Institutional Equities

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Maharashtra Institute of Technology

Maharashtra Institute of Technology Aurangabad An exclusive Guide by Maharashtra Institute of Technology Placements 2020: Top Companies and Alumni Placements Updated on Sep 9, 2020 Divya Shakti Shukla Maharashtra Institute of Technology (MIT), Aurangabad has an active training and placement cell responsible for helping students in developing communication skills and achieving their goals. Apart from this, the training and placement cell also maintains the database of students and recruiters, organises in-plant training sessions and placement drives. MIT, Aurangabad placements 2020 concluded with 33 students from BTech programme getting recruited by various companies. Students were hired from branches, including Mechanical, Civil, Plastic and Polymer, Electrical, Electronics and Telecommunication, and Computer Science and Engineering. Table of Contents 1. MIT Aurangabad Placement Highlights 2020 2. MIT Aurangabad Alumni Domain-wise Placements 2020 3. MIT Aurangabad Top Companies 2020 4. MIT Aurangabad Placement FAQs MIT Aurangabad Placement Highlights 2020 Particulars Statistics Number of recruiters 17 Number of students placed (CSE) 17 Recruiter with highest job offers Capgemini Top recruiters Infosys, Reliance, TCS, Wipro MIT Aurangabad Alumni Domain-wise Placements 2020 The Institute has a huge alumni base. Over 1750 alumni are working in domains, including Engineering, Education, Sales, Marketing, etc., according to the LinkedIn page of MIT Aurgranbad. The infographic below showcases the number of MIT Aurangabad alumni working in various -

October 30 the Gener Corporate BSE Limite Phiroze Je Dalal Stree

Reliance Infrastructure Limited Corporate Office: 3rd floor, north wing Tel: +91 22 3303 1000 Reliance Energy Centre Fax:+91 22 3303 3664 Santa Cruz (East) www.rinfra.com Mumbai 400 055 CIN : L75100MH1929PLC001530 October 30, 2017 The General Manager The Manger Corporate Relationship Department National Stock Exchange of India limited BSE Limited Plaza, 5th Floor, Plot no.C/1, G Block Phiroze Jeejeeboy Towers Bandra Kurla Complex, Bandra (E) Dalal Street, Fort Mumbai 400 051 Mumbai 400 001 NSE Scrip Symbol: RELINFRA BSE Scrip Code: 500390 Dear Sirs, Sub: Filing of Annual Report 2016-17 under Regulation 34 (1) Pursuant to Regulation 34 (1) and all other applicable regulations of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (Listing Regulations), we enclose herewith the Annual Report for the financial year 2016-17. Kindly take the same on record and inform your members accordingly. Yours faithfully, For Reliance Infrastructure Limited Ramesh Shenoy Company Secretary Encl. :- Ass above. Annual Report 2016-17 Padma Vibhushan Shri Dhirubhai H. Ambani (28th December, 1932 - 6th July, 2002) Reliance Group - Founder and Visionary Profile Reliance Infrastructure Limited (RInfra), constituent of the Reliance Group was incorporated in 1929 and is one of the largest infrastructure companies, developing projects through various Special Purpose Vehicles (SPVs) in several high growth sectors such as power, roads, metro rail and airport in the infrastructure space and the defence sector. RInfra is also a leading utility company having presence across the value chain of power businesses i.e. generation, transmission, distribution and power trading. RInfra through its SPVs has executed a portfolio of infrastructure projects such as a metro rail project in Mumbai on build, own, operate and transfer (BOOT) basis; eleven road projects with total length of about 1,000 kms on build, operate and transfer (BOT) basis. -

The How Jumboking Travels the Growth Path

COVER STORY l JUMBOKING 2001 23rd August- First outlet opened THE 2004 Franchising launched with 6 outlets. VADA PAV 2005 23rd August 15 operational outlets. 2007 Awarded as Best New Concept in Franchising & Most Innovative Franchisee model KING As a 2009 HOW JUMBOKING Case study by promoter, knowledge@ Wharton I have to on Jumboking TRAVELS THE graduate 2011 MS Dhoni from being a becomes GROWTH PATH Jumboking’s Jumboking is the success story of how the desi doer and an customer number 90,000,000 vada pav built growth in the international style executioner QSR chain. Mumbai-based Dheeraj Gupta 2012 to a culture Upgraded to an started Jumboking in 2001, making the vada pav International creator.” Frozen Products relevant to Jumboking in the way that burgers Supply Chain are to McDonalds, fried chicken to KFC and 2013 pizzas to Dominos. With 53 stores in nine cities, Expanded nationally with Jumboking is today the largest vada pav chain in the launch of India. Dheeraj shares the lessons he learnt while its expansion programme in traversing the path to transformational growth. 18 new cities. Awarded as Best Indian QSR Chain. AS NARRATED TO SANDEEP SONI 22 | Small Medium Entrepreneur | November 2013 November 2013 | Small Medium Entrepreneur | 23 COVER STORY l JUMBOKING Getting the operations tight realised that he of course would cities, though it will In the vada pav business, the have a slightly different way of FACT FILE stretch our supply margins are good but the ticket doing things. I had to redefine my Started with Rs 2 lakh as chain but once we size is low. -

IPO Note – Burger King India Limited

Burger King India Ltd IPO Note – Burger King India Limited 01-December-2020 1 Burger King India Ltd Background & Operations: Issue Snapshot: Burger King India Ltd (BKIL) is one of the fastest growing international QSR chains in India Issue Open: Dec 02 – Dec 04, 2020 during the first five years of its operations based on number of restaurants. As the national Price Band: Rs. 59 –60 master franchisee of the BURGER KING® brand in India, it has exclusive rights to develop, establish, operate and franchise Burger King branded restaurants in India. Its master *Issue Size: 135,000,000 eq shares franchisee arrangement provides with the ability to use Burger King’s globally recognised (Fresh Issue of 75,000,000eq sh + Offer for brand name to grow its business in India, while leveraging the technical, marketing and sale of 60,000,000 eq sh) operational expertise associated with the global Burger King brand. The globally recognised Burger King brand, also known as the “HOME OF THE WHOPPER®”in the United States and Issue Size: Rs. 796.5 – 810.0 cr is owned by Burger King Corporation, a subsidiary of Restaurant Brands International Inc. Reservation for: The Burger King brand is the second largest fast food burger brand globally as measured by QIB atleast 75% eq sh the total number of restaurants, with a global network of 18,675 restaurants in more than Non Institutional Upto 15% eq sh 100 countries and U.S. territories as at September 30, 2020. Retail Upto 10% eq sh BKIL’s master franchisee arrangement provides it with flexibility to tailor its menu to Indian Face Value: Rs 10 tastes and preferences, as well as its promotions and pricing. -

Retail 17Feb21 SR

February 2021 Sector Report Retail f cus QSR: The Right Combo Nihal Mahesh Jham Abneesh Roy Prateek Barsagade +91 22 6623 3352 +91 22 6620 3141 +91 22 4063 5407 Nihal.Jham@edelweissfin.com Abneesh.Roy@edelweissfin.com Prateek.Barsagade@edelweissfin.com Edelweiss Securities Limited Retail Contents Executive Summary ........................................................................................2 Story in Charts ................................................................................................8 Industry Outlook .......................................................................................... 10 o Food service industry: Overview .......................................................... 10 o Chain QSR market: Fastest-growing segment ...................................... 13 o Online food delivery spurt to continue ................................................. 22 o Covid-19: A blip, but an enabler as well ............................................... 25 o What’s the secret sauce to success? .................................................... 27 Outlook & valuations: Factoring opportunity and profitability .................. 29 Appendix: Global corporations - Business models ...................................... 31 Initiating Coverage: o Burger King India ................................................................................... 35 Company Update: o Jubilant Foodworks ............................................................................... 66 o Westlife Development ......................................................................... -

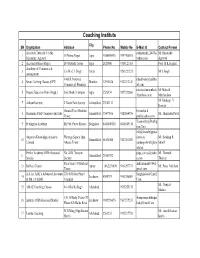

Coaching Institute

Coaching Institute City SN Orgnization Addresh Phone No Mobile No E-Mail Id Contact Person Accontax Tutorials C/o Mr. cahimanshu_2007@ Mr Himanshu 1 15 Nehru Nagar Agra 9358605595 9897405595 Himanshu Agrawal yahoo.com Agrawal 2 Accounts Palace (Regd.) B-9 Prateek Tower Agra 2623080 9319121165 Prof. M K Singhal Academy of Commerce & 3 C/o Prof. J. Singh Arrah 9263221272 Mr J Singh management 1406 R Navjivan mladiwala@rediffm 4 Smart Coching Classes (CPT) Mumbai 32911838 9322212141 Commercial Premises ail.com mirchandanimukesh Mr Mukesh 5 Dream Education Point (Regd.) Shiv Shakti Complex Agra 2526174 9897222880 [email protected] Mirchandani Mr.Sandeep V 7 Arihant Institute 2 Navin Park Society Ahmedabad 27683113 Kamdar Ground Floor Hirabhai himanshu d 8 Himanshu Patel Commerce Institute Ahmedabad 55437106 9825064596 Mr. Himanshu Patel Tower [email protected] Vasumathy@Prathig 9 Prathignya Academy Rh 906, Purva Riviera Bangalore 8041649138 8041649138 nya.Com info@knowledgeaca Angaram Knowledge Academy Heritage Sqyare Opp. demy.in, Mr. Sandeep R. 10 Ahmedabad 66131800 9227403030 Limited Atlanta Tower sandeep.shroff@kno Shroff wleled Perfect Academy Of Professional No. 41 B, Narayan paps_caclass@yaho Mr. Ramesh 11 Ahmedabad 26561592 Studies Society o.com Thakkar Paras Jain C/O Brilliant ankit.somani1984@ 13 Brilliant Tutors Ajmer 146,2231650 9414297773 Mr. Paras Mal Jain Tutors gmail.com A A A ( AJAI`s Advanced Accounts 320 3rd Floor Prince Singhajaica@Gmail. 14 Lucknow 4060739 9451246089 & FM ) at AIMS Complex Com Mr. Sanjeev 15 AMAZ Coaching Classes 64 A Bai Ka Bagh Allahabad 9935255178 Mishra C/O Of Balaj Video CD Awesomeprabhatpat 16 Institute Of Professional Studies Lucknow 9889296698 9839279237 House 628 Balda Road [email protected] M.G.Marg (Opp.Samrat Mr. -

Mr. Ranga Iyer, Former MD Wyeth Pg 38. DISCUSSION: Dr

1ST - 28TH Feb 2015 . Vol 2 Issue 2 . For Private Circulation Only pg 32. Attack of the Clones!! pg 35. INTERVIEW: Mr. Ranga Iyer, Former MD Wyeth pg 38. DISCUSSION: Dr. Goel, Chief Secretary, Agri Maharashtra GROUND VIEW - PREVIOUS ISSUES VOL 2 . ISSUE 2 . 1ST - 28TH FEB 2015 Vineet Bhatnagar- Managing Director and CEO EDITORIAL BOARD: Naveen Kulkarni, Manish Agarwalla, Kinshuk Bharti Tiwari COVER & MAGAZINE DESIGN Chaitanya Modak, www.inhousedesign.co.in FOR EDITORIAL QUERIES: PhillipCapital (India) Private Limited No. 1, 18th Floor, Urmi Estate, 95 Ganpatrao Kadam Marg, Lower Parel West, Mumbai 400 013 RESEARCH Automobiles Dhawal Doshi, Priya Ranjan 1st Jan 2015 Issue 1 16th Dec 2014 Issue 12 Banking, NBFCs Manish Agarwalla, Pradeep Agrawal, Paresh Jain Consumer, Media, Telecom Naveen Kulkarni, Jubil Jain, Manoj Behera Cement Vaibhav Agarwal Economics Anjali Verma Engineering, Capital Goods Ankur Sharma, Hrishikesh Bhagat Infrastructure & IT Services Vibhor Singhal, Deepan Kapadia Metals Dhawal Doshi, Ankit Gor Mid-caps Vikram Suryavanshi 15th Nov 2014 Issue 11 1st Oct 2014 Issue 10 Oil & Gas, Agri Inputs Gauri Anand, Deepak Pareek Pharmaceuticals Surya Patra, Mehul Sheth Retail, Real Estate Abhishek Ranganathan Technicals Subodh Gupta Production Manager Ganesh Deorukhkar Sr. Manager – Equities Support Rosie Ferns SALES & DISTRIBUTION Kinshuk Tiwari, Ashvin Patil, Shubhangi Agrawal, Kishor Binwal, Sidharth Agrawal, Bhavin Shah, Varun Kumar, Narayan Mulchandani CORPORATE COMMUNICATIONS Zarine Damania 1st Sep 2014 Issue 9 16th Aug 2014 Issue 8 [email protected] 2 GROUND VIEW 1 - 28 Feb 2015 1 - 28 Feb 2015 GROUND VIEW 3 LETTER FROM THE CONTENTS MANAGING DIRECTOR The Indian food services industry has undergone a remarkable transformation in the last 10 years and it is one of the fastest growing industries. -

TRANSFORMING Building a Smart Company

TRANSFORMING Building a smart company Annual Report 2020-21 Forward-looking statement In this Annual Report we have disclosed forward-looking information to enable investors to comprehend our prospects and take informed investment decisions. This report and other statements - written and oral - that we periodically make contain forward-looking statements that set out anticipated results based on the management’s plans and assumptions. We have tried wherever possible to identify such statements by using words such as ‘anticipates’, ‘estimates’, ‘expects’, ‘projects’, ‘intends’, ‘plans’, ‘believes’, and words of similar substance in connection with any discussion of future performance. We cannot guarantee that these forward looking statements will be realised, although we believe we have been prudent in assumptions. The achievement of results is subject to risks, uncertainties and even inaccurate assumptions. Should known or unknown risks or uncertainties materialise, or should underlying assumptions prove inaccurate, actual results could vary materially from those anticipated, estimated or projected. Readers should bear this in mind. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise Contents 2 Board of Directors 34 10 ways JK Tyre is transforming 72 Our R& D journey its business to enhance 4 Our management team 74 Brand JK Tyre shareholder value Part one: JK Tyre. Personality and 78 2- & 3-wheeler business Part three: JK Tyre. The catalysts of -

Terms and Conditions Campaign Date

Terms and Conditions Campaign Date: 00:00 hrs IST on 15th July, 2019, Till 23:59 hrs IST on 31st July, 2019 (hereinafter referred to as “Term” / ”Offer Period”). Offered By: OnePlus (hereinafter referred to as “OnePlus”) Details of the Offer: Citibank, N.A. (“Citibank”) and OnePlus are launching an Offer (hereinafter referred to as “Offer”) for the Term. Details of the Offer extended to all individuals, who are holders of valid Citibank credit cards issued in India only (hereinafter referred to “Customer”) are listed as under. However, the Offer is not valid on Citibank Corporate Credit Cards and Paytm First Cards. “Offer on One Plus 7 Pro”: 1. Customers are eligible for savings of Rs 2000 on purchase of Oneplus 7 Pro at Amazon app & website on Citibank Credit Cards. 2. Customers are eligible for cashback of Rs 2000 on purchase of Oneplus 7 Pro at OnePlus.in,OnePlus experience store and select offline stores on Citibank Credit Cards. “Offer on One Plus 7”: 1. Customers are eligible for savings of Rs 1500 on purchase of Oneplus 7 at Amazon app & website on Citibank Credit Cards. 2. Customers are eligible for cashback of Rs 1500 on purchase of Oneplus 7 at OnePlus.in,OnePlus experience store and select offline stores on Citibank Credit Cards. Offer Terms and Conditions: • This Offer is available to all Citi Credit card members for such cards issued in India only (Customer) except Citibank Corporate Card holders and Citibank Paytm First Card holders during the Term. • Add on cards will be treated as separate cards. -

Oneplus Stores City Store Name Store Address Ahmedabad Adinath

OnePlus Stores City Store Name Store Address Ahmedabad Adinath Marketing 105,Upper Level,Shikhar Complex,Ahmedabad New no. 213, Hira building, Brigade road, Bangalore - Bangalore OnePlus Experience store 560001 Ahmedabad OnePlus Kiosk Gulmohar Mall, Ahmedabad Chandigrah OnePlus Kiosk Elante Mall FF - 124, 1st Floor, Forum Vijaya Mall, Vadapalani, Chennai OnePlus Kiosk Chennai - 600026 DLF Saket, PVR Anupam, 1, Comunity center, Saket, Delhi OnePlus Kiosk Newdelhi - 110017 DLF Cyberhub, National Highway 8, DLF Cybercity, Gurgaon OnePlus Kiosk phase 2, Gurgaon Unit No: 312, 3rd Floor, Forum Sujana Mall, Hyderabad OnePlus Kiosk Kukatpally, Hyderabad - 500072 MGF Mall, Durgadas Colony, Ashok Nagar, Jaipur, Jaipur OnePlus Kiosk Rajasthan, 302001 South city mall, 375, Prince Anwar shah road, Kolkata Kolkata OnePlus Kiosk - 68 Wave mall, TC-54, Vibuthi khand, Gomti Nagar, Lucknow OnePlus Kiosk Lucknow Seawoods Mall, Seawoods Station Rd, Sector 40, Mumbai OnePlus Kiosk Nerul, Navi Mumbai, Maharashtra Mumbai OnePlus AS Prime Mall, Irla, vile parle, Mumbai Noida OnePlus Kiosk DLF Mall of India, sector 18, Noida Unit No. G-38, Lower Ground Floor, Phoenix Market Pune OnePlus Kiosk City, Pune All Stores City Store Name Store Address Ahmedabad Adinath Marketing 105,Upper Level,Shikhar Complex,Ahmedabad Croma,Basement-Himalaya Mall,Indraprasth Tower Ahmedabad Croma Drive in Road,Memnagar - 380052 Croma,Dev Arc Mall,Next to Fun Republic Junction of Ahmedabad Croma Sg Road & Satellite Road - 380053 Croma,Ratna Business Square,TP Scheme No.3 opp h Ahmedabad Croma k College,Ashram Road - 380009 Croma,Terminal-1,SHA,First Floor S.V.P.I.Airport - Ahmedabad Croma 380003 Croma The Emporio, Ground & 1st Floor, Opp. -

Burger King India

Burger King India VP Research: Sachin Bobade Associate: Nikhat Koor Tel: +91 22 40969731 Tel: +91 22 40969764 E-mail: [email protected] E-mail: [email protected] December 17, 2020 Index Sr. No. Particulars Page 1) Executive Summary 3 2) Company Overview 4 3) Investment Thesis 6 QSR industry offers multi-year growth potential 9 All ingredients in place for the growth in QSR industry 10 Multiple growth avenues 11 Opportunity to grow across India 12 Experienced and professional management team 13 Well defined restaurant roll-out and development process 13 4) Financial Analysis 15 5) Valuations 16 6) DCF Analysis 20 7) Industry Analysis 17 8) Risk to Valuation 18 9) Peer Comparison 19 10) Appendix 21 11) Financial Table 22 December 17, 2020 2 Burger King India Burger King India Buy King in the making…. CMP Rs 175 Burger King India, a globally recognized brand, is one of the fastest growing Target / Upside Rs 212 / 21% international QSR brands in India to reach 200+ restaurants within the first NIFTY 13,740 5 years of its operations. The company would to open at least 700 restaurants by CY26 implying 2.5x growth from current level. We believe Scrip Details that BKIL has a well-defined store expansion strategy which gives better Equity / FV Rs 3,817mn / Rs 10 revenue visibility in long term. Favorable demographics, change in Market Cap Rs 67bn customer preference, surge in online ordering are expected to boost prospects of QSR industry. Furthermore, strong customer value USD 908mn proposition, professional management team, pan India presence, efficient 52-week High/Low Rs 194/ 108 supply chain is likely to augur well for the company. -

Ids Working Paper

IDS WORKING PAPER Volume 2013 No 430 The Great Indian Calorie Debate: Explaining Rising Undernourishment during India’s Rapid E conomic Growth Lisa C. Smith August 2013 The Great Indian Calorie Debate: Explaining Rising Undernourishment during India’s Rapid Economic Growth Lisa C. Smith IDS Working Paper 430 First published by the Institute of Development Studies in August 2013 © Institute of Development Studies 2013 ISSN: 2040-0209 ISBN: 978-1-78118-129-4 A catalogue record for this publication is available from the British Library. All rights reserved. Reproduction, copy, transmission, or translation of any part of this publication may be made only under the following conditions: • with the prior permission of the publisher; or • with a licence from the Copyright Licensing Agency Ltd., 90 Tottenham Court Road, London W1P 9HE, UK, or from another national licensing agency; or • under the terms set out below. This publication is copyright, but may be reproduced by any method without fee for teaching or nonprofit purposes, but not for resale. Formal permission is required for all such uses, but normally will be granted immediately. For copying in any other circumstances, or for re-use in other publications, or for translation or adaptation, prior written permission must be obtained from the publisher and a fee may be payable. Available from: Central Communications, Institute of Development Studies, Brighton BN1 9RE, UK Tel: +44 (0) 1273 915637 Fax: +44 (0) 1273 621202 E-mail: [email protected] Web: www.ids.ac.uk/publications IDS is a charitable company limited by guarantee and registered in England (No.