Notice Concerning Property Acquisitions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Comfort Urban Smart

COMFORIA RESIDENTIAL REIT, INC ~Investor Presentation~ COMFORT 8th Fiscal Period (ended July 2014) September 2014 URBAN SMART Table of Contents 1. 8th Fiscal Period Highlights 5. Appendix Financial Highlights - 4 – P&L: 8th Period -23- Portfolio Highlights - 5 - Balance Sheet: 8th Period -24- 2. 8th Fiscal Period Results 8th ~ 9th Period Performance Forecast -25- Financial Results for the 8th Fiscal Period - 7 - CRR Characteristics -26- Stable Occupancy Rate - 8 - “COMFORIA” Series -27- Fluctuations in Rent Rate - 9 - “COMFORIA” Series Representative Properties -28- External Growth-①: PO Effect & Acquisition Portfolio Policy -29- Capacity -10- # of Net migration and Household in Tokyo 23 Wards -30- External Growth-②: Post-offering Acquisitions -11- Demand & Price Stability of Tokyo 23 Ward Assets -31- Property Management Initiatives -12- Portfolio Map (as at 8th FP end) -32- Financial Strategy-①: Borrowings & Bond Issue -13- Portfolio List -33- Financial Strategy-②: Financial Indicators Appraisal Value -36- (as at 8th FP end) -14- Occupancy and Rent Rates -39- Expansion of Retail Investor Base -15- Overview of Portfolio (as at 8th FP end) -40- 3. Future Strategy Status of Interest-bearing Debt (as at 8th FP end) -42- External Growth Targets -17- Unitholders (as at 8th FP end) -43- Solid External Growth-①: Historical Performance -18- Historical Unit Price -44- rd Solid External Growth-②: Opportunities Agenda of the 3 Unitholders’ Meeting -45- & Pipeline -19- Governance -46- 4. Performance Forecast Overview -

Time-Out-Tokyo-Magazine-Issue-22

• G-SHOCK GMW-B5000D Time out TOKYO AD (H297xW225) Discover regional Japan in Tokyo From the courtly refinement of Kyoto to the street smart vibes of Osaka and the tropical flavour of Okinawa, Japan is an amazingly diverse country, with 47 prefectures having their own unique customs, culture and cuisine. Oh Inside yes, the amazing regional cuisines, which keep travellers salivating on every step of a Japanese journey, from the seafood mecca of Hokkaido in the cold north to Fukuoka, the birthplace of the globally famed tonkatsu ramen in the April – June 2019 southern Kyushu prefecture. We know it all too well, the struggle is real: there are too many places to visit, things to do, food to eat – and too little time to do it all. But the good news is that you can easily experience the best of regional Japan right here in Tokyo. Think of our city as a Japan taster, which will inspire you to go visit a different part of the country. START YOUR EXPLORATION ON PAGE 24 â Swing this way The best jazz bars and venues in Tokyo PAGE 60 â KEISUKE TANIGAWA KEISUKE Tsukiji goes dark The former fish market reinvents itself as a nightlife destination PAGE 62 GMW-B5000D â KEISUKE TANIGAWA KEISUKE KISA TOYOSHIMA Playing footsie For heaven’s sake Evolution End a long day of sightseeing Where to savour the drink at these footbath cafés of Japan: sake PAGE 50 PAGE 40 â â back to the HOGUREST PIPA100/DREAMSTIME Origin â FEATURES AND REGULARS 06 Tokyo Update 12 Courtesy Calls 14 Open Tokyo 18 To Do 24 Discover regional Japan in Tokyo 44 Eating & Drinking 48 Shopping & Style 50 Things to Do 54 Art & Culture 58 Music 62 Nightlife 64 LGBT 65 Film 66 Travel & Hotels 70 Getting Around 74 You know you’re in Tokyo when… SMARTPHONE LINK MULTI BAND 6 TOUGH SOLAR * Bluetooth® is a registered trademark or trademark of Bluetooth SIG, Inc. -

Area Locality Address Description Operator Aichi Aisai 10-1

Area Locality Address Description Operator Aichi Aisai 10-1,Kitaishikicho McDonald's Saya Ustore MobilepointBB Aichi Aisai 2283-60,Syobatachobensaiten McDonald's Syobata PIAGO MobilepointBB Aichi Ama 2-158,Nishiki,Kaniecho McDonald's Kanie MobilepointBB Aichi Ama 26-1,Nagamaki,Oharucho McDonald's Oharu MobilepointBB Aichi Anjo 1-18-2 Mikawaanjocho Tokaido Shinkansen Mikawa-Anjo Station NTT Communications Aichi Anjo 16-5 Fukamachi McDonald's FukamaPIAGO MobilepointBB Aichi Anjo 2-1-6 Mikawaanjohommachi Mikawa Anjo City Hotel NTT Communications Aichi Anjo 3-1-8 Sumiyoshicho McDonald's Anjiyoitoyokado MobilepointBB Aichi Anjo 3-5-22 Sumiyoshicho McDonald's Anjoandei MobilepointBB Aichi Anjo 36-2 Sakuraicho McDonald's Anjosakurai MobilepointBB Aichi Anjo 6-8 Hamatomicho McDonald's Anjokoronaworld MobilepointBB Aichi Anjo Yokoyamachiyohama Tekami62 McDonald's Anjo MobilepointBB Aichi Chiryu 128 Naka Nakamachi Chiryu Saintpia Hotel NTT Communications Aichi Chiryu 18-1,Nagashinochooyama McDonald's Chiryu Gyararie APITA MobilepointBB Aichi Chiryu Kamishigehara Higashi Hatsuchiyo 33-1 McDonald's 155Chiryu MobilepointBB Aichi Chita 1-1 Ichoden McDonald's Higashiura MobilepointBB Aichi Chita 1-1711 Shimizugaoka McDonald's Chitashimizugaoka MobilepointBB Aichi Chita 1-3 Aguiazaekimae McDonald's Agui MobilepointBB Aichi Chita 24-1 Tasaki McDonald's Taketoyo PIAGO MobilepointBB Aichi Chita 67?8,Ogawa,Higashiuracho McDonald's Higashiura JUSCO MobilepointBB Aichi Gamagoori 1-3,Kashimacho McDonald's Gamagoori CAINZ HOME MobilepointBB Aichi Gamagori 1-1,Yuihama,Takenoyacho -

Pocket Handbill

Traditional culture experience programs Traditional culture experience programs for Overseas Visitors for Overseas Visitors A s a k u s a C u l t u r e E d o - To k y o M u s e u m Tourist Information Center Shamisen of Nagauta Every Saturday Every Second Saturday and Sunday from December 2015 to March 2016 14:45 / 16:00 / 17:15 (30 minutes) Appreciate Nagauta, traditional Japanese music and *Excluding 26th December 2015. instruments experience. It's held until 26th March 2016. Nihon Buyo Every Sunday You can wear a yukata and learn how to dance. 11:00 / 13:00 / 15:00 (60 minutes) *Excluding 13th December 2015 and 10th January, 14th February, 28th February, 13th March 2016. It's held until 27th March 2016. WAZUMA KAMIKIRI KYOKUGEI Japanese Paper Traditional Magic Cutting Acrobatics No age English Guidance limitations Available Free Organized by Arts Council Tokyo Nihon Buyo Nagauta(Shamisen) (Tokyo Metropolitan Foundation for History and Culture) Supported & Cooperated by Tokyo Metropolitan Government Inquiries: Tokyo Tradition Office, Arts Council Tokyo TEL: 03-5369-4541 FAX: 03-3225-1006 E-mail: [email protected] No age Please visit our limitations website for more English Guidance information Available Website: http://www.tokyo-tradition.jp Free Address: 1-4-1 Yokoami, Sumida-ku, Tokyo 130-0015 Address: 2-18-9 Kaminarimon, Taito-ku, Tokyo 111-0034 The Beauty of Japan and a Feast of Festival of Traditional Performing Arts Noh Theater: Beyond Words, Beyond Borders Traditional Performing Arts: FUJIYAMA - Memories of Asia - Treasures of Japan Saturday 21st November 2015 at 14:00 Saturday 2nd January 2016 at 13:30 Sunday 25th October 2015 at 17:00 (Experience Corner at 12:00) (Experience Corner at 12:30) The only chance to experience the new dance pieces, one entitled This program consists of both a behind-the-scenes ”experience corner” and A collection of Japan’s greatest traditional artists performing together. -

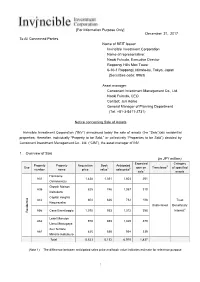

1 December 21, 2017 to All Concerned Parties Name of REIT

[For Information Purpose Only] December 21, 2017 To All Concerned Parties Name of REIT Issuer: Invincible Investment Corporation Name of representative: Naoki Fukuda, Executive Director Roppongi Hills Mori Tower 6-10-1 Roppongi, Minato-ku, Tokyo, Japan (Securities code: 8963) Asset manager: Consonant Investment Management Co., Ltd. Naoki Fukuda, CEO Contact: Jun Komo General Manager of Planning Department (Tel. +81-3-5411-2731) Notice concerning Sale of Assets Invincible Investment Corporation (“INV”) announced today the sale of assets (the “Sale”)(six residential properties; Hereafter, individually “Property to be Sold,” or collectively “Properties to be Sold”) decided by Consonant Investment Management Co., Ltd. (“CIM”), the asset manager of INV. 1. Overview of Sale (in JPY million) Expected Category Property Property Acquisition Book Anticipated Use gain on Transferee3 of specified number name price value1 sales price2 sale1 assets Harmonie A31 1,428 1,351 1,603 251 Ochanomizu Growth Maison A36 825 746 1,057 310 Ikebukuro Capital Heights A42 604 626 732 106 Trust Kagurazaka Undisclosed Beneficiary A56 Casa Eremitaggio 1,070 953 1,312 358 Interest4 Residential Lexel Mansion A62 970 859 1,329 470 Ueno Matsugaya Sun Terrace A81 625 595 934 339 Minami-Ikebukuro Total 5,523 5,132 6,970 1,837 (Note 1) The difference between anticipated sales price and book value indicates estimate for reference purpose 1 calculated using the book values as of June 30, 2017; INV estimates to recognize a gain on sales of JPY1,099 million in the fiscal period ending December 2017, and JPY597 million for the fiscal period ending June 2018. -

Waseda University Student Health Promotion Mutual Aid Association

Waseda University Student Health Promotion Mutual Aid Association CONTENTS Healthcare Benefi t Coverage ………………………P.3~4 How to Apply for Consultation and Healthcare Benefi ts ………………………………………P.5~7 Registration, confi rmation, and updates of bank account ………………………P.8 Health Checkup Coverage Exemption and partial refund of membership fees …………………………………………P.9 List of Contracted Hospitals/ Clinics and Pharmacies …………………………………P.10~11 Map of Contracted Hospitals/ Clinics and Pharmacies …………………………………P.12~13 What's SOKENKAI ? ……………………………………P.14~15 Healthy Campus Event by Waseda Student Health Association Committee ………………………P.16 1 What is the Waseda University Student Health Promotion Mutual Aid Association? The Waseda Univeristy Mutual Aid Association for Promotion of Student Health (Waseda Student Health Association for short) was founded in 1964 and is Waseda University's first mutual-aid association that organizes to help students maintain and improve their health. We provide aid or medical expenses, health examinations,and other costs incurred based on membership fees paid for by its members: the students. Those Eligible for Membership of the Waseda Student Health Association The following are those eligible for membership of the Association: (1) Regular undergraduate students including double-degree students with the exception of those in the Distance Education Program (E-school) of the Human Sciences. (2) Regular graduate students including double-degree students (3) Graduate research students * Sponsored-students, non-degree students, foreign exchange students, and Special Research students are not eligible. * Medical costs incurred at any institutions outside of Japan are not covered by the health care benefits provided by the Waseda Student Health Association. (see pages 4) As of April 2016, the program will be updated as follows: [Modified] Members will be required to pay a fixed fee of 1,000 yen per hospital each month which will be deducted from benefits received. -

Anonymous Partnership Equity Interests)

July 11, 2013 For Immediate Release Real Estate Investment Trust Securities Issuer: Comforia Residential REIT, Inc 1-16-3 Dogenzaka, Shibuya-ku, Tokyo Hiroyuki Tohmata, Executive Director (Code: 3282) Asset Management Company: TLC Comforia Investment Management INC. Hiroyuki Tohmata, President & CEO Inquires: Nobuhide Kashiwagi, Director and Finance & Accounting department (TEL: +81-3-6415-6200) Notice Concerning Acquisition of Investment Assets (Anonymous Partnership Equity Interests) Comforia Residential REIT, Inc (“Investment Corporation”) announced its decision to acquire the investment assets (anonymous partnership equity interests) as shown below. 1.Summary of Acquisition Equity interest in anonymous partnership investing the beneficial interest in real (1) Type of asset to be acquired estate trust (2) Name of asset to be acquired Godo Kaisha RB-1 anonymous partnership equity interests COMFORIA KUDAN COMFORIA MITA EAST COMFORIA UENOHIROKOJI COMFORIA KASUGATOMISAKA (3) Real estate in trust COMFORIA LIV KIBAKOEN COMFORIA ICHIGAYAYANAGICHO COMFORIA KAGURAZAKA OZIO SHINKAWA OZIO MORISHITA (4) Investment amount 100 million yen (About 2.3% of total anonymous partnership equity interests) (5) Scheduled agreement date July 16, 2013 (6) Scheduled acquisition date July 16, 2013 (7) Acquisition funds Own funds 2. Reason for the Acquisition Based on the asset management target and investment policy of the Articles of Investment Corporation, the decision to acquire the anonymous partnership equity interests was made to secure opportunity to acquire superior properties through investing in the anonymous partnership equity interests and ensure steady growth of the entire portfolio and stable revenues. Through this acquisition, Investment Corporation will receive dividends of profits as capital to rental revenues, etc in each beneficial interest in real estate trust from Godo Kaisha RB-1, the operator of the anonymous partnership. -

Presentation of the 18Th Fiscal Period Financial Results 19Th Table of Contents Fiscal Period

Presentation of the 18th Fiscal Period Financial Results 19th Table of Contents Fiscal Period Summary of Issuance of New Investment Units (Offering) APPENDIX Summary of Issuance of New Investment Units (Offering) 3-4 Investment Unit Price 32 Offering Highlights (Growth on Comprehensive Strengths of the NTT Group) 5 Breakdown of Unitholders 33 Overview of Newly Acquired Properties 6-8 Major Unitholders 34 Overview of Property Planned for Sale 9 Balance Sheets/Statements of Unitholders’ Equity 35 Track Record of Portfolio Expansion and Pipelines / Profit and Loss Statements 36 10 Portfolio Diversification Status Profit and Loss Statements (Forecast for the 19th Fiscal Period) 37 Assets Acquired in Respective Fiscal Periods and Acquisition Channels 11 Assumptions for the 19th and 20th Fiscal Period Forecasts 38 Market Commentary 12-13 Cash Flow Statements 39 18th Fiscal Period Financial Results Status of Interest-bearing Liabilities (as of October 31, 2011) 40 Market Environment and PIC’s Management Policy 15 Financial Indicators 41 Performance Overview for the 18th Fiscal Period 16 Property Portfolio Data (as of October 31, 2011) 42-43 Occupancy Rates and NOI Returns for the 18th Fiscal Period 17 Property Portfolio Appraisal 44-45 Change in Total Rents and Occupancy Rates (Office Buildings) 18 Rental Revenue and Expenses by Property 46-55 Data on Internal Growth of Office Buildings 19-20 Disclaimer and Notice 56 Office Market Data 21 Change in Total Rents and Occupancy Rates (Residential Properties) 22 Terms Used in This Document Rent Index and Occupancy Rates of Residential Properties 23 The Five Central Wards of Tokyo are the so-called Three Central Wards in the heart of Rent Index and Occupancy Rates of Residential Properties by Unit Type 24 Tokyo (Chiyoda, Chuo and Minato Wards) plus Shinjuku and Shibuya Wards. -

Wall to Wall Noriyuki Haraguchi

PRESS RELEASE √K Contemporary Opening Exhibition: wall to wall Noriyuki Haraguchi Oil Pool (2009 Bank Art NYK) ©Risaku Suzuki SEI-RIN Co. Ltd. is proud to announce The opening of √K Contemporary, in –Kagurazaka, Tokyo. The opening exhibition, “wall to wall Noriyuki Haraguchi ”, will present new works by the contemporary artist, Noriyuki Haraguchi. 7th of March (Saturday) – 6th of May, 2020 (Wednesday) √K Contemporary (Root K Contemporary) 6 Minamicho, Shinjuku-ku, Tokyo Total works: approx. 30 pieces. We are happy to announce the inaugruation of our new art complex, which includes, both, an art gallery and an event space. Located on the first and second floor, the art gallery, √K Contemporary (“Root K Contemporary”) will open on the 7th of March, (Saturday) 2020. The opening exhibition, “wall to wall Noriyuki Haraguchi”, will display works by Noriyuki Haraguchi, a leading figure in contemporary art. Approximately 30 works will be exhibited, including the highly acclaimed Oil Pool, in the futuristic interior of the gallery. Beginning his career in the 1960s as one of the leading figures of “Mono-ha”, Haraguchi was one of the first Japanese artists to be selected for the international 1977 exhibition "Documenta 6" (Kassel, Germany). It was in this occasion where Haraguchi presented the iconic Oil Pool, which significantly impacted the international art scene. Haraguchi has since participated in numerous exhibitions and projects worldwide, and his works have been collected by highly regarded institutions, such as the Tate Modern and MoMA. For the past fifty years, Haraguchi has continued to create three-dimesional works and installations from industrial materials such as iron, oil, honeycomb and polyurethane, and has sustained an essence of sheer substance and “materiality”. -

Shinjuku Municipal Library Guide

Shinjuku Municipal Library Guide Nishi-Ochiai Library Tsurumaki Library Shimo-Ochiai Library Chuo Library Children’s Library Toyama Library Nakamachi Okubo Library Library Kita-Shinjuku Library Gender Equality Promotion Center (With Shinjuku) Shinjuku Historical Museum Chuo Library City Office Annex Yotsuya Library Tsunohazu Library Make Your Local Library a Part of Your Life Shinjuku Municipal Library Website: www.city.shinjuku.lg.jp/library/ For cell phones: http://mobile.library.shinjuku.tokyo.jp/ Revised on March 2017 新宿図書館2017_E.indd 4 2017/02/27 10:04 1 Library Services (1) You Can Read Books and Other Materials Freely in the Library. (2) Reference (Survey/Search) Services (a) The library is equipped with an online public access catalog (OPAC) for people who are looking for reading materials. (b) The library staff at the Consultation Corner will help you look for reading materials. Please feel free to ask for help. (c) Also, you can make inquiries by telephone. (d) You can search through the library’s catalog via the Internet. (You can reserve books online as well.) (e) You can view commercial databases, and use a search engine for newspaper articles. (f) You can print the content of commercial databases to the extent permitted by the database copyright holder. (However, there may be some content that cannot be printed at Shinjuku Municipal Library.) You can get more detailed information at the Consultation Corner. (3) Computers for Library Users You can look at Web sites and commercial databases necessary for your research (up to 30 minutes per session). (As a rule, using the computer to listen to CDs, watch DVDs, or print the content of the screen is not permitted.) Please bring your library card or some other form of identifying document verifying your name and address and an applica- tion form to the circulation desk. -

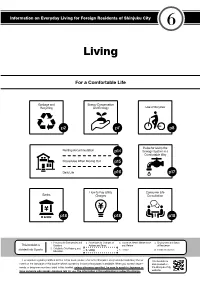

Living for Foreign Residents of Shinjuku City 6

Information on Everyday Living for Foreign Residents of Shinjuku City 6 Living For a Comfortable Life Garbage and Energy Conservation Recycling and Ecology Use of Bicycles p2 p7 p8 Rules for Using the Renting Accommodation p14 Sewage System in a Comfortable Way Procedures When Moving Out p15 Daily Life p16 p17 How to Pay Utility Consumer Life Banks Charges Consultation p18 p18 p18 1. Preparing for Emergencies and 2. Procedures for Changes of 3. Insurance, Health Maintenance 4. Employment and Status This booklet is Disasters Address and Taxes and Welfare of Residence 5. Childbirth, Child-Raising, and 6. Living 7. Leisure 8. Useful Information divided into 8 parts Education For inquiries regarding matters written in this book, please refer to the Shinjuku Foreign Resident Advisory Corner This booklet is noted on the last page of this booklet where counseling in foreign languages is available. When you contact depart- also posted on ments or telephone numbers listed in this booklet, unless otherwise specified, be sure to speak in Japanese or the Shinjuku City have someone who speaks Japanese talk for you. The information in this publication is subject to change. website. Living ● Reduce Waste with 3Rs Garbage and Recycling Recycling items instead of throwing them away as garbage helps the global environment in that it conserves natural resources. Let’s work together to ■ How to Dispose of Recyclable reduce garbage and reuse recyclable resources. Observe the following 3Rs to reduce garbage: Resources and Garbage ○ Reduce Reduce items that will become garbage. Shinjuku Waste Collection Office For example, do not buy unnecessary items. -

Special Feature on Libraries in Shinjuku City

No. 14 Publishing Date: September 25, 2008 Published by: Culture, Tourism and International Affairs Division, Region- al and Cultural Affairs Department, Shinjuku City Tel: 03-5273-3504 Fax: 03-3209-1500 1-4-1 Kabukicho, Shinjuku City, Tokyo 160-8484 Please make your inquiries in Japanese when calling the coordinating division. ShinjukuShinjuku MulticulturalMulticultural PlazaPlaza CelebratesCelebrates ItsIts ThirdThird AnniversaryAnniversary Shinjuku Multicultural Plaza (hereafter referred to as the “Plaza”), which opened in September 2005 as a place where Japanese and non-Japanese residents can have friendly exchanges, is celebrating its third anniversary. The plaza has welcomed visitors from 114 countries around the world, and in peak months, more than 2,000 peo- ple use this venue. Visitors can use the plaza for various purposes, including learning Japanese, using consultation services, and learning about the culture of other countries. Please feel free to drop by for a visit. Multipurpose Space Japanese Language Study Corner Besides Japanese language classes, International Ex- There are many teaching materials and textbooks change Salon is held on the 2nd Friday of the month. available here. Of course, you can study indepen- In addition, there are classes and seminars that introduce dently or receive help from volunteers of the Shin- the language and culture of various countries and areas. juku Nihongo (Japanese-language) Network (SNN) Why not tell everyone about the language and culture of on Monday, Tuesday, Thursday, and Saturday after- your country as well? noons. (Please call for more in- formation about the hours and program for a particular day of the week.) Dance performance by Peruvi- an children (at the Latin culture International Exchange Salon class) is bustling with participants ev- ery month.