Sustainability Report 2017 2 Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Comprehensive Annual Financial Report City Of

COMPREHENSIVE ANNUAL FINANCIAL REPORT of the CITY OF PALM DESERT, CALIFORNIA For the Fiscal Year Ended JUNE 30, 2008 Prepared by the Finance Department City Treasurer/Director of Finance Paul S. Gibson Assistant Finance Director Jose Luis Espinoza, CPA Finance Staff (in alphabetical order by positions and names) Accounting Technician II Deputy City Treasurer Information Systems James Bounds Thomas Jeffrey Technician Accounting Technician II Director of Information Ray Santos Horacio Celaya Systems Management Analyst Accounting Technician II Doug Van Gelder Jenny Barnes Sharon Christiansen G.I.S. Coordinator Office Assistant Accounting Technician II Robert Riches Vedrana Spasojevic Diana Leal G.I.S. Technician Office Assistant I Accounting Technician II John Urkov Cherie Thompson Barbara Wright Information Systems Senior Financial Analyst Administrative Secretary Analyst Anthony Hernandez Niamh Ortega Clay von Helf Sr. Office Assistant Business License Technician Information Systems Claudia Jaime Rob Bishop Technician Troy Kulas CITY OF PALM DESERT TABLE OF CONTENTS JUNE 30, 2008 Page Number INTRODUCTORY SECTION Table of Contents i Letter of Transmittal vii GFOA Certificate of Achievement for Excellence in Financial Reporting xii List of Principal Officials xiii Organization Chart xiv FINANCIAL SECTION AUDITORS' REPORT Independent Auditors' Report 1 MANAGEMENT’S DISCUSSION AND ANALYSIS 3 BASIC FINANCIAL STATEMENTS Exhibit A - Statement of Net Assets 15 Exhibit B - Statement of Activities 16 Exhibit C - Balance Sheet - Governmental Funds -

Home & Garden Issue

HOME & GARDEN ISSUE TeaPartySocietyMagazineNov09:Layout 1 9/30/09 11:16 AM Page 1 NATURALLY, YOU’LL WANT TO DO A LITTLE ENTERTAINING. Sometimes it’s the little moments that Septem matter most. Like when your children New d learn values that last a lifetime. Or laughter is shared for the sheer joy of it. That’s why families find it so easy to feel at home at Sherwood. Nestled in a lush valley of the Santa Monica Mountains, this gated country club community provides a sanctuary for gracious living and time well spent. Of course, with a respected address like Sherwood there may be times when you entertain on a grander scale, but it might just be the little parties that you remember most. For information about custom homesites available from $500,000, new residences offered from the high $1,000,000s or membership in Sherwood Lake Club please call 805-373-5992 or visit www.sherwoodcc.com. The Sherwood Lake Club is a separate country club that is not affiliated with Sherwood Country Club. Purchase of a custom homesite or new home does not include membership in Sherwood Country Club or Sherwood Lake Club or any rights to use private club facilities. Please contact Sherwood Country Club directly for any information on Sherwood Country Club. Prices and terms effective date of publication and subject to change without notice. CA DRE #01059113 A Community 2657-DejaunJewelers.qxd:2657-DejaunJewelers 1/6/10 2:16 PM Page 1 WHY SETTLE FOR LESS THAN PERFECTION The Hearts On Fire Diamond Engagement Ring set in platinum starting at $1,950 View our entire collection at heartsonfire.com Westfield Fashion Square | Sherman Oaks | 818.783.3960 North Ranch Mall | Westlake Village | 805.373.1002 The Oaks Shopping Center | Thousand Oaks | 805.495.1425 www.dejaun.com Welcome to the ultimate Happy Hour. -

Chapter 11 Case No. 21-10632 (MBK)

Case 21-10632-MBK Doc 249 Filed 04/06/21 Entered 04/06/21 16:21:35 Desc Main Document Page 1 of 92 UNITED STATES BANKRUPTCY COURT DISTRICT OF NEW JERSEY In re: Chapter 11 L’OCCITANE, INC., Case No. 21-10632 (MBK) Debtor. Judge: Hon. Michael B. Kaplan CERTIFICATE OF SERVICE I, Ana M. Galvan, depose and say that I am employed by Stretto, the claims and noticing agent for the Debtors in the above-captioned case. On April 2, 2021, at my direction and under my supervision, employees of Stretto caused the following documents to be served via first-class mail on the service list attached hereto as Exhibit A, and via electronic mail on the service list attached hereto as Exhibit B: Notice of Deadline for Filing Proofs of Claim Against the Debtor L’Occitane, Inc. (attached hereto as Exhibit C) [Customized] Official Form 410 Proof of Claim (attached hereto as Exhibit D) Official Form 410 Instructions for Proof of Claim (attached hereto as Exhibit E) Dated: April 6, 2021 /s/ Ana M. Galvan Ana M. Galvan STRETTO 410 Exchange, Suite 100 Irvine, CA 92602 Telephone: 855-434-5886 Email: [email protected] Case 21-10632-MBK Doc 249 Filed 04/06/21 Entered 04/06/21 16:21:35 Desc Main Document Page 2 of 92 Exhibit A Case 21-10632-MBK Doc 249 Filed 04/06/21 Entered 04/06/21 16:21:35 Desc Main Document Page 3 of 92 Exhibit A Served via First-Class Mail Name Attention Address 1 Address 2 Address 3 City State Zip Country 1046 Madison Ave LLC c/o HMH Realty Co., Inc., Rexton Realty Co. -

Silicon Valley Bank) 1\ M~Mt>Tr of SVB L'lrw~W Crwp Account Details Requested Date: From: 09/10/2015 To: 10/03/2015 Generated On: 10/15/2015

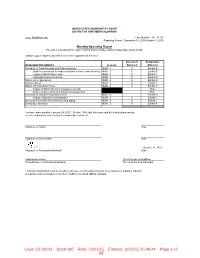

UNITED STATES BANKRUPTCY COURT DISTRICT OF NORTHERN CALIFORNIA In re: NewZoom, Inc. Case Number: 15 - 31141 Reporting Period: September 10, 2015-October 3, 2015 Monthly Operating Report File with Court and submit copy to United States Trustee within 20 days after end of month Submit copy of report to any official committee appointed in the case. Document Explanation REQUIRED DOCUMENTS Form No. Attached Attached Schedule of Cash Receipts and Disbursements MOR - 1 X Exhibit A Bank Reconciliation (or copies of debtor's bank reconciliation's) MOR - 1 X Exhibit B Copies of Bank Statements MOR - 1 X Exhibit C Cash disbursements journal MOR - 1 X Exhibit D Statement of Operations MOR - 2 X Exhibit E Balance Sheet MOR - 3 X Exhibit F Status of Postpetition Taxes MOR - 4 X Exhibit G Copies of IRS Form 6123 or payment receipt None Copies of tax returns filed during reporting period None Summary of Unpaid Postpetition Debts MOR - 4 Exhibit H Listing of aged accounts payable MOR - 4 X Exhibit I Accounts Receivable Reconciliation and Aging MOR - 5 X Exhibit J Debtor Questionnaire MOR - 5 X Exhibit K I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the attached documents are true and correct to the best of my knowledge and belief. Signature of Debtor Date Signature of Joint Debtor Date October 21, 2015 Signature of Authorized Individual* Date Andrew Hinkelman Chief Restructuring Officer Printed Name of Authorized Individual Title of Authorized Individual * Authorized individual must be an officer, director, or shareholder if debtor is a corporation; a partner if debtor is a partnership; a manager or member if debtor is a limited liability company. -

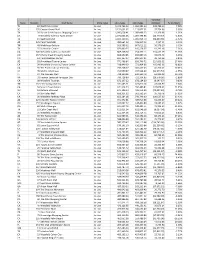

State Storeno Mall Name Store Type 2015 Sales 2014 Sales Variance

Variance State StoreNo Mall Name Store Type 2015 Sales 2014 Sales Inc/(Dec) % Inc/(Dec) TX 83 NorthPark Center In-Line 1,472,766.00 1,363,984.00 108,782.00 7.98% SC 135 Coastal Grand Mall In-Line 1,151,631.67 1,113,877.31 37,754.36 3.39% TX 20 Barton Creek Square Shopping Center In-Line 1,096,658.41 1,083,499.33 13,159.08 1.21% CA 8 Westfield Valencia Town Center In-Line 1,071,022.26 1,087,795.83 (16,773.57) -1.54% TX 19 Baybrook Mall In-Line 1,025,120.43 1,055,953.79 (30,833.36) -2.92% AZ 125 Park Place Mall In-Line 950,664.23 946,527.12 4,137.11 0.44% TN 48 Wolfchase Galleria In-Line 923,588.32 867,012.22 56,576.10 6.53% TX 55 Stonebriar Centre In-Line 876,800.55 815,558.37 61,242.18 7.51% CA 126 Westfield Galleria at Roseville In-Line 869,168.30 754,757.11 114,411.19 15.16% CO 167 Cherry Creek Shopping Center In-Line 868,959.85 835,887.13 33,072.72 3.96% CO 61 Park Meadows Center In-Line 831,157.07 800,397.91 30,759.16 3.84% AZ 28 Arrowhead Towne Center In-Line 771,406.64 656,746.72 114,659.92 17.46% CA 39 Westfield University Towne Center In-Line 738,949.33 573,464.00 165,485.33 28.86% CA 35 The Promenade at Temecula In-Line 733,268.27 666,557.65 66,710.62 10.01% KY 78 Mall St. -

The Bay Area-Silicon Valley and Australia an Expanding Trans-Pacific Partnership

The Bay Area-Silicon Valley and Australia An Expanding Trans-Pacific Partnership December 2020 Acknowledgments This report was developed in partnership with the Odette Hampton, Trade and Investment Commissioner American Chamber of Commerce in Australia, with and Deputy Consul General, Australian Trade and support from Cisco, Google, Lendlease, Salesforce, Investment Commission (Austrade) Telstra, University of Technology Sydney, and Wipro. Joe Hockey, Founding Partner and President, Bondi Development of the project was led by Sean Randolph, Partners, Australian Ambassador to the US, 2016–2020 Senior Director at the Bay Area Council Economic Institute. Neils Erich, a consultant to the Institute, Vikas Jain, Asia-Pacific Business Head for Engineering, was co-author. The Institute wishes to thank April Construction and Mining, Wipro Palmerlee, Chief Executive Officer of the American Claire Johnston, Managing Director, Google Chamber of Commerce in Australia, for her support Development Ventures, Lendlease throughout this effort and the following individuals for Joe Kaesshaefer, Trade and Investment Commissioner– their valuable input: USA, Department of Industry, New South Wales Jeff Bleich, Chief Legal Officer, Cruise, US Ambassador Michael Kapel, Trade and Investment Commissioner to to Australia 2009–2013 the Americas in San Francisco, Government of Victoria Michael Blumenstein, Associate Dean, Research Damian Kassabgi, Executive Vice President, Public Strategy and Management, Faculty of Engineering Policy and Communications, Afterpay and -

San Diego's Mid-Century Modern Marvels

SAVE OUR HERITAGE ORGANISATION PRESENTS SAN DIEGO’S MID-CENTURY MODERN MARVELS INTRODUCTION As we advance into the 2020s, 20th-century Modern architecture is having a renaissance. Not only is the style rising in popularity, but Mid-Century designs are reaching a level of maturity that qualifies many for historic designation and a higher level of recognition and importance. This self-guided driving tour will take you from North Park, Mission Valley, and Hillcrest to the coast with stops in Point Loma, Shelter Island, and La Jolla to see some of San Diego’s most marvelous Mid-Century Modern buildings. Built from the years 1949 to 1977, the movement’s end in the 1970s, these designs showcase the work of many of San Diego’s leading Modernist architects, including Lloyd Ruocco, Robert Mosher, and William Krisel. While this tour is limited to public buildings and represents only a dozen of the Mid-Century sites worthy of recognition and study, we hope it offers a taste of the diversity of Mid-Century Modern designs and their place in San Diego’s development. MAP Click below on this image to be redirected to an interactive Google Map that will help guide you to each of the 12 sites on the tour. 1. Rudford’s Restaurant, 1949 Photos by Sandé Lollis Photo by James Daigh 2900 El Cajon Boulevard A signature El Cajon Boulevard landmark, Rudford’s Restaurant has been in operation since 1949. The sleek modern design features oval porthole style windows and original neon signage. El Cajon Boulevard is historically significant as a commercial strip known for its neon, and Rudford’s is a key example of this mid-century neighborhood development. -

2020 Tax Return Guide

2020 Tax Return Guide Westfield Newmarket, NZ — Scentre Group Limited ABN 66 001 671 496 Scentre Management Limited ABN 41 001 670 579 AFS Licence 230329 as responsible entity of Scentre Group Trust 1 ABN 55 191 750 378 ARSN 090 849 746 RE1 Limited ABN 80 145 743 862 AFS Licence 380202 as responsible entity of Scentre Group Trust 2 ABN 66 744 282 872 ARSN 146 934 536 RE2 Limited ABN 41 145 744 065 AFS Licence 380203 as responsible entity of Scentre Group Trust 3 ABN 11 517 229 138 ARSN 146 934 652 This document does not constitute financial product or investment advice, and, in particular, it is not intended to influence you in making a decision in relation to financial products including Scentre Group Stapled Securities. You should obtain professional advice before taking any action in relation to this document, for example from your accountant, taxation or other professional adviser. About this Guide This 2020 Tax Return Guide (“Guide”) has been prepared to assist Australian resident individual securityholders to complete their 2020 Australian income tax return. This Guide provides general information Section 1 Important Information for only. Accordingly, this Guide should not be relied upon as taxation Australian Resident Individual advice. Each securityholder’s particular circumstances are different and we recommend you contact your accountant, taxation or other Securityholders Completing professional adviser for specific advice. a 2020 Tax Return This Tax Return Guide has two sections: General information - Scentre Group Scentre Group is a stapled group that comprises the following four Section 1 Provides information to assist entities: Australian resident individual - Scentre Group Limited (“SGL”) securityholders complete - Scentre Group Trust 1 (“SGT1”) their 2020 Australian income - Scentre Group Trust 2 (“SGT2”) tax return. -

2014 PRINT NAREIT Annual Report Layout 1

REITWay NAREIT’s Annual Report 2013 In Review & 2014 A Look Ahead National Association of Real Estate Investment Trusts® REITs: Building Dividends & Diversification® 2014 REITWay NAREIT’s Annual Report 2 To Our Members The past year was active for NAREIT as we Stock Exchange-Listed took the REIT story to all of our industry’s REIT Capital Offerings, 2013 audiences. This 2014 issue of REITWay: IPOs NAREIT’S Annual Report re-caps some of what Secured and we accomplished on the REIT industry’s behalf Unsecured Debt $5.71 billion during the year. $30.74 billion Policy & Politics Secondary Total: In the Policy and Politics area, we began the Equity year with a highly effective Washington $40.51 billion $76.96 billion Leadership Forum. Our industry’s leaders climbed Capitol Hill to provide legislators and their staffs with a better understanding of the REIT investment proposition, including its history, the REITs in today’s mortgage finance marketplace, to the impact of important functions REITs play in investment portfolios, their rising interest rates on REIT total returns. We also continued to channeling of capital to the real estate industry, and their role upgrade and expand our REIT.com online platform and our other creating jobs and economic growth. digital properties. Over the course of the year, our Policy & Politics team provided Additionally, we conducted a full schedule of successful constructive input to the ongoing discussion on tax reform, conference events for our members, including our major including input to the House Ways and Means Committee and investor conferences, REITWeek and REITWorld. -

Storeno State Mall Name FBC Store Type YTD Sales # Units Sold

Dec-19 StoreNo State Mall Name FBC Store Type YTD Sales # Units Sold # Receipts Units/Receipt Avg $ Receipt 1 CA The Shops at Mission Viejo Sam Guagliardo In-Line 579,475.02 12,413 10,379 1.20 $55.83 2 FL Dadeland Mall Chris Canada Kiosk 330,047.29 8,743 6,763 1.29 $48.80 4 FL Coconut Point Chris Canada In-Line 271,663.12 6,748 4,911 1.37 $55.32 5 PA Ross Park Mall Chris Canada In-Line 566,328.52 19,179 12,353 1.55 $45.85 6 CA South Bay Galleria Sam Guagliardo In-Line 216,941.59 5,432 4,355 1.25 $49.81 7 CT Westfield Trumbull Chris Canada Kiosk 279,730.18 16,039 11,910 1.35 $23.49 8 CA Westfield Valencia Town Center Sam Guagliardo In-Line 1,236,192.29 12,843 9,950 1.29 $124.24 9 PA Millcreek Mall Chris Canada In-Line 413,278.37 11,326 8,633 1.31 $47.87 10 CA The Mall of Victor Valley Sam Guagliardo Kiosk 396,509.02 11,596 8,639 1.34 $45.90 11 CA Antelope Valley Mall Sam Guagliardo In-Line 437,148.76 10,733 8,811 1.22 $49.61 12 FL Altamonte Mall Chris Canada In-Line 302,632.40 7,629 6,833 1.12 $44.29 13 NM Cottonwood Mall David Holland In-Line 139,928.50 5,898 4,006 1.47 $34.93 14 NM Coronado Center David Holland Kiosk 443,210.18 19,211 13,753 1.40 $32.23 15 FL The Falls Chris Canada In-Line 258,320.20 5,906 4,499 1.31 $57.42 16 FL Edison Mall Chris Canada Kiosk 354,239.65 12,014 9,353 1.28 $37.87 17 FL Boynton Beach Mall Chris Canada In-Line 18 FL Melbourne Square Mall Chris Canada Kiosk 315,866.19 7,161 5,834 1.23 $54.14 19 TX Baybrook Mall David Holland In-Line 980,316.56 18,848 14,975 1.26 $65.46 20 TX Barton Creek Square Shopping -

Seritage Growth Properties

ANNUAL REPORT 2019 ANNUAL REPORT 2019 Our Mission Create and own revitalized shopping, dining, entertainment and mixed-use destinations that provide enriched experiences for consumers and local communities, and that generate long-term value for our shareholders. Seritage Growth Properties is a publicly-traded, self-administered and self-managed REIT with 180 wholly-owned properties and 28 joint venture properties totaling approximately 30 million square feet of space across 44 states and Puerto Rico. ANNUAL REPORT 2019 Dear Fellow Shareholders We will get through this. We are focused on preserving the medium and long-term value of our assets and platform, balanced with the need to make immediate changes in response to the current environment. As this letter goes to print, we are in the midst of the COVID-19 pandemic, which has created significant uncertainty and volatility and put a pause on normal daily life. Our number one priority is the health and safety of our team, our families and loved ones, our communities and our partners, including our tenants, contractors, and other stakeholders. To you, our shareholders, we hope this letter finds that all is well with each of you and your families. I am very proud of our team. In the face of intense disruption, our team has met our business challenges head on while also balancing responsibilities at home. On the civic front, we want to widely broadcast that over 180 of our properties (certain full buildings and many of our parking lots) are available to governmental and community organizations for relief efforts. Please visit www.seritage.com/civic or email us at [email protected] to utilize these facilities at no cost. -

Presentation of the Group PDF 603KB

2 Universal Registration Document 2020 / UNIBAIL-RODAMCO-WESTFIELD Presentation of the Group Presentation of the Group 1.1 KEY FACTS 3 1.2 HISTORY 4 1.3 STRATEGY AND BUSINESS MODEL 6 1.4 BUSINESS OVERVIEW 12 Business segments 12 Portfolio breakdown 13 Development pipeline 15 CHAPTER 1.5 PORTFOLIO 16 1.5.1 France: Shopping Centres 16 1.5.2 France: Convention & Exhibition 18 1.5.3 France: Offices 19 1.5.4 Central Europe: Shopping Centres 20 1.5.5 Central Europe: Offices 21 1.5.6 Spain: Shopping Centres 21 1.5.7 Spain: Offices 21 1.5.8 Nordics: Shopping Centres 22 1.5.9 Nordics: Offices 22 1.5.10 Austria: Shopping Centres 23 1.5.11 Austria: Offices 23 1.5.12 Germany: Shopping Centres 24 1.5.13 Germany: Offices 24 1.5.14 The Netherlands: Shopping Centres 25 1.5.15 The Netherlands: Offices 25 1.5.16 United States: Shopping Centres 26 1.5.17 United States: Offices 28 1.5.18 United Kingdom: Shopping Centres 29 1.5.19 United Kingdom: Offices 29 1.6 OVERVIEW OF VALUATION REPORTS PREPARED BY UNIBAIL-RODAMCO-WESTFIELD’S INDEPENDENT EXTERNAL APPRAISERS FOR EUROPEAN ASSETS 30 1.7 OVERVIEW OF VALUATION REPORTS PREPARED BY UNIBAIL-RODAMCO-WESTFIELD’S INDEPENDENT EXTERNAL APPRAISERS FOR AMERICAN ASSETS 32 1.8 STRUCTURE 34 1.9 SIMPLIFIED GROUP ORGANISATIONAL CHART 35 Universal Registration Document 2020 / UNIBAIL-RODAMCO-WESTFIELD 3 Presentation of the Group Key facts 1.1 KEY FACTS 1. 87 16 OFFICES & OTHERS SHOPPING CENTRES BUILDINGS(1) 10 80% CONVENTION & EXHIBITION COLLECTION RATE(3) VENUES(2) 247 ~3,100 COVID-19 ESG INITIATIVES EMPLOYEES €1,790 Mn €7.28 ADJUSTED RECURRING NET RENTAL INCOME EARNINGS PER SHARE €2.3 Bn €56.3 Bn DISPOSALS(4) GROSS MARKET VALUE €166.8 €4.4 Bn EPRA NET REINSTATEMENT PIPELINE VALUE PER SHARE (1) Only standalone offices > 10,000 sqm and offices affixed to a shopping centre > 15,000 sqm, including La Vaguada offices.