INVESTOR MEETING November, 2010

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

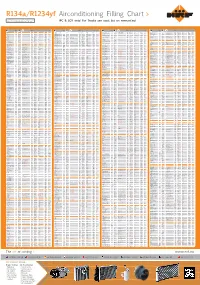

R134a/R1234yf Airconditioning Filling Chart

R134a/R1234yf Airconditioning Filling Chart > NOTE: Bold and orange printed information is always related to other information in the same data row! (PC & LCV only! For Trucks see total list on www.nrf.eu) Refri- Refri- Refri- Refri- Engine i gerant ± gr OE Oil ISO Oil ± 10ml Engine i gerant ± gr OE Oil ISO Oil ± 10ml Engine i gerant ± gr OE Oil ISO Oil ± 10ml Engine i gerant ± gr OE Oil ISO Oil ± 10ml ALFA ROMEO C-Max (DM2) 02.07-09.10 R134a 600 ±15 PAG46 PAG46 200 C-Class (S202/W202) 03.93-03.01 > VIN 1A168524/1F164269 R134a 950 ±25 ND-8 PAG46 150 Trafi c II (EL/FL/JL) 03.01- Delphi V5 comp./ + Rear evap. R134a 750/1150 ±35 RL488 PAG150 220/270 147 (937) 01.01-05.10 R134a 550 ±25 SP-10/ND-9 PAG46/ 130 C-Max II/Grand C-Max (DXA/ 12.10- R134a 530 ±15 PAG46 PAG46 150 C-/CLK-Class(C208/S202/W202) 03.93-07.02 VIN 1A168524/1F164270 > R134a 850 ±25 ND-8 PAG46 150 Trafi c II (EL/FL/JL) 1.9 dCi 03.01- Sanden comp./ + Rear evap. R134a 750/1150 ±35 SP-10 PAG46 135/175 PAG100 CB7,CEU) C-/CLC-/CLK-Class (C209/CL203/ 05.00-04.04 R134a 725 ±25 ND-8 PAG46 120 Trafi c II (EL/FL/JL) 2.0 dCi 08.06- Zexel comp./ + Rear evap. R134a 650/950 ±35 ZXL100PG PAG46 230/280 156 (932 Facelift) 2.4 JTD 03.02-05.06 R134a 500 ±25 SP-10/ND-9 PAG46/ 130/150 C-Max II/Grand C-Max 1.0i 10.12- R134a 460 ±15 PAG46 PAG46 120 S203/W203) Twingo I (C06/S06) 05.96-2007 Sanden SD6V12 comp. -

The Peugeotist” for a Long Period Or There Was an Event on the Sunday If We Were Organising Events

Issue 204 August 2020 TTHHEE PPEEUUGGEEOOTTIISSTT Club Officials Registrars Committee members are shown in blue Pre-war Janette Horton [email protected] 01543 262466 Vice President: Nick O’Hara 6 Hazell Road, Farnham, Surrey GU9 7BW 202, 302, 402 Richard Barker Tel: 01252 721093 [email protected] 01372 274053 203, D3 Alastair Inglis Chairman: Ian Kirkwood [email protected] 01604 862 369 15 Druids Park, Liverpool L18 3LJ 403, 404, D4 Ken Broughton Tel: 07970 257599 [email protected] 01483 421701 [email protected] 104, Samba Alison Budd Secretary: Mike Lynch [email protected] 01460 57572 81 Northumberland Road, Leamington Spa, 204 & 304 Jonathan Poolman Warks CV32 6HQ [email protected] 01343 544842 Tel: 01926 424377 504 Coupé/Cabriolet & [email protected] all 504 derivatives Gary Charlton [email protected] 01329 833029 Treasurer: Vacant Temporary contact: Chairman 604 Philip Christian [email protected] 07958 624377 Membership Secretary: Rob Exell 205 Jonathan Poolman Rose Cottage, Eathorpe, Leamington Spa, [email protected] 01343 544842 Warks CV33 9DE 305 Jonathan Poolman Tel: 07900 490906 [email protected] 01343 544842 [email protected] 309 David Chapman Events Secretary: Alison Budd [email protected] 07764 191744 Tel: 01460 57572 405 & Diesel specialist Michael Huntley [email protected] [email protected] 01268 561214 Editor: Alastair Inglis 505 Ken Broughton Stone House, Hartwell Road, Roade, [email protected] 01483 421701 Northants NN7 2NT -

Manual Do Proprietario Peugeot Boxer READ ONLINE

Manual Do Proprietario Peugeot Boxer READ ONLINE If you are searched for a ebook Manual do proprietario peugeot boxer in pdf form, then you have come on to right website. We presented the full option of this ebook in PDF, txt, doc, ePub, DjVu formats. You can read online Manual do proprietario peugeot boxer or download. Additionally to this book, on our site you can reading the instructions and diverse artistic eBooks online, either download them as well. We wish draw regard what our website not store the eBook itself, but we grant ref to site wherever you can download either reading online. So that if you need to load Manual do proprietario peugeot boxer pdf , then you've come to the right site. We have Manual do proprietario peugeot boxer PDF, DjVu, doc, ePub, txt formats. We will be glad if you go back to us more. Manual Do Proprietario Peugeot 206 Solei - Proprietario Peugeot 207 6. Manual Do Proprietario Peugeot Boxer 7. Searching for PDF manual do proprietario peugeot 206 sw Ebooks for Download, Read and Download owners manual peugeot 206 plus pdf - Download Manual do proprietario peugeot 206 solei.pdf Download Chrysler voyager owners manual 1994.pdf. Download Peugeot 206 service manual for sale.pdf. Peugeot 206 1.4 8v haynes manual!? | Yahoo - Jul 26, 2009 Does anyone know where i can get peugeot 206 manual? Loss of power white smoke from exhaust peugot boxer 290lx hdi whats wrong? 5 answers Pdf Manual Do Proprietario Peugeot Hoggar | - Pdf Manual Do Proprietario Peugeot Hoggar with owner manual 2011 peugeot hoggar, owner manual 2011 peugeot hoggar and owner manual 2011 peugeot hoggar . -

Peugeot 405 Manuals for Gta Iv

Peugeot 405 Manuals For Gta Iv If searching for the book Peugeot 405 manuals for gta iv in pdf form, in that case you come on to correct website. We present full version of this ebook in doc, txt, PDF, ePub, DjVu forms. You can reading Peugeot 405 manuals for gta iv online or download. Additionally to this book, on our website you may read the instructions and diverse art eBooks online, either load them. We like draw on note that our website not store the book itself, but we provide ref to the site wherever you may download either reading online. So that if you have necessity to download Peugeot 405 manuals for gta iv pdf, then you've come to the right website. We have Peugeot 405 manuals for gta iv doc, PDF, txt, ePub, DjVu forms. We will be pleased if you come back afresh. Used Peugeot 406 for sale on Auto Trader Used Peugeot 405; Used Peugeot 406; Manual; 2.0L; Diesel; 999: Peugeot 406 2.0 HDi Peugeot 406 GLX 4 door saloon auto 24 valve 3.0 V6 with digital air GTA 4 Peugeot 405 GLX Mod - GTAinside.com GTA 4 Peugeot 405 GLX Mod was downloaded 3789 times and it has 7.74 of 10 points so far. Download it now for GTA 4! Peugeot 308 2007 Wheel Pack. by Arti9609 1999 Peugeot 206 XS - GTA4-Mods.com - Grand Theft Grand Theft Auto 4 car mods, tools, and more! 1999 Peugeot 206 XS Manual install on OpenIV NEW HAYNES WORKSHOP MANUAL FOR PEUGEOT 405 DIESEL NEW HAYNES WORKSHOP MANUAL FOR PEUGEOT 405 DIESEL 88-97 - 3I98 in Vehicle Parts & Accessories, Car Manuals & Literature, Peugeot | eBay. -

Passenger Car OEM Quarterly Data Book Q2 - 2012 Passenger Car OEM Quarterly Data Book (Q2 - 2012)

Passenger Car OEM Quarterly Data Book Q2 - 2012 Passenger Car OEM Quarterly Data Book (Q2 - 2012) Published: August 2012 An AutomotiveWorld.com report published by: Automotive World Ltd 1 - 3 The Washington Buildings Stanwell Road, Penarth Vale of Glamorgan, CF64 2AD United Kingdom Tel: +44 (0)29 20 709 302 Fax: +44 (0)29 20 707 021 http://www.automotiveworld.com ABOUT THE EDITOR Jonathan Storey Jonathan Storey has worked in the motor industry for more than fifteen years. Beginning as a financial analyst for Ford Motor Company, he later moved into the consultancy sector providing research, analysis and forecasting services for vehicle manufacturers, suppliers and regulatory authorities. He is the author of AutomotiveWorld.com reports: “World’s Car Manufacturers - a financial and operating review” and “World’s Truck Manufacturers - a financial and operating review”. He is also co-author of “Electric Vehicles- prospects for battery, fuel cell and hybrid powered vehicles”. Polk-Marketing Systems The production and registration data for this quarterly report is supplied by Polk-Marketing Systems GmbH, one of the world’s leading suppliers of data to the automotive industry. Polk-Marketing Systems has provided planning and forecasting services to the automotive industry for over twenty-five years. It provides a full range of forecasting and consultancy services. Polk-Marketing Systems has its headquarters in Essen, Germany and offices in all the world’s major vehicle markets. Their comprehensive and ever-expanding databases are maintained and -

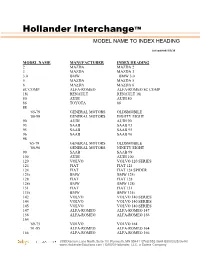

Model Name to Index Heading

Hollander Interchange™ MODEL NAME TO INDEX HEADING Last updated: 9/5/19 MODEL NAME MANUFACTURER INDEX HEADING 2 MAZDA MAZDA 2 3 MAZDA MAZDA 3 3.0 BMW BMW 3.0 5 MAZDA MAZDA 5 6 MAZDA MAZDA 6 8C COMP ALFA-ROMEO ALFA-ROMEO 8C COMP 18i RENAULT RENAULT 18i 80 AUDI AUDI 80 86 TOYOTA 86 88 ‘65-79 GENERAL MOTORS OLDSMOBILE ’80-99 GENERAL MOTORS EIGHTY EIGHT 90 AUDI AUDI 90 93 SAAB SAAB 93 95 SAAB SAAB 95 96 SAAB SAAB 96 98 ’65-79 GENERAL MOTORS OLDSMOBILE ’80-96 GENERAL MOTORS NINETY EIGHT 99 SAAB SAAB 99 100 AUDI AUDI 100 120 VOLVO VOLVO 120 SERIES 124 FIAT FIAT 124 124 FIAT FIAT 124 SPIDER 125i BMW BMW 125i 128 FIAT FIAT 128 128i BMW BMW 128i 131 FIAT FIAT 131 135i BMW BMW 135i 142 VOLVO VOLVO 140 SERIES 144 VOLVO VOLVO 140 SERIES 145 VOLVO VOLVO 140 SERIES 147 ALFA-ROMEO ALFA-ROMEO 147 156 ALFA-ROMEO ALFA-ROMEO 156 164 ’69-75 VOLVO VOLVO 164 ’91-95 ALFA-ROMEO ALFA-ROMEO 164 166 ALFA-ROMEO ALFA-ROMEO 166 2955 Xenium Lane North. Suite 10 I Plymouth, MN 55441 I [763] 553.0644 I [800] 825.0644 I www.HollanderSolutions.com I ©2020 Hollander, LLC, a Solera Company MODEL NAME MANUFACTURER INDEX HEADING 190 MERCEDES-BENZ MERCEDES 190 190D MERCEDES-BENZ MERCEDES 190 190E MERCEDES-BENZ MERCEDES 190 2.0 SPIDER ALFA-ROMEO ALFA-ROMEO 2000 200 ’65-68 MERCEDES-BENZ MERCEDES 200 ’89-91 AUDI AUDI 200 ’11-17 CHRYSLER 200 200D MERCEDES-BENZ MERCEDES 200 200SX NISSAN NISSAN 200SX 210 NISSAN 210 220 MERCEDES-BENZ MERCEDES 220 220D MERCEDES-BENZ MERCEDES 220 220SE MERCEDES-BENZ MERCEDES 220 228i BMW BMW 228i 230 ’65-70 (6 cyl) MERCEDES-BENZ MERCEDES 230/6 ’73-78 -

Gran Turismo 5 As of Today Sony Has Announced the Full Gran Turismo 5

Gran Turismo 5 As of today Sony has announced the full Gran Turismo 5 car list. It consists of 10000 cars. At launch it will only have 340 cars while the others will be developed in the future. Polyphony Digital will also develop cars for individual clients. That means in the future we could have any car put into the game for a special price. Of course the damage model will be not present in GT5. Below we are attaching the nearly official car list of GT5. Be ready for more info in the close future! 1G RACING/ROSSION AUTOMOTIVE Rossion Q1 Supercar '08 9FF FAHRZEUGTECHNIK 9ff [Cayman S] CCR42 {4.1L, 420hp} '06 9ff [996] 9fT1 Turbo '03 9ff [996] 9f V400 '04 9ff [997] Aero '05 9ff [997] Carrera Turbo Stage I '06 9ff [997] Carrera Turbo Stage II '06 9ff [977] Carrera Turbo Stage III '06 9ff [997] Carrera Turbo Cabrio Stage III '06 9ff [997] Cabrio [650hp] '06 9ff [Carrera GT] =unnamed= '06 9ff [997] TCR84 '07 9ff [997 Turbo] TRC 91 '07 A:LEVEL A:Level BIG '03 A:Level Volga V12 Coupe '03 A:Level Volga V8 Convertible '06 A:Level Impression '05 A&L RACING A&L Racing S2000 '04 AB FLUG Toyota Supra 80 ' Nissan Fairlady Z32 '89 Nissan Skyline GTR R32 ' Nissan Skyline GTR R33 ' Nissan Skyline GTR R34 ' Toyota Supra S900 '01 Toyota Supra 70 ' Mazda RX7 [FD3S] ' Toyota Aristo 161 ' Mazda RX8 ' Toyota Supra Tamura Veil Black S900 ' Toyota Supra Zefi:r MA04S ' ABARTH Abarth Simca ' Abarth Stola Monotipo Concept '98 Abarth 1000 Bialbero ' Abarth OT850 ' Abarth OT1000 ' Abarth OTR1000 ' Abarth OT1300/124 ' Abarth OT1600 ' Abarth OT2000 ' ABD RACING ABD -

The Pugilist December 2014

the pugilist December 2014 Magazine of the Peugeot Car Club of NSW Inc MUIRS EUROPEAN PEUGEOT Sydney’s newest Peugeot dealer Service your Peugeot at Muirs and experience a whole new level of personalised customer service and professionalaism 4008 Active SUV 2008 Active SUV From Keyless entry and pushbutton start $ From Colour touchscreen 27,990 Manual transmission $ 1 Reverse Camera Driveaway Reverse Camera 24,990 Driveaway1 TM Rear Parking Sensors Bluetooth and USB John Muir and his team always go the extra mile in customer service, because they believe that if they can’t save you money and provide the best service, then they don’t deserve your business. They prove this every day by offering benefits which include a free concierge drop off/pick up service, a complementary courtesy car if required and a clean and wash with all vehicles serviced. In addition, with all new cars purchased, Muirs offer a very unique Rewards Package* and an additional 3 year Vehicle Protection Plan* at no extra cost. 2 MUIRS AUTOMOTIVE. 205 Parramatta Rd (Cnr Alt St) Haberfield, NSW - 9798 8888 muirs.com.au ¹The driveaway price shown comprises vehicle price, registration, CTP, stamp duty and dealer delivery charges and is for model with manual transmission. Metallic paint extra cost. ²Capped price servicing is for 5 years or 75,000km, whichever comes first. The capped prices may vary between dealers. PEU342 Paris Motor Show Facelifted crossover set for 2015 launch Byron Mathioudakis RXH Diesel is the non-hybrid version of the The expected arrival of the 508 RXH does French mid-sizer, powered by a 133kW/400Nm not bode well for the Hybrid4 version, which eugeot is set to release a surprise high- 2.0-litre four-cylinder HDi turbo-diesel engine would cost well over $65,000 by the time it landed riding crossover-style version of the driving the front wheels via a six-speed automatic in this country due to its separate electric motor Pfacelifted 508 Touring wagon onto the transmission. -

Manual Do Proprietario Peugeot Boxer

Manual Do Proprietario Peugeot Boxer Download owners manual peugeot 206 plus pdf - Download Manual do proprietario peugeot 206 solei.pdf Download Chrysler voyager owners manual 1994.pdf. Download Peugeot 206 service manual for sale.pdf. Manual Do Proprietario Peugeot 307 Sw Pdf - Get more about Manual Do Proprietario Peugeot 307 Sw Pdf ebook in member area after you verify your free registration. PEUGEOT 306 OWNERS MANUAL HANDBOOK with WALLET - OWNERS HANDBOOK WALLET What Other Items Do Customers Buy After Viewing This Item? Peugeot 306 Petrol and Diesel Service and Repair Manual: 1993 to Manual Do Proprietario Peugeot 206 Solei - Proprietario Peugeot 207 6. Manual Do Proprietario Peugeot Boxer 7. Searching for PDF manual do proprietario peugeot 206 sw Ebooks for Download, Read and PEUGEOT SERVICE HISTORY BOOK 107 / 206 / 207 / - peugeot service history book 107 / 206 / 207 / 307 / 308 / 407 / 508 / 607 / 807 / 1007 / 3008 / 4007 / 5008 / partner / expert / boxer / bipper / tepee owners Manual Do Proprietario Peugeot 307 Pdf - Above is Manual Do Proprietario Peugeot 307 Pdf you might need. You can both download or read it online in this site. Pdf Manual Do Proprietario Peugeot Hoggar | - Pdf Manual Do Proprietario Peugeot Hoggar with owner manual 2011 peugeot hoggar, owner manual 2011 peugeot hoggar and owner manual 2011 peugeot hoggar . Peugeot 206 1.4 8v haynes manual!? | Yahoo - Jul 26, 2009 Does anyone know where i can get peugeot 206 manual? Loss of power white smoke from exhaust peugot boxer 290lx hdi whats wrong? 5 answers FAQs - Peugeot UK - How do I find a Peugeot Dealer? the specific Owner's Manual for your current registered Peugeot model can be found under the 'User Guide' link. -

2009 Registration Document

2009 REGISTRATION DOCUMENT 2009 Registration Document The original French version of this Registration Document was filed with the Autorité des marchés financiers (AMF) on 22 April 2010, in accordance with the provisions of Article 212-13 of the General Regulation of the AMF. It may be used in connection with a financial transaction in conjunction with an Information Memorandum approved by the Autorité des marchés financiers. It was prepared by the issuer and is the responsibility of the person whose Signature appears therein. It contains all of the information concerning the Annual Financial Report. PSA Peugeot Citroën 2009 Registration Document 1 CONTENTS 1 PERSONS RESPONSIBLE 5 9 OPERATING AND FINANCIAL REVIEW 93 Person responsible for the 2009 Registration Document 6 9.1. Financial Position 94 Statement by the Person Responsible 9.2. Group Operating Results for the Years for the 2009 Registration Document 6 Ended 31 December 2009 and 2008 95 Person Responsible for Financial Information 6 9.3. Other Income Statement Items 101 2 STATUTORY AUDITORS 7 10 CASH AND CAPITAL RESOURCES 103 Auditors 8 10.1. Balance Sheet and Financial Resources 104 10.2. Sources, Amounts and Description of consolidated Cash fl ows 106 3 SELECTED FINANCIAL INFORMATION 9 10.3. Liquidity and Funding 108 Consolidated Statements of Income 10 10.4. Information on Any Restrictions Consolidated Balance Sheets 10 on the Use of Capital Resources 109 Consolidated Statements of Cash Flows 11 10.5. Information on Anticipated Sources of Funds Needed to Fulfi ll Commitments 110 4 RISK FACTORS 13 CAPITAL EXPENDITURE AND 4.1. Issuer Risks 14 11 RESEARCH & DEVELOPMENT 111 4.2. -

Document De Référence 2009 Peugeot

DOCUMENT DE RÉFÉRENCE 2009 Document de référence 2009 Le présent document de référence a été déposé auprès de l’Autorité des marchés financiers le 22 avril 2010, conformément à l’article 212-13 de son règlement général. Il pourra être utilisé à l’appui d’une opération financière s’il est complété par une note d’opération visée par l’AMF. Ce document a été établi par l’émetteur et engage la responsabilité de ses signataires. Le document contient l’ensemble des informations relatives au Rapport financier annuel. PSA Peugeot Citroën Document de référence 2009 1 SOMMAIRE 1 PERSONNES RESPONSABLES 5 9 EXAMEN DE LA SITUATION Responsable du document de référence 2009 6 FINANCIÈRE ET DU RÉSULTAT 93 Attestation du responsable du document 9.1. Situation fi nancière 94 de référence 2009 6 9.2. Résultat opérationnel du Groupe Responsable de l’information fi nancière 6 pour l’exercice 2008 et l’exercice 2009 95 9.3. Autres éléments du compte de résultat 101 2 CONTRÔLEURS LÉGAUX DES COMPTES 7 Responsables du contrôle des comptes 8 10 TRÉSORERIE ET CAPITAUX 103 10.1. Informations sur le bilan et les ressources fi nancières du Groupe 104 3 INFORMATIONS FINANCIÈRES 10.2. Source et montant des fl ux de trésorerie SÉLECTIONNÉES 9 consolidés et description de ces fl ux 106 Comptes de résultats consolidés 10 10.3. Financement et ressources de liquidité 108 Bilans consolidés 10 10.4. Informations concernant toute restriction Tableaux de fl ux de trésorerie consolidés 11 à l’utilisation des capitaux ayant infl ué sensiblement ou pouvant infl uer sensiblement sur les opérations de la société 109 10.5. -

Peugeot Today P.4

200 years of excellence and emotion Table of contents Peugeot today p.4 1532 – 1886: From grain to steel p.14 1889 – 1918: Armand Peugeot: the automobile era p.18 1919 – 1946: The era of democracy p.26 1948 – 1973: The great recovery p.32 1974 – 1989: As hungry as a lion p.38 The 1990s: Heading into the 21st century p.42 The Noughties: Gathering speed p.48 Motor sport: A century of passion p.56 Concept cars: The future is written today p.62 Two wheeled locomotion: From velocipede to electric scooter p.68 The Lion and its history p.74 The Peugeot Adventure and Museum: More than just a museum; it’s an adventure p.78 Peugeot partnerships: Sport in the blood p 80 At Peugeot, we take Customer Relations to heart p.84 Peugeot models by year p.86 Concept cars p.88 “Counter” coffee grinder coffee “Counter” 4 BB1 Peugeot has an extraordinary history. For the past 200 years, the Peugeot name and its emblem, the Lion, has appeared on a range of products such as dress crinolines, coffee grinders, pepper mills, bicycles, scooters and cars. This is a unique history - a story of 200 years of inspiration. Peugeot added its own style and that certain “je ne sais quoi” to each of these products, objects or tools, whilst remaining true to the high quality and demanding nature of its original work in the steel industry. Peugeot’s strength is its singular ability to combine emotion with excellence. Dating back to 1810, this vision has seen the brand constantly adapt to the way history, practices and customers have changed.