Reported Daily Short Positions for 9/01/12

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

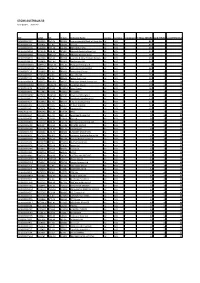

Code Security Description AAD ARDENT LEISURE GROUP ABC ADELAIDE BRIGHTON AGL AGL ENERGY LTD AHG AUTOMOTIVE HOLDINGS G AMP AMP LI

15-Jun-16 Australian Dividend Index Trust NTA & Allotment Notice The manager of the Australian Dividend Index Trust advises that as at close of business on 14 June 2016 a total of Nil units has been redeemed or allotted since 13 June 2016. The total number of units on issue on that day was 39,290,493. The asset backing for each ASD unit at close of business (Sydney) on 14 June 2016 was $1.49373 (NTA is net of applicable tax liability). The tracking difference was 2.35% Please note Basket applications and redemptions will be unavailable from Wednesday 15 June to Wednesday 29 June. Basket applications and redemptions will resume on Thursday 30 June. The following companies are currently in the Fund: Code Security description AAD ARDENT LEISURE GROUP ABC ADELAIDE BRIGHTON AGL AGL ENERGY LTD AHG AUTOMOTIVE HOLDINGS G AMP AMP LIMITED ANZ AUSTRALIA AND NEW ZEA APA APA GROUP AST AUSNET SERVICES ASX ASX LIMITED BEN BENDIGO AND ADELAIDE BOQ BANK OF QUEENSLAND CBA COMMONWEALTH BANK OF CGF CHALLENGER LIMITED CIM CIMIC GROUP LIMITED O CSR CSR LIMITED DOW DOWNER EDI LIMITED DUE DUET GROUP FLT FLIGHT CENTRE TRAVEL FXJ FAIRFAX MEDIA LTD FXL FLEXIGROUP LIMITED GEM G8 EDUCATION ORD GMA GENWORTH MORTGAGE INS HVN HARVEY NORMAN HOLDING IAG INSURANCE AUSTRALIA G IFL IOOF HOLDINGS LTD JBH JB HI-FI LIMITED LLC LENDLEASE CORPORATION MMS MCMILLAN SHAKESPEARE MQG MACQUARIE GROUP LTD NAB NATIONAL AUSTRALIA BA NVT NAVITAS LIMITED ORI ORICA LIMITED PPT PERPETUAL TRUSTEES AU PTM PLATINUM ASSET MANAGE RFG RETAIL FOOD GROUP RIO RIO TINTO LIMITED SHL SONIC HEALTHCARE LTD SKI SPARK INFRASTRUCTURE SPK SPARK NEW ZEALAND LIM SPO SPOTLESS GROUP HOLDIN SUL SUPER RETAIL GROUP LI SUN SUNCORP GROUP LTD SVW SEVEN GROUP HOLDINGS SYD SYDNEY AIRPORT UNITS TCL TRANSURBAN GROUP (ORD TLS TELSTRA CORPORATION L WBC WESTPAC BANKING CORP WES WESFARMERS LIMITED WOW WOOLWORTHS LIMITED WPL WOODSIDE PETROLEUM LT For further information please contact: Smartshares Limited 0800 80 87 80 [email protected]. -

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021 ASX listed securities ASX Code Security Name LVR ASX Code Security Name LVR A2M The a2 Milk Company Limited 50% CIN Carlton Investments Limited 60% ABC Adelaide Brighton Limited 60% CIP Centuria Industrial REIT 50% ABP Abacus Property Group 60% CKF Collins Foods Limited 50% ADI APN Industria REIT 40% CL1 Class Limited 45% AEF Australian Ethical Investment Limited 40% CLW Charter Hall Long Wale Reit 60% AFG Australian Finance Group Limited 40% CMW Cromwell Group 60% AFI Australian Foundation Investment Co. Ltd 75% CNI Centuria Capital Group 50% AGG AngloGold Ashanti Limited 50% CNU Chorus Limited 60% AGL AGL Energy Limited 75% COF Centuria Office REIT 50% AIA Auckland International Airport Limited 60% COH Cochlear Limited 65% ALD Ampol Limited 70% COL Coles Group Limited 75% ALI Argo Global Listed Infrastructure Limited 60% CPU Computershare Limited 70% ALL Aristocrat Leisure Limited 60% CQE Charter Hall Education Trust 50% ALQ Als Limited 65% CQR Charter Hall Retail Reit 60% ALU Altium Limited 50% CSL CSL Limited 75% ALX Atlas Arteria 60% CSR CSR Limited 60% AMC Amcor Limited 75% CTD Corporate Travel Management Limited ** 40% AMH Amcil Limited 50% CUV Clinuvel Pharmaceuticals Limited 40% AMI Aurelia Metals Limited 35% CWN Crown Limited 60% AMP AMP Limited 60% CWNHB Crown Resorts Ltd Subordinated Notes II 60% AMPPA AMP Limited Cap Note Deferred Settlement 60% CWP Cedar Woods Properties Limited 45% AMPPB AMP Limited Capital Notes 2 60% CWY Cleanaway Waste -

Some Common Service Providers Listing New Westpac Account

Some Common Service Providers Listing Here is a list of some common companies where you may have payments coming from or going to your old bank account. Westpac has prepared this listing of contact details based on information from third party websites, on 8 October 2010. If you have completed a Switch form, Westpac will pass on your new account details to the companies concerned. However, to ensure all your regular payments are redirected to your new Westpac account, please contact the companies you have arrangements with to let them know of your new Westpac account details or linked Westpac Debit MasterCard® card details. This will ensure all your regular payments are re-directed to your new Westpac account. New Westpac account: BSB – . Account number. Health Insurance Other Financial Institutions HBA 131 243 www.hba.com.au American Express www.americanexpress.com.au/ 1300 732 235 australia/ HBF 133 423 www.hbf.com.au ANZ 13 13 14 www.anz.com.au HCF 13 13 34 www.hcf.com.au Bank of Queensland www.boq.com.au MBF 131 137 www.mbf.com.au 1300 55 72 72 Medibank Private 132 331 www.medibank.com.au BankSA 13 13 76 www.banksa.com.au NIB 13 14 63 www.nib.com.au Bankwest 13 17 18 www.bankwest.com.au Commonwealth Bank www.commbank.com.au General & Car Insurance 13 2221 AAMI 13 22 44 www.aami.com.au NAB 13 22 65 www.nab.com.au Allianz 132 664 www.allianz.com.au St.George Bank 13 33 30 www.stgeorge.com.au Personal Banking CGU 13 15 32 www.cgu.com.au Citibank 13 24 84 www.citibank.com.au GIO 13 10 10 www.gio.com.au ING Direct 133 464 www.ingdirect.com.au -

Stoxx® Pacific Total Market Index

STOXX® PACIFIC TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) CSL Ltd. Health Care AU 7.79 Commonwealth Bank of Australia Banks AU 7.24 BHP GROUP LTD. Basic Resources AU 6.14 Westpac Banking Corp. Banks AU 3.91 National Australia Bank Ltd. Banks AU 3.28 Australia & New Zealand Bankin Banks AU 3.17 Wesfarmers Ltd. Retail AU 2.91 WOOLWORTHS GROUP Retail AU 2.75 Macquarie Group Ltd. Financial Services AU 2.57 Transurban Group Industrial Goods & Services AU 2.47 Telstra Corp. Ltd. Telecommunications AU 2.26 Rio Tinto Ltd. Basic Resources AU 2.13 Goodman Group Real Estate AU 1.51 Fortescue Metals Group Ltd. Basic Resources AU 1.39 Newcrest Mining Ltd. Basic Resources AU 1.37 Woodside Petroleum Ltd. Oil & Gas AU 1.23 Coles Group Retail AU 1.19 Aristocrat Leisure Ltd. Travel & Leisure AU 1.02 Brambles Ltd. Industrial Goods & Services AU 1.01 ASX Ltd. Financial Services AU 0.99 FISHER & PAYKEL HLTHCR. Health Care NZ 0.92 AMCOR Industrial Goods & Services AU 0.91 A2 MILK Food & Beverage NZ 0.84 Insurance Australia Group Ltd. Insurance AU 0.82 Sonic Healthcare Ltd. Health Care AU 0.82 SYDNEY AIRPORT Industrial Goods & Services AU 0.81 AFTERPAY Financial Services AU 0.78 SUNCORP GROUP LTD. Insurance AU 0.71 QBE Insurance Group Ltd. Insurance AU 0.70 SCENTRE GROUP Real Estate AU 0.69 AUSTRALIAN PIPELINE Oil & Gas AU 0.68 Cochlear Ltd. Health Care AU 0.67 AGL Energy Ltd. Utilities AU 0.66 DEXUS Real Estate AU 0.66 Origin Energy Ltd. -

2020-Annual-Report.Pdf

19|20 ANNUAL REPORT Contents Purpose Growing regional Australia by delivering bulk FY2020 in Review .................................................. 1 commodities to the world. Chairman’s Report ................................................ 2 Managing Director & CEO’s Report .............. 3 Vision The first choice for bulk commodity transport Directors’ Report ...................................................4 solutions. – Operating and Financial Review .................11 – Remuneration Report ....................................25 Values Auditors’ Independence Declaration ........ 39 Safety: We have a relentless focus towards ZEROHarm. Corporate Governance Statement .............40 People: We seek diverse perspectives. Financial Report .................................................. 46 Integrity: We have the courage to do Shareholder Information ................................110 the right thing. Glossary .................................................................. 112 Customer: We strive to be the first choice Corporate Information ....................................114 for customers. Excellence: We set and achieve ambitious goals. FY2020 in Review Result Highlights (Underlying and statutory continuing operations) ($M) FY2020 FY2019 VARIANCE Total revenue 3,064.6 2,907.6 5% EBITDA 1,467.6 1,371.6 7% EBIT 909.0 829.0 10% EBIT Statutory 1,014.4 829.0 22% NPAT 531.4 473.3 12% NPAT Statutory 605.1 473.3 28% Free cash flow (FCF) 714.7 734.4 (3%) Final dividend (cps) 13.7 12.4 10% Total dividend (cps) 27.4 23.8 15% Earnings -

Gas HUB Participant ID Table

HUB ID Table Registered Participant Retail Market Participant Type HUB ID AEMO Company ID 1st Energy Pty Ltd VICGAS Retailer FIRSTNGY 298 ACTEWAGL Distribution NSWACTGAS Network Operator ACTEWNWO 161 ACTEWAGL Retail NSWACTGAS Retailer ACTEWUSR 140 ADCHEM (Australia) Pty Ltd SAGAS Self Contracting User ADCHEM 312 AEMO MIBB interface for CSV and aseXML NSWACTGAS Market Operator AEMOMIBB N/A AGL Energy Sales and Marketing Limited NSWACTGAS Retailer AGLUSR 45 AGL Sales (Queensland) Pty Limited QLDGAS Retailer AGLQLD 42 AGL Sales Pty Limited SAGAS Retailer AGL 4 AGL Sales Pty Limited QLDGAS, VICGAS Retailer PULSE 4 AGL Sales Pty Limited WA Retailer PULSE WA Participant AGL Sales Pty Limited QLDGAS, VICGAS Retailer AUSPWRGAS - Deregistered 80 Agora Retail WA Retailer AGR WA Participant Agora Retail Pty Ltd VICGAS Retailer AGORA 270 Alinta Energy Retail Sales Pty Ltd QLDGAS, SAGAS, VICGAS Retailer ALNTARES 192 Alinta Energy Retail Sales Pty Ltd NSWACTGAS Retailer ALINTAUSR 192 Alinta Sales Pty Ltd WA Retailer ALS WA Participant Allgas Energy Pty Ltd QLDGAS Distributor APTALLGAS 82 Amanda Energy Pty Ltd WA Retailer AMDENGY WA Participant APA Gasnet Australia (Operations) P/L VICGAS Pipeline Operator GASNET 14 APR Parmelia WA Pipeline Operator CMSR WA Participant Aurora Energy Pty Ltd VICGAS Retailer AURORA - Deregistered 159 Ausnet Services Pty Ltd VICGAS Distributor TXUN 11 Australian Energy Market Operator NSWACTGAS Market Operator NAGMO N/A Australian Energy Market Operator SAGAS Market Operator REMCo N/A Australian Energy Market Operator -

ASX & Media Release

AGL Energy Limited Locked Bag 1837 Level 24, 200 George St T: +61 2 9921 2999 ABN: 74 115 061 375 St Leonards NSW 2065 Sydney NSW 2000 F: +61 2 9921 2552 Australia Australia www.agl.com.au ASX & Media Release AGL 2017 Annual Report 25 August 2017 AGL Energy Limited (AGL) has today commenced dispatch of its 2017 Annual Report. A copy is attached. AGL also issued its 2017 AGL Sustainability Report today. Online versions of the Annual Report and Sustainability Report are available at www.agl.com.au/2017ReportingSuite. Investor enquiries Media enquiries James Hall Chris Kotsaris Kathryn Lamond General Manager, Capital Markets Senior Manager, Investor Relations Senior Manager, Media T: +61 2 9921 2789 T: +61 2 9921 2256 T: +61 2 9921 2170 M: +61 401 524 645 M: +61 402 060 508 M: +61 424 465 464 E: [email protected] E: [email protected] E: [email protected] About AGL AGL is committed to helping shape a sustainable energy future for Australia. We operate the country’s largest electricity generation portfolio, we’re its largest ASX-listed investor in renewable energy, and we have more than 3.6 million customer accounts. Proudly Australian, with more than 180 years of experience, we have a responsibility to provide sustainable, secure and affordable energy for our customers. Our aim is to prosper in a carbon-constrained world and build customer advocacy as our industry transforms. That’s why we have committed to exiting our coal-fired generation by 2050 and why we will continue to develop innovative solutions for our customers. -

ANALYSIS of CA100+ COMPANY DATA for CDP Investor Signatories CONTENTS FOREWORD

DISCLOSURE INSIGHT ACTION ANALYSIS OF CA100+ COMPANY DATA for CDP Investor Signatories CONTENTS FOREWORD 03 FOREWORD BY GLOBAL DIRECTOR, CAPITAL MARKETS, CDP Emily S. Kreps 04 INTRODUCTION GLOBAL DIRECTOR, CAPITAL MARKETS, CDP 06 KEY FINDINGS Climate change has pushed the world to the brink. With precious forests burning, 08 DISCLOSURE hurricanes destroying communities, and floods and droughts wreaking havoc and pushing entire nations into famine, war and mass migration, the destructive power 10-14 GOVERNANCE AND STRATEGY of climate change cannot be ignored. Board-level oversight The global economy has ten years to halve emissions if we are to avoid the worst possible impacts of climate change. We must act with the greatest urgency. Risks and opportunities Reliable and easily applied information is the basis for effective environmental action. Integrating environmental issues into strategy Three years ago, investors around the world gathered under the Climate Action 100+ 16 METRICS AND TARGETS initiative to push the world’s largest corporate greenhouse gas emitters to decarbonize rapidly. Data collected through CDP’s global disclosure platform helped the initiative 22 CONCLUSION select the 100 companies targeted in the initial campaign. About 40 of them are Investors have the “systemically important emitters” that together account for two-thirds of annual 24 DATASET SAMPLE power to drive forward global industrial emissions, while the remainder have been identified as potential drivers of the clean-energy transition. 34 CONTACT greater accountability Without transparency, there can be no accountability; and without accountability, and transparency from any sustainability effort risks falling short. top emitters. In this report, we have provided analysis and samples of the full set of environmental data available to CDP through company-level disclosure on climate change, deforestation and water security of the 160 companies targeted by the CA100+ initiative. -

Bruce Robertson, Energy Finance Analyst, Gas/LNG September 2020

Bruce Robertson, Energy Finance Analyst, Gas/LNG September 2020 Review of Project Rationale of AGA/APA Gas Import Jetty and Pipeline Project at Crib Point, Victoria Prepared by: Bruce Robertson, Energy Finance Analyst, Gas/LNG Bruce Robertson 24 Pacific Parade, Manly NSW 2095 AGL’s Crib Point Project 2 Expert Witness Report of Bruce Robertson About IEEFA The Institute for Energy Economics and Financial Analysis conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. www.ieefa.org About the Author Bruce Robertson Energy Finance Analyst– Gas/LNG Bruce Robertson has been an investment analyst, fund manager and professional investor for over 35 years. He has worked for major domestic and international institutions, including Perpetual Trustees, UBS, Nippon Life Insurance and BT. Bruce is an active participant in the national debate on energy issues in Australia and has been invited to present to numerous government enquiries into the electricity and gas industries. Instructions The instructions that define the scope of this statement are set out at Attachment 1 (Letter of Brief dated 11 August 2020). Declaration I have made all the inquiries that I believe are desirable and appropriate and no matters of significance which I regard as relevant have to my knowledge been withheld from the Panel. AGL’s Crib Point Project 3 Expert Witness Report of Bruce Robertson AGL’s Emissions Intensive Crib Point No Solution to High Gas Prices Crib Point Is Not Needed to Supply A Declining Gas Industry Executive Summary AGL’s Crib Point gas import terminal proposal is a clear indicator that energy policy in Eastern Australia has failed. -

Coal-Faced Exposing AGL As Australia’S Biggest Climate Polluter Disclaimer

Coal-faced Exposing AGL as Australia’s biggest climate polluter Disclaimer While this report does not suggest any illegal conduct on the part of any of the individuals or organisations named, it shows that AGL is currently using its position and power to slow the transition to a low carbon economy which is jeopardising both human and planetary health, and it presents alternative approaches that would allow AGL to transition from Australia’s biggest polluter to a green energy leader. Acknowledgments Greenpeace Australia Pacific Limited acknowledges the Traditional Owners of Country throughout Australia and recognises their continuing connection to land, waters, and culture. We pay our respects to their Elders past, present and emerging. Lead author Drew Rooke Design Shaya Made May 2021 Authorised by Kate Smolski Greenpeace Australia Pacific Limited, Sydney www.greenpeace.org.au 2 Coal-faced Exposing AGL as Australia’s biggest climate polluter image: cover Front © Monika Wisniewska / Shutterstock image: Inner cover © Jaz Kaelin / Greenpeace Table of Contents Executive Summary.....................................................5 Introduction................................................................9 1. Australia’s dirtiest company.....................................10 1.1. A snapshot of the Australian electricity sector.....10 1.2. Who is AGL?....................................................11 1.3. Committed to coal............................................12 1.4. A new commitment..........................................15 -

STOXX AUSTRALIA 50 Selection List

STOXX AUSTRALIA 50 Last Updated: 20201201 ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) Rank (FINAL)Rank (PREVIOUS) AU000000CBA7 6215035 CBA.AX 621503 Commonwealth Bank of Australia AU AUD Y 86.2 1 2 AU000000CSL8 6185495 CSL.AX 618549 CSL Ltd. AU AUD Y 83.2 2 1 AU000000BHP4 6144690 BHP.AX 614469 BHP GROUP LTD. AU AUD Y 69.1 3 3 AU000000NAB4 6624608 NAB.AX 662460 National Australia Bank Ltd. AU AUD Y 46.4 4 5 AU000000WBC1 6076146 WBC.AX 607614 Westpac Banking Corp. AU AUD Y 44.8 5 4 AU000000ANZ3 6065586 ANZ.AX 606558 Australia & New Zealand Bankin AU AUD Y 39.6 6 6 AU000000WES1 6948836 WES.AX 694883 Wesfarmers Ltd. AU AUD Y 34.5 7 7 AU000000MQG1 B28YTC2 MQG.AX 655135 Macquarie Group Ltd. AU AUD Y 29 8 9 AU000000WOW2 6981239 WOW.AX 698123 WOOLWORTHS GROUP AU AUD Y 28.8 9 8 AU000000TCL6 6200882 TCL.AX 689933 Transurban Group AU AUD Y 23.6 10 10 AU000000RIO1 6220103 RIO.AX 622010 Rio Tinto Ltd. AU AUD Y 23.2 11 11 AU000000TLS2 6087289 TLS.AX 608545 Telstra Corp. Ltd. AU AUD Y 22.5 12 12 AU000000FMG4 6086253 FMG.AX 608625 Fortescue Metals Group Ltd. AU AUD Y 19.5 13 14 AU000000GMG2 B03FYZ4 GMG.AX 690433 Goodman Group AU AUD Y 19.1 14 13 AU0000030678 BYWR0T5 COL.AX AU80Q2 Coles Group AU AUD Y 14.7 15 16 AU000000APT1 BF5L8B9 APT.AX AU802E AFTERPAY AU AUD 14.2 16 17 AU000000NCM7 6637101 NCM.AX 663710 Newcrest Mining Ltd. -

Ausnet Services Full Year 2020 Results Release and Presentation

12 May 2020 AusNet Services Full Year 2020 Results Release and Presentation The following documents are attached: 1. AusNet Services Full Year 2020 Results Release 2. Investor Presentation Paul Lynch Company Secretary This announcement was authorised for release by the Board of AusNet Services Ltd. Investor Relations Enquiries Media Enquiries John Nicolopoulos + 61 3 9483 0989 Head of Tax & Investor Relations +61 3 9695 6301 or +61 409 672 912 12 May 2020 AusNet Services Full Year 2020 Results AusNet Services reported its full year results for the period ended 31 March 2020 (FY2020), delivering improved financial performance against a challenging operating environment. The Board declared a dividend of 5.1cps, taking the full year dividend to 10.20cps (FY2019 dividend of 9.72cps), franked to 50% (FY2019 42.5%). Financial performance was driven by increased underlying revenues in line with regulatory determinations as well as transmission excluded project revenues and customer contributions. Despite an overall increase in expenses, underlying operating expenditures declined through the ongoing delivery of efficiency initiatives. Cash flow from operations was impacted by higher income tax paid due to higher immediately deductible capital expenditure in the previous period. Cash flow from operations continues to underpin our ability to fund capital investment and provide dividends to shareholders. Tony Narvaez, Managing Director of AusNet Services said, “Recently, we have seen the unprecedented events of the global COVID-19 pandemic unfold