Annual Report 2016 Www

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chevron Corporation 1995 Annual Report

Chevron Corporation 1995 Annual Report New Prospects. New Perspectives. CHEVRON CORPORATION 1995 ANNUAL REPORT Table of Contents Chevron at a Glance 1 TO OUR STOCKHOLDERS BUSINESS AREAS OF OPERATION 3 FINANCIAL HIGHLIGHTS EXPLORATION AND PRODUCTION Explores for and produces crude oil and Major producing areas include the 4 OPERATING HIGHLIGHTS natural gas in the United States and 24 Gulf of Mexico, California, the Rocky 6 THE CHEVRON WAY other countries. Third-largest U.S. natu- Mountains, Texas, Canada, the North The company’s Mission and ral gas producer. Worldwide net produc- Sea, Australia, Indonesia, Angola, Vision statements tion was more than 1.4 million barrels a Nigeria and Kazakstan. Exploration day of oil and equivalent gas. areas include the above, as well as 7 NEW PROSPECTS. Competitive Advantage: Balanced U.S. frontiers such as Bolivia, Colombia, NEW PERSPECTIVES. and international short- and long-term Congo, Peru, Ireland and Namibia. STRATEGIES FOR THE FUTURE opportunities create high-value portfolio. 10 Build a committed team to accomplish the corporate mission. REFINING Converts crude oil into a variety of Principal U.S. locations are El Segundo 10 Continue exploration and pro- refined products, including motor gaso- and Richmond, Calif.; Pascagoula, duction growth in international line, diesel and aviation fuels, lubri- Miss.; Salt Lake City, Utah; El Paso, areas. cants, asphalt, chemicals and other Texas; and Honolulu, Hawaii. Also re- 14 Generate cash from North products. Chevron is one of the largest fines in Canada, Wales and (through its American exploration and pro- refiners in the United States. Caltex affiliate) Asia, Africa, the Mid- duction operations, while main- Competitive Advantage: Largest supplier dle East, Australia and New Zealand. -

Chevron 2006 Annual Report

2006 Annual Report LETTER TO STOCKHOLDERS 2 EMERGING ENERGY 10 OPERATING HIGHLIGHTS 18 FIVE-YEAR OPERATING SUMMARY 85 THE ENERGY PORTFOLIO: EFFICIENT ENERGY 12 GLOSSARY OF ENERGY FIVE-YEAR FINANCIAL SUMMARY 86 CONVENTIONAL ENERGY 6 HUMAN ENERGY 14 AND FINANCIAL TERMS 24 BOARD OF DIRECTORS 1 0 1 UNCONVENTIONAL ENERGY 8 CHEVRON PERSPECTIVES 16 FINANCIAL REVIEW 25 CORPORATE OFFICERS 102 Demand for energy continues to rise, posing a clear challenge for our industry: how to develop new and better ways to produce, process, use and deliver all forms of energy — from conventional crude oil and natural gas to the emerging sources of the future. At Chevron, we recognize the world needs all the energy we can develop, in every potential form. We’re managing our energy portfolio to deliver that energy — and to create growth and value for our stockholders, our customers, our business partners and the communities where we do business. The energy portfolio CONVENTIONAL UNCONVENTIONAL EMERGING EFFICIENT HUMAN ENERGY ENERGY ENERGY ENERGY ENERGY 6 8 10 12 14 TO OUR STOCKHOLDERS 2006 was an exceptional year for our company. We continued to deliver value to our stockholders and to make strategic investments that will drive sustained, superior performance over the long term. We reported record net income of $17.1 billion on sales and other operating revenues of approximately $205 billion. For the year, total stockholder return was 33.8 percent, which was more than double the rate of return delivered by the S&P 500. Return on capital employed was a strong 22.6 percent. We continued to return cash to stock- holders through our stock buyback program, purchasing $5 billion worth of shares in the open market, and we increased our annual dividend for the 19th year in a row. -

Expolanka Holdings Plc Integrated Annual Report

EXPOLANKA HOLDINGS PLC INTEGRATED ANNUAL REPORT 2020/21 EXPOLANKA HOLDINGS PLC | INTEGRATED REPORT 2020/21 2 fruitionEXPOLANKA HOLDINGS PLC | INTEGRATED ANNUAL REPORT 2020/21 At Expolanka, we remain fully committed to our promise made several years ago, to drive long term sustainable value, by adapting a focused, constant and consistent strategy. Even though the year under review post several challenges, we were able to pursue our said strategies and bring to fruition our plans for progress which was fueled by our innate resilience and strength. The seeds we planted have taken root and we keep our focus upward, expanding in our focused direction in order to adapt to the current environment. We remain fruitful in our optimism, our can-do attitude and endurance, a recipe for success that will carry us through to more opportunity. Overview EXPOLANKA HOLDINGS PLC | INTEGRATED ANNUAL REPORT 2020/21 2 CONTENTS Chairman’s Overview Compliance Reports 12 About Us 3 Corporate Governance 71 Message About this Report 4 Risk Management Report 93 Group Milestones 5 Related Party Transactions Financial Highlights 6 Review Committee Report 101 15 Group CEO’s Highlights of the Year 7 Remuneration Committee Report 103 Review Chairman’s Message 12 Group CEO’s Review 15 Financial Reports Board of Directors 18 Annual Report of the Board of Directors Group Senior Management Team 20 on the Affairs of the Company 108 23 Financial Indicators 22 The Statement of Directors’ Responsibility 112 Performance Group Performance 23 Audit Committee Report 113 Overcoming -

Annual Report 2012/2013

THE PURSUIT OF EXCELLENCE One hundred years of passion, hard work and perseverance have brought to where we are today: a highly respected, fast growing blue chip conglomerate with interests in several key growth industry sectors: beverages, telecommunications, plantations, hotels, textiles, finance, insurance, power genaration, media and logistics. And yet, we will not rest. Our story is far from over. Indeed, it has only just begun. Look to us for even greater achievements as we step into the next century of our lifetime, to build further upon our current successes. DCSL. 100 years in the passionate pursuit of excellence. Distilleries Company of Sri Lanka PLC | Annual Report 2012/13 1 Financial Highlights 2013 2012 2013 2012 Group Group Company Company Summary of Results Gross Turnover Rs Mn 65,790 63,125 51,549 49,136 Excise Duty Rs Mn 37,024 36,150 34,088 33,860 Net Turnover Rs Mn 28,766 26,975 17,461 15,276 Profit After Tax Rs Mn 5,258 6,052 6,873 4,297 Shareholders Funds Rs Mn 47,978 41,576 39,155 32,597 Working Capital Rs Mn (1,298) (3,234) (6,139) (21,374) Total Assets Rs Mn 78,245 73,355 55,942 62,563 Staff Cost Rs Mn 3,194 3,155 1,039 1,080 No. of Employees 18,674 18,158 1,343 1,389 Per Share Basic Earnings* Rs. 17.13 18.45 10.68 11.85 Net Assets Rs. 159.93 138.59 130.52 108.66 Dividends Rs. 3.00 3.00 3.00 3.00 Market Price - High Rs. -

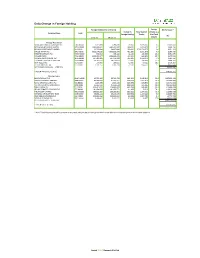

Daily Change in Foreign Holding

Daily Change in Foreign Holding Foreign Holding (No. of Shares) Foreign Net Turnover * Change in Total Volume Volume as a Company Name Code Foreign Holding Traded % of Total Rs. Volume 1-Feb-21 29-Jan-21 Foreign Purchases LANKA ORIX LEASING COMPANY PLC LOLC.N0000 2,313,835 2,286,635 27,200 2,699,110 1.0 13,702,000 EXPOLANKA HOLDINGS LIMITED EXPO.N0000 1,483,800,622 1,483,612,587 188,035 9,893,475 1.9 9,646,196 BROWNS INVESTMENTS LIMITED BIL.N0000 39,790,648 38,857,648 933,000 2,710,774,277 0.0 6,251,100 DIALOG AXIATA PLC DIAL.N0000 7,503,174,020 7,502,692,370 481,650 5,891,576 8.2 6,068,790 SWISSTEK (CEYLON) PLC PARQ.N0000 536,541 495,422 41,119 183,663 22.4 5,951,975 RICHARD PIERIS RICH.N0000 1,535,157,477 1,534,940,476 217,001 643,305 33.7 3,472,016 PIRAMAL GLASS CEYLON PLC GLAS.N0000 567,423,605 567,159,200 264,405 3,624,074 7.3 2,591,169 CHEVRON LUBRICANTS LANKA PLC LLUB.N0000 39,685,643 39,669,043 16,600 108,104 15.4 1,809,400 JOHN KEELLS PLC JKL.N0000 234,960 218,015 16,945 59,322 28.6 1,418,297 CIC HOLDINGS PLC (X) CIC.X0000 3,511,252 3,483,738 27,514 858,562 3.2 1,317,921 NET FOREIGN PURCHASE (TOP TEN) 52,228,863 FOREIGN PURCHASE (TOTAL) 149,626,332 Foreign Sales SAMPATH BANK PLC SAMP.N0000 49,752,499 50,713,780 (961,281) 2,948,613 32.6 (187,690,115) HATTON NATIONAL BANK PLC HNB.N0000 90,479,629 91,019,351 (539,722) 1,012,713 53.3 (81,363,092) ROYAL CERAMICS LANKA PLC RCL.N0000 1,825,896 1,946,188 (120,292) 826,955 14.5 (46,071,836) HATTON NATIONAL BANK PLC (X) HNB.X0000 25,447,044 25,629,644 (182,600) 625,195 29.2 (21,546,800) -

Chevron 2007 Annual Report Supplement

Energy Performance 2007 Supplement to the Annual Report Table of Contents Overview 1 2007 at a Glance 2 Financial Information Upstream 11 Highlights 14 United States 18 Africa 23 Asia-Pacific 30 Indonesia 32 Other International 38 Gas 39 Operating Data Downstream 49 Highlights 50 Refining 51 Marketing 52 Lubricants 52 Supply & Trading 53 Transportation 54 Operating Data Chemicals 60 Chevron Phillips Chemical Company LLC 61 Chevron Oronite Company Other Businesses 63 Technology 64 Power Generation 64 Chevron Energy Solutions 65 Mining Reference 66 Glossary of Energy and Financial Terms 68 Organizations Cautionary Statement Relevant to Forward-Looking Information for the Purpose of “Safe Harbor” Provisions of the Private Securities Litigation Reform Act of 1995 This 2007 Supplement to the Annual Report of Chevron Corporation contains forward-looking statements relating to Chevron’s operations that are based on management’s current expectations, estimates and projections about the petroleum, chemicals and other energy-related industries. Words such as “anticipates,” “expects,” “intends,” “plans,” “targets,” “projects,” “believes,” “seeks,” “schedules,” “estimates,” “budgets” and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond the company’s control and are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. The reader should not place undue reliance on these forward-looking statements, which speak only as of the date of this report. Unless legally required, Chevron undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. -

Annual Report 2014

BLENDING WITH THE NATION'S GROWTH Chevron Lubricants Lanka PLC Annual Report 2014 CONTENTS Chevron Lubricants Lanka PLC Our Vision / 02 Chevron House, 490, Galle Road, Financial Highlights / 03 Colombo, Sri Lanka Status: Listed Chairman’s Review / 06 Legal Form: Public Limited Company Managing Director’s Review of Operations / 08 Financial Auditors: PricewaterhouseCoopers Board of Directors / 12 www.chevron.com Management Team / 14 Management Discussion & Analysis / 18 Chevron Lubricants Lanka PLC engages Financial Review / 24 in blending, manufacturing, importing, Corporate Social Responsibility Report / 26 distributing, and marketing lubricants oils, Corporate Governance / 30 greases, brake fluids, and specialty products Risk Management / 35 in Sri Lanka. The Company offers its products for industrial, commercial, and consumer applications. Chevron Lubricants Lanka Financial Calender / 37 PLC markets its products under Chevron, Annual Report of the Directors / 38 Caltex, and Texaco brands. The Company was Statement of Directors’ Responsibilities / 40 incorporated in 1992 and is based in Colombo, Audit Committee Report / 41 Sri Lanka. Remuneration Committee Report / 42 Independent Auditor’s Report / 43 Income Statement / 44 Statement of Comprehensive Income / 45 Chevron Lubricants Statement of Financial Position / 46 Lanka PLC Statement of Changes in Equity / 47 Annual Report 2014 Cash Flow Statement / 48 Notes to the Financial Statements / 49 Statement of Value Added / 73 Ten Year Summary / 74 Shareholder Information / 75 Notice of Annual General Meeting / 77 Form of Proxy / 79 Scan this QR code with your smart device to view this version of the Annual report online www.chevron.lk/reports GROWTHBLENDING WITH THE NATION'S Chevron Lanka has always been a benchmark of business excellence in Sri Lanka, with a strong focus on value creation at every level of our business and production process. -

The Annual Report on Sri Lanka's Most Valuable and Strongest Brands April

Sri Lanka 100 2018 The annual report on Sri Lanka’s most valuable and strongest brands April 2018 Contents. Foreword - David Haigh 4 Foreword - Ruchi Gunewardene 5 About Brand Finance 6 Consulting Services 7 Definitions 8 Executive Summary 10 Consumer Brands Table 14 Understand Your Brand’s Value 16 Methodology 17 Our Clients 18 Our Services in Sri Lanka 19 Our People 20 Foreword. The Annual Review of Sri Lanka’s Brands. What is the purpose of a strong brand: to attract customers, to build loyalty, to Brand Finance Lanka has been publishing Sri Lanka’s brand league table consisting motivate staff? All true, but for a commercial brand at least, the first answer must of the most valuable brands for 15 consecutive years. Over the years, we have added always be ‘to make money’. and enhanced this so as to provide our readers with a well researched and definitive annual guide to the most valuable and strongest brands that are operating in Sri Huge investments are made in the design, launch, and ongoing promotion of Lanka. brands. Given their potential financial value, this makes sense. Unfortunately, most organisations fail to go beyond that, missing huge opportunities to Doing so requires data for a fact-based analysis and we use two sources. One is the effectively make use of what are often their most important assets. Monitoring of financial data available from listed companies on the Colombo Stock Exchange brand performance should be the next step, but is often sporadic. Where it does (CSE) and the other is the exclusive market research study that is conducted for take place, it frequently lacks financial rigour and is heavily reliant on qualitative Brand Finance Lanka. -

Appendix D: Securities Held by Funds

Annual Report of Activities Pursuant to Act 44 of 2010 September 30, 2015 Appendix D: Securities Held by Funds The Four Funds hold thousands of publicly and privately traded securities. Act 44 directs the Four Funds to publish “a list of all publicly traded securities held by the public fund.” For consistency in presenting the data, a list of all holdings of the Four Funds is obtained from Pennsylvania Treasury Department. The list includes privately held securities. Some privately held securities lacked certain data fields to facilitate removal from the list. To avoid incomplete removal of privately held securities or erroneous removal of publicly traded securities from the list, the Four Funds have chosen to report all publicly and privately traded securities. The list below presents the securities held by the Four Funds as of June 30, 2015. 1011778 BC ULC / NEW RED 144A ABCAM PLC ACCELYA KALE SOLUTIONS LTD 198 INVERNESS DRIVE WEST ABC-MART INC ACCENTURE PLC 21ST CENTURY FOX AMERICA INC ABC-MART INC NPV CFD ACCESS CIG 10/14 TL 21ST CENTURY ONCOLOGY 4/15 TL ABENGOA SA ACCIONA SA 22ND CENTURY GROUP INC ABENGOA YIELD PLC ACCO BRANDS CORP 32 CAPITAL FUND LTD (THE) ABERCROMBIE & FITCH CO ACCOR SA 361 DEGREES INTERNATIONAL LTD ABERDEEN ASSET MANAGEMENT PLC ACCRETIVE CO LTD CFD 3D SYSTEMS CORP ABERTIS INFRAESTRUCTURAS SA ACCRUED INTEREST FOR PRIVATE 3I GROUP PLC ABILITY ENTERPRISE CO LTD ACCTON TECHNOLOGY CORP 3M CO ABILITY NETWORK 5/14 COV-LITE ACCUVANT 12/14 COV-LITE 2ND 4L TECHNOLOGIES 5/14 COV-LITE ABINGWORTH BIOVENTURE V LP ACCUVANT 12/14 -

Line Rider Issue 5

Line Rider Chevron - Global Related Features North America Upstream’s ‘base business’ is racking up solid gains – and redefining the How It Works: status quo. Steamflooding – the 80 Percent Solution These operations might lack the glamour of new growth projects, but they currently account for more than 35 percent of Chevron’s net income. Read about CNAEP’s ‘base business’ achievements Issue 5, Dec. 2005 Also in This Issue Welcome to Tengiz – the Town HOW IT WORKS: Steamflooding – the 80 2005: The Year in Chevron Percent Solution HOW IT WORKS: Watch animation LETTER FROM... On Board the Gemini Voyager VOICES: How Did You Come to Work for Chevron? LETTERS TO THE EDITOR Last Update: 8 December 2005 Content Contact: PGPA - Internal Communications Company Confidential ©2005 Chevron Corporation Technical Contact: PGPA - Internal Communications Opco: PGPA Quiet Stars CNAEP’s Base Business Racks Up Solid Gains and Redefines the Status Quo by John Kelly orth America’s base business might lack the glamour of new growth projects, N but it currently accounts for more than 35 percent of Chevron’s net income. The production figures for the 105-year-old Kern River oil field in California’s San Joaquin Valley are a testament to hard-knuckled perseverance as much as to advances in technology. Output was said to have peaked at 60,000 barrels of oil a day in the early 1900s and, indeed, it gradually dropped by 75 percent. By the mid-1960s, however, the field benefited from a new heavy oil technology called steamflooding and reached a new high of 120,000 barrels a day. -

2015 Supplement to the Annual Report

2015 supplement to the annual report Chevron Corporation 2015 Supplement to the Annual Report FC table of contents Overview Upstream Downstream Technology Reference 1 2015 at a glance 9 Highlights 39 Highlights 48 Technology 50 Glossary of energy 2 Financial information 13 United States 40 Refining and and financial terms 17 Other Americas marketing 52 Additional information 20 Africa 41 Lubricants 23 Asia 41 Supply and trading 28 Australia/Oceania 41 Chemicals 30 Europe 42 Transportation 31 Operating data 43 Operating data Cover photo: The 37,000-metric-ton Wheatstone topsides were installed onto the steel gravity structure in April 2015, forming the Wheatstone platform. Chevron Corporation 2015 Supplement to the Annual Report Inside front cover photo: The Wheatstone platform topsides departed the fabricationFD yard in March 2015. 2015 at a glance financial highlights sales and other operating revenues $129.9 billion net income attributable to chevron corporation $4.6 billion, $2.45 per share - diluted return on capital employed 2.5% cash flow from operations $19.5 billion cash dividends $4.28 per share corporate strategies Portfolio management – Realized $5.7 billion in proceeds from asset divestments. Financial-return objective – Create shareholder value and achieve sustained financial returns from operations that will enable Chevron Upstream – Achieved an exploration drilling success rate of to outperform its competitors. Exploration 62 percent with 36 discoveries worldwide, and added 1.8 billion Enterprise strategies – Invest in people to strengthen organizational barrels of oil-equivalent resources. Continued shale and tight capability and develop a talented global workforce that gets results resource drilling programs in Argentina, Canada and the the right way. -

EPF Department of Central Bank of Sri Lanka Listed Equity Portfolio (Trading) As at 30/09/2018

EPF Department of Central Bank of Sri Lanka Listed Equity Portfolio (Trading) as at 30/09/2018 Rs. 000 Original Purchased No. Company Name No. of Shares Market Value Cost 1 ACL Cables Ltd 407,166 22,978.15 15,146.58 2 ACL Placstics PLC 153,063 19,892.82 12,183.81 3 Access Engineering PLC 4,694,885 102,915.50 65,258.90 4 Aitken Spence Co 3,170,859 280,028.13 136,029.85 5 Aitken Spence Hotels 2,838,466 164,977.10 71,529.34 6 Asian Hotels & Properties PLC 1,907,562 96,297.36 75,539.46 7 Balangoda Plantations 1,351,098 40,338.11 17,699.38 8 Bogawantalawa Tea State PLC 81,724 1,463.19 817.24 9 Browns & Co PLC 249,050 25,399.54 12,452.50 10 Browns Capital PLC 104,900 524.50 356.66 11 Browns Investment PLC_Voting 2,082,858 3,689.83 3,957.43 12 Bukith Darah 3,639 2,613.79 764.19 13 C W Mackie PLC 139,740 12,643.85 6,288.30 14 CIC Holdings PLC - Non Voting 341,335 29,551.80 12,083.26 15 CIC Holdings PLC Voting 1,114,909 119,043.32 52,400.72 16 Cargills (Cey) PLC 16,514 2,274.24 3,301.21 17 Carsons Cumberbatch PLC 30,429 13,160.41 5,172.93 18 Central Finance Company PLC 654,169 74,971.02 59,660.25 19 Ceylon Guardian Investment PLC 229,142 40,107.95 16,039.92 20 Ceylon Hospitals PLC - Voting 1,076,985 106,534.11 80,666.18 21 Ceylon Tea Services PLC 32,225 23,494.57 17,788.20 22 Ceylon Theatres 50,016 6,506.74 9,002.86 23 Chemanex PLC 23,288 1,454.47 1,276.18 24 DIMO PLC 125,282 88,707.20 43,811.12 25 Dialog Telekom 48,068 505.44 572.01 26 Dipped Products 582,865 65,127.94 44,880.61 27 EXPOLANKA HOLDINGS PLC_VOTING 966,450 8,420.58 3,865.80 28 Hayleys