Inform. Connect

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Media Nations 2019

Media nations: UK 2019 Published 7 August 2019 Overview This is Ofcom’s second annual Media Nations report. It reviews key trends in the television and online video sectors as well as the radio and other audio sectors. Accompanying this narrative report is an interactive report which includes an extensive range of data. There are also separate reports for Northern Ireland, Scotland and Wales. The Media Nations report is a reference publication for industry, policy makers, academics and consumers. This year’s publication is particularly important as it provides evidence to inform discussions around the future of public service broadcasting, supporting the nationwide forum which Ofcom launched in July 2019: Small Screen: Big Debate. We publish this report to support our regulatory goal to research markets and to remain at the forefront of technological understanding. It addresses the requirement to undertake and make public our consumer research (as set out in Sections 14 and 15 of the Communications Act 2003). It also meets the requirements on Ofcom under Section 358 of the Communications Act 2003 to publish an annual factual and statistical report on the TV and radio sector. This year we have structured the findings into four chapters. • The total video chapter looks at trends across all types of video including traditional broadcast TV, video-on-demand services and online video. • In the second chapter, we take a deeper look at public service broadcasting and some wider aspects of broadcast TV. • The third chapter is about online video. This is where we examine in greater depth subscription video on demand and YouTube. -

Local Commercial Radio Content

Local commercial radio content Qualitative Research Report Prepared for Ofcom by Kantar Media 1 Contents Contents ................................................................................................................................................. 2 1 Executive summary .................................................................................................................... 5 1.1 Background .............................................................................................................................. 5 1.2 Summary of key findings .......................................................................................................... 5 2 Background and objectives ..................................................................................................... 10 2.1 Background ............................................................................................................................ 10 2.2 Research objectives ............................................................................................................... 10 2.3 Research approach and sample ............................................................................................ 11 2.3.1 Overview ............................................................................................................................. 11 2.3.2 Workshop groups: approach and sample ........................................................................... 11 2.3.3 Research flow summary .................................................................................................... -

RIG Response to the BBC Trust Review of the BBC's National Radio

RIG response to The BBC Trust Review of the BBC’s national radio stations in Northern Ireland, Scotland and Wales RIG response to the BBC Trust Review of the BBC’s national radio stations in Wales About RIG The Radio Independents Group is the trade association for independent radio and audio producers in the UK. RIG has over 100 member companies, and rough estimates put the overall value of the sector at over £25m1. RIG has around 30 member companies based in Wales, making audio content for the BBC and commercial companies both in English and Welsh. RIG also has 6 members in Scotland. Overall comment on the Trust Review RIG is pleased to see the BBC Trust carrying out this review into Nations Radio. We passionately believe in the ability of a thriving independent production sector to increase the amount of innovation, ideas and talent available to the licence fee payer. This applies as much to Nations radio as it does to the major networks. For example one part of Wales is not the same as another and independent producers, based around that nation, can play a major part in sharing voices and perspectives from all of those areas. For the purposes of this consultation, RIG canvassed its members in both Wales and Scotland – there are currently very few producers making audio independently in Northern Ireland. On this occasion there have been no major comments to make about BBC Nations Radio in Scotland. Therefore the response is concentrated on BBC Radio Wales and Radio Cymru. We have sought to keep as closely to the remit of the questions as possible. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Ascential Secure

Ascential Secure Enhanced Health & Safety Standards at Ascential’s Events in a Post-COVID-19 World 1 About Ascential Secure Ascential Secure is our approach to enhanced health and safety standards at our events following COVID-19. From exhibitors to sponsors, speakers, visitors and journalists, those who come to our events do so to gain the information, insights, connections, data and digital tools that they need, effectively and safely. The standards and practices that make up Ascential Secure are designed to provide confidence that at every Ascential event, we are striving to provide the highest standards of safety, hygiene, cleanliness and quality. Whether they are exhibitors, attendees, visitors, speakers or sponsors, people come to events to connect, learn, know more and do more business, effectively, safely and with confidence. Ascential Secure is based on a set of event industry standards, called AllSecure. The AllSecure industry standards were developed collaboratively by a group including industry associations UFI, AEO and SISO, event organisers Informa, Reed Exhibitions and Clarion, a range of event venues, suppliers and with input from health, government and local authorities. Ascential Secure is the way these industry-wide AllSecure standards are being applied to Ascential live events. You can expect to see that health and safety continues to be a priority, and that a range of measures are in place to ensure everyone involved is able to enjoy a safe, hygienic, productive and high-quality organised event experience. As a starting point, Ascential Secure events will be run according to the guidance of the government or official local authority for that location, and according to any venue-specific regulations. -

The Mighty Boosh Is an Award Winning British Comedy Show Created and Written by Comedians Noel Fielding & Julian Barratt

Photography by Dave Brown 01.09.12 – 16.10.12 Exhibition at Oriel Colwyn, Theatre Colwyn, Abergele Road, Colwyn Bay Clwyd, Wales LL29 7RU All prints are available for sale unframed. Limited Edition of 100 Signed & Numbered. Page 1 of 3 The Mighty Boosh is an award winning British comedy show created and written by comedians Noel Fielding & Julian Barratt. Also starring regular cast members Rich Fulcher, Michael Fielding and Dave Brown. Developed from 3 stage shows appearing at Edinburgh & Melbourne Comedy Festivals, The Boosh has since produced a 6 episode radio series, 3 television series (a total of 20 television episodes) for the BBC, which have aired worldwide and 2 sell out live tours of the UK, as well as performing exclusive live shows in the United States and Australia. Dave Brown has been part of The Mighty Boosh since its conception in the late 90s. Over the years he has been involved in many aspects of the show from designing DVDs, books and merchandise to choreography, music and playing many characters in the show itself, most famously Bollo, the Gorilla. Dave’s also had a camera in his hand from day 1 of the show. These photographs of his fellow cast members and good friends span over 12 years. Photographs from early live gigs, filming the TV shows and behind the scenes whilst on tour. They provide a unique insight into the lives and characters of The Mighty Boosh collective. Dave is alone in his photographic documentation of the show. He has reduced his extensive archive to 46 of his personal favourites to exhibit here at Oriel Colwyn, many being shown for the first time. -

Introduction to Ascential Our Investment Case

INTRODUCTION TO ASCENTIAL OUR INVESTMENT CASE Clear long-term vision. Helping leading global brands connect with their customers in a data-driven world. Structural growth. Demand for information, data & analytics driven by growth of digital commerce. Market leaders. We are leaders, with a unique blend of specialisms, in the high growth areas in which we operate. Robust business model. High recurring and repeat revenue, with more than 50% revenues from digital subscription and platforms, across diverse global customer base. Attractive financial profile. Track record of high single digit revenue growth, strong margins and cash generation, supported by sound capital allocation. Introduction to Ascential 2 OUR CUSTOMER PROPOSITION Our information products and platforms support our customers to do three simple things… CREATE THE RIGHT MAXIMISE THE OPTIMISE DIGITAL PRODUCTS BRAND MARKETING COMMERCE IMPACT Know which products Know how to get Know how to execute the consumer wants maximum creativity with with excellence on the tomorrow. optimised media. winning platforms. 1. 2. 3. Introduction to Ascential 3 SEGMENTAL OVERVIEW –2019 Segment Revenue % Revenue1 Growth1 EBITDA2 Margin Business Model Advisory 10% Digital Subscriptions Product £86m 21% +8% £36m 42% & Platforms 90% Design Digital Subscriptions Advisory & Platforms 11% Marketing £136m 32% +9% £51m 37% 37% Events 52% Advisory 6% Digital Subscriptions & Sales - Platforms 94% Digital £90m 22% +21% £13m 15% Commerce Sales - Digital Subscriptions & Events Platforms 4% Non Digital £68m 16% -

Annual Report and Accounts 2004

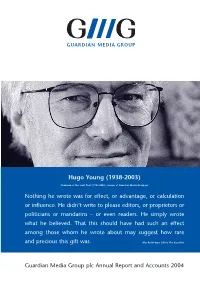

Hugo Young (1938-2003) Chairman of the Scott Trust (1989-2003), owners of Guardian Media Group plc Nothing he wrote was for effect, or advantage, or calculation or influence. He didn’t write to please editors, or proprietors or politicians or mandarins – or even readers. He simply wrote what he believed. That this should have had such an effect among those whom he wrote about may suggest how rare and precious this gift was. Alan Rusbridger, Editor, The Guardian Guardian Media Group plc Annual Report and Accounts 2004 1 Introduction Guardian Media Group plc is a UK media 2 Guardian Media Group plc structure 3 Chairman's statement business with interests in national newspapers, 6 Guardian Media Group plc Board of directors 8 Chief Executive’s review of operations community newspapers, magazines, radio 12 The Scott Trust 14 Corporate social responsibility 18 Financial review and internet businesses. The company is 20 Corporate governance 24 Report of the directors wholly-owned by the Scott Trust. 27 Independent auditors’ report 28 Group profit and loss account 29 Group balance sheet 30 Company balance sheet 31 Group statement of total recognised gains and losses The Scott Trust was created in 1936 to 32 Group cash flow statement 33 Cash flow reconciliations secure the financial and editorial 34 Notes relating to the 2004 financial statements 55 Group five year review independence of the Guardian in perpetuity. 56 Financial advisers Financial highlights 2004 73.5 67.3 634.8 62.1 43.6 526.0 456.4 47.4 36.9 439.0 437.4 29.4 29.8 9.8 1.6 2000 2001 2002 2003 2004 2000 2001 2002 2003 2004 2000 2001 2002 2003 2004 Turnover including share of Total group operating profit Profit before taxation. -

Removal of Absolute 80S & Planet Rock

Radio Multiplex Licence Variation Request Form This form should be used for any request to vary a local or national radio multiplex licence, e.g: • replacing one programme or data service with another • adding a programme or data service • removing a programme or data service • changing the Format description of a programme service • changing a programme service from stereo to mono • changing a programme service's bit-rate Please complete all relevant parts of this form. You should submit one form per multiplex licence, but you should complete as many versions of Part 3 of this form as required (one per change). Before completing this form, applicants are strongly advised to read our published guidance on radio multiplex licence variations, which can be found at: http://licensing.ofcom.org.uk/radio-broadcast- licensing/digital-radio/radio-mux-changes/ Part 1 – Details of multiplex licence Radio multiplex licence: DM01 National Commercial Licensee: Digital One Contact name: Glyn Jones Date of request: 4th April 2016 1 Part 2 – Summary of multiplex line-up before and after proposed change(s) Existing line-up of programme services Proposed line-up of programme services Service name and Bit-rate Stereo/ Service name and Bit-rate Stereo/ short-form description (kbps)/ Mono short-form (kbps)/ Mono Coding (H description Coding (H or F) or F) Absolute Radio 80F M Absolute Radio 80F M BFBS 80F M BFBS 80F M Capital XTRA 112F JS Capital XTRA 112F JS Classic FM 128F JS Classic FM 128F JS Heart extra 80F M Heart extra 80F M KISS 80F M KISS 80F M LBC 64H M LBC 64H M Magic UK 80F M Magic UK 80F M Radio X 80F M Radio X 80F M Smooth Extra 80F M Smooth Extra 80F M talkSPORT 64H M talkSPORT 64H M UCB 1 64H M UCB 1 64H M INRIX UK TPEG 16 Data INRIX UK TPEG 16 Data Absolute 80s 64H M Planet Rock 64H M Any additional information/notes: Part 3 – Details of proposed change For each proposed change you wish to make to your licence, please answer the following question and then complete the relevant sections of the rest of the application form. -

Jez Hunziker Cv 2017

Jez Hunziker 65A Kennington Lane, London, SE114EZ Email Address: [email protected] Mobile Number: 07702602124 Nationality/NIS No: British, JJ356151D Additional Training Specialist Skills • UWE: BA Hons Design and Visual Communication Avid / FCPX / Premiere • Filton College: HND Graphic Design Grading - DaVinci Resolve • BBC Archive Research & Infax Training After Effects, Graphic Design, Typography • BBC Storytelling & Narrative Narrative & Storytelling / Programme Development • Tigress Technical Support and Media Management Music Production Self Shooting with GH5 / C300 kit Over the last 8 years I have worked across a range of different projects for the BBC and companies such as Tigress, RDF Media, Nat Geo and Sky. Through a variety of tasks and responsibilities I have been able to develop a broad skill-set with regards to supporting leading content in documentary film making. My passion is editing factual documentaries but I love new challenges and broadening my experience. Additional skills include self shooting, scripting & storytelling, grading, tracklay, motion graphics and music which allow me to go that extra step further in achieving the best crafted work possible… Work experience July 2017- 1×90” Joanna Dennahy: Killing for Kicks – Ch5 / ITN Finishing Editor June 2017- 1×5” Flyride Offline & Behind The Scenes Promo – 4K VR Dome in Chinese National Park Offline Editor Moonraker VFX Bristol https://moonrakervfx.com/ May 2017- 1×4” Penguin: The Making of an Audio Book – Penguin Website -Offline/Online Editor Offline/Online Editor -

Addition of Heart Extra to the Multiplex Is Therefore Likely to Increase Significantly the Appeal of Services on Digital One to This Demographic

Radio Multiplex Licence Variation Request Form This form should be used for any request to vary a local or national radio multiplex licence, e.g: • replacing one programme or data service with another • adding a programme or data service • removing a programme or data service • changing the Format description of a programme service • changing a programme service from stereo to mono • changing a programme service's bit-rate Please complete all relevant parts of this form. You should submit one form per multiplex licence, but you should complete as many versions of Part 3 of this form as required (one per change). Before completing this form, applicants are strongly advised to read our published guidance on radio multiplex licence variations, which can be found at: http://licensing.ofcom.org.uk/radio-broadcast- licensing/digital-radio/radio-mux-changes/ Part 1 – Details of multiplex licence Radio multiplex licence: DM01 National Commercial Licensee: Digital One Contact name: Glyn Jones Date of request: 15 January 2016 1 Part 2 – Summary of multiplex line-up before and after proposed change(s) Existing line-up of programme services Proposed line-up of programme services Service name and Bit-rate Stereo/ Service name and Bit-rate Stereo/ short-form description (kbps)/ Mono short-form (kbps)/ Mono Coding (H description Coding (H or F) or F) Absolute Radio 80F M Absolute Radio 80F M Absolute 80s 80F M Absolute 80s 80F M BFBS 80F M BFBS 80F M Capital XTRA 112F JS Capital XTRA 112F JS Classic FM 128F JS Classic FM 128F JS KISS 80F M KISS 80F -

Ishares FTSE 250 UCITS ETF GBP (Dist)

iShares FTSE 250 UCITS ETF GBP (Dist) MIDD August Factsheet Unless otherwise stated, Performance, Portfolio Breakdowns and Net Assets information as at: 31-Aug-2021 All other data as at 07-Sep-2021 This document is marketing material. For Investors in Switzerland. Investors should read the Key Capital at risk. All financial investments Investor Information Document and Prospectus prior to investing. involve an element of risk. Therefore, the value of your investment and the income from it will The Fund seeks to track the performance of an index composed of 250 mid cap UK companies that vary and your initial investment amount cannot rank below the FTSE 100 Index be guaranteed. KEY FACTS KEY BENEFITS Asset Class Equity Fund Base Currency GBP Exposure to broadly diversified UK companies 1 Share Class Currency GBP 2 Direct investment into 250 UK companies Fund Launch Date 26-Mar-2004 Share Class Launch Date 26-Mar-2004 3 Single country exposure Benchmark FTSE 250 Index Valor 1828018 Key Risks: Investment risk is concentrated in specific sectors, countries, currencies or companies. ISIN IE00B00FV128 Total Expense Ratio 0.40% This means the Fund is more sensitive to any localised economic, market, political or regulatory Distribution Frequency Quarterly events. The value of equities and equity-related securities can be affected by daily stock market Domicile Ireland movements. Other influential factors include political, economic news, company earnings and Methodology Optimised significant corporate events. Counterparty Risk: The insolvency of any institutions providing Product Structure Physical services such as safekeeping of assets or acting as counterparty to derivatives or other Rebalance Frequency Quarterly instruments, may expose the Fund to financial loss.