Ford Motor Company

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

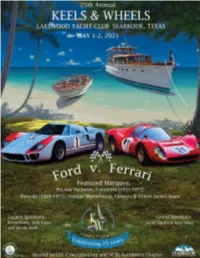

2021 Program

SPONSORS TITLE SPONSOR City of Seabrook LEGACY SPONSORS $50,000 Kevin Brady $10,000 Moody Bank | Tom Koger PLATINUM SPONSORS Bayway Auto Group Evergreen Environmental Services Chesapeake Bay Luxury Senior Living Tony Gullo City of Nassau Bay Meguiar’s Classic Cars of Houston UTMB GOLD SPONSORS Barrett-Jackson Marine Max Yachts Houston Edna Rice, Executive Recruiters McRee Ford Garage Ultimate MSR Houston Generator Exchange Paulea Family Foundation Golf Cars of Houston Ron Carter Clear Lake Cadillac Honda of Houston Star Motor Cars - Aston Martin John Ebeling Technical Automation Services Company Kendra Scott Texas Coast Yachts 6 | Concours d’ Elegance 2021 SPONSORS SILVER SPONSORS Associated Credit Union of Texas Georg Fischer Harvel Beck Design Glacier Pools & Spas Dean & Draper Insurance Company Hagerty Insurance Discover Roofing Hibbs-Hallmark Insurance Dockside Development & Construction LeafGuard Holdings Drilltec Patents & Technologies Co. Pfeiffer & Son Ltd. DriverSource Ranco Industries Frost Bank Reunion Court/12 Oaks - Clear Lake Galati Yacht Sales Shaw Systems Garages of Texas Temperature Solutions Gateway Classic Cars The Delaney at South Shore Geico Insurance Upstream Brokers Generator Supercenter BRONZE SPONSORS Art Jansen Rocking F Ranch - Janet & Dave Foshee Big 4 Erectors Rolli McGinnis Caru West Cargo Containers RV Insurance Solutions LLC John Wilkins South Land Title Lakeside Yachting Center Y.E.S. Yacht Equipment Maudlin & Sons Mfg. Co. Concours d’ Elegance 2021 | 7 CLUB CONCOURS TEXAS MATTRESS MAKERS $1,000 - $2,000 CLUB CONCOURS lub Concours is a new family, or entertain clients. You and unique feature will have exclusive access to the at Keels & Wheels Concours event, upgraded food Concours d’Elegance and beverage service, a private event. -

Field of Dreams: the Vision for the LTU Athletics Complex, and How You

LAWRENCE TECHNOLOGICAL UNIVERSITY MAGAZINE | Summer/Fall 2017 Field of dreams: The vision for the LTU athletics complex, and how you can be a part of it Meet LTU’s athletic coaches | President Moudgil visits India, China Breaking ground for a fourth residence hall | New DECA team shines | Alumni news | And more! Summer/Fall 2017 Volume XXXVI, Number 1 Published by Lawrence Technological University, Office of Marketing and Public Affairs, 21000 West Ten Mile LAWRENCE TECHNOLOGICAL UNIVERSITY MAGAZINE Road, Southfield, MI 48075-1058; 248.204.2200 or 800.225.5588, ext. 4 Fax 248.204.2318 FROM THE PRESIDENT [email protected] Virinder K. Moudgil President Editor: Bruce J. Annett, Jr. ([email protected]) Managing Editor: Matt Roush ([email protected]) With the start of fall semester, we mark the 85th anniversary Design: NetWorks Design, Inc. of the founding of Lawrence Technological University. On Writers: Bruce J. Annett, Jr., Stephanie September 6, 1932, Lawrence Institute of Technology opened with Casola, Sibrina Collins, Chris Mead, the first class of several hundred students. Jay Nicols, Matt Roush Editorial Support: Anne Adamus, It is hard to imagine a less promising time to launch a new Krysta Coleman, Howard Davis, enterprise. During what historians generally agree were the bleakest Kristen DeVries, Sofia Lulgjuraj, Brandé Oliver, Kristine L. Persinger, Lauren months of the worst economic year of the Great Depression, LTU Seebold, Julie Vulaj founder Russell Lawrence, supported by close members of his family Photography and Illustration: The Virinder K. Moudgil and a band of stalwart faculty, bravely faced the future. Collaborative, Gary Duncan, inFORM, Matt Lester, Justin Munter, Jay Nicols, Michigan’s unemployment rate was pushing 50 percent. -

Research Center New and Unprocessed Archival Accessions

NEW AND UNPROCESSED ARCHIVAL ACCESSIONS List Published: April 2020 Benson Ford Research Center The Henry Ford 20900 Oakwood Boulevard ∙ Dearborn, MI 48124-5029 USA [email protected] ∙ www.thehenryford.org New and Unprocessed Archival Accessions April 2020 OVERVIEW The Benson Ford Research Center, home to the Archives of The Henry Ford, holds more than 3000 individual collections, or accessions. Many of these accessions remain partially or completely unprocessed and do not have detailed finding aids. In order to provide a measure of insight into these materials, the Archives has assembled this listing of new and unprocessed accessions. Accessions are listed alphabetically by title in two groups: New Accessions contains materials acquired 2018-2020, and Accessions 1929-2017 contains materials acquired since the opening of The Henry Ford in 1929 through 2017. The list will be updated periodically to include new acquisitions and remove those that have been more fully described. Researchers interested in access to any of the collections listed here should contact Benson Ford Research Center staff (email: [email protected]) to discuss collection availability. ACCESSION NUMBERS Each accession is assigned a unique identification number, or accession number. These are generally multi-part codes, with the left-most digits indicating the year in which the accession was acquired by the Archives. There, are however, some exceptions. Numbering practices covering the majority of accessions are outlined below. - Acquisitions made during or after the year 2000 have 4-digit year values, such as 2020, 2019, etc. - Acquisitions made prior to the year 2000 have 2-digit year values, such as 99 for 1999, 57 for 1957, and so forth. -

DETROIT BUSINESS MAIN 04-07-08 a 1 CDB.Qxd

DETROIT BUSINESS MAIN 04-07-08 A 1 CDB 4/4/2008 6:35 PM Page 1 ® www.crainsdetroit.com Vol. 24, No. 14 APRIL 7 – 13, 2008 $2 a copy; $59 a year ©Entire contents copyright 2008 by Crain Communications Inc. All rights reserved THIS JUST IN Michael DeVos was hired to NCAA regional semifinals make unpopular decisions On tap: More give Detroit hotels a boost and change the The NCAA regional semi- finals brought a boost to the downtown Detroit ho- state’s system for tel market March 28 and 29, according to statistics re- leased to Crain’s by the awarding low- Hendersonville, Tenn.- could get based hospitality research firm Smith Travel Research. income housing Detroit’s hotel occupan- cy was 85 percent on March projects. He did 28, when there were two Sweet 16 games at Ford Field. And in preparation both and ran afoul of MEGA credits for March 30’s Elite 8 game, Saturday’s occupancy was 75 percent. entrenched interests. Was The city’s average occu- Need to look outside state may be cut pancy is 55 percent. his resignation a The entire region had a BY AMY LANE passed the Senate near-unanimously, small bump with Friday CAPITOL CORRESPONDENT and all are designed to give the 13- and Saturday occupancy at year-old tax credit and incentive pro- 61 percent and 62 percent, LANSING — Michigan businesses gram new competitiveness and rele- the company reported, may no longer have to shop outside vance. compared to the average of Culture clash the state for another location to quali- The timing is opportune, as the im- 59 percent. -

Roger and Barb Wothe's 1942 Continental Convertible

Volume 21 Issue 4 April 1, 2021 Roger and Barb Wothe’s 1942 Continental Convertible As fast as a speeding locomotive, and much prettier, a true work of art. Welcome to the For what seems to have been eons, your editor has been asking Roger Wothe to contribute an article about his magnificent 1942 Continental Cabriolet. I have progressed through the various Northstar News, the stages, asking nicely, begging, pleading, threatening, cajoling, shaming, and trying to do whatever monthly publication of it might take to have Roger sit down with pen in hand and create a missive suitable for publication the Northstar Region in our monthly newsletter. Alas, nothing worked. But, an article of sorts had been published in the January-February 2009 issue of Comments. Tim Howley authored it from information supplied by of the Lincoln and Roger. Tim was motivated to write about the car, as he had seen it in all its beauty at the 2008 Continental Owners LCOC Mid-America meet, which took place in Duluth, Minnesota. The 2008 meet was well at- Club. We value your tended, and those who attended had a delightful experience visiting the home town of your Northstar News editor. We had some great weather, many good friends in attendance, and a wide opinions and appreciate variety of cars entered in the show. Some 13 years later, the North Star Region is still receiving your input concerning compliments about how nice the event was. And now, here is the story about one of the best 1942 this newsletter and the Continentals extant! Roger and Barbara Wothe are North Star Region members who live in Wayzata, Minnesota. -

The Dearborn Historian Quarterly of the Dearborn Historical Commission

INSIDE: Dearborn’s Only WW1 Casualty The Dearborn Historian Quarterly of the Dearborn Historical Commission South End Starlet Dearborn’s Adele Mara appeared in nearly 100 films and TV shows. She joked with the Three Stooges, won renown as a pinup girl in World War II and taught John Wayne to jitterbug. SUMMER 2018 \ VOLUME 55, NUMBER 2 The New Editor David’s editing is a hard act to follow, but I will do my Bill McGraw best to maintain his standards and creativity. He will remain as contributing editor and will continue to write stories and Please Allow Me to contribute in other ways. Introduce Myself “The istorianH has a pretty impressive pedigree going back more than 50 years as a journal doing original research,” Good received some good news early this summer: The Dearborn told me. “And I’m grateful I had the chance to resurrect it as a Historian was looking for an editor. volunteer project in 2011 after the Historical Museum stopped I publishing for four years. I also appreciate the editorial freedom My friend David Good was retiring after putting out The that Jack Tate gave me after he took over as acting chief curator Historian for seven years as a volunteer. To make a long story in 2012. short, I got the job. This is my first issue. I couldn’t be happier. I’ve been a reader of The Historian since I moved to “During 34 years of writing and editing at the Detroit News, Dearborn 30 years ago August. Its I had a number of jobs I truly considered fun, but nothing was stories and photos supported my quite as rewarding as being editor of The Historian.” belief that Dearborn is the most As for me, I’m a local product: I was born in Detroit, and unique and interesting suburb prior to my 1988 move to Dearborn, I had lived in Grosse in metro Detroit, with the most Pointe, Detroit and St. -

Ford Anti-Report

ct/54 -t COUNTERINFORMATION SERVICES - A TRANSNATIONALINSTITUTE AFFILIATE 90p The FordMotor Company Counterlnfonnation Services 9 PolandStreet. London Wl. 01439 3764 .\nti-ReportNo.20 \: : \\ .:r; CIS -.S .. - .':irireof journalistswho pub- ..:: .: : ,::t3tionnot coveredor collated r. ::.3 eslablishedmedia. It is their aim - .:.',3s:rsatethe majorsocial and econo- :''.. .:.:rriutionsthat governour daily ,..;: .. order that the basicfacts and :::-:u:t1L)nSbehind them be as rvidely .\- \\ii as possible.CIS is financedby ,..:s. subscriptions,donations and grants. Subscribe l-+.00UK, {,5.00overseas, for six issues. Special Discount for bulk orders. All rvailablefrom CIS,9 PolandStreet, LondonWl. (01-4393164). Distributedby Pluto Press,Unit 10. SpencerCourt, 7 ChalcotRoad, London \wl 8LH. rsBN0 903660l8 0 Designby JulianStapleton. Publishedby CounterInformation Services. Printed by the Russell PressLimited. -l-iGamble Street. Nor ringham NG7 4ET. Far right. Henry II ERRATUMPAGE 26 TableFiesta Costings Thefirst figure $1,215 should reaci $215 rI I ilry i I t i ri.,: ,i$ru,fufo;, q#ah r$ffi.€) s*b ;\*ffi ffi " ft&1;'l i;$ +:;,it ::lrLn:: ;,[ji:, =* i $ H' $,' Sr lU Popperfoto The Ford Motor Company is in the tionally by geography'and nationality. ary.and governmentwage freezes cited to business of making money out of car- Ford, on the other hand. benefitsirom justify their refusal.Tax incentivesand workers. To do this it mounts a constant its centralisedcontrol of manaqementsubsidiesabound as national govern- three-pronged attack: on wages, on strategy. ments competefor Ford's favours.Ford productivity levels, and on workers' flourishesin Europe while Europeancar attempts to organisethemselves. In Europe.lor example.the UK work- firms struggleto survive.The company's force is threatened*rth an embargoon ability to make record profits at the In order to extract greater productivity further UK investmentunless continental expenseof Europeanworkers and national (more work for the same pay) from its levels oi productivity are achieved. -

CONGRESSIONAL RECORD— Extensions of Remarks E1521 HON

July 18, 2003 CONGRESSIONAL RECORD — Extensions of Remarks E1521 incident. In 1987, Judge Cristol began re- forever be remembered for the contributions of dedicated service to Lockheed Martin Mis- searching the tragedy that befell the United he provided his community and I am sorry for siles and Fire Control in Dallas, Texas, and to States Navy ship Liberty and her crew on his loss. My thoughts and prayers go out to congratulate him on his retirement from the June 8, 1967. Judge Cristol completed a doc- Dan’s family, friends, and his coworkers on company. toral dissertation on the subject in 1997 and the Pueblo Rural Fire Department. During his tenure with Lockheed Martin, published his book, The Liberty Incident, in f Brent has managed the company’s employee 2002. and company contribution programs, coordi- HONORING EDSEL BRYANT FORD In his continued quest for the truth, Judge nated employee volunteer efforts, and served II Cristol pressed and finally convinced the Na- as the company’s lobbyist for state and local tional Security Agency to release classified issues. He served as Lockheed Martin’s Con- transcripts proving that Israel’s attack on the HON. JOHN D. DINGELL stituent Relations Manager for local relations USS Liberty during the Six Day War was, in OF MICHIGAN with federal officials in the Dallas area and fact, accidental. IN THE HOUSE OF REPRESENTATIVES has served as executive director of the LTV On June 8, 1967, Israeli troops detected Thursday, July 17, 2003 Foundation and manager of the company’s large explosions along the Sinai shore. -

CVMC October 2017

October 2017 FallenFallen HeroesHeroes NEW Collectible For The Big Kids WEBMASTER CLUB INFORMATION Paul Beckley 323-7267 Central Valley Mustang Club, Inc. NEWSLETTER EDITOR P.O. Box 9864 • Fresno, CA 93794 Garo Chekerdemian 906-7563 Phone: (559) 715-CVMC (2862) Website: http://www.cvmustang.org ADVERTISING Talk to a Member at Large Club Purpose: To provide a common meeting ground for Mustang ADVERTISING RATES: owners and further the enjoyment of ownership; to include workshops, discussions and technical meetings; to promote a more favorable relationship with the general motoring public; to further the Classified Ads (3 Lines) preservation and restoration of all Mustangs. CVMC Members FREE Non Members per issue $3.00 Who Can Join: The club is open to all Mustang enthusiasts. Any with Photo $10.00 individual or family can join. Ownership of a Mustang is not essential, but enthusiasm is. CVMC embraces the practice of encouraging Business Card Ad diversity within the membership and involvement of the entire family in CVMC Members FREE its membership and at all club events. Issue $5.00 Six Months $13.00 A Family Oriented Organization: As a part of promoting family One Year $25.00 involvement in the club, children are allowed and in fact encouraged at all club functions. In deference to this family involvement and the driving of motor vehicles, consumption of alcoholic beverages is Double Business Card Ad (1/4 Page) discouraged at club events except where the club is staying Issue $7.00 overnight and there is no potential for any drinking member or guest Six Months $20.00 to get behind the wheel. -

Car Buyer Choice, Demographic Shifts Discussed in Auto Show's Affordable Mobility Summit on Capitol Hill

WANADA Bulletin # 5-13 Washington Auto Show Special! February 5, 2013 Headlines… Car buyer choice, demographic shifts discussed in Auto Show’s Affordable Mobility Summit on Capitol Hill Automakers raise concerns about 2025 fuel efficiency mandate at Auto Show Capitol Hill Summit Audi of America President describes OEM’s road to success and plans for the future in keynote remarks at Auto Show Sec. of Energy announces workplace EV program at Auto Show Media Day events at The WAS spotlight breadth and success of industry and its public policy priorities WAS Sneak Peek Preview draws Washingtonians to Show, Jan. 31 WANADA’s Member “Reception within the Reception” at Auto Show Preview Keith Crain, Automotive News recognize Edsel Ford at dinner in his honor at the Auto Show Thought for the Week… Preview of coming attractions… 2013 WAS Policy Summit on Capitol Hill, Jan. 30 Car buyer choice, demographic shifts discussed in Auto Show’s Affordable Mobility Summit on Capitol Hill At the leadoff event on the first Public Policy Day of the 2013 Washington Auto Show (WAS), speakers with diverse viewpoints discussed whether consumers are willing and able to take advantage of the new technologies for better fuel economy. The panel was heard at the National Journal Policy Summit on Affordable Mobility by a standing room-only crowd in the historic Caucus Room of the Cannon House Office Building, last Wednesday, Jan. 30. “The standards are farther out Summit on Affordable Mobility in the Cannon House Caucus Room than we’ve ever had,” said dealer and NADA Government Affairs Chairman Don Chalmers. -

New and Unprocessed Archival Accessions, April 2020

NEW AND UNPROCESSED ARCHIVAL ACCESSIONS List Published: April 2020 Benson Ford Research Center The Henry Ford 20900 Oakwood Boulevard ∙ Dearborn, MI 48124-5029 USA [email protected] ∙ www.thehenryford.org New and Unprocessed Archival Accessions April 2020 OVERVIEW The Benson Ford Research Center, home to the Archives of The Henry Ford, holds more than 3000 individual collections, or accessions. Many of these accessions remain partially or completely unprocessed and do not have detailed finding aids. In order to provide a measure of insight into these materials, the Archives has assembled this listing of more than 1100 new and unprocessed accessions. Accessions are listed alphabetically by title in two groups: New Accessions contains materials acquired 2018-2020, and Accessions 1929-2017 contains materials acquired since the opening of The Henry Ford in 1929 through 2017. The list will be updated periodically to include new acquisitions and remove those that have been more fully described. Researchers interested in access to any of the collections listed here should contact Benson Ford Research Center staff (email: [email protected]) to discuss collection availability. ACCESSION NUMBERS Each accession is assigned a unique identification number, or accession number. These are generally multi-part codes, with the left-most digits indicating the year in which the accession was acquired by the Archives. There, are however, some exceptions. Numbering practices covering the majority of accessions are outlined below. - Acquisitions made during or after the year 2000 have 4-digit year values, such as 2020, 2019, etc. - Acquisitions made prior to the year 2000 have 2-digit year values, such as 99 for 1999, 57 for 1957, and so forth. -

Calendar of Events

2018 Calendar of Events YEAR-ROUND SUMMER HOLIDAY PNC Tinkering for Tots Preschool Program The World of Charles and Ray Eames Exhibition Rockwell, Roosevelt & the Four Freedoms Second Monday of each month, 10 a.m.-noon Museum Running through September 3 Exhibition Museum November-April Museum Running through January 13, 2019 Village May-October National Invention Convention and Entrepreneurship Expo Member Appreciation Days Make Something: Saturdays Museum June 1 The Henry Ford November 17-19 Every Saturday, 10 a.m.-3 p.m. Members 25th Annual Museum September-May Cinetopia International Film Festival* Giant Screen Experience June 2-10 Holiday Lighting Ceremony* Throwback Thursday Nights* Museum November 19 Giant Screen Experience Most Thursdays, 7 p.m. Eames Happy Hour* thehenryford.org/tbt Museum June 7, July 19 and August 9 Visits with Santa Museum November 23-December 24 National Get Outdoors Day Village June 9 Holiday Nights in Greenfield Village* WINTER Village November 30, December 1-2, 7-9, 13-16, Historic Base Ball Games 18-23 and 26-27 The Science Behind Pixar Exhibition* Village June 9-10, 16-17 and 23-24; July 7-8, 14-15, Museum Running through March 18 Presented by Citizens Bank 21-22 and 28-29; August 4-5 and 18-19 Presented by Meijer Historic Base Ball in Greenfield Village is made possible through Holiday Nights in Greenfield Village the generous support of Cynthia and Edsel Ford II Engines Exposed Dinner Package at Eagle Tavern* Village November 30, December 1-2, 7-9, 13-16, Museum January 13-February 28 Artists in Residence