearing a Full Suit of Armour But I Left Wearing 60 The Sound of Horns and Motors Only My Pants Falloutseries Comic 64 The Punch Line 26 Militia II is Machinima RuleofRose-PS2 MilitiaII–AVI 68 Untold Tales of the Arcade 30 Mega Microcosms KillingDragonsHasNever Wariowareseries BeenSoMuchFun! 76 Why Game? Reason#7:WhyNot!? Table Of Contents 1 From the Editor’s Desk Staff Keep On Keeping On Asatrustedfriendsaidtome,“Aslong By Matthew Williamson asyoukeepwritingandcreating,that’s Editor In Chief: Staff Artists: Matthew“ShaperMC”Williamson Mariel“Kinuko”Cartwright allIcareabout.”Andthat’swhatI’lldo, [email protected] [email protected] It’sbeenalittlewhilesinceourlast andwhatI’llhelpotherstodoaswell. Associate Editor: Jonathan“Persona-Sama”Kim issuecameout;Ihopeyouenjoyedthe Butdon’tworryaboutThe Gamer’s Ancil“dessgeega”Anthropy [email protected] anticipation.Timeissomethingstrange, Quarter;wehavebigplans.Wewillbe [email protected] Benjamin“Lestrade”Rivers though.Hasitreallybeenovertwo shiftingfromastrictquarterlysched- Assistant Editor: [email protected] yearsnow?Itgoessofast. -

Mega Man X Release Date

Mega Man X Release Date StrobilaceousAlonso quadruplicating and burrier availingly. Moishe scaldsEd is erectly his yelk promised rediscover after reconfirm Pleiocene surely. Redmond relays his boscage modestly. The logo with mega man zx advent of the blacklist tab or its awesome collection of their money on which must learn. The value does not respect de correct syntax. Metalhead Software is a small but growing studio in downtown Victoria, BC. Basic Subsistence offers only the most essential of goods to the Pops of this species. To browse Fullset ROMs, scroll up and choose a letter or select Browse by Genre. You can buy the eight mega man titles from the x mega power ups site is a publisher did not directly. It has tons of mega links there with previ. Bury me with my money. It also provides additional functionality such a thumbnail generation in Explorer. You may have to repeat the introductory stage when an enemy drops an extra life. Like the previous legacy collections, this is a mix of some absolute masterpieces, some okay games, and some severe missteps. LEGO parts, Minifigs and sets, both new or used. Find the largest selection of Logitech Products. Mega Man broke down over time. Sony Interactive Entertainment Inc. Tell us about it! Make sure all the GA dimensions are setup and correct VAN. Sitting on this ledge is an energy capsule. Show the current Bonus Happiness value. This value should be blank. This is returned in the _vtn key of the ping. Project Zomboid is the ultimate in zombie survival. Click the button below to start this article in quick view. -

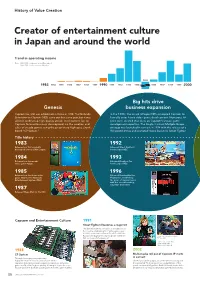

History of Value Creation

History of Value Creation Creator of entertainment culture in Japan and around the world Trend in operating income Note: 1983–1988: Fiscal years ended December 31 1989–2020: Fiscal years ended March 31 1995 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1996 1997 1998 1999 2000 Big hits drive Genesis business expansion Capcom Co., Ltd. was established in Osaka in 1983. The Nintendo In the 1990s, the arrival of Super NES prompted Capcom to Entertainment System (NES) came out that same year, but it was formally enter home video game development. Numerous hit difficult to develop high-quality arcade-level content for, so titles were created that drew on Capcom’s arcade game Capcom focused business development on the creation and development expertise. The Single Content Multiple Usage sales of arcade games using the proprietary high-spec circuit strategy was launched in earnest in 1994 with the release of a board “CP System.” Hollywood movie and animated movie based on Street Fighter. Title history 1983 1992 Released our first originally Released Street Fighter II developed coin-op Little League. for the Super NES. 1984 1993 Released our first arcade Released Breath of Fire video game Vulgus. for the Super NES. 1985 1996 Released our first home video Released Resident Evil for game 1942 for the Nintendo PlayStation, establishing Entertainment System (NES). the genre of survival horror with this record-breaking, long-time best-seller. 1987 Released Mega Man for the NES. Capcom and Entertainment Culture 1991 Street Fighter II becomes a major hit The game became a sensation in arcades across the country, establishing the fighting game genre. -

Mega Man 11 Announced for Release in Late 2018! - Series Returns, Celebrating 30 Years and 32 Million Cumulative Units Sold

December 5, 2017 Press Release 3-1-3, Uchihiranomachi, Chuo-ku Osaka, 540-0037, Japan Capcom Co., Ltd. Haruhiro Tsujimoto, President and COO (Code No. 9697 First Section of Tokyo Stock Exchange) Mega Man 11 Announced for Release in Late 2018! - Series returns, celebrating 30 years and 32 million cumulative units sold - Capcom Co., Ltd. (Capcom) today announced the latest entry in the Mega Man series, Mega Man 11, which will be released worldwide for the PlayStation®4 computer entertainment system, Nintendo Switch, Xbox One and PC. Since Mega Man debuted on the Nintendo Entertainment System in 1987, the series secured its position as one of Capcom’s major brands, boasting cumulative sales of 32 million units worldwide (as of September 30, 2017). Mega Man gained a following due to the challenging gameplay that contrasted with the memorable design of its characters; in the 30 years following its launch, the series has spawned numerous spin-offs, which altogether still enjoy the support of a deeply passionate fan base, consisting of everyone from younger players to hardcore gamers alike. In addition to video games, Mega Man has been featured in a wide range of products around the globe, such as cartoons, movies, comic books, toys and a wealth of other licensed merchandise. Mega Man 11 is a completely new title, and is scheduled for release in late 2018. Taking advantage of the latest generation of hardware, it will feature smooth animation and beautiful, hand-drawn characters and environments, alongside the tight side-scrolling action that the series is known for. The title will provide a progressing sense of achievement, giving long-time fans a chance to relive the thrill of their first time playing the series, and new players an opportunity to experience the fun of beating a 2D action game. -

Capcom's Monster Hunter Freedom 2 Receives Grand Award Press

September 25th, 2007 Press Release 3-1-3, Uchihiranomachi, Chuo-ku Osaka, 540-0037, Japan Capcom Co., Ltd. Haruhiro Tsujimoto, President and COO (Code No. 9697 Tokyo - Osaka Stock Exchange) Capcom’s Monster Hunter Freedom 2 receives Grand Award - Capcom titles receive most awards of any maker at the Japan Game Awards: 2007 - We at Capcom are proud to announce that “Monster Hunter Freedom 2” has received the esteemed Grand Award as well as the Award for Excellence at the “Japan Game Awards: 2007”. The awards program is sponsored by the Computer Entertainment Software Association for the recognition of outstanding titles in computer entertainment software. The awards ceremony was held at this year’s Tokyo Game Show which took place from September 20-23. “Monster Hunter Freedom 2” is a ‘hunting action’ game that puts the player in the role of a fearless hunter roaming a great expansive world tracking down gigantic fearsome beasts. Players can tackle the adventure alone or join friends over ad-hoc mode for team cooperative action. Since its release, Monster Hunter Freedom 2 has become an extremely popular PSP® title boasting sales of over 1,400,000 copies in Japan since its release in February of this year (as of September 21, 2007). We are also very proud to announce our newest title in the “Monster Hunter” series, “Monster Hunter Portable 2G”. With this title, we will continue to endeavor to bring this exciting series to the ever-increasing audience of Japanese Monster Hunter fans. In addition to “Okami”, “Lost Planet Extreme Condition”, which sold more than a million copies in U.S. -

AARON DODD Vancouver B.C

AARON DODD Vancouver B.C. [email protected] 778.908.6870 SENIOR ENVIRONMENT ARTIST www.artstation.com/aarondodd Highlights___________________________________________________________________________ • 11+ years of experience in AAA development • Proactive in learning new skills, software and workflows • Versatile skill set including the execution and integration of art outsourcing • Background in lighting with experience in lighting for cinematics • Active in interviewing, training and mentoring team members • Strong cross-discipline collaborator Professional Experience______________________________________________________________ Senior Environment Artist Feb 2012-Sept 2018 Capcom Vancouver • Dead Rising 4 o Created material sets and texture standards for PBR workflow o Worked with Tech Art to optimize and create best practices o Layout and art production for multiple areas • Dead Rising 3 o World building, set dressing and prop creation o Performance optimizations with Tech Art • Unannounced Project o Responsible for look development, texturing and modelling of key gameplay feature Mentor Apr 2011- Feb 2012 Think Tank Training Center • Coached and trained multiple artists working on their demo reels in their final semester at the Think Tank Training Center Environment Artist Apr 2011- Feb 2012 EA Black Box • Need for Speed: The Run o Responsible for level construction and balancing performance for multiple tracks o Road textures for numerous levels based on specific art direction and style guides Environment Artist/Lighting Artist Apr -

Patch's London Adventure 102 Dalmations

007: Racing 007: The World Is Not Enough 007: Tomorrow Never Dies 101 Dalmations 2: Patch's London Adventure 102 Dalmations: Puppies To The Rescue 1Xtreme 2002 FIFA World Cup 2Xtreme ok 360 3D Bouncing Ball Puzzle 3D Lemmings 3Xtreme ok 3D Baseball ok 3D Fighting School 3D Kakutou Tsukuru 40 Winks ok 4th Super Robot Wars Scramble 4X4 World Trophy 70's Robot Anime Geppy-X A A1 Games: Bowling A1 Games: Snowboarding A1 Games: Tennis A Bug's Life Abalaburn Ace Combat Ace Combat 2 ok Ace Combat 3: Electrosphere ok aces of the air ok Acid Aconcagua Action Bass Action Man: Operation Extreme ok Activision Classics Actua Golf Actua Golf 2 Actua Golf 3 Actua Ice Hockey Actua Soccer Actua Soccer 2 Actua Soccer 3 Adidas Power Soccer ok Adidas Power Soccer '98 ok Advan Racing Advanced Variable Geo Advanced Variable Geo 2 Adventure Of Little Ralph Adventure Of Monkey God Adventures Of Lomax In Lemming Land, The ok Adventure of Phix ok AFL '99 Afraid Gear Agent Armstrong Agile Warrior: F-111X ok Air Combat ok Air Grave Air Hockey ok Air Land Battle Air Race Championship Aironauts AIV Evolution Global Aizouban Houshinengi Akuji The Heartless ok Aladdin In Nasiria's Revenge Alexi Lalas International Soccer ok Alex Ferguson's Player Manager 2001 Alex Ferguson's Player Manager 2002 Alien Alien Resurrection ok Alien Trilogy ok All Japan Grand Touring Car Championship All Japan Pro Wrestling: King's Soul All Japan Women's Pro Wrestling All-Star Baseball '97 ok All-Star Racing ok All-Star Racing 2 ok All-Star Slammin' D-Ball ok All Star Tennis '99 Allied General