INSTALLATION GUIDE for OXID Eshop

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

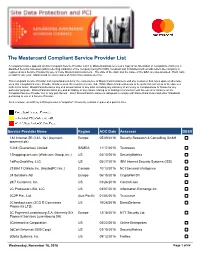

The Mastercard Compliant Service Provider List

The Mastercard Compliant Service Provider List A company’s name appears on this Compliant Service Provider List if (i) MasterCard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) MasterCard records reflect the company is registered as a Service Provider by one or more MasterCard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. MasterCard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of MasterCard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While MasterCard endeavors to keep the list current as of the date set forth in the footer, MasterCard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. MasterCard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each MasterCard Customer is obligated to comply with MasterCard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Service Provider Name Region AOC Date Assessor DESV 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/09/2016 Security Research & Consulting GmbH ipayment.de) 1Link (Guarantee) Limited SAMEA 11/17/2015 Trustwave 1Shoppingcart.com (Web.com Group, lnc.) US 04/13/2016 SecurityMetrics 1stPayGateWay, LLC US 05/27/2016 IBM Internet Security Systems (ISS) 2138617 Ontario Inc. -

Service Provider Name Region AOC Date Assessor DESV

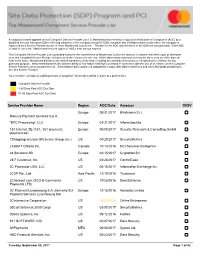

A company’s name appears on this Compliant Service Provider List if (i) Mastercard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) Mastercard records reflect the company is registered as a Service Provider by one or more Mastercard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. Mastercard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of Mastercard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While Mastercard endeavors to keep the list current as of the date set forth in the footer, Mastercard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. Mastercard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each Mastercard Customer is obligated to comply with Mastercard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Compliant Service Provider 1-60 Days Past AOC Due Date 61-90 Days Past AOC Due Date Service Provider Name Region AOC Date Assessor DESV “BPC Processing”, LLC Europe 03/31/2017 Informzaschita 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/08/2017 Security Research & Consulting GmbH ipayment.de) 1Shoppingcart.com (Web.com Group, lnc.) US 04/29/2017 SecurityMetrics 2138617 Ontario Inc. -

Service Provider Name Region AOC Date Assessor DESV

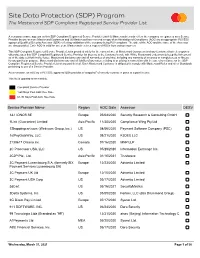

A company’s name appears on this Compliant Service Provider List if (i) Mastercard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) Mastercard records reflect the company is registered as a Service Provider by one or more Mastercard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. Mastercard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of Mastercard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While Mastercard endeavors to keep the list current as of the date set forth in the footer, Mastercard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. Mastercard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each Mastercard Customer is obligated to comply with Mastercard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Compliant Service Provider 1-60 Days Past AOC Due Date 61-90 Days Past AOC Due Date Service Provider Name Region AOC Date Assessor DESV Europe 08/31/2017 Bl4ckswan S.r.l. -

Novalnet Payment Module for Magento

Feringastr. 4 85774 Unterföhring Germany Tel: +49 89 9230683-19 Fax: +49 89 9230683-11 Installation Guide for Novalnet Magento Module Version Date Remarks 12.1.1 07.07.2021 [Fix] Adjusted the redirect payment methods to adapt to the latest shop version 2.4.2-p1 [Fix] Callback/Webhook order status update during credit payments [Fix] Invoice mail generation for every transaction captured for invoice payments in the shop admin For previous version changelog, go to https://github.com/Novalnet-AG/magento2-payment-integration-novalnet/blob/master/changelog.txt NOVALNET AG Tel.: +49 89 9230683-19 Board of Directors: Gabriel Dixon (CEO), Johnson Rajdaniel (CFO) Payment Institution Fax: +49 89 9230683-11 Chairman of the supervisory Board: Frank Haussmann Feringastr. 4 E-mail: [email protected] Commercial register number: HRB 167381 85774 Unterföhring Tax id: DE254954139 TABLE OF CONTENTS 1 QUICK SETUP .................................................................................................................................. 3 1.1 Module Installation .............................................................................................................................. 3 1.1.1 Module Installation via Composer ..................................................................................................... 3 1.1.2 Module Installation via Package ........................................................................................................ 4 1.2 Upgrading the Novalnet Payment Module.......................................................................................... -

Registros De Entidades 2016

REGISTROS DE ENTIDADES 2016 SITUACION A 31 DE DICIEMBRE DE 2016 BANCO DE ESPAÑA INDICE Página CREDITO OFICIAL ORDENADO ALFABETICAMENTE ........................................................................................................ 9 ORDENADO POR CODIGO B.E. ......................................................................................................... 11 BANCOS ORDENADO ALFABETICAMENTE ...................................................................................................... 15 ORDENADO POR CODIGO B.E. ......................................................................................................... 17 CAJAS DE AHORROS ORDENADO ALFABETICAMENTE ...................................................................................................... 27 ORDENADO POR CODIGO B.E. ......................................................................................................... 29 COOPERATIVAS DE CREDITO ORDENADO ALFABETICAMENTE ...................................................................................................... 33 ORDENADO POR CODIGO B.E. ......................................................................................................... 35 ENTIDADES DE DINERO ELECTRONICO ORDENADO ALFABETICAMENTE ...................................................................................................... 47 ORDENADO POR CODIGO B.E. ......................................................................................................... 49 ESTABLECIMIENTOS FINANCIEROS DE CREDITO ORDENADO -

Visa Europe Merchant Agent List

Visa Europe Merchant Agent List Effective November 2019 ______________________________________________________________________ Please note: the Merchant Agent Self Registration Programme is now CLOSED and we will not be accepting any further self-registrations. What to do going forward: Visa clients will be required to register their merchant agents via the PRM tool. These changes were communicated in a Visa Business News article to clients, dated 6 June 2019. Merchant Agents will now be registered by the Visa Client as Merchant Servicers through the Program Request Management (PRM) Tool. This will replace the current self-registration process via the Merchant Agent Registration Form (MARF). The current weblisting will be removed 31 December 2019 and Merchant Servicers will be listed on the Visa Global Registry of Service Providers. Please work with your acquirer(s) to register you as a Merchant Servicer. If the acquirer does not register your organization as a client, you will be at risk of not being listed as on the Visa Global Registry of Service Providers. All the Merchant Agents listed below have successfully completed a Merchant Agent Registration Form (MARF). The listed Merchant Agents have validated Payment Card Industry Data Security Standard (PCI DSS) compliance for the services indicated unless they have confirmed their services are out of scope of PCI DSS (see validation method). 1 The validation date is when the Merchant Agent was last PCI DSS validated. PCI DSS assessments are valid for one year, with the next annual PCI DSS validation due one year from the validation date. PCI DSS revalidations that are 1 to 30 days late are noted in orange, and PCI DSS revalidations that are 31 to 60 days late are noted in red. -

American Express Integrated Payments Providers.Xlsx

Operating Provider Name Service Provider Type URL Region Independent Software Vendor (ISV) Merchant Servicer (MS) 1&1 IONOS SE SafeKey MPI https://ipayment.de Germany PSP/Processor/Aggregator 2C2P Pte Ltd SafeKey http://www.2c2p.com Singapore 3G Direct Pay Ltd PSP/Processor/Aggregator https://www.directpay.online/ Ireland Independent Sales Organization (ISO) Independent Software Vendor (ISV) Integrated Point of Sale (iPOS) Merchant Servicer (MS) Aava Mobile SAS Value Added Reseller (VAR) http://www.oonacloud.com France mPOS Abacix S.C. PSP/Processor/Aggregator http://www.algebraix.com Mexico Independent Sales Organization (ISO) Independent Software Vendor (ISV) Integrated Point of Sale (iPOS) Merchant Servicer (MS) ABC Financial Services Value Added Reseller (VAR) https://abcfitness.com/ United States Abcchildcare Merchant Servicer (MS) http://www.abcchildcarellc.bugcommerce.com United States mPOS Abrantix AG SoftPOS https://www.abrantix.com/en/ Switzerland Integrated Point of Sale (iPOS) Access Limited mPOS http://www.access-is.com United Kingdom Independent Sales Organization (ISO) Independent Software Vendor (ISV) Integrated Point of Sale (iPOS) Merchant Servicer (MS) mPOS ACI Worldwide PSP/Processor/Aggregator http://www.aciworldwide.com United States 1/22/2021 AXP Internal 1 Merchant Servicer (MS) PSP/Processor/Aggregator SafeKey Adflex Limited SafeKey MPI http://www.adflex.co.uk United Kingdom PSP/Processor/Aggregator ADVAM Pty Ltd SafeKey MPI http://www.advam.com Australia Advanced Card Systems Ltd. mPOS http://www.acs.com.hk/ Hong Kong mPOS Advanced Mobile Payments PSP/Processor/Aggregator Inc SafeKey MPI http://www.amobilepayment.com Canada Independent Software Vendor (ISV) Advanced Mobile Payments Integrated Point of Sale (iPOS) Inc (US) Value Added Reseller (VAR) http://www.amobilepayment.com United States Merchant Servicer (MS) mPOS PSP/Processor/Aggregator Adyen N.V. -

SDP) Program the Mastercard SDP Compliant Registered Service Provider List

Site Data Protection (SDP) Program The Mastercard SDP Compliant Registered Service Provider List A company’s name appears on this SDP Compliant Registered Service Provider List if (i) Mastercard records reflect the company is registered as a Service Provider by one or more Mastercard Customers and (ii) Mastercard has received a copy of an Attestation of Compliance (AOC) by an appropriate PCI SSC approved Qualified Security Assessor (QSA) reflecting validation of the company being PCI compliant. The date of the AOC and the name of the Assessor are also provided. Each AOC is valid for one year. Mastercard receives copies of AOCs from various sources. This SDP Compliant Registered Service Provider List is provided solely for the convenience of Mastercard Customers and any Customer that relies upon or otherwise uses this SDP Compliant Registered Service Provider list does so at the Customer’s sole risk. While Mastercard endeavors to keep the list current as of the date set forth in the footer, Mastercard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. Mastercard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the SDP Compliant Registered Service Provider List or any part thereof. Each Mastercard Customer is obligated to comply with Mastercard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a PCI SSC approved QSA provides a “snapshot” of security controls in place at a point in time. -

Service Provider Name Region AOC Date Assessor DESV

A company’s name appears on this Compliant Service Provider List if (i) Mastercard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) Mastercard records reflect the company is registered as a Service Provider by one or more Mastercard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. Mastercard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of Mastercard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While Mastercard endeavors to keep the list current as of the date set forth in the footer, Mastercard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. Mastercard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each Mastercard Customer is obligated to comply with Mastercard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Compliant Service Provider 1-60 Days Past AOC Due Date 61-90 Days Past AOC Due Date Service Provider Name Region AOC Date Assessor DESV 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/08/2017 Security Research & Consulting GmbH ipayment.de) 1Link (Guarantee) Limited Asia Pacific 11/14/2017 Foregenix Limited 1Shoppingcart.com (Web.com Group, lnc.) US 04/29/2017 SecurityMetrics 2138617 Ontario Inc. -

Safekey Version

SafeKey Version Provider Name Software Name and Release Record Type Website 1.0.2 2.1.0 2.2.0 2C2P ACS.NET 1.0.2.1 ACS Vendor http://www.2c2p.com Yes 2C2P 2C2P ACS Server 2.1.0 ACS Vendor http://www.2c2p.com Yes ALIGNET S.A.C. ACS SecureKey 1.0 ACS Vendor https://www.alignet.com/ Yes Asseco SEE TriDES ACS 1.2.5 ACS Vendor https://see.asseco.com/ Yes BPC Banking Technologies SmartVista 3DS ACS v.1.0 ACS Vendor https://www.bpcbt.com/ Yes CA, Inc. Arcot Transfort Issuer CA TM 7.7 ACS Vendor https://www.ca.com Yes CardinalCommerce Corporation Cardinal Enrollment and Access Control Server 1.0.2 ACS Vendor http://www.cardinalcommerce.com Yes Yes Cherri Tech, Inc. Cherri 3DS ACS ACS Vendor https://cherritech.com/ No Yes CITIBANK NA Citibank SG 3D ACS ACS Vendor https://www.citigroup.com/citi/ Yes Compass Plus Ltd. TranzWare e-Commerce ACS 2.0 ACS Vendor http://www.compassplus.com Yes Dai Nippon Printing Co., Ltd DNP CDMS ACS Ver1.0 ACS Vendor http://www.dnp.co.jp/eng/ Yes Dai Nippon Printing Co., Ltd ACS 2.0 DNP CDMS ACS 2.0 ACS Vendor http://www.dnp.co.jp/eng/ Yes ENTERSECT Technologies (PTY) Ltd Interactive Transaction Authentication (ITA) 1.0.0 ACS Vendor https://www.entersekt.com/ Yes EPIC LANKA (PVT) LTD EPIC_ACS V1.00 ACS Vendor https://www.epictechnology.lk/ Yes Financial Software and Systems Pvt Ltd FSS ACS 1.0 ACS Vendor https://www.fsstech.com/ Yes FIS Australasia Webpay ACS 4.3 ACS Vendor https://www.fisglobal.com/ Yes GPayments ActiveAccess 6 ACS Vendor https://www.gpayments.com/ Yes HiTRUST.COM HiTRUSTacs 1.0.2 ACS Vendor http://www.hitrust.com.tw Yes Yes INFINITIUM SOLUTIONS SDN BHD Infinitium - IMS 1.1.2 ACS Vendor http://www.infinitium.com Yes Yes Innocore Co., Ltd. -

Mastercard SDP Compliant Registered Service Provider List

Site Data Protection (SDP) Program The Mastercard SDP Compliant Registered Service Provider List A company’s name appears on this SDP Compliant Registered Service Provider List if (i) Mastercard records reflect the company is registered as a Service Provider by one or more Mastercard Customers and (ii) Mastercard has received a copy of an Attestation of Compliance (AOC) by an appropriate PCI SSC approved Qualified Security Assessor (QSA) reflecting validation of the company being PCI compliant. The date of the AOC and the name of the Assessor are also provided. Each AOC is valid for one year. Mastercard receives copies of AOCs from various sources. This SDP Compliant Registered Service Provider List is provided solely for the convenience of Mastercard Customers and any Customer that relies upon or otherwise uses this SDP Compliant Registered Service Provider list does so at the Customer’s sole risk. While Mastercard endeavors to keep the list current as of the date set forth in the footer, Mastercard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. Mastercard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the SDP Compliant Registered Service Provider List or any part thereof. Each Mastercard Customer is obligated to comply with Mastercard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a PCI SSC approved QSA provides a “snapshot” of security controls in place at a point in time. -

X-Border Payments Optimization Tracker™ June 2017

X-BORDER PAYMENTS OPTIMIZATION TRACKER™ JUNE 2017 A MONTHLY UPDATE ON THE TRENDS AND PLAYERS DRIVING CROSS-BORDER PAYMENTS X-Border marketplaces FedEx bridges The top performers and the need for international borders in the X-border space better payout solutions with BlueSnap – Page 9 in our provider directory – Page 5 (Feature Story) (News and Trends) – Page 17 (Scorecard) X-Border Marketplaces And The Search for Better Payout Solutions © 2017 PYMNTS.com all rights reserved X-Border Payments Optimization Tracker™ Table of Contents What’s Inside 03 Behind the rush amongst payment service providers to offer settlements in multiple currencies. Feature Story 05 Tomas Likar, VP of strategy and business development for Hyperwallet, on building a seamless payout process for cross-border marketplaces. News & Trends 09 The latest headlines from around the world of cross-border commerce. Methodology 13 The organizing framework for evaluating the industry players that deliver merchant payment processing services aimed at enhancing cross-border commerce. Top 25 Rankings 14 The results are in. See who the top performers are. Watch List 15 The newest additions to the Tracker’s Scorecard. Scorecard 17 See how all the providers rank in our comprehensive provider directory. About 96 Information on the X-Border Payments Optimization Landscape™ and PYMNTS.com. © 2017 PYMNTS.com all rights reserved 2 What’s Inside y 2020, some 940 million cross-border shoppers Meanwhile, First Data announced the launch of its Global are expected to spend $1 trillion on eCommerce PFAC solution. The solution will give payment facilitators Btransactions, according to McKinsey. access to a single integration interface that can enable their merchants to seamlessly authorize transactions in And while growth in cross-border trade has created more than 150 currencies and make settlements in 17 new opportunities for businesses and consumers alike, currencies worldwide.