ZON Multimedia Towards the Future When It Is All a Matter of 'Fiber'

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

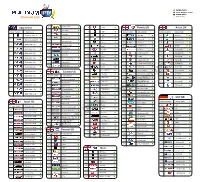

Liste Des Chaines

Available channel temporary unabled channel disabled channel Channels List channel replay Setanta Sport 46 92 Gold Family UK Asian UK 47 Box Nation channel number channel name 93 Dave channel number channel name channel number channel name 48 ESPN HD 1 beIN Sports News HD 94 Alibi 104 SKY ONE 158 Zee tv UK 49 Eurosport UK 95 E4 105 Sky Two UK 159 Zee cinema UK 2 Bein Sports Global HD 50 Eurosport 2 UK 96 More 4 106 Sky Living 160 Zee Punjabi UK 3 BEIN SPORT 1 HD 51 Sky Sports News 97 Dmax 107 Sky Atlantic UK 161 Zing UK 52 At The Races 4 BEIN SPORT 2 HD 98 5 STAR 108 Sky Arts1 162 Star Gold UK 53 Racing UK 5 BEIN SPORT 3 HD 99 3E 109 Sky Real Lives UK 163 Star Jalsha UK 54 Motor TV 100 Magic 110 Fox UK 164 Star Plus UK 6 BEIN SPORT 4 HD 55 Manchester United Tv 101 TV 3 111 Comedy Central UK 165 Star live UK 7 BEIN SPORT 5 HD 56 Chealsea Tv 102 Film 4 121 Comedy Central Extra UK 166 Ary Digital UK 57 Liverpool Tv 8 BEIN SPORT 6 HD 103 Flava 125 Nat Geo UK 167 Sony Tv UK 113 Food Network 126 Nat Geo Wild uk 168 Sony Sab Tv UK 9 BEIN SPORT 7 HD Cinema Uk 114 The Vault 127 Discovery UK 169 Aaj Tak UK 10 BEIN SPORT 8 HD channel number channel name 115 CBS Reality 128 Discovery Science uk 170 Geo TV UK 60 Sky Movies Premiere UK 11 BEIN SPORT 9 HD 116 CBS Action 129 Discovery Turbo UK 171 Geo news UK 61 Sky Select UK 12 BEIN SPORT 10 HD 130 Discovery History 172 ABP news Uk 62 Sky Action UK 117 CBS Drama 131 Discovery home UK 13 BEIN SPORT 11 HD 63 Sky Modern Great UK 118 True Movies 132 Investigation Discovery 64 Sky Family UK 119 True Movies -

Economic Analysis and Regulatory Principles

ERG (09) 17 Report on Next Generation Access - Economic Analysis and Regulatory Principles June 2009 I ERG (09) 17 Table of contents List of figures III A Introduction 1 B Summary of Country Case Studies 3 C Economic Analysis in light of Factual NGA Developments 5 C.1 General principles 6 C.2 Business case studies 7 C.3 Regulatory implications of NGA economics 8 C.4 Economic and Social Value of NGA 10 D Analysis of Regulatory Decisions and Principles 11 D.1 Market definition and analysis 11 D.2 Access obligations and the ladder of investment 12 D.3 Price control measures including assessment of investment risk 15 D.4 Regulatory/Competition law treatment of joint projects 23 D.5 Symmetric regulation 23 D.6 Procedural steps during the migration period 25 E Overall assessment 30 Annex 1: NGA - Country Case Study Updates 34 Annex 2: Table on NGA Factual Development 188 Annex 3: Table of Price Control Measurements 203 Literature 207 II ERG (09) 17 List of figures Figure 1: NGA ladder of investment 14 III ERG (09) 17 A. Introduction This ERG Report “Next Generation Access – Economic Analysis and Regulatory Principles” is a follow up document of the October 2007 Common Position on NGA (ERG CP NGA)1 looking at the economic and regulatory analysis in light of ongoing roll-out, the draft NGA Recommen- dation and more recent economic studies including the ERG Statement on the development of NGN Access, ERG (08) 68, December 2008. It is a report examining the latest evidence on NGA roll-out strategies (including cable) as well as regulatory approaches being announced or implemented across Europe by ERG members since the adoption of the ERG CP NGA to ensure that the original conclusions remain valid and fit-for purpose for national regulators to follow and take account of the latest develop- ments. -

Zero-Rating Practices in Broadband Markets

Zero-rating practices in broadband markets Report by Competition EUROPEAN COMMISSION Directorate-General for Competition E-mail: [email protected] European Commission B-1049 Brussels [Cataloguenumber] Zero-rating practices in broadband markets Final report February 2017 Europe Direct is a service to help you find answers to your questions about the European Union. Freephone number (*): 00 800 6 7 8 9 10 11 (*) The information given is free, as are most calls (though some operators, phone boxes or hotels may charge you). LEGAL NOTICE The information and views set out in this report are those of the author(s) and do not necessarily reflect the official opinion of the Commission. The Commission does not guarantee the accuracy of the data included in this study. Neither the Commission nor any person acting on the Commission’s behalf may be held responsible for the use which may be made of the information contained therein. Les informations et opinions exprimées dans ce rapport sont ceux de(s) l'auteur(s) et ne reflètent pas nécessairement l'opinion officielle de la Commission. La Commission ne garantit pas l’exactitude des informations comprises dans ce rapport. La Commission, ainsi que toute personne agissant pour le compte de celle-ci, ne saurait en aucun cas être tenue responsable de l’utilisation des informations contenues dans ce rapport. More information on the European Union is available on the Internet (http://www.europa.eu). Luxembourg: Publications Office of the European Union, 2017 Catalogue number: KD-02-17-687-EN-N ISBN 978-92-79-69466-0 doi: 10.2763/002126 © European Union, 2017 Reproduction is authorised provided the source is acknowledged. -

Nowy Kurjer Łódzki 1917 R. 2 Półrocze. Dziennik Polityczny, Społeczny I Literacki

1917 . Piątek. 31 sierpnia Ir~ . WsohodziejBMe si~ mo~ef nader łatwo, ryeh pr21yj~ciQ Ind ten nie był przygo .. jedną 2J wielu powatnyoh, prżyc2iyn. łowImy.. Potworzono bojówki 'P,rt11n~ dyktująoyoh mocarstwom europejskim stronnictw~ namil'Jtnie zwalolaJ~ol'ch potrzebt) rychłego zakońozenia wój· sit2 wzajem.nie. Wyłonił si~ mnich Ily, wyczerpującej wszystld~. Ja je bandytyzm, szerzący słt2 do dziś dnia, <III/? pońozycy .nie potrzebu,~ 8i~ śple~zy6, :pomimo energic~mego zwalczania 1ego gdy~ jeteli wojna potrwa. dłutel. a objawów przez Bt\dy polowe, kar'ił\Ge lak niektórzy 'PrzepOWiadają, lat jesz~ no śmiercif\ za rabunki i mordy_ . oze par«2, - Europa .na będzie dhl~i W o1na obecna! cał1mSlam~łem podaje do wiadomości, okres tak wyozerpaną.te JapOD]a towarzyszących 1e', lnb wytwono.. swobodnie bł2dzie mogła. > urzeczy.. nych przez nią warunk6w, przyakom. wistni6 swe dą~ą08 do zbu4o !er.prele.tlcje llflrji Dl 'idź i flkr~1 'Iizki "1,1 plany, pan1amenoie szale'lloe1 do· potwor wanla wielkiego imperjumjapońsl{Je~ nyoJ1 granic spekulaojl 1 wyzysku go na Dalekim Wschódzie~ jopełniła miary. Zdawało się; !ewo.,~ St. Li? )la f 1ej łdęski sprowadzą opami~t&... n nie. zwłaszcza, gdy zabłysła na ho w &odzi, przy 81. - ryzoncie dzie1ów ,jutrznia odrodzenia ui: Plolł'kOwskiej Qlczyzny w je1 Aamodzielnym, nie podl egłym byole. Nlestety~ złudzenia Wszyscy w Łodzi i okolicy, kt6rzy pragną o~rzyma6 kolektę o zDrowienaroDn. fe' zbyt szybko prysły. Zewsząd do- Joterji Legionów, proszeni są o zgłaszanie si~ dn p. Zółł:owsldego Jedną z l)ajf1owa~nieis~ych trosk cbodzą nas wieści o smutnym nad który udzielać będzie wB2I!elkioh infopmacjii odda w dobie obecne), która 1ratdego sr,c'te- wyraz moralnym stanie zdro\łla. -

United States Securities and Exchange Commission Form

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F អ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ፤ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2006 OR អ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 1-13758 PORTUGAL TELECOM, SGPS S.A. (Exact name of Registrant as specified in its charter) The Portuguese Republic (Jurisdiction of incorporation or organization) Av. Fontes Pereira de Melo, 40, 1069-300 Lisboa Codex, Portugal (Address of principal executive offices) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered American Depositary Shares, each representing one ordinary share, nominal value A0.03 per share ........ New York Stock Exchange Ordinary shares, nominal value A0.03 each ........... New York Stock Exchange* * Not for trading but only in connection with the registration of American Depositary Shares. Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. Ordinary shares, nominal value A0.03 per share ........................................ 1,128,856,000 Class A shares, nominal value A0.03 per share ........................................ -

United States Securities and Exchange Commission Form

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F អ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ፤ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2007 OR អ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR អ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 1-13758 PORTUGAL TELECOM, SGPS, S.A. (Exact name of Registrant as specified in its charter) The Portuguese Republic (Jurisdiction of incorporation or organization) Av. Fontes Pereira de Melo, 40, 1069-300 Lisboa Codex, Portugal (Address of principal executive offices) Nuno Prego, Investor Relations Director, Tel. +351 21 500 1701 Av. Fontes Pereira de Melo, 40, 1069-300 Lisboa Codex, Portugal (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered American Depositary Shares, each representing one ordinary New York Stock Exchange share, nominal value A0.03 per share .................. Ordinary shares, nominal value A0.03 each ............... New York Stock Exchange* * Not for trading but only in connection with the registration of American Depositary Shares. Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. -

Play Now (TV Only) Play Now (TV Only) Cont’D

Play Bold Play Now (TV Only) Play Now (TV Only) cont’d. Play Fast *Includes all channels from Play loud Play Plus Premium Local Entertainment Entertainment Music Stingray Music cont’d MOVIES+ 4 TV4 100 ABC- WPLG 405 Warner Channel 700 BET 5 CNC3 101 CBS- WFOR 415 Lifetime HD 704 MTV HD 401 Cinemax 6 CCN TV6 102 NBC-WTVJ 416 Lifetime Real Women 404 Film Zone 7 CTV 103 FOX-WSVN 419 SyFy HD Movies 408 Cinecanal 8 IBN 8 555 EWTN 422 TNT 400 Favourites Mosaic 450 HBO 9 IETV 557 3ABN 423 A&E HD 401 Cinemax 451 HBO 2 10 Acts25 558 TBN 425 TBS 409 AXN 452 HBO Caribbean 11 The Parliament Channel 601 UNIVISION 430 Comedy Central HD 420 Space 453 HBO Family Trinity TV Zee World 449 Bravo HD 454 HBO Plus East 12 622 News 13 WI Sports 523 Discovery Channel 455 HBO Plus West 14 WIN TV News 525 TLC 500 News Mosaic 456 HBO Signature 15 TV Jaagriti 517 Al Jazeera 527 Discovery Science 501 CNN Domestic 457 MAX East 16 Synergy TV 529 Discovery Health & Home 502 CNN HLN 458 MAX Prime East Fox News Channel HD 17 Sankhya TV 531 NatGeo HD 507 459 MAX Prime West FREE Local & International TV One Caribbean Weather HD 18 The Islamic Network 534 History Channel HD 513 460 MAX Caribbean channels included 19 MTM TV 540 Food Network HD Sports 19 MTM TV 461 Fox Movies Classics 542 Travel Channel HD 300 Sports Mosaic 462 Fox Movies Action East Justice Central HD 463 Fox Movies Action West 544 301 SportsMax HD The Africa Channel HD 464 Fox Movies Family 545 302 SportsMax 2 HD Zee TV 465 Fox Movies 606 305 ESPN 2 HD 26 617 Zee Cinema 709 BET JAMS 466 Fox Movies East CHANNELS -

NOS: Introducing Pay Per View

Marketing Plan NOS: introducing Pay Per View Pedro Azeredo Pereira Master of Science in Marketing Thesis Supervisor Professor Susana Marques, ISCTE Business School, Marketing, Operations and General Management Department October 2016 Marketing Plan NOS: Introducing Pay Per View Acknowledgements My first thanks goes to my mother because all of this would not be possible without her support, love and pressure to have the project concluded. Her advices have been very important for my life and this time it wasn’t different. In second place, I would like to thank to Professor Susana Marques for your availability, readiness and patience to supervise my thesis, guindance and great advices, and the opportunity to have your name associated to my project. Without you this would not be possible. I also want to thank to NOS Comunicações for the internship. It was a year full of challenges, achievements and results that gave me the experience and information need to develop this project. Another thank goes to my family that, during these years, always supported and adviced me to get where I am now. You are the best family anyone can have and thank you for being so present, woried and united. Also thank you Rita Sousa for dealing with all my stress to get this concluded and for the support, motivation and advices you give me in every situation. I Marketing Plan NOS: Introducing Pay Per View Abstract NOS, NOS Comunicações S.A., is a private telecommunications company of the portuguese market which is proud of being the “best communications and entertainment company in the market”. -

Management's Discussion and Analysis Altice Luxemborg

MANAGEMENT’S DISCUSSION AND ANALYSIS ALTICE LUXEMBORG S.A. FOR THE YEAR ENDED DECEMBER 31, 2018 Contents Overview Strategy and performance Key Factors Affecting Our Results of Operations Basis of Preparation Group financial review Significant Events Affecting Historical Results Discussion and analysis of the results and financial condition of the Group Revenue Adjusted EBITDA Other items Impacting Profit/(Loss) Capital Expenditure Liquidity and Capital Resources Capital expenditures Discussion and analysis of the financial condition of the Group Key Operating Measures Other Disclosures Key Income Statement Items 1 The Group is a multinational group operating across three sectors: (i) telecom (broadband and mobile communications), (ii) content and media and (iii) advertising. The Group operates in Western Europe (comprising France and Portugal), Israel, the Dominican Republic and the French overseas territories (comprising Guadeloupe, Martinique, French Guiana, La Réunion and Mayotte (the “French Overseas Territories”)). The parent company of the Group is Altice Luxembourg S.A. (the “Company”). The Group had expanded internationally in previous years through several acquisitions of telecommunications businesses, including: SFR and MEO in Western Europe; HOT in Israel; and Altice Hispaniola and Tricom in the Dominican Republic. The Group’s acquisition strategy has allowed it to target cable, FTTH or mobile operators with what it believes to be high- quality networks in markets the Group finds attractive from an economic, competitive and regulatory perspective. Furthermore, the Group is focused on growing the businesses that it acquired organically, by focusing on cost optimization, increasing economies of scale and operational synergies and improving quality of its network and services. As part of its innovative strategy, the Group is focusing on investment in its proprietary best-in-class infrastructure, both in fibre and mobile, commensurate with the Group’s position as a number one or number two operator in each market. -

Play Fast Play Loud Play Big/Play Large Play Strong/Play

Play Fast Play Loud Play Big/Play Large Play Plus Premium cont’d. Local Music Entertainment Music Entertainment Movies 1 Catch 1 HD 703 Hype TV 601 Univision HD 700 BET 416 Lifetime Real Women 404 Film Zone HD WORLD + 2 Catch 2 HD 433 Tru TV 427 E! (LatAm) 408 Cinecanal HD Sports 7 TVJ Sports 422 TNT 431 Comedy TV HD Music 8 CVM 300 Sports Mosaic 531 NatGeo HD HD 300 Sports Mosaic 435 AWE TV HD 408 Cinecanal HD 602 Telemundo HD 9 JNN 325 Fight Sports 537 DIY HD 301 Sport sMax HD 436 AXS TV HD 705 MTV 2 HD 427 E! (LatAm) 605 CNN Espanol 10 TVJ Sports 438 Classic Arts Showcase 712 VH1 (LatAm) HD 432 I-Sat 607 CCTV 4 Galaxy Music Kids 11 RE TV Outdoor Channel HD 715 Revolt HD 504 BBC World (Eng) HD 608 CCTV 9 205 Boomerang 439 12 CVM Plus 725 Hit List 441 FYI HD Sports 510 Euronews 13 PBCJ Pop Adult 206 Discovery Kids 515 France 24 (Eng) 726 442 Pivot 307 Fox Sports 2 HD CNS Standards News NHK World HD 15 727 535 Viceland HD 316 Fox Sports Racing HD 516 17 Love TV Jukebox Oldies 132 601 Univision (Miami) HD 728 504 BBC World (Eng) HD CHANNELS 536 Pets TV HD 317 Cars TV HD 18 Jam Vision Flashback 70’S 729 541 Recipe TV HD 320 World Fishing HD 19 Mercy & Truth Ministries Everything 80’S 730 Movies 543 My Destination TV HD 443 Maverick Mav TV HD 20 Power of Faith Ministries Nothin’ But 90’S KIDS + 731 401 Cinemax 604 Fox Sports (Deportes) HD 21 Jet TV 732 Maximum Party 403 TCM HD *Includes all channels from Play Fast 22 Jamaica Travel Channel 733 Dance Classics Kids 201 Disney Channel 208 Teen Nick (SD)(LatAm) 24 Mello TV 734 Dance Clubbn’ -

The Economics of Next Generation Access - Final Report

WIK-Consult • Report Study for the European Competitive Telecommunication Association (ECTA) The Economics of Next Generation Access - Final Report Authors: Dieter Elixmann Dragan Ilic Dr. Karl-Heinz Neumann Dr. Thomas Plückebaum WIK-Consult GmbH Rhöndorfer Str. 68 53604 Bad Honnef Germany Bad Honnef, September 10, 2008 The Economics of Next Generation Access I Contents Tables IV Figures VII Abbreviations X Preface XIII Executive Summary XV 1 Introduction 1 2 Literature review 3 2.1 OPTA: Business cases for broadband access 3 2.1.1 OPTA: Business case for sub-loop unbundling in the Netherlands 3 2.1.2 OPTA: Business case for fibre-based access in the Netherlands 5 2.2 Comreg: Business case for sub-loop unbundling in Dublin 8 2.3 BIPT: The business case for sub-loop unbundling in Belgium 10 2.4 Analysys: Fibre in the Last Mile 12 2.5 Avisem studies for ARCEP 15 2.5.1 Sharing of the terminal part of FTTH 16 2.5.2 Intervention of local authorities as facilitators 18 2.6 AT Kearney: FTTH for Greece 19 2.7 ERG opinion on regulatory principles of NGA 23 2.8 JP Morgan: The fibre battle 26 2.9 OECD 28 2.9.1 Public rights of way for fibre deployment to the home 29 2.9.2 Developments in fibre technologies and investment 32 3 Experiences in non-European countries 44 3.1 Australia 44 3.1.1 Overall broadband market penetration 44 3.1.2 Current broadband market structure 45 3.1.3 Envisaged nationwide “Fibre to the Node” network 47 3.1.4 Regulation, wholesale services 50 3.2 Japan 51 3.2.1 Overall broadband market penetration 51 II The Economics of -

Ago / 2021 Canal Posição 150 Canais Pack Extra 200 Canais Premium RTP1

Ago / 2021 FIBRA Canal Posição 150 canais Pack Extra 200 canais Premium RTP1 (HD) 1 X X RTP2 (HD) 2 X X SIC (HD) 3 X X TVI (HD) 4 X X SIC Notícias (HD) 5 X X RTP 3 (HD) 6 X X TVI24 (HD) 7 X X CMTV (HD) 8 X X SIC Mulher (HD) 9 X X Globo (HD) 10 X X 11 (HD) 11 X X TVI Ficção (HD) 12 X X A Bola TV (HD) 13 X X Sport TV + HD 14 X X Porto Canal (HD) 15 X X Slide Promocional 16 X X Veja (HD) 17 X X RTP Açores (HD) 18 X X RTP Madeira (SD) 19 X X Sport TV1 HD 21 X Sport TV2 HD 22 X Sport TV3 HD 23 X Sport TV4 HD 24 X Sport TV5 HD 25 X Sport TV6 HD 26 X NBA TV (HD) 27 X BTV HD 30 X Eleven Sports 1 (HD) 31 X Eleven Sports 2 (HD) 32 X Eleven Sports 3 (HD) 33 X Eleven Sports 4 (HD) 34 X Eleven Sports 5 (HD) 35 X Eleven Sports 6 (HD) 36 X Sporting TV HD 37 X X Eurosport 1 HD 38 X X Eurosport 2 HD 39 X X Disney Channel (SD) 40 X X Cartoon Network (SD) 41 X X Biggs (SD) 42 X X SIC K (HD) 43 X X Nickelodeon (SD) 44 X X Disney Junior (HD) 45 X X Panda (HD) 46 X X Jim Jam (SD) 47 X X Baby TV (SD) 48 X X Lolly Kids (HD) 49 X X Panda Kids (HD) 50 X X CN Premium 51 X Nick+ 52 X MEO Kids 53 X X TV Cine Top HD 55 X TV Cine Edition HD 56 X TV Cine Emotion HD 57 X TV Cine Action HD 58 X Cinemundo (HD) 60 X X Hollywood HD 61 X X FOX Movies HD 62 X X AMC (HD) 63 X X AXN Movies HD 64 X X MEO VideoClube (HD) 69 X X FOX (HD) 70 X X FOX Life HD 71 X X FOX Crime HD 72 X X FOX Comedy HD 73 X X AXN HD 74 X X AXN White HD 75 X X SyFy (HD) 76 X X Dizi Channel (HD) 77 X X MEO Apps (HD) 79 X X MEO Filmes e Séries 80 X Acorn TV 84 X Prime Video 87 X NETFLIX 88 X MEO Destaques