Ards and North Down Council Area

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Interpretation the Below Outlines Ards and North Down Borough Council

Interpretation The below outlines Ards and North Down Borough Council Terms and Conditions of Hire & Privacy Statement for Signal Centre. (a) “The Council” means Ards and North Down Borough Council. (b) “The Centre” means Signal Centre buildings and any rooms or individual facilities within the buildings. (c) “The Manager” means the Manager of the Centre or their designated Deputy. (d) “User” means any person using any of the facilities of the Centre. (e) “The Hirer” means the person, club, group or organisation hiring any part of the Centre or its facilities. (f) “Booked period” means the period or periods of any day reserved for the hirer. Application for Hire and Charges The facilities shall not be used for a period in excess of the period for which a booking has been accepted. In the event of this regulation being contravened the hirer will be charged for the excess period such as the Centre Manager considers appropriate for the use of that facility, but in any event not less than the normal hiring rate for that facility. The hire period will be inclusive of the time required to set up and take down equipment and also any cleaning that that might be necessary before there is any further use of the facility. No wines, spirits or food brought into the Centre may be consumed on the premises. There will be no sub-letting of the hire facilities without the Manager’s prior permission in writing. The hirer shall not levy any charge in connection with any period without obtaining prior consent of the Manager to do so. -

Places for People

Places for People A sustainable planning guide for councillors Ards and North Down Contents Introduction Your Local Council .........................................................................................................................................................................................................04 Northern Ireland is in Effectively, your council is now Background ............................................................................................................................................................................................................................06 transition to new forms of responsible for making decisions Sustainable Development ................................................................................................................................................................................... 08 that will shape the future of your Community Planning ...................................................................................................................................................................................................10 governance, service delivery area. Working in partnership with Themes and community development. other agencies, organisations and .......................................................................................................................................................................... • Coping with climate change 12 A new era has begun for local the people in your community, your .......................................................................................................................................................................... -

Protected Food Name: New Season Comber Potatoes/Comber Earlies

SPECIFICATION COUNCIL REGULATION (EC) No 510/2006 on protected geographical indications and protected designations of origin “New Season Comber Potatoes/Comber Earlies” EC No: PDO ( ) PGI () This summary sets out the main elements of the product specification for information purposes. 1 RESPONSIBLE DEPARTMENT IN THE MEMBER STATE Name: Department for the Environment, Food and Rural Affairs Area 6c Nobel House 17 Smith Square London, SWIP 3JR United Kingdom Tel: +44 (0)207 238 6075 Fax: +44 (0)207 238 5728 e-mail: [email protected] 2 GROUP Name: NI Potato Stakeholder Forum Address: C/O Derek Shaw (Chairman) Countryside Services 97 Moy Road Dungannon Co Tyrone BT71 7DX Northern Ireland Tel.: +44 (0) 28 87 78 9770 e-mail: [email protected] Composition: Producers: 3 TYPE OF PRODUCT Class 1.6 Fruit, vegetables and cereals fresh or processed. 4 SPECIFICATION (Summary of requirements under Article 4(2) of Regulation (EC) No 510/2006) 4.1 Name: New Season Comber Potatoes/Comber Earlies 4.2 Description: New Season Comber Potato/Comber Earlies is the name given to immature potatoes of the Solanum tuberosum species in the Solanaceae family. New Season Comber Potatoes/Comber Earlies are grown from the basic seed varieties catalogued in the national registers of varieties of the Member States of the EU. They must be planted, grown and harvested in the defined area and within the required timescale. The potato has the following characteristics: - Small in size (30-70mm diameter) - Round or oval - White/cream colour inside - Skin is soft, smooth, thin and loose, with colour depending on the variety - Earthy, sweet and nutty flavour – a distinctive „early‟ potato flavour - Dark green foliage - Sold either loose by weight, or packaged in a range of weights. -

Comber to Newtownards Greenway What Is a Greenway

COMBER TO NEWTOWNARDS GREENWAY WHAT IS A GREENWAY... Have your say on the proposed scheme 3. Greenways are corridors of land recognized for their ability to Greenways, as vegetated buffers protect natural habitats, improve connect people and places together. These ribbons of open water quality and reduce the impacts of flooding in floodplain areas. space are located within linear corridors that are either natural, Most Greenways contain trails, which enhance existing recreational PURPOSE OF CONSULTATION... such as rivers and streams, or man made, such as abandoned opportunities, provide routes for alternative transportation, and In November1. 2016 Ards and North Down Borough Council commissioned studies for The proposed Greenway is a ‘major’ development as the site railroad beds and utility corridors. improve the overall quality of life in an area. three potential Greenway routes as Stage Two of the Department for Infrastructure (DfI) area is greater than 1ha. The Planning Act (Northern Ireland) Greenways programme. The next stage (stage 3) looks at the Greenways in more detail. 2011 places a statutory duty on applicants to consult the The first of these stage 3 studies is the Comber to Newtownards Greenway and following community for a minimum of 12 weeks prior to submitting a the completion of the study the Council intend to submit a planning application. The planning application for a ‘major’ development. scheme proposes to extend the existing Comber Greenway from Belfast Road, Comber to Georges Street/Upper Greenwell Street, Newtownards. The proposed Greenway will The purpose of this consultation is to ensure that communities be approximately 12km long. are made aware of and have an opportunity to comment on the Greenway proposals before the planning application is submitted. -

Landscape Character Assessment

Local Development Plan (LDP) - Position Paper Landscape Character Assessment 2 Contents Executive Summary ............................................................................................. 4 Introduction .......................................................................................................... 5 European Context for Landscape Character Assessment ............................... 7 Regional Context for Landscape Character Assessment ................................ 8 The Regional Development Strategy (RDS) 2035 ................................................. 8 The Strategic Planning Policy Statement (SPPS) .................................................. 9 What is Landscape Character Assessment (LCA)? ........................................ 10 The existing NI Landscape Character Assessment (NILCA) 2000 ................. 11 Wind Energy in Northern Ireland’s Landscape (Supplementary Guidance to Planning Policy Statement 18) .......................................................................... 13 Northern Ireland’s Landscape Charter (January 2014) .................................. 15 NI Regional Character Assessment (NIRLCA) (Consultation draft Report, April 2015) .......................................................................................................... 17 Ecosystem Services .......................................................................................... 18 NI Regional Seascape Character Assessment (NIRSCA) ............................... 20 Existing Scenic Landscape Designation -

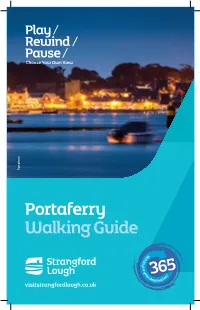

Portaferry Walking Guide

Portaferry Portaferry Walking Guide visitstrangfordlough.co.uk BElfastOWN AR& DS Portaferry NEWT oad h R ac Map Co t Anne Street e re t S h 6 OUGHEY rc CL u h C Aquarium 5 Ashmount The Square 2 High Street 1 4 Meeting Hou 16 3 Sho 15 e St re R se Lane d Castl 8 7 y St 13 14 r er F Strangford 12 Ballyphilip Road Ferry 9 Terminal 11 Steel Dickson Av Marina 18 10 W indmill Hill VIEWPOINT WINDMILL Sho 17 r e R d STRANGFORD LOUGH eet e Str Cook Sho r e R 1 Portaferry Castle and d Visitor Information Centre Cooke 2 The Northern Ireland Aquarium Street 3 Credit Union Jetty 4 Market House 5 St Cooey’s Oratory 6 Ballyphilip Parish Church and Temple Craney Graveyard 7 National School 8 The Presbyterian Church and Portico 9 Steel Dickson Avenue 10 Joseph Tomelty Blue Plaque 11 Blaney’s Shop 12 Dumigan’s Pub 13 Methodist Church 14 The Watcher 15 RNLI Lifeboat Station 16 Queens University and Belfast Marine Laboratory Additional Route (Follow Arrows) 17 The View Point Additional Route Please note that this map is not 18 Tullyboard Windmill to scale and is for reference only Portaferry Walking Guide Historical Walking Trail of Portaferry, Co Down The main route consists of flat The tour will last approximately concrete footpaths with pedestrian one hour. For your convenience, crossing opportunities. Please be there are also public toilets and a aware when crossing the road and wide range of cafes and restaurants keep an eye out for traffic at all times. -

Egad, Newtownards Airport Visiting Aircraft Guide

EGAD, NEWTOWNARDS AIRPORT VISITING AIRCRAFT GUIDE EGAD – Newtownards Airport 028 9181 3327 [email protected] 128.300MHz Local Chart NOT TO BE USED FOR NAVIGATION EGAD – Newtownards Airport 028 9181 3327 [email protected] 128.300MHz Airport Chart EGAD – Newtownards Airport 028 9181 3327 [email protected] 128.300MHz Airfield Information • All circuit traffic is left hand except RW03 which is right hand. • Standard circuit height is 1000ft agl and aerodrome elevation is 9ft. • Please avoid overflying Castle Espie bird sanctuary. (185° at 3nm from EGAD) • Standard overhead join recommended at 2000ft agl if possible. Runway Information Runway PAPI LIGHTS TODA LDA 03 4.5º Yes 747m 791m 08 - - 566m Unlicensed 15 4.5º Yes 594m 530m 21 4.5º Yes 791m 717m 26 - - Unlicensed 566m 33 4.5º Yes 586m 564m 15 Grass - 0 Unlicensed Unlicensed Remarks / Warnings Approaches to Runway 26 & 33 are directly over a sea wall which may be obstructed by persons and vehicles 15 Approach / 33 Climb out, Police station mast to the east of the centreline (153ft) Air Traffic Services Information • An Air/Ground service on frequency 128.300. Callsign ‘Newtownards Radio’ • Belfast Approach on frequency 130.850. Callsign ‘Belfast Approach’ Diversion Airfields • EGAC, Belfast City (289° at 6.7nm) NO AVGAS AVAILABLE o RW04/22 - 1829 x45m, equipped with ILS both ends • EGAA, Aldergrove (284° at 10nm) o RW07/25 - 2780 x45m, equipped with VOR 07 & ILS 25 o RW17/35 – 1891x45m, equipped with ILS 17 & VOR 35 o Aircraft Maintenance available EGAD – Newtownards Airport 028 9181 3327 [email protected] 128.300MHz Arrival & Departure Procedures NOT TO BE USED FOR NAVIGATION Arrivals • Aircraft arriving from the east / south will be able to route directly to the airfield below 2000ft. -

BRCD Council Panel

BRCD Council Panel Subject: Minutes of Belfast Region City Deal (BRCD) Council Panel Date: 12:30 pm, 30 September 2020 Councillor Uel Mackin – Lisburn & Castlereagh City Council (Chair) Alderman Mark Cosgrove – Antrim & Newtownabbey Borough Council Alderman Phillip Brett – Antrim & Newtownabbey Borough Council Councillor Stephen Ross – Antrim & Newtownabbey Borough Council Councillor Glenn Finlay – Antrim & Newtownabbey Borough Council Councillor Robert Adair – Ards & North Down Borough Council Alderman Alan McDowell – Ards & North Down Borough Council Councillor Richard Smart – Ards & North Down Borough Council Councillor Stephen Dunlop – Ards & North Down Borough Council Alderman Brian Kingston – Belfast City Council Councillor Carl Whyte – Belfast City Council Councillors in attendance: Councillor Ronan McLaughlin – Belfast City Council Councillor Eric Hanvey - Belfast City Council Councillor Sorcha Eastwood – Lisburn & Castlereagh City Council Alderman Allan Ewart MBE – Lisburn & Castlereagh City Council Alderman Billy Ashe MBE – Mid & East Antrim Borough Council Councillor Timothy Gaston – Mid & East Antrim Borough Council Alderman Audrey Wales MBE -Mid & East Antrim Borough Council Councillor Robin Stewart – Mid & East Antrim Borough Council Councillor Charlie Casey – Newry, Mourne & Down District Council Councillor Robert Burgess – Newry, Mourne & Down District Council Councillor Pete Byrne – Newry, Mourne & Down District Council Councillor Willie Clarke – Newry, Mourne & Down District Council David Burns – Chief Executive, Lisburn -

Ards and North Down Borough Council a G E N

ARDS AND NORTH DOWN BOROUGH COUNCIL 28 February 2019 Dear Sir/Madam You are hereby invited to attend a meeting of the Environment Committee of the Ards and North Down Borough Council which will be held in the Council Chamber, 2 Church Street, Newtownards on Wednesday 6 March 2019 commencing at 7.00pm. Tea, coffee and sandwiches will be available from 6.00pm. Yours faithfully Stephen Reid Chief Executive Ards and North Down Borough Council A G E N D A 1. Apologies 2. Declarations of Interest 3. Environment Directorate Budgetary Control Report January 2019 (Report attached) 4. Environment Directorate Annual Service Plans 2019-20 (Report attached) 5. Policy for Use of Council Vehicles (Report attached) 6. Donation of Lifebelt to Council (Report attached) 7. Waste Management Consultations (Report attached) 8. Recycling of Soft Plastics (Report attached) 9. Notice of Motion Report – Walker’s and TerraCycle Crisp Packet Recycling Scheme (Report attached) 10. Baseline Study and Gap Analysis of Coastal Erosion Risk Management NI (Report attached) 11. Recycling Community Investment Fund (RCIF) – 2018/19 Slippage/Underspend Proposal (Report attached) 12. RCIF 19/20 Funding Allocation Proposal (Report attached) 13. Live Here Love Here Small Grants – Public Liability Insurance Issues(Report attached) 14. Licensing and Regulatory Services Update (Report attached) 15. Further Report - Notice of Motion on Impact of Road Closure Legislation upon Community/Voluntary Events (Report attached) 16. Provision of Holding Kennels (Report attached) 17. Grant of Entertainment Licence (Report attached) 18. Street Café Licence (Report attached) 19. Attendance at Parkex (Report attached) 20. Capital Pilot for HRC Optimisation (Report attached) 20.1. -

Newtownards Walking Guide

View of Scrabo Newtownards Walking Guide visitstrangfordlough.co.uk Newtownards Map 2 6 1 Old Regent House 1 2 St Mark’s Parish Church 14 3 The Ards Hospital (The Old Workhouse) 3 5 4 A view of Scrabo Tower 5 Regency Gift House, Library (The Queen’s Hall) and Open and Direct Building 4 12 13 11 Strean Presbyterian Church 6 Conway 7 The Market Cross Square 8 Movilla Abbey (Extended Tour Route) 9 The War Memorial and Rose Garden 10 Newtownards Priory 8 11 The Blair Mayne Statue 12 The Ards TT (Tourist Trophy) 7 To Movilla Abbey 13 Ards Arts Centre 14 The Old Brewery/ Visitor Information Centre and Ards Crafts 9 10 Please note that this map is not to scale and is for reference only Newtownards Walking Guide Historical Walking Trail of Newtownards, Co Down This tour begins at the Visitor surface over grass to the Movilla Information Centre on Regent Abbey site. Please be aware when Street located beside the bus crossing the road and keep an station (point 14). eye out for traffic at all times. The tour will last approximately The main route consists of one hour. For your convenience, flat concrete footpaths with there are also public toilets pedestrian crossing opportunities. and a wide range of cafes and If you extend your walk please restaurants in Newtownards. be aware of a gradual incline along footpaths with an uneven We hope you enjoy learning more about the area. Be sure to look out for the other walking guides in the series. These can be downloaded from www.visitstrangfordlough.co.uk along with ideas on what to see and do in the area. -

501 Organisations Have Received £8,846,532 to Date. Updated 09/10

501 organisations have received £8,846,532 to date. Updated 09/10/2020 Awarded Organisation Locality Amount Antrim and Antrim Enterprise Agency Ltd Newtownabbey £17,744 Antrim and Antrim/All Saints/Connor/Church of Ireland Newtownabbey £6,460 Antrim and Coiste Ghaeloideachas Chromghlinne Newtownabbey £4,000 Antrim and Fitmoms & kids Newtownabbey £3,931 Antrim and Glenvarna Christian Fellowship Newtownabbey £28,327 Antrim and Hope And A Future Newtownabbey £7,422 Antrim and Hope365 Newtownabbey £11,590 Antrim and Journey Community Church Antrim Newtownabbey £32,602 Antrim and Kilbride Playgroup Newtownabbey £7,950 Newtownabbey/Mossley/Church of the Holy Antrim and Spirit/Connor/Church of Ireland Newtownabbey £13,425 Antrim and Randalstown Arches Association Ltd Newtownabbey £17,418 Randalstown/Drummaul, Duneane & Antrim and Ballyscullion/St. Brigid/Connor/Church Of Ireland Newtownabbey £7,000 Antrim and South Antrim community Transport Newtownabbey £51,259 The River Bann and Lough Neagh Association Antrim and Company Newtownabbey £7,250 Toomebridge Industrial Development Amenities Antrim and and Leisure Limited Newtownabbey £8,345 Antrim and World of Owls Newtownabbey £16,775 2nd Donaghadee Scout Group Ards and North Down £1,392 Bangor Drama Club Limited Ards and North Down £8,558 Bangor/Bangor Primacy/Christ Church/Down & Dromore/Church Of Ireland Ards and North Down £2,703 Bangor/Bangor:St. Comgall/St. Comgall/Down & Dromore/Church Of Ireland Ards and North Down £19,500 Bangor/Carnalea/St. Gall/Down & Dromore/Church Of Ireland Ards and -

The Belfast Gazette, February 25, 1927

THE BELFAST GAZETTE, FEBRUARY 25, 1927. Reference No. on Standard Keg. Map filed Purchase Standard No. Name of Tenant. Postal Address. Barony. Townland. in Land Area. Rent. Annuity. Price. Purchase Commis- sion. A. R. P. £ s. d. £ s d. £ s. d Holdings subject to Judicial Rents fixed between the 15th August, 1896, and the 16th August, 1911. 4 Patrick John Ballyminnish, Ards Upper Ballyminnish 4 3 1 20 3 10 0 2 17 8 60 14 0 McManus Portaferry, Co. Down 60 Do. do. do. do. 3 22 0 0 18 0 0 14 16 4 311 18 7 61 Henry Merron do. do. do. 1 45 1 0 41 2 6 33 17 0 712 12 8 62 Isabella McWhinney Market Sp uare do. do. 2 5 2 30 600 4 18 10 104 0 8 (widow) Portaferry 9 Patrick John Ballyphilip, do. Ballyphilip 1 700 600 4 18 10 104 0 8 McManus Portaferry 11 Robert Lennon High Street, do. do. 2 8 3 20 740 5 18 6 124 14 9 Portaferry 32 Alexander Kirkpatrick Cloughey, do. Tullyboard 1 13 3 0 14 9 0 11 17 10 250 7 0 Portaferry 33 James Con very New Road, do. do. 6 510 676 550 110 10 6 Portaferry 34 James McCarthy Tullyboarcl, do. do. 7 12. 3 15 14 10 0 11 18 8 251 4 7 .Portaferry 35 James Wilson do. do. do. 8 2 3 0 2 12 0 2 2 10 45 1 9 36 James Shanks do. do. do. 3 .3 0 20! 3 0 0 294 51 18 7 37 James McConvery do.