Sri Lanka 100

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Major Projects Completed in the Past Major Projects Completed in 2017

List of Major projects completed in the past Major Projects Completed in 2017 Project Client 1 Western Provincial Council Sanken Constructions 2 Labour Department Thudawe Brothers 3 National Environmental Secretariat Building CECB 4 IOC petrol station lighting IOC 5 Unidil Packaging Factory Fentons 6 Angunukolapalessa Prison Venora 7 Hayleys Fabric new factory Hayleys Fabric 8 Swisstek Aluminium Factory Fentons LED street lighting from Ingurukade Junction 9 CMC to Armour street 10 Galle Face Hotel Richardson Projects 11 HSBC Branches LED lighting HSBC 12 Brandix Batticlioa DIMO PLC 13 Vakkaru Island Resort Development Project Venora 14 John Keels Automation office LED Lighting John Keels Automation LED street Lighting in Bandaranaike 15 AASL International Airport 16 Sirimavo College Indoor Gym Sri Lanka Army 17 Clearpoint Residencies MAGA 18 New Anthonies Farm New Anthonies 19 Hemas Consumer Brands factory lighting Hemas 20 Hayleys Agro Fertilizers Office Hayleys Agro Fertilizers 21 HNB Nugegogda Sripali Construction 22 BOC Nugegoda Sripali Construction 23 Sojitz Powerplant-Area lighting Sojitz (Pvt) Ltd 24 Vidyalankara Buddhist Conference Hall CECB 25 KIA Motors Workshop KIA Motors 26 NAITA Automobile Training Centre Thudawe Brothers 27 NAVESTA Pharmaceuticals Factory Navesta Pharmaceuticals 28 Hayleys Main Board Room Hayleys PLC Major Projects Completed in 2016 Project Client 1 Dialog Old Corporate Building Dialog Axiata- Fentons 2 Greater Colombo Project Pubudu Engineering Colombo Municipal Council - Street Lighting 3 Colombo Municipal -

TAX UPDATE for Clients of KPMG in Sri Lanka Extension of VAT

TAX UPDATE For clients of KPMG in Sri Lanka Extension of VAT deferment facility and temporary registration The Department of Inland Revenue (“DIR”) had issued a notice (PN/VAT/2020-03) dated 26th March 2020 informing all tax payers that due to the prevailing situation in the country consequent to the outbreak of COVID-19, an extension of validity periods for VAT deferment facility related letters and Temporary VAT registration has been granted, which we have notified via our tax alert dated 27th March 2020. The DIR has now issued the attached notice (PN/VAT/2020-05) dated 28th April 2020, granting a further extension of the validity periods for VAT deferment facility related letters and Temporary VAT registration up to 30th June 2020. You may click on the link below to access the notice published by the DIR: http://www.ird.gov.lk/en/Lists/Latest%20News%20%20Notices/Attachments/242/VAT280420 20_E.pdf Online tax payments The DIR has via the previous notice (PN/PMT/2020-1) dated 8th April 2020 intimated the availability of an online tax payment method. They have now updated this notice informing that if a taxpayer uses the Real Time Gross Settlement System (“RTGS”), the taxpayer should contact an officer of the DIR, using the contact details provided in the notice, to obtain instructions for performing same. You may click on the link below to access the updated notice published by the DIR: http://www.ird.gov.lk/en/Lists/Latest%20News%20%20Notices/Attachments/236/PYMT0804 2020_E.pdf Follow us on, KPMG Sri Lanka @kpmgsl www.home.kpmg/lk The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. -

Expolanka Holdings Plc Integrated Annual Report

EXPOLANKA HOLDINGS PLC INTEGRATED ANNUAL REPORT 2020/21 EXPOLANKA HOLDINGS PLC | INTEGRATED REPORT 2020/21 2 fruitionEXPOLANKA HOLDINGS PLC | INTEGRATED ANNUAL REPORT 2020/21 At Expolanka, we remain fully committed to our promise made several years ago, to drive long term sustainable value, by adapting a focused, constant and consistent strategy. Even though the year under review post several challenges, we were able to pursue our said strategies and bring to fruition our plans for progress which was fueled by our innate resilience and strength. The seeds we planted have taken root and we keep our focus upward, expanding in our focused direction in order to adapt to the current environment. We remain fruitful in our optimism, our can-do attitude and endurance, a recipe for success that will carry us through to more opportunity. Overview EXPOLANKA HOLDINGS PLC | INTEGRATED ANNUAL REPORT 2020/21 2 CONTENTS Chairman’s Overview Compliance Reports 12 About Us 3 Corporate Governance 71 Message About this Report 4 Risk Management Report 93 Group Milestones 5 Related Party Transactions Financial Highlights 6 Review Committee Report 101 15 Group CEO’s Highlights of the Year 7 Remuneration Committee Report 103 Review Chairman’s Message 12 Group CEO’s Review 15 Financial Reports Board of Directors 18 Annual Report of the Board of Directors Group Senior Management Team 20 on the Affairs of the Company 108 23 Financial Indicators 22 The Statement of Directors’ Responsibility 112 Performance Group Performance 23 Audit Committee Report 113 Overcoming -

Annual Report 2012/2013

THE PURSUIT OF EXCELLENCE One hundred years of passion, hard work and perseverance have brought to where we are today: a highly respected, fast growing blue chip conglomerate with interests in several key growth industry sectors: beverages, telecommunications, plantations, hotels, textiles, finance, insurance, power genaration, media and logistics. And yet, we will not rest. Our story is far from over. Indeed, it has only just begun. Look to us for even greater achievements as we step into the next century of our lifetime, to build further upon our current successes. DCSL. 100 years in the passionate pursuit of excellence. Distilleries Company of Sri Lanka PLC | Annual Report 2012/13 1 Financial Highlights 2013 2012 2013 2012 Group Group Company Company Summary of Results Gross Turnover Rs Mn 65,790 63,125 51,549 49,136 Excise Duty Rs Mn 37,024 36,150 34,088 33,860 Net Turnover Rs Mn 28,766 26,975 17,461 15,276 Profit After Tax Rs Mn 5,258 6,052 6,873 4,297 Shareholders Funds Rs Mn 47,978 41,576 39,155 32,597 Working Capital Rs Mn (1,298) (3,234) (6,139) (21,374) Total Assets Rs Mn 78,245 73,355 55,942 62,563 Staff Cost Rs Mn 3,194 3,155 1,039 1,080 No. of Employees 18,674 18,158 1,343 1,389 Per Share Basic Earnings* Rs. 17.13 18.45 10.68 11.85 Net Assets Rs. 159.93 138.59 130.52 108.66 Dividends Rs. 3.00 3.00 3.00 3.00 Market Price - High Rs. -

08 Pan Asia Banking Corporation PLC - Annual Report 2013 09

Opportunities to grow Reliable, friendly, dynamic and accessible. As one of the nation’s fastest expanding banks we are very aware of our responsibilities to always be a bank that our customers trust and respect, whatever we do. This report offers the reader a detailed look at our governance and risk management processes as well as our triple bottom line results. We also analyse the challenges we face and how we plan to use our strategic vision, insights and deep local experience to turn each one into a powerful opportunity to grow even bigger in the years ahead. 06 Pan Asia Banking Corporation PLC - Annual Report 2013 Financial Highlights Gross Income (LKR Million) 3,484 5,278 7,766 9,054 2010 2011 2012 2013 Profit for the Year (LKR Million) 362 812 860 115 2010 2011 2012 2013 Total Assets (LKR Million) 46,999 31,242 56,074 64,918 2010 2011 2012 2013 07 2013 2012 Change % Results for the Year (Rs. Mn) Gross Income 9,054.04 7,766.22 16.58 Profit Before VAT on Financial Services 228.44 1,354.71 (83.14) Profit Before Taxation 123.91 1,145.41 (89.18) Profit for the Year 114.86 860.05 (86.64) Position at the Year End (Rs. Mn) Shareholders' Funds 4,048.76 4,232.59 (4.34) Due to Customers (Deposits) 53,835.90 47,911.09 12.37 Gross Loans and Receivables to Other Customers 47,128.70 45,089.50 4.52 Total Assets 64,918.45 56,074.29 15.77 Financial Ratios Net Assets Value per Share (Rs) 13.72 14.35 (4.37) Earnings Per Share (Rs) 0.39 2.92 (86.67) Return on Average Assets (%) 0.19 1.67 (88.62) Return on Average Shareholders' Funds (%) 2.89 22.79 (87.32) -

5G Ecosystem the Digital Haven of Opportunities September 2019 5G Ecosystem | the Digital Haven of Opportunities

5G Ecosystem The digital haven of opportunities September 2019 5G Ecosystem | The digital haven of opportunities ii 5G Ecosystem | The digital haven of opportunities Contents Foreword 03 Message from CII 04 5G commercial launch in India: Are we ready? 05 • National Digital Communications Policy (NDCP) lays the foundation for next generation 05 • Movement/transition of data traffic to 4G 06 • Regulatory endeavour for 5G spectrum allocation 06 • Progress made on policy front to prepare for a 5G future 08 • Efforts to have an indigenous 5G technology 09 • Mega cloud push will accelerate change in India’s infrastructure 09 Encircling the seamless – what is the 5G ecosystem? 10 • Handset manufacturers geared up for 5G 10 • Equipment manufacturers - Key for new business opportunities 12 • Infrastructure providers - Expanding the network footprint 13 • Mobile network operators - Supporting the 5G ecosystem 14 • Rise of application/software providers 22 Digital transformation across industry verticals – no one wants to be left behind 24 • Manufacturing 25 • Media and entertainment 26 • Automotive 27 • Government 28 Current 5G ecosystem in India 29 Conclusion 31 Glossary of terms 32 About Confederation of India Industry 33 Acknowledgements 34 Contacts 34 References 35 01 5G Ecosystem | The digital haven of opportunities 02 5G Ecosystem | The digital haven of opportunities Foreword 5G will be a game changer for India with the potential to create significant social and economic impact. As the 5G ecosystem develops in the country, telcos are expected to focus beyond connectivity towards collaboration across the telecom value chain and cross-sector, leading to the creation of new business models and innovation. -

Cargills (Ceylon)

Cargills (Ceylon) CARG – Rs.193.0 Disclaimer: CT CLSA Securities (Pvt) Ltd is an associate of C T Holdings PLC, the parent of CARG Chayanika Ranasinghe Key Highlights Email : [email protected] Phone : +94 77 2379731 3Q18 Results Update . 3Q18 recurring net profit of Rs.636mn (largely unchanged YoY), broadly in line with our expectations. Earnings are adjusted for CARG‟s proportion of the Rs.481mn capital gain received by associate Cargills Bank from disposal of subsidiary Colombo Trust Finance (CALF) . CARG group net profit forecasts broadly maintained at Rs.2,535mn for FY18E (+20% YoY) and Rs.3,055mn for FY19E (+21% YoY), particularly driven by the Retail and Restaurants sectors. Retail sector to marginally overtake FMCG earnings contribution in FY19E given the significant expansion plans in the pipeline - targeting to double its retail network in the medium term . On 01 Feb 2018, CARG announced a capitalisation of reserves amounting to Rs.6.4bn (out of reserves of Rs.9.4bn as at 30 Sep 2017), via the issuance of 32mn shares in the proportion of 01:07 at a consideration of Rs.200.0 per share; XC : 20 Mar 2018 . The CARG share has outperformed the market rising +13% both during the past 3 months and 12 months (vs. the ASI‟s gains of +1% and +2% respectively during the same period) ASI . CARG is trading at PER multiples of 19.5X FY18E and 16.2X FY19E whilst offering ROEs of 17- CARG 130 1,200 19% (up from low single digits in FY15) Share Volume ('000) - RHS 10 April 2018 1,000 Our estimated Sum-of-the-parts (SOTP) valuation suggests that CARG is currently trading at a 120 . -

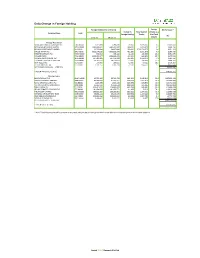

Daily Change in Foreign Holding

Daily Change in Foreign Holding Foreign Holding (No. of Shares) Foreign Net Turnover * Change in Total Volume Volume as a Company Name Code Foreign Holding Traded % of Total Rs. Volume 1-Feb-21 29-Jan-21 Foreign Purchases LANKA ORIX LEASING COMPANY PLC LOLC.N0000 2,313,835 2,286,635 27,200 2,699,110 1.0 13,702,000 EXPOLANKA HOLDINGS LIMITED EXPO.N0000 1,483,800,622 1,483,612,587 188,035 9,893,475 1.9 9,646,196 BROWNS INVESTMENTS LIMITED BIL.N0000 39,790,648 38,857,648 933,000 2,710,774,277 0.0 6,251,100 DIALOG AXIATA PLC DIAL.N0000 7,503,174,020 7,502,692,370 481,650 5,891,576 8.2 6,068,790 SWISSTEK (CEYLON) PLC PARQ.N0000 536,541 495,422 41,119 183,663 22.4 5,951,975 RICHARD PIERIS RICH.N0000 1,535,157,477 1,534,940,476 217,001 643,305 33.7 3,472,016 PIRAMAL GLASS CEYLON PLC GLAS.N0000 567,423,605 567,159,200 264,405 3,624,074 7.3 2,591,169 CHEVRON LUBRICANTS LANKA PLC LLUB.N0000 39,685,643 39,669,043 16,600 108,104 15.4 1,809,400 JOHN KEELLS PLC JKL.N0000 234,960 218,015 16,945 59,322 28.6 1,418,297 CIC HOLDINGS PLC (X) CIC.X0000 3,511,252 3,483,738 27,514 858,562 3.2 1,317,921 NET FOREIGN PURCHASE (TOP TEN) 52,228,863 FOREIGN PURCHASE (TOTAL) 149,626,332 Foreign Sales SAMPATH BANK PLC SAMP.N0000 49,752,499 50,713,780 (961,281) 2,948,613 32.6 (187,690,115) HATTON NATIONAL BANK PLC HNB.N0000 90,479,629 91,019,351 (539,722) 1,012,713 53.3 (81,363,092) ROYAL CERAMICS LANKA PLC RCL.N0000 1,825,896 1,946,188 (120,292) 826,955 14.5 (46,071,836) HATTON NATIONAL BANK PLC (X) HNB.X0000 25,447,044 25,629,644 (182,600) 625,195 29.2 (21,546,800) -

Colombo, a Modern City in the Making…

Colombo, a modern city in the making | July 2013 | Colombo, a modern city in the making… Colombo city calls for the need of development towards an urbanized metropolis in transforming to a regional hub. Steps have been taken by means of improving the quality of the road network and beautification of the city to make the metropolis one of the greenest and cleanest cities in Asia. To cater to the required capacity increase in hotels, apartments, office and retail space, many projects including mixed developments have been proposed. However due to back and forth movements in certain policies and other delays, only few out of the announced projects are currently underway while the others are expected in the medium term. Therefore due to the disparity between the currently needed capacity and actually completed, a deficit in supply exists. Thus we believe that there would not be a glut due to these projects being automatically phased out. The government through the state owned Urban Development Authority is involved in the city development whilst many private companies have proposed projects. However out of the listed companies, few such as John Keells Holdings (JKH : LKR260.10), Colombo Land and Development (CLND : LKR43.70), Overseas Realty (OSEA : LKR18.50) and Access Engineering (AEL : LKR20.30) have grasped such opportunities. In the five star city hotel segment a shortfall of c.1,500 hotel rooms (by 2016) would be seen in meeting the expected tourist arrivals trend where the city is currently equipped with 2,000 hotel rooms. A deficit would be evident till 2016/17 as only two five star hotels out of the proposed projects are off ground currently (of capacity 700 rooms). -

Annual Report 2018/19 Contents

ANNUAL REPORT 2018/19 CONTENTS ODEL AT A GLANCE | 02 2018/19 IN BRIEF | 03 CHAIRMAN’S MESSAGE | 04 BOARD OF DIRECTORS | 08 SENIOR MANAGEMENT TEAM | 10 MANAGEMENT DISCUSSION & ANALYSIS THE OPERATING ENVIRONMENT | 15 VALUE CREATING BUSINESS MODEL | 19 ODEL IN CONTEXT | 20 FINANCIAL REVIEW| 20 OUR BRANDS | 22 STRATEGIC FOCUS AREAS | 27 HUMAN CAPITAL | 29 CORPORATE GOVERNANCE | 40 RISK MANAGEMENT | 43 REPORT OF THE RELATED PARTY TRANSACTIONS REVIEW COMMITTEE | 47 REPORT OF THE REMUNERATION COMMITTEE | 48 REPORT OF THE AUDIT COMMITTEE | 49 FINANCIAL INFORMATION ANNUAL REPORT OF THE BOARD OF DIRECTORS ON THE AFFAIRS OF THE COMPANY | 53 STATEMENT OF DIRECTORS’ RESPONSIBILITY | 56 INDEPENDENT AUDITOR’S REPORT | 57 STATEMENT OF INCOME | 60 STATEMENT OF COMPREHENSIVE INCOME | 61 STATEMENT OF FINANCIAL POSITION | 62 STATEMENT OF CHANGES IN EQUITY | 64 STATEMENT OF CASH FLOWS | 65 NOTES TO THE FINANCIAL STATEMENTS | 66 INVESTOR INFORMATION | 127 NOTICE OF MEETING | 129 FORM OF PROXY | ENCLOSED CORPORATE INFORMATION | INNER BACK COVER VISION To inspire the world. MISSION To provide a complete Mind, Body and Soul experience as the premier fashion and lifestyle retailer promoting sustainable and unparalleled levels of retail experience. OUR VALUES Odel is guided by strong shared values. We love, we serve, we style, we innovate, we give, we save, we enjoy and we inspire ODEL AT A GLANCE Odel includes a number of private brands, each with their unique identity and an extensive portfolio of OUR BRANDS international brands. NUMBER OF STORES EXPANDING OUR REACH WITH 64 LARGE DEPARTMENT STORES Department store in Shangri-La’s massive new mall – ‘The Mall at One Galle Face’ Scheduled to open in 2019 Size: 100,000 square feet Efficient use of resources is a guiding principle behind our facilities: offices, stores and OUR SUSTAINABILITY LOGISTICS logistics operations. -

Guardian Acuity Equity Fund Open Ended Growth Fund June 2021 Tel: +94 112039377 E-Mail: [email protected]

Guardian Acuity Equity Fund Open Ended Growth Fund June 2021 Tel: +94 112039377 E-mail: [email protected] HIGHLIGHT Crishani Perera The fund recorded a 1.29% return for the month and 2.52% return for 3 Months. The Fund Manager Accelerated vaccine rollouts and generally strong economic data in developed YTD return of the fund was 2.19% vs.benchmark ASPI return of 15.70%. economies led to strong gains in equities with S&P 500 leading with an 8.5% RETURNS* gain during 2Q whilst European stocks followed closely with a 7.1% return. The vaccination programs in rest of the Europe is now catching up with the BENCHMARK PERIOD* FUND S&P SL 20 ASTRI ASPI UK & US. The reopening of economies and a fast rebound in activity has fueled 2021 June 1.29% 5.87% -0.35% 5.88% inflation in some of the developed economies which is expected to contribute 3 Months 2.52% 10.06% 4.15% 10.12% to market jitters in the 2H. The emerging equities lagged with a 5.1% gain Year To Date (YTD 2021) 2.19% 15.70% 12.52% 15.84% during 2Q amidst slow vaccination rollout in most economies, policy Since Inception Cum. 85.21% 43.11% 0.43% 58.15% tightening and regulatory concerns in China. 3.91% 0.05% 5.03% Since Inception CAGR 6.82% Note : All Share Price Index (ASPI) ,All Share Total Return Index(ASTRI) & S&P Srilanka 20 Index (S&P SL 20) are based on CSE data as of 30th June 2021 Retail activity continued to dominate the local equities as notable price gains * Performances are based on month end prices as of 30th June 2021. -

Sri Lanka Equities Aspi ^ 4.46% | S&P Sl20 ^ 7.04%

ACUITY STOCKBROKERS RESEARCH | SRI LANKA EQUITIES Weekly Market Review 02 Nov 2018 th nd ASPI Hits 2-Month High Amid Higher Volatility… LKR Indices vs. Turnover (29 Oct – 02 Nov) Falls as Foreign Sell-Off of Assets Increases… 6,300 3,500 ASPI Increases 6,200 S&P SL20 3,400 S&P SL20 S&P ASPI ^ 4.46% | S&P SL20 ^ 7.04% 6,100 3,300 ASPI 6,000 3,200 The Bourse ended the week… Cont. P2 5,900 3,100 5,800 3,000 29-Oct 30-Oct 31-Oct 01-Nov02-Nov Foreign investors closed the week... Cont. P3 5.00 4.00 3.00 Equity market volatility ….… Cont. P4 2.00 LKR Bn) LKR (Turnover 1.00 0.00 Economic Snapshot………… P5 29-Oct 30-Oct 31-Oct 01-Nov 02-Nov KEY STATISTICS Week ending 02-Nov 26-Oct +/- ASPI 6,092.21 5,831.96 4.46% S&P SL20 3,208.43 2,997.33 7.04% Banking & Finance 16,242.78 15,368.05 5.69% Food & Beverage 24,368.96 24,096.79 1.13% Diversified 1,591.90 1,482.33 7.39% Hotel & Travel 2,677.50 2,642.53 1.32% Plantations 749.11 725.44 3.26% Manufacturing 2,963.05 2,742.56 8.04% Turnover (LKR Bn) 9.92 3.15 215.37% Foreign Buying (LKR Mn) 2,656.24 1,959.06 35.59% Foreign Selling (LKR Mn) 6,519.96 2,403.48 171.27% Daily Average Turnover (LKR Bn) 1.98 0.79 152.29% Daily Average Foreign Buying (LKR Mn) 531.25 489.76 8.47% Daily Average Foreign Selling (LKR Mn) 1,303.99 600.87 117.02% TOP 10 GAINERS TOP 10 LOSERS Opening Closing WoW % Opening Closing WoW % Company Code Company Code Price Price Change Price Price Change MTD WALKERS KAPIN 8.0 12.9 61.3% KELSEY KDL N 35.0 29.5 -15.7% BLUE DIAMONDS[NV] BLUEX 0.2 0.3 50.0% UDAPUSSELLAWA UDPL 35.0 29.6 -15.4% AMANA LIFE ATLLN 9.0 12.9 43.3% MERC.