Annual Report 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Submission on the Productive Economy Policy Discussion Paper

From: Roger Drake Sent: Tuesday, 19 February 2019 4:35 PM To: DPTI:Planning Engagement Subject: Shopping Centre Zoning Follow Up Flag: Follow up Flag Status: Flagged To Whom it May Concern Drakes Supermarkets is a privately owned supermarket group, employing some 6000 staff and operating 37 supermarkets in South Australia; and we have been investing in the States independent supermarket retail market since 1974 with not only supermarkets, but also newsagencies and licensed post offices. As the owner of the business, I believe in the “centre hierarchy approach” (ie there should be a regional centre, a district centre and a local or neighbourhood centre.) Retailers like us have invested large amounts of money knowing there is some protection. I am gravely concerned when we see larger corporations (ie Coles, Woolworths, Aldi & especially Kaufland) investing outside the existing zoning requirements. If people are to invest in retail shopping zones, I believe they need some security knowing their investment has the ability to serve the community but also able to sustain competition. It is easy for the large players to invest outside the current zones knowing full well that the land they acquire is cheaper but all this does is splits the existing zoning. A perfect example of what I call “bad planning” is the Port Canal Development; whereby clearly there was a zone at the centre of Port Adelaide, and then another zone was created; namely the Port Canal, and now we have what I believe is two substandard shopping centre developments. This is just one example, and there are plenty more examples, especially when we examine country towns. -

Form G Commonwealth of Australia Competition and Consumer Act 2010 — Subsection 93 (1) NOTIFICATION of EXCLUSIVE DEALING

Form G Commonwealth of Australia Competition and Consumer Act 2010 — subsection 93 (1) NOTIFICATION OF EXCLUSIVE DEALING To the Australian Competition and Consumer Commission: Notice is hereby given, in accordance with subsection 93 (1) of the Competition and Consumer Act 2010, of particulars of conduct or of proposed conduct of a kind referred to subsections 47 (2), (3), (4), (5), (6), (7), (8) or (9) of that Act in which the person giving notice engages or proposes to engage. 1. Applicant (a) Name of person giving notice: Liberty Oil Australia Pty Ltd ACN 114 544 437 (Liberty) (formerly named Liberty Oil Rural Pty Ltd) (b) Short description of business carried on by that person: Retail sale of fuel from service stations. (c) Address in Australia for service of documents on that person: 381 Tooronga Road, Hawthorn East, Victoria Attention: Paul Edmends / Andrew Cossen 2. Notified arrangement (a) Description of the goods or services in relation to the supply or acquisition of which this notice relates: Petrol, diesel & LPG (b) Description of the conduct or proposed conduct: Liberty proposes offering a discount of 4 cents per litre on the supply of petrol, diesel and LPG by Liberty to consumers on the condition that the consumer produces evidence (in the form of a receipt or shopper docket) that they have spent at least $30 at a Drakes Foodland Supermarket or Drakes Supa IGA supermarket (Drakes Supermarkets). The discount will be offered at service stations operated by Liberty or its agent, branded either “Liberty” or “Shell” (Liberty Service Stations). 3. Persons, or classes of persons, affected or likely to be affected by the notified conduct (a) Class or classes of persons to which the conduct relates: Customers (actual and potential) of Drakes Supermarkets and nearby Liberty Service Stations. -

Part 6 — Implementation

PART 6 — IMPLEMENTATION 29 IMPLEMENTING THE REVIEW The Panel’s recommended agenda of competition reform is ambitious, encompassing Australia’s competition policy, laws and institutions. As noted in Part 1, a need for a new round of microeconomic reform persists, much like the extended reform horizon associated with the earlier National Competition Policy (NCP) reforms. It is vital for not only our standard of living but also our quality of life. However, to succeed, as the Business Council of Australia (BCA) notes, a clear plan for implementing the reform agenda is required: The panel has put forward a very large reform program. Implementation of each reform will be complex and take time so prioritisation will be important. A clear plan on how to implement the agenda will be required for the community to accept it. (DR sub, page 5) During consultation, many people pointed to the successful implementation of the NCP reforms as an example to emulate. This chapter begins by considering important features of the NCP, especially the time interval between completion of the Hilmer Review and governments agreeing to the NCP reform agenda. A distinguishing feature of the current environment is that the roles and responsibilities of the Australian Government and state and territory governments are currently being reconsidered through the White Paper on the Reform of the Federation and the White Paper on Reform of Australia’s Tax System (the White Papers). Although a number of the Panel’s recommendations can be implemented by jurisdictions acting independently, in many cases reform outcomes will be enhanced through co-operation or collaboration across jurisdictions. -

Issue 35 Stockists

Issue 35 Stockists Outlet Name Address Ainslie Newsagency 3 Edgar Street Woolworths Supermarket 1139 Belconnen Mall Coles Supermarket 779 19771 Cnr Emubank RD & Lathlain Dve Newsfront Newsagency Shop 211 Westfield Shopping Town Newsxpress Belconnen Shop 113 Westfield S/Town Woolworths Suparmarket 1457 61 Mabo Boulevard Woolworths Supermarket 1134 Johnston Drive Canberra House Newsagency Shop1 / 121 Marcus Clark Street Hunt'S Civic Centre Newsagency 47 Northbourne Avenue NLK Relay Canberra Domestic CBR101 Ground Floor Term. Building Convention Centre Newsagency Shop 1/33 Allara Street Supa 24 Convenience 2 Mort Street Charnwood Newsagency Shop 4 Fadco Building Coles Supermarket 858 19771 Shop Centre Halley Street Supanews Canberra Centre A30 Shop EG11 Canberra Centre Lanyon Newsagency SH 18 Lanyon Market Place Curtin Newsagency & Post Office Shop 38 Curtin Place Deakin Newsagency Duff Place Coles Express 1549 25 Hopetoun Circuit Woolworths Supermarket 1073 1 Dickson Place Dickson Newsagency 4 Dickson Place Erindale Newsagency Shop 12 Shopping Centre Coles 803 19771 Cnr Hibberson St & Gungahlin Plce Woolworths Supermarket 1279 Old Joe Road Penneys Papershop Shop 17 40-56 Hibberson Street Gungahlin Centre News Shop 12 Gungahlin Market Place Hawker Place Cards & Gifts Pty Ltd Shop 1&2/72-74 Hawker Place Kippax Fair Newsagency 25-27 Kippax Ctr & Hardwick Cres Coles Supermarket 748 19771 Redfern Street Kingston Newsagency 66 Giles Street Lyneham Newsagency Shop 3 Wattle Place Jamison Plaza News Shop A 06 Jamison Plaza Woolworths Suparmarket -

Metcash Limited ABN 32 112 073 480 1 Thomas Holt Drive Macquarie Park NSW 2113 Australia

Metcash Limited ABN 32 112 073 480 1 Thomas Holt Drive Macquarie Park NSW 2113 Australia 25 July 2018 Market Announcements Office Australian Securities Exchange Limited 20 Bridge Street Sydney NSW 2000 Dear Sir/Madam METCASH LIMITED – 2018 ANNUAL REPORT In accordance with ASX Listing Rule 4.7, please find attached a copy of the Metcash Limited 2018 Annual Report. Copies are being despatched today to those members who have requested a copy. An electronic copy will also be made available today on the company’s website, www.metcash.com. Yours faithfully Julie Hutton Company Secretary ABN 32 112 073 480 Metcash Limited Annual Report 2018 Championing SuccessfulIndependents 2018 Annual Report Metcash is Australia’s leading wholesaler and distributor, supplying and supporting more than 10,000 independent retailers across the Food, Liquor and Hardware sectors. Our focus is to champion successful independents to become the ‘Best Store in Town’, by providing our network of strong retail brands with merchandising, operational and marketing support. Contents About Us ............................................ 2 Logistics ...........................................18 Chairman’s Report ............................ 4 CSR ...................................................20 CEO’s Report ...................................... 6 Our People .......................................24 Financial Highlights ........................10 Our Board ........................................25 Food .................................................12 Financial Report -

GAIN Report Global Agriculture Information Network

Foreign Agricultural Service GAIN Report Global Agriculture Information Network Voluntary Report - public distribution Date: 12/10/2002 GAIN Report #AS2042 Australia Product Brief Confectionery Products 2002 Approved by: Andrew C. Burst U.S. Embassy Prepared by: Australian Centre for Retail Studies Report Highlights: Within the global confectionery market, Australia is ranked 11th for sugar confectionery consumption and 9th for chocolate. Nine out of ten people regularly consume confectionery from both the chocolate and sugar confectionery categories. Approximately 55 percent of confectionery sales are through supermarkets, with the remaining 45 percent sold through outlets such as milk-bars, convenience stores and specialty shops. New products are introduced fairly regularly to the Australian confectionery market; however highly innovative products are less common and this may be an area that offers opportunities for U.S. exporters to be successful in this market. In 2001, Australia was the 15th largest export market for U.S. confectionery products. Includes PSD changes: No Includes Trade Matrix: No Unscheduled Report Canberra [AS1], AS This report was drafted by consultants: The Australian Centre for Retail Studies Monash University PO Box 197 Caulfield East VIC 3145 Tel: +61 3 9903 2455 Fax: +61 3 9903 2099 Email: [email protected] Disclaimer: As a number of different sources were used to collate market information for this report, there are areas in which figures are slightly different. The magnitude of the differences is, in most cases, small and the provision of the data, even though slightly different, is to provide the U.S. exporter with the best possible picture of the Australian Confectionery Sector where omission may have provided less than that. -

Public Relations Media Report for September 2020 By

PUBLIC RELATIONS MEDIA REPORT FOR SEPTEMBER 2020 BY Media release 10 September 2020 A moment etched in history for Australian traceability The National GS1 Traceability Advisory Group inaugural meeting GS1 Australia brought together more than 60 senior executives from government and industry to navigate the way forward for enhanced traceability in Australia. The inaugural meeting of the National GS1 Traceability Advisory Group (NGTAG) saw members from across all sectors and supply chains including retail, liquor, agriculture and construction, converge to co-define a roadmap for implementing enhanced traceability and trade modernisation in Australia. Opening remarks were heard from GS1 Australia’s chief executive officer, Maria Palazzolo, setting the scene for the prestigious group. Woolworths’ Ram Akella, co-chair of the advisory group, in his introduction referred to the event as ‘a moment etched in history for traceability in Australia’. Akella continued to sum up the group’s purpose as ‘discussing what’s important from a customer point of view, what’s important from a regulation and government point of view and how changes can be made cost effectively at the same time’. Over the next 12 months the group will lead the future of transformation and innovation for Australian traceability, communicating, educating and co- defining a strategic master plan for implementing end-to-end supply chain visibility for Australian trade. Opening remarks and the introduction of the National GS1 Traceability Advisory Group inaugural meeting can be heard on the GS1 Australia website. GS1 Australia is a not-for-profit organisation that works with industry, for industry, providing global standards and technology-neutral services to help solve the business challenges of today and for the future. -

The Australian Grocery Sector: Structurally Irredeemable?

THE AUSTRALIAN GROCERY SECTOR: structurally irredeemable? Alexandra Merrett and Rhonda L Smith1 By all appearances, the grocery sector in Australia is less than ideally competitive and indeed less competitive than most other advanced economies. It may be that the size of the Australian economy imposes a natural limit on the market structure whereby the available economies of scale and scope mean that there is only room for two large players. The evidence suggests that, while Coles and Woolworths may have substantial market power, they do not take advantage of such market power by systematic monopoly pricing. Rather, any uses of market power are episodic and appear largely related to non-price conduct. Indeed, it seems the biggest impact for Australian consumers of our present market structure is reduced choice and innovation as sources of supply are rationalised. Australians may therefore need to consider the extent to which they prefer increased choice over lower prices and the convenience of one-stop shops. In considering these issues, this paper attempts to assess anecdotal claims – particularly in relation to ‘must have’ brands and private labels – by reference to available data. In doing so, we highlight several potential uses of publicly available information which may go some way to proving or disproving market power problems in the Australian grocery sector. 1 Alexandra Merrett is a competition lawyer and Senior Fellow at the Melbourne Law School, and may be contacted on [email protected]. Rhonda Smith is an economist and Senior Lecturer at the University of Melbourne. She may be contacted on [email protected]. -

REVIEW of PROPOSED RETAIL DEFINITION ~ NEIGHBOURHOOD SUPERMARKET

REVIEW of PROPOSED RETAIL DEFINITION ~ NEIGHBOURHOOD SUPERMARKET Prepared For: NSW DEPARTMENT of ENVIRONMENT and PLANNING Prepared By: LEYSHON CONSULTING PTY LTD SUITE 1106 LEVEL 11 109 PITT STREET SYDNEY NSW 2000 TELEPHONE (02) 9224-6111 FACSIMILE (02) 9224-6150 REP 1811 JULY 2018 © Leyshon Consulting Pty Ltd 2018 Leyshon Consulting TABLE of CONTENTS Page DISCLAIMER EXECUTIVE SUMMARY . i-ii 1 INTRODUCTION. 1 2 OVERVIEW. 3 2.1 Role of B1 Centres . 3 2.2 Prevalence of B1 Zones . 4 2.3 Characteristics of B1 Centres . 5 3 SUPERMARKET SCALE . 8 3.1 Supermarket Typology . 8 3.2 Supermarket Performance . 9 4 IMPACT on HIERARCHY . 11 4.1 Required Catchment Population. 11 4.2 Potential Impact . 15 5 REVIEW of SUBMISSIONS . 18 6 CONCLUSIONS . 19 6.1 Overview . 19 6.2 Recommended Floorspace Control. 19 6.3 Metropolitan and Regional Settings. 21 LIST of TABLES 4.1 : ESTIMATED POPULATION REQUIRED to SUPPORT NEIGHBOURHOOD SUPERMARKETS 4.2 : SELECTED SYDNEY METROPOLITAN AREA SUBURBAN POPULATIONS, 2016 4.3 : ESTIMATED POTENTIAL IMPACT of NEIGHBOURHOOD SUPERMARKET ($2017) Review of Proposed Retail Definition ~ Neighbourhood Supermarket July 2018 Leyshon Consulting DISCLAIMER This Report has been prepared solely for the purposes recorded at Section 1 of the Report and solely for the benefit of the party to whom the report is addressed. No third party is entitled to rely upon this Report for any purpose without the written consent of Leyshon Consulting Pty Ltd having first been sought and obtained. This Report involves the making of future projections. Those projections are grounded upon the facts and matters contained in this Report. -

Kaufland Australia Proposed Store Oakleigh South, Melbourne Economic Impact Assessment

Kaufland Australia Proposed store Oakleigh South, Melbourne Economic Impact Assessment December 2018 Prepared by: Anthony Dimasi, Managing Director – Dimasi & Co [email protected] Prepared for Kaufland Australia Table of contents Executive summary 1 Introduction 5 Section 1: The supermarket sector – Australia and Victoria 6 Section 2: Kaufland Australia – store format and offer 13 Section 3: Economic Impact Assessment 20 3.1 Site location and context 21 3.2 Trade area analysis 23 3.3 Competition analysis 27 3.4 Estimated sales potential 28 3.5 Economic impacts 30 3.6 Net community benefit assessment 43 Executive summary The Supermarkets & Grocery Stores category is by far the most important retail category in Australia. Total sales recorded by Supermarkets & Grocery Stores as measured by the Australian Bureau of Statistics have increased from $64.5 billion at 2007 to $103.7 billion at 2017, recording average annual growth of 4.9% per annum – despite the impacts of the global financial crisis (GFC). Over this past decade the category has also increased its share of total Australian retail sales from 31.3% to 33.7%. For Victoria, similar trends are evident. Supermarkets and grocery stores’ sales have increased over the past decade at a similar rate to the national average – 4.5% versus 4.9%. The share of total retail sales directed to supermarkets and grocery stores by Victorians has also increased over this period, from 31.6% at 2007 to 32.8% at 2017. Given the importance of the Supermarkets & Grocery Stores category to both the Victorian retail sector and Victorian consumers, the entry of Kaufland into the supermarket sector brings with it enormous potential for significant consumer benefits, as well as broader economic benefits. -

Overview of Australia and New Zealand Supermarkets

OVERVIEW OF KEY AUSTRALASIAN SUPERMARKET RETAILERS Briefing Document September 2003 Coriolis Research Ltd. is a strategic market research firm founded in 1997 and based in Auckland, New Zealand. Coriolis primarily works with clients in the food and fast moving consumer goods supply chain, from primary producers to retailers. In addition to working with clients, Coriolis regularly produces reports on current industry topics. Recent reports have included an analysis of Retail Globalization: Who’s Winning” and answering the question: “Will selling groceries over the internet ever work?” The lead researcher on this report was Tim Morris, one of the founding partners of Coriolis Research. Tim graduated from Cornell University in New York with a degree in Agricultural Economics, with a specialisation in Food Industry Management. Tim has worked for a number of international retailers and manufacturers, including Nestlé, Dreyer’s Ice Cream, Kraft/General Foods, Safeway and Woolworths New Zealand. Before helping to found Coriolis Research, Tim was a consultant for Swander Pace and Company in San Francisco, where he worked on management consulting and acquisition projects for clients including Danone, Heinz, Bestfoods and ConAgra. The coriolis force, named for French physicist Gaspard Coriolis (1792-1843), may be seen on a large scale in the movement of winds and ocean currents on the rotating earth. It dominates weather patterns, producing the counterclockwise flow observed around low-pressure zones in the Northern Hemisphere and the clockwise flow around such zones in the Southern Hemisphere. It is the result of a centripetal force on a mass moving with a velocity radially outward in a rotating plane. -

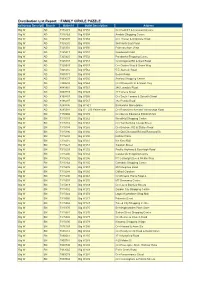

Distribution List Report

Distribution List Report: : FAMILY CIRCLE PUZZLE Retail Group DescriptionBranch Outlet Id Outlet Description Address Big W AD 7171473 Big W558 Cnr Reid ST & Commercial Lane Big W AD 7325269 Big W554 Arndale Shopping Centre Big W AD 7325270 Big W264 Cnr Thower & Dripstone Road Big W AD 7325282 Big W555 984 North East Road Big W AD 7325301 Big W550 Princess Anne Walk Big W AD 7325313 Big W551 Goodwood Road Big W AD 7325325 Big W552 Parabanks Shopping Centre Big W AD 7325337 Big W553 Cnr Diagonal RD & Sturt Road Big W AD 7325349 Big W557 Cnr Golden Way & Grove Way Big W AD 7868216 Big W562 5 El Alamein Road Big W AD 7900773 Big W559 Beach Road Big W AD 7933057 Big W565 Seaford Shopping Centre Big W AD 7980638 Big W564 Cnr Nineteenth St & Stuart Hwy Big W AD 8045861 Big W563 246 Lonsdale Road Big W AD 8099789 Big W549 27 Torrens Street Big W AD 8168457 Big W566 Cnr South Terrace & Seventh Street Big W AD 8186487 Big W567 182 Penola Road Big W AD 8243496 Big W 521 Brickworks Marketplace Big W AD 8295384 Big W - 236 Palmerston Cnr Roystonea Ave and Yarrawonga Road Big W BN 7170998 Big W278 Cnr Queen Edward & Elizabeth Sts Big W BN 7315159 Big W262 Westfield Shopping Centre Big W BN 7315172 Big W263 Cnr Yamba Rd & Cowap Street Big W BN 7315184 Big W265 Cnr Brisbane RD & Station Road Big W BN 7315196 Big W266 Cnr Old Cleveland Rd and Raymond St Big W BN 7315203 Big W250 Nathan Plaza Big W BN 7315215 Big W251 Kin Kora Mall Big W BN 7315227 Big W253 Takalvin Street Big W BN 7315239 Big W252 Pacific Highway & Beenleigh Road Big W BN 7315240 Big