Venues in Brussels: Overview

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Triple Impact

LE MAGAZINE DE L’ACTUALITÉ MUSICALE EN FÉDÉRATION WALLONIE-BRUXELLES N° 34 – SEPTEMBRE / OCTOBRE 2019 Le 77 TRIPLE IMPACT ARNO | DALTON TELEGRAMME | TANAË | ENTHRONED | COMMANDER SPOON | ECHT ! | Ô-CELLI | BERNARD FOCCROULLE | LA MUSIQUE À SANG POUR SANG | LE STORYTELLING | LES MUSIQUES TRAD | 2 : WEEK-END PRO LA COCOF PRÉSENTE DU 10 AU 13 OCT 2019 PLUS DE 50 CONCERTS, RÉSEAUTAGE, APÉROS, SOURIRE, GAUFRES ACCRÉDITATION : FRANCOFAUNE.BE/ESPACEPRO BERTRAND BELIN / KEREN ANN / PITCHO ET MUSIQUES NOUVELLES / DELGRES / SAPHO / GLAUQUE / NOA MOON LORD GASMIQUE (CARTE BLANCHE)/ CHOOLERS DIVISION / DALTON TELEGRAMME / MANU LOUIS (CARTE BLANCHE) FRONT DE CADEAUX / ORÉ / DAVID NUMWAMI (CARTE BLANCHE) / KÙZYLARSEN / CARL & LES HOMMES-BOÎTES BXL ATOME / CÉLÉNASOPHIA / I H8 CAMERA / NICOLAS JULES / LES HOTESSES D’HILAIRE / SARAHMÉE / FRANÇOIS BIJOU MEIMUNA / LA SOUTERRAINE (CARTE BLANCHE) : SABINE HAPPARD - MOHAMED LAMOURI - ANTOINE LOYER / PIERRES 3-13 OCT. INFECTICIDE / SECRÈTES SESSIONS / AIDONS ANTOINE / QUEEN KA / HIRSTO / ÉPOPÉE OSTENDAISE MACHOIRDÉE / ANK MAUDE AUDET / MCLEAN / TOO SMOOTH CHRIST / LES TRASH CROUTES / ANTOINE CORRIVEAU / FRED NEVCHÉ 2019 ARNAUD HÉRON / ADRIEN LEGRAND / MATTHIAS BILLARD / YOLANDE BASHING / MARBRE / ROUGE GORGE / BINI LES FLEURS DU SLAM SEPTEMBRE, OCTOBRE–2019 • LARSEN 3 CONSEIL DE LA MUSIQUE Quai au Bois de Construc- tion, 10 - 1000 Bruxelles 24 20 Édito www.conseildelamusique.be Contact par mail : Entre une rencontre avec Le 77, le dernier phé- [email protected] nomène déjanté du rap bruxellois, et une inter- Contactez la rédaction : première lettre du view du célébrissime organiste Bernard Foc- prénom.nom@conseil- croulle, le tout en passant par la case jazz avec delamusique.be Commander Spoon, ce numéro de rentrée ne fera pas exception aux précédents. -

Mont & Merveilles

LE MAGAZINE DE L’ACTUALITÉ MUSICALE EN FÉDÉRATION WALLONIE-BRUXELLES N° 12 - MARS / AVRIL 2015 Roscoe MONT & MERVEILLES VINCENT LIBEN | PAON | AKRO | JOSÉ VAN DAM | 75 ANS DE JEUNESSES MUSICALES | ARSONIC 3 CONSEIL DE LA MUSIQUE Quai au Bois de Construc- Édito tion, 10 - 1000 Bruxelles www.conseildelamusique.be L’ouverture de nouvelles salles de concert, Contact par mail : [email protected] c’est toujours un événement et une bonne Contactez la rédaction : nouvelle ! Fait assez rare que pour être souli- première lettre du gné, trois lieux ouvrent leurs portes en Wallo- prénom.nom@conseil- delamusique.be nie en ce début 2015. Tout d’abord, l’ajout d’une aile à la presti- RÉDACTION gieuse Chapelle Musicale Reine Élisabeth Directrice de la rédaction à Waterloo. Cette extension ajoute vingt Claire Monville logements de résidence d’artistes, des lieux Comité de rédaction Nicolas Alsteen 25 20 de formation et trois studios de diffusion Julien Chanet et d’enregistrement. Ce nouveau bâtiment François-Xavier Descamps Christophe Hars conforte donc la vocation de cet endroit Claire Monville mythique, entouré de nature, à être un écrin Coordinateur pour la formation musicale de haut niveau. de la rédaction François-Xavier Descamps Succédant à la Soundstation qui avait mis Rédacteur la clé sous le paillasson en 2008, le Reflek- Nicolas Alsteen tor ouvre ses portes en ce début de mois Collaborateurs de mars, en plein cœur de la cité ardente. Ayrton Desimpelaere Véronique Laurent Située au pied de l’ancienne piscine de La Luc Lorfèvre Sauvenière, cette salle de 600 places et dé- Catherine Makereel Rafal Naczyk diée au musiques actuelles a pour vocation Jacques Prouvost 38 35 d’accueillir découvertes et artistes confirmés. -

Katie Holmes Would Grace the Cover of Together Magazine

WWW.TOGETHERMAG.EU OCTOBER 2012 #33 K ATIE HOLMES Style princess BobbI BROWN Cosmetics queen JEAN-POL AUTU M N PIRON Belgium’s bathtub LOOK baron www.scapafashion.com Wow* *The new A-Class has arrived @ Mercedes Europa. Mercedes Europa. Where the star shines on diplomats. Official subsidiary of Mercedes-Benz Belgium Luxembourg • The most beautiful Mercedes-Benz window right in the heart of the European capital • Over 30 years of experience • Easy access • The full range of Mercedes-Benz passenger cars and utility vehicles • smart center • Experience in sales to members of the diplomatic corps and international organisations (Eurocontrol, European School, NATO, EC, EP, etc.) • Special diplomatic rates and promotions • Specialised diplomatic salesteam. A Daimler Brand Mercedes Europa Chaussée de Louvain 1150, 1200 Brussels, 3,8 - 6,4 L/100 KM • 98 -148 gCO 2 /KM Tel. +32 2 730 66 11, Fax. +32 2 705 73 13, [email protected] Environmental Information AR 19/3/2004 : www.mercedes-benz.be – Give priority to safety. ** Depending on the model. Publisher’s letter Inspirational people figure large in this issue roof that dreams can come true: I have long TIME ON YOUR SIDE wished that actress Katie Holmes would grace the cover of Together magazine. PI am by far not alone in my admiration for the actress, as demonstrated in the decision by Bobbi Brown to appoint Holmes as the first celebrity ambassador of her cosmetics brand. Learn about their mutual admiration for each other and discover their beauty tips on page 50. An interview with top jeweller Valerie Messika on page 63 reveals her secret to success, as does our interview with Belgium’s ‘bathtub baron’ Jean-Pol Piron, the man behind bathroom design firm Aquamass. -

Outils De La Langue

Page 1 sur 11 Outils de la langue Lis attentivement les articles suivants. Chaque article fait l’objet d’un exercice particulier. Veille à bien respecter la consigne. Pour chaque article, tu dois compléter la feuille de vocabulaire. 1. La ponctuation • . Des signes de ponctuation ont été enlevés et remplacés par un numéro. Dans l’espace à droite du texte, note le signe de ponctuation (en lettres) correspondant au numéro et justifie ton choix. Concerts annulés ou reportés en raison du coronavirus: pouvez-vous être remboursés? Le concert de Dadju du 26 mars est reporté au 23 octobre. Remboursement possible jusqu'au 8 juin. - © ZAKARIA ABDELKAFI - AFP K. F. Publié le mercredi 11 mars 2020 - Mis à jour le mercredi 11 mars 2020 à 15h28 Français 3. Outils de la langue. Mars 2020. Page 2 sur 11 Les rassemblements de plus de 1000 personnes dans des endroits confinés sont déconseillés -1 - c’est la décision prise mardi après-midi par le conseil de sécurité réuni autour de la Première ministre Sophie Wilmès (MR) -2- confronté à l’épidémie de coronavirus -3- Conséquences -4- des concerts annulés, reportés, comme à Bruxelles ou Anvers . Plusieurs salles sont concernées comme le Palais 12 -5- Forest National -6- le Cirque royal -7- La Madeleine - 8- le Sportpaleis, la Lotto Arena, l’Ancienne Belgique -9 - Mais qu’en est-il des spectateurs qui avaient acquis un billet – 10- Seront-ils remboursés -11- Une solution de report pour chaque événement est privilégiée mais -12- si ce n’est pas possible - 13- les tickets pour ces représentations seront remboursés : c’est par exemple ce qu’a expliqué ce mercredi le CEO de Sportpaleis Group, qui gère le Sportpaleis, la Lotto Arena et Forest National. -

Conditions Particulières

Conditions particulières Organisateur : COBELFRA S.A. (Radio Contact), 2 avenue Jacques Georgin à 1030 Bruxelles Nom de l’action : Concours Journée mondiale des auditeurs de Radio Contact. Durée de l’action : lundi 23/10/2107 Durée de recrutement : Lundi 23/10/2107 Mécanisme du jeu / Détermination du vainqueur : Grâce à Radio Contact tentez de remporter une année très feel good. 1. Good Morning : 1 an de concerts Radio Contact 2. GATEAN : 1 an de spectacle humoristique Radio Contact 3. JUSTIN : 1 an de fitness chez Basic Fit 4. 16/20 : 1 an de cinéma Modalités de participation : Envoyez toute la journée par SMS « FEEL GOOD » au 6691 Tirage au sort dans chaque émission pour gagner : 1. Dans le Good Morning : 1 an de concerts Radio Contact 2. Chez GATEAN : 1 an de spectacle humoristique/Stand up Radio Contact 3. Chez JUSTIN : 1 an de fitness chez Basic Fit 4. Dans le 16/20 : 1 an de cinéma Etre majeur Spécificités éventuelles quant au type de participants : Le concours est ouvert à toutes personnes physiques adultes (+18) domiciliés en Belgique. Prix et validité du prix : 1 an Prend effet à partir du 23 Octobre 2017 jusqu’au 23 ocotbre 2018. Disponibilité du règlement : www.radiocontact.be Remarques particulières : Dotation : 1 an de concert Durée : 1 année. Prend effet à partir du lundi 23 Octobre 2017 jusqu’au 23 octobre 2018. Qui : 1 gagnant / l’auditeur gagnant pourra participer avec un accompagnant. La place du gagnant est nominative et ne peut être revendue/remboursée. L’auditeur pourra choisir l’accès à ses concerts. -

Vragen Antwoorden Questions Réponses

N. 23 BRUSSELS PARLEMENT DE LA RÉGION HOOFDSTEDELIJK PARLEMENT DE BRUXELLES-CAPITALE GEWONE ZITTING 2011-2012 SESSION ORDINAIRE 2011-2012 15 NOVEMBER 2011 15 NOVEMBRE 2011 Vragen Questions en et Antwoorden Réponses Vragen en Antwoorden Questions et Réponses Brussels Hoofdstedelijk Parlement Parlement de la Région de Bruxelles-Capitale Gewone zitting 2011-2012 Session ordinaire 2011-2012 2 Vragen en Antwoorden – Brussels Hoofdstedelijk Parlement – 15 november 2011 (nr. 23) Questions et Réponses – Parlement de la Région de Bruxelles-Capitale – 15 novembre 2011 (n° 23) INHOUD SOMMAIRE In fine van het bulletin is een zaakregister afgedrukt Un sommaire par objet est reproduit in fine du bulletin Minister-President belast met Plaatselijke Besturen, Ruim- Ministre-Président chargé des Pouvoirs locaux, de telijke Ordening, Monumenten en Landschappen, Open- l’Amé nagement du Territoire, des Monuments et Sites, bare Netheid en Ontwikkelingssamenwerking de la Propreté publi que et de la Coopération au 35 Dévelop pe ment Minister belast met Financiën, Begroting, Openbaar Ambt Ministre chargé des Finances, du Budget, de la Fonction en Externe Betrekkingen 61 publique et des Relations extérieures Minister belast met Leefmilieu, Energie en Waterbeleid, Ministre chargée de l'Environnement, de l'Énergie et de Stadsvernieuwing, Brandbestrijding en Dringende Medi- la Politique de l'Eau, de la Rénovation urbaine, de la sche Hulp en Huisvesting Lutte contre l'Incendie et l'Aide médicale urgente et du 65 Loge ment Minister belast met Openbare Werken en Vervoer -

2015 Year End | Top 100 International Boxoffice

2015 YEAR END | TOP 100 INTERNATIONAL BOXOFFICE Artist Tickets Sold Artist Tickets Sold Date Facility/Promoter Support Capacity Gross Date Facility/Promoter Support Capacity Gross 04/23/15 Paul McCartney 149,117 $21,746,535 12/11/15 David Gilmour 84,526 $7,925,649 04/25,27 Tokyo Dome 49,725 12/12/15 Allianz Parque 45,555 Tokyo, JAPAN 99% Yen Sao Paulo, BRAZIL 92% Reals 3 shows Kyodo Tokyo 10,500 - 18,000 (2,610,628,451)1 2 shows Mercury Concerts 320.00 - 1,200.0017 (30,475,060) 05/23/15 The Toppers 310,604 $19,832,287 11/10/15 U2 69,864 $7,760,997 05/24/15 Amsterdam Arena 65,300 11/11/15 AccorHotels Arena 17,466 05/29-31 Amsterdam, NETHERLANDS 95% Euro 12/06-07 Paris, FRANCE 100% Euro 5 shows Rocket 48.95 - 75.95 (17,775,804)2 4 shows Live Nation Global Touring 30.00 - 170.0018 (7,054,618) 02/27/15 One Direction 120,328 $18,043,690 09/08/15 U2 68,463 $7,674,824 02/28/15 Saitama Super Arena 30,082 09/09/15 Ziggo Dome 17,115 03/01-02 Saitama, JAPAN 100% Yen 09/12-13 Amsterdam, NETHERLANDS 100% Euro 4 shows Creative Man Productions 11,000 - 25,000 (2,122,787,000)3 4 shows Live Nation Global Touring / Mojo Concerts 30.00 - 170.0019 (6,841,587) 06/04/15 Take That Ella Henderson 144,873 $15,956,779 07/09/15 AC/DC Vintage Trouble 90,034 $7,482,298 06/05-19 The O2 - London 15,903 Autodromo Enzo e Dino Ferrari 92,000 London, UNITED KINGDOM 91% Imola, ITALY 97% Euro 10 shows SJM 55.00 - 175.00 (£10,440,527)4 Barley Arts Promotion 75.0020 (6,752,550) 10/25/15 U2 104,913 $15,804,021 12/18/15 David Gilmour 65,136 $7,439,784 10/26,29-30 The O2 - London -

Smokefreeconcerts : Le Rock À L'intérieur, Les

#SMOKEFREECONCERTS : LE ROCK À L’INTÉRIEUR, LES CLOPES À L’EXTÉRIEUR Kom op tegen Kanker, les promoteurs de concerts et les directeurs de salles s’associent pour promouvoir des concerts où la cigarette n’a pas sa place Bruxelles, 6 mars 2019 – Tout le monde sait qu’il est interdit de fumer dans les salles de concert. Pourtant, il n’est pas rare de voir, en plein concert, des gens allumer une cigarette. Un geste qui ne plaît pas aux spectateurs non- fumeurs qui, de cette manière, fument passivement et respirent des substances nocives. Pour que les concerts restent non-fumeurs, Kom op tegen Kanker, les promoteurs de concerts et les directeurs de salles s’associent. Avec la campagne #smokefreeconcerts, ils veulent empêcher la fumée de cigarette de s’inviter dans les salles de concert. Afin de faire passer le message dans les salles, Kom op tegen Kanker va dès aujourd’hui distribuer des bracelets #smokefreeconcerts lors de plusieurs concerts à travers la Belgique. Car le rock c’est à l’intérieur et les clopes à l’extérieur. Une salle de concert est un endroit public fermé qui, depuis des années déjà, fait l’objet d’une interdiction légale de fumer. Lorsque quelqu’un allume une cigarette pendant un concert, cela a un impact sur les autres spectateurs qui fument de manière passive et respirent des substances nocives pour leur santé. De plus, ce geste encourage souvent d’autres personnes à s’allumer une cigarette. En un rien de temps, c’est toute la salle qui fume et inhale des substances nocives. -

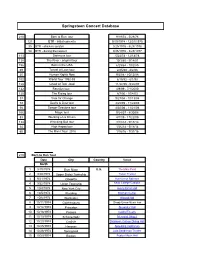

Springsteen Concert Database

Springsteen Concert Database 210 Born to Run tour 9/19/74 - 5/28/76 121 BTR - initial concerts 9/19/1974 - 12/31/1975 35 BTR - chicken scratch 3/25/1976 - 5/28/1976 54 BTR - during the lawsuit 9/26/1976 - 3/25/1977 113 Darkness tour 5/23/78 - 12/18/78 138 The River - original tour 10/3/80 - 9/14/81 156 Born in the USA 6/29/84 - 10/2/85 69 Tunnel of Love tour 2/25/88 - 8/2/88 20 Human Rights Now 9/2/88 - 10/15/88 102 World Tour 1992-93 6/15/92 - 6/1/93 128 Ghost of Tom Joad 11/22/95 - 5/26/97 132 Reunion tour 4/9/99 - 7/1/2000 120 The Rising tour 8/7/00 - 10/4/03 37 Vote for Change 9/27/04 - 10/13/04 72 Devils & Dust tour 4/25/05 - 11/22/05 56 Seeger Sessions tour 4/30/06 - 11/21/06 106 Magic tour 9/24/07 - 8/30/08 83 Working on a Dream 4/1/09 - 11/22/09 134 Wrecking Ball tour 3/18/12 - 9/18/13 34 High Hopes tour 1/26/14 - 5/18/14 65 The River Tour 2016 1/16/16 - 7/31/16 210 Born to Run Tour Date City Country Venue North America 1 9/19/1974 Bryn Mawr U.S. The Main Point 2 9/20/1974 Upper Darby Township Tower Theater 3 9/21/1974 Oneonta Hunt Union Ballroom 4 9/22/1974 Union Township Kean College Campus Grounds 5 10/4/1974 New York City Avery Fisher Hall 6 10/5/1974 Reading Bollman Center 7 10/6/1974 Worcester Atwood Hall 8 10/11/1974 Gaithersburg Shady Grove Music Fair 9 10/12/1974 Princeton Alexander Hall 10 10/18/1974 Passaic Capitol Theatre 11 10/19/1974 Schenectady Memorial Chapel 12 10/20/1974 Carlisle Dickinson College Dining Hall 13 10/25/1974 Hanover Spaulding Auditorium 14 10/26/1974 Springfield Julia Sanderson Theater 15 10/29/1974 Boston Boston Music Hall 16 11/1/1974 Upper Darby Tower Theater 17 11/2/1974 18 11/6/1974 Austin Armadillo World Headquarters 19 11/7/1974 20 11/8/1974 Corpus Christi Ritz Music Hall 21 11/9/1974 Houston Houston Music Hall 22 11/15/1974 Easton Kirby Field House 23 11/16/1974 Washington, D.C. -

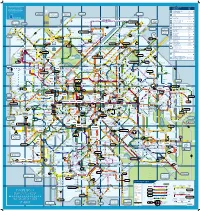

En Route Vers Un Bruxelles Plus Mobile Brussel Gaat Er

Bezienswaardigheden Halte Dit plan is onderhevig Points d’intérêt Arrêt aan wijzigingen tegen 2018. Point of interest Stop Ce plan est encore susceptible Koning Boudewijn stadion Heizel B3 d’être modifié avant 2018. Stade Roi Baudouin Heysel Naar / Vers / To Naar / Vers / To Naar / Vers / To Naar / Vers / To Naar / Vers / To Puurs via Liezele Luchthaven Humbeek Humbeek Malines, Anvers Malderen Heizel Puurs via Willebroek Kapelle-op-den-Bos Mechelen, Antwerpen Atomium C3 Heysel Boom via Londerzeel Verbrande Brug Willebroeksevaart Boom via Tisselt Heizel Zone tarifaire MTB Tariefzone MTB Brussels Expo C2 Jordaen Heysel H H Naar / Vers / To Ennepetal Minnemolen Sportcomplex Kerk Vilvoorde Heldenplein Luchthaven Brussel-Nationaal Keebergen 820 47 HH 47 Naar / Vers / To Kampenhout Aéroport Bruxelles National Brussels Airport H2 H Twee Leeuwenweg Vlierkens H H H Asse 230-231-232 Station Haacht Brussels National Airport H Naar / Vers / To H H 250-251 460-461 233-260 Dendermonde H ¾ New Pellenberg HH Wemmel Drijpikkel HH VRT Kerk Diamant Kerk Machelen G4 VTM RTBF Blokken H Drie Fonteinen H Koningin Fabiola Naar / Vers / To Basiliek van Koekelberg HH Naar / Vers / To Bossaert-Basiliek Zone tarifaire MTB Tariefzone MTB Rijkendal Raedemaekers Basilique de Koekelberg B5 56 Malines, Anvers Naar / Vers / To Bossaert-Basilique 230 57 Windberg 231-232 Hoogveld Louvain, Liège, Hasselt National Basilica Mercator De Bejar Parkstraat Mechelen, Antwerpen De Villegas 820 58 ¾ Witloof Leuven, Luik, Hasselt H H H H Bloemendal Grote Markt Beurs Kerk Gemeenteplein Bicoque Kasteel Beaulieu 270-271-470 Leuven E6 New 65 Grand-Place Kaasmarkt HH 233-260 Twyeninck Leuven Bourse Markt Mutsaard SAO DGHR Domaine Militaire Haacthsestw. -

Le « Soap Opera »

LeMonde Job: WMR2697--0001-0 WAS TMR2697-1 Op.: XX Rev.: 27-06-97 T.: 20:05 S.: 75,06-Cmp.:28,15, Base : LMQPAG 33Fap:99 No:0682 Lcp: 196 CMYK b TELEVISION a RADIO H MULTIMEDIA VUE SUR LES DOCS PORTRAIT Un CD-ROM Le devoir Macha Béranger, de mémoire vingt ans de nuit à la gloire de et la transmission à France-Inter. Charles de Gaulle ont marqué Page 27 Page 36 la programmation du 8e festival marseillais. Page 5 Produits à l’origine par les fabricants de lessive qui y trouvaient le moyen Le « soap opera » de promouvoir leurs produits à l’heure où les ménagères vaquent à leurs occupations domestiques, les « soap operas », interminables feuilletons, connaissent depuis l’après-guerre un succès qui ne se dément pas. Ils fleurissent maintenant hors des Etats-Unis. Arte, la chaîne culturelle, s’est penchée sur ces « opéras de savon » qui répondent aux principes du vieux mélodrame et sont devenus un phénomène de TRANSWORLD société, à l’échelle mondiale. Pages 2, 3 et 4 des origines à nos jours Salles de paris virtuels, cyberpoker, Cybercasinos, armé de sa carte de crédit, l’internaute peut gagner le jackpot, ou se ruiner, ou comment sans sortir de chez lui. Ces sites ont d’abord trouvé refuge aux Caraïbes, se ruiner mais les bookmakers anglais commencent à les concurrencer. sur Internet Pages 32 et 33 SEMAINE DU 30 JUIN AU 6 JUILLET 1997 LeMonde Job: WMR2697--0002-0 WAS TMR2697-2 Op.: XX Rev.: 28-06-97 T.: 08:19 S.: 75,06-Cmp.:28,15, Base : LMQPAG 33Fap:99 No:0683 Lcp: 196 CMYK ENQUÊTE Les recettes Ci-dessous, de haut en bas et de gauche à droite : « Haine et passion » du télé-mélo (« Guiding Light »), une telenovela mexicaine et « Amoureusement vôtre » Arte présente un dossier sur le « soap opera », succédané américain (« Loving ») du mélo de toujours, qui fait désormais recette dans le monde entier En pages 1 et 3 : « Amour, gloire et beauté » (« The Bold and the Beautiful ») L y a fort à parier que, aujourd’hui, Alfred de Musset ne manquerait pas, de jeter au moins un œil sur « Amour, gloire et beauté », tous les matins sur France 2. -

Aalleonso I 3EGIN

NOVEMBER 17, 2001 Music Volume 19, Issue 47 £3.95 Michael Jackson's Invinci- ble (Epic) goes straight in at number one on this week's European Top 100 Media Albums chart . e taller it41010 radio M&M chart toppers this week Radio faces biggest slump for decade Eurochart Hot 100 Singles by Emmanuel Legrand across [the whole of] Europe will be However, Neuville remains cau- KYLIE MINOGUE down by 0.5%, and that's an opti-tiouslyoptimisticfor2002. He Can't Get You Out Of My Head PARIS- The European radio industrymistic estimate," says Main Neu-explains: "For a start, 2002 will (Parlophone) is on course for its worst year since the ville, managing directorof Frenchcompare to a very bad year, 2001, European Top 100 Albums recession at the beginning of the '90s. independentmediaconsultancyso it should not be too difficult to do MICHAEL JACKSON According toestimates,Europe's Anima. better. We also see that consumer Invincible three biggestmarkets-the UK, Neuville says that 2001 wasspending in Europe doesn't seem to France and Germany-will all see neg- (Epic) affected by the slump in dotcombe too affected so far, and this ative growth in advertising revenues and telecoms advertising expendi-should bring back some confidence European Radio Top 50 for 2001. tures. He also says that the badto advertisers. And last but not MICHAEL JACKSON In its most recent Status Report,economic situation in the US hasleast, there are a few major events You Rock My World pan-European sales house IP antici-affected European media in thatsuch as the Winter Olympic Games (Epic) pates that radio's advertising revenuesUS companies facing tough marketand the football World Cup that for 2001 as a whole will be down 6% in conditions at home have cut downare likely to be supported by mas- European Dance Traxx the UK, 9% in France and 5% in Ger-on all expenditures, including thatsive advertising and sponsorship KYLIE MINOGUE many, while Spain and Italy are alsoof theiraffiliatesin Europe, ainvestments." Can't Get You Out Of My Head expected to report negative figures.