TV18 Investors Update Covering Letter.Jpg

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

EARNINGS RELEASE: Q4 and FY 2020-21

EARNINGS RELEASE: Q4 and FY 2020-21 Mumbai, 20th April, 2021 – Network18 Media & Investments Limited today announced its results for the quarter and financial year ended 31st March 2021. Consolidated EBITDA up 29% in COVID year; Highest ever EBITDA margins led by cost controls and innovative measures. PAT up by ~9x at Rs. 547 cr. Strong recovery in TV ad-growth to high single digits in Q4; Digital growing at fast clip TV News remains #1 on reach; margins expanded all through the year TV Entertainment grew viewership share by ~2% to 10.9%; full year margins highest ever Flagship GEC Colors returns to a strong #2 position during the year Entertainment OTT fastest to 1mn D2C subscribers within first year of launch Digital News breaks even for the full year; subscription the next engine of growth Summary Consolidated Financials Q4FY21 Q4FY20 Growth FY21 FY20 Growth Consolidated Operating Revenue (Rs Cr) 1,415 1,464 -3% 4,705 5,357 -12% Consolidated Operating EBITDA (Rs Cr) 279 225 24% 796 617 29% Operating EBITDA margin 19.7% 15.4% 16.9% 11.5% Highlights for Q4 Q4 Operating EBITDA up 24% YoY, Q4 Operating Margin expanded to highest ever ~20% Entertainment operating margins are at a healthy ~19% in Q4. News margins rose to highest ever levels of ~27% in Q4, led by 5% YoY revenue growth. Digital News maintained its break-even performance. Consolidated revenue ex-film production grew 2% YoY, despite deferral of award shows Highlights for FY2020-21 Consolidated Annual EBITDA margins rose to ~17%, the best ever inspite of COVID Group EBITDA up 29% YoY despite pandemic impact dragging revenue down 12% YoY. -

S.NO CHANNEL NAME 1 SUN TV 2 KTV 3 Adithya TV 4 Sun Music 5

DIGICON TAMIL MAXX - Rs.101.99+GST S.NO CHANNEL NAME 1 SUN TV 2 KTV 3 Adithya TV 4 Sun Music 5 Chutti TV 6 Sun News 7 SUN Life 8 Vijay TV 9 Vijay Super 10 Star Sports 1 Tamil 11 Star Sports 2 12 Star Sports 3 13 Star Sports First 14 National Geographic 15 Nat Geo Wild 16 CNN News 18 17 Colors Tamil 18 FY1 TV18 19 The History Channel 20 News 18 Tamil Nadu 21 News 18 Urdu 22 NICK 23 NICK JR 24 SONIC 25 VH 1 26 Zee Action 27 Zee News 28 Zee Hindustan 29 Living Foodz 30 Zee ETC 31 WION 32 Zee Tamil 33 Zee Keralam 34 Raj TV 35 Raj Digital Plus 36 Raj News 37 Raj Musix 38 Mega TV 39 Mega Musiq 40 Mega 24 41 Jaya TV 42 Jaya Plus 43 Jaya Max 44 J Movies DIGICON TAMIL BASIC - Rs.70+GST S.NO CHANNEL NAME 1 ADITHYA TV 2 CHUTTI TV 3 COLORS TAMIL 4 K TV 5 NEWS18 TN 6 SUN LIFE 7 SUN MUSIC 8 SUN NEWS 9 SUN TV 10 STAR TAMIL 11 WION 12 ZEE ACTION 13 ZEE ETC 14 ZEE HINDUSTAN 15 ZEE KERALAM 16 ZEE NEWS 17 ZEE TAMIL DIGICON FAMILY PACK-Rs.126+GST S.NO CHANNEL NAME 1 AAJ TAK 38 SONIC 2 AAJ TAK TEZ 39 SONY BBC EARTH 3 ADITHYA TV 40 SONY YAY 4 BBC 41 SUN LIFE 5 CARTOON NETWORK 42 SUN MUSIC 6 CHUTTI TV 43 SUN NEWS 7 CNN 44SUN TV 8 CNN NEWS 18 45 TIMES NOW 9 COLORS TAMIL 46 VH1 10 DISNEY 47 VIJAY 11 DISNEY HD 48 WB 12 DISNEY JUNIOR 49 WION 13 DISNEY XD 50 ZEE ACTION 14 ET NOW 51 ZEE ETC 15 FYI 52 ZEE HINDUSTAN 16 HBO 53 ZEE KERALAM 17 HISTORY 54 ZEE NEWS 18 HUNGAMA 55 ZEE TAMIL 19 INDIA TODAY 56 ZOOM 20 K TV 21 MEGA 24 22 MEGA MUSIQ 23 MEGA TV 24 MIRROR NOW 25 MNX 26 MOVIES NOW 27 MTV BEATS HD 28 NEWS 18 TAMIL 29 NEWS 18 URDU 30 NICK 31 NICK JUNIOR 32 POGO 33 -

Viacom18 Media Private Limited– Update on Material Event Rationale

April 29, 2021 Viacom18 Media Private Limited– Update on Material Event Summary of rating(s) outstanding Previous Rated Amount Current Rated Amount Instrument* Rating Outstanding (Rs. crore) (Rs. crore) Commercial Paper Programme 500.0 500.0 [ICRA]A1+ Short-term, Fund-based/Non 1,610.7 1,610.7 [ICRA]A1+ fund based Limits Total 2,110.7 2,110.7 *Instrument details are provided in Annexure-1 Rationale On February 17, 2020, Network18 intimated the stock exchanges regarding a scheme of amalgamation and arrangement amongst Network18, TV18, DEN Networks Limited (DEN) and Hathway Cable & Datacom Limited (Hathway). Under the scheme, DEN, Hathway and TV18 were to merge into Network18 with effect from February 1, 2020, subject to receipt of necessary approvals to consolidate Reliance Industries Limited’s (RIL, rated [ICRA]AAA (Stable) / [ICRA]A1+ and Baa2 Stable by Moody’s Investors Service) media and distribution business spread across multiple entities into Network18. The company again announced on April 20, 2021 that considering more than a year has passed from the time the Board considered the Scheme, the Board of the Company has decided not to proceed with the arrangement envisaged in the Scheme. ICRA has taken cognizance of the above and the rating remain unchanged at the earlier rating of [ICRA]A1+ as the parent company, TV18 would continue with the existing corporate structure. Please refer to the following link for the previous detailed rationale that captures Key rating drivers and their description, Liquidity position, Rating sensitivities,: Click here Analytical approach Analytical Approach Comments Corporate Credit Rating Methodology Applicable Rating Methodologies Rating Methodology for Media Broadcasting Industry Impact of Parent or Group Support on an Issuer’s Credit Rating Parent / Group Company: RIL Group. -

Entertainment

TVml August 28, 2020 National Stock Exchange of India Limited BSE Limited Exchange Plaza, Plot No. C/1, P J Towers G-Block Bandra-Kurla Complex, Dalal Street Bandra (E) Mumbai - 400051 Mumbai - 400 001 Trading Symbol: TV18BRDCST SCRIP CODE: 532800 Dear Sirs, Sub: Annual Report for the financial year 2019-20 including Notice of Annual General Meeting The Annual Report for the financial year 2019-20, including the Notice convening Annual General Meeting, being sent to the members through electronic mode, is attached. The Secretarial Audit Report of material unlisted subsidiary is also attached. The Annual Report including Notice is also uploaded on the Company's website www.nw18.com. This is for your information and records. Thanking you, Yours faithfully, For TV18 Broadcast Limited c ~~ ~"OrJ . )," ('.i/'. ~ . .-...e:--.-~ l \ I Ratnesh Rukhariyar Company Secretary Encl. As Above TV18 Broadcast Limited (eIN - L74300MH2005PLC281753) Regd. office: First Floor, Empire Complex, 414- Senopoti Sopot Marg, Lower Parel, Mumboi-400013 T +91 2240019000,66667777 W www.nw18.com E:[email protected] CONTENTS 01 - 11 Corporate Overview 01 Information. Entertainment. Impact TV18 is as unique as 02 Driven to Inform 04 Inspired to Involve it is impactful. It blends 06 Brands that Stimulate compelling and insightful 08 Letter to Shareholders news with inspiring and 09 Corporate Information stimulating entertainment; 10 Board of Directors an attribute that makes it 12 - 68 stand out amongst peers Statutory Reports regardless of size or vintage. 12 Management Discussion and Analysis 29 Board’s Report 40 Business Responsibility Report India’s largest News Broadcast network and the third 49 Corporate Governance Report largest player in the Television entertainment space, TV18 has infused into the Media and Entertainment industry a large dose of youthful dynamism. -

Corporate Presentation Media & Investments

Media & Investments Corporate Presentation FY19-20 OVERVIEW 2 Key Strengths Leading Media company in India with largest bouquet of channels (56 domestic channels and 16 international beams), and a substantial digital presence Market-leader in multiple genres (Business News #1, Hindi General News & Entertainment #2 Urban, Kids #1, English #1) Key “Network effect” and play on Vernacular media growth - Benefits of Strengths Regional portfolio across News (14) and Entertainment (9) channels Marquee Digital properties (MoneyControl, BookMyShow) & OTT video (VOOT) provides future-proof growth and content synergy Experienced & Professional management team, Strong promoters 3 Network18 group : TV & Digital media, specialized Print & Ticketing ~75% held by Independent Media Trust, of which RIL is Network18 Strategic Investment the sole beneficiary Entertainment Ticketing & Live Network18 has ~39% stake Digital News Broadcasting Print + Digital Magazines Business Finance News Auto Entertainment News & Niche Opinions Infotainment All in standalone entity Network18 holds ~92% in Moneycontrol. Network18 holds ~51% of subsidiary TV18. Others are in standalone entity. TV18 in turn owns 51% in Viacom18 and 51% in AETN18 (see next page for details) TV18 group – Broadcasting pure-play, across News & Entertainment ENTITY GENRE CHANNELS Business News (4 channels, 1 portal) Standalone entity TV18 TV18 General News Group (Hindi & English) Regional News 50% JV with Lokmat group (14 geographies) IBN Lokmat AETN18 Infotainment (Factual & Lifestyle) 51% subsidiary -

Corporate Presentation Media & Investments

Media & Investments Corporate Presentation FY18-19 OVERVIEW 2 Key Strengths Leading Media company in India with largest bouquet of channels (55 domestic channels and 16 international beams), and a substantial digital presence Market-leader in multiple genres (Business News #1, Hindi General News & Entertainment #2 Urban, Kids #1, English #1) Key “Network effect” and play on Vernacular media growth - Benefits of Strengths Regional portfolio across News (14) and Entertainment (8) channels Marquee Digital properties (MoneyControl, BookMyShow) & OTT video (VOOT) provides future-proof growth and content synergy Experienced & Professional management team, Strong promoters 3 Building India’s leading media company 2016+ • OTT video platform, revamp of portals Filling whitespaces, umbrella branding, • Hindi Movie and Music channels thrust on digital • News (TV+Digital) expanded and relaunched • ETV acquisition (Regional News +Entertainment) 2012-2015 • Indiacast setup for distribution of TV bouquet Regional entry to tap vernacular market • NW18 acquired by RIL, corporatization thrust • JVs with Viacom & A+E networks, Forbes 2005-2011 • Invest in Home shopping, Online Ticketing Entry into Entertainment and Digital • News, Opinions & Info portals 1999-2005 • Business News (CNBC cluster) Built core platforms and launched • General News (IBN cluster) flagships • Finance portal (MoneyControl) 4 Network18 group : TV & Digital media, specialized Print & Ticketing ~75% held by Independent Media Trust, of which RIL is Network18 Strategic Investment the sole beneficiary Entertainment Ticketing Network18 has ~39% stake Digital News Broadcasting Print + Digital Magazines Business Finance News Auto Entertainment News & Niche Opinions Infotainment All in standalone entity Infotainment Network18 holds ~51% of subsidiary TV18. TV18 in turn owns 51% in Viacom18 and 51% in AETN18 (see next page for details) Network18 holds ~92% in Moneycontrol. -

(E) Mumbai - 400051 Mumbai - 400001

July 20, 2021 National Stock Exchange of India Limitec BSE Limited Exchange Plaza, Plot No. C/1, P J Towers K3-Block Bandra-Kurla Complex, Dalal Street Bandra (E) Mumbai - 400051 Mumbai - 400001 Ifrading Symbol: TV18BRDCST Scrip Code: 532800 Sub: Investors' Update - Unaudited Financial Results (Standalone and Consolidated) for the quarter ended June 30, 2021 Dear Sirs, In continuation of our letter of today's date on the above subject, we send herewith a copy of the Investors' Update on the aforesaid financial results released by the Company in this regard. The Investors' Update will also be available on the Company's website, www.nw18.com. You are requested to take the same on record. Thanking you, Yours faithfully, For TV18 Broadcast Limited ~1R__ ~= Ratnesh Rukhariyar Company Secretary Encl. As Above TV18 Broadcast Limited (eIN - L74300MH2005PLC281753) Regd. office: First Floor, Empire Complex, 414- Senopoti Bopot Marg, Lower Parel, Mumboi-400013 T +91 2240019000,6666 7777 W www.nw18.com E:[email protected] A listed subsidiary of Network18 EARNINGS RELEASE: Q1 1 While Digital is rising fast off a low base, TV remained resilient and in growth territory. Domestic TV subscription dynamics remain in flux due to the proposed new tariff order (NTO 2.0). Cost controls maintained across business lines, des789 cntained across ls roposD 2/Lang 3-s5rossedacross 60oncnta 2[(C)5(os)4(t)-3( )-4(co)84 644.98 Tm [<04E>] TJ ET BT /F3 11.04 Tf 1 0 0 1 112.34 695.5 Tm 25m ] TJ ET BT 1 0 0 1 121.58 695.5 Tm [(D)5(omest)-4(i25m ] TJ ))-3(.)] TJ ET BT 1 0 0 1 17325m ] TJ (ntow rr36yno3(r)-3-4(i)5(oc)3(s-3(36yo3(r)-3(36y)13(nosts-3(39,)-44( )-123(s5(s)13(i36ybut)-(ow)1 TJ ss-3(36y t)-7(e)3( )(l) ET BT 1 0 0 1 416.23 67(i25m ] TJ ))-3(.)] TJ ET BT 1 0372Tc[(F25m ] TJ )-14d(r)-3(36ya-3(24(du)3(ed(r)ucn)133)13( )-1236)-4(he)1424)-4( )] TJ 3( )up(r)-3(36yo2/Lang 3-60. -

Athulya Tamil Pack

ATHULYA TAMIL PACK - 317 CHANNELS (267FTA+50PAY) - Rs.270 Sl.No CHANNELS LANGUAGE GENRE 1 NT3 (Local-Shopping) MALAYALAM GEC 2 ATHULYA (Local) MALAYALAM GEC 3 JANAPRIYAM (Local) MALAYALAM GEC 4 MAZHAVIL MANORAMA MALAYALAM GEC 5 FLOWERS MALAYALAM GEC 6 ASIANET MALAYALAM GEC 7 SURYA TV MALAYALAM GEC 8 ZEE KERALAM MALAYALAM GEC 9 SURYA COMEDY MALAYALAM GEC 10 ASIANET PLUS MALAYALAM GEC 11 KAIRALI MALAYALAM GEC 12 NAPTOL MALAYALAM MALAYALAM GEC 13 JANAM TV MALAYALAM GEC 14 DD MALAYALAM MALAYALAM GEC 15 JAIHIND MALAYALAM GEC 16 AMRITA TV MALAYALAM GEC 17 KAUMUDY MALAYALAM GEC 18 JEEVAN MALAYALAM GEC 19 DARSANA MALAYALAM GEC 20 TEST MALAYALAM GEC 21 KAIRALI WE MALAYALAM GEC 22 KAPPA TV MALAYALAM GEC 23 ATHULYA HD (Local) MALAYALAM GEC 24 MAZHAVIL MANORAMA HD MALAYALAM GEC 25 SUN TV TAMIL GEC 26 ZEE TAMIL TAMIL GEC 27 COLORS TAMIL TAMIL GEC 28 RAJ DIGITAL PLUS TAMIL GEC 29 IMAYAM TAMIL GEC 30 MAKKAL TV TAMIL GEC 31 VENDHAR TAMIL GEC 32 CAPTAIN TAMIL GEC 33 PUTHUYUGAM TAMIL GEC 34 TAMILAN TV TAMIL GEC 35 SUPER TV TAMIL GEC 36 KALAIGNAR TAMIL GEC 37 DHEERAN TAMIL GEC 38 DD POTHIGAI TAMIL GEC 39 KALAIGNAR SIRIPPOLI TAMIL GEC 40 MK TELEVISION TAMIL GEC 41 PEPPERS TAMIL GEC 42 SHOPPING ZONE TAMIL GEC 43 AHSAS TAMIL GEC 44 JEET PRIME HINDI GEC 45 DD NATIONAL HINDI GEC 46 DD INDIA HINDI GEC 47 DD BHARATHI HINDI GEC 48 DANGAL HINDI GEC 49 SHAKHUN HINDI GEC 50 DILLAGI HINDI GEC 51 DHAMAAL HINDI GEC 52 DABANG HINDI GEC 53 ENTER10 HINDI GEC 54 NEPAL 1 HINDI GEC 55 ANJAN TV HINDI GEC 56 MANORANJAN TV HINDI GEC 57 MULTIPLEX HINDI GEC 58 GEMPORIA HINDI GEC -

Annual Report 2019-20

Annual Report 2019-20 Creating Experiences The Group commissioned India’s largest integrated TV and Digital Newsroom at Mumbai. What’s Inside Corporate Overview 01 Creating Experiences 02 Across Mediums 03 Across Languages 04 Across Screens 05 Across Narratives 06 Across Genres 08 Letter to Shareholders 09 Corporate Information 10 Board of Directors Statutory Reports 12 Management Discussion and Analysis 30 Board’s Report 40 Business Responsibility Report 49 Corporate Governance Report Financial Statements 71 Standalone Financial Statements 121 Consolidated Financial Statements Notice 181 Notice of Annual General Meeting View this report online or download at www.nw18.com A large bouquet of diversified brands, crafted to meet the diverse needs of audiences across regions, cultures, segments, genres and languages, defines the ethos of Network18 Media & Investments Limited (Network18). As one of India’s largest media conglomerates, Network18 has redefined the Media and Entertainment sector of the country, while carving a distinctive niche for itself as a thought leader in the industry. With our finger on the pulse of people across the culturally contrasting milieus of Bharat and India, we remain closely connected with audiences through multiple channels of mediums, languages, platforms, screens, devices and formats. At the heart of this consumer connect lies our ability to align ourselves to the differentiated and evolving aspirations, needs and consumption patterns of people across the country. From News to Entertainment and across TV, Digital and Print, our portfolio of offerings is designed to engage with audiences across segments and genres. We create enriching experiences for them with our quality content that caters as effectively to the premium audiences as it does to the masses. -

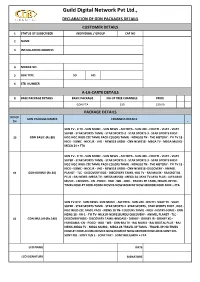

Customer Application Form

Guild Digital Network Pvt Ltd., DECLARATION OF GDN PACKAGES DETAILS CUSTOMER DETAILS 1 STATUS OF SUBSCRIBER INDIVIDUAL / GROUP CAF NO 2 NAME 3 INSTALLATION ADDRESS 4 MOBILE NO 5 BOX TYPE SD HD 6 STB NUMBER A-LA-CARTE DETAILS 8 BASE PACKAGE DETAILS BASIC PACKAGE NO OF FREE CHANNELS PRICE GDN FTA 230 130.00 PACKAGE DETAILS NO OF GDN PACKAGE NAMES CHANNELS DETAILS CH P SUN TV - K TV - SUN MUSIC - SUN NEWS - ADITHYA - SUN LIFE - CHUTTI - VIJAY - VIJAY SUPER - STAR SPORTS TAMIL - STAR SPORTS 2 - STAR SPORTS 3 - STAR SPORTS FIRST- 20 GDN BASIC-(Rs.80) NGC-NGC WILD-ZEE TAMIL PACK-COLORS TAMIL - NEWS18 TN - THE HISTORY - FYI TV 18 - NICK - SONIC - NICK JR - VH1 - NEWS18 URDU - CNN NEWS18 - MEGA TV - MEGA MUSIQ - MEGA 24 + FTA SUN TV - K TV - SUN MUSIC - SUN NEWS - ADITHYA - SUN LIFE - CHUTTI - VIJAY - VIJAY SUPER - STAR SPORTS TAMIL - STAR SPORTS 2 - STAR SPORTS 3 - STAR SPORTS FIRST- NGC-NGC WILD-ZEE TAMIL PACK-COLORS TAMIL - NEWS18 TN - THE HISTORY - FYI TV 18 - NICK - SONIC - NICK JR - VH1 - NEWS18 URDU - CNN NEWS18 -DISCOVERY - ANIMEL 62 GDN KURINJI-(Rs.10) PLANET - TLC - DISCOVERY KIDS - DISCOVERY TAMIL -RAJ TV - RAJ MUSIX - RAJ DIGITAL PLUS - RAJ NEWS -MEGA TV - MEGA MUSIQ - MEGA 24 -JAYA TV-JAYA PLUS - JAYA MAX MUSIC - J MOVIES - CN - POGO - HBO - WB - CNN - TRAVEL XP TAMIL,TRAVEL XP HD - TIMES NOW-ET NOW-ZOOM-MOVIES NOW-ROMEDY NOW-MIRROR NOW-MNX + FTA SUN TV-KTV - SUN NEWS- SUN MUSIC - ADITHYA - SUN LIFE -CHUTTI- VIJAY TV - VIJAY SUPER - STAR SPORTS TAMIL - STAR SPORTS 2 -STAR SPORTS , STAR SPORTS FIRST , NGC - NGC WILD-ZEE TAMIL PACK -

Corporate Presentation Media & Investments

Media & Investments Corporate Presentation FY20-21 OVERVIEW 2 Key Strengths Leading Media company in India with largest bouquet of channels (56 domestic channels and 16 international beams), and a substantial digital presence Market-leader in multiple genres (Global top 20 in news pay-apps; top 2 in Digital News in India, #1 Business News channel, top 3 in National News, #2 premium Hindi GEC, Kids #1, English #1) Key “Network effect” and play on Vernacular media growth - Benefits of Strengths Regional portfolio across News (14) and Entertainment (10) channels Marquee Digital properties (MoneyControl, BookMyShow) & OTT video (VOOT) provides future-proof growth and content synergy Experienced & Professional management team, Strong promoters 3 Network18 group : TV & Digital media, specialized Print & Ticketing ~73.15% held by Independent Media Trust, of Network18 Strategic Investment which RIL is the sole beneficiary (total promoter Entertainment holding is 75%) Ticketing & Live Network18 has ~39% stake Digital News Broadcasting Print + Digital Magazines Business Finance News Auto Entertainment News & Niche Opinions Infotainment All in standalone entity Network18 holds ~92% in e-Eighteen Network18 holds ~51% of subsidiary TV18. (Moneycontrol). Others are in standalone TV18 in turn owns 51% in Viacom18 and entity. 51% in AETN18 (see next page for details) TV18 group – Broadcasting pure-play, across News & Entertainment ENTITY GENRE CHANNELS Business News (4 channels, 1 portal) Standalone entity TV18 TV18 General News Group (Hindi & English) Regional News 50% JV with Lokmat group (14 geographies) IBN Lokmat AETN18 Infotainment (Factual & Lifestyle) 51% subsidiary - JV with A+E Networks Entertainment VIACOM18 (inc. Movie production / distribution & OTT) 51% subsidiary - JV with Viacom Inc Regional Entertain. -

INDIAN OTT PLATFORMS REPORT 2019 New Regional Flavours, More Entertaining Content

INDIAN OTT PLATFORMS REPORT 2019 New Regional Flavours, more Entertaining Content INDIAN TRENDS 2018-19 Relevant Statistics & Insights from an Indian Perspective. Prologue Digital technology has steered the third industrial revolution and influenced human civilization as a whole. A number of industries such as Media, Telecom, Retail and Technology have witnessed unprecedented disruptions and continue to evolve their existing infrastructure to meet the challenge. The telecom explosion in India has percolated to every corner of the country resulting in easy access to data, with Over-The-Top (OTT) media services changing how people watch television. The Digital Media revolution has globalized the world with 50% of the world’s population going online and around two-thirds possessing a mobile phone. Social media has penetrated into our day-to-day life with nearly three billion people accessing it in some form. India has the world’s second highest number of internet users after China and is fully digitally connected with the world. There is a constant engagement and formation of like-minded digital communities. Limited and focused content is the key for engaging with the audience, thereby tapping into the opportunities present, leading to volumes of content creation and bigger budgets. MICA, The School of Ideas, is a premier Management Institute that integrates Marketing, Branding, Design, Digital, Innovation and Creative Communication. MICA offers specializations in Digital Communication Management as well as Media & Entertainment Management as a part of its Two Year Post Graduate Diploma in Management. In addition to this, MICA offers an online Post-Graduate Certificate Programme in Digital Marketing and Communication.