Subject: Performance of Domestic Airlines for the Year 2015. Traffic

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Performance of Domestic Airlines for the Year 2016

Subject: Performance of domestic airlines for the year 2016. Traffic data submitted by various domestic airlines has been analysed for the month of September 2016. Following are the salient features: Passenger Growth Passengers carried by domestic airlines during Jan-Sept 2016 were 726.98 lakhs as against 590.21 lakhs during the corresponding period of previous year thereby registering a growth of 23.17 % (Ref Table 1). 800.00 726.98 Growth: YoY = + 23.17 % MoM = + 23.46% 700.00 8 % 590.21 600.00 500.00 400.00 2015 2016 300.00 200.00 Pax Lakhs) Carried(in Pax 82.30 100.00 66.66 0.00 YoY MoM Passenger Load Factor The passenger load factors of various scheduled domestic airlines in Sept 2016 are as follows (Ref Table 2): 100.0 93.2 93.5 89.4 90.0 86.0 83.3 82.8 82.1 82.1 81.7 79.9 79.0 78.9 77.7 77.7 77.5 75.6 80.0 73.72 72.7 70.8 69.2 65.57 70.0 64.48 60.0 50.0 40.0 30.0 Pax Pax FactorLoad (%) 20.0 10.0 0 0.0 0.0 Air Jet JetLite Spicejet Go Air IndiGo Air Air Asia Vistara Air Trujet Air India Airways Costa Pegasus Carnival Aug-16 Sep-16 1 The passenger load factor in the month of Sept 2016 has almost remained constant compared to previous month primarily due to the end of tourist season. Cancellations The overall cancellation rate of scheduled domestic airlines for the month of Sept 2016 has been 0.42 %. -

Ministry of Civil Aviation I GROWTH in the SECTOR • 998.88 Lakhs

Ministry of Civil Aviation I GROWTH IN THE SECTOR 998.88 lakhs passengers carried by domestic airlines during Jan- Dec 2016 as against 810.95 lakhs during the corresponding period of previous year ; a growth of 23.2% Highest growth rate in domestic market among major economies of the world at 23%; closest China (14%) Huge jump in no of Aircraft for scheduled ops: 395 operational as on 1.04.2014; orders for 674 new aircraft between 2014 & 2016 • Indigo - 400 • Go - 72 • Air India - 27 • Vistara - 20 • Spicejet- 155 II GROWTH IN THE SECTOR- AIRLINES Scheduled Air Operator’s permit to four operators since June 2014 – Air Vistara – Air Pegasus ( Regional) – Turbo Megha Airways ( Regional) – Air Carnival ( Regional) – Quick Jet Cargo Airline Ltd – Zoom Air Air India commenced operations to various international destinations in 2015-2016,: San Francisco, Vienna, Newark, Vienna Madrid etc. Further domestic flights were started from Bhatinda and Kanpur III AIRPORT DEVELOPMENT • AAI operationalized new terminals at Chandigarh, Tirupati and Khajuraho with an investment of Rs 1173 crores • Durgapur International Airport in West Bengal, with an investment of Rs. 750 crore operationalised on 18.5.2015 • New Integrated Terminal Building at Vadodra airport inaugurated on 22-10-2016 by Hon’ble Prime Minister • Foundation stone for development of airport at Mopa, Goa with an estimated cost of Rs. 3000 cr. laid by Hon’ble Prime Minister on 13.11.2016 • Foundation Stone laid for ugradation of Rajahmundry Airport by Hon’ble Chief Minister on 19.09.2016 • Tender for Navi Mumbai airport at an estimated cost of Rs. -

Handbook on Civil Aviation Statistics

HHAANNDDBBOOOOKK OONN CCIIVVIILL 2017-18 AAVVIIAATTIIOONN SSTTAATTIISSTTIICCSS a glimpse of aviation statistics….. DIRECTORATE GENERAL OF CIVIL AVIATION OVERVIEW Directorate General of Civil Aviation is the regulatory body governing the safety aspects of civil aviation in India. It is responsible for regulation of air transport services to/from/within India and for enforcement of civil air regulations, air safety and airworthiness standards. It also interfaces with all the regulatory functions of International Civil Aviation Organization. DGCA’s Vision Statement: “Endeavour to promote safe and efficient Air Transportation through regulation and proactive safety oversight system.” REGIONAL AND SUB-REGIONAL OFFICES OF DGCA. DGCA Head Quarters Western Region Northern Region Eastern Region Sothern Region Bengaluru Mumbai Delhi Kolkata Chennai RO RO RO RO RO Bhopal Lucknow Patna Hyderabad Kochi SRO SRO SRO SRO SRO Kanpur Bhubaneswar SRO SRO Patiala Guwahati SRO SRO RO: Regional office SRO: Sub-Regional office S DGCA has several directorates and divisions under its purview to carry out its functions. DIRECTORATE GENERAL OF CIVIL AVIATION AIR TRANSPORT LEGAL AFFAIRS STATE SAFETY PERSONNEL LICENSING PROGRAMME FLIGHT TRAINING AND INTERNATIONAL SPORTS COOPERATION INVESTIGATION AND AIRCRAFT CERTIFICATION PREVENTION CONTINUING SURVEILLANCE AND AIRWORTHINESS ENFORCEMENT INFORMATION AIRCRAFT OPERATIONS TECHNOLOGY AERODROMES AND ADMINISTRATION GROUND AIDS AIR NAVIGATION TRAINING SERVICES Sl. No. CONTENTS PAGE No. 1. PASSENGER TRAFFIC STATISTICS 1-5 2. CARGO TRAFFIC STATISTICS 6-7 3. AIRCRAFT STATISTICS 8-10 4. NSOP STATISTICS 11-12 5. OPERATING ECONOMICS STATISTICS 13-15 6. HUMAN RESOURCE STATISTICS 16-19 7. AIR SAFETY STATISTICS 20 8. OTHER AVIATION RELATED STATISTICS 21-24 PASSENGER TRAFFIC Air Passenger Traffic in India, both domestic and international witnessed a positive growth in the year 2017-18 compared to the previous year. -

Corporate Buddha

CORPORATE BUDDHA This case study is prepared by Team Think Tank Flight of the Phoenix The Indian Aviation Industry “Indian aviation market is the 9th largest in the world with size of US$ 16 Billion and has a potential to become the third largest by 2020 and largest by 2030.” Nobody would have predicted this in 1912, when the first air route between Delhi and Karachi was established. The first major development in the sector happened in 1953, when nationalization of Indian Airlines (IA) brought the domestic civil aviation sector under the purview of Indian Government. But government took the first major step in 1990, with its Open Sky policy and various other liberalization policies. In the year 2000, many private players started entering the Indian Aviation Industry, and it still is an attractive sector with great market potential and drivers, like: Foreign Direct Investments in domestic airlines Low Cost Carriers (LCC) Modern airports and a growing emphasis on No-Frills Airports (NFA) Cutting edge Information Technology (IT) interventions Despite all these initiatives most of the airlines operating in India are incurring losses. These losses are due to high operational cost, High cost of aviation turbine fuel, High service tax and other charges and Shortage of maintenance facilities. Present Scenario In the second quarter of 2015, domestic air passenger traffic surged by 19.2 per cent to 20.3 million from 17 million in the corresponding period a year ago. Total passenger carried in June 2015 increased at a rate of 13 per cent Y-o-Y to 8.8 million from 7.8 million in June 2014. -

Vayu Issue IV July Aug 2015

IV/ 2015 Aerospace & Defence Review Airline of the Preserving the (Aerial) Thunder Dragon Lifeline Airbus Innovation Paris Air Show 2015 Days 2015 St Petersburg Helicopters for India Maritime Show When you absolutely have to get there NOW Enemy aircraft in restricted airspace: ‘SCRAMBLE’ The EJ200 engine provides so much thrust that it can get the Typhoon from ‘brakes o ‘ to 40,000 feet in under 90 secs. When it matters most, the EJ200 delivers. The engine‘s advanced technology delivers pure power that can be relied on time and again. Want to make sure your next mission is a success? Choose the EJ200. The EJ200 and EUROJET: Making the di erence when it counts most Visit us at www.eurojet.de EJ_Ad_VAYU_215x280.indd 1 08/07/2015 15:34:46 IV/ 2015 IV/ 2015 Aerospace & Defence Review Airline of the “complete confidence” in the A400M Paris Air Show 2015 36 which was vigorously demonstrated in 75 Thunder Dragon flight at Le Bourget. Meanwhile, there are several new operators of the C295 medium transport aircraft and the A330 MRTT has also been selected by the Airline of the Preserving the (Aerial) Republic of Korea. Thunder Dragon Lifeline Airbus Innovation Paris Air Show 2015 Days 2015 St Petersburg Helicopters for India Maritime Show 58 A Huge Wish List Artist’s dramatic imaging of Drukair Airbus A319s in Bhutan (Painting by Priyanka Joshi) This Vayu on-the-spot report of the 51st Paris Air Show highlights the key events at Le Bourget in mid- EDITORIAL PANEL June, even though the ‘fizz’ seemed to have gone, with non-participation MANAGING EDITOR of some major firms and a subdued Vikramjit Singh Chopra air display. -

Subject: Performance of Domestic Airlines for the Year 2015. Traffic

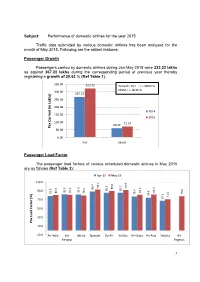

Subject: Performance of domestic airlines for the year 2015. Traffic data submitted by various domestic airlines has been analysed for the month of May 2015. Following are the salient features: Passenger Growth Passengers carried by domestic airlines during Jan-May 2015 were 322.32 lakhs as against 267.22 lakhs during the corresponding period of previous year thereby registering a growth of 20.62 % (Ref Table 1). 350.00 322.32 Growth: YoY = + 20.62 % MoM = + 18.35 % 300.00 ) 267.22 s h k 250.00 a L n i 200.00 ( d 2014 e i r 150.00 r 2015 a C 100.00 x 71.27 a 60.22 P 50.00 0.00 YoY MoM Passenger Load Factor The passenger load factors of various scheduled domestic airlines in May 2015 are as follows (Ref Table 2): Apr-15 May-15 110.0 1 9 . 4 7 3 . 1 7 5 9 9 . 8 9 0 9 4 2 1 8 5 5 4 . 8 . 4 . 5 0 . 8 8 2 1 9 . 1 . 1 1 0 . 4 9 8 8 90.0 8 8 8 8 . 8 8 6 1 7 7 7 4 . 7 ) 3 7 1 . 7 7 % ( 6 r 70.0 o t c a F 50.0 d a o L 30.0 x a P 10.0 -10.0 Air India Jet JetLite Spicejet Go Air IndiGo Air Costa Air Asia Vistara Air Airways Pegasus 1 The passenger load factor in the month of May 2015 has shown increasing trend compared to previous month primarily due to the onset of tourist season. -

Performance of Domestic Airlines for the Year 2015. Traffic Data

Subject: Performance of domestic airlines for the year 2015. Traffic data submitted by various domestic airlines has been analysed for the month of December 2015. Following are the salient features: Passenger Growth Passengers carried by domestic airlines during Jan-Dec 2015 were 810.91 lakhs as against 673.83 lakhs during the corresponding period of previous year thereby registering a growth of 20.34% (Ref Table 1). 900.00 810.91 Growth: YoY = + 20.34 % 800.00 MoM = + 19.71% 673.83 700.00 600.00 500.00 2014 400.00 2015 300.00 Pax Carried (inLakhs) Pax 200.00 77.09 100.00 64.40 0.00 YoY MoM Passenger Load Factor The passenger load factors of various scheduled domestic airlines in Dec 2015 are as follows (Ref Table 2): Dec-15 Nov-15 92.1 100.0 90.7 88.5 87.1 86.7 86.5 83.9 83.8 83.5 83.0 83.0 82.7 82.7 82.2 81.7 80.6 79.7 79.2 78.1 78.0 77.6 80.0 72.2 60.0 40.0 Pax Load (%) Factor Load Pax 20.0 0.0 Air India Jet JetLite Spicejet Go Air IndiGo Air Costa Air Asia Vistara Air Trujet Airways Pegasus 1 The passenger load factor in the month of December 2015 has increased compared to previous month primarily due to the ongoing tourist season. Cancellations The overall cancellation rate of scheduled domestic airlines for the month of December 2015 has been 2.49%. Airline-wise details of cancellations are as follows: Air Pegasus 19.33 Air Costa 14.59 Jet Airways 4.14 Air India (Dom) 2.39 IndiGo 2.01 Go Air 1.52 Trujet 1.26 JetLite 0.88 Air Asia 0.49 Vistara 0.43 Spicejet 0.34 0.00 5.00 10.00 15.00 20.00 25.00 Cancellation Rate (%) Various reasons of cancellations are indicated below: Conse/Misc Commercial 1.1% 10.5% Technical 6.2% Operational 6.3% Weather 75.9% 2 Passenger Complaints during the month During December 2015, a total of 1091 passenger related complaints had been received by the scheduled domestic airlines. -

May 14, 2019 I Research Airline Industry

May 14, 2019 I Research Airline Industry- Developments Jet Airways is yet another addition to over half a dozen airlines in the industry globally, which either ceased operations or merged with other Contact: airlines in 2018 & 2019. This includes prominent names like WOW, Madan Sabnavis Germania, Primera, Cobalt, Flybmi, Virgin America etc. Chief Economist Despite the impressive traffic growth and high capacity utilization, [email protected] +91-22- 6837 4433 financial performance of Indian Airline companies has remained under pressure due to increased crude prices and currency Author: volatility in FY18 and FY19. 2 out of the three listed domestic Ashish K Nainan airlines have reported operating and net losses during 9M FY19 Research Analyst and the third reported operating profit but net losses during the [email protected] +91-22-6837 4347 same period. In order to capture market share, domestic airlines slashed fares on major routes. The fares were 1/3rd the fares charged by airlines Mradul Mishra (Media Contact) [email protected] in developed markets like The US and Europe on comparable +91-22-6837 4424 routes. Graph 1 Traffic Growth (Annual) & Average Crude Prices (Monthly) 80.00 23.2% 0.25 20.3% 18.6% 70.00 0.2 17.3% 60.00 0.15 50.00 0.1 40.00 5.0% 0.05 30.00 20.00 0 Jan-15 Jan-16 Jan-17 Jan-18 Jan-19 Disclaimer: This report is prepared by CARE Ratings Ltd. CARE Ratings has taken utmost care to ensure accuracy and objectivity while developing this report based on Crude Oil (Brent $/bbl) Passenger Traffic Growth information available in public domain. -

SP's Airbuz October-November 2012

EMBRAER E-JETS: HELICOPTERS CONFERENCE THE FIRST FOR LAW REPORT: FDI IN PICK ENFORCEMENT AVIATION P 17 P 28 P 33 OCTOBER-NOVEMBER 2012 `100.00 (INDIA-BASED BUYER ONLY) WWW.SPSAIRBUZ.NET ANAIRBUZ EXCLUSIVE MAGAZINE ON CIVIL AVIATION FROM INDIA DREAMLINER COMES TO INDIA ATR: MODERN REGIONAL TURBOPROPS ❚ POOR AIR TRANSPOrtatION ❚ INFRASTRUCTURE IN ARUNACHAL AN SP GUIDE PUBLICATION REGIONAL AVIatION: ❚ RNI NUMBER: DELENG/2008/24198 A StratEGIC PERSPECTIVE get moreconnectivity The Q400 NextGen gives SpiceJet the lower operating costs and superior performance they need to expand their connectivity. SpiceJet has proven that it is possible for an airline to grow their business in today’s economy. Their fleet of Bombardier Q400 NextGen aircraft has given SpiceJet, India’s most preferred low cost airline, the ability to add new destinations and more passengers. The Q400 NextGen aircraft is one of the most technologically advanced regional aircraft in the world. It has an enhanced cabin, low operating costs, low fuel burn and low emissions – providing an ideal balance of passenger comfort and operating economics, with a reduced environmental scorecard. Welcome to the Q economy. www.q400.com Bombardier, NextGen and Q400 are Trademarks of Bombardier Inc. or its subsidiaries. ©2012 Bombardier Inc. All rights reserved. Q400_SpiceJet_SPAirbuz-October issue.indd 1 9/21/12 1:45 PM TABLE OF CONTENTS EMBRAER E-JETS: HELICOPTERS CONFERENCE THE FIRST FOR LAW REPORT: FDI IN PICK ENFORCEMENT AVIATION Cover: P 17 P 28 P 33 OCTOBER-NOVEMBER 2012 `100.00 (INDIA-BASED -

Subject : Performance of Domestic Airlines for the Year 2015

Subject : Performance of domestic airlines for the year 2015. Traffic data submitted by various domestic airlines has been analysed for the month of September 2015. Following are the salient features: Passenger Growth Passengers carried by domestic airlines during Jan-Sep 2015 were 590.21 lakhs as against 491.44 lakhs during the corresponding period of previous year thereby registering a growth of 20.10% (Ref Table 1) . 700.00 Growth: YoY = + 20.10 % 590.21 MoM = + 14.56 % 600.00 491.44 500.00 400.00 2014 300.00 2015 200.00 Pax Carried(in Lakhs) Pax 100.00 58.19 66.66 0.00 YoY MoM Passenger Load Factor The passenger load factors of various scheduled domestic airlines in Sep 2015 are as follows (Ref Table 2): #REF! Aug-15 100.0 93.0 92.1 83.7 80.8 79.8 79.4 79.3 79.0 78.9 78.7 77.9 77.3 77.1 76.9 76.8 75.6 74.9 80.0 73.2 72.1 67.7 62.9 62.4 60.0 40.0 Pax Load Factor (%) Factor Load Pax 20.0 0.0 Air India Jet JetLite Spicejet Go Air IndiGo Air Costa Air Asia Vistara Air Trujet Airways Pegasus 1 The passenger load factor in the month of September 2015 has shown declining trend compared to previous month primarily due to the end of tourist season. Cancellations The overall cancellation rate of scheduled domestic airlines for the month of September 2015 has been 0.6%.Airline-wise details of cancellations are as follows: Air Pegasus 20.50 Trujet 3.95 Air India (Dom) 2.09 Air Costa 1.53 JetLite 0.58 Air Asia 0.29 Jet Airways 0.28 Spicejet 0.09 Go Air 0.05 IndiGo 0.01 Vistara 0.00 0.00 5.00 10.00 15.00 20.00 25.00 Cancellation Rate (%) Various reasons of cancellations are indicated below: Technical 18.0% Conse/Misc 37.5% Operational 30.2% Commercial 3.7% Weather 10.7% 2 Passenger Complaints during the month During September 2015, a total of 710 passenger related complaints had been received by the scheduled domestic airlines. -

Monthly Newsletter August, 2012

ASSOCIATION OF PRIVATE AIRPORT OPERATORS Monthly Newsletter August, 2012 Members: CONTENTS 1. Aviation Sector ............................................................................................. 3 2. Airports AAI Managed Airports………………………………………………………………………………16 APAO Member Airports 2.1 Bangalore International Airport Limited……………………………………………..16 2.2 Delhi International Airport Limited……………………………………………………..17 2.3 GMR Hyderabad International Airport Limited……………………………………18 2.4 Mumbai International Airport Limited………………………………………………..19 3. Airlines………………………………………………………………………………………………………20 3.1 Air India………………………………………………………………………………………………20 3.2 Kingfisher Airlines……………………………………………………………………………….23 3.3 SpiceJet………………………………………………………………………………………………23 3.4 Jet Airways…………………………………………………………………………………………24 3.5 IndiGo………………………………………………………………………………………………..25 3.6 GoAir………………………………………………………………………………………………….25 3.7 International Airlines………………………………………………………………………….26 4. Cargo ……………..………………………………………………………………………………………..27 5. AERA Appellate Tribunal Renotified………………………………………………………..28 6. Traffic…….…………………………………………………………………………………………………29 7. Source………………………………………………………………………………………………………32 Page 1 of 32 ABBREVIATIONS AAI Airports Authority of India ADF Airport Development Fee AERA Airports Economic Regulatory Authority of India AERAAT Airports Economic Regulatory Authority Appellate Tribunal ATF Aviation Turbine Fuel BCAS Bureau of Civil Aviation Security BIAL Bangalore International Airport Limited BPCL Bharat Petroleum Corporation Limited CAG Comptroller -

WEEKLY MEDIA UPDATE 16 January, 2017 Monday

Issue 276 WEEKLY MEDIA UPDATE 16 January, 2017 Monday (This document comprises news clips from various media in which Balmer Lawrie is mentioned, news related to GOI and PSEs, and news from the verticals that we do business in. This will be uploaded on intranet and website every Monday.) India will remain one of the fastest IIP clocks 13-mth high growth of growing major economies in 2017: ICRA 5.7% in Nov despite note ban Moody's Investors Service and its Indian affiliate Industrial production grew at a 13-month high ICRABSE -1.16 % said India will remain one of the of 5.7 per cent in November notwithstanding fastest growing major economies globally in 2017, the demonetisation that was implemented, although GDP growth will moderate in the first half while retail inflation remained subdued at of the year, as the economy adjusts after multi-year low of 3.41 per cent in December, demonetisation. India is rated Baa3 positive by government data showed today. The industrial Moody's. Moody's also believes that the output during November, when the government will likely achieve its fiscal deficit government announced demonetisation of target of 3.5% of GDP for the current fiscal year high value currency notes of Rs 500 and Rs ending 31 March 2017, the international rating 1000 effective from 9th of the month, showed agency said in a statement on Monday. ICRA overall improvement in manufacturing, mining expects the country's growth of gross value added and electricity sectors, according to the figures at basic prices to remain healthy in 2017, although released by the Central Statistics Office (CSO).