Corporate Summary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report and Financial Statements 2018 Sainsbury’S Group Helping Customers Live Well for Less Has Been at the Heart of What We Do Since 1869

Live Well For Less Annual Report and Financial Statements 2018 Sainsbury’s Group Helping customers live well for less has been at the heart of what we do since 1869. We employ over 185,000 colleagues who work hard every day to make our customers’ lives easier and to provide them with great products, quality and service whenever and wherever it is convenient to access them. Food Our strategic focus is to help 608 our customers live well for less. Sainsbury’s supermarkets We offer customers quality and convenience as well as great value. Our distinctive ranges and innovative 102 partnerships differentiate stores offering Same Day our offer. More customers delivery to 40 per cent are shopping with us than of the UK population ever before and our share of customer transactions has increased. See more on page 12 General Merchandise 191 and Clothing Argos stores in Sainsbury’s We are one of the largest general supermarkets merchandise and clothing retailers in the UK, offering a wide range of products across our Argos, Sainsbury’s Home and 16 Habitat brands, in stores and Habitat stores and online. We are a market leader in Click & Collect available toys, electricals and technology in over 2,300 locations and Tu clothing offers high street style at supermarket prices. See more on page 14 Financial Services Financial Services are an 3.9m integral part of our business. Active customers Sainsbury’s Bank offers at Sainsbury’s Bank and accessible products such as Argos Financial Services credit cards, insurance, travel money and personal loans that reward loyalty. -

Live Well for Less

Live Well For Less Annual Report and Financial Statements 2019 Sainsbury’s Group at a glance Helping customers live well for less has been at the heart of what we do for 150 years, since John James and Mary Ann Sainsbury opened the doors of our first shop in Drury Lane in 1869. We employ 178,000 colleagues who work hard every Read more about our business model on page 08 day to make our customers’ lives easier and provide Read more about our business strategy on page 09 them with great products, quality and service. Food We are committed to helping our customers 2.2% live well for less. We offer customers quality Growth in Taste the Difference volumes and convenience as well as great value. Our distinctive ranges and innovative partnerships differentiate our offer. Customers consistently 57% rate the quality of our food as market-leading Of UK households benefit from and continue to switch to us from more Same Day delivery premium competitors. See more on page 10 General Merchandise and Clothing 281 Argos stores in We are one of the largest general merchandise Sainsbury’s supermarkets and clothing retailers in the UK, offering a wide range of products across Argos, Sainsbury’s Home and Habitat, in stores and online. We are a market leader in toys, 1bn+ electricals and technology and Tu clothing Visits to the Argos website offers high street style at supermarket prices. every year and sales generated through mobile devices passed See more on page 12 £2 billion for the first time Financial Services Financial Services are an integral part of our 2m+ business. -

J Sainsbury Plc Board of Directors

Live Well For Less Annual Report and Financial Statements 2019 Sainsbury’s Group at a glance Helping customers live well for less has been at the heart of what we do for 150 years, since John James and Mary Ann Sainsbury opened the doors of our first shop in Drury Lane in 1869. We employ 178,000 colleagues who work hard every Read more about our business model on page 08 day to make our customers’ lives easier and provide Read more about our business strategy on page 09 them with great products, quality and service. Food We are committed to helping our customers 2.2% live well for less. We offer customers quality Growth in Taste the Difference volumes and convenience as well as great value. Our distinctive ranges and innovative partnerships differentiate our offer. Customers consistently 57% rate the quality of our food as market-leading Of UK households benefit from and continue to switch to us from more Same Day delivery premium competitors. See more on page 10 General Merchandise and Clothing 281 Argos stores in We are one of the largest general merchandise Sainsbury’s supermarkets and clothing retailers in the UK, offering a wide range of products across Argos, Sainsbury’s Home and Habitat, in stores and online. We are a market leader in toys, 1bn+ electricals and technology and Tu clothing Visits to the Argos website offers high street style at supermarket prices. every year and sales generated through mobile devices passed See more on page 12 £2 billion for the first time Financial Services Financial Services are an integral part of our 2m+ business. -

Swale Borough Council

SWALE BOROUGH COUNCIL Project: RETAIL STUDY 2010: Bulky and DIY Goods Addendum Latest Revision: 20/05/2011 - DRAFT Study area population by zone Zone 2010 2015 2020 2025 1 39,501 40,410 41,418 42,595 2 12,888 13,185 13,514 13,897 3 46,052 47,112 48,287 49,659 4 11,242 11,501 11,788 12,123 5 19,162 19,603 20,092 20,663 6 5,340 5,463 5,599 5,758 TOTAL 134,185 137,274 140,698 144,695 Sources/notes for frontispiece 1. 2010 population for each zone from Pitney Bowes Business Insight Area Profile Report (6 July 2010) 2. Growth in population based on growth rates implied by scenarioKent County 3 of Council 6 scenarios population prepared forecasts by Research for Swale & Intelligence, Borough - South Kent CouEastntyPlan Council Strategy (16- Septemberbased Forecasts 2010). (September The KCC projections 2009) Total are Population based on SwaleForecasts. Borough Available: Counciil's 'Option 1' for newhttps://shareweb.kent.gov.uk/Documents/facts homes which assumes an additional 13,503-and dwellings-figures/sep between-forecasts 2006-sep-2031-09 -usingweb.pdf a phasing Access provideddate: 12 byOctober SBC 2010 OTHER COMPARISON GOODS Table 3.1 Expenditure per capita (£) Zone 2007 2010 2015 2020 2025 1 2,062 2,162 2,592 3,124 3,764 2 2,356 2,470 2,962 3,569 4,301 3 2,164 2,269 2,721 3,278 3,950 4 2,336 2,449 2,937 3,539 4,264 5 2,194 2,300 2,758 3,324 4,005 6 2,347 2,460 2,951 3,555 4,284 Sources/notes for Table 3.1 1. -

Annual Information Form for the Financial Year

ANNUAL INFORMATION FORM FOR THE FINANCIAL YEAR ENDED DECEMBER 31, 2014 March 20, 2015 i TABLE OF CONTENTS EXPLANATORY NOTES ............................................................................................................................................ 1 Forward-Looking Statements .................................................................................................................................... 1 Trademarks ................................................................................................................................................................ 2 CORPORATE STRUCTURE ....................................................................................................................................... 2 Name, Address and Incorporation ............................................................................................................................. 2 Intercorporate Relationship ....................................................................................................................................... 2 GENERAL DEVELOPMENT OF THE BUSINESS .................................................................................................... 3 History ....................................................................................................................................................................... 3 THE BUSINESS .......................................................................................................................................................... -

Habitat Ltd, Furniture and Household Goods Manufacturer and Retailer: Records, Ca

V&A Archive of Art and Design Habitat Ltd, furniture and household goods manufacturer and retailer: records, ca. 1960 – 2000 1 Table of Contents Introduction and summary description ................................................................ Page 4 Context .......................................................................................................... Page 4 Scope and content ....................................................................................... Page 4 Provenance ................................................................................................... Page 5 Access ......................................................................................................... Page 5 Related material .......................................................................................... Page 5 Detailed catalogue ................................................................................ Page 6 Corporate records .............................................................................................. Page 6 Offer for sale by tender, 1981 ................................................................................................ Page 6 Annual Reports and Accounts, 1965-1986 ............................................................................. Page 6 Marketing and public relations records ............................................................. Page 7 Advertising records, 1966-1996 ............................................................................................ -

Prospectus Dated 5 July 2016

This document comprises a prospectus (the ‘‘Prospectus’’) for the purposes of Article 3 of EU Directive 2003/71/EC, as amended (the ‘‘Prospectus Directive’’) relating to the New Sainsbury’s Shares and has been prepared in accordance with the Prospectus Rules of the Financial Conduct Authority (the ‘‘FCA’’) made under section 73A of the Financial Services and Markets Act 2000 (the ‘‘FSMA’’). The Prospectus will be made available to the public in accordance with the Prospectus Rules. The directors of J Sainsbury plc (‘‘Sainsbury’s’’ or the ‘‘Company’’), whose names appear on page 44 of this Prospectus, and the Company accept responsibility for the information contained in this Prospectus. To the best of the knowledge of the Company and the Sainsbury’s Directors (each of whom has taken all reasonable care to ensure that such is the case), the information contained in this Prospectus is in accordance with the facts and contains no omission likely to affect the import of such information. Investors are advised to examine all the risks that might be relevant in connection with the value of an investment in the New Sainsbury’s Shares. Investors should read the entire Prospectus (including the documents, or parts thereof, incorporated by reference) and, in particular, the section headed ‘‘Risk Factors’’ for a discussion of certain factors that should be considered in connection with an investment in the Company, the Combined Group, the existing Sainsbury’s Shares and the New Sainsbury’s Shares. J SAINSBURY PLC (incorporated under the Companies -

Annual Report and Accounts 2018Mothercare Plc Annual Report 2018 Annual Report and Accounts

mothercare plc annual report 2018 and accounts 2018 Annual report and accounts Contents Our brands Overview Mothercare 2 At a glance and financial highlights Our aim is to meet the needs of mothers-to-be, babies and children up to pre-school age. Our clothing & Strategic report footwear product includes ranges for babies, pre-school children and maternity wear and has a growing selection 3 Chairman’s statement of branded product. Home & travel includes pushchairs, 4 Business model car seats, furniture, bedding, feeding and bathing 5 Chief executive’s review equipment. Toys is mainly for babies and complements 11 KPIs – measuring our performance our ELC ranges. 12 Enterprise risk management 15 Principal risks and uncertainties STORES 18 Financial review UK – in town: 38 27 Corporate responsibility UK – out of town: 96 International partners: 932 Governance 36 Board of directors 37 Executive committee 38 Corporate governance Early Learning Centre 44 Audit and risk committee 49 Nomination committee Our aim is to provide children up to pre-school age 50 Directors’ report with toys that nurture and encourage learning through 53 Directors’ remuneration report play. Whilst the ranges are mainly own brand and are 57 Annual report on remuneration designed and sourced through our facilities in Hong Kong, we selectively bring in branded product that enhances Financial statements our ranges. 80 Directors’ responsibilities statement STORES 81 Independent auditor’s report UK – in town: 3 90 Consolidated income statement UK – inserts: 115 91 Consolidated -

Tools That Build a Better Future

Tools that build a better future Annual Report FY2018 July 1, 2017 – June 30, 2018 Habitat for Humanity International The tools in our toolbox ______________________ 2 Annual Report FY2018 Celebrating our global numbers _________________ 17 Summary of individuals served _________________ 22 July 1, 2017 – June 30, 2018 Letter from the chair of the board habitat.org of directors and the CEO _________________________ 24 A commitment to global stewardship _________ 25 Financial statements ______________________________ 26 FY18 feature spotlights ___________________________ 28 Corporate, foundation, institution and individual support ____________________________ 33 Tithe ___________________________________________________ 45 Donations _____________________________________________ 46 Board of directors and senior leadership ____ 49 “It’s a unique set of tools that builds a future, and I think Habitat is that toolbox that just brings it all together.” Habitat Humanitarian Since our founding in 1976, Habitat for Humanity has helped more Jonathan Scott than 22 million people build or improve the place they call home. With your support, in fiscal year 2018 alone, we most, we also faithfully bring a few of our helped more than 8.7 million people, and an favorite tried-and-true tools to the workbench. additional 2.2 million gained the potential to improve Volunteerism, service, advocacy, awareness. their living conditions through training and advocacy. These engines — fueled by your generous We’ve accomplished all of this with the trowel and support — propel the inclusion, innovation and the power saw, to be sure, but also by working inspiration that are hallmarks of our work around alongside families to help them access the tools the world. they need for a better tomorrow. -

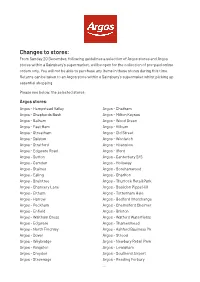

Changes to Stores

Changes to stores: From Sunday 20 December, following guidelines a selection of Argos stores and Argos stores within a Sainsbury’s supermarket, will be open for the collection of pre-paid online orders only. You will not be able to purchase any items in these stores during this time. Returns can be taken to an Argos store within a Sainsbury’s supermaket whilst picking up essential shopping. Please see below, the selected stores: Argos stores: Argos - Hempstead Valley Argos - Chatham Argos - Shepherds Bush Argos - Milton Keynes Argos - Balham Argos - Wood Green Argos - East Ham Argos - Kilburn Argos - Streatham Argos - Old Street Argos - Dalston Argos - Woolwich Argos - Stratford Argos - Hounslow Argos - Edgware Road Argos - Ilford Argos - Sutton Argos - Canterbury S/S Argos - Camden Argos - Holloway Argos - Staines Argos - Borehamwood Argos - Ealing Argos - Charlton Argos - Braintree Argos - Thurrock Retail Park Argos - Chancery Lane Argos - Basildon Pipps Hill Argos - Eltham Argos - Tottenham Hale Argos - Harrow Argos - Bedford Interchange Argos - Peckham Argos - Chelmsford Chelmer Argos - Enfield Argos - Brixton Argos - Waltham Cross Argos - Watford Waterfields Argos - Edgware Argos - Thamesmead Argos - North Finchley Argos - Ashford Business Pk Argos - Dover Argos - Strood Argos - Weybridge Argos - Newbury Retail Park Argos - Kingston Argos - Lewisham Argos - Croydon Argos - Southend Airport Argos - Stevenage Argos - Reading Forbury ... Argos stores continued: Argos - H’Hempstead Apsley Argos - Edmonton Ravenside Argos - Leighton Buzzard -

The Case for Firing Prosecutor General Viktor Shokin

October 9, 2015, Vol. 2, Issue 3 Obstruction Of Justice The case for fi ring Prosecutor General Viktor Shokin Special coverage pages 4-15 Editors’ Note Contents This seventh issue of the Legal Quarterly is devoted to three themes – or three Ps: prosecu- 4 Interview: tors, privatization, procurement. These are key areas for Ukraine’s future. Lawmaker Yegor Sobolev explains why he is leading drive In the fi rst one, prosecutors, all is not well. More than 110 lawmakers led by Yegor Sobolev to dump Shokin are calling on President Petro Poroshenko to fi re Prosecutor General Viktor Shokin. Not only has Shokin failed to prosecute high-level crime in Ukraine, but critics call him the chief ob- 7 Selective justice, lack of due structionist to justice and accuse him of tolerating corruption within his ranks. “They want process still alive in Ukraine to spearhead corruption, not fi ght it,” Sobolev said of Shokin’s team. The top prosecutor has Opinion: never agreed to be interviewed by the Kyiv Post. 10 US ambassador says prosecutors As for the second one, privatization, this refers to the 3,000 state-owned enterprises that sabotaging fi ght against continue to bleed money – more than $5 billion alone last year – through mismanagement corruption in Ukraine and corruption. But large-scale privatization is not likely to happen soon, at least until a new law on privatization is passed by parliament. The aim is to have public, transparent, compet- 12 Interview: itive tenders – not just televised ones. The law, reformers say, needs to prevent current state Shabunin says Poroshenko directors from looting companies that are sold and ensure both state and investor rights. -

J Sainsbury Plc Preliminary Results Announcement 2020-21 Wednesday, 28 April 2021 - 9:30 Am

J Sainsbury plc Preliminary Results Announcement 2020-21 Wednesday, 28 April 2021 - 9:30 am Simon Roberts Chief Executive Officer Good morning. Welcome to our 2020/2021 results presentation. Thank you everyone for joining us today. It’s been an exceptional year for the business, for our people and in everything we've delivered for our customers. First and foremost, I want to recognise the outstanding contribution of my colleagues, of our entire team. They have risen to the huge challenges and have been heroic in how they have looked after our customers, and each other, every day. I’m really proud of the business and the part we played within the wider industry response, as food supply chains really stepped up to feed the nation. My thanks also to our suppliers for all their support and partnership. They have done a fantastic job throughout the last 12 months. Every day in every part of what we do, we cared about what mattered most for our customers, our colleagues and the communities we serve. Safety first, prioritising the elderly, disabled and vulnerable from day one, protecting availability, supporting shielding colleagues, supporting communities with food donation. Our values really came to the fore. And it’s been a time of extraordinary change, learning and agility for the business too. We have responded and adapted well throughout the pandemic. We have delivered at pace, every step of the way and as a result, we’re stronger & fitter for the future. I set out a clear plan and strategy in November to transform our busines over the next three years.