Preliminary Results 2017/18 Combination of J Sainsbury Plc And

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report and Financial Statements 2018 Sainsbury’S Group Helping Customers Live Well for Less Has Been at the Heart of What We Do Since 1869

Live Well For Less Annual Report and Financial Statements 2018 Sainsbury’s Group Helping customers live well for less has been at the heart of what we do since 1869. We employ over 185,000 colleagues who work hard every day to make our customers’ lives easier and to provide them with great products, quality and service whenever and wherever it is convenient to access them. Food Our strategic focus is to help 608 our customers live well for less. Sainsbury’s supermarkets We offer customers quality and convenience as well as great value. Our distinctive ranges and innovative 102 partnerships differentiate stores offering Same Day our offer. More customers delivery to 40 per cent are shopping with us than of the UK population ever before and our share of customer transactions has increased. See more on page 12 General Merchandise 191 and Clothing Argos stores in Sainsbury’s We are one of the largest general supermarkets merchandise and clothing retailers in the UK, offering a wide range of products across our Argos, Sainsbury’s Home and 16 Habitat brands, in stores and Habitat stores and online. We are a market leader in Click & Collect available toys, electricals and technology in over 2,300 locations and Tu clothing offers high street style at supermarket prices. See more on page 14 Financial Services Financial Services are an 3.9m integral part of our business. Active customers Sainsbury’s Bank offers at Sainsbury’s Bank and accessible products such as Argos Financial Services credit cards, insurance, travel money and personal loans that reward loyalty. -

Live Well for Less

Live Well For Less Annual Report and Financial Statements 2019 Sainsbury’s Group at a glance Helping customers live well for less has been at the heart of what we do for 150 years, since John James and Mary Ann Sainsbury opened the doors of our first shop in Drury Lane in 1869. We employ 178,000 colleagues who work hard every Read more about our business model on page 08 day to make our customers’ lives easier and provide Read more about our business strategy on page 09 them with great products, quality and service. Food We are committed to helping our customers 2.2% live well for less. We offer customers quality Growth in Taste the Difference volumes and convenience as well as great value. Our distinctive ranges and innovative partnerships differentiate our offer. Customers consistently 57% rate the quality of our food as market-leading Of UK households benefit from and continue to switch to us from more Same Day delivery premium competitors. See more on page 10 General Merchandise and Clothing 281 Argos stores in We are one of the largest general merchandise Sainsbury’s supermarkets and clothing retailers in the UK, offering a wide range of products across Argos, Sainsbury’s Home and Habitat, in stores and online. We are a market leader in toys, 1bn+ electricals and technology and Tu clothing Visits to the Argos website offers high street style at supermarket prices. every year and sales generated through mobile devices passed See more on page 12 £2 billion for the first time Financial Services Financial Services are an integral part of our 2m+ business. -

Sustainable Investing for a Changing World Annual Report 2016 About Schroders

Sustainable investing for a changing world Annual Report 2016 About Schroders At Schroders, asset management is our only business and our goals are completely aligned with those of our clients: the creation of long-term value to assist them in meeting their future financial requirements. We have responsibility for £397.1 billion As responsible investors and signatories (€465.2 billion/$490.6 billion) on behalf to the UN’s Principles for Responsible of institutional and retail investors, Investment (PRI) we consider the long-term financial institutions and high net worth risks and opportunities that will affect the clients from around the world, invested resilience of the assets in which we invest. across equities, fixed income, multi-asset, This approach is supported by our alternatives and real estate. Environmental, Social and Governance (ESG) Policy and our Responsible Real Estate Investment Policy. Presence in 41 offices P 27 countries globally £397.1 bn assets 4,100+ under management employees and administration 15% 15% 4% 4% 10% 10% 39% 39% 40% 40% 21% 21% by client by client By product domicile domicile By product 21% 21% 25% 25% 25% 25% United KingdomUnited Kingdom Asia Pac ific Asia Pacific uities uities ultiasset ultiasset urope iddleurope ast and iddle frica ast and fricamericas mericas Wealth manaementWealth manaementied income ied income merin maretmerin debt commoditiesmaret debt andcommodities real estate and real estate Source: Schroders, as at 31 December 2016 1 The companies and sectors mentioned herein are for illustrative purposes only and are not to be considered a recommendation to buy or sell. % W P X AA AAA 2016 has shown that the social and environmental backdrop facing companies is changing quickly and pressures are coming to a head. -

Chronology, 1963–89

Chronology, 1963–89 This chronology covers key political and economic developments in the quarter century that saw the transformation of the Euromarkets into the world’s foremost financial markets. It also identifies milestones in the evolu- tion of Orion; transactions mentioned are those which were the first or the largest of their type or otherwise noteworthy. The tables and graphs present key financial and economic data of the era. Details of Orion’s financial his- tory are to be found in Appendix IV. Abbreviations: Chase (Chase Manhattan Bank), Royal (Royal Bank of Canada), NatPro (National Provincial Bank), Westminster (Westminster Bank), NatWest (National Westminster Bank), WestLB (Westdeutsche Landesbank Girozentrale), Mitsubishi (Mitsubishi Bank) and Orion (for Orion Bank, Orion Termbank, Orion Royal Bank and subsidiaries). Under Orion financings: ‘loans’ are syndicated loans, NIFs, RUFs etc.; ‘bonds’ are public issues, private placements, FRNs, FRCDs and other secu- rities, lead managed, co-managed, managed or advised by Orion. New loan transactions and new bond transactions are intended to show the range of Orion’s client base and refer to clients not previously mentioned. The word ‘subsequently’ in brackets indicates subsequent transactions of the same type and for the same client. Transaction amounts expressed in US dollars some- times include non-dollar transactions, converted at the prevailing rates of exchange. 1963 Global events Feb Canadian Conservative government falls. Apr Lester Pearson Premier. Mar China and Pakistan settle border dispute. May Jomo Kenyatta Premier of Kenya. Organization of African Unity formed, after widespread decolonization. Jun Election of Pope Paul VI. Aug Test Ban Take Your Partners Treaty. -

J Sainsbury Plc Board of Directors

Live Well For Less Annual Report and Financial Statements 2019 Sainsbury’s Group at a glance Helping customers live well for less has been at the heart of what we do for 150 years, since John James and Mary Ann Sainsbury opened the doors of our first shop in Drury Lane in 1869. We employ 178,000 colleagues who work hard every Read more about our business model on page 08 day to make our customers’ lives easier and provide Read more about our business strategy on page 09 them with great products, quality and service. Food We are committed to helping our customers 2.2% live well for less. We offer customers quality Growth in Taste the Difference volumes and convenience as well as great value. Our distinctive ranges and innovative partnerships differentiate our offer. Customers consistently 57% rate the quality of our food as market-leading Of UK households benefit from and continue to switch to us from more Same Day delivery premium competitors. See more on page 10 General Merchandise and Clothing 281 Argos stores in We are one of the largest general merchandise Sainsbury’s supermarkets and clothing retailers in the UK, offering a wide range of products across Argos, Sainsbury’s Home and Habitat, in stores and online. We are a market leader in toys, 1bn+ electricals and technology and Tu clothing Visits to the Argos website offers high street style at supermarket prices. every year and sales generated through mobile devices passed See more on page 12 £2 billion for the first time Financial Services Financial Services are an integral part of our 2m+ business. -

Morningstar Report

Report as of 02 Oct 2021 Threadneedle Monthly Extra Income Fund Retail Income GBP Morningstar® Category Morningstar® Benchmark Fund Benchmark Morningstar Rating™ Category_EUCA000916 Morningstar UK Moderately 20% ICE BofA Sterling Corp&Coll TR QQQ Adventurous Target Allocation NR GBP EUR, 80% FTSE AllSh TR GBP Used throughout report Investment Objective Performance The Fund aims to provide a monthly income with prospects 172 for capital growth over the long term. It looks to provide 154 an income yield higher than the FTSE All-Share Index over 136 rolling 3-year periods, after the deduction of charges. The 118 Fund is actively managed, and invests in a combination of 100 company shares and bonds; typically, between 70-80% in 82 UK company shares and 20%-30% in bonds. 2016 2017 2018 2019 2020 2021-08 12.39 6.59 -5.45 19.10 -5.17 11.72 Fund - - - - 4.52 9.96 Benchmark 13.23 10.00 -6.37 15.67 5.25 9.54 Category Risk Measures Trailing Returns % Fund Bmark Cat Quarterly Returns % Q1 Q2 Q3 Q4 3Y Alpha -4.50 3Y Sharpe Ratio 0.33 3 Months 1.16 0.35 0.46 2021 2.78 4.59 - - 3Y Beta 1.30 3Y Std Dev 14.34 6 Months 6.14 5.16 5.16 2020 -20.71 10.08 -0.11 8.77 3Y R-Squared 89.79 3Y Risk abv avg 1 Year 17.92 15.22 15.32 2019 6.46 2.75 4.10 4.59 3Y Info Ratio -0.54 5Y Risk abv avg 3 Years Annualised 3.80 6.62 6.12 2018 -4.05 8.69 -0.28 -9.09 3Y Tracking Error 5.57 10Y Risk abv avg 5 Years Annualised 4.71 7.20 6.49 2017 3.91 2.73 -0.15 0.01 Calculations use Morningstar UK Moderately Adventurous Target Allocation NR GBP 10 Years Annualised 8.86 8.92 8.05 -

Annual Report and Accounts 2018 01 Overview Performance Highlights for the Year to 31 March 2018

3i Group plc Overview Governance Introduction 01 Chairman’s introduction 58 Performance highlights 02 Board of Directors and Executive Committee 60 Chairman’s statement 02 Nominations Committee report 65 Chief Executive’s statement 04 Audit and Compliance Committee report 66 Action 08 Valuations Committee report 70 Directors’ remuneration report 73 Our business Relations with shareholders 83 Our business at a glance 10 Additional statutory and corporate governance information 84 Our business model 12 Our strategic objectives 14 Audited financial statements Key performance indicators 16 Private Equity 18 Consolidated statement of comprehensive income 92 Infrastructure 25 Consolidated statement of financial position 93 Performance, risk and sustainability Consolidated statement of changes in equity 94 Consolidated cash flow statement 95 Financial review 29 Company statement of financial position 96 Investment basis 35 Company statement of changes in equity 97 Reconciliation of Investment basis and IFRS 39 Company cash flow statement 98 Alternative Performance Measures 43 Significant accounting policies 99 Risk management 44 Notes to the accounts 104 Principal risks and mitigations 47 Independent Auditor’s report 139 Sustainability 52 Portfolio and other information 20 Large investments 148 Strategic report: Portfolio valuation – an explanation 150 pages 2 to 56. Information for shareholders 152 Directors’ report: pages Glossary 154 58 to 72 and 83 to 90. For definitions of our financial terms, used throughout this report, please see Directors’ remuneration our glossary on pages 154 to 156. report: pages 73 to 82. Consistent with our approach since the introduction of IFRS 10 in 2014, the financial data presented in the Overview and Strategic report is taken from the Investment basis financial statements. -

Annual Report and Accounts 2019 Introduction

Annual report and accounts 2019 Introduction Our purpose is to deliver a long-term sustainable return to shareholders from investing in infrastructure. Our strategy is to maintain a balanced portfolio of infrastructure investments delivering an attractive mix of income yield and capital appreciation for shareholders. 15.4% Total return for the year 13.4% In the 12 years since the initial public offering (‘IPO’) the Company has delivered an annualised total shareholder return of 13.4% per annum For further information, Cover image: Attero see our website Page 37 www.3i-infrastructure.com Inside this report Overview Financial review, 1 Performance highlights Risk and Sustainability 2 Chair’s statement 42 Financial review 4 At a glance 50 Risk report 6 Our markets 58 Sustainability report 8 Our business model 12 Our objectives and strategic priorities 13 How we measure our performance Governance and KPIs 64 Introduction to Governance 14 2019 realisation 66 Leadership 72 Division of responsibilities Investment Manager’s review 76 Relations with shareholders 77 Composition, succession and evaluation 18 Review from the Managing Partner 80 Audit, Risk and Internal Control 20 Investment activity 84 Remuneration 22 Portfolio 85 Directors’ statement 24 Movements in portfolio value Accounts and Review of investments other information 30 Tampnet 92 Independent auditor’s report 32 Infinis to the members of 3i Infrastructure plc 33 Wireless Infrastructure Group (‘WIG’) 99 Consolidated statement 34 TCR of comprehensive income 35 ESVAGT 100 Consolidated statement of changes 36 Oystercatcher in equity 37 Attero 101 Consolidated balance sheet 38 Valorem 102 Consolidated cash flow statement 39 Projects portfolio 103 Reconciliation of net cash flow to movement in net debt 104 Significant accounting policies 110 Notes to the accounts 126 Investment policy 127 Portfolio valuation methodology 128 Information for shareholders Chair’s statement At a glance 2 4 Review from the Financial Managing Partner review 18 42 The Strategic report comprises pages 1 to 61. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

JS Journal Nov 1988

si .vis ^ 'im A 'i „3i AWARDS ISSUE P10/11 'iBSl»:- r*^1 *\,« V C^ *^^- -jb U it o ^i ,y '! • i^pilv,,- K^/AWNCI?^ > •JEST ^: :ici % .^ \ii! ^^G-y ^T^^ .^S^ >^ of SEavic|§j fAmrsi Pfopji. 13* SsF"*- ^i *TS '•^^ <t^. oP (ysf CREATIVE EFFECTIVE \iil\t OFADVFRTI&INfc ^^^ JSJOURNAL FRONTLINE FIRST HALF PROFITS up The real glittering prize as we went to press. So, appro is published by 23 per cent. The company's amongst a sparkling array is priately, the Christmas Journal for employees of interim results were announced the Marplan Marketing Week will contain further celeb J Sainsbury pic as the Journal went to press awards in which JS came top, ration. Stamford House and ears are still ringing with as it has indeed for each of the In the meantime, this issue Stamford Street cries of admiration from the three years of the awards. It'? a contains an early gift for London SEI 9LL City of Fleet Street. As The hat trick which represents an readers — a full colour pull- Telephone: 01-921 6660 Times said: 'There seems to be incredible achievement when out guide to the company's no stopping Sainsbury's.' you consider the competition most senior management. Editor The results show we can put includes every big fry company More than an adornment to Yvonne Burke our money where other in Britain. any office or notice board, the Assistant editor people's mouths are, because As many awards as we pull-out puts a face to the Dominic Long this has been a month of crammed into this Journal we names of the people at the top. -

Lessons from FRS17 Disclosures

Is Pension Fund Asset Allocation Really Determined by Fundamentals? Mike Orszag W W W . W A T S O N W Y A T T . C O M Paris, April 2, 2004 Key Question z Do pension funds make asset allocation decisions based on corporate finance risk considerations? z Factors which might matter: – Size of pension scheme relative to company – Size of deficits relative to company – Maturity of scheme Copyright © Watson Wyatt Worldwide. All rights reserved. Data z UK listed companies have had to report pension liabilities on FRS17 basis since late 2001 z Collected roughly 150 data items for FTSE350 on corporate finance from FRS17 disclosures z Matched data to other data on market returns/option price data, betas, etc. Copyright © Watson Wyatt Worldwide. All rights reserved. Accounting Dates z Roughly 48% of FTSE350 (168 companies) use Dec. 31 as end of year, 17% (60 companies) use 31 March, 8% (29 companies) use 30 September, remainder use a variety of dates z Define a panel with two waves: – 2001 Wave = Accounting dates between 30 June 2001 and 29 June 2002 – 2002 Wave = Accounting dates between 30 June 2002 and 29 June 2003 Copyright © Watson Wyatt Worldwide. All rights reserved. Pension Surplus(Deficit)/Pension Liabilities FTSE 350 companies with positive reported pension liabilities 2001 2002 Wave 2002 has 5% -30% -48.1% only 10 10% -24.9% -43.7% companies with 25% -15.2% -34.0% surpluses as 50% -7.7% -27.4% opposed to 81 in 2001. 75% 3.3% -17.3% Among FTSE 90% 15.5% -8.3% 100, wave 2001 95% 21.8% -1.0% has only 4 companies in surplus as N 242 257 opposed to 46 in 2001 Copyright © Watson Wyatt Worldwide. -

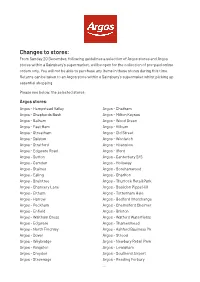

Changes to Stores

Changes to stores: From Sunday 20 December, following guidelines a selection of Argos stores and Argos stores within a Sainsbury’s supermarket, will be open for the collection of pre-paid online orders only. You will not be able to purchase any items in these stores during this time. Returns can be taken to an Argos store within a Sainsbury’s supermaket whilst picking up essential shopping. Please see below, the selected stores: Argos stores: Argos - Hempstead Valley Argos - Chatham Argos - Shepherds Bush Argos - Milton Keynes Argos - Balham Argos - Wood Green Argos - East Ham Argos - Kilburn Argos - Streatham Argos - Old Street Argos - Dalston Argos - Woolwich Argos - Stratford Argos - Hounslow Argos - Edgware Road Argos - Ilford Argos - Sutton Argos - Canterbury S/S Argos - Camden Argos - Holloway Argos - Staines Argos - Borehamwood Argos - Ealing Argos - Charlton Argos - Braintree Argos - Thurrock Retail Park Argos - Chancery Lane Argos - Basildon Pipps Hill Argos - Eltham Argos - Tottenham Hale Argos - Harrow Argos - Bedford Interchange Argos - Peckham Argos - Chelmsford Chelmer Argos - Enfield Argos - Brixton Argos - Waltham Cross Argos - Watford Waterfields Argos - Edgware Argos - Thamesmead Argos - North Finchley Argos - Ashford Business Pk Argos - Dover Argos - Strood Argos - Weybridge Argos - Newbury Retail Park Argos - Kingston Argos - Lewisham Argos - Croydon Argos - Southend Airport Argos - Stevenage Argos - Reading Forbury ... Argos stores continued: Argos - H’Hempstead Apsley Argos - Edmonton Ravenside Argos - Leighton Buzzard