2019 Annual Report Other Than the Consolidated Financial Statements and Our Auditor’S Report Thereon

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

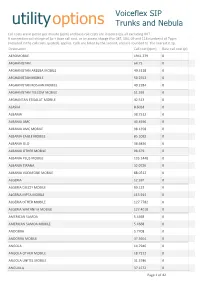

Utilityoptions Trunks and Nebula

Voiceflex SIP utilityoptions Trunks and Nebula Call costs are in pence per minute (ppm) and base call costs are in pence (p), all excluding VAT. A connection call charge of 1p + base call cost, or an access charge (for 087, 084, 09 and 118 numbers) of 7ppm (included in the call costs quoted), applies. Calls are billed by the second, and are rounded to the nearest 0.1p. Destination Call cost (ppm) Base call cost (p) AEROMOBILE 1941.279 0 AFGHANISTAN 64.75 0 AFGHANISTAN AREEBA MOBILE 49.3118 0 AFGHANISTAN MOBILE 50.2552 0 AFGHANISTAN ROSHAN MOBILE 49.2284 0 AFGHANISTAN TELCOM MOBILE 51.393 0 AFGHANTAN ETISALAT MOBILE 42.513 0 ALASKA 8.6024 0 ALBANIA 38.7512 0 ALBANIA AMC 40.4596 0 ALBANIA AMC MOBILE 98.1358 0 ALBANIA EAGLE MOBILE 85.1092 0 ALBANIA OLO 38.6836 0 ALBANIA OTHER MOBILE 98.679 0 ALBANIA PLUS MOBILE 105.1448 0 ALBANIA TIRANA 32.0726 0 ALBANIA VODAFONE MOBILE 88.0512 0 ALGERIA 12.397 0 ALGERIA DJEZZY MOBILE 89.133 0 ALGERIA MPTA MOBILE 113.914 0 ALGERIA OTHER MOBILE 127.7782 0 ALGERIA WATANIYA MOBILE 127.4018 0 AMERICAN SAMOA 5.4668 0 AMERICAN SAMOA MOBILE 5.4668 0 ANDORRA 5.7708 0 ANDORRA MOBILE 37.3604 0 ANGOLA 14.7946 0 ANGOLA OTHER MOBILE 18.7312 0 ANGOLA UNITEL MOBILE 31.3746 0 ANGUILLA 37.1572 0 Page 1 of 42 Destination Call cost (ppm) Base call cost (p) ANGUILLA DIGICEL MOBILE 50.396 0 ANGUILLA MOBILE 74.2312 0 ANTARCTICA AUS 322.0664 0 ANTARCTICA GSM AQ 805.1108 0 ANTIGUA AND BARBUDA 38.3864 0 ANTIGUA AND BARBUDA MOBILE 47.2468 0 ANTIGUA DIGICEL MOBILE 53.2244 0 ARGEN BUENOS AIRES 1.34 0 ARGENTINA 7.1152 0 ARGENTINA CENTRAL -

OTT and Related On-Line Services in Arab Region

OTT and related on-line services in Arab Region Release 1.1 31/01/2017 Reality of OTTs in Arab Region The objective of the study is: 1- to have a global view on OTT and on-line services worldwide with the impact and trends of these services on national players and economies, 2- to have an overview on associated practices and relevant public policies worldwide and in the Region, 3- to propose recommendations on methods and approaches for preparation of associated policies and frameworks. _____________________________ The present document is the first release of the report. A draft questionnaire is proposed with this release and is intended to be submittedfor a survey to Regulators/policy Makers and Operators in the Region. The outcome of the survey with the related findings will be commented and included in a next version of this report. It is to note that, as the subject of OTT is being regularly debated in almost all regions with potential move and change in the related positions and decisions, some information reported in the present report may become outdated. __________________________________________________________________ OTT and related on-line services in Arab Region Executive Summary With the increase of global mobile broadband penetration, as well as the rapid adoption of connected devices, consumers have been provided with an access to a wide variety of on-line services which go beyond the traditional voice and messaging services provided by telecom operators (alias telcos *). These on-line services are reshaping the entire telecommunication eco-system, and are of great benefit to consumers worldwide, to the global economy and ubiquitous connectivity. -

Buyer Role Company Focused Markets What

BUYER ROLE COMPANY FOCUSED WHAT IS MAIN CRITERIA NEW TYPES OF MARKETS REPLACING LIVE FOR QUICK BUYS CONTENT IN SHOWS / NOW CONSIDERATION TO FURTHER FILL GAPS SPORTS ON TV? Airin Zainul Director Media Prima Berhad Malaysia New Dramas, New Price Animation Kids Animation / Prog Andri Detulong Head of PT. Satuvisi Abadi / Indonesia New Dramas, New Price, Genre Non-Dialogue Programming Onevision Kids Animation / Animation, Dubbed Acquisition Entertainment Prog, Reruns Content In Bahasa Arthit Promprasit Director - Thailand Motion Content Thailand Reruns Price, Quality -- Group Billy Yang Managing Director Chong-I Taiwan New Kids Animation Price, Quality, Genre Animation, International / Prog, Documentary Documentary, Corporation / Factual Drama. Chen Su Chiang Program Purchasing Wonder Singapore New Dramas, Price, Quality Same content Director Hypermedia Documentary / genres – need more Corporation Factual programs Chiyo MORI Manager ABC International Japan New Dramas Price, Quality Mini drama series with less episodes Didi Mukti CEO MOX Digital Indonesia New Dramas, New Price, Quality, eSports Indonesia Kids Animation / Genre, Language Prog, Reruns ATF Buyers Survey | April 2020 www.asiatvforum.com BUYER ROLE COMPANY FOCUSED WHAT IS MAIN CRITERIA NEW TYPES OF MARKETS REPLACING LIVE FOR QUICK BUYS CONTENT IN SHOWS / NOW CONSIDERATION TO FURTHER FILL GAPS SPORTS ON TV? Dominique Ullman Content Director, PT. OONA Media USA New Unscripted Price eSports Oona Global Indonesia Formats, Reruns Doris Ng Senior Manager - Medialink China New Dramas, -

Usage Charges for Selected Services

eye Multimedia Service - Service Charge Summary eye 多媒睇服務收費表 Item 項目 Charges 費用 Monthly Rate within Month-to-Month Rate Commitment Period 月費 承諾期內月費 Premium Kids’ Pack HK$20 x 18/ 24months HK$20 升級益智樂園 HK$20 x 18/ 24個月 MOOV on eye Multimedia Service HK$30 x 18/ 24 months HK$30 eye多媒睇服務 – MOOV屋企點唱機服務 HK$30 x 18/ 24個月 Now Sports on eye Multimedia Service HK$30 x 18/ 24 months HK$30 eye多媒睇服務 – Now體育頻道服務 HK$30 x 18/ 24個月 Now Adult Channel – 901 Ice Fire note 1 HK$38 x 18 months HK$38 Now 成人頻道901 – 冰火頻道備註1 HK$38 x 18個月 Now Adult Channel – 903 Channel Adult note 1 HK$48 x 18 months HK$48 Now 成人頻道 – 903成人極品台備註1 HK$48 x 18個月 Now Adult Channel Pack – Channel 901 Ice Fire & 903 Channel Adult note 1 HK$60 x 18 months HK$60 Now 成人頻道組合 – 頻道901冰火頻道及903成人極品台備註1 HK$60 x 18個月 Now Adult Channel Mini Pack A - Channel 901 & 903 note 1, Now Sports Package on eye, 100 HK$88 x 18 months HK$88 Real Time Stock Quotes note 1, 2 & 3 and Voice Package HK$88 x 18個月 Now 成人頻道特選組合A – 頻道901及903備註1, Now體育頻道組合, 100個即時股價查詢備註1, 2 & 3及 通話組合 Now Adult Channel Mini Pack B - Channel 901 & 903 note 1, MOOV on eye, 200 Real Time Stock HK$88 x 18 months HK$88 Quotes note 1, 2 & 3 and Voice Package HK$88 x 18個月 Now 成人頻道特選組合B – 頻道901及903備註1, MOOV屋企點唱機, 200個即時股價查詢備註1, 2 & 3及 通話組合 Real-time Stock Quote note 1 HK$0.3 per quote 即時股價查詢備註1 每個報價HK$0.3 200 Real-time Stock Quote note 1, 2 HK$30 per month HK$30 200個即時股價查詢備註1, 2 每月HK$30 500 Real-time Stock Quote note 1, 2 HK$58 per month HK$58 500個即時股價查詢備註1, 2 每月HK$58 1,000 Real-time Stock Quote note 1, 2 HK$98 per month HK$98 1,000個即時股價查詢備註1, -

Annual Report 2018 1 CORPORATE PROFILE (CONTINUED)

CONTENTS 1 Corporate Profile 3 Statement from the Chairman 4 Statement from the Group Managing Director 8 PCCW in Numbers 10 Significant Events in 2018 12 Awards 18 Board of Directors 24 Corporate Governance Report 42 Management’s Discussion and Analysis 53 Financial Information 224 Investor Relations CORPORATE PROFILE PCCW Limited is a global company headquartered in Hong Kong which holds interests in telecommunications, media, IT solutions, property development and investment, and other businesses. The Company holds a majority interest in the HKT Trust and HKT Limited, Hong Kong’s premier telecommunications service provider and leading operator in fixed-line, broadband and mobile communication services. Beyond connectivity, HKT provides innovative smart living and business services to individuals and enterprises. PCCW also owns a fully integrated multimedia and entertainment group in Hong Kong, PCCW Media. PCCW Media operates the largest local pay-TV operation, Now TV, and is engaged in the provision of OTT (over-the-top) video service under the Viu brand in Hong Kong and other places in the region. Through HK Television Entertainment Company Limited, PCCW also operates a domestic free television service in Hong Kong. Also wholly-owned by the Group, PCCW Solutions is a leading information technology outsourcing and business process outsourcing provider in Hong Kong and mainland China. In addition, PCCW holds a majority interest in Pacific Century Premium Developments Limited, and other overseas investments. Employing over 23,600 staff, PCCW maintains a presence in Hong Kong, mainland China as well as other parts of the world. PCCW shares are listed on The Stock Exchange of Hong Kong Limited (SEHK: 0008) and traded in the form of American Depositary Receipts (ADRs) on the OTC Markets Group Inc. -

Global Video Insights - June 2011

Global Video Insights - June 2011 For millions of people around the world, Vuclip is an essential part of their daily lives. We deliver video on-the-fly, on any device, and in any country, providing unparalleled reach for our partners Country Top Searches Top Videos Introduction 2 Global Video Insights - June 2011 As 2011 kicked off, Vuclip delivered 5.5 million monthly video views on January 1st. A huge number, right? In retrospect, not at all. As we near the mid-point of 2011, we consistently deliver more than double that number of video views on a daily basis. With increased consumption comes stunning insights into the minds of mobile video consumers worldwide. We know what users are searching for, what country they’re in, and what devices they’re using. When we aggregate that data, it makes for a compelling snapshot of trends in the mobile world. As the year moves on, we’ll release monthly reports on trends viewed through the Vuclip prism, but here’s a first crack at breaking down the first five months of 2011. See you in July… Cheers! -Nickhi Vuclip • 1551 McCarthy Boulevard, Suite 213, Milpitas,CA 95035 • Phone: +1.408.649.2240 Fax: +1.408.649.2245 • [email protected] Top Searches and Videos 3 Top Searches and Videos 4 Top Searches and Videos by Country We also love to check into what our users are searching on and watching en masse. We crunched the data True viral videos transcend language, as evidenced by the popularity of the Twin Baby video in both the UK for the first five months of 2011 and came up with our top searches and most-viewed videos for ten coun- and Saudi Arabia. -

Mobile Operators' Measures in Preventing Mobile Bill Shock

Mobile Operators’ Measures in Preventing Mobile Bill Shock Disclaimer: This document sets out the Mobile Operators’ Measures in Preventing Mobile Bill Shock in Hong Kong. It contains data and information submitted by the relevant operators to, and compiled by the Office of the Communications Authority (OFCA), and is published for public information only. This document will be updated periodically upon advice by mobile operators on new or enhanced initiatives they have taken on board. The mobile operators’ measures are voluntary in nature and the mobile operators may adjust their service packages and revise their measures from time to time. Therefore, consumers are strongly advised to consult individual mobile operators directly on their latest initiatives, service terms and conditions, as well as charging schemes and methods and other pertinent details prior to committing themselves to any mobile data services. While OFCA has endeavoured to ensure that the information in this document is correct, no warranty or guarantee, express or implied, is given as to its accuracy. The Government of the Hong Kong Special Administrative Region (HKSAR), the Communications Authority (CA) and OFCA shall not be responsible and accept no liability for any error, omission or inaccuracy in the materials and reserve the right to omit, suspend or edit any materials submitted. The Government of HKSAR, the CA and OFCA shall not be liable for any direct, indirect, special or consequential losses or damages (including, without limitation, damages for loss of business or loss of profits) arising in contract, tort or otherwise from the use of or inability to use this document, or any material contained in it, or from any action or decision taken as a result of using this document or any material contained in it. -

A Coalition of the Willing

FACILITATING CHANGE LEADING THE TRANSITION FROM FEMALE EMPOWERMENT TO GENDER INCLUSION A COALITION THE FUTURE OF THE WILLING OF CITIES THE FIVE ROLES Tapping the YOU NEED TO MAKE transformative power YOUR CORPORATE of exponential VENTURING PROGRAM technologies A SUCCESS IMPACT AT SCALE TARIQ CHAUHAN THE GROUP CEO OF EFS FACILITIES SERVICES GROUP REVEALS HIS VISION TO BUILD A US$1 BILLION ORGANIZATION 9 7 7 2 3 1 1 5 4 1 0 0 8 > JULY 2018 | WWW.ENTREPRENEUR.COM/ME | UAE AED20 Wake up to BAREEM TOWNHOUSES from AED 899,000* No residency visa required to buy property Open to all nationalities Following outstanding sales in phases 1, 2 & 3, • No service fee for life ARADA presents Nasma Residences Phase 4. • Pay 60% on completion Located in the lush surroundings of • Up to 10% ROI a record-breaking community. Visit our Sales Office 800-ARADA (27232) Badriyah Ballroom, arada.com Radisson Blu Resort, Sharjah 10am – 7pm *T&C apply JULY 2018 CONTENTS Wake up to BAREEM TOWNHOUSES 22 * Tariq Chauhan, Group CEO, from AED 899,000 EFS Facilities Services Group No residency visa required to buy property Open to all nationalities 22 28 32 62 INNOVATOR: INNOVATOR: INNOVATOR: ‘TREPONOMICS: IMPACT AT SCALE DESIGNS ON THE FUTURE THE FUTURE OF CITIES PRO Following outstanding sales in phases 1, 2 & 3, • No service fee for life Tariq Chauhan, Group CEO, Dubai’s Area 2071 is all Singularity University Building tomorrow’s ARADA presents Nasma Residences Phase 4. • Pay 60% on completion EFS Facilities Services set to deliver on the vision co-founder and Executive workforce Group, reveals his vision of making the UAE the Chairman Dr. -

The Holmes Report 2017 Book After Awards and Events Around the +1 914 450 3462 Was Designed by 05Creative* World

THE AGENCY HOLMES RANKINGS REPORT IN2 SABRE AWARDS THE 2017 THE SABRE HOLMES AWARDS REPORT EMEA 2017 The Best Agencies, Campaigns, Influencers and Stories of the Year AGENCY OF THE YEAR IN2 INNOVATION SUMMIT 2017 THE THE INFLUENCE INNOVATOR 100 25 2017 2017 THE GLOBAL EDITION GLOBAL PR SUMMIT 2017 THE “Proving and improving the value of HOLMES public relations” REPORT Paul Holmes The Holmes Group is dedicated to Paul Holmes North America proving and improving the value of Founder & Chair The Holmes Group public relations, by providing [email protected] 271 West 47th Street insight, knowledge and recognition Suite 23-A Arun Sudhaman to public relations professionals. New York, NY 10036 CEO & Editor-in-Chief +1 212 333 2300 The Holmes Group was founded in +852 96187774 2000 by Paul Holmes, publisher and [email protected] Europe CEO, who has more than two decades The Holmes Group Aarti Shah of experience writing about and 6 Sussex Mews West Head of Strategic Partnerships evaluating the public relations W2 2SE & Operations United Kingdom Holmes Report’s delivers — not only +1 510 808 5855 +44 (0)203 238 2048 the most sophisticated reporting and [email protected] analysis on PR trends and issues — Diana Marszalek but also the industry’s most sought- Senior Reporter (New York) The Holmes Report 2017 book after awards and events around the +1 914 450 3462 was designed by 05creative* world. [email protected] Celeste Picco Administrative +1 212 333 2300 [email protected] Patrick Drury Event Manager +1 732 299 1847 [email protected] -

Confirmed 2021 Buyers / Commissioners

As of April 13th Doc & Drama Kids Non‐Scripted COUNTRY COMPANY NAME JOB TITLE Factual Scripted formats content formats ALBANIA TVKLAN SH.A Head of Programming & Acq. X ARGENTINA AMERICA VIDEO FILMS SA CEO XX ARGENTINA AMERICA VIDEO FILMS SA Acquisition ARGENTINA QUBIT TV Acquisition & Content Manager ARGENTINA AMERICA VIDEO FILMS SA Advisor X SPECIAL BROADCASTING SERVICE AUSTRALIA International Content Consultant X CORPORATION Director of Television and Video‐on‐ AUSTRALIA ABC COMMERCIAL XX Demand SAMSUNG ELECTRONICS AUSTRALIA Head of Business Development XXXX AUSTRALIA SPECIAL BROADCASTING SERVICE AUSTRALIA Acquisitions Manager (Unscripted) X CORPORATION SPECIAL BROADCASTING SERVICE Head of Network Programming, TV & AUSTRALIA X CORPORATION Online Content AUSTRALIA ABC COMMERCIAL Senior Acquisitions Manager Fiction X AUSTRALIA MADMAN ENTERTAINMENT Film Label Manager XX AUSTRIA ORF ENTERPRISE GMBH & CO KG content buyer for Dok1 X Program Development & Quality AUSTRIA ORF ENTERPRISE GMBH & CO KG XX Management AUSTRIA A1 TELEKOM AUSTRIA GROUP Media & Content X AUSTRIA RED BULL ORIGINALS Executive Producer X AUSTRIA ORF ENTERPRISE GMBH & CO KG Com. Editor Head of Documentaries / Arts & AUSTRIA OSTERREICHISCHER RUNDFUNK X Culture RTBF RADIO TELEVISION BELGE BELGIUM Head of Documentary Department X COMMUNAUTE FRANCAISE BELGIUM BE TV deputy Head of Programs XX Product & Solutions Team Manager BELGIUM PROXIMUS X Content Acquisition RTBF RADIO TELEVISION BELGE BELGIUM Content Acquisition Officer X COMMUNAUTE FRANCAISE BELGIUM VIEWCOM Managing -

Pacific Century Regional Developments Limited

Pacific Century Regional Developments Limited Century Developments Regional Pacific Pacific Century Regional Developments Limited 50 Raffles Place, #35-01 Singapore Land Tower, Singapore 048623 Tel: (65) 6438 2366 Fax: (65) 6230 8777 Company Registration No. 196300381N Annual Report 2016 Annual Report Annual Report 2016 Pacific Century Regional Developments Limited Contents Corporate Profile 01 Message from the Executive Chairman 02 Corporate Structure 03 Board of Directors 04 Business Review 06 Financial Highlights 10 Corporate Information 12 Financial Statements 13 Report on Corporate Governance 74 Shareholding Statistics 88 Notice of 53rd Annual General Meeting 91 Notes to the Proxy Form 98 Proxy Form Corporate Profile Pacific Century Regional Developments Limited (PCRD), a Singapore-based company listed on the Singapore Exchange Securities Trading Limited (SES: P15), with interests in telecommunications, media, IT solutions, logistics and property development and investment, in the Asia-Pacific region. PCRD’s most significant investment is its stake in Hong Kong-listed PCCW Limited (PCCW) (SEHK: 0008; American Depositary Receipts on the OTC Markets Group Inc. in the US: PCCWY). PCRD is 89% owned by the Pacific Century Group, which was founded in 1993. The Pacific Century Group acquired control of PCRD in September 1994. Pacific Century Regional Developments Limited 01 Annual Report 2016 Message from the Executive Chairman I am pleased to present the annual report of PCRD for the The overseas property projects of PCCW’s subsidiary, financial year ended 31 December 2016. Pacific Century Premium Developments (PCPD), progressed as scheduled. In particular, Pacific Century Place Jakarta, PCRD’s most significant asset, PCCW Limited (PCCW), reported the 40-storey Premium Grade A office building in Indonesia, a steady performance for 2016. -

Interim Report 2010 1 KEY FIGURES

CONTENTS 1 Corporate Profile 2 Key Figures 3 Statement from the Chairman 4 Statement from the Group Managing Director 6 Board of Directors 11 Management’s Discussion and Analysis 20 Consolidated Income Statement 21 Consolidated Statement of Comprehensive Income 22 Consolidated and Company Balance Sheets 24 Consolidated Statement of Changes in Equity 25 Condensed Consolidated Cash Flow Statement 26 Notes to the Unaudited Condensed Consolidated Interim Financial Information 36 General Information 44 Investor Relations CORPORATE PROFILE PCCW Limited (PCCW or the Company) is the holding company of HKT Group Holdings Limited (HKT), Hong Kong’s premier telecommunications provider and a world-class player in Information and Communications Technologies. PCCW also holds a majority interest in Pacific Century Premium Developments Limited, and overseas investments including the wholly-owned UK Broadband Limited. As the provider of Hong Kong’s first quadruple-play experience, PCCW/HKT offers a range of innovative media content and services across four platforms – fixed-line, broadband Internet access, TV and mobile. In addition, the Group meets the sophisticated needs of the local and international business community, while supporting network operators with cutting-edge technical services and handling large-scale IT outsourcing projects for public and private sector organizations. Employing approximately 18,700 staff, PCCW is headquartered in Hong Kong and maintains a presence in Europe, the Middle East, Africa, the Americas and mainland China, as well as other parts of Asia. PCCW shares are listed on The Stock Exchange of Hong Kong Limited (SEHK: 0008) and traded in the form of American Depositary Receipts (ADRs) on the Pink OTC Markets in the U.S.