Annual Report & Accounts 2009

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

THE NEW WPP December 11, 2018

THE NEW WPP December 11, 2018 WPP plc Forward looking statement In order to utilize the ‘safe harbour’ provisions of the United States Private Securities Litigation Reform Act of 1995 (the ‘PSLRA’), WPP plc is providing the following cautionary statement. This presentation contains certain forward-looking statements – that is, statements related to future, not past events and circumstances – which may relate to one or more of the financial condition, results of operations and businesses of WPP plc and certain of the plans and objectives of WPP with respect to these items. These statements are generally, but not always, identified by the use of words such as ‘will’, ‘expects’, ‘is expected to’, ‘aims’, ‘should’, ‘may’, ‘objective’, ‘is likely to’, ‘intends’, ‘believes’, ‘anticipates’, ‘plans’, ‘we see’ or similar expressions. Actual results may differ from those expressed in such statements, depending on a variety of factors including the risk factors set forth in our most recent Annual Report and Form 20-F under “Risk factors” and in any of our more recent public reports. Nothing in this presentation is intended as a forecast, nor should it be taken as such. Our most recent Annual Report and Form 20-F and other period filings are available on our website at www.wpp.com, or can be obtained from the SEC by calling 1-800-SEC-0330 or on its website at www.sec.gov. WPP plc AGENDA OUR STRATEGY OUR VISION AND OFFER A SIMPLER STRUCTURE TECHNOLOGY CULTURE, LEADERSHIP AND TALENT WPP plc TECHNOLOGY IS FUNDAMENTALLY RESHAPING OUR INDUSTRY MEDIA PROLIFERATION -

WPP 2020 Interim Results Morning Teleconference Transcript

WPP 2020 Interim Results Morning Teleconference Transcript Thursday, 27th August 2020 Disclaimer By reading this transcript you agree to be bound by the following conditions. You may not disseminate this transcript, in whole or in part, without our prior consent. Information in this communication relating to the price at which relevant investments have been bought or sold in the past or the yield on such investments cannot be relied upon as a guide to the future performance of such investments. This communication does not constitute an offering of securities or otherwise constitute an invitation or inducement to any person to underwrite, subscribe for or otherwise acquire or dispose of securities in any company within the WPP Group. Non-IFRS Measures Certain Non-IFRS measures included in this communication have been derived from amounts calculated in accordance with IFRS but are not themselves IFRS measures. They should not be viewed in isolation as alternatives to the equivalent IFRS measure, rather they should be read in conjunction with the equivalent IFRS measure. These include constant currency, pro-forma (‘like-for-like’), headline PBIT (Profit Before Interest and Taxation), headline PBT (Profit Before Taxation), headline EBITDA (Earnings before Interest, Taxation, Depreciation and Amortisation), billings, estimated net new billings, free cash flow and net debt and average net debt, which we define, explain the use of and reconcile to the nearest IFRS measure in the WPP Annual Report & Accounts 2019 for the year ended December 31, 2019. Management believes that these measures are both useful and necessary to present herein because they are used by management for internal performance analyses; the presentation of these measures facilitates comparability with other companies, although management’s measures may not be calculated in the same way as similarly titled measures reported by other companies; and these measures are useful in connection with discussions with the investment community. -

2017 Agency Family Tree

2017 GLOBAL AGENCY FAMILY TREE TOP 10 WPP OMNICOM Publicis Groupe INTERPUBLIC Dentsu HAVAS HAKUHODO DY MDC Partners CHEIL BlueFocus (Revenue US 17,067M) (Revenue US 15,417M) (Revenue US 10,252M) (Revenue US 7,847M) (Revenue US 7,126M) (Revenue US 2,536M) (Revenue US 2,282M) (Revenue US 1,370M) (Revenue US 874M) (Revenue US 827M) OGILVY GROUP WPP DIGITAL BBDO WORLDWIDE PUBLICIS COMMUNICATIONS MEDIABRANDS DENTSU INC. DENTSU AEGIS NETWORK HAVAS CREATIVE GROUP HAKUHODO HAKUHODO MDC PARTNERS CHEIL WORLDWIDE DIGITAL Ogilvy & Mather ACCELERATION BBDO Worldwide Publicis Worldwide Ansible Dentsu Inc. Other Agencies Havas Worldwide Hakuhodo Hakuhodo 6degrees Cheil Worldwide BlueDigital OgilvyOne Worldwide BLUE STATE DIGITAL Proximity Worldwide Publicis BPN DENTSU AEGIS NETWORK Columbus Arnold Worldwide ADSTAFF-HAKUHODO Delphys Hakuhodo International 72andSunny Barbarian Group Phluency Ogilvy CommonHealth Worldwide Cognifide Interone Publicis 133 Cadreon Dentsu Branded Agencies Copernicus Havas Health Ashton Consulting Hakuhodo Consulting Asia Pacific Sundae Beattie McGuinness Bungay Madhouse Ogilvy Government Relations F.BIZ Organic Publicis Activ Identity Dentsu Coxinall BETC Backs Group Grebstad Hicks Communications Allison + Partners McKinney Domob Ogilvy Public Relations HOGARTH WORLDWIDE Wednesday Agency Publicis Africa Group Initiative DentsuBos Inc. Crimson Room FullSIX Brains Work Associates Taiwan Hakuhodo Anomaly Cheil Pengtai Blueplus H&O POSSIBLE DDB WORLDWIDE Publicis Conseil IPG Media LAB Dentsu-Smart LLC deepblue HAVAS MEDIA GROUP -

2019 Creative Agencies New Business League

2019 CREATIVE AGENCIES NEW BUSINESS LEAGUE Global / Feb 2019 ESTIMATED ESTIMATED YTD RANK THIS RANK LAST OVERALL YTD No.of AGENCY RECENT WINS WIN REVENUE RECENT LOSSES MONTH MONTH REVENUE Wins (USD $ m) (USD $m) Mercedes Benz China Retainer , MillerCoors (Cape Line, Redd's 1 1 BBDO 29.0 29.0 45 Apple Ale) US AOR , Remy Martin China Pfizer China, Nestle (Content Studio) L.P.N DEVELOPMENT THAILAND 2 8 Ogilvy China, Confidential Consumer 21.3 20.1 60 AOR Goods Brand China, Maxus China 3 2 Johannes Leonardo Volkswagen US 20.0 20.0 1 Dickies US Project, Grub Hub US, 4 6 Havas Worldwide 14.5 14.5 16 Bel Brands Global Refinitiv Global, Singapore Airlines 5 3 TBWA 12.5 12.5 6 Global, Gatorade Global HPB Singapore, Ohmyhome 6 22 Publicis 11.9 DS China 11.8 35 Singapore Audi-Branding China, Yili-Yousuanru 7 4 Leo Burnett 11.2 Abbott - baby nutrition China 10.4 40 China, CarDekho.com India Geely China, Kabrita China, Porsche 8 7 Saatchi & Saatchi China Retainer, Yili International 9.7 Mondelez India 9.6 16 China TerryWhite Chemmart Australia, 9 9 VMLY&R Australian Defence Force Recruiting 8.6 8.6 36 Australia, Nature Bounty US Barclays UK, Audi UK, Volkswagen 10 12 BBH 8.0 8.0 3 UK Huawei China, Mercedes-Benz 11 10 Digitas China Project, Heineken China 7.8 7.8 20 Retainer 12 5 Deutsch Reebok Global 8.0 Target US 7.5 1 Skyworth TV China,Yinji Holiday 13 23 McCann Worldgroup Resort China, Opel Europe, Magnet 7.9 WINIX 5.9 29 Kitchens UK, Columbia Sportswears 14= 25 MediaMonks Avon Global digital content creation 5.0 5.0 1 Brixton Finishing School -

Who We Are (PDF

Who we are 8 WPP ANNUAL REPORT 2009 WPP ANNUAL REPORT 2009 9 Who we are Our companies & associates Advertising Consumer Insight Prime Policy Group www.prime-policy.com ADK1 Kantar: Public Strategies www.adk.jp www.kantar.com www.pstrategies.com Bates 141 Added Value Quinn Gillespie www.bates141.com www.added-value.com www.quinngillespie.com BrandBuzz■ Center Partners Robinson Lerer & Montgomery■ www.brandbuzz.com www.centerpartners.com www.rlmnet.com CHI & Partners1 IMRB International Wexler & Walker Public Policy Associates www.chiandpartners.com www.imrbint.com www.wexlergroup.com Dentsu Y&R1,2,■ Kantar Health www.dyr.co.jp www.kantarhealth.com Grey Kantar Japan Branding & Identity www.grey.com www.jp.kantargroup.com HS Ad1 Kantar Media Addison Corporate Marketing● www.hs-ad.co.kr www.kantarmedia.com www.addison.co.uk JWT Kantar Operations BDGMcColl www.jwt.com www.kantaroperations.com www.bdg-mccoll.com Johannes Leonardo1 Kantar Retail BDGworkfutures www.johannesleonardo.com www.kantarretail.com www.bdgworkfutures.com Marsteller Advertising■ Kantar Worldpanel Coley Porter Bell www.marsteller.com www.kantarworldpanel.com www.cpb.co.uk Ogilvy & Mather Lightspeed Research Dovetail www.ogilvy.com www.lightspeedresearch.com www.dovetailfurniture.com Santo Millward Brown FITCH● www.santo.net www.millwardbrown.com www.fitchww.com Scangroup1 The Futures Company Lambie-Nairn● www.scangroup.biz www.thefuturescompany.com www.lambie-nairn.com Soho Square TNS Landor Associates■,● www.sohosq.com www.tnsglobal.com www.landor.com Tapsa Other marketing -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Printmgr File

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F (Mark One) ‘ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR È ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended 31 December 2020 OR ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ‘ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report For the transition period from to Commission file number 001-38303 WPP plc (Exact Name of Registrant as specified in its charter) Jersey (Jurisdiction of incorporation or organization) Sea Containers, 18 Upper Ground London, United Kingdom, SE1 9GL (Address of principal executive offices) Andrea Harris Group Chief Counsel Sea Containers, 18 Upper Ground, London, United Kingdom, SE1 9GL Telephone: +44(0) 20 7282 4600 E-mail: [email protected] (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act. Title of each class Trading Symbol (s) Name of each exchange on which registered Ordinary Shares of 10p each WPP London Stock Exchange American Depositary Shares, each WPP New York Stock Exchange representing five Ordinary Shares (ADSs) Securities registered or to be registered pursuant to Section 12(g) of the Act. Not applicable (Title of Class) Not applicable (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. -

Annual Report & Accounts 2017

Annual Report & Accounts 2017 Accounts & Report Annual Annual Report & Accounts 2017 Report &Annual Accounts Visit us online Annual Report wpp.com/annualreport2017 Pro bono work 2017 wpp.com/probono/2017 You can sign up to receive WPP’s public monthly online news bulletin at wpp.com/subscriptions Follow us on Twitter twitter.com/wpp Become a fan on Facebook facebook.com/wpp Watch us on YouTube youtube.com/wpp Connect with us on LinkedIn linkedin.com/company/wpp This year, our Annual Report takes its visual cue from commissioned work created especially for us by illustrator Christopher Corr. The brief was simple. Convey in images the global creative strength that distinguishes WPP – with its unrivalled repertory of talent, a global team of 203,000 people, possessing between them every skill required to launch, defend, reimagine and expand clients’ businesses. More information on the artist, see inside back cover. Contents The big picture How we behave and how we’re rewarded 2 The fast read 81 Letter from the Chairman of the Company 4 Who we are 83 Review of the Company’s governance and 6 What we do the Nomination and Governance Committee 8 Where we are 86 Review of the Audit Committee 89 Letter from the Chairman of the How we’re doing Compensation Committee 90 Performance at a glance 11 Financial summary 92 Compensation Committee Report 14 Strategic report to share owners 105 Implementation of reward policy for 16 Geographic performance management outside the Board 18 Sector performance 20 Financial commentary About share ownership 24 -

This Is the Message

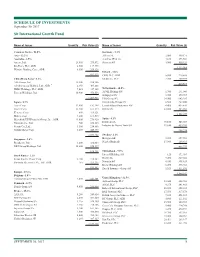

SCHEDULE OF INVESTMENTS September 30, 2017 Sit International Growth Fund Name of Issuer Quantity Fair Value ($) Name of Issuer Quantity Fair Value ($) Common Stocks - 96.0% Germany - 5.3% Asia - 22.2% Allianz SE 2,000 449,171 Australia - 2.5% Aurelius SE & Co. 4,160 273,564 Amcor, Ltd. 23,400 279,872 Siemens AG 3,900 550,324 Rio Tinto, PLC, ADR 2,500 117,975 1,273,059 Westpac Banking Corp., ADR 8,300 209,326 Ireland - 1.8% 607,173 CRH, PLC, ADR 5,800 219,588 China/Hong Kong - 6.2% Medtronic, PLC 2,700 209,979 AIA Group, Ltd. 32,200 238,386 429,567 Alibaba Group Holding, Ltd., ADR * 2,350 405,868 HSBC Holdings, PLC, ADR 7,025 347,105 Netherlands - 10.5% Tencent Holdings, Ltd. 10,900 476,556 ASML Holding NV 1,700 291,040 Galapagos NV * 3,725 379,717 1,467,915 ING Groep NV 34,900 643,285 Japan - 8.7% Koninklijke Philips NV 6,500 267,800 Asics Corp. 12,900 192,398 LyondellBasell Industries NV 4,400 435,820 Daicel Corp. 13,400 161,574 RELX NV 22,800 485,033 Keyence Corp. 600 319,121 2,502,695 Makita Corp. 4,200 169,515 Mitsubishi UFJ Financial Group, Inc., ADR 43,000 276,920 Spain - 4.1% Nintendo Co., Ltd. 700 258,113 Iberdrola SA 70,100 545,069 Secom Co., Ltd. 3,500 254,886 Industria de Diseno Textil SA 11,650 439,205 Suzuki Motor Corp. 8,400 440,875 984,274 2,073,402 Sweden - 2.1% Singapore - 2.6% Hexagon AB 5,200 257,962 Broadcom, Ltd. -

Havas Group Dentsu Aegis Network

WPP OMNICOM PUBLICIS INTERPUBLIC DENTSU AEGIS HAVAS GROUP GROUP GROUPE GROUP NETWORK DOMANI Global CEO Sir Martin Sorrell ➜ J. WALTER THOMPSON ➜ WPP DIGITAL CEO & President John Wren ➜ NATIONAL ADVERTISING ➜ DIVERSIFIED AGENCY Chairman & CEO Maurice Lévy ➜ ➜ PUBLICIS MEDIA Chairman & CEO ➜ MCCANN ➜ MARKETING CEO, Dentsu Aegis Network and Chairman & CEO CEO Tamara Ingram SERVICES (continued) BBH DIRECT CEO Steve King WORLDGROUP SPECIALISTS (CMG) Established 1986 BLUE STATE DIGITAL Established 1986 AGENCIES Established 1926 Michael Roth Executive Officer, Dentsu Inc. Yannick Bolloré Number of countries 90+ Regional CEO (Americas) Chairman & CEO Headquarters London Headquarters New York Headquarters Paris Established 1961 Jerry Buhlmann Established 1835 COGNIFIDE CUSTOM PUBLISHING PUBLICIS Tim Jones Harris Diamond CASSIDY & ASSOCIATES MIRUM GOODBY, SILVERSTEIN CEO Kai Anderson, Number of countries 113 F.BIZ Number of countries 100+ AND PARTNERS CEDAR Number of countries 100+ COMMUNICATIONS Regional CEO (EMEA) Headquarters New York Established Dentsu (1901) Headquarters Puteaux SANTO McCANN Barry D. Rhoads Number of offices 3,000+ Employees 74,000+ Number of countries US only Employees 77,574 (continued) Iain Jacob Number of countries 100+ Aegis (1978) Number of countries 140+ GLOBANT Number of countries 3 Chairman & CEO CONTRACT Number of offices 1 Regional CEO (APAC) Employees 194,000 (inc. assocs) HOGARTH WORLDWIDE Revenue for 2015 $15.13bn Revenue for 2015 €9.60bn Employees 50,100 Harris Diamond CURRENT MARKETING Dentsu Aegis Network -

Chronology of Unbundled Agency Media Departments

Chronology of Unbundled Agency Media Departments 1972-2008 1972 • Lintas formed Initiative Media in Europe. • Advanswers was founded by Gardner Advertising in St. Louis as the first agency-backed media buying service. Gardner was later acquired by WRG and closed in 1989. Advanswers was then managed as part of Wells BDDP. (Marketing & Media Decisions 5/90). Became part of Omnicom when GGT was acquired in 1998. (Adweek 2/16/98) 1978 • McCann formed Universal Media in Europe. Lowe became a 50-50 partner in August 1991. (Media & Mktg Pocket Guide 2001; Inside Media 8/7/91) 1987 • Lintas media department set up as a separate company with its own P&L. (AA 9/12/94) 1988 • Saatchi & Saatchi formed Zenith by buying a leading British media buying company and folding it in with Saatchi & Saatchi media billings. 1989 • Optimedia launched by Publicis. 1991 • Impetus for unbundling media departments in the U.S. came in 1991, when the Advertising Agency Register decided to handle media-only searches for clients and contacted large agencies to gauge their interest. 1992 • Bozell spun off its entire media department in May 1992 into a financially autonomous unit called BJK&E Media. (AA 11/16/92) (First to do so!) • No structural change, but N.W. Ayer branded its media department to attract media-only assignments. • DDB Needham Media Group formed to pitch separate media services. National TV & Radio Buying Group formed by DDB’s NY and Chicago offices to consolidate national broadcast buying for DDB Needham and outside clients. (Ad Age 11/16/92) • Grey established Media Connections, a stand-alone subsidiary with its own profit-and-loss responsibility, to pursue, plan, and service media-only clients, and some clients of Grey subsidiaries. -

Immersive Brand Experiences & the Aspirational Shopper

WPP GLOBAL RETAIL FORUM MAY 5 & 6 2016 EDEN ROC RESORT MIAMI IMMERSIVE BRAND EXPERIENCES & THE ASPIRATIONAL SHOPPER THANK YOU TO OUR SPONSORS! PLATINUM SPONSORS GOLD SPONSORS SILVER SPONSOR SESSION SPONSORS DESIGN PARTNER PR SPONSOR WELCOME It is my pleasure to welcome you to WPP’s Global Retail Forum, hosted by The Store. We’ve curated a range of topics and cases that represent the leading international trends in retail. With our theme, “Immersive Brand Experiences & The Aspirational Shopper,” we hope to deliver both innovation and inspiration. The sessions today and tomorrow will highlight how data, content and technology are having a huge impact on the ways retail marketers can reach shoppers, and how shoppers experience retail. Brands are under pressure to stay relevant and engage, but by looking ahead to the new tools and technology adoption, the possibilities for personalization are endless. The importance of creativity has never been more critical as we look at the application of technology in our environment. The future of retail will optimize physical stores, with increased emphasis of “soft” digital experiences within them. In this session, we will also look at retail in the context of society. Retail helps facilitate the fundamental need for people to connect with one another. The rise of social networks and Big Data enables marketers to not only have a better understanding of consumers but to engage in long-term shared values that can foster innovation and open up new markets. Please open your mind to the ideas presented today and feel free to ask questions. Even if you work in different categories than our speakers cover, there will be many concepts to apply to your business.