The Thinking Behind a Planned Gulf Coast Ethylene

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chris Billam-Smith

MEET THE TEAM George McMillan Editor-in-Chief [email protected] Remembrance day this year marks 100 years since the end of World War One, it is a time when we remember those who have given their lives fighting in the armed forces. Our features section in this edition has a great piece on everything you need to know about the day and how to pay your respects. Elsewhere in the magazine you can find interviews with The Undateables star Daniel Wakeford, noughties legend Basshunter and local boxer Chris Billam Smith who is now prepping for his Commonwealth title fight. Have a spooky Halloween and we’ll see you at Christmas for the next edition of Nerve Magazine! Ryan Evans Aakash Bhatia Zlatna Nedev Design & Deputy Editor Features Editor Fashion & Lifestyle Editor [email protected] [email protected] [email protected] Silva Chege Claire Boad Jonathan Nagioff Debates Editor Entertainment Editor Sports Editor [email protected] [email protected] [email protected] 3 ISSUE 2 | OCTOBER 2018 | HALLOWEEN EDITION FEATURES 6 @nervemagazinebu Remembrance Day: 100 years 7 A whitewashed Hollywood 10 CONTENTS /Nerve Now My personal experience as an art model 13 CONTRIBUTORS FEATURES FASHION & LIFESTYLE 18 Danielle Werner Top tips for stress-free skin 19 Aakash Bhatia Paris Fashion Week 20 World’s most boring Halloween costumes 22 FASHION & LIFESTYLE Best fake tanning products 24 Clare Stephenson Gracie Leader DEBATES 26 Stephanie Lambert Zlatna Nedev Black culture in UK music 27 DESIGN Do we need a second Brexit vote? 30 DEBATES Ryan Evans Latin America refugee crisis 34 Ella Smith George McMillan Hannah Craven Jake Carter TWEETS FROM THE STREETS 36 Silva Chege James Harris ENTERTAINMENT 40 ENTERTAINMENT 7 Emma Reynolds The Daniel Wakeford Experience 41 George McMillan REMEMBERING 100 YEARS Basshunter: No. -

ARTISTS ACROSS the DECADES the Beatles, the Rolling Stones, Coldplay

ARTISTS ACROSS THE DECADES The Beatles, The Rolling Stones, ColdPlay P. S. Priya Shukla 9th December 2018 Abstract For the following website, I researched about three bands: 1. The Beatles 2. The Rolling Stones 3. Coldplay Through the research, I was able to understand how the bands were formed, how they became popular and how they impacted the society and/or the music industry. The following documentation allows the reader a better understanding about these bands. It includes a brief back story of how each band formed, outlines their most popular songs and also talks about their impact. Contents Contents i List of Figures ii 1 The Beatles 1 2 The Rolling Stones 2 2.1 .................................... 4 3 Coldplay 4 3.1 .................................... 6 i List of Figures ii 1 The Beatles The Beatles are a famous English rock band who got together in Liverpool, England during the 1960s. The band, formally called the Quarrymen orthe Sliver Beatles is formed by John Lennon, Paul McCartney, Gorge Harrison and Ringo Starr. Lennon and McCartney who first performed together in Liverpool in 1957, were the ones who started forming the band. The group got bigger because of a shared enthusiasm for American rock and roll. Lennon, a guitarist and singer and McCartney a bassist and singer have mostly self taught themselves and became such musicians. The band later added a drummer, Pete Best and joined a small but booming “beat music” scene, first in Liverpool and then during small visits between 1960 and 1962 in Hamburg. In 1964, the Beatles were at the top of the charts in the UK, but only recently did they start to attract audiences overseas with songs from their first two albums, “Please Please Me” and “With the Beatles”. -

Songs Fund Limited (“Hipgnosis” Or the “Company”)

10 May 2019 Hipgnosis Songs Fund Limited (“Hipgnosis” or the “Company”) Acquisition of Music Catalogue The Board of Hipgnosis Songs Fund Limited and its Investment Adviser, The Family (Music) Limited, are pleased to announce that the Company has acquired a music catalogue from David A. Stewart. David A. Stewart is an English musician, songwriter, and record producer, best known for Eurythmics, his successful partnership with Annie Lennox. David A. Stewart co-wrote and produced each of Eurythmics’ albums, including eight Top 5 and three Number 1 UK albums, which are estimated to have sold over 100 million albums worldwide. With Eurythmics, David A. Stewart co-wrote 13 US Number 1 singles, including ‘Sweet Dreams (Are Made of This)’, ‘Would I Lie To You’ and ‘There Must Be An Angel (Playing With My Heart)’. According to the British Phonographic Institute (BPI), the iconic ‘Sweet Dreams (Are Made Of This)’ is the most streamed song of any song originally released in 1983. Eurythmics were awarded the Ivor Novello Award for ‘Songwriters of the Year’ in 1984 and 1987 and ‘Best Contemporary Song’ in 1987 for ‘It’s Alright (Baby’s Coming Back)’, the 1987 Grammy Award for ‘Best Rock Performance by a Duo or Group with Vocal’ for ‘Missionary Man’ and the 1999 Brit Award for ‘Outstanding Contribution to British Music’. In 2005, both David A. Stewart and Annie Lennox were elected to the UK Music Hall of Fame. Both during and following Eurythmics, David A. Stewart has produced and written songs with globally successful artists including Tom Petty on his US Number 3 ‘Don’t Come Around Here No More’, No Doubt on their US Number 1 ‘Underneath It All’, Shakespear’s Sister on ‘Stay’, which was a UK Number 1 for eight consecutive weeks, in addition to songs with Mick Jagger, Bono, Bob Dylan, Gwen Stefani, Bon Jovi, Stevie Nicks, Bryan Ferry, Katy Perry, Sinead O’Connor and Joss Stone. -

Klers' Violin Repository of Dance Music

r A\[}lo THE GLEN COLLECTION OF SCOTTISH MUSIC Presented by Lady Dorothea Ruggles- Brise to the National Library of Scotland, m memory of her brother, Major Lord George Stewart Murray, Black Watch, killed in action in France in 1914. 28th Jn II liar!/ 1927. (BOOK Third.] KOHLERS' . VIOLIN EEPOSITOET DANCE MUSIC, COMPRISING %xh, %\xi\%%ti%, p0nipp> (im^\xi ^um, QUADRILLES, WALTZES, &g. EDITED BY A. PROFESSIONAL PLAYER. r^ SCOTLAND OF ^J EDINBURGH: ERNEST KOHLER & SON, MUSICSELLERS, 11 NORTH BRIDGE. MORISON" BROTHERS, 99 BUOHAlSrAlSr STREET, GLASGOW. MABTIN, ABERDEEN. MENZIE3 & CO., EDINBURGH. J. CUNNINGHAM, DUNDEE. J. M. MILLER, PERTH. WILLIAM DBAS, KIEKCALDY. JAMES H0RSBUR6H, 73 GEORGE STREET, DUNEDIX, NEW ZEALAND. LONDON : CATTY & DOBSON, 14 PILGRIM ST., LUDGATE HILL. Digitized by the Internet Archive in 2011 with funding from National Library of Scotland http://www.archive.org/details/klersviolinrepos03rugg .. CONTENTS. Page No. No. No. A 1, The, Jig 274 S5 Huntly's Wedding Medley—Strathspey, 20 Old Favourite Minnetto (Duet), 30 Aerial Quadrille 241 31 Imperial Hornpipe, 29 Old Hickory Hornpipe, 31 Annie is my Darling—Reel, , . .230 29 Inverness Lasses' Reel, . 231 29 Old Toon of Bro.\burn Reel, 35 Annie's Hornpipe 250 32 Irish Jig 268 34 Old Woodhouselee Castle Strathspey, 34 Arthur's Seat "Waltz 285 3G James Ware of Wick's Strathspey, 224 Old Woodhouselee Reel, . 34 Baillie's Violin Duet 278 35 Jeanie in the Glen—Strathspey, 214 27 Opera Polka, 33 Ball, Ihe, Hornpipe 251 32 Jeanie's Reel 214 27 Our little Beauties' Valse, Balmoral Strathspey, . 219 28 John Dwight's Plantation Dance, 240 30 Owre the Muir aniang the Heather, var., Banks of Loch Ness Strathspey, . -

Case No COMP/M.6459 - SONY/ MUBADALA DEVELOPMENT/ EMI MUSIC PUBLISHING

EN Case No COMP/M.6459 - SONY/ MUBADALA DEVELOPMENT/ EMI MUSIC PUBLISHING Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 6(1)(b) in conjunction with Art 6(2) Date: 19/04/2012 In electronic form on the EUR-Lex website under document number 32012M6459 Office for Publications of the European Union L-2985 Luxembourg EUROPEAN COMMISSION In the published version of this decision, some Brussels, 19/04/2012 information has been omitted pursuant to Article C(2012) 2745 17(2) of Council Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and PUBLIC VERSION other confidential information. The omissions are shown thus […]. Where possible the information omitted has been replaced by ranges of figures or a general description. MERGER PROCEDURE To the notifying parties: Dear Sir/Madam, Subject: Case No. COMP/M.6459– Sony/ Mubadala/ EMI Music Publishing Commission decision pursuant to Article 6(1)(b) in conjunction with Article 6(2) of Council Regulation No 139/20041 1. On 27 February 2012, the Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 by which Sony Corporation of America and Mubadala Development Company PJSC acquire within the meaning of Article 3(1)(b) of the Council Regulation joint control of the whole of the undertaking EMI Music Publishing, which currently forms part of the EMI Group, by way of purchase of shares and assets. Sony and Mubadala are collectively referred to as “the Parties”. EMI Music Publishing will be administered by Sony/ATV. -

CILLA a New Three-Part Drama for ITV

CILLA A new three-part drama for ITV Press Release .................................................................................................................... Pages 2-3 Foreword by Executive Producer and Writer, Jeff Pope ................................................... Pages 4-5 Character Biographies ..................................................................................................... Pages 6-11 Sheridan Smith is Cilla ................................................................................................. Pages 12-15* Aneurin Barnard is Bobby ............................................................................................. Pages 16-20 Ed Stoppard is Brian Epstein ......................................................................................... Pages 21-24 Melanie Hill is Big Cilla .................................................................................................. Pages 25-27 John Henshaw is John White ........................................................................................ Pages 28-30 Synopses ....................................................................................................................... Pages 31-32 Cast and Production Credits ............................................................................................... Page 33 *Please note that Sheridan Smith’s quotes are to only be used as part of a wider feature on the show and not written as a one-to-one profile or cover opportunity. 1 CILLA Acclaimed writer Jeff Pope -

Rock and Popular Music 1960

Rock and Popular Music 1960 - 2000 Cultural and Historic Background Information Rock music is a broad genre of popular music that originated as "rock and roll" in the United States in the early 1950s and developed into a range of different styles in the 1960s and later, particularly in the United States and the United Kingdom. It originates from 1940s and 1950s rock and roll, a style which drew heavily from the genres of blues, rhythm and blues, and from country music. Rock music also drew strongly from several other genres such as electric blues and folk, and incorporated influences from jazz, classical and other musical styles. Musically, rock has centered on the electric guitar, usually as part of a rock group with electric bass, drums, and one or more singers. Usually, rock is song-based music with a 4/4 time signature using a verse–chorus form, but the genre has become extremely diverse. Like pop music, lyrics often stress romantic love but also address a wide variety of other themes that are frequently social or political. At the beginning of the 1960s, pop and rock and roll trends of the 1950s continued; nevertheless, the rock and roll of the decade before started to merge into a more international, eclectic variant. In the early 1960s, rock and roll in its purest form was gradually overtaken by pop rock, psychedelic rock, blues rock, and folk rock, which had grown in popularity. The country and folk influenced style associated with the latter half of 1960s rock music spawned a generation of popular singer songwriters who wrote and performed their own work. -

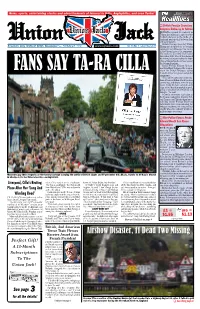

Airshow Disaster, 11 Dead Two Missing

R British Foreign Secretary Reopens Embassy In Tehran BRITAIN reopened its embassy in Tehran last month in a sign of newly thawed relations in the wake of a landmark nuclear deal between Iran and world powers. British Foreign Secretary Philip Vol. 33 No. 6 September 2015 Hammond attended the reopening ceremony and witnessed the raising of the Union flag over the compound. The embassy has been closed since November 2011, when it was stormed by demonstrators protesting the impo- sition of international sanctions against the Islamic Republic. Iranian Foreign Minister Moham- mad Javad Zarif welcomed the reopen- ing of the British Embassy, saying FANS SAY TA-RA CILLA it showed Iran’s regional and global significance. “This will be a new start in the rela- tions of Iran and Britain which has seen several ups and downs over the past years. Today we have entered a new stage of ties based on mutual respect, policy of constructive interaction and dialogue,” he said. A similar ceremony took place at the Iranian embassy in London. Sev- eral Iranian and British dignitaries, including former Foreign Secretary Jack Straw, were seen entering the embassy residence, but it was unclear exactly when the embassy would for- mally resume operations. R Five Police Forces Probe Edward Heath Sex Abuse Allegations FIVE POLICE forces in Britain are investigating sex abuse alle- gations against the late Edward Heath, as the probe into the former prime minister’s past broadened. Detectives in Wiltshire, London, Kent, Jersey and Hampshire are now investigating. Heath’s name emerged last month, when Britain’s police watchdog said it would investigate whether police failed to pursue an allegation against him. -

Springfield Springfield

GREAT )hop BRITAIN lore Britain's onslaught on the American charts gathers momentum as more more artists crash into the Top 100. There seems no end to the growing and States. pro British-Be British-Buy British cult now raging in the United ;ns Beatles Hand" at No. 1 after n The s and a"She Loves You"Youant " atodold No. 20urnow have the fantastic total of ix Decc in the Top 100 the latest entry being "Twist And Shout." Meantime, singles which The Dave Clark Five continues to head for the top with "Glad All Over" brought them their first Gold Disk for a million British sales. eoe spectacular is the meteoric climb of The Searchers with "Needles Even more Blue And Pins." The latest group to catch on in a big way is The Swinging dr Cliff Richard continues to enjoy his I Jeans with "Hippy Hippy Shake" and American success to date with "It's All In The Game." Dusty Spring- biggest and an- field still in the top bracket with "I Only Want To Be With You" other solo British artiste Danny Williams starts his Top 100 climb with "White On White." Next please. o The next Beatles single for simultaneous release in Britain and America hen recorded on March 20th couples "Can't Buy Me Love," one of the tracks during their recent visit to Paris, with "Can't Do That," which they cut eB C immediately after their triumphant return from the United States. in London and published DUSTY Both titles were penned by John Lennon and Paul McCartney eldn by Northern Songs. -

Lesbian News August 2018

LESBIAN NEWS VOL. 44 ∙ NO. 02 ∙ September 2018 KEIRA KNIGHTLEY & COLETTE THE POWER OF HERSTORY LIZ BAXTER FILM DEBUT: FEMALE CONNECTION CLEXACON IS COMING TO LONDON ARETHA: THE UNDISPUTED QUEEN OF SOUL LN Contributors Anne Laure Pineau At 32, Anne Laure is a Parisian journalist working for national magazines (ELLE, Paris-Match, Liberation) on many subjects, from the far-right and conservative movements in France, to the Angola Prison Rodeo in Louisiana. She has the absolute conviction that her job is political and can enlighten the human complexity. As a feminist, as an anti-racist and as a lesbian, she is working daily to give a space to the untold stories. (Photo: Juliette Robert). Beth Shipp is the first Executive Director of LPAC, the lesbian Super PAC that builds the political power of lesbian, queer, bisexual and transgender women by electing candidates who champion LGBTQ rights, women’s equality and social justice. She is a political strategist with more than 20 years of experience working for women’s reproductive rights, Democratic candidates and progressive causes. Prior to joining LPAC, Ms. Shipp was the political director for NARAL Pro- Choice and worked on a variety of federal and state campaigns throughout the nation. Carl Matthes is the current president of UGLA, Uptown Gay and Lesbian Alliance, an organization providing a support system for gay men, lesbians and education for individuals and the community He is a columnist on the Lesbian News, owned and published by his sister, Ella and her wife, Gladi. He was editor of the GLAAD/newsletter, and a GLAAD/LA representative on the Board. -

LGBT+ PRIDE MONTH JUNE 2021 #Proudlyunited TIM COOK CEO of Apple Inc

East Central proudly celebrates Pride Month, which commemorates the events of June 1969 and works to achieve equal justice and equal opportunity for LGBT+ Americans. LGBT+ PRIDE MONTH JUNE 2021 #ProudlyUnited TIM COOK CEO of Apple Inc. Timothy Donald Cook (born November 1, 1960) is an American business executive who has been the chief executive officer of Apple Inc. since 2011. Cook previously served as the company's chief operating officer under its co-founder Steve Jobs. Cook joined Apple in March 1998 as a senior vice president for worldwide operations, and then served as the executive vice president for worldwide sales and operations. He was made the chief executive on August 24, 2011, prior to Jobs' death in October of that year. During his tenure as the chief executive, he has advocated for the political reformation of Photo Credit: Austin Community College international and domestic surveillance, cybersecurity, American manufacturing, and EAST CENTRAL CELEBRATES environmental preservation. Since 2011 when he took over Apple, to 2020, Cook doubled the company's revenue and profit, and the company's market value increased from $348 billion to $1.9 LGBT+ PRIDE trillion. In 2014, Cook became the first chief executive of MONTH a Fortune 500 company to publicly come out as gay. Cook also serves on the boards of directors of Nike, Inc. and the National Football JUNE 2021 Foundation, and is a trustee of Duke University. Outside of Apple, Cook engages in philanthropy, and in March 2015, he said he planned to donate his fortune to charity. #PROUDLYUNITED AMBER WHITTINGTON YouTuber, Host, Actress Amber Whittington (September 17, 1985), who is popularly known for Amber's Closet, in an American YouTuber, basketball player, actress and activity. -

THE BEATLES IMAGE: MASS MARKETING 1960S BRITISH and AMERICAN MUSIC and CULTURE, OR BEING a SHORT THESIS on the DUBIOUS PACKAGE of the BEATLES

THE BEATLES IMAGE: MASS MARKETING 1960s BRITISH AND AMERICAN MUSIC AND CULTURE, OR BEING A SHORT THESIS ON THE DUBIOUS PACKAGE OF THE BEATLES by Richard D Driver, Bachelor of Arts A Thesis In HISTORY Submitted to the Graduate Faculty of Texas Tech University in Partial Fulfillment of the Requirements for the Degree of MASTER OF ARTS Approved Aliza S Wong Randy McBee John Borrelli Dean of the Graduate School May, 2007 Copyright 2007, Richard Driver Texas Tech University, Richard D Driver, May 2007 ACKNOWLEDGMENTS This work could not have been possible without the encouragement and guidance of a number of individuals, as well as countless persons who pulled books, worked through interlibrary loans, and simply listened to me talk about it. Without the guidance, tolerance, insight, time, and encouragement of my committee, Aliza S Wong and Randy McBee, this thesis would have remained nothing more than a passing thought. Aliza, more than any other professor has been there for me since this project truly began over two years ago. It was her initial push for me to write about something I loved that drove me to attend Graduate school and then build upon what I had done previously with The Beatles “image.” Dr. McBee provided excellent guidance into understanding many of the post-war American facets of this work, not simply those related to The Beatles or music in general. Additional thanks are reserved for Dr. Julie Willett for her class on sexuality and gender where new methods and modes of historical thought were founded in this work. Finally, this thesis would have been impossible had I not been accepted into and granted a teaching position in the History Department at Texas Tech University, and it is to the entire department that I owe my greatest thanks.