Richard Bernstein Advisors LLC February 28, 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report

COUNCIL ON FOREIGN RELATIONS ANNUAL REPORT July 1,1996-June 30,1997 Main Office Washington Office The Harold Pratt House 1779 Massachusetts Avenue, N.W. 58 East 68th Street, New York, NY 10021 Washington, DC 20036 Tel. (212) 434-9400; Fax (212) 861-1789 Tel. (202) 518-3400; Fax (202) 986-2984 Website www. foreignrela tions. org e-mail publicaffairs@email. cfr. org OFFICERS AND DIRECTORS, 1997-98 Officers Directors Charlayne Hunter-Gault Peter G. Peterson Term Expiring 1998 Frank Savage* Chairman of the Board Peggy Dulany Laura D'Andrea Tyson Maurice R. Greenberg Robert F Erburu Leslie H. Gelb Vice Chairman Karen Elliott House ex officio Leslie H. Gelb Joshua Lederberg President Vincent A. Mai Honorary Officers Michael P Peters Garrick Utley and Directors Emeriti Senior Vice President Term Expiring 1999 Douglas Dillon and Chief Operating Officer Carla A. Hills Caryl R Haskins Alton Frye Robert D. Hormats Grayson Kirk Senior Vice President William J. McDonough Charles McC. Mathias, Jr. Paula J. Dobriansky Theodore C. Sorensen James A. Perkins Vice President, Washington Program George Soros David Rockefeller Gary C. Hufbauer Paul A. Volcker Honorary Chairman Vice President, Director of Studies Robert A. Scalapino Term Expiring 2000 David Kellogg Cyrus R. Vance Jessica R Einhorn Vice President, Communications Glenn E. Watts and Corporate Affairs Louis V Gerstner, Jr. Abraham F. Lowenthal Hanna Holborn Gray Vice President and Maurice R. Greenberg Deputy National Director George J. Mitchell Janice L. Murray Warren B. Rudman Vice President and Treasurer Term Expiring 2001 Karen M. Sughrue Lee Cullum Vice President, Programs Mario L. Baeza and Media Projects Thomas R. -

Histories of Paris

UC Center Program Courses - Fall 2013 PCC 111. Histories of Paris Professor Christina von Koehler Lecture: Tuesdays 4:30-6:00 pm Contact: Site Visits: Wednesdays 1:30-3:00 pm (Group A) e-mail: [email protected] Wednesdays 3:30-5:00 pm (Group B) Tel: 01-47-70-29-42 Cell (visits only): 06 85 36 74 11 Office Hours: By appointment This class examines how the history of political ideology and social conflict in France since the Middle Ages has been embodied in the urban landscape of Paris. More than in any other city, the meaning, message, and significance to state and nation of most Parisian sites was -- and continues to be -- violently contested. We will look at the histories of the conception, construction, and public perception of Parisian monuments and place their stories within the larger context of the development of the French state and of French national identity. Major events of French history form the chronological backbone for this course, with emphasis placed on the forces that literally shaped some of the city’s most emblematic neighborhoods and monuments. The readings are selected from works by specialists in French political, urban, and social history; and the class will include weekly visits to sites in Paris, as the student learns to “read” architecture and to use the city as a rich primary source for historical analysis. Be advised: while no prior knowledge of French history is required, a high level of commitment to learning about France is. All of the writing for this class demands careful consideration of both readings for class and information given during site visits. -

Bernstein and Munro: the Coming Conflict with China, 5 Tulsa J

Tulsa Journal of Comparative and International Law Volume 5 | Issue 2 Article 7 3-1-1998 Bernstein and Munro: The ominC g Conflict with China Amy Click Follow this and additional works at: http://digitalcommons.law.utulsa.edu/tjcil Part of the Law Commons Recommended Citation Amy Click, Bernstein and Munro: The Coming Conflict with China, 5 Tulsa J. Comp. & Int'l L. 413 (1997). Available at: http://digitalcommons.law.utulsa.edu/tjcil/vol5/iss2/7 This Casenote/Comment is brought to you for free and open access by TU Law Digital Commons. It has been accepted for inclusion in Tulsa Journal of Comparative and International Law by an authorized administrator of TU Law Digital Commons. For more information, please contact daniel- [email protected]. THE COMING CONFLICT WITH CHINA BY RICHARD BERNSTEIN* AND ROSS H. MUNRO" Review by Amy Click According to a poll conducted in six Chinese provinces by the China Youth Research Center, 90 percent of Chinese youth think the United States tries to dominate China on specific issues, 96 percent of Chinese college students are of this same opinion.' It is this "love/hate" relation- ship2 among the Chinese that concerns the authors of the Coming Con- flict with China. The actors on the world stage were once discernable. Countries knew their enemies and their friends. The United States knew that communist countries were the enemy and democratic countries were friends. How- ever, with the end of the Cold War the balance of power (if it can be called a balance rather than forced cooperation) shifted with the mighty force of the disintegration of the Soviet Union, and the end of the Berlin Wall. -

Commonlit | TURMOIL in CHINA; in Shanghai, Protesters Turn Defiant

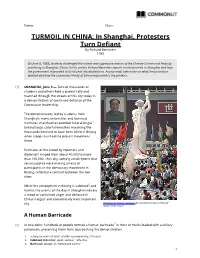

Name: Class: TURMOIL IN CHINA; In Shanghai, Protesters Turn Defiant By Richard Bernstein 1989 On June 9, 1989, students challenged the violent and oppressive actions of the Chinese Communist Party by protesting in Shanghai, China. In this article, Richard Bernstein reports on the protests in Shanghai and how the government responded to its citizens’ dissatisfactions. As you read, take notes on what the protestors wanted and how the Communist Party of China responded to the protests. [1] SHANGHAI, June 9 — Tens of thousands of students and others held a protest rally and marched through the streets of this city today in a demonstration of continued defiance of the Communist leadership. The demonstrators, led by students from Shanghai’s many universities and technical institutes, marched to recorded funeral dirges1 behind large, colorful wreathes mourning the thousands believed to have been killed in Beijing when troops crushed the protest movement there. Estimates of the crowd by reporters and diplomats ranged from about 40,000 to more than 100,000. The rally, coming amid reports that security police were making arrests of participants in the democracy movement in Beijing, reflected a contrast between the two cities. While the atmosphere in Beijing is subdued2 and fearful, the events of the day in Shanghai indicate a mood of continued anger and defiance in China’s largest and economically most important city. "Tiananmen_Square_protests" by openDemocracy is licensed under CC BY-SA 2.0. A Human Barricade [5] At one point, hundreds of people formed a human barricade3 in front of trucks loaded with auxiliary policemen, preventing them from approaching the demonstration. -

The New China Threat School

THE JAMES A. BAKER III INSTITUTE FOR PUBLIC POLICY OF RICE UNIVERSITY CHINA AND LONG-RANGE ASIA ENERGY SECURITY: AN ANALYSIS OF THE POLITICAL, ECONOMIC AND TECHNOLOGICAL FACTORS SHAPING ASIAN ENERGY MARKETS SLAYING THE CHINA DRAGON: THE NEW CHINA THREAT SCHOOL JOE BARNES RESEARCH FELLOW JAMES A. BAKER INSTITUTE FOR PUBLIC POLICY RICE UNIVERSITY PREPARED IN CONJUNCTION WITH AN ENERGY STUDY SPONSORED BY THE CENTER FOR INTERNATIONAL POLITICAL ECONOMY AND THE JAMES A. BAKER III INSTITUTE FOR PUBLIC POLICY RICE UNIVERSITY – APRIL 1999 SLAYING THE CHINA DRAGON: THE NEW CHINA THREAT SCHOOL "...China, rapidly becoming the globe's second most powerful nation, will be a predominant force as the world takes shape in the new millennium. As such, it is bound to be no strategic friend of the United States, but a long term adversary." -Richard Bernstein and Ross H. Munro, Foreign Affairs. 1 "The United States and China are not on a collision course. They have already collided." -Jacob Heilbrunn, The New Republic. 2 "We must contain China." -Charles Krauthammer, Time. 3 1989: The Year the Trouble Began Since the end of the Cold War, no issue in foreign affairs has so agitated the American political class and policy elite as China. From Democratic candidate Bill Clinton's excoriation of then-President George Bush for "coddling dictators" in 1992 to Republican accusations today that the Clinton Administration has all but betrayed our national security for the sake of campaign contributions, China has emerged as our most politically divisive foreign policy issue. The yearly Congressional review of China's Most Favored Nation (MFN) trading status ensures that Sino-American relations remain the near-constant subject of partisan contention, much of it vociferous. -

Restoring Stockbridge Bowl

Photo by Andy Gold Restoring Stockbridge Bowl Not a Member? Come Join Us Anyway! Richard Seltzer, SBA President Annual Meeting Four years ago, at our annual meeting at The Mount, you Stockbridge Association heard us describe the “tool box” of seven alternative means available to combat invasive plants in Stockbridge Bowl. At Saturday, July 28, 2018 our annual meeting last summer, you heard a vigorous plea from one member strongly advocating one of those 1:15 pm to 3:30 pm methods, namely the use of herbicides to control invasive BERKSHIRE COUNTRY DAY SCHOOL Eurasian Water Milfoil. Furey Hall - Kim & James Taylor Music Performance Room 55 Interlaken Road (Rte. 183), Stockbridge Another part of that annual meeting was a presentation by Simon’s Rock professor, Tom Coote, telling us more than 1:15 pm: Registration and Refreshments Annual Meeting most of us ever knew about the morphology and life cycle of 2:00 pm: the rare and endangered snail that lives in our lake. Theme: Discussing New Directions to Restore Stockbridge Bowl Both discussions are particularly relevant now. By-Law Amendment: Executive Committee Quorum and Powers. For proposed change, please see: www.theSBA.org Come...Celebrate Progress! Continued on Page 2 The endangered mollusk, M. lustrica, is prolific in seven states west of Massachusetts and is not ranked as rare or endangered in any of those states or by the EPA (even before Scott Pruitt). However, it is at the edge of its habitat here in Stockbridge, a fact that inspired the Natural Heritage Endangered Species Program (NHESP) of Massachusetts to offer its succor to this little mollusk. -

Dictatorship of Virtue Multiculturalism in Elementary and Secondary Schools

48 Teaching Approaches IIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIII Dictatorship of Virtue Multiculturalism in Elementary and Secondary Schools Richard Bernstein This selection first appeared in the American Experiment Quarterly’s Summer 1998 edition. Journalist Richard Bernstein is a book critic for the New York Times, where he has also been United Nations correspondent and national cultural correspondent.Two of his four books are about China; he opened Time magazine’s first Beijing bureau in 1980. In his book Dictatorship of Virtue: Multiculturalism and the Battle for America’s Future (1994), Bernstein wrote, “Scratch the surface of a multicul- turalist curriculum, and there is this worm gnawing away at any notion of American goodness. What emerges is the passion play of victims and oppressors, colonizers and colonized.” A Boston Globe reviewer called the book “tart, some- times eloquent, always graceful and lucid.” Bernstein spoke to a Center of the American Experiment audience on this subject in October 1997. One of the frustrations of the topic of multiculturalism and the assault on the concept of an American identity is that it takes such a multitude of forms that it is difficult to keep track of it all. Multiculturalism and its closely allied phenomenon of political correctness (PC) show up mostly in small ways, in a statement here, a program there. It is not a centralized movement with a head office and an official newsletter. It is, in short, dif- ficult to keep track of and difficult to define with precision. And when we do define it, we tend to focus attention on certain outrageous episodes that happen to catch the media’s attention—like some excess of gender- neutral language, or the book Politically Correct Bedtime Stories, or an outra- geous sexual harassment charge: a six-year-old boy, for example, accused of harassment for kissing a six-year-old girl on the cheek. -

Missing Sex Talk in the Supreme Court's Same-Sex Marriage Cases

University of Chicago Law School Chicago Unbound Journal Articles Faculty Scholarship 2016 Missing Sex Talk in the Supreme Court's Same-Sex Marriage Cases Mary Anne Case Follow this and additional works at: https://chicagounbound.uchicago.edu/journal_articles Part of the Law Commons Recommended Citation Mary Anne Case, "Missing Sex Talk in the Supreme Court's Same-Sex Marriage Cases," 84 University of Kansas City Law Review 675 (2016). This Article is brought to you for free and open access by the Faculty Scholarship at Chicago Unbound. It has been accepted for inclusion in Journal Articles by an authorized administrator of Chicago Unbound. For more information, please contact [email protected]. MISSING SEX TALK IN THE SUPREME COURT'S SAME-SEX MARRIAGE CASES Mary Anne Case* Two kinds of sex talk are noticeably absentfrom the Supreme Court's same-sex marriage opinions: there is very little discussion either of the joy of sex or of the constitutionally mandated prohibition of discrimination in law on grounds of sex. This Essay reflects on some of the troubling reasons for and implications of the absence of such sex talk. I have been worrying for more than two decades about what a U.S. Supreme Court opinion recognizing a constitutional right for same-sex couples to marry might say.' My worry was less about the bottom-line result-after all, as even Justice Scalia has long conceded,2 few legal conclusions have been as inescapable as the conclusion that our current constitutional case law, applied in routine fashion, mandates a victory for the plaintiffs in the same sex-marriage cases3 Obergefell v. -

Brooklyn College Magazine, Volume 5 | Number 1

During her seven é years as president, INCREASE OF 10% Karen L. Gould IN ENROLLMENT INCREASE35% IN Brooklyn College Magazine initiated capital SINCE 2010 TRANSFER B projects, increased STUDENTS SINCE 2010 international Volume 5 | Number 1 engagement, and NEW improved student 5 ENDOWED retention. SCHOOL CHAIRS STRUCTURE 67 Brooklyn College 2900 Bedford Avenue Brooklyn, NY 11210-2889 [email protected] www.brooklyn.cuny.edu Feirstein’s First Class From the President’s Desk TOW PERFORMING © 2016 Brooklyn College ARTS CENTER Students connect with As president of Brooklyn College for the past seven years, I have had the great fortune GROUNDBREAKING industry professionals in NEW Immediate Past President to lead one of the most exciting, inspiring, and diverse academic institutions in the ATHLETIC Karen L. Gould the inaugural year of the country. As I prepared for retirement I have reflected fondly on the many people I have FIELD President new, state-of-the art film worked with and the many outstanding qualities of the campus community. RIBBON Michelle J. Anderson school. Since my arrival in 2009, we have improved the conditions for student success, CUTTING Provost 9 which is our core responsibility as an institution of higher learning. More of our William A. Tramontano students are graduating as a result of our focus on degree completion, and we have Restoring Resilience supported and promoted the exceptional research and scholarship of our faculty to $100 million in fundraising Editor-in-Chief foster academic excellence and enhance the reputation of Brooklyn College. Keisha-Gaye Anderson The Science and Resilience The impact of private philanthropy through the Campaign for Success has Institute at Jamaica Bay Managing Editor expanded funding for student scholarships, study abroad, and paid internships. -

China's Arrival: a Strategic Framework for a Global Relationship

SEPTEMBER China’s Arrival: 2009 A Strategic Framework for a Global Relationship Edited by Abraham Denmark and Nirav Patel Contributing Authors: Linton Brooks, Joshua W. Busby, Abraham M. Denmark, Lindsey Ford, Michael J. Green, G. John Ikenberry, Robert D. Kaplan, Nirav Patel, Daniel Twining, Richard Weitz Acknowledgements We would like to thank our colleagues at the Center for a New American Security for their helpful comments and excellent suggestions throughout the research and writing of this report. Research assistants Michael Zubrow, Zachary Hosford, and Joseph S. Nye, Jr. National Security Intern Micah Springut, provided fine research and editing support. Whitney Parker’s creativity and assistance in the publication process was indispensable and helped take this final product from text to reality. Over the course of the past several years we have had the good fortune to meet and interact with many capable and impressive Asia hands at various conferences, seminars, and meetings in Washington and across the Asia-Pacific region. We only hope that we can offer to them the level of hospitality and openness that they extended to us as CNAS continues its work and outreach in Asia. We would also like to acknowledge the American friends, experts, and government officials, both former and current, who offered their valuable insights and critiques, including Dr. Michael Green, Dr. John Ikenberry, Ambassador Linton Brooks, Robert Kaplan, Dr. Richard Weitz, Dr. Joshua Busby, Dan Twining, Lindsey Ford, Dr. James Miller, Dr. Evan Medeiros, Admiral Michael McDevitt, Ralph Cossa, the Honorable James Kelly, Randy Schriver, Dr. Victor Cha, Dr. Patrick Cronin, Sharon Burke, Robert Scher, Derek Mitchell, and most importantly Dr. -

Studio 54: Night Magic

NIGHT MAGI C EN TLISG CRISRANH PT #Studio54AGO Irina Moore West Studio 54: Night Magic Known for its celebrity-studded parties, extravagant décor, and dazzling disco nights, the nightclub Studio 54 offered a magical escape from the turbulent 1970s in America. At Studio 54, political scandal, financial collapse, and the aftermath of the Vietnam War could be forgotten; race, sexuality, and creed didn’t matter. People from all walKs of life—from ordinary people to A-list celebrities—gathered together to dance the night away. This exhibition tells the story of how two Brooklyn-born entrepreneurs transformed a former Manhattan opera house and television studio into one of the world’s most legendary nightclubs. The innovative scenery and soundscapes of this disco hotspot are represented here in couture and street fashion, photographs, films, and ephemera. Though its doors were open for less than three years (from April 1977 to February 1980), Studio 54 left a glittering impression on popular culture and changed nightlife forever. Studio 54: Night Magic is organized by the BrooKlyn Museum. It is curated by Matthew YokobosKy, Senior Curator of Fashion and Material Culture, BrooKlyn Museum. Bypass instructions and content warning: To help stop the spread of COVID-19 we are limiting the number of visitors in the exhibition. Please use the Bypass Lanes, indicated with arrows on the floor, if you would liKe to move through the space quicKly. This exhibition contains some photographs and films which contain brief scenes of nudity, some references to illicit drug use, and other adult content. This exhibition contains images that include out-dated cultural depictions and examples of cultural appropriation Warning: this exhibition contains flashing lights, which may affect visitors with photosensitivity. -

Home Address 50 Park Avenue, Apt 4C New York, NY 10016 Tel: +1

Benhabib CV 2019 Home Address Yale University 50 Park Avenue, Apt 4C Department of Political Science New York, NY 10016 P.O. Box 208301 Tel: +1 646-649-2227 New Haven, CT 06520 Tel: +1 203-432-5246 Fax: +1 203-432-6196 SEYLA BENHABIB PERSONAL INFORMATION Birth date and location September 9, 1950; Istanbul, Turkey Children Laura Schaefer; born October 8, 1986 Citizenship United States of America ACADEMIC POSITIONS July 2001 — Present Eugene Meyer Professor of Political Science and Philosophy, Yale University Spring 2019 James S. Carpentier Visiting Professor of Law, Columbia Law School Spring 2018 - Scholar in Residence, Columbia University Law School and Senior Associate, Center for Contemporary Critical Thought, Columbia University Spring 2017 Diane Middlebrook and Carl Djerassi Visiting Professor, Center for Gender Studies, University of Cambridge (U.K.) Spring 2016 Scholar in Residence, Columbia Law School and Senior Associate, Center for Contemporary Critical Thought, Columbia University Summer 2015 Visiting Professor, European University Institute (Florence, Italy) Fall 2015 Professor of Law (Adjunct), Yale Law School Fall 2014 Professor of Law (Adjunct), Yale Law School Spring 2014 Professor of Law (Adjunct), Yale Law School Spring 2011 Professor of Law (Adjunct), Yale Law School 1 Benhabib CV 2019 Summer 2010 Visiting Professor of Law, Zvi Meitar Center for Advanced Legal Studies, Tel-Aviv University (Israel) Spring 2008 Professor of Law (Adjunct), Yale Law School Spring 2007 Professor of Law (Adjunct), Yale Law School 2002 – 2008