Annual Report 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report-2020

Building Value Building Annual Report Annual Report Value Annual Report 2020 2020 Overseas Realty has been in the forefront, pioneering the way as Sri Lanka’s premier real estate developer. We have led the way in transforming the city of Colombo with landmarks such as the World Trade Centre Colombo and the Havelock City we have indeed dedicated ourselves to building value. Today we witness the city unravelling itself in grandeur defining itself as a world class city. In this setting we are set to expand and consolidate our frontiers further through our expansionary projects which will enhance and multiply the many dimensions of value. Contents Financial Highlights ..........................4 Chairman’s Message .........................6 Profiles of Directors...........................8 Management Review Property Leasing ...........................12 Property Trading ...........................13 Property Services ...........................14 Financial Review ...........................15 Sustainability Report.........................17 Risk Management Report .....................21 Corporate Governance Report..................24 Remuneration Committee Report ................45 Audit Committee Report ......................46 Related Party Transactions Review Committee Report ..48 Financial Report Financial Calender..........................51 Annual Report of the Board of Directors ...........52 Directors, Statement on Internal Controls ...........57 Directors’ Responsibility for Financial Reporting ......58 Independent Auditor’s Report...................59 -

Colombo, a Modern City in the Making…

Colombo, a modern city in the making | July 2013 | Colombo, a modern city in the making… Colombo city calls for the need of development towards an urbanized metropolis in transforming to a regional hub. Steps have been taken by means of improving the quality of the road network and beautification of the city to make the metropolis one of the greenest and cleanest cities in Asia. To cater to the required capacity increase in hotels, apartments, office and retail space, many projects including mixed developments have been proposed. However due to back and forth movements in certain policies and other delays, only few out of the announced projects are currently underway while the others are expected in the medium term. Therefore due to the disparity between the currently needed capacity and actually completed, a deficit in supply exists. Thus we believe that there would not be a glut due to these projects being automatically phased out. The government through the state owned Urban Development Authority is involved in the city development whilst many private companies have proposed projects. However out of the listed companies, few such as John Keells Holdings (JKH : LKR260.10), Colombo Land and Development (CLND : LKR43.70), Overseas Realty (OSEA : LKR18.50) and Access Engineering (AEL : LKR20.30) have grasped such opportunities. In the five star city hotel segment a shortfall of c.1,500 hotel rooms (by 2016) would be seen in meeting the expected tourist arrivals trend where the city is currently equipped with 2,000 hotel rooms. A deficit would be evident till 2016/17 as only two five star hotels out of the proposed projects are off ground currently (of capacity 700 rooms). -

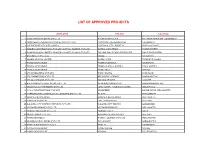

List of Approved Projects

LIST OF APPROVED PROJECTS DEVELOPER PROJECT LOCATION 1 INDOCEAN DEVELOPERS (PVT) LTD ALTAIR RESIDENCIES SIR JAMES PIERIS MW, COLOMBO 02 2 JOHN KEELLS RESIDENTIAL PROPERTIES (PVT) LTD CINNAMON LIFE RESIDENCIES COLOMBO 02 3 OVERSEAS REALTY (CEYLON) PLC HAVELOCK CITY - PHASE III HAVELOCK ROAD 4 SANKEN CONSTRUCTIONS (PVT) LTD / CAPITAL TOWERS (PVT) LTD CAPITAL TWIN PEAKS STAPLE STREET 5 SHANGRI-LA ASIA LIMITED / SHANGRI-LA HOTELS LANKA (PVT) LTD THE ONE GALLE FACE RESIDENCIES GALLE FACE GREEN 6 BRIX REALTY (PVT) LTD VERGE RAJAGIRIYA 7 GLOBAL LEASING LIMITED SCIENIC VIEW THALAWATHUGODA 8 PRIME LANDS GROUP PRIME SPLENDOUR RAJAGIRIYA 9 PRIME LANDS GROUP PRIME 616 ETHUL KOTTE 2 ETHUL KOTTE 2 10 PRIME LANDS GROUP PRIME AQUA NAWALA 11 STK DEVELOPERS (PVT) LTD PARK HEIGHTS PARK ROAD 12 STK ENGINEERING (PVT) LTD MELBOURNE HEIGHTS BAMBALAPITIYA 13 STK QUICKSHAWS (PVT) LTD KALINGA HEIGHTS JAWATTE 14 A & D PROPERTY DEVELOPERS (PVT) LTD GLORIOUS RESIDENCIES BANDARANAYAKE MW 15 UNION PLACE APARTMENTS (PVT) LTD LUNA TOWER - FOUR FOUR SEVEN UNION PLACE 16 J P K L CONSTRUCTIONS (PVT) LTD SEA BREEZE MARINE DRIVE, WELLAWATTE 17 INTERNATIONAL CONSTRUCTION CONSORTIUM (PVT) LTD NILAVELI TRINCOMALEE 18 HAMPDEN RESIDENCIES HAMPDEN RESIDENCIES WELLAWATTE 19 HOMELANDS SKYLINE LUXE APARTMENTS KOTTAWA 20 COLOMBO CITY CENTER PARTNERS (PVT) LTD COLOMBO CITY CENTER GANGARAMA 21 VESTA RESIDENCIES (PVT) LTD VESTA RESIDENCIES WELLAWATTE 22 FAIRWAY HOLDINGS (PVT) LTD FAIRWAY GALLE GALLE 23 MITIKO HOMES (PVT) LTD BRICKSGATE APARTMENTS WATTALA 24 RASIKA MARVELLA RASIKA HOLDINGS -

John Keells Holdings

John Keells Holdings JKH - Rs.157.0 Yasas Wijethunga Key Highlights Email : [email protected] Phone : +94 77 0532059 4Q18 Results Update . 4Q18 recurring net profit of Rs.5,946mn for 4Q18 (+32% YoY), above our expectations, driven by increased earnings from the Insurance business, due to a transfer of insurance contract liabilities . JKH’s group NP forecast broadly maintained at Rs.16,676mn for FY19E (-2% YoY on a recurring basis) and forecast a NP of Rs.17,641mn for FY20E (+6% YoY) . The JKH share underperformed the broader market during last 12 months and last three months declining -7% and -2% respectively (vs. ASI’s decrease of -3% and -1%) . The JKH share trades at forward PER multiples of 13.1x for FY19E and 12.4X for FY20E . Based on our estimated break up Sum of The Parts (SOTP) valuation of Rs.164, the JKH share is currently trading at a 5% discount . Whilst further significant downside is limited, amid the recent declines and share coupled with the share trading at a slight discount we do not anticipate material share price gains with continuous 28 May 2018 moderate earnings growth expected in the near term. However, JKH may continue to be favored by medium to long term investors, amid its unrivalled share liquidity, being the only company Sri Lanka with over US$1mn average daily turnover on the CSE and potential for upside in its core sectors over the long term Diversified Holdings Key Trading Information Relative Share Price Movement (%) Shares in Issue (mn) 1,387.5 110 Market Cap (US$ mn) 1,378.7 ASPI Estimated Free Float (%) -

John Keells Holdings (JKH) 1Q19 Results Update

John Keells Holdings JKH - Rs.136.1 Yasas Wijethunga Key Highlights [email protected] 1Q19 Results Update +94 77 053 2059 ❑ 1Q19 NP of Rs.2,361mn (-22% YoY), below our expectations, amid decline in earnings in Leisure, ‘Others’, Consumer Foods and Retail Sectors ❑ JKH’s group NP forecast revised down by -7% to Rs.15,479mn for FY19E (-9% YoY on a recurring basis) and by -6% to Rs.16,627mn for FY20E (+7% YoY), amid continued pressure on earnings expected from Leisure, Consumer Foods and Retail sectors. NP expected to rebound in FY21E to Rs.22,371mn (+35% YoY) amid the profit recognition of Cinnamon Life apartment projects. Subsequently, NP forecast 01 August 2018 at Rs.22,600mn in FY22E (+1% YoY) Sri Lanka ❑ The JKH share underperformed the broader market during last 12 and three Diversified Holdings months declining -21% and -17% respectively (vs. ASI’s decreases of -7% and -6% respectively) – the share was removed from MSCI Frontier Markets 100 Index in Jun 2018 as the company failed to meet the minimum liquidity requirement ❑ The JKH share trades at forward PER multiples of 12.2X for FY19E, 11.4X for FY20E, 8.4X for both FY21E and FY22E ❑ Based on our estimated break up Sum of The Parts (SOTP) valuation of Rs.167, the JKH share is currently trading at a 23% discount ❑ Despite the decrease in earnings, we believe that the extent of the recent share price decline seems unwarranted. Whilst, near term earnings weakness may remain due to expansion and construction related expenses in key sectors, we believe current share price provide a decent entry point to value oriented investors. -

IE Singapore Partners SBF to Help Singapore Companies in Consumer, Tourism and Infrastructure Access Opportunities in Sri Lanka

JOINT R EL E AS E IE Singapore partners SBF to help Singapore companies in consumer, tourism and infrastructure access opportunities in Sri Lanka MR No.: 004/18 Singapore, Wednesday, 24 January 2018 1. Following the signing of the Sri Lanka-Singapore Free Trade Agreement (SLSFTA), three Singapore companies sealed deals with Sri Lankan partners today. To capture opportunities in this growing market, Food Studio1, Ark Holdings2 and HPL Hotels & Resorts3 signed four agreements for new projects across food, aquaculture, hospitality and infrastructure at the Sri Lanka-Singapore Business Forum 2018 (Please see Annex 1 for details). The forum was organised by International Enterprise (IE) Singapore, Singapore Business Federation (SBF), Ceylon Chamber of Commerce and Sri Lanka Singapore Business Council. The signings were witnessed by Sri Lankan Minister of Development Strategies and International Trade, Malik Samarawickrama and Singapore Minister for Trade and Industry (Industry) S. Iswaran, who is in Sri Lanka for the SLSFTA signing. 2. With an economy worth S$107.5 billion4 in 2016, Sri Lanka is targeted to grow at 5% in 20185, among the fastest in Asia. As Sri Lanka’s third largest import partner, Singapore has close trade ties with Sri Lanka (Please see Annex 2 for an infographic on Singapore-Sri Lanka trade). With Sri Lanka’s strategic location along the East-West shipping route and the new SLSFTA lowering trade barriers, Singapore companies can leverage Sri Lanka’s connectivity to enter markets in South Asia. IE Singapore has been partnering Singapore companies closely to explore opportunities in Sri Lanka 1 Food Studio is a food court operator. -

Company Profile 2020

1 Corporate Overview Informex Concreting (Pvt) Ltd is the pioneer and leader of the readymix concrete industry in Sri Lanka. It commenced operations with the supply of readymix concrete to the World Trade Centre in Colombo where it delivered a mega 55,000m³ of concrete under stringent quality and demanding performance standards. Since then the company has provided concreting solutions to many large and small scale projects adapting to the needs of the project and working with a variety of local and foreign contractors. Notable among these have been the World Trade Center in Colombo, Crescat and Monarch Residencies, Havelock City, Sapugaskande and Kelanitissa Power Stations, the Central Bank Extension Project, Shangri-la Phaze 1, II and III Colombo and Shangri-la Hambantota, Astoria Residential Project Colombo 3, ITC Hotel Project and the Lotus Tower. The latter involved the largest concrete pour in Sri Lanka’s construction history and Informex’s design mix for Grade 40 mixes was adopted for the entire project. Informex Concreting (Pvt) Ltd handles in excess of 100,000 cubic meters of concrete annually. With over 20 years of experience in providing quality concreting solutions to large, medium, and small scale enterprises, The Company’s competitive advantage is embodied in its efficient cost structure and 24x7 support. Its expertise is in providing and developing workable concreting solutions and “best-of-breed” readymix design mixes for both mega scale projects and small scale construction. These include commercial buildings, residential buildings, bridges and highways. In response to project requirements Informex also provides mobile batching plant services. The company’s readymix concrete batching plants are located in Colombo 10, Galle, Hambantota and Horana, its pre-mix asphalt plant is at Horana and its cement mortar plant is located in Chilaw. -

Govt. to Continue Dubious Tests? Z Concerns About J’Pura Uni Z Three Letters Sent to Prez

PAGES 48 / SECTIONS 5 VOL. 02 – NO. 33 SUNDAY, MAY 10, 2020 Maintain Distance, Stay Safe www.themorning.lk epaper.themorning.lk WEIGHING www.aruna.lk epaper.aruna.lk BETWEEN DEFINITE DEBT WORST IS EMPLOYERS TO ELECTIONS AND NOOSE YET TO BEGIN PRORATED INDEFINITE DATE TIGHTENS COME SALARIES »SEE PAGES 8&9 »SEE PAGE 6 »SEE PAGE 7 »SEE BUSINESS PAGE 1 DESPITE CONCERNS OF ACCURACY Govt. to continue dubious tests? z Concerns about J’pura Uni z Three letters sent to Prez. z We need J’pura: Health Ministry BY SKANDHA GUNASEKARA to increase the number of daily she said yesterday (9). “We sent a letter on 26 April where The final letter was sent on 6 May,” The Government is to continue to rely on PCR tests PCR tests. The College of Medical Laboratory we urged the President to carry out said CMLS and Sri Lanka Association “There is a need to increase testing Science (CMLS) has submitted an investigation into the matter and of Government Medical Laboratory conducted outside the Ministry of Health, despite repeated and we appreciate the help given by three letters to President Gotabaya resolve it. Then we sent a letter again Technologists (SLAGMLT) President warnings from medical laboratory experts on the lack of outside laboratories such as the lab at Rajapaksa; the first as far back as 26 on 3 May that included a 12-point Ravi Kumudesh, adding that no accuracy and false results. Sri Jayawardenepura University. We April, warning about defective PCR explanation of the problems in the official response had been received Speaking to The Sunday Morning, Bhadrani Jayawardena said that the haven’t taken any decision to stop tests, particularly from the lab at Sri various laboratories, including the one up to date. -

Tie up with Condominium Apartments

Tie up with Condominium Apartments Name of the Project Lending % Contact Point Colombo City Centre (at 1 Ganagaramaya) Up to 75% Mr Richard Buultjens (General Manager ) - 0718 440308 of the value of the Abans & SilverNeedle Hospitality apartment Mr Mayurr Hasarika (Sales Manager) - 0712 513213 2 Havelock City (Phase III) Up to 80% Ms Dilkushi Jayawardena ( Senior Executive) of the value of the - 0773 262950 Mireka Capital & Overseas Reality apartment Prime Residencies Bauddhaloka Mw Mrs Dilukshi Rajakaruna (Sales Executive ) 3 II (at Colombo 04) Up to 75% - 0710 200556 of the value of the Prime Lands apartment Mr Sudath Siriwardena (General Manager) - 0714 756007 Prime Residencies Barnes Place (at Mrs Dilukshi Rajakaruna (Sales Executive ) 4 Barnes Place) Up to 75% - 0710 200556 of the value of the Prime Lands apartment Mr Sudath Siriwardena (General Manager) - 0714 756007 Prime Residencies Malabe (at Mrs Dilukshi Rajakaruna (Sales Executive ) 5 Malabe) Up to 75% - 0710 200556 of the value of the Prime Lands apartment Mr Sudath Siriwardena (General Manager) - 0714 756007 Prime 616 - Ethul Kotte II (at Ethul Mrs Dilukshi Rajakaruna (Sales Executive ) 6 Kotte) Up to 75% - 0710 200556 of the value of the Prime Lands apartment Mr Sudath Siriwardena (General Manager) - 0714 756007 Prime Residencies Ethul Kotte (at Mrs Dilukshi Rajakaruna (Sales Executive ) 7 Ethul Kotte) Up to 75% - 0710 200556 of the value of the Prime Lands apartment Mr Sudath Siriwardena (General Manager) - 0714 756007 Mrs Dilukshi Rajakaruna (Sales Executive ) 8 Prime -

Japanese Tiff Trips Power Sector? Z Transmission and Distribution Loss Reduction Project Lost Z No Transmission Lines from Power Plants

FAST-TRACKING SL’S ECONOMIC REVIVAL A GREEN ECONOMY OF DUMINDA DISSANAYAKE A DIFFERENT KIND Marijuana exports RS. 70.00 PAGES 80 / SECTIONS 7 VOL. 03 – NO. 09 SUNDAY, NOVEMBER 29, 2020 a saving AMW TO NSA DOVAL MEETS grace? RETIRE 175 PM AND PREZ. EMPLOYEES DURING VISIT »SEE PAGE 11 »SEE BUSINESS PAGE 1 »SEE PAGES 8 & 9 »SEE PAGE 6 GENERAL PREVENTIVE GUIDELINES For verified information on the coronavirus (Covid-19) contact any of the following authorities Suwasariya Ambulance Service 1999 Health Promotion Bureau Quarantine Unit 0112 112 705 1990 Epidemiology Unit 0112 695 112 Govt. coronavirus hotline 0113071073 PRESIDENTIAL SPECIAL TASK FORCE FOR ESSENTIAL SERVICES Telephone 0114354854, 0114733600 Wash hands with soap for 40-60 Wear a commercially available mask/ Maintain a minimum distance Use gloves when shopping, using Use traditional Sri Lankan greeting Always wear a mask, avoid crowded Hotline 0113456200-4 seconds, or rub hands with alcohol- cloth mask or a surgical mask at all of 1 metre from others, especially public transport, etc. and discard into at all times instead of handshaking, vehicles, maintain distance, and wash Fax 0112333066, 0114354882 based handrub for 20-30 seconds times in public places in public places a lidded bin lined with a bag hugging, and/or kissing hands before and after travelling Email [email protected] Japanese tiff trips power sector? z Transmission and Distribution Loss Reduction Project lost z No transmission lines from power plants BY MAHEESHA MUDUGAMUWA if the authorities opt for emergency The -

John K Eells Holdings PLC L Annual R Eport 2015/16

John Keells Holdings PLC l Annual Report 2015/16 CONNECTED The John Keells story has been telling itself for over 145 years; a complex narrative of partnership, innovation, enterprise and endurance. A balance between corporate prudence, entrepreneurship and the satisfaction of societal needs has underlined, and is reflected in, our business model, resulting in our present dominance in several of the nation’s valuable industry sectors. Today we are benchmarked by many, as one of Sri Lanka’s most respected diversified companies with interests in shipping and logistics, consumer foods, hospitality, property development, retail, financial services, information technology and the manufacture and brokering of tea. We have a pool of exceptionally talented employees who bring a variety of skills, experience and innovative ideas to the work we do each day. The John Keells team includes over twelve thousand people, from diverse backgrounds. Recent investments, by our Group, in long-term projects are expected to significantly multiply the direct and indirect employment generated. Yet through all of this runs the single thread of John Keells’ intent; to create and share value by building sustainable businesses of excellence, integrity and worth. Diverse networks and synergies have evolved between John Keells and its many local and global partners, linking businesses, consumers, individuals, families and communities and the thousands of people whose lives we touch every day. We believe that their success is ours. Our society centric projects and initiatives have empowered, and enriched, the lives of individuals and communities in villages and cities across the island. Ours is an open-systems organisation constantly aligning itself to the environment we operate in and striving to satisfy our aspiration “To empower the nation for tomorrow”. -

Preparatory Survey on the Project for Establishment of New Light Rail Transit System in Colombo

MINISTRY OF MEGAPOLIS AND WESTERN DEVELOPMENT DEMOCRACTIC SOCIALIST REPUBLIC OF SRI LANKA PREPARATORY SURVEY ON THE PROJECT FOR ESTABLISHMENT OF NEW LIGHT RAIL TRANSIT SYSTEM IN COLOMBO FINAL REPORT MAIN REPORT MAY 2018 JAPAN INTERNATIONAL COOPERATION AGENCY Oriental Consultants Global Co., Ltd. Japan International Consultants for Transportation Co., Ltd. Tonichi Engineering Consultants, Inc. 4R Environmental Resource Management JR(先) ERM Japan Ltd. 18-030 MINISTRY OF MEGAPOLIS AND WESTERN DEVELOPMENT DEMOCRACTIC SOCIALIST REPUBLIC OF SRI LANKA PREPARATORY SURVEY ON THE PROJECT FOR ESTABLISHMENT OF NEW LIGHT RAIL TRANSIT SYSTEM IN COLOMBO FINAL REPORT MAIN REPORT MAY 2018 JAPAN INTERNATIONAL COOPERATION AGENCY Oriental Consultants Global Co., Ltd. Japan International Consultants for Transportation Co., Ltd. Tonichi Engineering Consultants, Inc. Environmental Resource Management ERM Japan Ltd. US$ 1.00 = LKR 153 US$ 1.00 = JPY 113 (Exchange rate of January 2018) Conceptual Image of JICA-LRT System in Colombo Colombo Port Coastal Line To Galle, Matara Main Line To Badulla Fort Bus Station SLTB, Bastian, Gunasinghapura Pettah Fort / Pettah Baseline Road Transport World Trade Center Center Kelani Valley Line Beire Lake To Avissawella NationalN ti l H it l Hospital ID / Passport Cotta Rd. Office Lumbini Town Hall Borella Walikada Temple Talahena Coastal Line Diyawana Lake Sethsiripaya To Galle, Matara Sethsirypaya Kaduwela Road Borella Bus Station Rajagiriya Robert G. Kollupitiya Bus IT Park Station Malabe Battaramulla Ministry of Defence Outline of JICA-LRT Road Development Parliament Authority Head Office Malabe Bus Length (based on station KP): 15.67 km Battaramulla Bus Bureau of Foreign Station Station Employment Nos. of Station: 16 stations Department of Motor Traffic Central Environmental Outer Circular Expressway Authority (CEA) Kottwa Road Travel Time required: Narahenpita Road Colombo Galle Road Galle Colombo - Fort/Pettah – Malabe 28-32 min.