Grocery Loyalty

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Stimulating Supermarket Development in Maryland

STIMULATING SUPERMARKET DEVELOPMENT IN MARYLAND A report of the Maryland Fresh Food Retail Task Force Task Force Baltimore Development Maryland Department of Maryland Family Network Safeway Inc. Members Corporation Agriculture Linda Ramsey, Deputy Director Greg Ten Eyck, Director of Public Will Beckford, Executive Director Joanna Kille, Director of of Family Support Affairs and Government Relations of Commercial Revitalization Government Relations Margaret Williams, Executive (Task force co-chair) Advocates for Children Kristen Mitchell, Senior Economic Mark Powell, Chief of Marketing Director and Youth Development Officer and Agribusiness Development Santoni’s Super Market Becky Wagner, Executive Director Leon Pinkett, Senior Economic Maryland Food Bank Rob Santoni, Owner (Task force co-chair and Development Officer Maryland Department of Deborah Flateman, CEO convening partner) Business and Economic Saubel’s Markets Bank of America Development Maryland Governor’s Office Greg Saubel, President Ahold USA Brooke Hodges, Senior Vice Victor Clark, Program Manager, for Children Tom Cormier, Director, President Office of Small Business Christina Drushel, Interagency Supervalu Government Affairs Dominick Murray, Deputy Prevention Specialist Tim Parks, Area Sales Director, B. Green Co. Secretary Eastern Region Angels Food Market Benjy Green, CEO Maryland Hunger Solutions Walt Clocker, Owner and Chairman Maryland Department of Cathy Demeroto, Director The Association of Baltimore of the Maryland Retailers CommonHealth ACTION Health and Mental -

NGA Retailer Membership List October 2013

NGA Retailer Membership List October 2013 Company Name City State 159-MP Corp. dba Foodtown Brooklyn NY 2945 Meat & Produce, Inc. dba Foodtown Bronx NY 5th Street IGA Minden NE 8772 Meat Corporation dba Key Food #1160 Brooklyn NY A & R Supermarkets, Inc. dba Sav-Mor Calera AL A.J.C.Food Market Corp. dba Foodtown Bronx NY ADAMCO, Inc. Coeur D Alene ID Adams & Lindsey Lakeway IGA dba Lakeway IGA Paris TN Adrian's Market Inc. dba Adrian's Market Hopwood PA Akins Foods, Inc. Spokane Vly WA Akins Harvest Foods- Quincy Quincy WA Akins Harvest Foods-Bonners Ferry Bonner's Ferry ID Alaska Growth Business Corp. dba Howser's IGA Supermarket Haines AK Albert E. Lees, Inc. dba Lees Supermarket Westport Pt MA Alex Lee, Inc. dba Lowe's Food Stores Inc. Hickory NC Allegiance Retail Services, LLC Iselin NJ Alpena Supermarket, Inc. dba Neimans Family Market Alpena MI American Consumers, Inc. dba Shop-Rite Supermarkets Rossville GA Americana Grocery of MD Silver Spring MD Anderson's Market Glen Arbor MI Angeli Foods Company dba Angeli's Iron River MI Angelo & Joe Market Inc. Little Neck NY Antonico Food Corp. dba La Bella Marketplace Staten Island NY Asker's Thrift Inc., dba Asker's Harvest Foods Grangeville ID Autry Greer & Sons, Inc. Mobile AL B & K Enterprises Inc. dba Alexandria County Market Alexandria KY B & R Stores, Inc. dba Russ' Market; Super Saver, Best Apple Market Lincoln NE B & S Inc. - Windham IGA Willimantic CT B. Green & Company, Inc. Baltimore MD B.W. Bishop & Sons, Inc. dba Bishops Orchards Guilford CT Baesler's, Inc. -

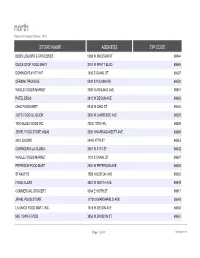

Store Name Address Zip Code

north Based on Grocery Stores - 2013 STORE NAME ADDRESS ZIP CODE BOB'S LIQUORS & GROCERIES 5069 W MADISON ST 60644 QUICK STOP FOOD MART 2751 W PRATT BLVD 60645 DOMINICK'S #147/1147 1340 S CANAL ST 60607 CERMAK PRODUCE 5220 S PULASKI RD 60632 WHOLE FOODS MARKET 3300 N ASHLAND AVE 60657 PATEL BROS 2610 W DEVON AVE 60659 OHIO FOOD MART 5345 W OHIO ST 60644 JOE'S FOOD & LIQUOR 3626 W LAWRENCE AVE 60625 TWO BLUE FOODS INC 702 E 100TH PL 60628 JEWEL FOOD STORE #3349 2520 N NARRAGANSETT AVE 60639 200 LIQUORS 204 E 47TH ST 60653 CARNICERIA LA GLORIA 2551 W 51ST ST 60632 WHOLE FOODS MARKET 1101 S CANAL ST 60607 PETERSON FOOD MART 2534 W PETERSON AVE 60659 STANLEY'S 1558 N ELSTON AVE 60622 FOOD 4 LESS 4821 W NORTH AVE 60639 COMMERCIAL GROCERY 3004 E 100TH ST 60617 JEWEL FOOD STORE 11730 S MARSHFIELD AVE 60643 LA UNICA FOOD MART, INC. 1515 W DEVON AVE 60660 MID TOWN FOODS 3855 W DIVISION ST 60651 Page 1 of 50 09/26/2021 north Based on Grocery Stores - 2013 WARD 28 50 2 23 44 50 37 39 8 36 3 14 2 50 32 37 10 34 40 27 Page 2 of 50 09/26/2021 north Based on Grocery Stores - 2013 7400 S HALSTED FOOD AND LIQUORS, INC. 7400 S HALSTED ST 60621 THREE BROTHER 900 N FRANCISCO AVE 60622 CUENCA'S BAKERY & GROCERIES 4229 W MONTROSE AVE 60641 JEWEL FOOD STORES #3262 4660 W IRVING PARK RD 60641 ROMAN BROS 1 INC 6978 N CLARK ST 60626 TAI NAM CORPORATION 4925 N BROADWAY 60640 LA JALISCIENCE 3239 W 26TH ST 60623 HOLLYWOOD TOWER MKT 5701 N SHERIDAN RD 60660 A & R FOOD MART 5952 W GRAND AVE 60639 S. -

Incorporating Food Systems in Planning

Incorporating Food Systems into Planning Matthew Potteiger Landscape Architecture SUNY College of Environmental Science and Forestry Evan Weissman Public Health, Food Studies & Nutrition Syracuse University Scope: __ Purposes for food system planning __ Precedents and current practice __ FoodPlanCNY Project Overview __ Approaches to food system planning – assessment, engagement __ Challenges and Opportunities Increased public awareness around food and food issues The food system: A stranger to the planning field Kameshwari Pothukuchi; Jerome L Kaufman American Planning Association. Journal of the American Planning Association; Spring 2000; 66, 2; ABI/INFORM Global pg. 113 Why? Perception that there is not a problem markets full of produce “Food is Reproducedan agricultural with permission of the copyright issue owner. notFurther reproductionurban” prohibited without permission. “What can planners do? Who can we collaborate with?” “Where’s the funding?” Reproduced with permission of the copyright owner. Further reproduction prohibited without permission. Emerging Practice: Over the past decade, the food system has enjoyed increased attention from planners and policy makers. Scholars, activists, practitioners, planners, and policy makers engage in various efforts to assess the environmental, economic, and social (including public health) impacts of the food system and used planning to strengthen the food system (Clancy 2004; Jacobson 2008; Freedgood, et al 2011; Meter 2010, 2011; Pothukuchi & Kaufman 1999, 2007). Why do food system planning? The market alone is not working -- social, health and environmental externalities -- concentration and lack of transparency Planners have skills and stake in the food system -- land use, spatial, multi-sectoral/systems thinking Effective means of addressing economic, public health, and environmental imperatives Opportunities to have positive local impacts in relation to globalized system Recognition of opportunities . -

How Will the Royal Ahold Purchase of Pathmark Supermarkets Affect Prices?

Food Marketing Policy Issue Paper Food Marketing Policy Issue Papers address particular No. 19 August 1999 policy or marketing issues in a non-technical manner. They summarize research results and provide insights How Will the Royal Ahold Purchase for users outside the research community. Single copies Of Pathmark Supermarkets Affect Prices? are available at no charge. The last page lists all Food by Policy Issue Papers to date, and describes other Ronald W. Cotterill publication series available from the Food Marketing Policy Center. Tel (860) 486-1927 Fax (860) 486-2461 Food Marketing Policy Center email: [email protected] University of Connecticut http://vm.uconn.edu/~wwware/ fmktc.html Food Marketing Policy Center, Department of Agricultural and Resource Economics, University of Connecticut, 1376 Storrs Road, U-21, Storrs, CT 06269-4021 How Will the Royal Ahold Purchase of Pathmark Supermarkets Affect Prices? By Ronald W. Cotterill1 When a competitor buys another competitor in a local food market, prices may increase because there is less competition. The antitrust laws are designed to prevent mergers that most likely will result in higher prices. Economists do three things to help legal authorities determine whether a merger should be stopped or limited because it will likely increase sellers power over the market and consumer prices. First, economists measure the impact of a merger on the structure of a market. Then economists estimate the relationship between market structure and prices and use it to predict the impact of the merger on prices. Here we estimate the impact of the Royal Ahold/Pathmark merger on prices for each of the 16 New York and New Jersey counties and for one county in Pennsylvania and one in Delaware. -

California Avocado Retail Availability Expands

California Avocado Retail Availability Expands he California Avocado Commission’s (CAC) retail marketing directors (RMDs) maintain close contact with retailers and handlers throughout the season, helping to facilitate smooth inventory transitions to California avocados. TRetail distribution of California avocados began in January with small, local retailers showcasing Big Game promotions. In March and April, retail distribution expanded to retailers located within and beyond California, with more significant retail distribution from May to early summer as the volume of harvested fruit increased. 36 / From the Grove / Summer 2020 At press time, California avocados were available at: • California retailers including: Bristol Farms Food 4 Less FoodMaxx Gelson’s Lucky Supermarkets Lunardi’s Markets Board Mercado Mi Tierra Mollie Stone’s of Nugget Markets Directors Raley’s Ralphs District 1 Save Mart Supermarkets Member/Jessica Hunter Sprouts Member/ Ryan Rochefort-Vice Chairman Stater Bros. Alternate/Michael Perricone Whole Foods District 2 • The Fresh Market (Alabama, Arkansas, Connecticut, Delaware, Florida, Georgia, Illinois, Indiana, Kentucky, Louisiana, Maryland, Massachusetts, Member/Charley Wolk Member/Ohannes Karaoghlanian Mississippi, New Jersey, New York, North Carolina, Ohio, Oklahoma, Alternate/John Cornell Pennsylvania, South Carolina, Tennessee, Virginia) • Hy-Vee (Illinois, Iowa, Kansas, Minnesota, Missouri, Nebraska, District 3 South Dakota, Wisconsin) Member/John Lamb-Chairman Member/Robert Grether-Treasurer • New Seasons -

TOP TRENDS in FRESH FOODS Connected Consumer and Personalization Webinar 4 of 5

BRINGING TO LIFE: TOP TRENDS in FRESH FOODS Connected Consumer and Personalization Webinar 4 of 5 Sally Lyons Wyatt Jennifer Pelino EVP & Practice Leader SVP Omni Channel Media Copyright © 2018 Information Resources, Inc. (IRI). Confidential and proprietary. 1 FMI is the trade association that serves as the voice of food retail. We assist food retailers in their role of feeding families and enriching lives. Copyright © 2018 Information Resources, Inc. (IRI). Confidential and proprietary. 2 The Association: Our members are food retailers, wholesales and suppliers of all types and sizes FMI provides comprehensive programs, resources and advocacy for the food, pharmacy and grocery retail industry CONSUMER & FOOD SAFETY GOVERNMENT INDEPENDENT CENTER STORE COMMUNITY AFFAIRS & DEFENSE RELATIONS OPERATOR PRIVATE BRANDS SUPPLY CHAIN TECHNOLOGY ASSET COMMUNICATION EDUCATION FRESH FOODS HEALTH & WELLNESS INFORMATION RESEARCH SUSTAINABILITY WHOLESALER PROTECTION SERVICE Copyright © 2018 Information Resources, Inc. (IRI). Confidential and proprietary. 3 Fresh @ FMI FMI is committed to the growth and success of fresh companies and their partners. FMI provides resources and networks that support the interests of member companies throughout the global, fresh produce supply chain, including family-owned, private and publicly traded businesses as well as regional, national and international companies. Emphasis on fresh • Produce • Meat • Seafood • Deli/In-store, fresh prepared foods and assortments • Bakery Rick Stein Fresh Foods • Floral Vice President, Fresh Foods Food Marketing Institute [email protected] 202.220.0700 Copyright © 2018 Information Resources, Inc. (IRI). Confidential and proprietary. 4 FMI Fresh Foods Research and Education Networking Advocacy In-depth information, trends and Share ideas, explore best Understand what is going on in insights to foster innovation, practices and develop business Washington and make your take advantage of new relations voice heard opportunities and help develop winning strategies Copyright © 2018 Information Resources, Inc. -

New Economic Approaches to Consumer Welfare and Nutrition

New Economic Approaches to Consumer Welfare and Nutrition Conference Proceedings Food and Agricultural Marketing Consortium Alexandria, Virginia January 14-15, 1999 EXPANSION OF NON-TRADITIONAL FOOD RETAIL OUTLETS: EFFECT ON CONSUMER WELFARE ERS Commissioned Paper for the January 1999 Meeting of the Food and Agricultural Marketing Consortium *Michelle A. Morganosky Associate Professor of Consumer and Retail Marketing Department of Agricultural and Consumer Economics University of Illinois 326 Mumford Hall 1301 West Gregory Drive Urbana, IL 61801-3681 Tel: 217-333-0737 -or- 217-333-3217 Fax: 217-333-5538 Email: [email protected] Brenda J. Cude Professor and Head Department of Housing and Consumer Economics The University of Georgia 215 Dawson Hall Athens, GA 30602-3622 Tel: 706-542-4856 -or- 706-542-4857 Fax: 706-542-4397 Email: [email protected] *Send correspondence to Michelle A. Morganosky EXPANSION OF NON-TRADITIONAL FOOD RETAIL Version: March 3, 1999 BC OUTLETS: EFFECT ON CONSUMER WELFARE ABSTRACT In this study three different methods of data collection (telephone interviews/focus groups/on-line consumer surveys) were used to assess the impact of non-traditional retail outlets on consumer welfare. We analyzed consumer cross patronage between supermarkets and non- traditional food retail channels, examined reasons for cross patronage, and made a preliminary assessment of consumer response to one of the newest retail channels: on-line food shopping. Telephone interviews were conducted in a medium-size market with 300 individuals and focus groups were conducted in two major metropolitan markets and one medium-size market. The on-line survey consisted of responses from 243 on-line food shoppers in six different markets. -

United Natural Foods Annual Report 2020

United Natural Foods Annual Report 2020 Form 10-K (NYSE:UNFI) Published: September 29th, 2020 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended August 1, 2020 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number: 001-15723 UNITED NATURAL FOODS, INC. (Exact name of registrant as specified in its charter) Delaware 05-0376157 (State or other jurisdiction of (I.R.S. Employer Identification No.) incorporation or organization) 313 Iron Horse Way, Providence, Rhode Island 02908 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (401) 528-8634 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol Name of each exchange on which registered Common stock, par value $0.01 UNFI New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Happy Holidays!

AFL-CIO, CLC Pathmark Bankruptcy Update Pages 4 & 5 | Local 1500 raises over $125,000 for Charity Page 6 | Labor Day Parade Page 7 | Shop Steward Seminar Pages 8 & 9 FR Happy OM LOCAL Holidays! 1500 2 The Register December 2015 The Register 3 THE PRESIDENT’S PERSPECTIVE JUST FOR THE RECORD By Bruce W. Both By Anthony G. Speelman, Secretary-Treasurer @Aspeel1500 New York’sLocal Grocery Workers’1500 Union STATE OF THE UNION OUR NEW UNION 2015 presented many challenges to us. The relied on its convenience and size for its popu- On-demand shopping habits through the digital As I mentioned in my September column, For the many workers at Pathmark stores heads about, what’s next? They immediately A&P bankruptcy obviously overshadows them all. larity. It’s been the place where you can find 10 age have molded our society’s workforce into on- 2015 year was an enormous test for our entire that were bought by other employers, you contacted our Union’s Organizing Department. The bankruptcy comes at a time where the tradi- different types of pasta or five different brands of demand workers. union. It feels like years ago that we negotiat- know that wasn’t the case for every transition Just as our department was there for the eight tional grocery store’s future is very much in doubt. peanut butter. Two-income families are prevalent across ed eight new excellent contracts in the early agreement. Some new store owners wouldn’t Mrs. Green’s workers when they were fired ille- Companies are now merging in order to com- You’ll find that peanut butter in the aisle, America, therefore there aren’t as many stay at months of 2015. -

Former Pathmark & Waldbaums Stores Converted Into New Union

AFL-CIO, CLC RESTORED Former Pathmark & Waldbaums stores converted into new union supermarkets - See pages 6-9 THE OFFICIAL PUBLICATION OF UFCW LOCAL 1500 • MARCH 2016 • VOL. 50 • NO. 1 2 The Register March 2016 The Register 3 THE PRESIDENT’S PERSPECTIVE JUST FOR THE RECORD By Bruce W. Both By Anthony G. Speelman, Secretary-Treasurer @Aspeel1500 New York’sLocal Grocery Workers’1500 Union A COURT CASE TO CHANGE THE LABOR MOVEMENT 2016 CHALLENGES Friedrichs v. California Teachers Association aims to rewrite the rules how public unions operate The A&P bankruptcy is over. We saved nearly This is especially important to our union The company also recently announced it would 2,500 jobs and now it’s time to focus on what after the A&P bankruptcy. One year ago, 27% be purchasing the 70,000 square foot former A monumental case, posed to rewrite a 40-year compete is on the forefront of union-members across According to The New York Times, “A ruling in the challenges we face in 2016. of our members worked at Stop & Shop. Today Pathmark in East Meadow. The idea I’m getting precedent guiding public sector labor relations, will America. If unions are defunded, who then, fights for teachers’ favor would affect millions of government In 2014 we negotiated a three-year contract over 40% of our union works under the Stop & at is there’s a growing number of new grocery be ruled on later this summer by the five Republican- working men and women? workers and culminate a political and legal campaign with ShopRite. -

Major Work Stoppages in 2003 by Ann C

COMPENSATION AND WORKING CONDITIONS U.S. BUREAU OF LABOR STATISTICS Major Work Stoppages in 2003 by Ann C. Foster Bureau of Labor Statistics Originally Posted: November 23, 2004 There were 14 major work stoppages that began in 2003, idling 129,200 workers and resulting in 4.1 million days of idleness. Although these figures are up from the previous year, they are low by historical standards. The number of workers idled, the number of days of idleness, and the percent of estimated working time lost because of strikes and lockouts rose in 2003, but each of these measures remained low by historical standards. There were 14 major work stoppages that began during the year,1 idling 129,200 workers and resulting in 4.1 million workdays of idleness (about 1 out of every 10,000 available workdays).2 In comparison, 19 major work stoppages began in 2002, which idled 46,000 workers and resulted in 660,000 days of idleness. (See table 1 and charts 1, 2, and 3.) Major work stoppages are those involving 1,000 or more workers and lasting a full shift or longer; they include worker- initiated strikes, as well as lockouts by employers. A strike is defined as a temporary stoppage of work by a group of workers (not necessarily union members) to express a grievance or enforce a bargaining demand. A lockout is a temporary withholding or denial of employment by employers during a labor dispute to enforce employment terms on an employee group. Because of the complexity of labor disputes, BLS does not attempt to distinguish between strikes and lockouts in its statistics.3 In this article, however, either of these terms may be used when referring to information from other sources.