Williams Companies Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Eligible Company List - Updated 12/1/2016

Eligible Company List - Updated 12/1/2016 S31083 2V Industries Inc Supplier Employees Only S15122 2-Way Communication LLC Supplier Employees Only S10009 3 Dimensional Services Supplier Employees Only S65830 3BL Media LLC Supplier Employees Only S65361 3CSI LLC Supplier Employees Only S66495 3D Sales Inc Supplier Employees Only S69510 3D Systems Supplier Employees Only S65364 3IS Inc Supplier Employees Only S15863 3LK Construction LLC Supplier Employees Only F05233 3M Company Fleet Employees Only S70521 3R Manufacturing Company Supplier Employees Only S61313 7th Sense LP Supplier Employees Only D18911 84 Lumber Company DCC Employees Only S42897 A & S Industrial Coating Co Inc Supplier Employees Only S73205 A and D Technology Inc Supplier Employees Only S57425 A G Manufacturing Supplier Employees Only S86063 A G Simpson Automotive Inc Supplier Employees Only F02130 A G Wassenaar Fleet Employees Only S12115 A M G Industries Inc Supplier Employees Only S19787 A OK Precision Prototype Inc Supplier Employees Only S62637 A Raymond Tinnerman Automotive Inc Supplier Employees Only S82162 A Schulman Inc Supplier Employees Only D80005 A&E Television Networks DCC Employees Only S80904 A.J. Rose Manufacturing Supplier Employees Only S78336 A.T. Kearney, Inc. Supplier Employees Only S34746 A1 Specialized Services Supplier Employees Only S58421 A2MAC1 LLC Supplier Employees Only D60014 AAA East Central DCC Employees & Members S36205 AAA National Office (Only EMPLOYEES Eligible) Supplier Employees Only D60013 AAA Ohio Auto Club DCC Employees & Members -

Tortoise North American Energy Infrastructure Fund a Sub-Fund of Tortoise SICAV

Tortoise North American Energy Infrastructure Fund A sub-fund of Tortoise SICAV 3Q 2019 QUARTERLY COMMENTARY Investment strategy The broader energy sector, as represented by the S&P Energy Select Sector® Index, fell during the third quarter, returning -6.2%, bringing year-to-date performance to 6.1%. The fund will primarily invest in Energy demand is at an all-time high and a global energy transition is taking place securities of North American reducing global carbon emissions while meeting that demand. We are witnessing the midstream energy infrastructure next phase of U.S. energy independence emerge as the U.S. becomes a net exporter companies. Midstream energy of low-cost energy to the rest of the world. Against that backdrop, approximately $15 infrastructure companies own and trillion1 of investment in global energy infrastructure is required to support this energy operate a network of asset systems transition, making it a compelling opportunity for midstream energy investors. that transport, store, distribute, North American pipeline sector update gather and process natural gas, Midstream sector performance fared slightly better than broader energy for the third quarter with natural gas liquids (primarily the Tortoise North American Pipeline IndexSM return of -0.8% and the Tortoise MLP Index® return propane), crude oil or refined of -4.3%, bringing year to date performance to 22.2% and 14.2%, respectively. Phillips 66 Partners petroleum products. LP (PSXP) announced the elimination of its Incentive Distribution Rights (IDRs) in the third quarter. As the era of simplification comes to a close, the results have advanced the midstream sector and accomplished widespread cost of capital and corporate governance improvements. -

Reliability. Integrated

MIX Paper from responsible sources FSC® C103375 ONEOK 2019 ANNUAL Integrated Reliability. REPORT ONEOK 2019 ANNUAL REPORT 100 West Fifth Street Tulsa, Oklahoma 74103-4298 Post Office Box 871 Tulsa, Oklahoma 74102-0871 www.oneok.com BOARD OF DIRECTORS ONEOK, Inc. (pronounced ONE-OAK) (NYSE: OKE) is a leading midstream service provider and owner of one of the nation's premier natural gas liquids (NGL) systems, Brian L. Derksen Jim W. Mogg connecting NGL supply in the Rocky Mountain, Permian and Mid-Continent regions with key market centers and an extensive network of natural gas gathering, Retired Global Deputy Chief Executive Officer, Deloitte Touche Tohmatsu Limited Retired Chairman, DCP Midstream GP, L.L.C. processing, storage and transportation assets. Dallas, Texas Hydro, Oklahoma Julie H. Edwards Pattye L. Moore ONEOK is a FORTUNE 500 company and is included in the S&P 500. For the latest news about ONEOK, find us on LinkedIn, Facebook, Twitter and Instagram. Former Chief Financial Officer, Southern Union Company; Former Chairman, Red Robin Gourmet Burgers; Former Chief Financial Officer, Frontier Oil Corporation Former President, Sonic Corp. Houston, Texas Broken Arrow, Oklahoma John W. Gibson Gary D. Parker Chairman of the Board and Retired Chief Executive Officer, ONEOK, Inc. President, Moffitt, Parker & Company, Inc. Financial Performance Tulsa, Oklahoma Muskogee, Oklahoma Mark W. Helderman Eduardo A. Rodriguez Retired Managing Director and Co-Portfolio Manager, Sasco Capital Inc. President, Strategic Communications Consulting Group Cleveland, Ohio El Paso, Texas Randall J. Larson Terry K. Spencer Retired Chief Executive Officer, TransMontaigne Partners L.P. President and Chief Executive Officer, ONEOK, Inc. -

In Re: Williams Companies, Inc. Securities Litigation 02-CV-00072

UNITED STATES DISTRICT COURT NORTHERN DISThICT OF OKLAHOMA TN RE WILLIAMS SECURITIES LITIGATION } Case No . 02-CV-72-H(M } Lead Case } Judge Sven Erik Holme s 1 JURY TRIAL DEMANDED CONSOLIDATED AMENDED COMPLAINT ~ar~[, t~l~rk m Uwt pub. p15tR{C'~ r'~ R. THOMAS SEYMOUR , OBA #?8 099 C. ROBERT BURTON , OBA #14195 SEYMOUR LAW FIRM 100 West 51h Street, Suite 550 Tulsa, Oklahoma 74102 Telephone: (918) 583-5791 SAMUEL P . SPORN NYBA #4444 JOEL P . LAITMAN NYBA #8177 CHRISTOPHER LOMETTI NBA #9124 JAY P. SALTZMAN NYBA #7335 ASHLEY KIM NY13A 90105 SCIIOENGOLD & SPORN, P .C . 19 Fulton St reet, Suite 406 New York, NY 10038 Telephone : (212) 964-0046 Co-Lead Counsel for Plaintiffs TABLE Q ' CONTENT S 1. NATURE OF THE ACTION . I A. Overview of The Allegations . 1 B. WMB's Conniving Culture of Concealriient . 1 D II. JUMSDICTION AND VENUE . 17 II. PARTIES TO THE LITIGATION . is A. Plaintiffs . 18 B. Defendants . 18 C. The Underwriter Defendants . 26 D. Definitions . 32 IV. CLASS ACTION ALLEGATIONS . 33 V. SUBSTANTIVE ALLEGATIONS . 36 A. An Overview of WMB Before and At the Start of the Class Period , 7-24-00 . 36 B . Material Misrepresentations and Omissions About WCCr . 4 1 1 . The Need to Build the Ne~ ork . 4 1 2. Building the Network Would Not Produce the Results Originally Planned . 42 3. The Meltdown of the Telecommunications Industry . 44 4. The Meltdown of the Price of WCG' s Common Stock . 47 5. WCG' s Inability to Stand on Its Own Two Financial Feet . 47 (a) WMB Had to Extend Unplanned Guarantees for WCG . -

Who Is Most Impacted by the New Lease Accounting Standards?

Who is Most Impacted by the New Lease Accounting Standards? An Analysis of the Fortune 500’s Leasing Obligations What Do Corporations Lease? Many companies lease (rather than buy) much of the equipment and real estate they use to run their business. Many of the office buildings, warehouses, retail stores or manufacturing plants companies run their operations from are leased. Many of the forklifts, trucks, computers and data center equipment companies use to run their business is leased. Leasing has many benefits. Cash flow is one. Instead of outlaying $300,000 to buy five trucks today you can make a series of payments over the next four years to lease them. You can then deploy the cash you saved towards other investments that appreciate in value. Also, regular replacement of older technology with the latest and greatest technology increases productivity and profitability. Instead of buying a server to use in your data center for five years, you can lease the machines and get a new replacement every three years. If you can return the equipment on time, you are effectively outsourcing the monetization of the residual value in the equipment to an expert third-party, the leasing company. Another benefit of leasing is the accounting, specifically the way the leases are reported on financial statements such as annual reports (10-Ks). Today, under the current ASC 840 standard, leases are classified as capital leases or operating leases. Capital leases are reported on the balance sheet. Operating leases are disclosed in the footnotes of your financial statements as “off balance sheet” operating expenses and excluded from important financial ratios such as Return on Assets that investors use to judge a company’s performance. -

CDP Climate Change Questionnaire 2021 Wednesday, July 28, 2021

Williams Companies, Inc. CDP Climate Change Questionnaire 2021 Wednesday, July 28, 2021 Welcome to your CDP Climate Change Questionnaire 2021 C0. Introduction C0.1 (C0.1) Give a general description and introduction to your organization. Williams (NYSE: WMB) is committed to being the leader in providing infrastructure that safely delivers natural gas products to reliably fuel the clean energy economy. Headquartered in Tulsa, Oklahoma, Williams is an industry-leading, investment grade C-Corp with operations across the natural gas value chain including gathering, processing, interstate transportation and storage of natural gas and natural gas liquids. With major positions in top U.S. supply basins, Williams connects the best supplies with the growing demand for clean energy. Williams owns and operates more than 30,000 miles of pipelines system wide — including Transco, the nation’s largest volume and fastest growing pipeline — and handles approximately 30% of the natural gas in the United States that is used every day for clean-power generation, heating and industrial use. Our Core Values are engrained in how we do our work, every day, on behalf of our key stakeholders, including our communities, customers, employees and investors. At Williams, we are: · Authentic: Our integrity cannot be compromised; for more than a century we've remained true to ourselves, always striving to do the right thing. · Safety Driven: Safeguarding our people and neighbors is engrained in our culture and fundamental to everything we do. · Reliable Performers: We stand behind our reputation as a dependable and trustworthy business that delivers on our promises. · Responsible Stewards: We are dedicated to strengthening our people and communities and to protecting the environment. -

Climate Change 2019

Williams Companies, Inc. - Climate Change 2019 C0. Introduction C0.1 (C0.1) Give a general description and introduction to your organization. Williams (NYSE: WMB) is a publicly traded Fortune 500 energy infrastructure company and its common stock is a component of the S&P 500. As one of the largest energy infrastructure companies in North America, with more than 5,400 employees, Williams is focused on connecting North America’s significant hydrocarbon resource plays to markets for natural gas and natural gas liquids. Founded in 1908 and Headquartered in Tulsa, Oklahoma, Williams is an industry-leading, investment grade C-Corp with operations across the natural gas value chain including gathering, processing, interstate transportation and storage of natural gas and natural gas liquids. With major positions in top U.S. supply basins, Williams owns and operates more than 30,000 miles of pipelines across 24 U.S. states and has strategic assets in the deepwater Gulf of Mexico, the Rockies, the Pacific Northwest and the Eastern Seaboard that provide natural gas for clean-power generation, heating and industrial use. Williams’ operations handle approximately 30% of U.S. natural gas. Its Transcontinental (Transco) Gas Pipeline is the nation's largest-volume interstate natural gas pipeline system. As a responsible member of the energy industry, we support the Federal Energy Regulatory Commission in its mission to provide economically efficient, safe, reliable and secure energy to consumers. Williams is committed to positively contributing to the communities where we operate, prudently managing environmental impacts, and safeguarding our employees, contractors, and the public. The boundaries of the emissions data provided in this disclosure inventory exclude corporate offices and focus solely on our direct operations. -

The Williams Companies, Inc. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K (Mark One) þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2018 OR ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-4174 The Williams Companies, Inc. (Exact Name of Registrant as Specified in Its Charter) Delaware 73-0569878 (State or Other Jurisdiction of (IRS Employer Incorporation or Organization) Identification No.) One Williams Center, Tulsa, Oklahoma 74172 (Address of Principal Executive Offices) (Zip Code) 918-573-2000 (Registrant’s Telephone Number, Including Area Code) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock, $1.00 par value New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None I ndicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Your CDP Climate Change Questionnaire 2020 C0. Introduction

Williams Companies, Inc. CDP Climate Change Questionnaire 2020 Tuesday, August 25, 2020 Welcome to your CDP Climate Change Questionnaire 2020 C0. Introduction C0.1 (C0.1) Give a general description and introduction to your organization. Williams (NYSE: WMB) is committed to being the leader in providing infrastructure that safely delivers natural gas products to reliably fuel the clean energy economy. Headquartered in Tulsa, Oklahoma, Williams is an industry-leading, investment grade C-Corp with operations across the natural gas value chain including gathering, processing, interstate transportation and storage of natural gas and natural gas liquids. With major positions in top U.S. supply basins, Williams connects the best supplies with the growing demand for clean energy. Williams owns and operates more than 30,000 miles of pipelines system wide — including Transco, the nation’s largest volume and fastest growing pipeline — and handles approximately 30% of the natural gas in the United States that is used every day for clean-power generation, heating and industrial use. Our Core Values are engrained in how we do our work, every day, on behalf of our key stakeholders, including our communities, customers, employees and investors. At Williams, we are: · Authentic: Our integrity cannot be compromised; for more than a century we've remained true to ourselves, always striving to do the right thing. · Safety Driven: Safeguarding our people and neighbors is engrained in our culture and fundamental to everything we do. · Reliable Performers: We stand behind our reputation as a dependable and trustworthy business that delivers on our promises. · Responsible Stewards: We are dedicated to strengthening our people and communities and to protecting the environment. -

Affiliate Rewards Eligible Companies

Affiliate Rewards Eligible Companies Program ID's: 2013MY 2014MY Designated Corporate Customer 28HDR 28HER Fleet Company 28HDH 28HEH Supplier Company 28HDJ 28HEJ Company Name Company Type 3 Point Machine SUPPLIER 3-Dimensional Services SUPPLIER 3M Employee Transportation & Travel FLEET 84 Lumber Company DCC A & R Security Services, Inc. FLEET A G Manufacturing SUPPLIER A G Simpson Automotive Inc SUPPLIER A I M CORPORATION SUPPLIER A M G INDUSTRIES INC SUPPLIER A&D Technology Inc SUPPLIER A&E Television Networks DCC A. Raymond Tinnerman Automotive Inc SUPPLIER A. Schulman Inc SUPPLIER A.J. Rose Manufacturing SUPPLIER A.M Community Credit Union DCC A.T. Kearney, Inc. SUPPLIER A-1 SPECIALIZED SERVICES SUPPLIER AAA East Central DCC AAA National Office (Only EMPLOYEES Eligible, Not Members) SUPPLIER AAA Ohio Auto Club DCC ABB, Inc. FLEET Abbott Ball Co SUPPLIER Abbott Labs FLEET Abbott, Nicholson, Quilter, Esshaki & Youngblood P DCC Abby Farm Supply, Inc DCC ABC GROUP-CANADA SUPPLIER Abednego Environmental Services SUPPLIER Abercrombie & Fitch FLEET ABF Freight System Inc SUPPLIER ABM Industries, Inc. FLEET AboveNet FLEET ABP Induction SUPPLIER ABRASIVE DIAMOND TOOL COMPANY SUPPLIER ABT Electronics, Inc FLEET ACCENTURE SUPPLIER Access Fund SUPPLIER Affiliate Rewards Eligible Companies Program ID's: 2013MY 2014MY Designated Corporate Customer 28HDR 28HER Fleet Company 28HDH 28HEH Supplier Company 28HDJ 28HEJ Acciona Energy North America Corporation FLEET Accor North America FLEET Accu-Die & Mold Inc SUPPLIER Accumetric, LLC SUPPLIER ACCURATE MACHINE AND TOOL CORP SUPPLIER Accurate Technologies Inc SUPPLIER Accuride Corporation SUPPLIER Ace Hardware Corporation FLEET ACE PRODUCTS INC SUPPLIER ACG Direct Inc. SUPPLIER ACME GROOVING TOOL COMPANY SUPPLIER ACME MANUFACTURING COMPANY SUPPLIER ACOUSTEK NONWOVENS SUPPLIER ACRO-FEED INDUSTRIES INC SUPPLIER ACS INDUSTRIES INC SUPPLIER ACT ASSOCIATES SUPPLIER Actavis FLEET Actelion Pharmaceuticals US, Inc. -

Oklahoma-Largest-Employers-List.Pdf

Oklahoma Top Employers by # of Employees (1,000 and above) New Updated! 2019 Statewide 2018 Statewide 2016 Statewide 2019 Current Employer NAICS CURRENT Employment Employment Employment State Ranking Estimate Estimate Estimate 1 Department Of Defense (U.S.)- *See breakdown on last pg. 928110 68,000 - 69,000 68,000 - 69,000 68,000 - 69,000 2 Wal-Mart Associates Inc. 493110, 452311 32,100-32,200 33,500 - 34,000 33,000 - 33,500 3 Integris Health, Inc. 622110 8,800-8,900 8,500 - 9,000 9,000 - 9,500 4 Chickasaw Nation (gaming and non-government business) 713290, 453 7,400-7,500 7,000 - 7,500 7,000 - 7,500 5 Oklahoma State University 611310 7,100-7,200 7,000 - 7,500 7,000 - 7,500 6 U.S. Postal Service 491110 6,800-6,900 6,500 - 7,000 6,500 - 7,000 7 OU Health Sciences Center (Board of Regents) 611310, 621111 6,700-6,800 6,500 - 7,000 7,000 - 7,500 8 Hobby Lobby Store Inc 424990 6,500-6,600 5,500 - 6,000 5,500 - 6,000 8 University Of Oklahoma (Norman Campus) 611310 6,500-6,600 6,500 - 7,000 7,000 - 7,500 10 Oklahoma Department of Human Services 923130 6,300-6,400 6,500 - 7,000 7,500 - 8,000 11 Mercy Health (MHM Support Services) 561110, 622110 6,200-6,300 6,000 - 6,500 6,000 - 6,500 12 Choctaw Nation Of OK (other businesses/non-government) 445, 447, 713 6,100-6,200 5,500 - 6,000 4,500 - 5,000 12 Saint Francis Hospital Inc 622110 6,100-6,200 5,500 - 6,000 5,500 - 6,000 14 Tulsa Public Schools 611110 5,800-5,900 6,000 - 6,500 6,000 - 6,500 923140, 622110, 15 Department of Veterans Affairs/ U.S. -

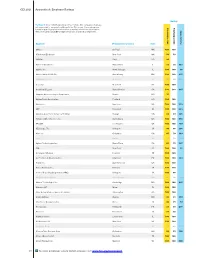

CEI 2021 Appendix A: Employer Ratings to View Employer Score

CEI 2021 Appendix A: Employer Ratings Rating Ratings in Gray / Unofficial ratings of the Fortune 500 companies that have not responded to repeated invitations to the CEI survey. These ratings are based on publicly available information as well as information submitted to HRC from unofficial LGBTQ employee groups or individual employees. Employer Headquarters Location State CEI Rating 2021 CEI Rating2020 1000 Fortune 3M Co. St. Paul MN 100 100 A|X Armani Exchange New York MN 50 50 ABB Inc. Cary NC 90 Abbott Laboratories Abbott Park IL 95 90 103 AbbVie Inc. North Chicago IL 100 100 96 Abercrombie & Fitch Co. New Albany OH 100 100 675 ABM Industries Inc. New York NY 20 20 463 Accenture New York NY 100 100 Activision Blizzard Santa Monica CA 100 100 405 Adaptive Biotechnologies Corporation Seattle WA 75 Adidas North America Inc. Portland OR 100 100 Adobe Inc. San Jose CA 100 100 339 ADP Roseland NJ 100 100 239 Advance Auto Parts (Advance Holding) Raleigh NC 90 90 326 Advanced Micro Devices Inc. Santa Clara CA 100 100 460 AECOM Los Angeles CA 100 100 157 AES Corp., The Arlington VA 85 85 296 Aflac Inc. Columbus GA 85 70 143 Agco Duluth GA 10 10 335 Agilent Technologies Inc. Santa Clara CA 85 75 547 AIG New York NY 100 100 66 Air Liquide US, LLC Houston TX 100 100 Air Products & Chemicals Inc. Allentown PA 100 100 344 Airbnb Inc. San Francisco CA 100 100 Airbus Americas Inc. Herndon VA 100 100 Airlines Reporting Corporation (ARC) Arlington VA 100 85 AK Steel Holding Corp.