Colombo, a Modern City in the Making…

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report-2020

Building Value Building Annual Report Annual Report Value Annual Report 2020 2020 Overseas Realty has been in the forefront, pioneering the way as Sri Lanka’s premier real estate developer. We have led the way in transforming the city of Colombo with landmarks such as the World Trade Centre Colombo and the Havelock City we have indeed dedicated ourselves to building value. Today we witness the city unravelling itself in grandeur defining itself as a world class city. In this setting we are set to expand and consolidate our frontiers further through our expansionary projects which will enhance and multiply the many dimensions of value. Contents Financial Highlights ..........................4 Chairman’s Message .........................6 Profiles of Directors...........................8 Management Review Property Leasing ...........................12 Property Trading ...........................13 Property Services ...........................14 Financial Review ...........................15 Sustainability Report.........................17 Risk Management Report .....................21 Corporate Governance Report..................24 Remuneration Committee Report ................45 Audit Committee Report ......................46 Related Party Transactions Review Committee Report ..48 Financial Report Financial Calender..........................51 Annual Report of the Board of Directors ...........52 Directors, Statement on Internal Controls ...........57 Directors’ Responsibility for Financial Reporting ......58 Independent Auditor’s Report...................59 -

Annual Report 2018/19 Contents

ANNUAL REPORT 2018/19 CONTENTS ODEL AT A GLANCE | 02 2018/19 IN BRIEF | 03 CHAIRMAN’S MESSAGE | 04 BOARD OF DIRECTORS | 08 SENIOR MANAGEMENT TEAM | 10 MANAGEMENT DISCUSSION & ANALYSIS THE OPERATING ENVIRONMENT | 15 VALUE CREATING BUSINESS MODEL | 19 ODEL IN CONTEXT | 20 FINANCIAL REVIEW| 20 OUR BRANDS | 22 STRATEGIC FOCUS AREAS | 27 HUMAN CAPITAL | 29 CORPORATE GOVERNANCE | 40 RISK MANAGEMENT | 43 REPORT OF THE RELATED PARTY TRANSACTIONS REVIEW COMMITTEE | 47 REPORT OF THE REMUNERATION COMMITTEE | 48 REPORT OF THE AUDIT COMMITTEE | 49 FINANCIAL INFORMATION ANNUAL REPORT OF THE BOARD OF DIRECTORS ON THE AFFAIRS OF THE COMPANY | 53 STATEMENT OF DIRECTORS’ RESPONSIBILITY | 56 INDEPENDENT AUDITOR’S REPORT | 57 STATEMENT OF INCOME | 60 STATEMENT OF COMPREHENSIVE INCOME | 61 STATEMENT OF FINANCIAL POSITION | 62 STATEMENT OF CHANGES IN EQUITY | 64 STATEMENT OF CASH FLOWS | 65 NOTES TO THE FINANCIAL STATEMENTS | 66 INVESTOR INFORMATION | 127 NOTICE OF MEETING | 129 FORM OF PROXY | ENCLOSED CORPORATE INFORMATION | INNER BACK COVER VISION To inspire the world. MISSION To provide a complete Mind, Body and Soul experience as the premier fashion and lifestyle retailer promoting sustainable and unparalleled levels of retail experience. OUR VALUES Odel is guided by strong shared values. We love, we serve, we style, we innovate, we give, we save, we enjoy and we inspire ODEL AT A GLANCE Odel includes a number of private brands, each with their unique identity and an extensive portfolio of OUR BRANDS international brands. NUMBER OF STORES EXPANDING OUR REACH WITH 64 LARGE DEPARTMENT STORES Department store in Shangri-La’s massive new mall – ‘The Mall at One Galle Face’ Scheduled to open in 2019 Size: 100,000 square feet Efficient use of resources is a guiding principle behind our facilities: offices, stores and OUR SUSTAINABILITY LOGISTICS logistics operations. -

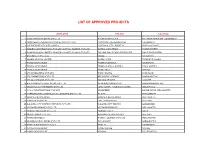

List of Approved Projects

LIST OF APPROVED PROJECTS DEVELOPER PROJECT LOCATION 1 INDOCEAN DEVELOPERS (PVT) LTD ALTAIR RESIDENCIES SIR JAMES PIERIS MW, COLOMBO 02 2 JOHN KEELLS RESIDENTIAL PROPERTIES (PVT) LTD CINNAMON LIFE RESIDENCIES COLOMBO 02 3 OVERSEAS REALTY (CEYLON) PLC HAVELOCK CITY - PHASE III HAVELOCK ROAD 4 SANKEN CONSTRUCTIONS (PVT) LTD / CAPITAL TOWERS (PVT) LTD CAPITAL TWIN PEAKS STAPLE STREET 5 SHANGRI-LA ASIA LIMITED / SHANGRI-LA HOTELS LANKA (PVT) LTD THE ONE GALLE FACE RESIDENCIES GALLE FACE GREEN 6 BRIX REALTY (PVT) LTD VERGE RAJAGIRIYA 7 GLOBAL LEASING LIMITED SCIENIC VIEW THALAWATHUGODA 8 PRIME LANDS GROUP PRIME SPLENDOUR RAJAGIRIYA 9 PRIME LANDS GROUP PRIME 616 ETHUL KOTTE 2 ETHUL KOTTE 2 10 PRIME LANDS GROUP PRIME AQUA NAWALA 11 STK DEVELOPERS (PVT) LTD PARK HEIGHTS PARK ROAD 12 STK ENGINEERING (PVT) LTD MELBOURNE HEIGHTS BAMBALAPITIYA 13 STK QUICKSHAWS (PVT) LTD KALINGA HEIGHTS JAWATTE 14 A & D PROPERTY DEVELOPERS (PVT) LTD GLORIOUS RESIDENCIES BANDARANAYAKE MW 15 UNION PLACE APARTMENTS (PVT) LTD LUNA TOWER - FOUR FOUR SEVEN UNION PLACE 16 J P K L CONSTRUCTIONS (PVT) LTD SEA BREEZE MARINE DRIVE, WELLAWATTE 17 INTERNATIONAL CONSTRUCTION CONSORTIUM (PVT) LTD NILAVELI TRINCOMALEE 18 HAMPDEN RESIDENCIES HAMPDEN RESIDENCIES WELLAWATTE 19 HOMELANDS SKYLINE LUXE APARTMENTS KOTTAWA 20 COLOMBO CITY CENTER PARTNERS (PVT) LTD COLOMBO CITY CENTER GANGARAMA 21 VESTA RESIDENCIES (PVT) LTD VESTA RESIDENCIES WELLAWATTE 22 FAIRWAY HOLDINGS (PVT) LTD FAIRWAY GALLE GALLE 23 MITIKO HOMES (PVT) LTD BRICKSGATE APARTMENTS WATTALA 24 RASIKA MARVELLA RASIKA HOLDINGS -

John Keells Holdings

John Keells Holdings JKH - Rs.157.0 Yasas Wijethunga Key Highlights Email : [email protected] Phone : +94 77 0532059 4Q18 Results Update . 4Q18 recurring net profit of Rs.5,946mn for 4Q18 (+32% YoY), above our expectations, driven by increased earnings from the Insurance business, due to a transfer of insurance contract liabilities . JKH’s group NP forecast broadly maintained at Rs.16,676mn for FY19E (-2% YoY on a recurring basis) and forecast a NP of Rs.17,641mn for FY20E (+6% YoY) . The JKH share underperformed the broader market during last 12 months and last three months declining -7% and -2% respectively (vs. ASI’s decrease of -3% and -1%) . The JKH share trades at forward PER multiples of 13.1x for FY19E and 12.4X for FY20E . Based on our estimated break up Sum of The Parts (SOTP) valuation of Rs.164, the JKH share is currently trading at a 5% discount . Whilst further significant downside is limited, amid the recent declines and share coupled with the share trading at a slight discount we do not anticipate material share price gains with continuous 28 May 2018 moderate earnings growth expected in the near term. However, JKH may continue to be favored by medium to long term investors, amid its unrivalled share liquidity, being the only company Sri Lanka with over US$1mn average daily turnover on the CSE and potential for upside in its core sectors over the long term Diversified Holdings Key Trading Information Relative Share Price Movement (%) Shares in Issue (mn) 1,387.5 110 Market Cap (US$ mn) 1,378.7 ASPI Estimated Free Float (%) -

SVAT RIP Details Report As At

SVAT RIP Details Report As at - 2020-07-22 TIN No Taxpayer Name SVAT No Project Name 100871157 VIRCO INTERNATIONAL (PRIVATE) LIMITED 11465 - 100871483 CEILAN COIR PRODUCTS 10606 - 100872420 CONSOLIDATED PRINTING (PVT) LTD 10086 - 100872722 THERMOTEX (PVT) LTD 11616 - 100873087 ALPINE CLOTHINGS POLPITHIGAMA (PVT) LTD 10040 - 100874776 O C M LANKA (PRIVATE) LIMITED 10227 PROVIDING CUSTOMISIZED BAGGING SOLUTIONS AT PORT IN COLOMBO 100875713 N D C EXPORTS (PVT) LTD 10163 - 100876507 DEVON TEAS LIMITED 11295 - 100877007 UNIFI TEXTILES COLOMBO (PRIVATE) LIMITED 10578 - 100877449 VENUS EMBELLISHERS (PRIVATE) LIMITED 10232 - 100878704 CONTINENTAL TEA (PRIVATE) LIMITED 10554 - 100878771 AARON TEXTILES LANKA (PRIVATE) LIMITED 11205 - 100879905 TUNA WORKS LANKA (PRIVATE) LIMITED 10742 TUNA WORKS LANKA (PVT) LTD 100880164 KALPITIYA LAGOON RESORT (PRIVATE) LIMITED 11204 KALPITIYA LAGOON RESORT (PRIVATE) LIMITED 100882884 ANDRITZ HYDRO GMBH 10110 - 100883546 DUNDY TRADING COMPANY 10108 - 100885930 PRIME STRUCTURES ENGINEERING LANKA (PRIVATE) LIMITED 10265 - 100888122 CREATIVE ACCESSORIES LANKA (PRIVATE) LIMITED 10146 - 100888980 ICONIC DEVELOPMENTS (PRIVATE) LIMITED 11620 ICONIC DEVOLOPMENTS (PVT) LTD 100889218 KEFRO INTERNATIONAL (PRIVATE) LIMITED 11428 - 100889820 ROYAL FRESH EXPORTS (PRIVATE) LIMITED 10582 - 100890151 ION EXCHANGE (INDIA) LIMITED 11358 ALUTHGAMA, MATHUGAMA, AGALAWATTA WATER SUPPLY PROJECT 100890232 D AND H APPARELS (PRIVATE) LIMITED 11351 - 100890828 JITF - KDESH JV 11632 AMBATHALE WATER SUPPLY SYSTEM IMPROVEMENT, ENERGY SAVING COLOMBO -

Real Estate Investment Leads Sri Lanka's Remarkable Transformation

REAL ESTATE INVESTMENT LEADS SRI LANKA’S REMARKABLE TRANSFORMATION September 2018: The Asia Pacific region has emerged as the best real estate investment destination globally, registering the highest year-on-year investment growth of 29% (H1 2018 vs H1 2017) against 9% in the Americas and EMEA regions (Source: JLL Research Report “Global Capital Flows”, Q2 2018). Within this region, Sri Lanka is a shining example of a thriving emerging market. The ‘Pearl of the Indian Ocean’, Sri Lanka is experiencing a surge in real estate investment following a steady period of impressive economic growth over the past decade. A vibrant democracy, political stability, a transparent and robust legal system based on the canons of the Laws of England, freedom for foreigners to invest, a transparent regulatory regime for free capital movements, a relatively benign tax environment, a peaceful South Asian region and an economy getting into a sustained growth all combine to put the spotlight on this island one of the top opportunities for real estate investments in emerging Asian economies. Extensive government investment and private consumption has helped deliver an impressive GDP growth of 4.5% according to World Bank estimates. Sri Lanka’s capital city, Colombo, is one of the region’s fastest-growing commercial hubs. Located at the centre of major shipping routes connecting South Asia and the Far East with Europe, Africa and America, it enjoys enormous strategic importance and today the city is a base for numerous businesses and government institutions. Additionally, strong air connectivity and popularity for tourists have provided a solid foundation for the country’s transformation. -

John Keells Holdings (JKH) 1Q19 Results Update

John Keells Holdings JKH - Rs.136.1 Yasas Wijethunga Key Highlights [email protected] 1Q19 Results Update +94 77 053 2059 ❑ 1Q19 NP of Rs.2,361mn (-22% YoY), below our expectations, amid decline in earnings in Leisure, ‘Others’, Consumer Foods and Retail Sectors ❑ JKH’s group NP forecast revised down by -7% to Rs.15,479mn for FY19E (-9% YoY on a recurring basis) and by -6% to Rs.16,627mn for FY20E (+7% YoY), amid continued pressure on earnings expected from Leisure, Consumer Foods and Retail sectors. NP expected to rebound in FY21E to Rs.22,371mn (+35% YoY) amid the profit recognition of Cinnamon Life apartment projects. Subsequently, NP forecast 01 August 2018 at Rs.22,600mn in FY22E (+1% YoY) Sri Lanka ❑ The JKH share underperformed the broader market during last 12 and three Diversified Holdings months declining -21% and -17% respectively (vs. ASI’s decreases of -7% and -6% respectively) – the share was removed from MSCI Frontier Markets 100 Index in Jun 2018 as the company failed to meet the minimum liquidity requirement ❑ The JKH share trades at forward PER multiples of 12.2X for FY19E, 11.4X for FY20E, 8.4X for both FY21E and FY22E ❑ Based on our estimated break up Sum of The Parts (SOTP) valuation of Rs.167, the JKH share is currently trading at a 23% discount ❑ Despite the decrease in earnings, we believe that the extent of the recent share price decline seems unwarranted. Whilst, near term earnings weakness may remain due to expansion and construction related expenses in key sectors, we believe current share price provide a decent entry point to value oriented investors. -

IE Singapore Partners SBF to Help Singapore Companies in Consumer, Tourism and Infrastructure Access Opportunities in Sri Lanka

JOINT R EL E AS E IE Singapore partners SBF to help Singapore companies in consumer, tourism and infrastructure access opportunities in Sri Lanka MR No.: 004/18 Singapore, Wednesday, 24 January 2018 1. Following the signing of the Sri Lanka-Singapore Free Trade Agreement (SLSFTA), three Singapore companies sealed deals with Sri Lankan partners today. To capture opportunities in this growing market, Food Studio1, Ark Holdings2 and HPL Hotels & Resorts3 signed four agreements for new projects across food, aquaculture, hospitality and infrastructure at the Sri Lanka-Singapore Business Forum 2018 (Please see Annex 1 for details). The forum was organised by International Enterprise (IE) Singapore, Singapore Business Federation (SBF), Ceylon Chamber of Commerce and Sri Lanka Singapore Business Council. The signings were witnessed by Sri Lankan Minister of Development Strategies and International Trade, Malik Samarawickrama and Singapore Minister for Trade and Industry (Industry) S. Iswaran, who is in Sri Lanka for the SLSFTA signing. 2. With an economy worth S$107.5 billion4 in 2016, Sri Lanka is targeted to grow at 5% in 20185, among the fastest in Asia. As Sri Lanka’s third largest import partner, Singapore has close trade ties with Sri Lanka (Please see Annex 2 for an infographic on Singapore-Sri Lanka trade). With Sri Lanka’s strategic location along the East-West shipping route and the new SLSFTA lowering trade barriers, Singapore companies can leverage Sri Lanka’s connectivity to enter markets in South Asia. IE Singapore has been partnering Singapore companies closely to explore opportunities in Sri Lanka 1 Food Studio is a food court operator. -

A N N U a L R E P O R T 2 0 1 9

ANNUAL REPORT 2019/20 02 | Odel at a Glance 03 | 2019/20 In Brief CONTENTS 04 | Chairman’s Message 08 | Board of Directors 10 | Corporate Governance 13 | Risk Management 18 | Report of the Related Party Transactions Review Committee 19 | Report of The Audit Committee 20 | Report of The Remuneration Committee FINANCIAL INFORMATION 22 | Annual Report of The Board of Directors on the Affairs of the Company 25 | Statement of Directors’ Responsibility 26 | Independent Auditor’s Report 30 | Statement of Income 31 | Statement of Comprehensive Income 32 | Statement of Financial Position 34 | Statement of Changes In Equity 35 | Statement of Cash Flows 37 | Notes to the Financial Statements 105 | Investor Information 107 | Notice of Meeting 111 | Form of Proxy Inner Back Cover | Corporate Information VISION To inspire the world. MISSION To provide a complete Mind, Body and Soul experience as the premier fashion and lifestyle retailer promoting sustainable and unparalleled levels of retail experience. OUR VALUES Odel is guided by strong shared values. We love, we serve, we style, we innovate, we give, we save, we enjoy and we inspire ODEL PLC 1 Annual Report 2019/2020 2 ODEL PLC Annual Report 2019/2020 Odel at a Glance Over 7 Bn Sri Lanka is positioning Net Asset itself as the primary shopping hub in the region with ODEL taking leading initiatives in these areas of crucial economic 84 development. Number of Stores Over Over 7.4 Bn 375,000 Sq.ft Turnover Floor Area Age Analysis Total No.of Employees 38% 62% Female Male Age 20 - 25 Age 40 - 45 1,100+ -

Company Profile 2020

1 Corporate Overview Informex Concreting (Pvt) Ltd is the pioneer and leader of the readymix concrete industry in Sri Lanka. It commenced operations with the supply of readymix concrete to the World Trade Centre in Colombo where it delivered a mega 55,000m³ of concrete under stringent quality and demanding performance standards. Since then the company has provided concreting solutions to many large and small scale projects adapting to the needs of the project and working with a variety of local and foreign contractors. Notable among these have been the World Trade Center in Colombo, Crescat and Monarch Residencies, Havelock City, Sapugaskande and Kelanitissa Power Stations, the Central Bank Extension Project, Shangri-la Phaze 1, II and III Colombo and Shangri-la Hambantota, Astoria Residential Project Colombo 3, ITC Hotel Project and the Lotus Tower. The latter involved the largest concrete pour in Sri Lanka’s construction history and Informex’s design mix for Grade 40 mixes was adopted for the entire project. Informex Concreting (Pvt) Ltd handles in excess of 100,000 cubic meters of concrete annually. With over 20 years of experience in providing quality concreting solutions to large, medium, and small scale enterprises, The Company’s competitive advantage is embodied in its efficient cost structure and 24x7 support. Its expertise is in providing and developing workable concreting solutions and “best-of-breed” readymix design mixes for both mega scale projects and small scale construction. These include commercial buildings, residential buildings, bridges and highways. In response to project requirements Informex also provides mobile batching plant services. The company’s readymix concrete batching plants are located in Colombo 10, Galle, Hambantota and Horana, its pre-mix asphalt plant is at Horana and its cement mortar plant is located in Chilaw. -

An Examination of Postwar Urban Development in Colombo, Sri Lanka Leoma T

St. Cloud State University theRepository at St. Cloud State Culminating Projects in Social Responsibility Interdisciplinary Programs 9-2016 Neoliberalism and Social Justice in the City: An Examination of Postwar Urban Development in Colombo, Sri Lanka Leoma T. Van Dort Saint Cloud State University Follow this and additional works at: https://repository.stcloudstate.edu/socresp_etds Part of the Other Sociology Commons Recommended Citation Van Dort, Leoma T., "Neoliberalism and Social Justice in the City: An Examination of Postwar Urban Development in Colombo, Sri Lanka" (2016). Culminating Projects in Social Responsibility. 7. https://repository.stcloudstate.edu/socresp_etds/7 This Thesis is brought to you for free and open access by the Interdisciplinary Programs at theRepository at St. Cloud State. It has been accepted for inclusion in Culminating Projects in Social Responsibility by an authorized administrator of theRepository at St. Cloud State. For more information, please contact [email protected]. Neoliberalism and Social Justice in the City: An Examination of Postwar Urban Development in Colombo, Sri Lanka by Leoma Therese Van Dort A Thesis Submitted to the Graduate Faculty of St. Cloud State University in Partial Fulfillment of the Requirements for the Degree of Master of Science in Social Responsibility September, 2016 Thesis Committee: Dr. Ajaykumar Panicker, Chairperson Dr. Stephen Philion Dr. Jason Lindsey 2 Abstract Neoliberal urban development has witnessed tremendous changes in urban landscapes around the world. It has also contributed to increasing inequalities and social injustices in these changing urban landscapes. This study is an attempt to explore how neoliberal urban processes and accumulation by dispossession have shaped the new and rapid urban (re)development drive in Sri Lanka that is dramatically restructuring Colombo’s landscape and the socio-economic positions of its people. -

Abans PLC / Annual Report 2017/18

ABANS PLC / ANNUAL REPORT 2017/18 THE PAST, THE PRESENT, THE FUTURE; WE AT ABANS PRESENT THE ANNALS OF A GOLDEN ERA THAT HAS MADE US ONE OF SRI LANKA’s MOST RECOGNISED AND RESPECTED BUSINESS ENTITIES NOW AND IN THE YEARS TO COME. AS WE CELEBRATE 50 YEARS OF INGENUITY, PASSION AND EXCEPTIONAL SERVICE, WE BRING TO MIND THE MILESTONE MOMENTS AND DEDICATION TO CUSTOMER CENTRICITY THAT HAS BROUGHT US TO WHERE WE ARE TODAY. Abans PLC | Annual Report 2017/18 | 1 Overview Management Discussion and Analysis OVERVIEW ManagEMENT Governance and Compliance Financial Reports The Abans Story 4 DISCUSSION AND Supplementary Information Our Journey 6 ANALYSIS Our Presence 7 Colombo City Centre 8 Industry Overview 29 Abans’ Milestones 12 Financial Review 31 Financial Highlights - Group 14 Performance of Subsidiaries 35 Group Structure 16 Product Portfolio Management 37 Branch Network 17 New Products at Abans 42 Message from the Chairperson 18 Awards and Recognition 49 Board of Directors 22 Channel Management Strategy 51 Managing Director’s Review of Performance 25 ICT Integration 55 Customer Engagement 56 COLOMBO Human Resource Management 60 08 CITY CENTRE Corporate Social Responsibility 66 NEW 42 PRODUCTS AT ABANS VISION To attract and retain our customers for life... MISSION Adding value to our most precious asset, our customers, by bestowing a novel range of world-class products and services that reflect comfort, convenience and quality. 2 | Abans PLC | Annual Report 2017/18 GOVERNANCE AND SUPPLEMENTARY COMPLIANCE INFORMATION Risk Management 71 Statement