Trading with Sainsbury's

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report and Financial Statements 2018 Sainsbury’S Group Helping Customers Live Well for Less Has Been at the Heart of What We Do Since 1869

Live Well For Less Annual Report and Financial Statements 2018 Sainsbury’s Group Helping customers live well for less has been at the heart of what we do since 1869. We employ over 185,000 colleagues who work hard every day to make our customers’ lives easier and to provide them with great products, quality and service whenever and wherever it is convenient to access them. Food Our strategic focus is to help 608 our customers live well for less. Sainsbury’s supermarkets We offer customers quality and convenience as well as great value. Our distinctive ranges and innovative 102 partnerships differentiate stores offering Same Day our offer. More customers delivery to 40 per cent are shopping with us than of the UK population ever before and our share of customer transactions has increased. See more on page 12 General Merchandise 191 and Clothing Argos stores in Sainsbury’s We are one of the largest general supermarkets merchandise and clothing retailers in the UK, offering a wide range of products across our Argos, Sainsbury’s Home and 16 Habitat brands, in stores and Habitat stores and online. We are a market leader in Click & Collect available toys, electricals and technology in over 2,300 locations and Tu clothing offers high street style at supermarket prices. See more on page 14 Financial Services Financial Services are an 3.9m integral part of our business. Active customers Sainsbury’s Bank offers at Sainsbury’s Bank and accessible products such as Argos Financial Services credit cards, insurance, travel money and personal loans that reward loyalty. -

Live Well for Less

Live Well For Less Annual Report and Financial Statements 2019 Sainsbury’s Group at a glance Helping customers live well for less has been at the heart of what we do for 150 years, since John James and Mary Ann Sainsbury opened the doors of our first shop in Drury Lane in 1869. We employ 178,000 colleagues who work hard every Read more about our business model on page 08 day to make our customers’ lives easier and provide Read more about our business strategy on page 09 them with great products, quality and service. Food We are committed to helping our customers 2.2% live well for less. We offer customers quality Growth in Taste the Difference volumes and convenience as well as great value. Our distinctive ranges and innovative partnerships differentiate our offer. Customers consistently 57% rate the quality of our food as market-leading Of UK households benefit from and continue to switch to us from more Same Day delivery premium competitors. See more on page 10 General Merchandise and Clothing 281 Argos stores in We are one of the largest general merchandise Sainsbury’s supermarkets and clothing retailers in the UK, offering a wide range of products across Argos, Sainsbury’s Home and Habitat, in stores and online. We are a market leader in toys, 1bn+ electricals and technology and Tu clothing Visits to the Argos website offers high street style at supermarket prices. every year and sales generated through mobile devices passed See more on page 12 £2 billion for the first time Financial Services Financial Services are an integral part of our 2m+ business. -

J Sainsbury Plc Board of Directors

Live Well For Less Annual Report and Financial Statements 2019 Sainsbury’s Group at a glance Helping customers live well for less has been at the heart of what we do for 150 years, since John James and Mary Ann Sainsbury opened the doors of our first shop in Drury Lane in 1869. We employ 178,000 colleagues who work hard every Read more about our business model on page 08 day to make our customers’ lives easier and provide Read more about our business strategy on page 09 them with great products, quality and service. Food We are committed to helping our customers 2.2% live well for less. We offer customers quality Growth in Taste the Difference volumes and convenience as well as great value. Our distinctive ranges and innovative partnerships differentiate our offer. Customers consistently 57% rate the quality of our food as market-leading Of UK households benefit from and continue to switch to us from more Same Day delivery premium competitors. See more on page 10 General Merchandise and Clothing 281 Argos stores in We are one of the largest general merchandise Sainsbury’s supermarkets and clothing retailers in the UK, offering a wide range of products across Argos, Sainsbury’s Home and Habitat, in stores and online. We are a market leader in toys, 1bn+ electricals and technology and Tu clothing Visits to the Argos website offers high street style at supermarket prices. every year and sales generated through mobile devices passed See more on page 12 £2 billion for the first time Financial Services Financial Services are an integral part of our 2m+ business. -

Swale Borough Council

SWALE BOROUGH COUNCIL Project: RETAIL STUDY 2010: Bulky and DIY Goods Addendum Latest Revision: 20/05/2011 - DRAFT Study area population by zone Zone 2010 2015 2020 2025 1 39,501 40,410 41,418 42,595 2 12,888 13,185 13,514 13,897 3 46,052 47,112 48,287 49,659 4 11,242 11,501 11,788 12,123 5 19,162 19,603 20,092 20,663 6 5,340 5,463 5,599 5,758 TOTAL 134,185 137,274 140,698 144,695 Sources/notes for frontispiece 1. 2010 population for each zone from Pitney Bowes Business Insight Area Profile Report (6 July 2010) 2. Growth in population based on growth rates implied by scenarioKent County 3 of Council 6 scenarios population prepared forecasts by Research for Swale & Intelligence, Borough - South Kent CouEastntyPlan Council Strategy (16- Septemberbased Forecasts 2010). (September The KCC projections 2009) Total are Population based on SwaleForecasts. Borough Available: Counciil's 'Option 1' for newhttps://shareweb.kent.gov.uk/Documents/facts homes which assumes an additional 13,503-and dwellings-figures/sep between-forecasts 2006-sep-2031-09 -usingweb.pdf a phasing Access provideddate: 12 byOctober SBC 2010 OTHER COMPARISON GOODS Table 3.1 Expenditure per capita (£) Zone 2007 2010 2015 2020 2025 1 2,062 2,162 2,592 3,124 3,764 2 2,356 2,470 2,962 3,569 4,301 3 2,164 2,269 2,721 3,278 3,950 4 2,336 2,449 2,937 3,539 4,264 5 2,194 2,300 2,758 3,324 4,005 6 2,347 2,460 2,951 3,555 4,284 Sources/notes for Table 3.1 1. -

Habitat Ltd, Furniture and Household Goods Manufacturer and Retailer: Records, Ca

V&A Archive of Art and Design Habitat Ltd, furniture and household goods manufacturer and retailer: records, ca. 1960 – 2000 1 Table of Contents Introduction and summary description ................................................................ Page 4 Context .......................................................................................................... Page 4 Scope and content ....................................................................................... Page 4 Provenance ................................................................................................... Page 5 Access ......................................................................................................... Page 5 Related material .......................................................................................... Page 5 Detailed catalogue ................................................................................ Page 6 Corporate records .............................................................................................. Page 6 Offer for sale by tender, 1981 ................................................................................................ Page 6 Annual Reports and Accounts, 1965-1986 ............................................................................. Page 6 Marketing and public relations records ............................................................. Page 7 Advertising records, 1966-1996 ............................................................................................ -

Tools That Build a Better Future

Tools that build a better future Annual Report FY2018 July 1, 2017 – June 30, 2018 Habitat for Humanity International The tools in our toolbox ______________________ 2 Annual Report FY2018 Celebrating our global numbers _________________ 17 Summary of individuals served _________________ 22 July 1, 2017 – June 30, 2018 Letter from the chair of the board habitat.org of directors and the CEO _________________________ 24 A commitment to global stewardship _________ 25 Financial statements ______________________________ 26 FY18 feature spotlights ___________________________ 28 Corporate, foundation, institution and individual support ____________________________ 33 Tithe ___________________________________________________ 45 Donations _____________________________________________ 46 Board of directors and senior leadership ____ 49 “It’s a unique set of tools that builds a future, and I think Habitat is that toolbox that just brings it all together.” Habitat Humanitarian Since our founding in 1976, Habitat for Humanity has helped more Jonathan Scott than 22 million people build or improve the place they call home. With your support, in fiscal year 2018 alone, we most, we also faithfully bring a few of our helped more than 8.7 million people, and an favorite tried-and-true tools to the workbench. additional 2.2 million gained the potential to improve Volunteerism, service, advocacy, awareness. their living conditions through training and advocacy. These engines — fueled by your generous We’ve accomplished all of this with the trowel and support — propel the inclusion, innovation and the power saw, to be sure, but also by working inspiration that are hallmarks of our work around alongside families to help them access the tools the world. they need for a better tomorrow. -

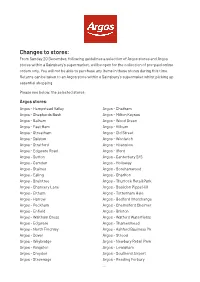

Changes to Stores

Changes to stores: From Sunday 20 December, following guidelines a selection of Argos stores and Argos stores within a Sainsbury’s supermarket, will be open for the collection of pre-paid online orders only. You will not be able to purchase any items in these stores during this time. Returns can be taken to an Argos store within a Sainsbury’s supermaket whilst picking up essential shopping. Please see below, the selected stores: Argos stores: Argos - Hempstead Valley Argos - Chatham Argos - Shepherds Bush Argos - Milton Keynes Argos - Balham Argos - Wood Green Argos - East Ham Argos - Kilburn Argos - Streatham Argos - Old Street Argos - Dalston Argos - Woolwich Argos - Stratford Argos - Hounslow Argos - Edgware Road Argos - Ilford Argos - Sutton Argos - Canterbury S/S Argos - Camden Argos - Holloway Argos - Staines Argos - Borehamwood Argos - Ealing Argos - Charlton Argos - Braintree Argos - Thurrock Retail Park Argos - Chancery Lane Argos - Basildon Pipps Hill Argos - Eltham Argos - Tottenham Hale Argos - Harrow Argos - Bedford Interchange Argos - Peckham Argos - Chelmsford Chelmer Argos - Enfield Argos - Brixton Argos - Waltham Cross Argos - Watford Waterfields Argos - Edgware Argos - Thamesmead Argos - North Finchley Argos - Ashford Business Pk Argos - Dover Argos - Strood Argos - Weybridge Argos - Newbury Retail Park Argos - Kingston Argos - Lewisham Argos - Croydon Argos - Southend Airport Argos - Stevenage Argos - Reading Forbury ... Argos stores continued: Argos - H’Hempstead Apsley Argos - Edmonton Ravenside Argos - Leighton Buzzard -

J Sainsbury Plc Preliminary Results Announcement 2020-21 Wednesday, 28 April 2021 - 9:30 Am

J Sainsbury plc Preliminary Results Announcement 2020-21 Wednesday, 28 April 2021 - 9:30 am Simon Roberts Chief Executive Officer Good morning. Welcome to our 2020/2021 results presentation. Thank you everyone for joining us today. It’s been an exceptional year for the business, for our people and in everything we've delivered for our customers. First and foremost, I want to recognise the outstanding contribution of my colleagues, of our entire team. They have risen to the huge challenges and have been heroic in how they have looked after our customers, and each other, every day. I’m really proud of the business and the part we played within the wider industry response, as food supply chains really stepped up to feed the nation. My thanks also to our suppliers for all their support and partnership. They have done a fantastic job throughout the last 12 months. Every day in every part of what we do, we cared about what mattered most for our customers, our colleagues and the communities we serve. Safety first, prioritising the elderly, disabled and vulnerable from day one, protecting availability, supporting shielding colleagues, supporting communities with food donation. Our values really came to the fore. And it’s been a time of extraordinary change, learning and agility for the business too. We have responded and adapted well throughout the pandemic. We have delivered at pace, every step of the way and as a result, we’re stronger & fitter for the future. I set out a clear plan and strategy in November to transform our busines over the next three years. -

A Historical Look at the Shops – Past and Present in the Colchester Town Centre Area

A HISTORICAL LOOK AT THE SHOPS – PAST AND PRESENT IN THE COLCHESTER TOWN CENTRE AREA 1 INTRODUCTION Having written about walking around our town and others over Christmas and the month of January, looking at churches in Essex, Suffolk and Norfolk, the weekend of 1st and 2nd February 2014, saw me writing and photographing the main shops in our town of Colchester and trying to find out the National History of the businesses. So here is my story again …… 99p STORE (84-86 Culver Street East) 99p Stores Ltd. is a family run business founded in January 2001 by entrepreneur Nadir Lalani, who opened the first store in the chain in Holloway, London, with a further three stores opening later that year. In 2002, Lalani decided to expand the business throughout the UK and has rapidly developed 99p Stores, operating a total of 129 stores as of March 2010 and serving around 1.5 million customers each week, undercutting their main rival Poundland by a penny. As of mid-2009 the company offered more than 3,500 different product lines throughout its stores. Most of their stores are based in the south of the UK, although there are stores as far north as Liverpool and Hartlepool. The chain saw accelerated store expansion upon the collapse of Woolworths Group, where they took the opportunity to acquire 15 of these former stores, increasing their estate to 79 at that time. Landlords are now regarding 99p Stores as an anchor tenant due to the significant number of customers one of their stores can bring to a location. -

Sainsbury's Argos

• Our Purpose • Our Heritage • Our Scale • Our Vision, Values & Sustainability • The Opportunity – Bedding • Next Steps Our Purpose live well for less • Founded by John James Sainsbury and his wife Mary Ann over 150 years ago, we’ve grown from one store on Dury Lane in London to become one of the UK’s largest food retailers • In 2016 Sainsburys purchased Argos. Argos introduced its iconic catalogue in 1973 and has grown the UK’s leading multi-channel retailer. • Habitat has been bringing cutting-edge interior design to UK high streets since the 1960s. Our Scale • With over 600 supermarkets, 800 convenience stores, and nearly • With 29 million store customers and nearly a billion online visitors 250,000 online orders every week. every year, Argos is the 3rd most visited website in the UK. • The quality, range and provenance of our food sets us apart from • We have something for all the family, including top brands like other supermarkets. And it will continue to do so. We’re investing Bose, Dyson, and Samsung, and exclusive lines like Chad Valley. in a three-year programme to upgrade over 3,000 of our own- brand products • We offer customers what they want, how they want it, 92.5% of households can benefit from our same-day Fast Track Delivery • Sainsbury’s GM business gives shoppers easy access to the kind and free in-store Fast Track Collection services. of general merchandise they want to pick up while they’re picking up their groceries. Our GM range covers everything from homeware, toys and seasonal products. -

Corporate Summary

RETAIL PARKS PORTFOLIO 7 August 2008 UK Abbey Retail Park, Newtownabbey, Belfast The scheme is located approximately three miles north of Belfast City Centre in an established retail location adjacent Size: 23,400m² to the Abbey Centre and a new flagship Marks & Spencer No of tenants: 5 store. The scheme is currently let at rents of between Ownership: Hammerson 100% £100/m² and £180/m². Proposals have been prepared for Main tenants: Tesco, B&Q an extension of the scheme to provide six new retail Tenure: Leasehold warehouse units. Planning: Part Open A1, part bulky goods Average rent: £140/m² Battery Retail Park, Birmingham Built in 1990, Battery Retail Park is located four miles to the South West of Birmingham City Centre. The park currently Size: 12,600m² consists of seven units and planning permission has been No of tenants: 7 obtained to build a further 900m² unit, which has been let to Ownership: Hammerson 25%/TIAA-CREF 75% Next. The extension will be completed in September and is Main tenants: B&Q, Currys, Homebase, PC World expected to open in November. Tenure: Leasehold Planning: Open A1 and restaurants Average rent: £285/m² Brent South Shopping Park, London, NW2 Owned by Hammerson and Standard Life, Brent South Shopping Park was constructed in November 2004. The Size: 8,500m² scheme, which is located directly opposite Brent Cross No of tenants: 9 Shopping Centre on the North Circular Road, is fully let. Ownership: Hammerson 41%/Standard Life 59% Main tenants: Arcadia, Borders, Next, TK Maxx, Tenure: Freehold Planning: Mainly open A1 Average rent: £505/m² Central Retail Park, Falkirk The scheme is anchored by a Tesco superstore and incorporates a 3,900m² Cineworld cinema and a 2,335m² Size: 37,200m² Ballantyne’s Health Club. -

Annual Report and Financial Statements 2017 Performance Highlights

Live Well For Less Annual Report and Financial Statements 2017 Performance highlights £29,112m Group sales (inc. VAT) up 12.7% 3,000 Food will always be at the heart of our business and we have completed our programme to improve the quality of 3,000 Sainsbury’s branded products. We £581m have a strong and differentiated offer that gives our customers market leading choice, quality and value. Underlying profit before tax down 1% Read more about our food business on page 15 -0.6% Sainsbury’s like-for-like sales (inc. VAT, ex fuel) £6bn We are one of the largest general merchandise and clothing retailers in the UK, offering customers a wide range of products across Sainsbury’s, 10.2p Argos and Habitat. Full-year dividend Read more about our General Merchandise and Clothing business on page 18 21.8p Underlying basic earnings per share 1.8m 17.5p Financial Services are an important part of our Basic earnings per share business. Sainsbury’s Bank played a key part in our acquisition of Argos and Habitat, enabling us to finance the deal in an efficient way. Sainsbury’s Bank and Argos Financial Services each have 1.8m £503m active customers. Statutory profit before tax Read more about Sainsbury’s Bank and Argos Financial Services on page 21 8.8% Return on capital employed down 4 bps £500m Read more about our financial KPIs onpage 40 We are on track to reach our £500 million cost savings target by 2017/18 and benefit from astrong balance sheet. We plan to reduce costs by a further £500m over three years from 2018/19.