TOP TRENDS in FRESH FOODS Connected Consumer and Personalization Webinar 4 of 5

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Stimulating Supermarket Development in Maryland

STIMULATING SUPERMARKET DEVELOPMENT IN MARYLAND A report of the Maryland Fresh Food Retail Task Force Task Force Baltimore Development Maryland Department of Maryland Family Network Safeway Inc. Members Corporation Agriculture Linda Ramsey, Deputy Director Greg Ten Eyck, Director of Public Will Beckford, Executive Director Joanna Kille, Director of of Family Support Affairs and Government Relations of Commercial Revitalization Government Relations Margaret Williams, Executive (Task force co-chair) Advocates for Children Kristen Mitchell, Senior Economic Mark Powell, Chief of Marketing Director and Youth Development Officer and Agribusiness Development Santoni’s Super Market Becky Wagner, Executive Director Leon Pinkett, Senior Economic Maryland Food Bank Rob Santoni, Owner (Task force co-chair and Development Officer Maryland Department of Deborah Flateman, CEO convening partner) Business and Economic Saubel’s Markets Bank of America Development Maryland Governor’s Office Greg Saubel, President Ahold USA Brooke Hodges, Senior Vice Victor Clark, Program Manager, for Children Tom Cormier, Director, President Office of Small Business Christina Drushel, Interagency Supervalu Government Affairs Dominick Murray, Deputy Prevention Specialist Tim Parks, Area Sales Director, B. Green Co. Secretary Eastern Region Angels Food Market Benjy Green, CEO Maryland Hunger Solutions Walt Clocker, Owner and Chairman Maryland Department of Cathy Demeroto, Director The Association of Baltimore of the Maryland Retailers CommonHealth ACTION Health and Mental -

NGA Retailer Membership List October 2013

NGA Retailer Membership List October 2013 Company Name City State 159-MP Corp. dba Foodtown Brooklyn NY 2945 Meat & Produce, Inc. dba Foodtown Bronx NY 5th Street IGA Minden NE 8772 Meat Corporation dba Key Food #1160 Brooklyn NY A & R Supermarkets, Inc. dba Sav-Mor Calera AL A.J.C.Food Market Corp. dba Foodtown Bronx NY ADAMCO, Inc. Coeur D Alene ID Adams & Lindsey Lakeway IGA dba Lakeway IGA Paris TN Adrian's Market Inc. dba Adrian's Market Hopwood PA Akins Foods, Inc. Spokane Vly WA Akins Harvest Foods- Quincy Quincy WA Akins Harvest Foods-Bonners Ferry Bonner's Ferry ID Alaska Growth Business Corp. dba Howser's IGA Supermarket Haines AK Albert E. Lees, Inc. dba Lees Supermarket Westport Pt MA Alex Lee, Inc. dba Lowe's Food Stores Inc. Hickory NC Allegiance Retail Services, LLC Iselin NJ Alpena Supermarket, Inc. dba Neimans Family Market Alpena MI American Consumers, Inc. dba Shop-Rite Supermarkets Rossville GA Americana Grocery of MD Silver Spring MD Anderson's Market Glen Arbor MI Angeli Foods Company dba Angeli's Iron River MI Angelo & Joe Market Inc. Little Neck NY Antonico Food Corp. dba La Bella Marketplace Staten Island NY Asker's Thrift Inc., dba Asker's Harvest Foods Grangeville ID Autry Greer & Sons, Inc. Mobile AL B & K Enterprises Inc. dba Alexandria County Market Alexandria KY B & R Stores, Inc. dba Russ' Market; Super Saver, Best Apple Market Lincoln NE B & S Inc. - Windham IGA Willimantic CT B. Green & Company, Inc. Baltimore MD B.W. Bishop & Sons, Inc. dba Bishops Orchards Guilford CT Baesler's, Inc. -

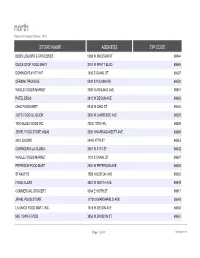

Store Name Address Zip Code

north Based on Grocery Stores - 2013 STORE NAME ADDRESS ZIP CODE BOB'S LIQUORS & GROCERIES 5069 W MADISON ST 60644 QUICK STOP FOOD MART 2751 W PRATT BLVD 60645 DOMINICK'S #147/1147 1340 S CANAL ST 60607 CERMAK PRODUCE 5220 S PULASKI RD 60632 WHOLE FOODS MARKET 3300 N ASHLAND AVE 60657 PATEL BROS 2610 W DEVON AVE 60659 OHIO FOOD MART 5345 W OHIO ST 60644 JOE'S FOOD & LIQUOR 3626 W LAWRENCE AVE 60625 TWO BLUE FOODS INC 702 E 100TH PL 60628 JEWEL FOOD STORE #3349 2520 N NARRAGANSETT AVE 60639 200 LIQUORS 204 E 47TH ST 60653 CARNICERIA LA GLORIA 2551 W 51ST ST 60632 WHOLE FOODS MARKET 1101 S CANAL ST 60607 PETERSON FOOD MART 2534 W PETERSON AVE 60659 STANLEY'S 1558 N ELSTON AVE 60622 FOOD 4 LESS 4821 W NORTH AVE 60639 COMMERCIAL GROCERY 3004 E 100TH ST 60617 JEWEL FOOD STORE 11730 S MARSHFIELD AVE 60643 LA UNICA FOOD MART, INC. 1515 W DEVON AVE 60660 MID TOWN FOODS 3855 W DIVISION ST 60651 Page 1 of 50 09/26/2021 north Based on Grocery Stores - 2013 WARD 28 50 2 23 44 50 37 39 8 36 3 14 2 50 32 37 10 34 40 27 Page 2 of 50 09/26/2021 north Based on Grocery Stores - 2013 7400 S HALSTED FOOD AND LIQUORS, INC. 7400 S HALSTED ST 60621 THREE BROTHER 900 N FRANCISCO AVE 60622 CUENCA'S BAKERY & GROCERIES 4229 W MONTROSE AVE 60641 JEWEL FOOD STORES #3262 4660 W IRVING PARK RD 60641 ROMAN BROS 1 INC 6978 N CLARK ST 60626 TAI NAM CORPORATION 4925 N BROADWAY 60640 LA JALISCIENCE 3239 W 26TH ST 60623 HOLLYWOOD TOWER MKT 5701 N SHERIDAN RD 60660 A & R FOOD MART 5952 W GRAND AVE 60639 S. -

Incorporating Food Systems in Planning

Incorporating Food Systems into Planning Matthew Potteiger Landscape Architecture SUNY College of Environmental Science and Forestry Evan Weissman Public Health, Food Studies & Nutrition Syracuse University Scope: __ Purposes for food system planning __ Precedents and current practice __ FoodPlanCNY Project Overview __ Approaches to food system planning – assessment, engagement __ Challenges and Opportunities Increased public awareness around food and food issues The food system: A stranger to the planning field Kameshwari Pothukuchi; Jerome L Kaufman American Planning Association. Journal of the American Planning Association; Spring 2000; 66, 2; ABI/INFORM Global pg. 113 Why? Perception that there is not a problem markets full of produce “Food is Reproducedan agricultural with permission of the copyright issue owner. notFurther reproductionurban” prohibited without permission. “What can planners do? Who can we collaborate with?” “Where’s the funding?” Reproduced with permission of the copyright owner. Further reproduction prohibited without permission. Emerging Practice: Over the past decade, the food system has enjoyed increased attention from planners and policy makers. Scholars, activists, practitioners, planners, and policy makers engage in various efforts to assess the environmental, economic, and social (including public health) impacts of the food system and used planning to strengthen the food system (Clancy 2004; Jacobson 2008; Freedgood, et al 2011; Meter 2010, 2011; Pothukuchi & Kaufman 1999, 2007). Why do food system planning? The market alone is not working -- social, health and environmental externalities -- concentration and lack of transparency Planners have skills and stake in the food system -- land use, spatial, multi-sectoral/systems thinking Effective means of addressing economic, public health, and environmental imperatives Opportunities to have positive local impacts in relation to globalized system Recognition of opportunities . -

How Will the Royal Ahold Purchase of Pathmark Supermarkets Affect Prices?

Food Marketing Policy Issue Paper Food Marketing Policy Issue Papers address particular No. 19 August 1999 policy or marketing issues in a non-technical manner. They summarize research results and provide insights How Will the Royal Ahold Purchase for users outside the research community. Single copies Of Pathmark Supermarkets Affect Prices? are available at no charge. The last page lists all Food by Policy Issue Papers to date, and describes other Ronald W. Cotterill publication series available from the Food Marketing Policy Center. Tel (860) 486-1927 Fax (860) 486-2461 Food Marketing Policy Center email: [email protected] University of Connecticut http://vm.uconn.edu/~wwware/ fmktc.html Food Marketing Policy Center, Department of Agricultural and Resource Economics, University of Connecticut, 1376 Storrs Road, U-21, Storrs, CT 06269-4021 How Will the Royal Ahold Purchase of Pathmark Supermarkets Affect Prices? By Ronald W. Cotterill1 When a competitor buys another competitor in a local food market, prices may increase because there is less competition. The antitrust laws are designed to prevent mergers that most likely will result in higher prices. Economists do three things to help legal authorities determine whether a merger should be stopped or limited because it will likely increase sellers power over the market and consumer prices. First, economists measure the impact of a merger on the structure of a market. Then economists estimate the relationship between market structure and prices and use it to predict the impact of the merger on prices. Here we estimate the impact of the Royal Ahold/Pathmark merger on prices for each of the 16 New York and New Jersey counties and for one county in Pennsylvania and one in Delaware. -

Happy Holidays!

AFL-CIO, CLC Pathmark Bankruptcy Update Pages 4 & 5 | Local 1500 raises over $125,000 for Charity Page 6 | Labor Day Parade Page 7 | Shop Steward Seminar Pages 8 & 9 FR Happy OM LOCAL Holidays! 1500 2 The Register December 2015 The Register 3 THE PRESIDENT’S PERSPECTIVE JUST FOR THE RECORD By Bruce W. Both By Anthony G. Speelman, Secretary-Treasurer @Aspeel1500 New York’sLocal Grocery Workers’1500 Union STATE OF THE UNION OUR NEW UNION 2015 presented many challenges to us. The relied on its convenience and size for its popu- On-demand shopping habits through the digital As I mentioned in my September column, For the many workers at Pathmark stores heads about, what’s next? They immediately A&P bankruptcy obviously overshadows them all. larity. It’s been the place where you can find 10 age have molded our society’s workforce into on- 2015 year was an enormous test for our entire that were bought by other employers, you contacted our Union’s Organizing Department. The bankruptcy comes at a time where the tradi- different types of pasta or five different brands of demand workers. union. It feels like years ago that we negotiat- know that wasn’t the case for every transition Just as our department was there for the eight tional grocery store’s future is very much in doubt. peanut butter. Two-income families are prevalent across ed eight new excellent contracts in the early agreement. Some new store owners wouldn’t Mrs. Green’s workers when they were fired ille- Companies are now merging in order to com- You’ll find that peanut butter in the aisle, America, therefore there aren’t as many stay at months of 2015. -

Former Pathmark & Waldbaums Stores Converted Into New Union

AFL-CIO, CLC RESTORED Former Pathmark & Waldbaums stores converted into new union supermarkets - See pages 6-9 THE OFFICIAL PUBLICATION OF UFCW LOCAL 1500 • MARCH 2016 • VOL. 50 • NO. 1 2 The Register March 2016 The Register 3 THE PRESIDENT’S PERSPECTIVE JUST FOR THE RECORD By Bruce W. Both By Anthony G. Speelman, Secretary-Treasurer @Aspeel1500 New York’sLocal Grocery Workers’1500 Union A COURT CASE TO CHANGE THE LABOR MOVEMENT 2016 CHALLENGES Friedrichs v. California Teachers Association aims to rewrite the rules how public unions operate The A&P bankruptcy is over. We saved nearly This is especially important to our union The company also recently announced it would 2,500 jobs and now it’s time to focus on what after the A&P bankruptcy. One year ago, 27% be purchasing the 70,000 square foot former A monumental case, posed to rewrite a 40-year compete is on the forefront of union-members across According to The New York Times, “A ruling in the challenges we face in 2016. of our members worked at Stop & Shop. Today Pathmark in East Meadow. The idea I’m getting precedent guiding public sector labor relations, will America. If unions are defunded, who then, fights for teachers’ favor would affect millions of government In 2014 we negotiated a three-year contract over 40% of our union works under the Stop & at is there’s a growing number of new grocery be ruled on later this summer by the five Republican- working men and women? workers and culminate a political and legal campaign with ShopRite. -

Download Nick Freudenberg's Presentation

What evidence is needed to inform food retail policy in New York City? Nicholas Freudenberg Panel on Increasing Food Access through Policy and Advocacy February 25, 2015 Goals for New York City food retail policies • Make healthy food more available and affordable • Ensure food safety • Reduce hunger and food insecurity • Promote development of food businesses and food employment • Encourage local and regional food producDon • Reduce promoDon and availability of unhealthy food What evidence is needed to guide (retail) food policy in New York City? • DistribuDon and changes in types of outlets (e.g., bodegas, supermarkets, farmers markets) • Temporal and geographic variaon in food sales by product and populaon • Paerns of food consumpDon • Receipt and use of food benefits such as SNAP and WIC • Prevalence and incidence of hunger, food insecurity, obesity and diet-related diseases Retail Food Outlets in East Harlem Zip Number of Food Licensed Farmers Establishments with Retail Food Markets Ac>ve Liquor Outlets Licenses 10029 135 4 140 10035 69 0 64 Total 204 4 204 From NY State Dept of Agriculture Databases hKps://data.ny.gov/Economic-Development/Retail-Food-Stores/9a8c-vfzj? In 2013, 11,629 households in East Harlem received an EH residents spend esDmated total of $339,690,627 on food, $38 million in SNAP the largest single benefits category of expenditures (at 12.7%). Currently $90.4 million is spent in East Harlem- leaving a gap of $249.4 million. CB 11 Retail Corridor Study,2011 Food labor What are the most common food jobs? Est Industry Projected Openings per Occupaon Est. -

Perfect Empowered Drinking Water® Redemption Centers

Perfect Empowered Drinking WaterTM CT, NY Redemption Centers & Oregon Redemption Form State Page Number Total Pages Connecticut - CT 1-3 3 New York - NY 4 - 24 21 Oregon, OR See Return Form on page 25 Connecticut Centers to Redeem Perfect Water Bottles Store / Location Name Street Address City, State, Zip State ROGER'S MARKETPLACE 45 CHAMBERLAIN HIGHWAY BERLIN, CT 06037 CT STOP & SHOP 1135 FARMINGTON AVE BERLIN, CT 06037 CT STOP & SHOP 313 COTTAGE GROVE ROAD BLOOMFIELD, CT 06002 CT CARONS CORNER 147 MONTOWESE STREET BRANFORD, CT 06405 CT PRICE RITE 4425 MAIN STREET BRIDGEPORT, CT 06606 CT STOP & SHOP 2145 FAIRFIELD AVENUE BRIDGEPORT, CT 06606 CT PRICE RITE 164 BOSTON AVENUE BRIDGEPORT, CT 06610 CT GREEN PLANET REDEMPTION CENTER, LLC 370 RIVERSIDE AVENUE BRISTOL, CT 06010 CT SHOPRITE 1200 FARMINGTON AVENUE BRISTOL, CT 06010 CT STOP & SHOP 597 FARMINGTON AVENUE BRISTOL, CT 06010 CT WAL-MART 325 OAKLAND STREET BRISTOL, CT 06010 CT BJ'S 106 FEDERAL ROAD BROOKFIELD, CT 06804 CT WAL-MART 58 BRICKYARD ROAD BROOKLYN, CT 06234 CT STOP & SHOP 215 EAST MAIN STREET CLINTON, CT 06413 CT WESTCHESTER MARKET PLACE 493 WESTCHESTER ROAD COLCHESTER, CT 06415 CT HIGHLAND PARK MARKET 1721 BOSTON TURNPIKE COVENTRY, CT 06238 CT PRICE RITE 136 BERLIN ROAD CROMWELL, CT 06416 CT STOP & SHOP 195 WEST STREET CROMWELL, CT 06416 CT WAL-MART 161 BERLIN ROAD CROMWELL, CT 06416 CT STOP & SHOP 72 NEWTOWN ROAD DANBURY, CT 06810 CT TRADER JOE'S 113 MILL PLAIN ROAD DANBURY, CT 06811 CT PALMER'S MARKET 264 HEIGHTS ROAD DARIEN, CT 06820 CT TRADER JOE'S 440 BOSTON POST ROAD -

UFCW LOCAL 1500 WELFARE FUND to Help People

IED PRINTI ALL NG UNION TRADES LABEL COUNCIL 505 THE OFFICIAL PUBLICATION OF UFCW LOCAL 1500 • JUNE 2016 • VOL. 50 • NO. 2 N EW YORK SPEELMAN ELECTED PRESIDENT On May 11, 2016 Tony Speelman was unanimously voted in as President by the Local 1500 Executive Board. Tony succeeds Bruce W. Both, who retired in April 2016. Speelman began his career as a Local 1500 member working part-time for Dairy Barn while attending college. Speelman pledged to keep an open door policy for all members, encourages all Local 1500 members to follow & tweet him @Aspeel1500. Continued on page 4. The new Officers of UFCW Local 1500 President, Anthony G. Speelman NEWELL ELECTED SECRETARY-TREASURER Robert W. Newell, Jr. began his career in 1990 working as a part-time shopping cart kid for Pathmark in Bayshore, NY. Newell was instrumental in working to organize Wild by Nature, an organic chain of stores throughout Long Island in the 1990’s. Prior to becoming Secretary-Treasurer, Newell was previously Assistant to the President of UFCW Local 1500. “I want this union to become an even greater and stronger union for decades ahead.” Secretary-Treasurer, Robert W. Newell, Jr. Continued on page 4. 2 The Register June 2016 The Register 3 THE PRESIDENT’S PERSPECTIVE JUST FOR THE RECORD Tony Speelman @aspeel1500 Rob Newell - Secretary-Treasurer @ufcw1500 New York’sLocal Grocery Workers’1500 Union From Part-Time Cart Kid This Is YOUR Union! to Union Leader, It’s Possible I want to begin my first column as President by saying how much of we work incredibly well together. -

Grocery Loyalty

Grocery Loyalty Grocery chains are hungry to increase shopper loyalty, as it can be a key factor in the health of their businesses. inMarket’s first-party, SDK derived location insights platform has the ability to reveal these metrics as well as a wide variety of other important consumer trends. In this inMarket inSights Report Card, we rank the 25 grocery chains with the highest customer loyalty indexes using 50 million Comscore-verified monthly active users. The inMarket location platform delivers powerful visibility into every step in the path to purchase using direct integrations into more than 750 of the most popular shopping and lifestyle apps. Our analysts leverage this data and scale to understand visitation trends at brick-and-mortar retailers, predicting future performance while enabling better decisions and better engagement. For more information on methodology, info about our advertising programs, or to request data for a particular retail chain, please contact inMarket today. Key Takeaways: • Some grocery chains with heavy penetrations in urban areas tend to have higher loyalty metrics than their rural competitors. This could be because denser geographic areas incentivize more frequent trips. • Loyalty has often been a barometer of success for businesses. By using metrics like customer loyalty index, grocery stores can determine the health of their repeat shopper business. • Grocery stores have higher customer loyalty than their retail counterparts due to necessity. Consumers simply need to purchase food more often than other retail products. That said, by looking at the grocery category average, we can understand which chains are thriving or struggling in terms of customer loyalty. -

Grocery Store 541 Monroe Ave

Updated 6/1/2021 Name Address City State Zip M & P MINI MARKET 174 CENTRAL AVE. PASSAIC NJ 07055 EL MANANTIAL II 142 S. BROAD ST. WOODBURY NJ 08096 MJ CORNER DELI & GROCERY, INC 133 N. MUNN AVE. EAST ORANGE NJ 07017 POPULAR SUPER DELI 468 FOURTH AVE. NEWARK NJ 07107 TULCINGO DELI AND GROCERY 2 CORP 256 OCEAN AVE. LAKEWOOD NJ 08701 LOS AMIGOS DELI & GROCERY 638 LIBERTY ST. TRENTON NJ 08611 MERY SUPERMARKET, LLC 101-103 1ST STREET ELIZABETH NJ 07206 QUISQUEYA SUPERMARKET 249 MADISON AVE. PERTH AMBOY NJ 08861 A & E SUPERMARKET 585 SOMERSET ST. SOMERSET NJ 08873 BROOKDALE SUPERMARKET 89 BROOKDALE AVE. NEWARK NJ 07106 DREAMER'S SUPERMARKET 71 7TH AVE. NEWARK NJ 07104 AMEZQUITA DELI & GROCERY, LLC 126 GOVERNOR ST. PATERSON NJ 07501 BELLA VISTA GROCERY, LLC 126 HOPE AVE. PASSAIC NJ 07055 BELLA VISTA SUPERMARKET 752 RIVER STREET PATERSON NJ 07524 EL BODEGON INC. 119-21 BROADWAY AVE. PASSAIC NJ 07055 LATINO MINI MARKET 207 E. MAIN ST. BOUND BROOK NJ 08805 LATINO MINI MARKET II 38 MAIN ST. FLEMINGTON NJ 08822 NORFOLK GROCERY 151 NORFOLK ST. NEWARK NJ 07103 SCARPAZI'S ONE STOP DELI 96 N. VIRGINIA AVE. PENNS GROVE NJ 08069 LAS PALMAS SUPERMARKET 6155 BERGENLINE AVE. WEST NEW YORK NJ 07093 TORRES & RODRIGUEZ DELI 21 ROEBLING AVE. TRENTON NJ 08611 TU PAIS SUPERMARKET 101 ANDERSON ST. TRENTON NJ 08611 BRIDGETON FOOD & GAS, LLC 176 N. PEARL ST. BRIDGETON NJ 08302 NOVEDADES ESPINOZA 37 S. LAUREL ST. BRIDGETON NJ 08302 AZCONA SANHICAN, LLC 2 SANHICAN DRIVE TRENTON NJ 08618 LA TAPATIA 703 MAIN STREET ASBURY PARK NJ 07712 JJ MINI MARKET 855 MONROE AVE.