201923 Eng Bocom H

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Interim Report Can Be Obtained: JIANG Chaoliang

主席報告 70375 (Bank of Communication) \ 11/08/2007 \ M05 1 交通銀行 Contents 1. Corporate Information 2 2. Financial Highlights 4 3. Reconciliation of Net Assets 6 and Net Profit from PRC GAAP to IFRS 4. Management Discussion 7 and Analysis 5. Details of Changes in Share 28 Capital and Shareholding of Substantial Shareholders 6. Directors, Supervisors, 33 Senior Management and Staff 7. Corporate Governance 35 8. Significant Events 37 9. List of Branches 42 10. Auditors’ Report 45 11. Unaudited Condensed 47 Consolidated Interim Financial Information 1. CORPORATE INFORMATION Legal name in Chinese: Selected Newspapers and Websites for Information Disclosure: 交通銀行股份有限公司 PRC: China Securities Journal, Shanghai Securities News Legal name in English: Hong Kong: South China Morning Post, Bank of Communications Co., Ltd. Hong Kong Economic Times Legal representative: Places where the Interim Report can be obtained: JIANG Chaoliang Headquarters and principal place of business of the Secretary of the Board: Bank ZHANG Jixiang Website designated by CSRC to publish the Interim Report: Authorized Representatives: http://www.sse.com.cn PENG Chun ZHANG Jixiang Website designated by The Stock Exchange of Hong Kong Limited to Office Address and Investor publish the Interim Report: Relations: http://www.hkex.com.hk No. 188 Yin Cheng Zhong Lu, Pudong New District, Shanghai, China Post code: 200120 Auditors for PRC GAAP Report: Telephone: 8621-58766688 Fax: 8621-58798398 Deloitte Touche Tohmatsu Certified Public E-mail: [email protected] Accountants Limited Company Website: www.bankcomm.com Auditors for IFRS Report: Place of Business in Hong Kong: PricewaterhouseCoopers 20 Pedder Street, Central, Hong Kong 2 Bank of Communications Co., Ltd. -

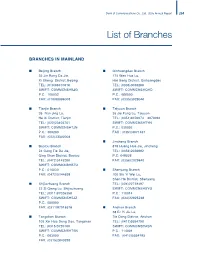

List of Branches

Bank of Communications Co., Ltd. 2005 Annual Report 204 List of Branches BRANCHES IN MAINLAND I Beijing Branch I Qinhuangdao Branch 33 Jin Rong Da Jie, 174 Wen Hua Lu, Xi Cheng District, Beijing Hai Gang District, Qinhuangdao TEL: (010)66101616 TEL: (0335)3038260 SWIFT: COMMCNSHBJG SWIFT: COMMCNSHQHD P.C.: 100032 P.C.: 066000 FAX: (010)88086008 FAX: (0335)3028046 I Tianjin Branch I Taiyuan Branch 35 Nan Jing Lu, 35 Jie Fang Lu, Taiyuan He Xi District, Tianjin TEL: (0351)4070074 4070094 TEL: (022)23403701 SWIFT: COMMCNSHTYN SWIFT: COMMCNSHTJN P.C.: 030002 P.C.: 300200 FAX : (0351)4071457 FAX: (022)23302004 I Jincheng Branch I Baotou Branch 878 Huang Hua Jie, Jincheng 24 Gang Tie Da Jie, TEL: (0356)2026882 Qing Shan District, Baotou P.C: 048026 TEL: (0472)5143280 FAX: (0356)2029840 SWIFT: COMMCNSHBTU P.C.: 014030 I Shenyang Branch FAX: (0472)5144698 100 Shi Yi Wei Lu, Shen He District, Shenyang I Shijiazhuang Branch TEL: (024)22719497 22 Zi Qiang Lu, Shijiazhuang SWIFT: COMMCNSHSYG TEL: (0311)87026358 P.C.: 110014 SWIFT: COMMCNSHSJZ FAX: (024)22825238 P.C.: 050000 FAX: (0311)87016376 I Anshan Branch 38 Er Yi Jiu Lu, I Tangshan Branch Tie Dong District, Anshan 103 Xin Hua Dong Dao, Tangshan TEL: (0412)5554790 TEL: (0315)3720100 SWIFT: COMMCNSHASN SWIFT: COMMCNSHTSN P.C.: 114001 P.C.: 063000 FAX: (0412)5554785 FAX: (0315)2849299 205 Bank of Communications Co., Ltd. 2005 Annual Report I Fushun Branch I Changchun Branch 2-1 Xi Yi Lu, 502 Tong Zhi Jie, Changchun Xin Fu District, Fushun TEL: (0431)8928485 TEL: (0413)2861877 SWIFT: COMMCNSHCCN -

The Confusing Identity of Pternopetalum Molle (Apiaceae)

Botanical Journal of the Linnean Society, 2008, 158, 274–295. With 15 figures The confusing identity of Pternopetalum molle (Apiaceae) LI-SONG WANG1,2* 1State Key Laboratory of Systematics and Evolutionary Botany, Institute of Botany, Chinese Academy of Sciences, Xiangshan, Beijing 100093, China 2Graduate School of Chinese Academy of Sciences, Beijing 100039, China Received 25 April 2006; accepted for publication 24 June 2008 The misapplication of the name Pternopetalum molle (Franch.) Hand.-Mazz. has resulted in considerable taxonomic confusion in the genus, involving 11 names belonging to seven taxa (according to a recent treatment). A supplementary taxonomic revision of P. botrychioides (Dunn) Hand.-Mazz., P. molle and P. vulgare (Dunn) Hand.-Mazz. is presented, after a detailed examination of the morphological variation. Four new synonyms, P. longicaule var. humile R.H.Shan & F.T.Pu, P. molle var. dissectum R.H.Shan & F.T.Pu, P. radiatum (W.W.Smith) P.K.Mukherjee and P. trifoliatum R.H.Shan & F.T.Pu, are proposed. Pternopetalum delicatulum (H.Wolff) Hand.- Mazz. should be reduced to P. botrychioides rather than P. radiatum. The previous taxonomic treatments of P. cuneifolium (H. Wolff) Hand.-Mazz., P. cartilagineum C.Y.Wu ex R.H.Shan & F.T.Pu and P. molle var. crenulatum R.H.Shan & F.T.Pu are reinstated. A key and distribution maps are provided for the accepted species. © 2008 The Linnean Society of London, Botanical Journal of the Linnean Society, 2008, 158, 274–295. ADDITIONAL KEYWORDS: East Asia – morphology – taxonomic revision – Umbelliferae. INTRODUCTION subfamily Apioideae (Pu, 1985; Pimenov & Leonov, 1993), two morphological characters, petals saccate at Pternopetalum Franch., one of the largest genera of the base and umbellules usually with only 2–3(–4) Apiaceae in Asia (Pimenov & Leonov, 2004), includes flowers (Shen et al., 1985; Pu, 2001; Pu & Phillippe, about 20–32 taxa which occur in South Korea, Japan, 2005), make it relatively easy to identify. -

El Sector De La Logística En China

Oficina Económica y Comercial de la Embajada de España en Shanghai El sector de la Logística en China 1 El sector de la Logística en China Este estudio ha sido realizado por Blanca Ohlsson bajo la supervisión de la Oficina Económica y 2 Comercial de la Embajada de España en Shanghai Septiembre de 2006 EL SECTOR DE LA LOGÍSTICA EN CHINA ÍNDICE RESUMEN Y PRINCIPALES CONCLUSIONES 7 ANÁLISIS DAFO PARA LAS EMPRESAS ESPAÑOLAS 9 I. CARACTERÍSTICAS DEL SECTOR 13 1. INTRODUCCIÓN 13 2. EL SECTOR LOGÍSTICO Y LA OMC 15 3. 11º PLAN QUINQUENAL 17 4. ESTRUCTURA DEL GOBIERNO COMPETENTE EN EL SECTOR 20 5. INFRAESTRUCTURAS 20 6. TENDENCIAS DEL SECTOR 21 II. DEMANDA DEL SECTOR 23 1.1. Comercio exterior chino 24 1.2. Comercio España-China 24 III. OFERTA DEL SECTOR 25 1. TRANSPORTE POR CARRETERA 25 1.1. Infraestructuras 26 1.2. Principales problemas en el sector 28 1.3. Conclusión 29 2. TRANSPORTE POR FERROCARRIL 30 2.1. Infraestructuras 30 2.2. Principales problemas del transporte por vía férrea 34 2.3. Planes Gubernamentales 37 2.4. Conclusión 38 3. TRANSPORTE MARÍTIMO 39 3.1. Puertos costeros más importantes de China 42 3.2. Nuevas áreas de actuación 48 3.3. Conclusión 49 4. TRANSPORTE FLUVIAL 49 Oficina Económica y Comercial de la Embajada de España en Shanghai 3 EL SECTOR DE LA LOGÍSTICA EN CHINA 4.1. Los tres grandes ríos chinos 51 4.2. Conclusión 54 5. TRANSPORTE AÉREO 55 5.1. Agentes del sector 57 5.2. Infraestructuras 58 5.3. Presencia extranjera 61 5.4. -

Official-Gazette-Vol.-89.Pdf

ສາທາລະນະລດັ ປະຊາທິປະໄຕ ປະຊາຊນົ ລາວ LAO PEOPLE’S DEMOCRATIC REPUBLIC ກະຊວງ ວທິ ະຍາສາດ ແລະ ເຕັກໂນໂລຊ ີ ກມົ ຊບັ ສນິ ທາງປນັ ຍາ MINISTRY OF SCIENCE AND TECHNOLOGY DEPARTMENT OF INTELLECTUAL PROPERTY ຈດົ ໝາຍເຫດທາງລດັ ຖະການ ກຽ່ ວກບັ ການເຜີຍແຜຜ່ ນົ ຂອງການຈດົ ທະບຽນ ຊບັ ສນິ ອດຸ ສາຫະກາ ຢ່ ສປປ ລາວ OFFICIAL GAZETTE OF INDUSTRIAL PROPERTY ສະບບັ ທີ (Vol.) 89 Official Gazette of Industrial Property Vol. 89, 20/03/2020 ສາລະບານ ພາກທີ I: ຜນົ ຂອງການຂໍຈດົ ທະບຽນເຄື່ ອ ງໝາຍການຄາ້ ພາກທີ II: ຜນົ ຂອງການຈດົ ທະບຽນເຄື່ ອ ງໝາຍການຄາ້ ພາກທີ III: ຜນົ ຂອງການຂໍຈດົ ທະບຽນເຄື່ ອ ງໝາຍການຄາ້ ສາກນົ ພາກທີ IV: ຜນົ ຂອງການຈດົ ທະບຽນເຄື່ ອ ງໝາຍການຄາ້ ສາກນົ ພາກທີ V: ຜນົ ຂອງການຕື່ ອາຍກຸ ານຈດົ ທະບຽນເຄື່ ອ ງໝາຍການຄາ້ CONTENT Part I: New Application of Trademark Part II: Registration of Trademark Part III: Madrid New Application of Trademark Part IV: Madrid Registration of Trademark Part V: Renewal of Trademark I Official Gazette of Industrial Property Vol. 89, 20/03/2020 ພາກທີ I ຜນົ ຂອງການຂໍຈດົ ທະບຽນເຄື່ ອ ງໝາຍການຄາ້ ຄາ ແນະນາ ກຽື່ ວກບັ ລະຫດັ ຫຍ ້ (540) ເຄື່ ອ ງໝາຍການຄາ້ (511) ໝວດຂອງສນິ ຄາ້ ແລະ ການບ ລິການ (210) ເລກທີຄາ ຮອ້ ງ (220) ວນັ ທີທື່ ີຍື່ ນ ຄາ ຮອ້ ງ (732) ຊື່ ແລະ ທື່ ີຢື່ ຂອງຜຍ້ ື່ ນຄາ ຮອ້ ງ Part I New Application of Trademark Introduction of Codes (540) Trademark (511) Classification of goods and services (Nice Classification) (210) Number of the application (220) Date of filing of the application (732) Name and Address of applicant II Official Gazette of Industrial Property Vol. 89, 20/03/2020 ພາກທີ II ຜນົ ຂອງການຈດົ ທະບຽນເຄື່ ອ ງໝາຍການຄາ້ ຄາ ແນະນາ ກຽື່ ວກບັ ລະຫດັ ຫຍ ້ (540) ເຄື່ -

Provider Directory for Mainland China 中国大陆医疗网络指南

Provider directory for Mainland China 中国大陆医疗网络指南 The Provider Directory is intended for reference only and subject to changes. For most updated facility information, please visit www.aetnainternational.com. 本医院目录仅供参考且可能发生变化,请登陆www.aetnainternational.com 以了解最新的医疗机构信息。 This Provider Directory is for Aetna International Members only. Any unauthorized circulation of this directory is prohibited. 本医院目录仅供Aetna International会员使用,禁止任何未经授权的转载与引用。 46.01.303.0-CH (9/14) 直接结算指南 在直接结算网络内就诊时,请遵守以下程序: 12. 不孕不育/计划生育 • 在接受医疗服务之前,请向医院/诊所出示您的会员卡及身份证 13. 产伤/先天性异常/遗传性畸形或疾病 明 14. 性传播疾病 • 会诊治疗结束后,请在治疗收据/索赔申请表上签字以示确认 1 5 . 精 神 病 治 疗 • 免赔额、共同保险以及任何理赔范围以外的项目须与医院/诊 16. 自残损伤,酒精/物质(毒品)依赖,睡眠窒息或其他睡眠异 所结算完毕后方可离开 常 • 如需急诊治疗,请立即前往医院或指定医疗机构就医。如急诊 17. 康复治疗 后需住院治疗,我们将在下一工作日为您启动直接结算。 18. 根据诊所所在城市和地区的具体情况,超过合理和惯常范围 • 然而,如果您在急诊后出院,那么您将预付所有产生的费用,并 的费用 向Aetna递交索赔表申请赔付 19. 提供医疗文件或完成要求表格所需费用 以下项目不能直接结算,会员需要在就医时支付。其中属 20. 救护车服务的使用(除非得到我们的事先同意)。遇到紧急 于保障利益范围的费用,会员可以向保险公司提交理赔 情况,请及时拨打会员卡后的紧急求助电话 申请,以获得补偿。如您需要了解所拥有的保障利益,请 21. 任何总费用超过500美元的检查或治疗需事前获得我们的同 致电会员卡背后的客户服务热线查询。 意。 1. 牙科治疗(除非在本公司指定的牙科诊所) 2. 生育/妊娠 3. 饮食补充剂,维他命,矿物质和营养素的费用 4. 接种疫苗,常规检查和旅行建议 5. 物理治疗必须由经治医生或专家推荐。如对任一疾病,需有 超过6次以上的物理治疗,您的注册治疗师必须在理赔申请 表上注明理由以便我们考虑承担保险责任。 6. 任何“替代疗法”,包括但不限于,脊椎指压疗法,整骨疗法, 顺势疗法与针灸疗法;及单独的传统中医中药治疗 7 . 电 话,传 真 或 复 印 费 用 8. 任何在登记日前已经存在的医学疾病,包括相关的,次要的 或有关联的疾病 9 . 超过持卡人保险卡到期日之后的任何治疗,该日期显示于保 险卡上 10. 慢性疾病,指目前已知医学手段无法根本治愈的病情,包括 但 不 限 于 高 血 压,糖 尿 病,高 胆 固 醇 血 症,血 脂 代 谢 异 常 等 11. 屈光不正/视力缺陷矫正手术 The Provider Directory is intended for reference only and subject to changes. For most updated facility information, please visit www.aetnainternational.com. 本医院目录仅供参考且可能发生变化,请登陆www.aetnainternational.com 以了解最新的医疗机构信息。 This Provider Directory is for Aetna International Members only. Any unauthorized circulation of this directory is prohibited. 本医院目录仅供Aetna International会员使用,禁止任何未经授权的转载与引用。 2 Guidelines to the direct settlement network When visiting the medical providers within the 9. -

List of Branches

List of Branches & Beijing Branch & Huhhot Branch 33JinRongDaJie,XiChengDistrict,Beijing 110 West Daxue Lu, Sai Han District, Huhhot TEL: (010) 66101616 TEL: (0471) 3396646 P.C.: 100032 P.C.: 010020 FAX: (010) 88086008 FAX: (0471) 3396580 & Tianjin Branch & Baotou Branch 35 Nanjing Lu, He Xi District, Tianjin 24 Gang Tie Da Jie, Qing Shan District, Baotou TEL: (022) 23403701 TEL: (0472) 5143280 P.C.: 300200 P.C.: 014030 FAX: (022) 23302004 FAX: (0472) 5144698 & Shijiazhuang Branch & Shenyang Branch 22 Zi Qiang Lu, Shijiazhuang 100 Shi Yi Wei Lu, Shen He District, Shenyang TEL: (0311) 87026358 TEL: (024) 22719497 P.C.: 050000 P.C.: 110014 FAX: (0311) 87016376 FAX: (024) 22825238 & Tangshan Branch & Anshan Branch 103 Xin Hua Dong Dao, Tangshan 38 Er Yi Jiu Lu, Tie Dong District, Anshan TEL: (0315) 3720100 TEL: (0412) 5554790 P.C.: 063000 P.C.: 114001 FAX: (0315) 2849299 FAX: (0412) 5554785 & Qinhuangdao Branch & Fushun Branch 174 Wen Hua Lu, Hai Gang District, Qinhuangdao 2–1XiYiLu,XinFuDistrict,Fushun TEL: (0335) 3038260 TEL: (0413) 2861800 P.C.: 066000 P.C.: 113008 FAX: (0335) 3028046 FAX: (0413) 2648493 & Taiyuan Branch & Dandong Branch BOCOM Tower, 35 Jie Fang Lu, Taiyuan 68JinShanDaJie,Dandong TEL: (0351) 4070074 4070094 TEL: (0415) 2125736 P.C.: 030002 P.C.: 118000 FAX: (0351) 4071457 FAX: (0415) 2131250 & Jincheng Branch & Jinzhou Branch 878 Huang Hua Jie, Jincheng 42 Yun Fei Jie, Er Duan, Jinzhou TEL: (0356) 2026882 TEL: (0416) 3124258 P.C: 048026 P.C.: 121000 FAX: (0356) 2029840 FAX: (0416) 3125832 205 2006 Annual Report List of -

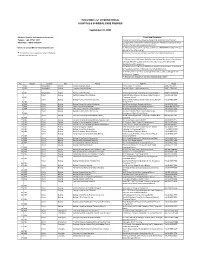

Hospital & Surgical Care Premier Provider List International

PROVIDER LIST INTERNATIONAL HOSPITAL & SURGICAL CARE PREMIER September 24, 2021 24 Hours Helpline International Assistance Terms and Conditions : Telepon : +60 3 7962 1814 1. Only for clients who are using Hospital & Surgical Care Premier Whatsapp : +60 16 686 6284 2. Suggest to contact International Assistance Medical Helpline to check the provider list before seeking treatment Email : [email protected] 3. All hospitals, however, accept cashless for INPATIENT. Kindly refer for details to the attached list ** for another country please contact Helpline 4. Letter of Guarantee will be issued by International Assistance International Assistance 5. Please contact 24 Hours Helpline International Assistance in advance (at least 5 working days) prior to overseas medical treatment for Guarantee Letter issuance. 6. Please contact 24 hours Helpline International Assistance in advance for hospital providers information for Worldwide plan. 7. All Hospitals is base on coverage area due to plan coverage in the 8. Return Of Deposit 9. This list can change at any time without prior notice No Region Country City Name Address Phone 1 ASIA Bangladesh Dhaka United Hospital Limited Plot 15, Road 71, Gulshan +880 2 883 6444 2 ASIA Bangladesh Dhaka Evercare Hospital Dhaka Plot #81, Block E, Bashundhara R/A +8801713064563 3 ASIA Bangladesh Dhaka Family Health Practice Campus of American International School, Roade 2 +88021713396770 China Beijing Raffles Medical Clinic (Beijing) Suite 105 Wing 1 Kunsha Building, No.16 Xinyuanli, +86 10 6462 9112 4 ASIA Chaoyang District China Beijing Beijing New Century Harmony Clinic Block 19 K-01 Harmony Walk, LiYuan Street, Tianzhu +86 10 6456 2599 5 ASIA Shunyi District 6 ASIA China Beijing Beijing Puhua International Hospital No.12 Tiantan Nanli, Dongcheng District +86 10 5715 9610 7 ASIA China Beijing Oasis International Hospital No. -

China CHINA-People Republic Of

China I.H.T. keep afloat the large state-owned enterprises, most of which had not participated CHINA-People Republic of in the vigorous expansion of the economy and many of which had been losing the ability to pay full wages and pensions. From 50 to 100 million surplus rural workers are adrift between the villages and the cities, many subsisting through part-time low-paying jobs. Popular resistance, changes in central policy, and loss of authority by rural cadres have weakened China's population control program, which is essential to maintaining growth in living standards. Another long-term threat to continued rapid economic growth is the deterioration in the environment, notably air pollution, soil erosion, and the steady fall of the water table especially in the north. China continues to lose arable land because of erosion and economic development. The next few years will witness increasing tensions between a highly centralized political system and an increasingly decentralized economic system. Industries: iron and steel, coal, machine building, armaments, textiles and apparel, petroleum, cement, chemical fertilizers, footwear, toys, food processing, automobiles, consumer electronics, telecommunications Currency: 1 yuan = 10 jiao Railways: total: 65,650 km (including 5,400 km of provincial "local" rails) standard gauge: 62,050 km 1.435-m gauge (12,150 km electrified; 20,250 km double track) narrow gauge: 3,600 km 0.750-m gauge local industrial lines (1998 est.) note: a new total of 68,000 km has been estimated for early 1999 Highways: -

Early Cultural Developments on the Eastern Rim of the Tibetan Plateau: Establishing a New Chronological Scheme for the Liangshan Region

Early Cultural Developments on the Eastern Rim of the Tibetan Plateau: Establishing a New Chronological Scheme for the Liangshan Region Anke hein abstract Research on the eastern rim of the Tibetan Plateau is generally hampered by the lack of established chronologies. The mountains of southwest China in particular are not very well explored. As a point of intersection of various culture-geographic regions and of long-distance exchange networks, the Liangshan region in southwest Sichuan deserves special attention. Unfortunately, this area is usually excluded from studies into the pre- history of southwest China, chiefly because the archaeological material is remarkably heterogeneous and the local prehistoric cultural sequence therefore has long remained obscure. Based on the results of excavations and survey work conducted during recent decades, this article represents a first attempt to suggest a chronological scheme for southwest China and neighboring parts of Yunnan from the earliest evidence of human occupation around 3000 b.c. to the onset of large-scale han influence arounda.d. 100. Additionally, the article reconstructs processes of early cultural developments and human occupation of the southeastern rim of the Tibetan Plateau that can serve as a point of departure for future research on the prehistory of western China. Keywords: Tibetan Plateau, prehistory, chronology, Sichuan, Yunnan, Liangshan, cultural history. introduction Knowledge of the prehistory of Southwest China has long been hampered by a lack of established chronologies and cultural sequences for many of its sub- regions. While relatively flat regions such as the Chengdu Basin in Sichuan and the area around Lake Dian in Yunnan are well researched (Flad and Chen 2013; Li 1998; Pirazzoli-t’Serstevens 1974; Psarras 2015; Sun 2000; Yao 2008), the mountains on the far eastern rim of the Tibetan Plateau are comparatively under-explored. -

Daftar Rumah Sakit Rekanan Sequis (Sequis Hospital Partners List) Hong Kong, Taiwan, Tiongkok (Hong Kong Taiwan, China)

Daftar Rumah Sakit Rekanan Sequis (Sequis Hospital Partners List) Hong Kong, Taiwan, Tiongkok (Hong Kong Taiwan, China) Hong Kong No. Kota Nama Rumah Sakit Alamat No. Telepon 1 Raffles Medical Group - Taikoo Place Suites 906-7, 9/F Lincoln House, Taiko Place, 979 King's Road +852 25251730 2 Sports Performance Limited 8/F Aon China Building, 29, Queen's Road +852 25216380 3 Matilda International Hospital 41 Mount Kellett Road, +852 28490111 4 OT&P The Bay practice 1/F Razor Hill Dairy Farm Shopping Centre, Clearwater Bay Road, Pik UK +852 27196366 5 Bayley & Jackson Dental Surgeons 210-216, 2/F Podium Level, Jardine House, 1, Connaught Place +852 25261061 6 Dr. Ma Shing Yan, Lawrence Suites 2403-05, 24/F, Hang Lung Center, 2-20 Pater, Causeway Bay +852 21042018 7 Hong Kong Health Practice Suite 1902, 19F, Hing Wai Building, 36, Queen's Road +852 23230268 8 Ken Lee Mongkok Medical Center Rm1825-27 Argyle Center Phase,1688 Nathan Road, Mongkok +852 27870222 9 Premier Medical Center Suite 718/733 Central Building, 1, Pedder Street +852 36511718 10 OT&P Central 1 503 Century Square, 1, D'Aguilar Street +852 25213181 11 OT&P Central 2 (Therapists) 5/F Century Square, 1, D'Aguilar Street +852 21211402 12 OT&P Central Specialist 20/F, Century Square, 1, D'Aguilar Street +852 25216830 13 Asia Medical Specialists 8/F China Building, 29, Queen's Road +852 25216830 14 Raffles Medical Group - HK International Airport Rm 6T-004 & 6T-009, Level 6, Terminal 1, International Airport +852 22612626 Hong Kong 15 Matilda Medical Centre Suite 502, Prosperity -

WPS Hotelguide WPS Hotelguide

WPS HotelGuide Last Update: 27 FEB 2017 WPS understands that in order to fulfill your goals with the commission collection process, it is also important to be supplied with a guide of hotels, clients of WPS, known to be regular and predictable commission payers. The hotel listing of this guide is organized in alphabetical order listed by Country and Town and is updated on a regular basis. This reduced version guide is a useful instrument and is a complement to the already existing and more detailed WPS Hotel Guide posted on the WPS Network. WPS HotelGuide 1 WPS HotelGuide 25HOUR 25HOUR AAE AAE TRAVEL PTE. LTD. ABBA ABBA HOTELES AC AC HOTELES ACA ACA ACR ACCOR ADDRSS EMAAR HOSPITALITY GROUP L.L.C // THE ADDADVAN ADVANCE HOTEL MANAGEMENT & DEV (EHC AER AEROWISATA INTERNATIONAL AFFILL AFFILIATE PARTNERS (PREFE) AHI AUSTRIA HOTELS INTERNATIONAL ALES ALESIA DISTRIBUTION ALEXAN ALEXANDRE HOTELS ALILA ALILA HOTELS ALMA ALMA HOTELS ALT ALTHOFF PRIVATHOTELS ALTIS ALTIS HOTELS AMALIA AMALIA HOTELS AMAN AMAN RESORTS AMCD AMADEUS LINKHOTEL AMERIA AMERIAN HOTELES AMRATH AMRATH HOTELS AMRES AMRESORTS SECRETS DREAMS & SUNSCAPAMT ACQUA MARCIA TURISMO SPA (AMT HOTELS) AMURA AMURA HOTELES ANANT ANANTARA RESORTS & SPAS ANDRO ANDRONIS EXCLUSIVE HOTELS ANGOLO ANGOLO HOTELS APH AFRICAN PRIDE HOTELS APOL APOLLO HOTELS & RESORTS ARANZ ARANZAZU HOTELES ARCAV ARC AVENUE HOTELS ARCOS LOS ARCOS WORLD CLASS BEACH RESORTARP ARP-HANSEN GROUP ARTH ARTHUR HOTELS ARVENA ARVENA HOTELS ASLA ASLA TRAVEL GROUP ASTOT ASTOTEL ATA ATAHOTELS ATE ATEL HOTELS AUBER AUBERGE RESORTS