Conduct and Competition in SME Lending

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Office of the Advisory Committee On

OFFICE OF THE ADVISORY COMMITTEE ON BUSINESS APPOINTMENTS Room G/8, 1 Horse Guards Road, London, SW1A 2HQ Telephone: 020 7271 0839 Email: [email protected] Website: http://www.gov.uk/acoba Alex Chisholm Permanent Secretary and Chief Operating Officer for the Civil Service By email 14 May 2021 Dear Mr Chisholm, Thank you for your reply to my letter of 13 April 2021. I found the response helpful, particularly your confirmation that civil servants must seek permission before accepting any outside employment which might affect their work either directly or indirectly as set out in the Civil Service Management Code; and applying the principles set out in government’s Business Appointment Rules. The Cabinet Secretary, in his letter to the Public Administration and Constitutional Affairs Committee, also helpfully summarised the process around managing conflicts of interest and identified several areas of improvement. I support much of this work. However, the lack of transparency remains a significant concern here. Mr Crothers was advised that he could take up an outside role whilst he remained in office - in line with the process set out in your letter and by the Cabinet Secretary1. Yet, neither the appointment, nor the process for managing conflicts was transparent. This means there was no publicly available information to demonstrate: ● if potential conflicts were considered and if any action was taken to mitigate any potential risks to the integrity of government; nor ● why an application to ACOBA was not considered necessary. The critical question is whether the government will introduce the transparency necessary to provide assurance around this process: 1 And therefore in line with the Civil Service Management Code; and applying the principles set out in government’s Business Appointment Rules and the Civil Service Code. -

Cabinet Office – Annual Report and Accounts 2020-21

Annual Report and Accounts 2020-21 HC 391 Annual Report and Accounts 2020-21 (for period ended 31 March 2021) Accounts presented to the House of Commons pursuant to Section 6 (4) of the government Resources and Accounts Act 2000 Annual Report presented to the House of Commons by Command of Her Majesty Ordered by the House of Commons to be printed on 15 July 2021 HC 391 This is part of a series of departmental publications which, along with the Main Estimates 2021-22 and the document Public Expenditure: Statistical Analyses 2019, present the government’s outturn for 2020-21 and planned expenditure for 2021-22. © Crown copyright 2021 This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit nationalarchives.gov.uk/doc/open-Government-licence/version/3 Where we have identified any third-party copyright information you will need to obtain permission from the copyright holders concerned. This publication is available at: www.gov.uk/official-documents Any enquiries regarding this publication should be sent to us at: [email protected] ISBN – 978-1-5286-2550-0 CCS – CCS0421468362 07/21 Printed on paper containing 75% recycled fibre content minimum. Printed in the UK by the APS Group on behalf of the Controller of Her Majesty’s Stationery Office. Contents Directors’ Report 7 Foreword 8 Ministers and Board Members 10 Permanent Secretary’s perspective on performance 14 Cabinet Office Lead Non-Executive’s Report 17 Performance Report 19 Cabinet Office Overview 20 Long Term Expenditure Trends 24 Supporting the Government response to COVID-19 27 Strategic Objectives 32 Governance Report 55 Statement of Accounting Officer’s responsibilities 56 Governance Statement 58 Accountability Report 75 Remuneration and staff report 76 1. -

He Transformed the Empty Docklands

100 SPECIAL KIT MALTHOUSE SUSAN KILBY GERALD RONSON 100 Deputy Mayor 91 Chairman, Shire 82 CEO, of London for Business & New entry Heron International Enterprise; Chairman, Last year: 66 London & Partners KATHERINE Last year: 98 90 GARRETT-COX CBE JAMES LUPTON CEO and CIO, Alliance Trust 81 Chairman, CLARE WOODMAN Last year: 87 Greenhill Europe 99 Chief Operating Last year: 79 Officer, Morgan Stanley NICK HUNGERFORD International 89 Co-founder and ALEX WILMOT- Last year: 100 CEO, Nutmeg 80 SITWELL New entry President for EMEA, Bank LADY BARBARA of America Merrill Lynch; 98 JUDGE DAME ALISON Director, Merrill Lynch UK Chairperson, Pension 88 CARNWATH DBE Holdings and MBNA Limited Protection Fund Chairman, Land Securities; Last year: 78 Last year: 99 Non-executive Director of Zurich Insurance Group, KURT BJÖRKLUND & ANDREW Paccar Inc, and The British 79 TOM LISTER 97 WOLSTENHOLME Library Trust Co-Managing Partners, CEO, Crossrail Last year: 77 Permira New entry New entry 73 ALAN YARROW SIR GEORGE IACOBESCU CBE IAIN ANDERSON 87 Lord Mayor of CRAIG DONALDSON 96 Director and the City of London 78 CEO, Metro Bank CHAIRMAN & CEO, CANARY WHARF GROUP LAST YEAR: 73 Chief Corporate Counsel, Last year: 55 Last year: 38 Canary Wharf boss Sir George had a better start to 2015 Cicero Consulting than most, as he is set to trouser more than £3m from Last year: 96 JOSEPH SCHULL JOHN CRIDLAND the sale of the Docklands estate to the Qataris. His total 86 UK CEO, 77 CBE potential windfall from the sale of his Songbird shares JOHN ARMITAGE Warburg Pincus Director General, CBI – the parent company of Canary Wharf Group – comes 95 Co-founder and CIO, New entry Last year: 75 to just shy of £6m, when the shares he was awarded Egerton Capital in 2013 are released. -

Ministerial Appointments, July 2018

Ministerial appointments, July 2018 Department Secretary of State Permanent Secretary PM The Rt Hon Theresa May MP The Rt Hon Brandon Lewis MP James Cleverly MP (Deputy Gavin Barwell (Chief of Staff) (Party Chairman) Party Chairman) Cabinet Office The Rt Hon David Lidington The Rt Hon Andrea Leadsom The Rt Hon Brandon Lewis MP Oliver Dowden CBE MP Chloe Smith MP (Parliamentary John Manzoni (Chief Exec of Sir Jeremy Heywood CBE MP (Chancellor of the MP (Lord President of the (Minister without portolio) (Parliamentary Secretary, Secretary, Minister for the the Civil Service) (Head of the Civil Duchy of Lancaster and Council and Leader of the HoC) Minister for Implementation) Constitution) Service, Cabinet Minister for the Cabinet Office) Secretary) Treasury (HMT) The Rt Hon Philip Hammond The Rt Hon Elizabeth Truss MP The Rt Hon Mel Stride MP John Glen MP (Economic Robert Jenrick MP (Exchequer Tom Scholar MP (Chief Secretary to the (Financial Secretary to the Secretary to the Treasury) Secretary to the Treasury) Treasury) Treasury) Ministry of Housing, The Rt Hon James Brokenshire Kit Malthouse MP (Minister of Jake Berry MP (Parliamentary Rishi Sunak (Parliamentary Heather Wheeler MP Lord Bourne of Aberystwyth Nigel Adams (Parliamentary Melanie Dawes CB Communities & Local MP State for Housing) Under Secretary of State and Under Secretary of State, (Parliamentary Under Secretary (Parliamentary Under Secretary Under Secretary of State) Government (MHCLG) Minister for the Northern Minister for Local Government) of State, Minister for Housing of State and Minister for Faith) Powerhouse and Local Growth) and Homelessness) Jointly with Wales Office) Business, Energy & Industrial The Rt Hon Greg Clark MP The Rt Hon Claire Perry MP Sam Gyimah (Minister of State Andrew Griffiths MP Richard Harrington MP The Rt Hon Lord Henley Alex Chisholm Strategy (BEIS) (Minister of State for Energy for Universities, Science, (Parliamentary Under Secretary (Parliamentary Under Secretary (Parliamentary Under Secretary and Clean Growth) Research and Innovation). -

Alex Chisholm KICKSTARTS CIVIL SERVICE REFORM

Issue 307 | June 2021 | www.civilserviceworld.com FORWARD THINKING Alex Chisholm KICKSTARTS CIVIL SERVICE REFORM DOM AND GLOOM DAVE PENMAN AND ANDY COWPER ON CUMMINGS BOLT AT THE DOOR INSPECTOR’S HOME OFFICE REFLECTIONS OFFICIAL PROTEST A CIVIL SERVANT’S ETHICAL DILEMMA 01 CSW307 cover.indd 1 09/06/2021 11:55:41 ai1621941567144_Appian June event - PlanesTanksShipsPhone.pdf 1 25/05/2021 12:19:28 Planes, Tanks, Ships, and Smartphones How defence integration can improve military capability Tuesday 15 June 2021 from 12:00 - 13:30. Richard Johnstone, acting editor, CSW, is hosting a virtual roundtable with senior spokespeople from across the defence sector and our partners at Appian, to explore: • How transformation can happen • Can intelligent automation deliver critical support faster and more efficiently Spaces are limited, to register your interest in attending please RSVP to: Bella Frimpong at [email protected] In partnership with: Appian June event - PlanesTanksShipsPhone - 230x300 PRINT READY.indd 1 09/06/2021 11:37:54 CONTENTS June 2021 Editorial Published by ON THE COVER [email protected] A photo of 020 7593 5569 Alex Chisholm taken by Photoshot Advertising [email protected] www.civilserviceworld.com 020 7593 5606 RED BOX 4 INBOX Comments and your letter from the editor 6 NEWS New procurement rules, and a call for more ministerial training OPINION 8 THOMAS POPE How to make a success of post-Brexit subsidies 9 DAVE PENMAN Cummings is playing the blame game, but he hasn’t backed up his claims 10 COLIN -

How to Improve Collaboration Across Government (PDF)

IfG ROUNDTABLE | OCTOBER 2020 How to improve collaboration across government IfG–Oracle roundtable 13 October 2020 In summer 2020, the new chief operating officer of the civil service, Alex Chisholm, launched a reform and modernisation programme – Shaping Our Future Together.1 He said that this programme would examine ways to meet the challenges facing the civil service, notably by 2 looking at the case for more collaboration across government. The idea of ‘joining up’, collaborating and working across departmental and other public bodies to meet government’s objectives has been part of reform plans since at least the 1990s. Collaboration is not an end in itself; rather, it is a means of delivering better results for the public by meeting their needs in a seamless way. According to successive governments, its 3 other benefits include saving money, reducing duplication and promoting innovation. In the last few years, civil servants have worked across departments on programmes to manage the UK’s exit from the European Union, the transition period and the coronavirus pandemic. Yet, successful examples of joined-up working across government are not common enough, and there is limited work that has been 4 done on the practical benefits of departments working together for citizens. The Futures Survey5 conducted by the civil service in June 2020 identified insufficient collaboration across teams as the main challenge to overcome for government to deliver better public services. That requires breaking down departmental silos and changing the way public spending and accountability work. 1 COLLABORATION IN GOVERNMENT The Institute for Government organised a roundtable with civil service leaders and representatives from the devolved governments in October 2020 to discuss collaboration and joining up. -

A Letter from Alex Chisholm to PACAC

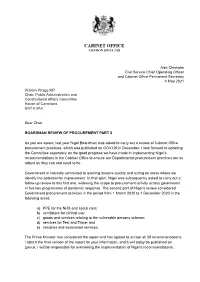

CABINET OFFICE LONDON SW1A 2AS Alex Chisholm Civil Service Chief Operating Officer and Cabinet Office Permanent Secretary 4 May 2021 William Wragg MP Chair, Public Administration and Constitutional Affairs Committee House of Commons SW1A 0AA Dear Chair, BOARDMAN REVIEW OF PROCUREMENT PART 2 As you are aware, last year Nigel Boardman was asked to carry out a review of Cabinet Office procurement practices, which was published on GOV.UK in December. I look forward to updating the Committee separately on the good progress we have made in implementing Nigel’s recommendations in the Cabinet Office to ensure our Departmental procurement practices are as robust as they can and need to be. Government is naturally committed to learning lessons quickly and acting on areas where we identify the potential for improvement. In that spirit, Nigel was subsequently asked to carry out a follow-up review to this first one, widening the scope to procurement activity across government in five key programmes of pandemic response. The second part of Nigel’s review considered Government procurement activities in the period from 1 March 2020 to 1 December 2020 in the following areas: a) PPE for the NHS and social care; b) ventilators for clinical use; c) goods and services relating to the vulnerable persons scheme; d) services for Test and Trace; and e) vaccines and associated services. The Prime Minister has considered the report and has agreed to accept all 28 recommendations. I attach the final version of the report for your information, and it will today be published on gov.uk. I will be responsible for overseeing the implementation of Nigel’s recommendations. -

Moving Out: Making a Success of Civil Service Relocation

IfG INSIGHT | NOVEMBER 2020 Moving out Making a success of civil service relocation Sarah Nickson, Erenie Mullens-Burgess and Alex Thomas Summary In its March 2020 budget, the UK government committed to moving 22,000 civil service jobs out of London by the end of the decade. It will do this by moving central government jobs to other cities and towns, rather than devolving funding and decision making power. There are several forms the commitment to moving 22,000 jobs out of London could have taken. The most radical would have been to devolve functions and decision making power – and therefore jobs – to local government and city regions. The other primary model would be to change the location in which central government work is carried out. This latter model is the one the government is using to fulfil the commitment it made in the March budget and is the focus of this paper. Ministers have said they want to move civil service jobs out of London as part of the Johnson government’s ‘levelling-up’ agenda, and to ensure policy makers better reflect the whole of the UK population. Both ministers and senior civil servants have pointed to widespread remote working during the coronavirus pandemic as evidence that civil servants – even those working directly with ministers – do not need to be physically present in London to do their jobs well. With only 13% of the UK’s population but around two thirds of its policy makers in London, relocations should help the UK civil service attract and retain talented staff who do not want to live in the capital. -

CDL and Minister for the Cabinet Office Michael Gove Minister Of

Post Incumbent CDL and Minister for the Cabinet Office Michael Gove Minister of State, Cabinet Office Lord Agnew International Trade Secretary and Minister for Liz Truss Women and Equalities Cabinet Secretary and Head of Civil Service Simon Case Civil Service Chief Operating Officer, Cabinet Alex Chisholm Office Permanent Secretary and Civil Service Diversity & Inclusion Champion Permanent Secretary for Ministry of Justice Antonia Romeo and Civil Service Gender Champion Chief People Officer, CSHR Rupert McNeil Senior Private Secretary - CDL and Minister Harriet Gordon for the Cabinet Office Senior Private Secretary - Lord Agnew Anna Kere Private Secretary - Cabinet Secretary Katherine Redmond Acting Private Secretary - Civil Service Chief Pooja Kawa Operating Officer and Cabinet Office Permanent Secretary Senior Private Secretary – International Trade Ieuan Willox Secretary and Minister for Women and Equalities Assistant Private Secretary - Permanent Imogen Edwards Secretary for Ministry of Justice and Civil Service Gender Champion Private Secretary to the Chief People Officer Holly Reed Chief Press Officer Daniel Hatton Senior Press Officer Ben Walker-Collins Civil Service Employee Policy Chris Brown Deputy Director, Civil Service Inclusive Jason Ghaboos Practice Team, CSHR Head of Socio-economic Diversity, Gender Jordon Zaman and LGBTI+, CSHR Civil Service Workforce Policy and Reward, Rebecca Hedges CSHR Civil Service Priority and Emergency John Stafford Resourcing, CSHR Head of Strategic Workforce Planning, CSHR Corin Garbett Head of People Planning, Places for Growth Lee Bushby Deputy Director Analysis & Insight Directorate Olly Clifton-Moore . -

Hampton-Alexander Review FTSE Women Leaders

Hampton-Alexander Review FTSE Women Leaders Improving gender balance in FTSE Leadership November 2019 Sponsored by For over a decade McKinsey research has supported the economic, business and societal case for gender parity. In 2019, our dataset continues to show a significant link between diversity and financial performance, with companies in the top quartile for executive team diversity 15-24% more likely to outperform their national industry median EBIT margin than their bottom quartile peers. Whilst progress on representation is perceptible, the pace of change remains disappointing. There is a need for far bolder action to make leaders accountable for participation, advance women into senior and technical roles, and tackle obstacles in the way of building truly inclusive, agile organisations. Vivian Hunt DBE Managing Partner, UK and Ireland McKinsey & Company 2 Contents Forewords 4 Executive Summary 8 1. Executive Committee and Direct Reports FTSE 100 Progress 10 FTSE 250 Progress 15 Leading by Example 20 Experiences of Workplace Culture 24 2. Women on Boards FTSE 100 Progress 28 FTSE 250 Progress 30 FTSE Board Stories 34 UK Progress Compared Internationally 38 3. Stakeholders Executive Search Firms 40 Investor Community 42 The UK Diversity Landscape for Business 44 Closing Word from Chris Cummings 46 Thanks to our Contributors during the Year 47 Appendices A – FTSE 350 Women on Boards 9 Year Analysis 48 B – FTSE 350 Women in Leadership 4 Year Analysis 49 C – FTSE 100 Rankings Women on Boards and in Leadership 50 D – FTSE 250 Rankings Women on Boards and in Leadership 54 E – FTSE 350 Sector Analysis 64 Further Reading 78 @HA_Review www.ftsewomenleaders.com 3 Joint Foreword Alex Chisholm John Manzoni Permanent Secretary, Department for Business Chief Executive of the Civil Service and Energy & Industrial Strategy Permanent Secretary for the Cabinet Office We thank Sir Philip Hampton, Denise Wilson and the Review team for all their efforts this year and for producing once again such a comprehensive and authoritative report. -

WIG Events 2016 Branded Highlights

WIG Events 2016 Start Date/Time Event Type Name 13/01/2016 08:00 Breakfast Briefing Martin Wolf, Chief Economics Commentator, Financial Times 14/01/2016 09:30 Learning Exchange Group Government/Public Affairs Forum - Measuring and demonstrating the value of the Government Affairs function 19/01/2016 08:00 Breakfast Briefing Melanie Dawes, Permanent Secretary, Department for Communities and Local Government (DCLG) 22/01/2016 09:00 Workshop Sustainability Network Workshop: Valuing Natural Capital and Developing the Natural Capital Protocol 25/01/2016 12:30 Round Table Heads of Learning & Development 27/01/2016 09:00 Workshop Workings of Brussels - An Insight into the EU and How Policy is Developed 29/01/2016 08:00 Breakfast Briefing WIG-BIS Innovation Series: UK and EU Innovation – increasing collaboration within the EU, including access to EU funds 01/02/2016 08:00 Workshop People Reporting: Fairness, Transparency and Latest Thinking 02/02/2016 09:00 Workshop Employment Law Briefing: Tribunals and Early Conciliation Two Years On 03/02/2016 08:00 Breakfast Briefing Susan Acland-Hood, Director of Enterprise and Growth Unit, Treasury 03/02/2016 17:30 Evening Briefing John Kittmer, British Ambassador to Greece 04/02/2016 09:00 Workshop Regulatory Network: The Evolving Role of Regulators 05/02/2016 08:00 Breakfast Briefing James Hughes, Deputy Director, International Climate Change, Department of Energy and Climate Change 08/02/2016 18:00 Evening Briefing Annual Reception 2016 10/02/2016 09:30 Learning Exchange Group Government/Public Affairs -

University of Pardubice Faculty of Arts and Philosophy Modernity

University of Pardubice Faculty of Arts and Philosophy Modernity and the Development of Energy Policy in Great Britain Michal Marek Bachelor Thesis 2020 1 2 3 Prohlašuji: Tuto práci jsem vypracoval samostatně. Veškeré literární prameny a informace, které jsem v práci využil, jsou uvedeny v seznamu použité literatury. Byl jsem seznámen s tím, že se na moji práci vztahují práva a povinnosti vyplývající ze zákona č. 121/2000 Sb., autorský zákon, zejména se skutečností, že Univerzita Pardubice má právo na uzavření licenční smlouvy o užití této práce jako školního díla podle § 60 odst. 1 autorského zákona, a s tím, že pokud dojde k užití této práce mnou nebo bude poskytnuta licence o užití jinému subjektu, je Univerzita Pardubice oprávněna ode mne požadovat přiměřený příspěvek na úhradu nákladů, které na vytvoření díla vynaložila, a to podle okolností až do jejich skutečné výše. Beru na vědomí, že v souladu s § 47b zákona č. 111/1998 Sb., o vysokých školách a o změně a doplnění dalších zákonů (zákon o vysokých školách), ve znění pozdějších předpisů, a směrnicí Univerzity Pardubice č. 9/2012, bude práce zveřejněna v Univerzitní knihovně a prostřednictvím Digitální knihovny Univerzity Pardubice. V Pardubicích dne 20. 4. 2020 Michal Marek 4 ACKNOWLEDGEMENTS I would like to express my gratitude to my supervisor Mgr. Michal Kleprlík, Ph.D., for his valuable advice and guidance. Additionally, I would like to thank my father and friends for continuous support and encouragement throughout my studies 5 ANNOTATION This bachelor thesis deals with modernity and development of energy policy in Great Britain. The theoretical part examines the historical, technological, sociological, economical and legislative context of energy policy from the year 1880 to the Paris Agreement in 2015.