CBIS Global Funds Plc an Umbrella Fund with Segregated Liability Between Sub-Funds

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Premium Thresholds for Equity Options Traded at Euronext Amsterdam Premium Based Tick Size

Premium Based Tick Size Premium thresholds for equity options traded at Euronext Amsterdam Trading Trading Premium Company symbol symbol threshold Underlying American European €0.50 €5.00 1 Aalberts AAI x 2 ABN AMRO Bank ABN x 3 Accell Group ACC x 4 Adidas ADQ x 5 Adyen (contract size 10) ADY x 6 Aegon AGN x 7 Ageas AGA x 8 Ahold Delhaize, koninklijke AH AH9 x 9 Air France-KLM AFA x 10 Akzo Nobel AKZ x 11 Allianz AZQ x 12 Altice Europe ATC x 13 AMG AMG x 14 Aperam AP x 15 Arcadis ARC x 16 ArcelorMittal MT MT9 x 17 ASM International ASM x 18 ASML Holding ASL AS9 x 19 ASR Nederland ASR x 20 BAM Groep, koninklijke BAM x 21 Basf BFQ x 22 Bayer REG BYQ x 23 Bayerische Motoren Werke BWQ x 24 BE Semiconductor Industries BES x 25 BinckBank BCK x 26 Boskalis Westminster, koninklijke BOS x 27 Brunel International BI x 28 Coca-Cola European Partners CCE x 29 CSM CSM x 30 Daimler REGISTERED SHARES DMQ x 31 Deutsche Bank DBQ x 32 Deutsche Lufthansa AG LUQ x 33 Deutsche Post REG DPQ x 34 Deutsche Telekom REG TKQ x 35 DSM, koninklijke DSM x 36 E.ON EOQ x 37 Euronext ENX x 38 Flow Traders FLW x 39 Fresenius SE & CO KGAA FSQ x 40 Fugro FUR x 41 Grandvision GVN x 42 Heijmans HEY x 43 Heineken HEI x 44 IMCD IMD x 45 Infineon Technologies NTQ x 46 ING Groep ING IN9 x 47 Intertrust ITR x 48 K+S KSQ x 49 Kiadis Pharma KDS x 50 Klépierre CIO x 51 KPN, koninklijke KPN x 52 Marel MAR x 53 Muenchener Rueckver REG MRQ x 54 NIBC Holding NIB x 55 NN Group NN x 56 NSI NSI x 57 OCI OCI x 58 Ordina ORD x 59 Pharming Group PHA x 60 Philips Electronics, koninklijke PHI -

FIDELITY SALEM STREET TRUST Form NPORT-P Filed 2021-03-17

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-03-17 | Period of Report: 2021-01-31 SEC Accession No. 0001752724-21-055741 (HTML Version on secdatabase.com) FILER FIDELITY SALEM STREET TRUST Mailing Address Business Address 245 SUMMER STREET 245 SUMMER STREET CIK:35315| IRS No.: 000000000 | State of Incorp.:MA | Fiscal Year End: 0430 BOSTON MA 02210 BOSTON MA 02210 Type: NPORT-P | Act: 40 | File No.: 811-02105 | Film No.: 21749300 617-563-7000 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Quarterly Holdings Report for Fidelity® SAI Emerging Markets Low Volatility Index Fund January 31, 2021 Offered exclusively to certain clients of the Adviser or its affiliates - not available for sale to the general public. Fidelity SAI is a product name of Fidelity® funds dedicated to certain programs affiliated with Strategic Advisers LLC. MLV-QTLY-0321 1.9892172.102 Schedule of Investments January 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks - 99.3% Shares Value Bailiwick of Jersey - 0.6% WNS Holdings Ltd. sponsored ADR (a) 133,901 $8,995,469 Bermuda - 1.3% China Resource Gas Group Ltd. 2,526,000 12,640,996 Shenzhen International Holdings Ltd. 3,307,714 5,452,241 TOTAL BERMUDA 18,093,237 Brazil - 0.2% Atacadao SA 902,600 3,140,970 Cayman Islands - 17.1% Anta Sports Products Ltd. 1,584,000 26,211,872 Bosideng International Holdings Ltd. 9,214,000 4,088,113 China Biologic Products Holdings, Inc. (a) 33,383 3,934,187 Hansoh Pharmaceutical Group Co. -

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 128.4 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 69.3 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.3 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 57.5 4 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 37.7 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 32.6 6 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 32.0 7 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.5 8 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 26.5 9 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.4 10 15 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 19.4 11 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 18.9 12 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 17.9 14 11 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.8 15 14 HK0688002218 6192150 0688.HK 619215 China Overseas Land & Investme CN HKD Y 14.8 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 14.6 17 17 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.5 18 19 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. -

Successful NLII Business Loan Fund Continues to Grow

Successful NLII business loan fund continues to grow Another € 480 million available for Dutch SMEs through institutional investors Amsterdam/Rotterdam, 8 March 2017 – Dutch investment institution Nederlandse Investeringsinstelling N.V. (NLII) and Robeco today announce that the SME corporate lending fund Bedrijfsleningenfonds (BLF), created by NLII with Robeco acting as fund manager, has raised € 480 million in the second funding round, bringing the fund total to € 960 million. This will make extra funding from institutional investors available to larger Dutch SMEs. An amount of € 195 million has already been lent to Dutch SMEs since the fund was established. The parties participating in this second round of funding are NN Group, Pensioenfonds Metaal & Techniek (PMT), Pensioenfonds van de Metalektro (PME), a.s.r. and the European Investment Fund (EIF). Most of these parties also participated in the first funding round. NLII CEO Loek Sibbing: “The success of the BLF is clearly highlighted by this second round of funding. Our objective is to enable institutional investors such as pension funds and insurers to invest directly in the Dutch economy and that is exactly what the BLF offers investors. The fund has already enabled a number of Dutch companies to continue to grow. Expanding the fund increases the lending opportunities for SMEs significantly.” Robeco BLF fund manager Erik Hylarides: “The BLF was established to bring about a change in the funding landscape by offering companies access to multiple sources of finance. The current expansion of the fund and the pipeline of transactions we are working on prove that this has been a success. -

Abn Amro Bank Nv

7 MAY 2020 ABN AMRO ABN AMRO BANK N.V. REGISTRATION DOCUMENT constituting part of any base prospectus of the Issuer consisting of separate documents within the meaning of Article 8(6) of Regulation (EU) 2017/1129 (the "Prospectus Regulation") 250249-4-270-v18.0 55-40738204 CONTENTS Page 1. RISK FACTORS ...................................................................................................................................... 1 2. INTRODUCTION .................................................................................................................................. 26 3. DOCUMENTS INCORPORATED BY REFERENCE ......................................................................... 28 4. SELECTED DEFINITIONS AND ABBREVIATIONS ........................................................................ 30 5. PRESENTATION OF FINANCIAL INFORMATION ......................................................................... 35 6. THE ISSUER ......................................................................................................................................... 36 1.1 History and recent developments ............................................................................................. 36 1.2 Business description ................................................................................................................ 37 1.3 Regulation ............................................................................................................................... 40 1.4 Legal and arbitration proceedings .......................................................................................... -

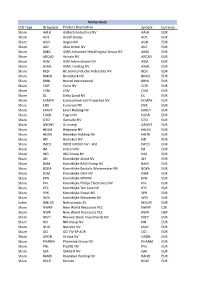

CFD Type IB Symbol Product Description Symbol Currency Share

Netherlands CFD Type IB Symbol Product Description Symbol Currency Share AALB Aalberts Industries NV AALB EUR Share AO1 Accell Group AO1 EUR Share AGN Aegon NV AGN EUR Share AKZ Akzo Nobel NV AKZ EUR Share AMG AMG Advanced Metallurgical Group NV AMG EUR Share ARCAD Arcadis NV ARCAD EUR Share ASM ASM International NV ASM EUR Share ASML ASML Holding NV ASML EUR Share BESI BE Semiconductor Industries NV BESI EUR Share BINCK BinckBank NV BINCK EUR Share BRNL Brunel International BRNL EUR Share COR Corio NV COR EUR Share CSM CSM CSM EUR Share DL Delta Lloyd NV DL EUR Share ECMPA Eurocommercial Properties NV ECMPA EUR Share ENX Euronext NV ENX EUR Share EXACT Exact Holding NV EXACT EUR Share FUGR Fugro NV FUGR EUR Share GTO Gemalto NV GTO EUR Share GRONT Grontmij GRONT EUR Share HEIJM Heijmans NV HEIJM EUR Share HEHN Heineken Holding NV HEHN EUR Share HEI Heineken NV HEI EUR Share IMCD IMCD GROUP NV - W/I IMCD EUR Share IM Imtech NV IM EUR Share ING ING Groep NV ING EUR Share AH Koninklijke Ahold NV AH EUR Share BAM Koninklijke BAM Groep NV BAM EUR Share BOKA Koninklijke Boskalis Westminster NV BOKA EUR Share DSM Koninklijke DSM NV DSM EUR Share KPN Koninklijke KPN NV KPN EUR Share PHI Koninklijke Philips Electronics NV PHI EUR Share KTC Koninklijke Ten Cate NV KTC EUR Share VPK Koninklijke Vopak NV VPK EUR Share WES Koninklijke Wessanen NV WES EUR Index IBNL25 Netherlands 25 IBNL25 EUR Share NWRP New World Resources PLC NWRP CZK Share NWR New World Resources PLC NWR GBP Share NISTI Nieuwe Steen Investments NV NISTI EUR Share NN NN Group NV -

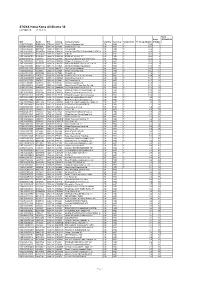

Schedule of Investments (Unaudited) Ishares MSCI Total International Index Fund (Percentages Shown Are Based on Net Assets) September 30, 2020

Schedule of Investments (unaudited) iShares MSCI Total International Index Fund (Percentages shown are based on Net Assets) September 30, 2020 Mutual Fund Value Total International ex U.S. Index Master Portfolio of Master Investment Portfolio $ 1,034,086,323 Total Investments — 100.4% (Cost: $929,170,670) 1,034,086,323 Liabilities in Excess of Other Assets — (0.4)% (3,643,126) Net Assets — 100.0% $ 1,030,443,197 iShares MSCI Total International Index Fund (the “Fund”) seeks to achieve its investment objective by investing all of its assets in International Tilts Master Portfolio (the “Master Portfolio”), which has the same investment objective and strategies as the Fund. As of September 30, 2020, the value of the investment and the percentage owned by the Fund of the Master Portfolio was $1,034,086,323 and 99.9%, respectively. The Fund records its investment in the Master Portfolio at fair value. The Fund’s investment in the Master Portfolio is valued pursuant to the pricing policies approved by the Board of Directors of the Master Portfolio. Fair Value Hierarchy as of Period End Various inputs are used in determining the fair value of financial instruments. These inputs to valuation techniques are categorized into a fair value hierarchy consisting of three broad levels for financial reporting purposes as follows: • Level 1 – Unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access • Level 2 – Other observable inputs (including, but not limited to, quoted prices -

Aegon Fixed Income

Executing our strategy April 2014 Fixed income presentation aegon.com Key messages . Focus on executing our strategy is delivering clear results ► Strategic transformation to become a truly customer-centric company is well underway ► Solid business growth is driving increase in profitability ► Risk profile significantly improved . Executing on balanced capital deployment strategy, supporting a sustainable dividend . Making progress towards 2015 targets . Intention to remain on track to be within leverage target ranges by the end of 2014 2 Over 150 Life insurance, pensions years of & asset management history AA- financial Present in more than 25 strength rating markets throughout the Americas, Europe and Asia Underlying earnings before tax Revenue-generating investments Paid out in claims and benefits in 2013 in 2013 Over EUR 1.9 EUR 20 26,500 billion billion EMPLOYEES1 EUR 475 billion1 Aegon at a glance 1) As per December 31, 2013 3 Building on leading market positions United States United Kingdom The Netherlands China of America # 7 Individual pensions # 1 Group pensions # 11 of foreign-owned life # 5 Individual life # 3 Group pensions # 6 Individual life insurers in China # 8 Variable Annuities # 10 Individual protection # 6 Accident & health # 12 Pensions # 10 Annuities # 10 Property & casualty Japan Canada Central & Spain # 1 Variable annuities # 5 Universal life Eastern Europe Historic positions do not reflect # 6 Term life # 1 Household in Hungary current business India # 6 Life in Hungary Start up # 3 Pensions Romania1 Brazil # -

Controversial Arms Trade

Case study: Controversial Arms Trade A case study prepared for the Fair Insurance Guide Case study: Controversial Arms Trade A case study prepared for the Fair Insurance Guide Anniek Herder Alex van der Meulen Michel Riemersma Barbara Kuepper 18 June 2015, embargoed until 18 June 2015, 00:00 CET Naritaweg 10 1043 BX Amsterdam The Netherlands Tel: +31-20-8208320 E-mail: [email protected] Website: www.profundo.nl Contents Summary ..................................................................................................................... i Samenvatting .......................................................................................................... viii Introduction ................................................................................................................ 1 Chapter 1 Background ...................................................................................... 2 1.1 What is at stake? ....................................................................................... 2 1.2 Trends in international arms trade .......................................................... 3 1.3 International standards............................................................................. 4 1.3.1 Arms embargoes ......................................................................................... 4 1.3.2 EU arms export policy ................................................................................. 4 1.3.3 Arms Trade Treaty ..................................................................................... -

Assicurazioni Generali

Assicurazioni Generali MANAGEMENT REPORT AND PARENT COMPANY STATEMENTS th year 2009 MANAGEMENT REPORT AND PARENT COMPANY STATEMENTS 2009 APPROVED BY THE SHAREHoLDERS’ MEETING OF 24 APRIL 2010 Registered Office and Central Head Office in Trieste Head Office for Italian Operations in Mogliano Veneto Capital (fully paid in) Euro 1,556,864,483.00 Fiscal code and Trieste Companies Register 00079760328 Company entered in the Register of Italian Insurance and Reinsurance Companies under no. 100003 Parent Company of Generali Group, entered in the Register of Insurance Groups under no. 026 CHAIRMAN Cesare Geronzi VICE-CHAIRMEN Vincent Bolloré, Francesco Gaetano Caltagirone, Alberto Nicola Nagel MANAGING DIRECTORS AND GROUP CEO Giovanni Perissinotto (*) (*) He acts also as General Manager MANAGING DIRECTOR Sergio Balbinot (*) (*) He acts also as General Manager DIRECTORS Ana Patricia Botìn / Cesare Calari / Carlo Carraro (**) Directors who, together with the Chairman, Diego Della Valle / Leonardo Del Vecchio (**) / Petr Kellner Vice-Chairmen and Managing Directors, form the Executive Committee Angelo Miglietta / Alessandro Pedersoli / Lorenzo Pellicioli (**) Reinfried Pohl / Paola Sapienza / Paolo Scaroni / Francesco Saverio Vinci GENERAL COUNCIL Giorgio Davide Adler / José Ramón Álvarez Rendueles Comprising, besides the below listed elective José Maria Amusátegui de la Cierva / Francesco Maria Attaguile Members, the Members of the Board of Directors and the General Managers Claude Bébéar / Kenneth J. Bialkin / Gerardo Broggini Giacomo Costa / Maurizio -

STOXX Hong Kong All Shares 50 Last Updated: 01.10.2015

STOXX Hong Kong All Shares 50 Last Updated: 01.10.2015 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 79.6 1 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 59.3 2 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 55.8 3 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 49.6 4 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 36.3 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 29.3 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 23.2 7 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 23.1 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 22.6 9 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 18.5 10 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 18.3 11 HK0004000045 6435576 0004.HK 643557 Wharf (Holdings) Ltd. HK HKD Y 15.2 12 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 14.6 13 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 13.9 14 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.1 15 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 11.7 16 HK0011000095 6408374 0011.HK 640837 Hang Seng Bank Ltd. -

2019Semi-Annual Report

CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds SEMI-ANNUAL 2019 REPORT For the six months ended 30 June 2019 Value Partners Limited 43rd Floor, The Center 99 Queen’s Road Central, Hong Kong Tel: (852) 2880 9263 Fax: (852) 2565 7975 Email: [email protected] Website: www.valuepartner-group.com In the event of inconsistency, the English text of this Semi-Annual Report shall prevail over the Chinese text. This report shall not constitute an offer to sell or a solicitation of an offer to buy shares in any of the funds. Subscriptions are to be made only on the basis of the information contained in the explanatory memorandum, as supplemented by the latest semi-annual and annual reports. CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds (A Cayman Islands unit trust) CONTENTS Pages General information 2-3 Manager’s report 4-8 Statement of fnancial position (unaudited) 9 Investment portfolio (unaudited) 10-13 Statement of movements in portfolio holdings (unaudited) 14-15 SEMI-ANNUAL REPORT 2019 For the six months ended 30 June 2019 1 CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds (A Cayman Islands unit trust) GENERAL INFORMATION Manager Legal Advisors Value Partners Limited With respect to Cayman Islands law: 43rd Floor, The Center Maples and Calder 99 Queen’s Road Central P.O. Box 309, Ugland House Hong Kong Grand Cayman, KY1-1104 Cayman Islands Directors of the Manager Dato’ Seri Cheah Cheng Hye With respect to Hong Kong law: Mr. So Chun Ki Louis Deacons Mr.