Dublin Retail Guide

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SHEL Holdings Europe Limited ANNUAL REPORT AND

SHEL Holdings Europe Limited ANNUAL REPORT AND FINANCIAL STATEMENTS For the period ended 28 January 2017 Pag© CONTENDS Strategic report Directors' report 5 Statement of directors' responsibilities 6 Independent auditors' report to the members of SHEL Holdings Europe Limited g Consolidated income statement and other comprehensive income 10 Consolidated balance sheet 12 Consolidated statement of changes In equity 13 Consolidated cash flow statement 14 Notes to the financial statements 51 Company balance sheet 52 Company statement of changes in equity 53 Company cash flow statement 54 Notes to the company financial statements COMPANY SECRETARY AND REGISTERED OFFICE S Hemsley, 400 Oxford Street, London \A/1 A1AB INDEPENDENT AUDITORS PricewaterhouseCoopers LLP, Chartered Accountants and Statutory Auditors, The Atrium, 1 Harefield Road, Oxbridge, UBB1EX COMPANY'S REGISTERED NUMBER The Company's registered number is 07826605. SHEL Holdings Europe Limited Strategic report for the period ended 28 January 2017 The directors present their strategic report and the audited financial statements of the Company and the Group for the period ended 28 January 2017. Review of the business Principal activities The principal activity of the Company is as a holding Company for Group activities which are department store arid online retailing. Results The financial statements reflect the results of SHEL Holdings Europe Limited and Its subsidiary undertakings. Turnover for the 52 weeks to 28 January 2017 was £1,205.7 million (52 weeks ended 30 January 2016; £1,032.8 million). Group profit on ordinary activities before taxation was £105.2 million (2016: £81.1 million). The profit after taxation for the financial period of £78.5 million (2016: £64.3 million) has been transferred to reserves. -

Stjosephsclonsilla.Ie

stjosephsclonsilla.ie A NEW STANDARD OF LIVING WELCOME TO Following on a long tradition of establishing marquee developments WELCOME TO in the Dublin 15 area, Castlethorn are proud to bring their latest creation St Josephs Clonsilla to the market. Comprising a varying mix of 2, 3 and 4 bed homes and featuring a mixture of elegant red brick and render exteriors, the homes provide a variety of internal designs, all of which are built with requirements necessary for todays modern living in mind. Designed by DDA Architects, all homes at St Josephs have thoughtfully laid out interiors, including spacious living rooms, fully fitted kitchens with integrated appliances, while upstairs well proportioned bedrooms with all 3 and 4 bedroom houses benefiting from ensuites. In addition, all homes will have an A3 BER energy rating ensuring that the houses will benefit from reduced energy bills and increased comfort. Superbly located in Clonsilla, St Josephs is within easy reach of many schools, parks, shops and transport infrastructure including Clonsilla train station that adjoins the development. EXCELLENT AMENITIES RIGHT ON YOUR DOORSTEP Clonsilla is a thriving village that of- fers an array of amenities including shops, restaurants, schools and sports clubs making it an attractive Dublin suburb with excellent transport links. The Blanchardstown Centre provides a large retail, food and beverage offering as well as a cinema and numerous leisure facilities. Retailers include Penneys, Marks & Spencer and Debenhams. Local primary schools include Scoil Choilm, St. Mochtas and Hansfield Educate Together. At secondary level there is Coolmine Community School, Castleknock Community College, Mount Sackville and Castleknock College. -

Coolmine Industrial Estate, Dublin 15. D15 Ax9a

TO LET RETAIL/ WAREHOUSE UNIT, C. 326 SQ. M./ 3,513 SQ. FT., UNIT 8A, COOLMINE CENTRAL, COOLMINE INDUSTRIAL ESTATE, DUBLIN 15. D15 AX9A. LOCATION: This property is situated in the Coolmine Central Development in Coolmine Industrial Estate. Coolmine Industrial Estate is a hybrid business park, comprising a variety of indigenous inhabitants, strategically located at the junction of the Blanchardstown Road and the Clonsilla Road. The subject property enjoys a prominent position off Porters Road, the estates thoroughfare. The estate is located c.12 km North West from Dublin City Centre and c. 3 km from M50/N3 interchange, enabling access around the city and to all primary arterial routes serving the country. Blanchardstown Shopping Centre and Westend Retail Park are located in close proximity, providing occupiers access to a large consumer base. Notable occupiers in the estate include An Post, Des Kelly Interiors and Power City. DESCRIPTION: The property comprises a high profile business unit extending to 326 Square Metres/ 3,513 Square Feet. The property is of steel portal frame construction, with concrete block infill walls and feature glass elevation. ACCOMMODATION : Warehouse: 326 Square Metres/ 3,513 Square Feet. COMMERCIAL RATES 2018: €6,278. All intending tenants are specifically advised to verify the floor area and undertake their own due diligence. TERM The property is available by way of a flexible new lease. VIEWING: BY APPOINTMENT ONLY RENT: €23,000 Per Annum (Plus VAT, Rates & Service Charges) 105 Terenure Road East, Dublin 6, D06 XD29. t: (01) 490 3201 f: (01) 490 7292 e: [email protected] J.P. -

Review of the Economic Impact of the Retail Cap

REVIEW OF THE ECONOMIC IMPACT OF THE RETAIL CAP Report prepared for the Departments of Enterprise, Jobs and Innovation and Environment, Community and Local Government APRIL 2011 Review of the Economic Impact of the Retail Cap Executive Summary i 1. Introduction 1 1.1 Objectives of the study 1 1.2 Structure of the report 2 2. Background 3 2.1 Policy and legislative framework for retail planning 3 2.2 Overview of the current retail caps 4 3. Overview of recent retail sector developments 6 3.1 Economy wide developments 6 3.2 Retail developments 8 3.3 Structure of the retail market 15 4. Factors driving costs and competition in retail 35 4.1 Impact of the retail caps on costs 35 4.2 Impact of the retail caps on competition 38 4.3 Other factors that impact competition/prices 41 4.4 Impact of the retail cap on suppliers 42 5. Conclusions and recommendations 44 APPENDIX: Terms of Reference 48 Review of the Economic Impact of the Retail Cap Executive Summary One of the conditions of the EU-IMF Programme for Financial Support for Ireland is that ‘the government will conduct a study on the economic impact of eliminating the cap on the size of retail premises with a view to enhancing competition and lowering prices for consumers and discuss implementation of its policy implications with the Commission services’. This process must be concluded by the end of Q3 2011. Forfás was requested to undertake the study and worked closely with a steering group comprising officials from the Departments of Enterprise and Environment. -

VA10.5.002 – Simon Mackell

Appeal No. VA10/5/002 AN BINSE LUACHÁLA VALUATION TRIBUNAL AN tACHT LUACHÁLA, 2001 VALUATION ACT, 2001 Simon MacKell APPELLANT and Commissioner of Valuation RESPONDENT RE: Property No. 2195188, Office (over the shop), Unit 3B, Main Street, Ongar Village, County Dublin B E F O R E John Kerr - Chartered Surveyor Deputy Chairperson Veronica Gates - Barrister Member Patrick Riney - FSCS.FIAVI Member JUDGMENT OF THE VALUATION TRIBUNAL ISSUED ON THE 1ST DAY OF DECEMBER, 2010 By Notice of Appeal dated the 2nd day of June, 2010 the appellant appealed against the determination of the Commissioner of Valuation in fixing a valuation of €23,000 on the above relevant property. The Grounds of Appeal are on a separate sheet attached to the Notice of Appeal, a copy of which is attached at the Appendix to this judgment. 2 The appeal proceeded by way of an oral hearing held in the Tribunal Offices on the 18th day of August, 2010. The appellant Mr. Simon MacKell, Managing Director of Ekman Ireland Ltd, represented himself and the respondent was represented by Ms. Deirdre McGennis, BSc (Hons) Real Estate Management, MSc (Hons) Local & Regional Development, MIAVI, a valuer in the Valuation Office. Mr. Joseph McBride, valuer and Team Leader from the Valuation Office was also in attendance. The Tribunal was furnished with submissions in writing on behalf of both parties. Each party, having taken the oath, adopted his/her précis and valuation as their evidence-in-chief. Valuation History The property was the subject of a Revaluation of all rateable properties in the Fingal County Council Area:- • A valuation certificate (proposed) was issued on the 16th June 2009. -

Britain's Tesco Scraps Irish Supplier Over Horse Meat Scare 30 January 2013

Britain's Tesco scraps Irish supplier over horse meat scare 30 January 2013 British retail giant Tesco said Wednesday it has "Ultimately Tesco is responsible for the food we axed an Irish beef supplier which sparked a food sell, so it is not enough just to stop using the scare after horse DNA was found in beefburgers in supplier." Britain and Ireland, where horse meat consumption is taboo. "We want to leave customers in no doubt that we will do whatever it takes to ensure the quality of Tesco said in a statement that it has decided to their food and that the food they buy is exactly what stop using Silvercrest after uncovering evidence the label says it is," added Smith. that it used meat from non-approved suppliers, mirroring a move by US fast-food chain Burger The consumption of horse meat is a common sight King last week. in central Asia, China, Latin America and parts of Europe. Two weeks ago, the Food Safety Authority of Ireland (FSAI) had revealed that up to 29 percent (c) 2013 AFP of the meat content of some beefburgers was in fact horse, while they also found pig DNA. The frozen burgers were on sale in high-street supermarket chains Tesco and Iceland in both Britain and Ireland, and in Irish branches of Lidl, Aldi and Dunnes Stores. The FSAI had said burgers had been made at two processing plants in Ireland and one in northern England. Following the news, Britain's biggest retailer Tesco issued an immediate apology and pledged to investigate the matter. -

UCD Commuting Guide

University College Dublin An Coláiste Ollscoile, Baile Átha Cliath CAMPUS COMMUTING GUIDE Belfield 2015/16 Commuting Check your by Bus (see overleaf for Belfield bus map) UCD Real Time Passenger Information Displays Route to ArrivED • N11 bus stop • Internal campus bus stops • Outside UCD James Joyce Library Campus • In UCD O’Brien Centre for Science Arriving autumn ‘15 using • Outside UCD Student Centre Increased UCD Services Public ArrivED • UCD now designated a terminus for x route buses (direct buses at peak times) • Increased services on 17, 142 and 145 routes serving the campus Transport • UCD-DART shuttle bus to Sydney Parade during term time Arriving autumn ‘15 • UCD-LUAS shuttle bus to Windy Arbour on the LUAS Green Line during Transport for Ireland term time Transport for Ireland (www.transportforireland.ie) Dublin Bus Commuter App helps you plan journeys, door-to-door, anywhere in ArrivED Ireland, using public transport and/or walking. • Download Dublin Bus Live app for updates on arriving buses Hit the Road Don’t forget UCD operates a Taxsaver Travel Pass Scheme for staff commuting by Bus, Dart, LUAS and Rail. Hit the Road (www.hittheroad.ie) shows you how to get between any two points in Dublin City, using a smart Visit www.ucd.ie/hr for details. combination of Dublin Bus, LUAS and DART routes. Commuting Commuting by Bike/on Foot by Car Improvements to UCD Cycling & Walking Facilities Parking is limited on campus and available on a first come first served basis exclusively for persons with business in UCD. Arrived All car parks are designated either permit parking or hourly paid. -

PDF (Full Report)

A Collective Response Philip Jennings 2013 Contents Acknowledgements…………………………....2 Chairperson’s note…………………………….3 Foreword……………………………………...4 Melting the Iceberg of Intimidation…………...5 Understanding the Issue………………………8 Lower Order…………………………………10 Middle Order………………………………...16 Higher Order………………………………...20 Invest to Save………………………………..22 Conclusion…………………………………..24 Board Membership…………………………..25 Recommendations…………………………...26 Bibliography………………………………....27 1 Acknowledgements: The Management Committee of Safer Blanchardstown would like to extend a very sincere thanks to all those who took part in the construction of this research report. Particular thanks to the staff from the following organisations without whose full participation at the interview stage this report would not have been possible; Mulhuddart Community Youth Project (MCYP); Ladyswell National School; Mulhuddart/Corduff Community Drug Team (M/CCDT); Local G.P; Blanchardstown Local Drugs Task Force, Family Support Network; HSE Wellview Family Resource Centre; Blanchardstown Garda Drugs Unit; Local Community Development Project (LCDP); Public Health Nurse’s and Primary Care Team Social Workers. Special thanks to Breffni O'Rourke, Coordinator Fingal RAPID; Louise McCulloch Interagency/Policy Support Worker, Blanchardstown Local Drugs Task Force; Philip Keegan, Coordinator Greater Blanchardstown Response to Drugs; Barbara McDonough, Social Work Team Leader HSE, Desmond O’Sullivan, Manager Jigsaw Dublin 15 and Sarah O’Gorman South Dublin County Council for their editorial comments and supports in the course of writing this report. 2 Chairpersons note In response to the research findings in An Overview of Community Safety in Blanchardstown Rapid Areas (2010) and to continued reports of drug debt intimidation from a range of partners, Safer Blanchardtown’s own public meetings and from other sources, the management committee of Safer Blanchardstown decided that this was an issue that required investigation. -

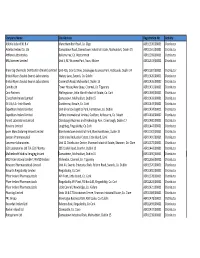

Company Name Site Address Registration No

Company Name Site Address Registration No. Activity AbbVie Ireland NL B.V Manorhamilton Road, Co. Sligo ASR11336/00001 Distributor Astellas Ireland Co. Ltd Damastown Road, Damastown Industrial Estate, Mulhuddart, Dublin 15 ASR11341/00001 Distributor Athlone Laboratories Ballymurray, Co. Roscommon ASR11399/00001 Distributor BNL Sciences Limited Unit S, M7 Business Park, Naas, Kildare ASR11343/00001 Distributor Brenntag Chemicals Distribution (Ireland) Limited Unit 405, Grants Drive, Greenogue Business Park, Rathcoole, Dublin 24 ASR11387/00001 Distributor Bristol‐Myers Squibb Swords Laboratories Watery Lane, Swords, Co. Dublin ASR11426/00001 Distributor Bristol‐Myers Squibb Swords Laboratories Cruiserath Road, Mulhuddart, Dublin 15 ASR11426/00002 Distributor Camida Ltd Tower House, New Quay, Clonmel, Co. Tipperary ASR11431/00001 Distributor Cara Partners Wallingstown, Little Island Industrial Estate, Co. Cork ASR11494/00001 Distributor Clarochem Ireland Limited Damastown, Mulhuddart, Dublin 15 ASR11433/00001 Distributor Eli Lilly S.A ‐ Irish Branch Dunderrow, Kinsale, Co. Cork ASR11449/00001 Distributor Expeditors Ireland Limited Unit 6 Horizon Logistics Park, Harristown, Co. Dublin ASR11434/00001 Distributor Expeditors Ireland Limited Caffery International Limited, Coolfore, Ashbourne, Co. Meath ASR11434/00002 Distributor Forest Laboratories Limited Clonshaugh Business and Technology Park. Clonshaugh, Dublin 17 ASR11400/00001 Distributor Hovione Limited Loughbeg, Ringaskiddy, Co.Cork ASR11447/00001 Distributor Ipsen Manufacturing Ireland -

Dan Ryan Lessons Learnt and Still Learning from a Life in Retail Life Who Am I? a Retailer from Cork Loud Laugh Retail

Dan Ryan Lessons learnt and still learning from a life in retail Life Who am I? A Retailer From Cork Loud Laugh Retail My3 Journey Retail My experience . Retailer Manager . Retail Buyer . Retail Merchandiser . Trading Director . Head of Commercial Trading Experience Domestic & International . Ireland . UK . Spain . Netherlands . Canada 5 Penneys/Primark 1985 -1999 Trainee Merchandise Manager Controller How did that happen? Brown Thomas 1999 - 2006 Merchandise Controller From ridiculous prices at Primark To sublime prices at BT From private label at Primark To Global Brands at BT Penneys/Primark 2006 - 2008 Re-joined as Director of Merchandising Why go back? Primark comes to Spain Expanding into new markets . The budget fashion chain opened it’s first store outside the UK & Ireland . 1st store in a new shopping centre in Madrid 2006 . Primark executives say they chose Spain as the launching point for a European expansion because Spanish consumer patterns are similar to those of Ireland. 5/23/2019 ADD A FOOTER Lifestyle Sports 2008 - 2012 Appointed to the Board as Trading Director SPORTS RETAIL Fantastic Combination - love Sports & love Retail 2008 Financial Crash What do we do? . Devised 5 Year Strategy . Restructured Buying and Merchandising Team . What categories are we going to be famous for? . Closed loss making stores/opened new stores . Refurbished existing stores Shop Direct Group, Liverpool 2012 - 2013 From Bricks to Clicks Shop Direct Group . A merger of once bitter rivals Littlewoods and Great Universal Stores . Based in Liverpool . Legacy of home catalogue shopping . Restructured . Now trading online only : Littlewoods , Very 5/23/2019 ADD A FOOTER Selfridges Group 2013 - 2019 Renewing old acquaintances Pastures New – The Netherlands & Canada de Bijenkorf More change . -

66 Bus Time Schedule & Line Route

66 bus time schedule & line map 66 Merrion Square South - Kingsbury Estate View In Website Mode The 66 bus line (Merrion Square South - Kingsbury Estate) has 2 routes. For regular weekdays, their operation hours are: (1) Merrion Square South - Kingsbury Estate: 6:00 AM - 11:15 PM (2) Straffan Road (Kingsbury Estate) - Merrion Square South: 5:45 AM - 11:15 PM Use the Moovit App to ƒnd the closest 66 bus station near you and ƒnd out when is the next 66 bus arriving. Direction: Merrion Square South - Kingsbury 66 bus Time Schedule Estate Merrion Square South - Kingsbury Estate Route 60 stops Timetable: VIEW LINE SCHEDULE Sunday 7:05 AM - 11:05 PM Monday 6:00 AM - 11:15 PM Merrion Sq South, Stop 7391 Merrion Square South, Dublin Tuesday 6:00 AM - 11:15 PM Holles Street, Stop 493 Wednesday 6:00 AM - 11:15 PM 27 Merrion Square North, Dublin Thursday 6:00 AM - 11:15 PM Clare Street Friday 6:00 AM - 11:15 PM 20 Clare Street, Dublin Saturday 6:15 AM - 11:15 PM Pearse Station, Stop 495 Westland Row, Dublin Shaw Street, Stop 400 194 Pearse Street, Dublin 66 bus Info Direction: Merrion Square South - Kingsbury Estate Pearse St Garda Stn, Stop 346 Stops: 60 17 Botany Bay, Dublin Trip Duration: 68 min Line Summary: Merrion Sq South, Stop 7391, Holles Westmoreland Street Street, Stop 493, Clare Street, Pearse Station, Stop 28 Westmoreland Street, Dublin 495, Shaw Street, Stop 400, Pearse St Garda Stn, Stop 346, Westmoreland Street, Temple Bar, Temple Bar, Wellington Quay Wellington Quay, Merchant's Quay, Stop 1444, 11 Essex Street East, Dublin Usher's -

The Avenue Cookstown, Tallaght

THE AVENUE COOKSTOWN, TALLAGHT FOR SALE BY PRIVATE TREATY THE AVENUE This site is located in Cookstown, Tallaght an established suburb in West Dublin. The site is approximately 13km from Dublin City Centre and is within walking distance of The Square Tallaght The providing amenities including shopping, dining, leisure facilities and significant cultural attractions such as the Rua Red Arts Theatre. Tallaght is home to 31 primary schools and 7 secondary schools including Scoil Maelruain Junior School, Sacred Heart Junior DunshaughlinLocation ASHBOURNENational School, Tallaght Community School and Kingswood Community College. SWORDS Malahide M2 Dublin M1 Portmarnock Airport M3 Finglas Blanchardstown MAYNOOTH North Bull Howth Island Cabra M50 Clontarf M4 Lucan DUBLIN Cellbridge Ballsbridge Dublin Bay Clondalkin Rathmines Straffan Booterstown Greenogue E20 Business Park Clane TALLAGHT Dun Laoghaire Dundrum Knocklyon City West Dalkey M50 N81 Rockbrook Stepaside THE AVENUE Carrickmines Johnstown M11 Manor BRAY Kilbride Blessington Greystones Wicklow Mountains National Park Poulaphouca Newtown Mount Kennedy Newcastle Roundwood For illustration purposes only. Tallaght is a thriving centre for business and is home to major state institutions including Tallaght Hospital (2,885 staff ), Institute of Technology Tallaght (6,000+ students) and the head office of South Dublin County Council (1,260 staff ). There are major employment The Avenue hubs nearby such as the Citywest Business Campus and Grange Castle Business Park. The continually expanding campus of Intel is located on Ireland in Leixlip is also just over a 20-minute drive. the Red Luas Tallaght also has numerous outdoor parks including Sean Walsh Memorial Park, Tymon Park and the Dublin Mountains. Tallaght line, in close is also home to the National Basketball Arena and Tallaght Football Stadium.