Comprehensive Annual Financial Report City Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chapter 11 Case No. 21-10632 (MBK)

Case 21-10632-MBK Doc 249 Filed 04/06/21 Entered 04/06/21 16:21:35 Desc Main Document Page 1 of 92 UNITED STATES BANKRUPTCY COURT DISTRICT OF NEW JERSEY In re: Chapter 11 L’OCCITANE, INC., Case No. 21-10632 (MBK) Debtor. Judge: Hon. Michael B. Kaplan CERTIFICATE OF SERVICE I, Ana M. Galvan, depose and say that I am employed by Stretto, the claims and noticing agent for the Debtors in the above-captioned case. On April 2, 2021, at my direction and under my supervision, employees of Stretto caused the following documents to be served via first-class mail on the service list attached hereto as Exhibit A, and via electronic mail on the service list attached hereto as Exhibit B: Notice of Deadline for Filing Proofs of Claim Against the Debtor L’Occitane, Inc. (attached hereto as Exhibit C) [Customized] Official Form 410 Proof of Claim (attached hereto as Exhibit D) Official Form 410 Instructions for Proof of Claim (attached hereto as Exhibit E) Dated: April 6, 2021 /s/ Ana M. Galvan Ana M. Galvan STRETTO 410 Exchange, Suite 100 Irvine, CA 92602 Telephone: 855-434-5886 Email: [email protected] Case 21-10632-MBK Doc 249 Filed 04/06/21 Entered 04/06/21 16:21:35 Desc Main Document Page 2 of 92 Exhibit A Case 21-10632-MBK Doc 249 Filed 04/06/21 Entered 04/06/21 16:21:35 Desc Main Document Page 3 of 92 Exhibit A Served via First-Class Mail Name Attention Address 1 Address 2 Address 3 City State Zip Country 1046 Madison Ave LLC c/o HMH Realty Co., Inc., Rexton Realty Co. -

Silicon Valley Bank) 1\ M~Mt>Tr of SVB L'lrw~W Crwp Account Details Requested Date: From: 09/10/2015 To: 10/03/2015 Generated On: 10/15/2015

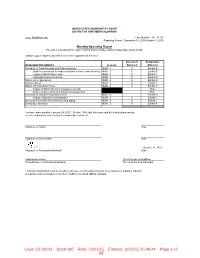

UNITED STATES BANKRUPTCY COURT DISTRICT OF NORTHERN CALIFORNIA In re: NewZoom, Inc. Case Number: 15 - 31141 Reporting Period: September 10, 2015-October 3, 2015 Monthly Operating Report File with Court and submit copy to United States Trustee within 20 days after end of month Submit copy of report to any official committee appointed in the case. Document Explanation REQUIRED DOCUMENTS Form No. Attached Attached Schedule of Cash Receipts and Disbursements MOR - 1 X Exhibit A Bank Reconciliation (or copies of debtor's bank reconciliation's) MOR - 1 X Exhibit B Copies of Bank Statements MOR - 1 X Exhibit C Cash disbursements journal MOR - 1 X Exhibit D Statement of Operations MOR - 2 X Exhibit E Balance Sheet MOR - 3 X Exhibit F Status of Postpetition Taxes MOR - 4 X Exhibit G Copies of IRS Form 6123 or payment receipt None Copies of tax returns filed during reporting period None Summary of Unpaid Postpetition Debts MOR - 4 Exhibit H Listing of aged accounts payable MOR - 4 X Exhibit I Accounts Receivable Reconciliation and Aging MOR - 5 X Exhibit J Debtor Questionnaire MOR - 5 X Exhibit K I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the attached documents are true and correct to the best of my knowledge and belief. Signature of Debtor Date Signature of Joint Debtor Date October 21, 2015 Signature of Authorized Individual* Date Andrew Hinkelman Chief Restructuring Officer Printed Name of Authorized Individual Title of Authorized Individual * Authorized individual must be an officer, director, or shareholder if debtor is a corporation; a partner if debtor is a partnership; a manager or member if debtor is a limited liability company. -

Seritage Growth Properties

ANNUAL REPORT 2019 ANNUAL REPORT 2019 Our Mission Create and own revitalized shopping, dining, entertainment and mixed-use destinations that provide enriched experiences for consumers and local communities, and that generate long-term value for our shareholders. Seritage Growth Properties is a publicly-traded, self-administered and self-managed REIT with 180 wholly-owned properties and 28 joint venture properties totaling approximately 30 million square feet of space across 44 states and Puerto Rico. ANNUAL REPORT 2019 Dear Fellow Shareholders We will get through this. We are focused on preserving the medium and long-term value of our assets and platform, balanced with the need to make immediate changes in response to the current environment. As this letter goes to print, we are in the midst of the COVID-19 pandemic, which has created significant uncertainty and volatility and put a pause on normal daily life. Our number one priority is the health and safety of our team, our families and loved ones, our communities and our partners, including our tenants, contractors, and other stakeholders. To you, our shareholders, we hope this letter finds that all is well with each of you and your families. I am very proud of our team. In the face of intense disruption, our team has met our business challenges head on while also balancing responsibilities at home. On the civic front, we want to widely broadcast that over 180 of our properties (certain full buildings and many of our parking lots) are available to governmental and community organizations for relief efforts. Please visit www.seritage.com/civic or email us at [email protected] to utilize these facilities at no cost. -

Radio Shack Closing Locations

Radio Shack Closing Locations Address Address2 City State Zip Gadsden Mall Shop Ctr 1001 Rainbow Dr Ste 42b Gadsden AL 35901 John T Reid Pkwy Ste C 24765 John T Reid Pkwy #C Scottsboro AL 35768 1906 Glenn Blvd Sw #200 - Ft Payne AL 35968 3288 Bel Air Mall - Mobile AL 36606 2498 Government Blvd - Mobile AL 36606 Ambassador Plaza 312 Schillinger Rd Ste G Mobile AL 36608 3913 Airport Blvd - Mobile AL 36608 1097 Industrial Pkwy #A - Saraland AL 36571 2254 Bessemer Rd Ste 104 - Birmingham AL 35208 Festival Center 7001 Crestwood Blvd #116 Birmingham AL 35210 700 Quintard Mall Ste 20 - Oxford AL 36203 Legacy Marketplace Ste C 2785 Carl T Jones Dr Se Huntsville AL 35802 Jasper Mall 300 Hwy 78 E Ste 264 Jasper AL 35501 Centerpoint S C 2338 Center Point Rd Center Point AL 35215 Town Square S C 1652 Town Sq Shpg Ctr Sw Cullman AL 35055 Riverchase Galleria #292 2000 Riverchase Galleria Hoover AL 35244 Huntsville Commons 2250 Sparkman Dr Huntsville AL 35810 Leeds Village 8525 Whitfield Ave #121 Leeds AL 35094 760 Academy Dr Ste 104 - Bessemer AL 35022 2798 John Hawkins Pky 104 - Hoover AL 35244 University Mall 1701 Mcfarland Blvd #162 Tuscaloosa AL 35404 4618 Hwy 280 Ste 110 - Birmingham AL 35243 Calera Crossing 297 Supercenter Dr Calera AL 35040 Wildwood North Shop Ctr 220 State Farm Pkwy # B2 Birmingham AL 35209 Center Troy Shopping Ctr 1412 Hwy 231 South Troy AL 36081 965 Ann St - Montgomery AL 36107 3897 Eastern Blvd - Montgomery AL 36116 Premier Place 1931 Cobbs Ford Rd Prattville AL 36066 2516 Berryhill Rd - Montgomery AL 36117 2017 280 Bypass -

Mission Valley

MISSION VALLEY GERMANY CentrO - Oberhausen Gera Arcaden - Gera Gropius Passagen - Berlin Höfe am Brühl - Leipzig Minto - Mönchengladbach Palais Vest - Recklinghausen Pasing Arcaden - Munich Paunsdorf Center - Leipzig OUR PORTFOLIO Ring-Center - Berlin Ruhr Park - Bochum Westfield Hamburg- Überseequartier - Hamburg THE NETHERLANDS Citymall Almere - Almere SWEDEN Westfield Mall of Greater Stockholm the Netherlands - Leidschendam Westfield Mall of Scandinavia Stadshart Amstelveen - Amstelveen Nacka Forum SEATTLE Stadshart Zoetermeer - Zoetermeer Solna Centrum Westfield Southcenter Täby Centrum POLAND SAN FRANCISCO AREA Warsaw Westfield Galleria at Roseville UNITED KINGDOM DENMARK Westfield Arkadia Westfield Oakridge CHICAGO London Copenhagen Centrum Ursynów Westfield San Francisco Centre Westfield Old Orchard Westfield Stratford City Fisketorvet Galeria Mokotów Westfield Valley Fair Chicago O’Hare International CONNECTICUT Croydon Galeria Wileńska Westfield Meriden Westfield London Złote Tarasy Westfield Trumbull Wrocław Wroclavia BELGIUM Brussels CZECH REPUBLIC Mall of Europe Prague SLOVAKIA Westfield Chodov NEW YORK AREA Bratislava Bubny Westfield Garden State Plaza Aupark Centrum Černý Most Metropole Zličín Westfield South Shore ITALY Westfield Sunrise Milan Westfield World Trade Center Westfield Milano JFK International AUSTRIA Newark Liberty International Vienna Donau Zentrum Shopping City Süd WASHINGTON D.C. AREA Westfield Annapolis Westfield Montgomery Westfield Wheaton SPAIN FRANCE UNITED STATES Benidorm - Benidorm Westfield Carré Sénart - Greater Paris -

Westfield Corporation Annual Financial Report 31 December 2014 WESTFIELD CORPORATION 31 ANNUAL FINANCIAL REPORT DECEMBER 2014

Westfield Corporation Annual Financial Report 31 December 2014 WESTFIELD CORPORATION WESTFIELD ANNUAL FINANCIAL REPORT 31 DECEMBER 2014DECEMBER Westfield Corporation Limited ABN 12 166 995 197 WorldReginfo - affa2c63-531d-4428-8985-53744410b2e9 Annual Financial Report WESTFIELD CORPORATION (1) For the Financial Year ended 31 December 2014 Contents 1 Directors’ Report 32 Independent Audit Report 33 Income Statement 34 Statement of Comprehensive Income 35 Balance Sheet 36 Statement of Changes in Equity 37 Cash Flow Statement 38 Notes to the Financial Statements 89 Directors’ Declaration 90 Corporate Governance Statement 102 Investor Relations 104 Members’ Information IBC Directory (1) Westfield Corporation comprises Westfield Corporation Limited and its controlled entities as defined in Note 2. WorldReginfo - affa2c63-531d-4428-8985-53744410b2e9 Directors’ Report The Directors of Westfield Corporation Limited Company( ) submit the following report for the period from 1 July 2014 to 31 December 2014. 1. OPERATIONS AND ACTIVITIES 1.1 Review of Operations, Business Strategy and Drivers We are pleased to report on the inaugural results for Westfield Corporation (theGroup ) for the six months ended 31 December 2014. In June 2014 the Westfield Group successfully implemented the restructure and merger to create two new independent companies (the Restructure). The Group was created to own and manage the Westfield Group’s business in the United States and United Kingdom / Europe, while Scentre Group was created to own and manage Westfield’s Australian and New Zealand shopping centres. The combined market capitalisation of Westfield Corporation and Scentre Group is currently over A$41 billion, representing A$12 billion of value creation for securityholders of the Westfield Group and Westfield Retail Trust who participated in the Restructure. -

Comprehensive General Plan

CITY OF PALM DESERT COMPREHENSIVE GENERAL PLAN Adopted March 15, 2004 Prepared By Community Development Department City of Palm Desert 73-510 Fred Waring Drive Palm Desert, CA 92260 and Terra Nova Planning & Research, Inc.® 400 South Farrell Dr., Suite B-205 Palm Springs, CA 92262 City of Palm Desert Riverside County, California COMPREHENSIVE GENERAL PLAN CITY COUNCIL Mayor Council Members Mayor Pro-Tempore Jean M. Benson Buford A. Crites Robert A. Spiegel Jim Ferguson Richard S. Kelly PLANNING COMMISSION Sonia Campbell, Chair Sabby Jonathan, Vice Chair Cynthia Finerty Jim Lopez Dave Tschopp GENERAL PLAN ADVISORY COMMITTEE Jean M. Benson, Chair Tim Bartlett Dr. Bill Kroonen Richard S. Kelly, Vice Chair Dick Baxley Bob Leo Leon Bennett Kurt Leuschner Jim Butzbach Jim Lewis Sonia Campbell Rick Post Roger Dash Tim Sullivan Cynthia Finerty Van Tanner Dennis Guinaw Maureen Thompson Aurora Kerr John Vuksic Phil Drell Community Development Director Terra Nova ® Planning & Research, Inc. 400 South Farrell Drive, Suite B-205 Palm Springs, CA 92262 Adopted March 15, 2000 ii City of Palm Desert/Adopted 3.15.04 Comprehensive General Plan/Table of Contents CITY OF PALM DESERT COMPREHENSIVE GENERAL PLAN TABLE OF CONTENTS Page I. INTRODUCTION TO THE GENERAL PLAN Introduction I-1 II. ADMINISTRATION AND IMPLEMENTATION Administration Element II-1 III. COMMUNITY DEVELOPMENT A. Land Use Element III-1 B. Circulation Element III-42 C. Housing Element III-85 D. Parks and Recreation Element III-114 E. Community Design Element III-135 F. Arts and Culture Element III-156 F. Economic and Fiscal Element III-176 IV. ENVIRONMENTAL RESOURCES ELEMENT A. -

Store Address City State Zip Muscle Beach - S.M

Store Address City State Zip Muscle Beach - S.M. 1633 Ocean Front Santa Monica CA 90401 Westfield Fox Hills 6000 S. Sepulveda Blvd #2286 Culver City CA 90230 Santa Maria Town Center 197 Santa Maria Town Center East Santa Maria CA 93454 Westfield Parkway 713 Parkway Plaza El Cajon CA 92020 Glendale Galleria 1146 Glendale Galleria Glendale CA 91210 Vintage Fair Maill 3401 Dale Road, #443 Modesto CA 95356 Puente Hills Mall 1600 S. Azusa Avenue, Unit #169G City Of Industry CA 91748-1617 The Oaks Shopping Center 382 W. Hillcrest Drive, Suite 6 Thousand Oaks CA 91360 The Shops at Mission Viejo 1005 The Shops at Mission Viejo, Sp. VC-05 Mission Viejo CA 92691 South Bay Pavilion at Carson 463 Carson Mall Carson CA 90746 Westfield Plaza Bonita 3030 Plaza Bonita Road, Space FC-9 National City CA 91950 Santa Rosa Plaza 2103 Santa Rosa Plaza Santa Rosa CA 95401 Serramonte Center 80-B Serramonte Center Daly City CA 94015 Brea Mall 2153 Brea Mall Brea CA 92821 Westfield Palm Desert 72-840 Highway 111, Space 357 Palm Desert CA 92260 The Galleria at South Bay 1815 Hawthorne Boulevard, #309 Redondo Beach CA 90278 Southland Mall 13 Southland Mall Dr. Hayward CA 94545 Montebello Town Center 1644 Montebello Town Center Montebello CA 90640 Montclair Plaza 2022 Montclair Plaza Lane Montclair CA 91763 Fashion Fair Mall 521 East Shaw Avenue, #101 Fresno CA 93710 Westfield North County 200 Via Rancho Parkway, Space #435 Escondido CA 92025 Los Cerritos Center 121 Los Cerritos Center Cerritos CA 90703 NewPark Mall #2073 NewPark Mall Newark CA 94560 The Mall at Victor -

1 List of Group's Standing Assets 1. France: Shopping

LIST OF GROUP’S STANDING ASSETS 1. FRANCE: SHOPPING CENTRES GLA of Portfolio as at Dec. 31, 2020 the whole complex Consolidation method1 (sqm) SHOPPING CENTRES IN THE PARIS REGION Westfield Carré Sénart (Lieusaint) 155,500 FC Westfield Les 4 Temps (La Défense) 142,000 FC Westfield Parly 2 (Le Chesnay) 129,800 FC Westfield Vélizy 2 (Vélizy-Villacoublay) 124,300 FC Westfield Rosny 2 (Rosny-sous-Bois) 114,500 FC & EM-JV Aéroville (Roissy-en-France) 84,900 EM-A Westfield Forum des Halles (Paris 1) 75,700 FC So Ouest (Levallois-Perret) 56,900 EM-A Ulis 2 (Les Ulis) 54,200 FC CNIT (La Défense) 28,400 FC L'Usine Mode & Maison (Vélizy-Villacoublay) 21,100 FC Carrousel du Louvre (Paris 1) 13,500 FC Les Ateliers Gaîté2 (Paris 14) n.a FC SHOPPING CENTRES IN THE FRENCH PROVINCES La Part-Dieu (Lyon) 156,400 FC La Toison d’Or (Dijon) 78,700 EM-A Polygone Riviera (Cagnes-sur-Mer) 75,200 FC Westfield Euralille (Lille) 67,700 FC Villeneuve 2 (Villeneuve-d'Ascq) 56,600 FC Rennes Alma (Rennes) 55,700 EM-A Confluence (Lyon) 53,900 EM-A La Valentine (Marseille) 39,500 FC OTHER ASSETS Bel-Est (Bagnolet) 48,800 FC Aquaboulevard (Paris) 38,400 FC Maine Montparnasse (Paris) 35,500 FC Villabé (Corbeil) 35,300 FC Go Sport (Saintes) 2,500 FC 1 FC = Fully Consolidated; EM-JV = Joint Venture under the equity method; EM-A = Associates under the equity method; JO = Joint Operation. 2 Under redevelopment. 1 2. FRANCE: OFFICES & OTHERS Total floor space Portfolio as at Dec. -

Desert Hills Premium Outlets® the Simon Experience — Where Brands & Communities Come Together

DESERT HILLS PREMIUM OUTLETS® THE SIMON EXPERIENCE — WHERE BRANDS & COMMUNITIES COME TOGETHER More than real estate, we are a company of experiences. For our guests, we provide distinctive shopping, dining and entertainment. For our retailers, we offer the unique opportunity to thrive in the best retail real estate in the best markets. From new projects and redevelopments to acquisitions and mergers, we are continuously evaluating our portfolio to enhance the Simon experience - places where people choose to shop and retailers want to be. We deliver: SCALE Largest global owner of retail real estate including Malls, Simon Premium Outlets® and The Mills® QUALITY Iconic, irreplaceable properties in great locations INVESTMENT Active portfolio management increases productivity and returns GROWTH Core business and strategic acquisitions drive performance EXPERIENCE Decades of expertise in development, ownership, and management That’s the advantage of leasing with Simon. PROPERTY OVERVIEW DESERT HILLS PREMIUM OUTLETS® CABAZON, CA MAJOR METROPOLITAN AREAS SELECT TENANTS Palm Springs: 18 miles east Neiman Marcus Last Call, Saks Fifth Avenue OFF 5TH, Armani DESERT HILLS Los Angeles: 75 miles west Outlet, Barneys New York Warehouse, Bottega Venetta, Brunello 15 PREMIUM OUTLETS Cucinelli, Burberry, Coach, Diane von Furstenberg, Diesel, Dolce & Los Angeles San Bernardino CABAZON, CA RETAIL Gabbana, Elie Tahari Outlet, Ermenegildo Zegna Outlet Store, Furla, Gucci, Helmut Lang, HUGO BOSS Factory Store, James Perse, Malki Rd. Jimmy Choo, kate spade new -

The Premier Global Developer and Operator of Flagship Shopping Destinations

THE PREMIER GLOBAL DEVELOPER AND OPERATOR OF FLAGSHIP SHOPPING DESTINATIONS 02 03 “Unibail-Rodamco-Westfield builds on June 2018: Unibail-Rodamco-Westfield is born. Unibail-Rodamco’s established leadership in Our ambition: to lead the industry as the premier global developer Europe and operational excellence and on Westfield’s development and investment and operator of flagship shopping destinations. expertise and its famous brand. As the Unibail-Rodamco-Westfield brings together two leaders in the retail world’s premier developer and operator of flagship shopping destinations, property industry, Unibail-Rodamco and Westfield. Thanks to their Unibail-Rodamco-Westfield is the must have combined strengths, Unibail-Rodamco-Westfield offers the best partner for international retailers and brands platform for retailers in the most dynamic cities in Europe across Europe and select markets in the United States. With an unparalleled and in the United States. track-record and know-how in retail, offices With the largest development pipeline and its best-in-class and convention & exhibition, CHRISTOPHE CUVILLIER, GROUP CHIEF EXECUTIVE OFFICER Unibail-Rodamco-Westfield is ideally management, Unibail-Rodamco-Westfield will deploy its vision positioned to develop world-class projects. for the future of retail in shopping centres and airports, for offices As one Group, our ambition is to create better places together and deliver superior and for convention & exhibition venues in 13 countries. — performance.” — KEY DATES q We concentrate on the best assets in q We offer the best customer experience 1959: John Saunders and 1977: Westfield enters 2011: Europe’s largest 2017: Unibail-Rodamco the world’s most dynamic cities. -

Attorney Or Party Name, Address, Telephone & Fax Numbers, And

Case 2:17-bk-17292-VZ Doc 204 Filed 10/30/17 Entered 10/30/17 12:05:44 Desc Main Document Page 1 of 77 Attorney or Party Name, Address, Telephone & FAX FOR COURT USE ONLY Nos., State Bar No. & Email Address TIMOTHY J. YOO (SBN 155531) EVE H. KARASIK (SBN 155356) JULIET Y. OH (SBN 211414) LEVENE, NEALE, BENDER, YOO & BRILL L.L.P. 10250 Constellation Boulevard, Suite 1700 Los Angeles, California 90067 Telephone: (310) 229-1234 Facsimile: (310) 229-1244 Email: [email protected]; [email protected]; [email protected] Attorney for: Chapter 11 Debtor and Debtor in Possession UNITED STATES BANKRUPTCY COURT CENTRAL DISTRICT OF CALIFORNIA – LOS ANGELES DIVISION In re: CASE NO.: 2:17-bk-17292-VZ CORNERSTONE APPAREL, INC., d/b/a Papaya Clothing, CHAPTER: 11 Debtor. DISCLOSURE STATEMENT AND PLAN OF REORGANIZATION OF A DEBTOR WHO IS NOT AN INDIVIDUAL [11 U.S.C. §§ 1123, 1125] Initial Disclosure Statement and Plan 1st Amended Disclosure Statement and Plan For information on court hearings, Debtor(s). see the separately filed notice(s) of hearing. On June 15, 2017, the Debtor filed a voluntary bankruptcy petition under Chapter 11 of the Bankruptcy Code (“Code"). This form Disclosure Statement and Plan of Reorganization (“DS and Plan”) is both the Disclosure Statement (“DS”) and the Plan of Reorganization (“Plan”). PROPONENT: The party who filed the DS and Plan (“Proponent”) is: Debtor, or . PLAN: The terms of the Plan, located at Sections VIII – X, comply with the requirements of 11 U.S.C. § 1123, including the proposed treatment of claims of the Debtor’s creditors and, if applicable, the interests of shareholders or partners.