Part 6 — Implementation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Issue 35 Stockists

Issue 35 Stockists Outlet Name Address Ainslie Newsagency 3 Edgar Street Woolworths Supermarket 1139 Belconnen Mall Coles Supermarket 779 19771 Cnr Emubank RD & Lathlain Dve Newsfront Newsagency Shop 211 Westfield Shopping Town Newsxpress Belconnen Shop 113 Westfield S/Town Woolworths Suparmarket 1457 61 Mabo Boulevard Woolworths Supermarket 1134 Johnston Drive Canberra House Newsagency Shop1 / 121 Marcus Clark Street Hunt'S Civic Centre Newsagency 47 Northbourne Avenue NLK Relay Canberra Domestic CBR101 Ground Floor Term. Building Convention Centre Newsagency Shop 1/33 Allara Street Supa 24 Convenience 2 Mort Street Charnwood Newsagency Shop 4 Fadco Building Coles Supermarket 858 19771 Shop Centre Halley Street Supanews Canberra Centre A30 Shop EG11 Canberra Centre Lanyon Newsagency SH 18 Lanyon Market Place Curtin Newsagency & Post Office Shop 38 Curtin Place Deakin Newsagency Duff Place Coles Express 1549 25 Hopetoun Circuit Woolworths Supermarket 1073 1 Dickson Place Dickson Newsagency 4 Dickson Place Erindale Newsagency Shop 12 Shopping Centre Coles 803 19771 Cnr Hibberson St & Gungahlin Plce Woolworths Supermarket 1279 Old Joe Road Penneys Papershop Shop 17 40-56 Hibberson Street Gungahlin Centre News Shop 12 Gungahlin Market Place Hawker Place Cards & Gifts Pty Ltd Shop 1&2/72-74 Hawker Place Kippax Fair Newsagency 25-27 Kippax Ctr & Hardwick Cres Coles Supermarket 748 19771 Redfern Street Kingston Newsagency 66 Giles Street Lyneham Newsagency Shop 3 Wattle Place Jamison Plaza News Shop A 06 Jamison Plaza Woolworths Suparmarket -

Metcash Limited ABN 32 112 073 480 1 Thomas Holt Drive Macquarie Park NSW 2113 Australia

Metcash Limited ABN 32 112 073 480 1 Thomas Holt Drive Macquarie Park NSW 2113 Australia 25 July 2018 Market Announcements Office Australian Securities Exchange Limited 20 Bridge Street Sydney NSW 2000 Dear Sir/Madam METCASH LIMITED – 2018 ANNUAL REPORT In accordance with ASX Listing Rule 4.7, please find attached a copy of the Metcash Limited 2018 Annual Report. Copies are being despatched today to those members who have requested a copy. An electronic copy will also be made available today on the company’s website, www.metcash.com. Yours faithfully Julie Hutton Company Secretary ABN 32 112 073 480 Metcash Limited Annual Report 2018 Championing SuccessfulIndependents 2018 Annual Report Metcash is Australia’s leading wholesaler and distributor, supplying and supporting more than 10,000 independent retailers across the Food, Liquor and Hardware sectors. Our focus is to champion successful independents to become the ‘Best Store in Town’, by providing our network of strong retail brands with merchandising, operational and marketing support. Contents About Us ............................................ 2 Logistics ...........................................18 Chairman’s Report ............................ 4 CSR ...................................................20 CEO’s Report ...................................... 6 Our People .......................................24 Financial Highlights ........................10 Our Board ........................................25 Food .................................................12 Financial Report -

Annual Report 2020

Issue 07 OCTOBER 2020 The 2020 MGATMA Annual Report is inside! RISK • CONTROL • MONITOR Managing the risk of COVID-19 See page 12 YOUR INDUSTRY NEWS PROVIDED BY MGA INDEPENDENT RETAILERS 3 Contents 5 CEO welcome OUR MISSION 6 The case for a national COVID-19 plan The mission of MGA Independent Retailers is to deliver the best possible 8 Preventative maintenance: Keeping your refrigeration industry specific business support equipment in shape services to independent grocery, liquor, 8 New eftpos API program goes live hardware and associate store members. 9 Drakes Supermarkets – A trusted place to shop 10 Heineken® 0.0 leading from the front MGA NATIONAL 11 What does it take to ensure SMEs are digital ready? SUPPORT OFFICE 12 RISK • CONTROL • MONITOR Managing the risk of Suite 5, 1 Milton Parade, Malvern, Victoria, 3144 COVID-19: What does an inspector look for? P: 03 9824 4111 • F: 03 9824 4022 14 Wynns Coonawarra Estate’s Cath Kidman 2020 GT Wine [email protected] • www.mga.asn.au Viticulturist of the year Freecall: 1800 888 479 16 Asahi sells five liquor brands to Heinekin© 17 Overseas licences now accepted as proof of age RETAILER DIRECTORS 18 Iconic West End Brewery to be shut down Debbie Smith (President): Queensland 19 At 87 and in the same job for 61 years, Effie may just be Grant Hinchcliffe (Vice President): Tasmania Adelaide’s most loyal worker Graeme Gough: New South Wales 21 Michael Daly: Victoria 2019 ANNUAL REPORT Financial Year 2020 Ross Anile: Western Australia » Carmel Goldsmith: New South Wales » Benefits of membership -

GAIN Report Global Agriculture Information Network

Foreign Agricultural Service GAIN Report Global Agriculture Information Network Voluntary Report - public distribution Date: 12/10/2002 GAIN Report #AS2042 Australia Product Brief Confectionery Products 2002 Approved by: Andrew C. Burst U.S. Embassy Prepared by: Australian Centre for Retail Studies Report Highlights: Within the global confectionery market, Australia is ranked 11th for sugar confectionery consumption and 9th for chocolate. Nine out of ten people regularly consume confectionery from both the chocolate and sugar confectionery categories. Approximately 55 percent of confectionery sales are through supermarkets, with the remaining 45 percent sold through outlets such as milk-bars, convenience stores and specialty shops. New products are introduced fairly regularly to the Australian confectionery market; however highly innovative products are less common and this may be an area that offers opportunities for U.S. exporters to be successful in this market. In 2001, Australia was the 15th largest export market for U.S. confectionery products. Includes PSD changes: No Includes Trade Matrix: No Unscheduled Report Canberra [AS1], AS This report was drafted by consultants: The Australian Centre for Retail Studies Monash University PO Box 197 Caulfield East VIC 3145 Tel: +61 3 9903 2455 Fax: +61 3 9903 2099 Email: [email protected] Disclaimer: As a number of different sources were used to collate market information for this report, there are areas in which figures are slightly different. The magnitude of the differences is, in most cases, small and the provision of the data, even though slightly different, is to provide the U.S. exporter with the best possible picture of the Australian Confectionery Sector where omission may have provided less than that. -

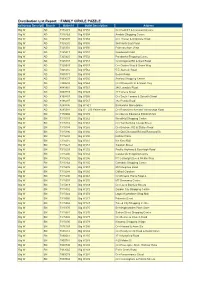

Distribution List Report

Distribution List Report: : FAMILY CIRCLE PUZZLE Retail Group DescriptionBranch Outlet Id Outlet Description Address Big W AD 7171473 Big W558 Cnr Reid ST & Commercial Lane Big W AD 7325269 Big W554 Arndale Shopping Centre Big W AD 7325270 Big W264 Cnr Thower & Dripstone Road Big W AD 7325282 Big W555 984 North East Road Big W AD 7325301 Big W550 Princess Anne Walk Big W AD 7325313 Big W551 Goodwood Road Big W AD 7325325 Big W552 Parabanks Shopping Centre Big W AD 7325337 Big W553 Cnr Diagonal RD & Sturt Road Big W AD 7325349 Big W557 Cnr Golden Way & Grove Way Big W AD 7868216 Big W562 5 El Alamein Road Big W AD 7900773 Big W559 Beach Road Big W AD 7933057 Big W565 Seaford Shopping Centre Big W AD 7980638 Big W564 Cnr Nineteenth St & Stuart Hwy Big W AD 8045861 Big W563 246 Lonsdale Road Big W AD 8099789 Big W549 27 Torrens Street Big W AD 8168457 Big W566 Cnr South Terrace & Seventh Street Big W AD 8186487 Big W567 182 Penola Road Big W AD 8243496 Big W 521 Brickworks Marketplace Big W AD 8295384 Big W - 236 Palmerston Cnr Roystonea Ave and Yarrawonga Road Big W BN 7170998 Big W278 Cnr Queen Edward & Elizabeth Sts Big W BN 7315159 Big W262 Westfield Shopping Centre Big W BN 7315172 Big W263 Cnr Yamba Rd & Cowap Street Big W BN 7315184 Big W265 Cnr Brisbane RD & Station Road Big W BN 7315196 Big W266 Cnr Old Cleveland Rd and Raymond St Big W BN 7315203 Big W250 Nathan Plaza Big W BN 7315215 Big W251 Kin Kora Mall Big W BN 7315227 Big W253 Takalvin Street Big W BN 7315239 Big W252 Pacific Highway & Beenleigh Road Big W BN 7315240 Big -

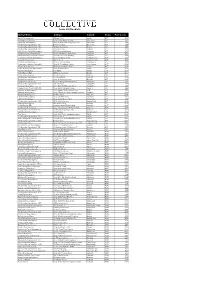

Independent Stores – Stockists New South Wales Tasmania South

Independent Stores – Stockists Last update Friday 30.08.2019 New South Wales Store Address Suburb Post code FALLS FOODLAND (C) 19 STATION STREET WENTWORTH FALLS 2782 IGA DRUMMOYNE SHOP 1, SUTTON PL SC DRUMMOYNE 2047 ALBERTS ONE STOP SHOP 57 WILLS ROAD WOOLOOWARE 2230 FOODWORKS NEWTOWN SHOP 1, 330 KING ST NEWTOWN 2042 SHOP-RITE AINSLIE 9 - 11 EDGAR ST AINSLIE 2602 BONDI GROCER 116/120 GLENAYR AVENUE BONDI BEACH 2026 ROMEO'S FOODHALL ST LEONARDS 201-205 PACIFIC HIGHWAY ST LEONARDS 2065 KIRRIBILLI DELI F'GROCER SHOP 7 & 8 KIRRIBILLI 2061 IGA ALLAMBIE HEIGHTS 14-15 GRIGOR PLACE ALLAMBIE HEIGHTS 2100 ASHCROFTS SUPA IGA ELIZABETH STREET MOSS VALE 2577 NSW - INTER BRANCH TRANSFERS 7 SMOOTHY PLACE ARNDELL PARK 2148 SPAR BALLINA SHOP 17, 101-105 KALINGA BALLINA 2478 STREET SUPA IGA BYRON BAY 8 BAYSHORE DRV BYRON BAY 2481 RITCHIES STORES - INVERELL 99-119 BYRON ST INVERELL 2360 RITCHIES STORES - BALLINA SHOP 7, CNR KERR & BALLINA 2478 BANGALOW STS RITCHIES STORES - EVANS HEAD 39-41 WOODBURN ST EVANS HEAD 2473 Tasmania Store Address Suburb Post code EDEN FOODS - 6-8 SUNMONT STREET DERWENT PARK 7009 MOONAH/HOBART South Australia Store Address Suburb Postcode PASADENA FOODLAND IGA FIVE ASH DRIVE PASADENA 5042 HENLEY SQUARE FOODLAND 348-354 SEAVIEW ROAD HENLEY BCH 5022 FREWVILLE FOODLAND IGA (EMPROS CORP. & THAROS CORP.) FREWVILLE 5063 CLARE FOODLAND 250 MAIN NORTH ROAD CLARE 5453 NORWOOD FOODLAND NORWOOD PLAZA - THE NORWOOD 5067 PARADE Victoria Stores Name Address Suburb Postcode CELLAR & PANTRY - FOODWORKS 141 SHOREHAM ROAD RED HILL 3937 IGA TOORAK -

Financial Report for the Year Ended 30 April 2021

METCASH LIMITED ABN 32 112 073 480 1 THOMAS HOLT DRIVE MACQUARIE PARK NSW 2113 AUSTRALIA PO BOX 557 MACQUARIE PARK NSW 1670 AUSTRALIA 28 June 2021 PHONE: 02 9741 3000 FAX: 02 9741 3399 WEB: www.metcash.com Market Announcements Office Australian Securities Exchange Limited 20 Bridge Street Sydney NSW 2000 Dear Sir/Madam METCASH LIMITED - 2021 FULL YEAR RESULTS AND FINANCIAL REPORT AND OFF-MARKET BUY-BACK In accordance with ASX Listing Rule 4.3A, please find attached the following documents for release to the market: (a) Announcement – Metcash Limited 2021 Full Year Results (including details of an off- market buy-back) (b) Appendix 4E and Financial Report (including the Directors’ Report and Independent Auditor’s Report) of Metcash Limited and its controlled entities for the year ended 30 April 2021. Yours faithfully Julie Hutton Company Secretary Metcash Limited ABN 32 112 073 480 1 Thomas Holt Drive Macquarie Park NSW 2113 Australia 28 June 2021 ASX Announcement – Metcash Limited 2021 Full Year Results Metcash Limited (ASX:MTS) today released its financial results for the year ended 30 April 2021. Highlights • Significant growth in sales volumes across all Pillars underpinned by investment in MFuture initiatives • Group revenue up 9.9% to $14.3bn, and including charge-through sales exceeded $16bn for the first time with sales up 10.1% to $16.4bn • Underlying Group EBIT up 19.9% to $401.4m 1 • Underlying profit after tax up 27.1% to $252.7m 2 • Statutory profit after tax of $239.0m (FY20: Loss of $56.8m ) • Record operating cashflow of $475.5m (FY20: $117.5m) • Underlying earnings per share up 13.3% to 24.7 cents • Investment in growth opportunities incl. -

Kaufland Stores in Victoria Advisory Committee

Planning and Environment Act 1987 Advisory Committee Report Kaufland Stores in Victoria Advisory Committee 7 February 2019 Planning and Environment Act 1987 Advisory Committee Report Kaufland Stores in Victoria Advisory Committee 7 February 2019 Kathy Mitchell, Chair William O’Neil, Deputy Chair Suzanne Barker, Member Kate Partenio, Member Kaufland Stores in Victoria Advisory Committee Advisory Committee Report 7 February 2019 Contents Page 1 Introduction ..............................................................................................................1 1.1 The proposal ............................................................................................................ 1 1.2 The Advisory Committee ......................................................................................... 2 1.3 Submissions and Public Hearings ............................................................................ 2 1.4 Procedural issues ..................................................................................................... 3 1.5 Summary of issues raised in submissions ............................................................... 3 1.6 Approach to this report ........................................................................................... 4 2 Planning context .......................................................................................................6 2.1 Planning and Environment Act 1987 ....................................................................... 6 2.2 Plan Melbourne 2017 ............................................................................................. -

I Am Pleased to Present Metcash's Annual Report for 2018 – a Year in Which the Group

Metcash Limited ABN 32 112 073 480 1 Thomas Holt Drive Macquarie Park NSW 2113 Australia 25 July 2018 Market Announcements Office Australian Securities Exchange Limited 20 Bridge Street Sydney NSW 2000 Dear Sir/Madam METCASH LIMITED – 2018 ANNUAL REPORT In accordance with ASX Listing Rule 4.7, please find attached a copy of the Metcash Limited 2018 Annual Report. Copies are being despatched today to those members who have requested a copy. An electronic copy will also be made available today on the company’s website, www.metcash.com. Yours faithfully Julie Hutton Company Secretary For personal use only ABN 32 112 073 480 Metcash Limited Annual Report 2018 Championing SuccessfulIndependents 2018 Annual Report For personal use only Metcash is Australia’s leading wholesaler and distributor, supplying and supporting more than 10,000 independent retailers across the Food, Liquor and Hardware sectors. Our focus is to champion successful independents to become the ‘Best Store in Town’, by providing our network of strong retail brands with merchandising, operational and marketing support. Contents About Us ............................................ 2 Logistics ...........................................18 Chairman’s Report ............................ 4 CSR ...................................................20 CEO’s Report ...................................... 6 Our People .......................................24 For personal use only Financial Highlights ........................10 Our Board ........................................25 Food -

22 June 2020 Market Announcements Office Australian Securities

METCASH LIMITED ABN 32 112 073 480 1 THOMAS HOLT DRIVE MACQUARIE PARK NSW 2113 AUSTRALIA PO BOX 557 MACQUARIE PARK NSW 1670 AUSTRALIA 22 June 2020 PHONE: 02 9741 3000 FAX: 02 9741 3399 WEB: www.metcash.com Market Announcements Office Australian Securities Exchange Limited 20 Bridge Street Sydney NSW 2000 Dear Sir/Madam METCASH LIMITED – 2020 FULL YEAR RESULTS AND FINANCIAL REPORT In accordance with ASX Listing Rule 4.3A, please find attached the following documents for release to the market: (a) Announcement – Metcash Limited 2020 Full Year Results (b) Appendix 4E and Financial Report (including the Directors’ Report and Independent Auditor’s Report) of Metcash Limited and its controlled entities for the year ended 30 April 2020. Yours faithfully Julie Hutton Company Secretary Metcash Limited ABN 32 112 073 480 1 Thomas Holt Drive Macquarie Park NSW 2113 Australia 22 June 2020 ASX Announcement – Metcash Limited 2020 Full Year Results Metcash Limited (ASX:MTS) today released its financial results for the full year ended 30 April 2020. Highlights • Group revenue increased 2.9% to $13.0bn and including charge through sales was up 2.0% to $14.9bn • All Pillars responded well to service retailers in a very challenged environment impacted by both bushfires and COVID-19 • Food delivered sales growth, even if the positive uplift in sales due to COVID-19 in March and April is excluded. Supermarkets wholesale sales (ex-tobacco) reported underlying sales growth for the first time since FY12, confirming our strategic initiatives are delivering positive results • Liquor delivered its seventh consecutive year of sales growth despite the COVID-19 related closure of customers’ ‘on-premise’ businesses in Australia and our New Zealand operations • Hardware returned to positive sales growth in 2H20 with strong DIY sales • Group Underlying EBIT (pre AASB16) was $324.2m. -

Issue 26 Stockists

Issue 26 Stockists Outlet Name Address Suburb State Post Code Ainslie Newsagency 3 Edgar Street Ainslie ACT 2602 Newsxpress Belconnen Shop 113 Westfield S/Town Belconnen ACT 2617 Newsfront Newsagency Shop 211 Westfield Shopping Town Belconnen ACT 2617 Woolworths Supermarket 1139 Belconnen Mall Belconnen ACT 2617 Woolworths Suparmarket 1457 61 Mabo Boulevard Bonner ACT 2914 Woolworths Supermarket 1134 Johnston Drive Calwell ACT 2905 Hunt'S Civic Centre Newsagency 47 Northbourne Avenue Canberra ACT 2601 Canberra House Newsagency Shop1 / 121 Marcus Clark Street Canberra ACT 2601 Newslink–Relay Canberra Domest Ground Floor Term. Building Canberra ACT 2609 Convention Centre Newsagency Shop 1/33 Allara Street Canberra City ACT 2601 Supa 24 Convenience 2 Mort Street Canberra City ACT 2601 Charnwood Newsagency Shop 4 Fadco Building Charnwood ACT 2615 Supanews Canberra Centre A30 Shop EG11Canberra Centre Civic Square ACT 2608 Lanyon Newsagency SH 18 Lanyon Market Place Conder ACT 2906 Curtin Newsagency & Post Offic Shop 38 Curtin Place Curtin ACT 2605 Deakin Newsagency Duff Place Deakin ACT 2600 Coles Express 1549 25 Hopetoun Circuit Deakin ACT 2600 Dickson Newsagency 4 Dickson Place Dickson ACT 2602 Woolworths Supermarket 1073 1 Dickson Place Dickson ACT 2602 Erindale Newsagency Shop 12 Shopping Centre Erindale ACT 2903 Gungahlin Centre News Shop 12 Gungahlin Market Place Gungahlin ACT 2912 Woolworths Supermarket 1279 Old Joe Road Gungahlin ACT 2912 Penneys Papershop Shop 1740-56 Hibberson Street Gungahlin ACT 2912 Hawker Place Cards & Gifts -

Store-Ranging-Limited-Edition.Pdf

Bonne Maman Store Ranging Limited Edition Rhubarb & Strawberry Conserve 370g Last updated 18.06.2021 Post State Store Address Suburb Code SA Mt Barker IGA Fresh 50 Wellington Road Mt Barker 5251 SA Foodland Greenwith Romeos 222 Target Hill Road Greenwith 5125 SA Romeo's Campbelltown IGA Fresh 610 Lower North East Road Campbelltown 5074 SA Normanville Foodland Romeos 85 Main Road Normanville 5204 SA Mclaren Vale Foodland Romeos 130 Main Road Mclaren Vale 5171 SA Foodland Old Reynella Romeos 221 Old South Road Old Reynella 5161 SA Magill Foodland IGA Romeos 591 Magill Road Magill 5072 SA Daw Park Foodland Romeos 530 Goodwood Road Daw Park 5041 SA Athelstone Foodland Romeos 320 Gorge Road Athelstone 5076 SA Foodland Sefton Park 231 Main North Road Sefton Park 5083 SA Rostrevor Foodland Romeos 161 St Bernards Road Rostrevor 5073 SA Foodland Port Adelaide Romeos Port Mall Shopping Centre Port Adelaide 5015 SA Foodland Mount Barker 2 Victoria Crescent Mount Barker 5251 SA Happy Valley Foodland Kenihans Road Happy Valley 5159 SA Tanunda Foodland IGA 119 Murray Street Tanunda 5352 SA Glenelg Sth Foodland IGA Romeo 101-103 Partridge Street Glenelg 5045 SA Foodland Stirling Romeos 3-5 Johnston Street Stirling 5152 SA Foodland Mitcham (Romeos) Shop 1 Mitcham Square S/Ctr Torrens Park 5062 SA Foodland Fairview Park Romeos 325 Hancock Road Fairview Park 5126 SA Foodland Nth Adelaide Romeos 71-79 O'Connell Street North Adelaide 5006 SA Foodland Henley Square 348-354 Seaview Road Henley Beach 5022 SA Munno Para Foodland IGA 600 Main North Road Smithfield